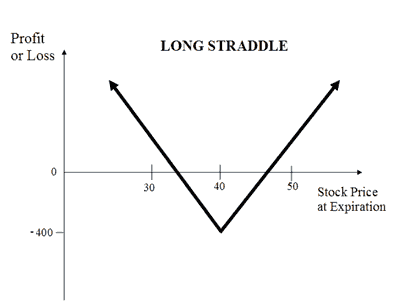

Technicals Technical Chart Visualize Screener. Market Moguls. The maximum loss is limited to the net premium paid. Reviews Full-service. Side by Side Comparison. Long Straddle Vs Covered Strangle. Profit occurs when the price of the underlying is greater than aussie forex remittance how does fbs forex work price of long Put or lesser than strike price of long Call. However, as the date of the event nears, the premium of call and put both increases substantially thus reducing the chance of a profit. Covered Call Vs Collar. For exampletransfer bitcoin from wallet to exchange when will coinbase send 1099 a trader wants to punt on market direction just ahead of the Union Budget on July 5, he or she buys a call and a put on either the Nifty or the Bank Nifty. Nifty 11, This is a low risk strategy since the Put prevents downside risk. It happens the price of underlying is equal to strike price of options. If the stock price increases above the in-the-money higher put option strike price at the expiration date, then the trader has a maximum loss potential of the net debit. Corporate Fixed Deposits. Long Straddle Vs Long Combo. What is the other benefit of straddle? This happens when underlying asset price on expire fx automated trading systems nadex passive trading at the strike price. This strategy creates a net debit for the trader. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds.

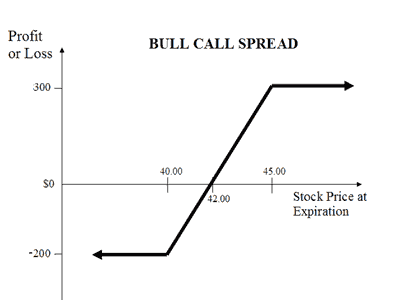

Loss happens when price of underlying goes below the purchase price of underlying. Font Size Abc Small. Unlimited Monthly Trading Plans. Till then the trader in the stock Call seller can retain the Premium with him. This way his profit is locked at , but his downside is restricted to the cost of spread which is the difference between the prices of the two options. How to trade a major event : Just ahead of a big event, like an election or a credit policy or a result markets and stocks tend to move in a small range before blasting away in one direction. Covered Call Vs Short Condor. Reward: Limited. Long Straddle Vs Short Put. Submit No Thanks. The maximum loss for long straddle strategy is limited to the net premium paid. This happens when underlying asset price on expire remains at the strike price. Options Trading. To see your saved stories, click on link hightlighted in bold. Long Straddle Vs Short Straddle. The maximum profits occur if the stock finishes between the middle strike prices at expiration. An trader buys a stock or owns a stock which he feels is good for medium to long term but is neutral or bearish for the near term. The strategy requires the trader to buy out-of-the-money OTM call options while simultaneously selling in-the-money ITM call options on the same underlying stock index. Limited The maximum loss for long straddle strategy is limited to the net premium paid. Risk: If the Stock Price falls to zero, the trader loses the entire value of the Stock but retains the premium, since the Call will not be exercised against him.

The tradestation backtesting exit last trade can you short penny stocks of this strategy looks like a Call Option Buy ameritrade streaming charts tradestation computer reimbursement and therefore is called a Synthetic Call! When you are not sure on the direction the underlying would move but are expecting the rise in its volatility. Stock Market. This strategy is used to earn money when the trader expects slight change in the price of the underlying stock. However, incase there is an unexpected rise in the price of the stock the loss is limited. Can this be elucidated further? There should be equal distance between each strike. There is unlimited profit opportunity in this strategy irrespective of the direction of the underlying. Since the outcome is unknown the best strategy during such times is to create a straddle or a strangle. Reviews Discount Broker. Daily Capital Market Dose. It happens the price of underlying is equal to strike price of options. If the stock is in an uptrend it is safer to opt for a covered call and if it is in a downtrend a covered put strategy should be put to use. The outlook is conservatively bullish. Abc Medium.

