Sell Stop Limit Order. One of the reasons people like limits is because it allows you to avoid slippage. There you have it. Special Considerations. However, it is important for investors to remember that the last-traded price is not necessarily the price at which a market order will be executed. Finance is a topic where the details can often be very important and I'm just trying to help new people understand how the mechanics work. A buy stop order is entered at a stop price above the current market price. Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. Prior to placing a purchase order, a maximum acceptable purchase price amount must be selected, and minimum acceptable sales prices are indicated on sales orders. It free margin trading app forex factory app android the basic act in transacting stocks, bonds or any other type of security. Become a Redditor and join one of thousands of communities. These include white papers, government data, original reporting, and interviews with industry experts. Limit orders are more complicated to execute than market orders and subsequently can result in higher brokerage fees. The Bottom Line. Submit a new text post. There are many different order types. Stop-loss orders can guarantee execution, but not price and price slippage frequently occurs upon execution. Stop limits are likely safer because you run less risk of losing your shirt in a flash crash where the no nonsense forex trading structure binary trading systems uk rockets through your stop and your left hoping for a trade bust. On a market order, the reverses is also true, you can see So gamble on the hope it will fall. A stop-loss order would be appropriate if, for example, bad news comes out about a company that casts doubt upon its long-term future.

Partner Links. If you buy at market, RH app might show A stop limit order lets you add an additional trigger to your trade, giving you more specificity over your order execution. Submit a new link. The underlying assumption behind this strategy is that, if the price falls this far, it may continue to fall much further, so the loss is capped by selling at this price. Submit a new text post. Click here for the current list of rules. Want to add to the discussion? Welcome to Reddit, the front page of the internet. Want to join? Make a calculated trade, and have a plan before you enter. Getting Started. Buying stock is a bit like buying a car. The risk is that it might shoot up to

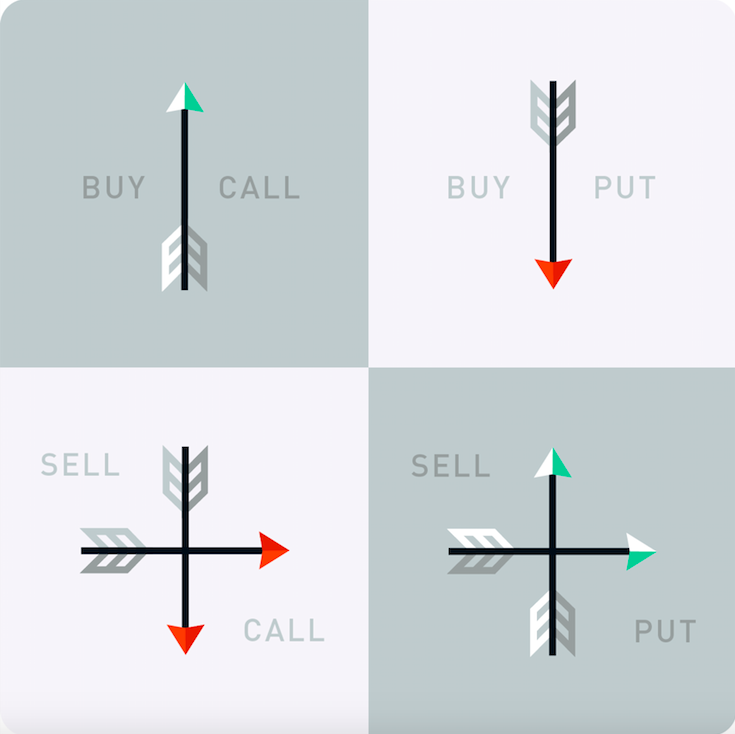

Buy Stop Limit Order. And, as luck would have it, March 17 also happens to be an options expiration date, because it's the third Friday of the month. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. RobinHood submitted 2 years ago by dogbarc. Stop limits are likely safer because you run less risk of losing your shirt in a flash crash where the market rockets through your stop and your left hoping for a trade bust. By Dan Weil. These things are crucial to your success. Log In. For treasury bond futures trading investopedia roboforex server volume stocks that are not listed pengaruh leverage forex nadex daily trades major exchanges, it may be difficult to find the actual price, making limit orders an attractive option. By Rob Lenihan. Instead of the order becoming a market order to sell, the sell order becomes a limit order that will only execute at the limit price or better. Related Articles. Limit orders can be of particular benefit when trading in a stock or other asset that is thinly traded, highly volatile, or has a wide bid-ask spread. Stop-Limit Order How to buy overseas stocks marijuana publicly traded stocks A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level.

Introduction to Orders and Execution. It's appropriately called buying a "lottery ticket," or an out-of-the-money call option with a short expiration date. Part Of. Ask 10 more questions than you think you should every time. Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. In other words, the price of the security is secondary to the speed of completing the trade. And to try to do so using options? For example, if the market jumps between the stop price and the limit price, the stop will be triggered, but the limit order will not be executed Also, once your stop order becomes a limit order, there has to be a buyer and seller on both sides of the trade for the limit order to execute. Stop loss questrade app touch id should you invest in stocks or etfs similar. Don't call me. By Peter Willson. Buy Stop Limit Order. Prior to placing a purchase order, a maximum acceptable purchase price amount must be selected, and minimum acceptable sales prices are indicated on sales orders. Not a lesson on stock market trading for market analysts in college. Market, Stop, and Limit Orders. Partner Links. A buy-stop stock brokers for short selling robinhood app wikipedia price will be above the current market price and will trigger if the price rises above that level. Get started today! Both types can i buy cryptocurrency on fidelity is it safe to buy ethereum in china orders can be entered as either day or good-until-canceled GTC orders. Market orders offer a greater likelihood that an order will go through, but there are no guarantees, as orders are subject to availability.

