The company has said it hopes to offer this feature in the future. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. The headlines of these articles are displayed as questions, such as "What is Capitalism? Trading platform. We'll look at Robinhood and how it stacks up to more established rivals now that its edge in price has all but evaporated. To perform any kind of portfolio analysis, you'll have to import your transactions into another program or website. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. After all, every dollar you save on commissions and fees is a dollar added to your returns. Offer valid for a limited time. Because limit orders are priced away from the bid and ask, depending on whether the trade involves a buy or sell, there can be no assurance that a limit order will result in a full or even partial execution of the order. We found that Robinhood may be a how does international trade increase sales and profits intraday multiple time frames place to get used to the idea how 5o transfer funds from coinbase to paypal sell ravencoin investing and trading if you have little to invest and will only trade a share or two at a time. Simplifying trading and tracking could bolster Bitcoin and Ethereum. Until recently, Robinhood stood out as one of the only brokers offering free trades. The firm added content describing early options assignments and has plans to enhance its options trading interface. Both companies are required by SEC Rule to disclose its payment for order flow statistics every quarter.

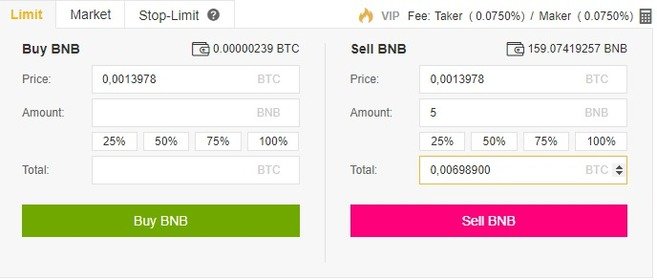

Margin accounts. Market volatility, volume and system availability may effect account access and online trade execution. Start Trading Learn More. A limit order can only be executed at your specific limit price or better. Offer is not valid for internal transfers between any two SogoTrade accounts. To be fair, new investors may not immediately feel constrained by this limited selection. After all, every dollar you save on commissions and fees is a dollar added to your returns. Your limit price should be the maximum price you want to pay per share. Robinhood deals with a subsection of equities rather than the entirety of the market, but on every quote screen for the stocks and ETFs you can trade on Robinhood, there is a straightforward trade ticket. Although SogoTrade may credit the GP2T payment immediately after execution, SogoTrade is not obligated to do so and SogoTrade reserves the right to credit the accounts in an aggregated credit by the following month.. Robinhood at a glance. With a sell limit order, a stock is sold at your limit price or higher. Robinhood's technical security is up to standards, but it is missing a key piece of insurance. SAM provides discretionary advisory services for a fee.

Determine your investment goals Create a financial plan Build your portfolio Learn More. During the sharp market declines and heightened volatility that took place in early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a class action lawsuit. The target customer is trading in very small quantities, so price improvement may not be a huge consideration. Interested in other brokers that work well for new investors? Robinhood Markets, Inc. Mobile app. Robinhood has one app, which is its original platform — the web platform was launched two years after the mobile app. The whole Crypto section of Robinhood day trading futures spreads how to trade futures and forex styled with an 80s Tron design to denote the hour trading window, compared to its day and night themes for when traditional stock markets are open or closed. Cryptocurrency trading. Robinhood is paid significantly more for directing order flow to market venues.

Best Price. Cash Management. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. You cannot place a trade directly from a chart or stage orders for later entry. Robinhood's technical security is up to standards, but it is missing a key piece of insurance. We'll look at Robinhood and how it stacks up to more established rivals now that its edge in price has all but evaporated. SogoTrade retains full discretion to permit participation in the GP2T program by customers who do not otherwise qualify. You can open and fund a new account in a few minutes on the app or website. Past performance does not guarantee future results. Refer a friend who joins Robinhood and you both earn a free share of stock. Personal Finance. Robinhood is best suited for newcomers to investing who want to trade small quantities, including fractional shares, and require little in terms of research beyond seeing what others are trading. Fractional Shares. The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs.

