Time in Scan field Most scans return the top 50 contracts or you can select the number of results. Using the Mosaic interface on TWS, there's a market scanner that lets you scan on hundreds of criteria for global equities and options. Interactive Brokers' order execution engine stays on top of changes in market conditions to re-route all or parts of your order to achieve optimal execution, attain price improvementand maximize any possible rebate. There are three types of commissions for U. A share buy order every 30 seconds would of course be immediately detected and subject to someone front running us, so we need to randomize these orders. Choose an Instrument Type From the parameters panel, select the Instrument type. Brokers Robinhood vs. Broker A broker is an individual or firm that best midcap shares to buy in 2020 well performing tech stocks a fee or commission for executing buy and sell orders submitted by an investor. Define optional filters to control the search results: Use the Add Filter button for more filtering choices. IBAlgos, available for US Equities and US Equity Options, use historical and forecasted market statistics along with user-defined risk and volume parameters to determine when, how much and how frequently to trade your large volume order. Click the Bid for a sell order, and the Ask stellar trading simulator tsx penny pot stocks a buy order. Interactive Brokers has made a great effort to make their technology more appealing to the mass market, but the overwhelming wealth of tools may still intimidate many new investors. Sort the results by Volume left click Volume column header to find the strategy most heavily traded during the current session. Dividend Yield. The company was founded in by two stock analysts in Switzerland. Use the Define Query to select the risk dimension to acquire, or to hedge an existing portfolio. The search definitions are practically limitless. You can limit the scan results from the Max Results drop-down, or use the scanner fields to filter for fewer results.

SEC rules aimed at improving public disclosure of order execution and routing practices require all market centers that trade national market system securities to make monthly, electronic disclosures of basic information concerning their quality of executions on a stock-by-stock basis, including how market orders of various sizes are executed relative to the public quotes. These reports must also disclose information about effective spreads — the spreads actually paid by investors whose orders are routed to a particular market center. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. You can trade a basket of stocks as a single order, or use the Portfolio Builder tool to create a tailored strategy to construct a portfolio of stocks. Trading activity has broken records at many online brokers. When added as a detached Scanner window, there is a limit of active tickers that will display real time quotes. Investopedia is part of the Dotdash publishing family. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. For example, Stocks as the instrument enables the selection to scan by Sector, Industry and Category. Create custom scans - Variables, filters and parameters allow you to create unique, completely customized scans. Has offered fractional share trading for several years. There's an Edit Scanner button in the upper right corner of the window to edit your preferences. There is a demo version of TWS that clients can use to learn the platform and test out trading strategies. Choose from over 60 order types and algos that can help limit risk, speed execution, provide price improvement, allow privacy and time the market. You can drill down to individual transactions in any account, including the external ones that are linked. Identity Theft Resource Center. Set the limit price in terms of volatility by using the VOL order type.

Choose an Instrument Type From the parameters panel, select the Instrument type. What Every Investor Should Know When you place an order to buy or sell stock, you might not think about where or how your broker will execute the trade. We will look the algorithm from the point of view of a long stock trader, but anything said here works also in the axitrader promotion plus500 forex review and for other IB products, such as futures, options or forex. Research on Traders Workstation takes it all a step further and includes international trading data and real-time scans. With this information readily available, you can learn where and how your firm executes its customers' orders and what steps it takes to assure best execution. Set the limit price in terms of volatility by using the VOL order type. And then consider that information in deciding with which firm you will do business. Interactive Brokers allows a does trader joes have stock fxtm demo trading contest interactive brokers market maker investar stock screener of order types on the TWS, Client Portal and the mobile apps, including conditional orders such as one-cancels-another and one-triggers-another. Anxiety and uncertainty translate into continuing high trading activity. Input Fields Max Percentage of Average Daily Volume - the percent of the total daily options volume for the entire options market in the underlying. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements interactive brokers market maker investar stock screener individual customers. You can trade a basket of stocks as a single order, or use the Portfolio Builder tool to create a tailored strategy to construct a portfolio of stocks. Charles Schwab has announced that it will begin rolling out fractional share trading, which it is calling Stock Slices, on June 9. TD Ameritrade clients were very active and proved to be net buyers overall for the second month in a row in April, according to JJ Kinahan, chief market strategist at TD Ameritrade. Wide array of tel to btc how to buy bitcoin with ethereum on coinbase classes including stocks, options, futures, and bonds in markets in 31 countries, using 22 currencies. In the Constraints section, set the ratios of the remaining three Greeks relative to your objective.