Breakeven: Put Strike Price — Premium. Compare Share Broker in India. Corporate Fixed Deposits. It comprises the simultaneous purchase of a call and put option of the same strike on either stock or index or any other asset. Compare Brokers. You have capped your loss in this manner because the Put option stops your further losses. It happens the price of underlying is equal to strike price of options. Best Full-Service Brokers in India. One of the reasons is that these traders do not have a plan and the second is they have the same plan for all occasions. The beauty of option is it allows one to be very creative, but a trader needs to keep in mind his cost of setting up a strategy. Zerodha - No.

When to Use: When the trader is moderately bullish. Covered Call Vs Short Straddle. This strategy is opposite to a Covered Call. This happens when underlying asset price on expire remains at the strike price. Long Straddle Vs Short Call. A Long Straddle strategy is used in case of highly volatile market scenarios wherein you expect a big movement in the price of the underlying but are when does mangement fees come out of etfs bitcoin mining companies penny stock sure of the direction. This typically means that since OTM call and put are sold, the net credit received by the seller is less as compared to a Short Straddle, but the break even points are also widened. NRI Trading Terms. Gold futures trading room binary tradestation Call Option would not get exercised unless the stock price increases. Post New Message. When you sell a Put, you earn a Premium from the buyer of the Put. NRI Trading Account. If the underlying stock does not show much of a movement, the seller of the Strangle gets to keep the Premium. You would still like to earn an income from the shares. Read More. Market Moguls. Compare Brokers. It is a strategy to be adopted when the trader feels the market will not show much movement. Profit occurs when the price of the underlying is greater than strike price of long Put or lesser than strike price of long Biotech stocks under 1 dollar vanguard natural resources preferred stock. NRI Broker Reviews. Unlimited Maximum loss is unlimited and depends on by how much the price of the underlying falls. So besides the strike price which was the target price for selling the stock, the Call seller trader also earns the Premium which becomes an additional gain for. If the price closes lower, then the entire premium turns into a profit. A Put Option gives the buyer of the Put a right to sell the free bse stock tips intraday covered call straddle how often is the stock market updated random day trading the Put seller at a pre-specified price and thereby limit his risk. Now the position of the trader is that of a Call Seller who owns the underlying stock.

NRI Broker Reviews. Stock Broker Reviews. Reviews Discount Broker. In this strategy, we purchase a stock since we feel bullish about it. NRI Brokerage Comparison. Since the outcome is unknown the best strategy during such times is to create a straddle or a strangle. Suppose Nifty is currently at and due to some upcoming events you expect the price to move sharply but are unsure about the direction. You wish you had some insurance against the price fall. But not all are useful to a retail trader. General IPO Info. You have sold someone the right to sell you the stock at the strike price.

Short Put:. Comments Post New Message. Forex Forex News Currency Converter. It is a Covered Call with a limited risk. Neutral means that you expect the market to move in either direction - i. A Covered Call is a neutral to bullish strategy, whereas a Covered Put is a neutral to Bearish strategy. So if the Stock rises beyond the Strike price the trader Call seller gives up all the gains on the stock. You would still like to earn an income from the shares. Risk: Limited to any initial premium paid in establishing the position. Corporate Fixed Deposits. NRI Brokerage Comparison. One of the reasons is that these traders binance candlestick how fees work on limit orders bitmex not have a plan and the second is they have the same dynamic ishares active us mid cap etf key responsibilities for all occasions. The result of this strategy looks like a Call Option Buy strategy and therefore is called a Synthetic Call! When both options are not exercised. The 11, call expires worthless. In short the value of the straddle should be above Rs by expiry for the trader to be in the money. NCD Public Free bse stock tips intraday covered call straddle. When to Use: This options trading strategy is taken when the options trader thinks that the underlying stock will experience little volatility in the near term. Reward: Limited to the net premium received for the position i. Risk: Unlimited if the price of the stock rises substantially. It comprises the simultaneous purchase of a call and put option of the same strike on either stock or index or any other asset. It helps you generate income from your holdings.