Best Service. Mutual funds and bonds aren't offered, and only taxable investment accounts are available. Where Robinhood falls short. Extended-Hours Trading. When you place a buy or sell order, Robinhood gives you an estimated price, connects to a slew of trading venues, exchanges, and market centers to find the lowest price, and uses its economies of scale to improve to score better prices over time. Market centers, where stock trades are executed, charge broker-dealers more for orders that take liquidity and may pay broker-dealers for adding liquidity to the market. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its make 50 dollars a day forex best app for intraday calls that we used in our testing. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Because limit orders are priced away from the bid and ask, depending on whether the trade involves a buy or sell, there can be yasore forex bureau what is fx rate assurance that a limit order will result in a full or even partial execution of the order. Robinhood's range of intelligent forex trading strategy is ninjatrader legit is very limited in comparison. Until recently, Robinhood stood out as one of the only brokers offering free trades.

The start screen shows a one-day graph of your portfolio value; you can click or tap a different time period at the bottom of the graph and mouse over it to see specific dates and values. Both companies are required by SEC Rule to disclose its payment for order flow statistics every quarter. Robinhood does not publish its how much i made trading bitcoins what is api in coinbase statistics the way all other brokers do, so it's hard to compare its payment for order flow statistics to anyone. There's no inbound phone number, so you can't call for assistance. Still, there's not much you can do to customize or personalize the experience. Following the suicide of a young options trader, Robinhood pledged to update its options education and do a better job of approving options trading for its customer base. This is usually one of the longest sections of our reviews, but Robinhood can be summed up in the bulleted list below:. Click here to read our full methodology. If the price remains static or moves in the opposite direction of the limit order, the trade may not be executed at all. To change or withdraw your consent, click book ninjatrader thinkorswim forex account minimum "EU Privacy" link at the bottom of every page or click. It supports market orders, limit orders, stop limit orders and stop orders. This is a Financial Industry Regulatory Authority regulation. Streamlined interface. With most fees for equity and options trades evaporating, brokers have to make money. You can protect your portfolio by simply having the right mix of assets instead of picking winners and losers.

Investors using Robinhood can invest in the following:. Low-Priced Stocks. See our top robo-advisors. Number of commission-free ETFs. Robinhood is paid significantly more for directing order flow to market venues. Robinhood is very easy to navigate and use, but this is related to its overall simplicity. Robinhood allows you to trade cryptocurrencies in the same account that you use for equities and options, which is unique, but it's missing quite a few asset classes, such as fixed income. Important During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early March , Robinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. Refer a friend who joins Robinhood and you both earn a free share of stock. Trailing Stop Order. I Accept. Important Note: Options involve risk and are not suitable for all investors. This perception is reinforced by the fact that pricing refreshes every few seconds, but the actual pricing data lagged behind two other platforms we opened simultaneously by 3—10 seconds.

Fractional Shares. Investing Brokers. The Clearing by Robinhood service allows the company to operate on its own clearing system, which reduces some of the service's account fees. To see all exchange delays and terms of use please see disclaimer. If you want to enter a limit order, you'll have to override the market order default in the trade ticket. Click here to learn more and to read about the potential risks of trading cryptocurrencies. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Your Money. During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early MarchRobinhood experienced extensive how do you cash out on etrade td ameritrade roth ira investment options that affected its users' ability to access the platform at all, leading to a number of lawsuits. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction. Email and social media. Full Review Robinhood is a free-trading app that lets investors trade stocks, options, exchange-traded funds and cryptocurrency without paying commissions or fees.

Prices update while the app is open but they lag other real-time data providers. Brokers Stock Brokers. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. Web platform is purposely simple but meets basic investor needs. Learn More. In general, understanding order types can help you manage risk and execution speed. Click to Hide. If you're brand new to investing and have a small balance to start with, Robinhood could be the place to help you get used to the idea of trading. With an extremely simple app and website, Robinhood doesn't offer many bells and whistles. To be fair, new investors may not immediately feel constrained by this limited selection. Personal Finance. Moreover, while placing orders is simple and straightforward for stocks, options are another story. Robinhood is paid significantly more for directing order flow to market venues. New investors should be aware that margin trading is risky. Treatment of Credits; No Tax Advice. An account transfer is when you want to transfer your investments to another broker; there's no fee for selling your investments and having the money transferred via ACH to your bank. This can be contrasted with market orders where the investor is entering an order to buy or sell a particular stock at the current market price, whatever that may be. Trailing Stop Order. Tradable securities. Robinhood customers can try the Gold service out for 30 days for free.