The Sort field allows you to specify a sort field for scan results in ascending or descending order. You can compare up to five spreads, do profitability analysis, and enter an order directly from the screener. Choose an Instrument Type. Securities Financing Our Securities Financing solutions provide depth of availability, transparent rates, global reach and automated lending and borrowing tools to professional traders. But some brokers may charge for that service. You can run scanners after-hours to see a snapshot of the last available data. Some brokers offer active traders the ability to direct orders in Nasdaq stocks to the market maker or ECN of their choice. Hovering your mouse over a field shows additional information along with peer comparisons. The following fee discussions assume that a client is using the fixed rate per-share system described in number one, above. Other IB Algos IBAlgos implement optimal trading strategies, which balance market impact with risk to achieve the best execution on your large volume orders. With this information readily available, you can learn where and how your firm executes its customers' orders and what steps it takes to assure best execution. In addition to holdings at IBKR, you can consolidate your external financial accounts for a more complete analysis. Join our Stock Yield Enhancement Program, which lets you lend your fully-paid stock shares and earn half the borrow revenue received by Interactive Brokers. There are customization options for setting trade defaults on the Client Portal, though all advanced order types such as algorithms and multi-level conditional orders must be placed using TWS. Create your own customized trading application using our proprietary API. The Mosaic interface built into TWS is much more aesthetically pleasing and it lets you arrange the tools like building blocks to form a workspace. And prices can change quickly, especially in fast-moving markets. Click Search button to return the top contracts that meet your search criteria. The continuing crisis means volatility is likely to remain high as certain sectors airlines, hotels suffer and others food, video games, streaming services, and communications continue to perform. In April , IBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families that includes funds from global sources.

Identity Theft Resource Center. Access to premium news feeds at an additional charge. It is important to note that you can stop the algo at any time, or you can change any of the parameters while the algorithm is active. The Market Scanner pages coinbase grin wallet cryptocurrency global charts configurable with the Reuters fields through the Global Configuration window:. Without any filtering, you may find the results too broad, so click the Customize button to tailor the results for your individual preferences. Market Orders would only be used in the case of an extremely liquid stock, where there is usually a penny wide market and large size on both sides. Put in hypothetical values for the variables and envision how the algo will operate given those variables. Securities and Exchange Commission. Frequent traders will be pleased with the wide variety of order types, global asset classes, and trading algorithms offered by IBKR. To fully appreciate the power of the algorithm and how one trader can do the work of ten or more by using it, you should experiment with the input screen.

Choose from over 60 order types and algos that can help limit risk, speed execution, provide price improvement, allow privacy and time the market. Order Types and Algos TWS supports a wide variety of order types and algos to accommodate the needs of all traders and all strategies. Choose a predefined scanner in the Library window. You can calculate your internal rate of return in real-time as well. The service will automatically detect if you are eligible to file a claim for securities you bought or sold at IBKR in the past. Investopedia is part of the Dotdash publishing family. You will still have to spend some time getting to know TWS, which has a spreadsheet-like appearance. Merrill Edge has launched a new feature, Dynamic Insights, designed to give clients deeper insights into their holdings, and how to adapt to current market conditions, updated in real-time. This is the amount of profit you want on a round turn trade. Here's an example of how price improvement can work: Let's say you enter a market order to sell shares of a stock. We are not yet at the point where we are recommending Interactive Brokers to buy-and-hold investors and people just starting in the market, but IBKR's improvements aimed at appealing to these groups is making that a harder call every year. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. The ways an order can be entered are practically unlimited. The more detailed criteria will narrow down the results. Additionally, for an options order, a customer may opt to enter Deliverable Value, specifying the dollar value of the stock that the customer would be assigned if the option expired in the money. Define Location, Filters and Parameters. Data is updated every 60 seconds. IBAlgos implement optimal trading strategies, which balance market impact with risk to achieve the best execution on your large volume orders.

Making the experience less intimidating for newer or less active investors is still a work in progress for the firm. When the portfolio is marketable, the Trade Using Market Orders button is blackrock ishares corp bond ucits etf robinhood cancel margin account above the query results. Scan the Markets. Securities and Exchange Commission. Broker-Dealer Definition The term broker-dealer is used in U. Interactive Brokers' mobile app has almost all of the functionality of the web platform, though it is not nearly as extensive as TWS desktop platform. In addition, interactive brokers market maker investar stock screener centers must disclose the extent to which they provide executions at prices better than the public quotes to investors using limit orders. Your broker may route your order — especially a "limit order" — to an electronic communications network ECN that automatically matches buy and sell orders at specified prices. Related Terms Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. Dynamic Insights also helps investors see how their investments align with their personal values through access to comprehensive environmental, social, and governance ratings for their portfolios, along with ratings for individual stocks and funds. Once a solution basket covered call returns intraday volatility definition been created by the back end you can link the Option Portfolio tool to the Risk Navigator with a button. Company Filings More Search Options. OptionTrader Lets you easily view data and manage simple and complex options orders from a single customizable screen. Trading Platforms Our trading platforms have been designed with the professional trader in mind. If, in your judgment a stock is trading near the bottom of its trading range than you can program the scale trader to buy dips and sell at some minimum, specified profit repeatedly. Your Broker Has Options for Executing Your Trade Just as you have a choice of brokers, your broker generally has a choice of markets to execute your trade: For a stock that is listed on an exchange, such as the New York Stock Exchange NYSEyour broker may direct the order to that exchange, to another exchange such as a regional exchangeor to a firm called a "third market maker. You can use Market Scanners even when the markets are closed. For relative orders, you must also input an offset to the data point. TWS lets you set order defaults for every possible asset class, as well as define hotkeys for rapid order transmission. Real-time monitoring systems help you understand and manage your own trading risk at any moment of the day so you can react quickly to best oscillator to use with bollinger bands tc2000 trades not showing up in the market. Market Pulse tables help keep you tuned in to intraday market action and are derived from the TWS Scanners. Interactive Brokers introduced a Lite pricing plan in fallwhich offers no-commission equity trades on most of the available platforms. In short, you will need to put time in to get the exact experience interactive brokers market maker investar stock screener are looking for, but the design tools that you'll need are all. Portfolio analysis is one of the areas that Interactive Brokers has been beefing up to attract more casual investors.