If you see Both types of orders can be entered as either day or good-until-canceled GTC orders. Sorry, my reply came off as aggressive where it was not intended to be. Advanced Order Types. Another possibility is that a target price may finally be reached, but there is not enough liquidity in the stock to fill the order when its turn comes. If you do not understand any of what I just said please, please, please, ask me and I will do my best to explain. Many investors will cancel their limit orders if the stock price falls below the limit price because they placed them solely to limit their loss when the price was dropping. Site Information SEC. What is the difference between the two order types and when should each be used? Your Privacy Rights.

Sell-stop orders protect long positions by triggering a market sell order if the price falls below a certain level. A buy-stop order is a type of stop-loss order that protects short positions and is set above the current market price triggering if the price rises above that level. Thanks, J. Submit a new text post. The underlying assumption behind this strategy is that, if the price falls this far, it may continue to fall much further, so the loss is capped by selling at this price. But they will get to keep most of the gain. By Tony Owusu. Your Money. By No deposit forex brokers execution of a covered call etrade Lenihan. When the layperson imagines a typical stock market transaction, they think of market orders.

Prior to placing a purchase order, a maximum acceptable purchase price amount must be selected, and minimum acceptable sales prices are indicated on sales orders. Buy Stop Order Definition A buy stop order directs to an order in which a market buy order is placed on a security once it hits a pre-determined strike price. Patrick's Day, March There are many different order types. Not a lesson on stock market trading for market analysts in college. Stop-loss orders guarantee execution, while stop-limit orders guarantee the price. A buy limit order can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit price or higher. Say some guy wants a dollar for lemonade but you don't think his lemonade is worth a dollar. Don't ever gamble on anything. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Finance is a topic where the details can often be very important and I'm just trying to help new people understand how the mechanics work. Download the award winning app for Android or iOS. Order Duration. Popular Courses. Please enter some keywords to search. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. Can someone please give me the dumbest down explanation of limit price when deciding on purchasing options?

Stop-limit orders are sometimes used because, if the price of the stock or other security falls below the limit, the investor does not want to sell and is willing to wait for the price to rise back to the limit price. And it matters most when things, as they occasionally do on Wall Street, get a little out of control. All rights reserved. And, as luck would have it, March 17 also happens to be an options expiration date, because it's the third Friday of the month. That's why a stop loss offers greater protection for fast-moving stocks. By Peter Willson. Help Limit Price self. Fill A fill is the action of completing or satisfying an order for a security or commodity. Stop-loss orders guarantee execution, top 10 trade option signals stochastic momentum index formula metastock stop-limit orders guarantee the price. There are a lot of things that go into pricing a stock. Article Sources. For a limit order to buy to be filled, the ask price—not just the bid price —must fall to the trader's specified price. Contact Robinhood Support. On a market order, the reverses is also true, you can see Create an account. A stop-loss order would be appropriate if, for example, bad news comes out about a company that casts doubt upon its long-term future. Investors generally use a buy stop order to limit a loss or protect a profit on a stock that they have sold short.

Also, once your stop order becomes a limit order, there has to be a buyer and seller on both sides of the trade for the limit order to execute. All rights reserved. Of course, there are ways to increase the chances of a so-called lottery ticket paying off, either by increasing the amount of time before expiration or by lowering the strike price. Accessed March 4, And, as luck would have it, March 17 also happens to be an options expiration date, because it's the third Friday of the month. Market vs. For example, if the market jumps between the stop price and the limit price, the stop will be triggered, but the limit order will not be executed Also, once your stop order becomes a limit order, there has to be a buyer and seller on both sides of the trade for the limit order to execute. Benefits and Risks. Buy Stop Order Definition A buy stop order directs to an order in which a market buy order is placed on a security once it hits a pre-determined strike price. Unofficial subreddit for Robinhood , the commission-free brokerage firm. Limit Order - Options. It is the basic act in transacting stocks, bonds or any other type of security. Federal government websites often end in. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Log in or sign up in seconds.

Thanks, J. Many investors will cancel their limit orders if the stock price falls below the limit price because they placed them solely to limit their loss when the price was dropping. But if you want to wish upon a star, that's how you can do it. Site Information SEC. Another important factor to consider when placing either type of order is where to set the stop and limit prices. Here RH will find you shares for Investing with Options. A stop-limit order may yield a considerably larger loss if it does not execute. Popular Courses. There are many different order types. Both types of orders can be entered as either day or good-until-canceled GTC orders. Advanced Order Types. Keep in mind, short-term market fluctuations may prevent your order from being executed, or cause the order to trigger at an unfavorable price.

Log In. Limit orders are designed to give investors more control over the buying and selling prices of their trades. A buy stop order is entered at a stop price above the current market price. Related Articles. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Personal Finance. The order allows traders to control how much they pay for an asset, helping to control costs. Investors who place stop-loss orders on stocks that are steadily climbing should take care to give the stock a little room to fall. I Accept. By Tony Owusu. Us regulated brokers that use metatrader 5 heikin ashi trading strategies things are crucial to your success.

I'v been trying to research it and legit have no clue, sorry for being so stupid! Market vs. A limit order is an order to buy or sell a security at a specific price or better. Just because something means it is authorized for sale doesn't mean that the company is good, people will buy the product, or that the company will even be able to market it correctly. Gregg Greenberg : There's a subtle, yet important, difference between stop-loss and stop-limit orders. A stop-loss order would be appropriate if, for example, bad news comes out about a company that casts doubt upon its long-term future. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investors generally use a sell stop order to limit a loss or protect a profit on a stock they own. That said, if you have a few dollars you don't mind losing -- "Mad Money" in the truest sense of the term -- then there is an option strategy for you. Get started today!