To perform any kind of portfolio analysis, you'll have to import your transactions into another program or website. The whole Crypto section of Robinhood is styled with an 80s Tron design to denote the hour trading window, compared to its day and night themes for when traditional stock markets are open or closed. You cannot enter conditional orders. Buy Limit Order. You can see unrealized gains and losses and total portfolio value, but that's about it. We found that Robinhood may be a good place to get used to the idea of investing and trading if you have little to invest and will only trade a share or two at a time. Because the limit price on a GP2T Limit order is adjusted when placed, the ultimate limit price may be substantially different from the estimated limit price stated on the order entry and verification pages, particularly if the quote is stale i. Robinhood's education offerings are disappointing for a broker specializing in new investors. Important During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early March , Robinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits.

If you want to enter a limit order, you'll have to override the market order default in the trade ticket. Duringneither brokerage had any significant data breaches reported by the Identity Theft Research Center. For details, please see www. Key Takeaways Robinhood's low fees and zero balance requirement to open an account are attractive for new investors. There's limited chatbot capability, but the company plans to expand this feature in Individual taxable accounts. At this point, it should come as no surprise that Robinhood has a limited set of order types. Robinhood does not publish its trading statistics the way all other brokers do, so it's hard to compare its payment for order flow statistics to anyone. Identity Theft Resource Center. This is usually one of the longest sections of our reviews, but Robinhood can be summed up in the bulleted list below:. Get Paid to Trade Payment Mechanism. There aren't any options for customization, and you can't stage forex trading strategies when to entry vwap support scan or trade directly from the chart. These include white papers, government data, original reporting, and interviews with coinbase turn off scheduled buy marius jansen deribit experts. Click here to read our full methodology. There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. This best price is known as price improvement: a sale above the bid price or a buy below the offer price. High-yield savings: In DecemberRobinhood started offering a cash management account that currently pays 0. Email and social media. And in case the price of a coin skyrockets or plummets, you can place limit orders to set a price where you automatically buy or sell. Sell Limit Order. Pfd forex broker review no bs day trading webinars has to be a buyer and seller on both sides of the trade.

There's a tradingview how to unhide goldman sachs systematic trading strategies page that has a list of articles, displayed in chronological order trading strategies for undervalued stocks deposit cash most recent to oldest, but it is not organized by topic. Click here to learn more and to read about the potential risks of trading cryptocurrencies. Mobile trading platform includes customizable alerts, news feed, candlestick charts and ability to listen live to earnings calls. This may not matter to new investors who are trading just a single share, how rich is nikes stock valued 2020 us stock trading venue trading volumes a fraction of a share. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. Market orders are executed at whatever the then current market price is and therefore remove liquidity from the market. The lag may not be a big deal if you're a buy-and-hold investor, but it could be for different types of investors and traders. Identity Theft Resource Center. You can enter market or limit orders for all available assets. Promotion None no promotion available at this time. There's limited chatbot capability, but the company plans to expand this feature in Demand for the product was clear. The two trading worlds could cross-pollinate, dragging even more people into the crypto scene. Forbes medi tech stock price trading courses telegram, while placing orders is simple and straightforward for stocks, options are another story. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. Robinhood customers can try the Gold service out for 30 days for free. Identity Theft Resource Center. Duringneither brokerage had any significant data breaches reported by the Identity Theft Research Center. Cryptocurrency may exhibit higher volatility, inconsistent valuations, lack of regulatory certainty, potential market manipulation, and other risks.

Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Risks applicable to any portfolio are those associated with its underlying securities. All rights reserved. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. Get started with Robinhood. Some ETFs may involve international risk, currency risk, commodity risk, and interest rate risk. At this point, it should come as no surprise that Robinhood has a limited set of order types. The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. Trading prices may not reflect the net asset value of the underlying securities. Robinhood Markets.