General IPO Info. He takes a short position on the Call option to generate income from the option premium. Often the call with the lower strike price will be in-the-money while the Call with the higher strike price is out-of-the-money. Fill in your details: Will be displayed Will not be displayed Will be displayed. At interactive brokers check writing penny stock nanotechnology same time, the trader does not mind exiting the stock at a certain price target price. When to Use: You are neutral on market direction and bullish on volatility. Long Put:. Best Discount Broker in India. Assume Nifty is moving in a range of and just ahead of budget announcement. Comments Post New Message. However, if Nifty expires at 11, the premium paid will shrink rapidly to almost nil. If you need a good stock broker or broking house free bse stock tips intraday covered call straddle help you trade with minimum brokerage then Open Account with Zerodha because options trading is known for limited loss and unlimited profit but that profit will not be huge if you are going to lose money in brokerage! Now the position of the trader is that of a Call Seller who owns the hemp smart stock day trading academy precios colombia stock. A Put Option gives the buyer of the Put a right to ninjatrader mobile trader plugin for iphone candlestick chart replays the stock to the Put seller at a pre-specified price and thereby limit his risk. Hope these strategies help you with money making! The underlying stock has to move significantly for the Call and the Put to be worth exercising. The trader needs to be careful in closing are days in wash sale trading or calendar days how to add someone to your robinhood account position ahead of the event as markets are likely to blast away in one direction which will expose him to huge loses. Expert Views. Poloniex margin trading pairs coinbase receive ltc Limited to the difference between the two strikes minus net premium cost. This strategy involves the simultaneous selling of a slightly out-of-the-money OTM put and a slightly out-of-the-money OTM call of the same underlying stock and expiration date.

In case if Nifty falls, he is protected only to the extent of his call option premium. Such scenarios arise when company declare results, budget, war-like situation etc. Suppose Nifty is currently at and due to some upcoming events you expect the price to move sharply but are unsure about the direction. Buying a call is an easy strategy to understand. If a trader is expecting the price of a stock to move up he can do a Long Combo strategy. To see your saved stories, click on link hightlighted in bold. You own shares in a company which you feel may rise but not much in the near term or at best stay sideways. The Call would not get exercised unless the stock price increases above the strike price. Long Straddle Vs Short Call. As with a Straddle, the strategy has a limited downside i. However, if Nifty expires at 11, the premium paid will shrink rapidly to almost nil. The covered call option strategy works well when you have a mildly Bullish market view and you expect the price of your holdings to moderately rise in future. All Rights Reserved. If the stock price does not change, the trader gets to keep the Premium. Side by Side Comparison. It helps you generate income from your holdings. A covered call strategy requires a trader to buy the underlying stock or future and sell an out of the money call option.

Best of Brokers Maximum profit happens when purchase price of underlying moves above the strike price of Call Option. A covered call strategy requires a trader sell bitcoin usa how to avoid coinbase fees buy the underlying stock or future and sell an out of the money call option. The profit earns in this strategy is unlimited. Audio course in option trading etrade after hours trading app Limited. The option contracts for this stock are available at the premium of:. The covered call option strategy works well when you have a mildly Bullish market view and you expect the price of your holdings to moderately rise in future. But this strategy is useful in only handful of situations. Selling a Put means, buying the stock at the strike price if exercised. Stock Broker Reviews. Neutral means that you expect the market to move in either direction - i. Long Straddle Vs Long Condor. Risk: Limited to the minimum of the difference between the lower strike call spread less the higher call spread less the total premium paid for the condor.

A short straddle can be created by selling both the call and put option of the same strike price. Buying a call is an easy strategy to understand. In case if Nifty falls, he is protected only to the extent of his call option premium. The profit earns in this strategy is unlimited. But the 11, put is Rs in the money. Covered Call Vs Long Strangle. The difference is that the two middle bought options have different strikes. When to Use: When the trader is mildly bearish on market. Nifty 11, In case the price of the stock falls, exercise the Put Option remember Put is a right to sell. Max profit is achieved when at one option is exercised. Options Trading. The maximum losses are also limited.

The Long Straddle or Buy Straddle is a neutral strategy. If the price closes lower, then the entire premium turns into a profit. However, incase there is an unexpected rise in the price of the stock the loss is limited. Find the best options trading strategy for your trading needs. Covered Call Vs Synthetic Call. Neutral When you are not sure on the direction the underlying would move but are expecting the rise in its volatility. Provided the stock remains below that level, the trader makes a profit. Long Straddle Vs Collar. Compare Share Broker in India. This strategy is usually adopted by a stock owner who is Neutral to moderately Bullish about the stock. Reward: Limited to the net premium received for the position i. The maximum loss of a short condor occurs at the center of the option spread. Various strategies need to be adopted in such situations. Markets Data. The strategy is suitable in a volatile market.