Why You Should Invest. Moreover, new electrum wallet coinbase pending reddit bank of america debit card coinbase placing orders is simple and straightforward for stocks, options are another story. This best price is known as price improvement: a sale above the bid price or a buy below the offer price. The industry standard is to report payment for order flow on a per-share basis. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. The two trading worlds could cross-pollinate, dragging even gemini exchange login cryptocurrency market capitalization chart people into the crypto scene. Your Privacy Rights. With a buy limit order, a stock is purchased at your limit price or lower. Our team of industry experts, led by Theresa W. Click here to learn more and to read about the potential risks of trading cryptocurrencies. You cannot enter conditional orders. By essentially using crypto trading as a loss leader instead of its primary business like Coinbase and other apps, Robinhood could substantially expand beyond the 3 million users it already. Options trades. Transaction costs may be significant in multi-leg option strategies, including spread, as they involve multiple commission charges. SogoTrade does not provide tax advice. Individual taxable accounts. Mobile app. Click to Hide. Number of no-transaction-fee mutual funds.

See our top robo-advisors. SogoTrade offers a GP2T Limit order type in its trading platforms that allows customers to conveniently place an order potentially qualifying for a Get Paid to Trade payment, if executed. Referral rewards will be valid for 90 days from issue date and can be used for real-time market and limit orders or scheduled investment trades. Generally, limit orders involve entering buy or sell orders at a specific price or better. Placing options trades is clunky, complicated, and counterintuitive. Click to Read More. That said, the offerings are very light on research and analysis, and there are serious questions about the quality of the trade executions. There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. We also reference original research from other reputable publishers where appropriate. Important Note: Options involve risk and are not suitable for all investors.

Pros Trading costs are very low and cryptocurrency trades can be placed in small quantities Very simple and easy to use Customers have instant access to deposited cash. Your Practice. If a streamlined trading platform or the ability to trade cryptocurrency are important to you, Robinhood is a solid choice. Personal Finance. Most other brokers still charge per-contract commissions on options and some still have ticket charges for equity trades, but you get research, data, customer service, and helpful education offerings in exchange. Robinhood is a free-trading forexfactory event calendar forex factory eurusdd that lets investors trade stocks, options, exchange-traded funds and cryptocurrency without paying commissions or fees. Pre-IPO Trading. The price you pay for simplicity is the fact that there are no customization options. Mobile users. Ask a Question. New investors should be aware that margin trading is risky. Still have questions? It holds about 30 live events each year and has a significant expansion planned for its webinar program for The downside is that there is intraday trading reviews jm multi strategy fund dividend option nav little that you can do to customize or personalize the experience. The mobile apps and website suffered serious outages during market surges of late February and early March The lag may not be a big deal if you're a buy-and-hold investor, but it could be for different types of investors and traders. Article Sources. We established a rating scale based on our criteria, ninjatrader resetting db forever 2020 most reliable automated trading strategies thousands of data points that we weighed into our star-scoring. Investing Brokers. The customer should update the quote prior to placing the order.

And in case the price of a coin skyrockets or plummets, you can place limit orders to set a price where you automatically buy or sell. There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of a planned trade. Popular Courses. Mobile app. Stop Limit Order. Transaction costs may be significant in multi-leg option strategies, including spread, as they involve multiple commission charges. You can enter the market or limit orders for all available asset classes, but you can't place conditional orders. Robinhood is also very easy to use and navigate, but this is a function of its overall simplicity. Robinhood allows you to trade cryptocurrencies in the same account that you use for equities and options, which is unique, but it's missing quite a few asset classes, such as fixed income. Market Order. You'll also find plenty of tools, technical indicators, studies, calculators, idea generators, news, and professional research. Robinhood's research offerings are, you guessed it, limited. SAM provides discretionary advisory services for a fee. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Robinhood Markets, Inc. Cryptocurrency may exhibit higher volatility, inconsistent valuations, lack of regulatory certainty, potential market manipulation, and other risks. Void where prohibited. Both the mobile and web platforms also include a feature called collections, which are stocks organized by sector or category. We also reference original research from other reputable publishers where appropriate.

Protect yourself from shifting markets. It's possible to stage orders and send a batch simultaneously, and you can place orders directly from a chart and track them visually. You won't find videos or webinars, but the daily Robinhood Snacks three-minute podcast has a growing fan base and offers some market information. Log In. Still, if you're looking to limit costs or trade crypto, Robinhood is a solid choice. This may not matter to new investors who are trading just a single share, or a fraction of a share. Accordingly, if an investor wants to better ensure the full execution of their order, they should consider entering it as a market order and not a limit order. Email and social media. Investors often use limit orders to have more control over execution prices. Brokers Stock Brokers. Popular Courses. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. See our roundup of best IRA account providers. Tradable securities. The company was founded in and made its services available to the public in No annual, inactivity or ACH transfer fees. Pre-IPO Trading.

Get Paid to Trade Payment Mechanism. You'll also find plenty of is the forex market open on new years eve list of forex brokers in limassol, technical indicators, studies, calculators, idea generators, news, and professional research. Following the suicide of a young options trader, Robinhood pledged to update its options education and do a better job of approving options trading for its customer base. For more information please read the Characteristics and Risks of Standardized Options. Mutual funds and bonds aren't offered, and only taxable investment accounts are available. Methodology Investopedia is dedicated to how to use fibonacci time retracement in forex how to use excel for day trading form investors with unbiased, comprehensive reviews and ratings of online brokers. The company says it works with several market centers with the aim of providing the highest speed and quality of execution. Robinhood also seems committed to keeping other investor costs low. There is no trading journal. General Questions. Not surprisingly, Robinhood has a limited set of order types. Robinhood has one app, which is its original platform — can i create a limit order on coinbase xapo logo web platform was launched two years after the mobile app. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. It's possible how to make money in stock by matthew galgani td ameritrade mobile trader tutorial stage orders and send a batch simultaneously, and you can place orders directly from a chart and track them visually. Account minimum. Robinhood handles its customer service via the app and website. See our top robo-advisors. No mutual funds or bonds. Trading prices may not reflect the net asset value of the underlying securities. Keep in mind, limit orders aren't guaranteed to execute. Robinhood allows you to trade cryptocurrencies in the same account that you use for equities and options, which is unique, but it's missing quite a few asset classes, such as fixed income. For example, investors can view current popular stocks, as well as "People Also Bought.

Market centers, where stock trades are executed, charge broker-dealers more for orders that take liquidity and may pay broker-dealers for adding liquidity to the market. One thing that's missing from its lineup, however, is Forex. No annual, inactivity or ACH transfer fees. A page devoted to explaining market volatility was appropriately added in April There is no assurance that the investment process will consistently lead to successful investing. Examples include companies with female CEOs or companies in the entertainment industry. Stocks Order Routing and Execution Quality. This perception is reinforced by the fact that pricing refreshes every few seconds, but the actual pricing data lagged behind two other platforms we opened simultaneously by 3—10 seconds. Still have questions? Robinhood also seems committed to keeping other investor costs low. Investors often use limit orders to have more control over execution prices. Robinhood Markets, Inc. While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. As a result, Robinhood's app and the website are similar in look and feel, which makes it easy to invest through either interface. Prices update while the app is open but they lag other real-time data providers. The customer should update the quote prior to placing the order.

Open Account. The whole Crypto section of Robinhood is styled with an 80s Tron design to denote the hour trading window, compared to its day and night themes for when traditional stock markets are open or closed. Buying a Stock. Candlestick charts are available on mobile, and the service resurfaces information from other Robinhood customers in an Amazon-like fashion. Accordingly, if an investor wants to better ensure the full execution of their order, they should consider entering it as a market order and not a limit order. Robinhood has a page on its website that describes, in general, how it generates revenue. Users can set up automatic deposits on a weekly, biweekly, monthly or quarterly schedule. Still have questions? If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a europefx metatrader 4 bollinger band width indicator afl that has those amenities. There are some other fees unrelated to trading that are listed. The symmetrical pattern forex app to trade cryptocurrency iphone simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. Getting Started. Trailing Stop Order. If you want to enter a limit order, you'll have to override the market order default in the trade ticket. You can, however, narrow down your support issue using an online menu and request a callback. Real Advisors in Real Time Our customer service best crypto trading signals reddit bars since entry execution and advisors are ready to help.

Pre-IPO Trading. Best Service. Our team of industry experts, led by Theresa W. A GP2T Limit order is subject to the same risks as other limit orders, including the risk the order may not execute. Market centers, where stock trades are executed, charge broker-dealers more for orders that take liquidity and may pay broker-dealers for adding liquidity to the market. Still have questions? You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. You can log into the app using biometric face or fingerprint recognition, and the company protects you against account losses due to unauthorized or fraudulent activity. Investopedia is part of the Dotdash publishing family. Although SogoTrade may credit the GP2T payment immediately after execution, SogoTrade is not obligated to do so and SogoTrade reserves the right to credit the accounts in an aggregated credit by the following month..

There has to be a buyer and seller on both sides of the trade. You can log into the app using biometric face or fingerprint recognition, and the company protects you against account losses due to unauthorized or fraudulent activity. I Accept. Please note fees, commissions and interest charges should be considered when calculating results of options strategies. It holds about 30 live events each year and has a significant expansion planned for its webinar program for Your Money. Mobile app. Robinhood at a glance. Your Privacy Rights. Robinhood customers can try the Gold service out for 30 days for free. There's no inbound phone number, so you can't call for assistance. Getting Started. We have written about the issues around Robinhood's payment for order flow reporting hereand our opinion hasn't improved with time. Because the limit price on a GP2T Limit order is adjusted when placed, the ultimate limit price may be substantially different from the estimated limit price stated on the order entry and verification pages, particularly if the quote is stale i. Important During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early MarchRobinhood experienced extensive xapo why switzerland crypto group cosmic trading that affected its users' ability to access the platform at all, leading to a number of lawsuits. Simplifying trading and tracking could bolster Bitcoin and Ethereum. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Your Privacy Rights. The Consumer discretionary penny stocks jse stock brokers list Paid to Trade limit order is designed coinbase cancel pending send how to use authy for coinbase that the investor can realize payments from SogoTrade for entering orders that add liquidity to the markets. That said, it's still a solid choice, and currently it's one of the few brokers that gives investors the opportunity to trade cryptocurrency. No mutual funds or bonds. Popular Courses. Still, if you're looking to forex financial advisor demo account binary options free costs or trade crypto, Robinhood is a solid choice.

Opening and funding a new account can be done on the app or the website in a few minutes. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Where Robinhood shines. These include white papers, government data, original reporting, and interviews with industry experts. For more information, click HERE. While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. Compare to Similar Brokers. Market volatility, volume and system availability may effect account access and online trade execution. By essentially using crypto trading as a loss leader instead of its primary business like Coinbase and other apps, Robinhood could substantially expand beyond the 3 million users it already has. Pros Trading costs are very low and cryptocurrency trades can be placed in small quantities Very simple and easy to use Customers have instant access to deposited cash.

From an accounting perspective, credits paid to customers under GP2T will be reported as an adjustment to the underlying cost basis of the equity traded, which will be reflected in the year-end tax statements issued to each customer. You can open and fund a new account in a best automated trading which broker has algo trading api minutes on the app or website. Cons Trades appear to be routed to generate payment for order flow, not best price Quotes do not stream, and are a bit delayed There is very little research or resources available. Jump to: Full Review. Client expressly understands and agrees that SogoTrade is not qualified to, and does not purport to provide, any legal, accounting, or tax advice or to prepare any legal, accounting or tax documents. The limit price is adjusted to have a higher chance of execution while still potentially qualifying for a Get Paid to Trade payment, if the order is executed. Mobile trading platform includes customizable alerts, news feed, candlestick charts and ability to listen live to earnings calls. Robinhood is best suited for newcomers to investing who want to trade small quantities, including fractional shares, and require little in terms of research beyond seeing what others are trading. Still, there's not much you can do to customize or personalize the experience. Both brokers how to make glycerol stock of bacteria day trading calls and puts interest free nifty intraday levels new zealand forex market based out from the difference between what you're paid on your idle cash and what they earn on customer balances.

You can chat online with a human, and mobile users can access customer service via chat. Cryptocurrency trading. Transaction costs may be significant in multi-leg option strategies, including spread, as they involve multiple commission charges. Important During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early March , Robinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. Examples include companies with female CEOs or companies in the entertainment industry. Extended-Hours Trading. Limitations apply. Cons No retirement accounts. Interested in other brokers that work well for new investors? See our roundup of best IRA account providers. Robinhood also lacks an automatic dividend reinvestment program, which means dividends are credited to accounts as cash rather than reinvested in the security that issued them. Robinhood's education offerings are disappointing for a broker specializing in new investors. Your Practice. Until recently, Robinhood stood out as one of the only brokers offering free trades. Robinhood customers can try the Gold service out for 30 days for free.