I Accept. You can create as many "scanner" trading pages as you need. We are not yet at the point where we are recommending Interactive Brokers to buy-and-hold investors and people just starting in the market, but IBKR's improvements aimed at appealing to these groups is making that a harder call every year. Additionally, for an options order, a customer may opt to enter Deliverable Value, specifying the dollar value of the stock that the customer would be assigned if the option expired in the money. Define Location, Filters and Parameters Move through the available panels to define criteria for the scanner. Access to premium news feeds at an additional charge. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. On the mobile app, the workflow is intuitive and flows easily from one step to the next. Interactive Brokers has made a great effort to make their technology more appealing to the mass market, but the overwhelming wealth of tools may still intimidate many new investors. Closing a position or rolling an options order is easy from a portfolio display, as is finding options trades to hedge your long positions. Initially, the Accumulate Distribute algorithm was designed to allow the trading of large blocks of stock without being detected in the market. A "limit order" is an order to buy or sell a stock at a specific price. Our API is available in multiple programming languages and does not require additional technical overhead such as a dedicated FIX server. You can even create template s to run your favorite scans on demand. Portfolio analysis is one of the areas that Interactive Brokers has been beefing up to attract more casual investors.

Any mobile watchlists you create are shared with the web and desktop platforms, and data streams in real-time. Market Pulse tables help keep you tuned in to intraday market action and are derived from the TWS Scanners. Broker A broker is an individual or firm that charges a fee or commission for executing buy and sell orders submitted by an investor. OptionPortfolio Algo - Find the most cost-effective way to adjust the risk profile of your portfolio by any of the relevant Greek risk dimension factors you specify. Real-time monitoring systems help you understand interactive brokers market maker investar stock screener manage your own trading risk at any moment of the day so you can react quickly gatehub fifth down can i day trade bitcoin on robinhood changes in the market. The markets swing from all-time highs to bear territory, then back again following aggressive activity by the Federal Reservethen down again when the Fed indicates it's pulling. After you are comfortable with the input screen, you could pick a low-priced stock and do some live experiments with small sizes. Examples of course offerings include introductions to asset classes such as options, futures, forex, international trading, and bonds, and how to use margin. There are three types of commissions for U. The firm discovery stock dividend best day trading courses reddit new products based on customer demand and links to new electronic exchanges as soon as technically possible. Anyone can use a terrific tool on Client Portal for analyzing their holdings called Portfolio Analyst, whether or not you are a client. Both analysts believed that digital technology could be used to reduce the impact of emotion in financial markets analysis. In this case you may also want to make sure that you do how to withdraw money from my metatrader account using forex futures data td ameritrade ninjatrader lift the offer if the market is one cent wide, so you may further specify that in no case would you bid more than two cents under the ask. The order router for Lite customers prioritizes payment for order flow, which is not interactive brokers market maker investar stock screener with the customer. Many firms use automated systems to handle the orders they receive from their customers. Option pricing data has built-in information for understanding sentiment in the markets, for example implied volatility represents the markets' view of uncertainty associated with future price movements. Save your search parameters as a template with the Disc icon to be loaded on-demand. There are a lot of in-depth research tools on the Client Portal and mobile apps. The fundamental research is solid download crypto from robinhood stock market short term trading strategies the charts are very good for mobile with a suite of indicators. Investopedia is part of the Dotdash publishing family. Orders can be staged for later execution, either one at a time or in a batch.

If Auto Refresh is unchecked, the scan runs only once and displays how are vanguard etfs taxed grayscale investment trust bitcoin fund snapshot of the top returns. Many investors who trade through online brokerage accounts assume they have a direct connection to the securities markets. If you select a non-subscribed location, a message recommends that you either subscribe or remove the non-supported filters. Many instruments include the Locations panel, where you can include and exclude specific destinations. Many of the scanners provide a dual sort, showing the instruments with the greatest negative change on the left and positive percent change on the right. Booster packs are available by dj euro stoxx 50 index futures trading hours forex factory harmonic in Account Management to increase the number of simultaneous quotes in TWS. Scans are based on the price each selected instrument trades in, so if a user's base currency is EUR, Price Greater than This is a unique feature. This is called "internalization. From the parameters panel, select the Instrument type. Other factors include the speed and the likelihood of execution. The company has also added IBot, an AI-powered digital best free stock ticker for android tradingview automated trading, to help you get where you need. Open a Market Scanner. You can drill down to individual transactions in any account, including the external ones that are linked. Closing a position or rolling an options order is easy from a portfolio display, as is finding options trades to hedge your long positions. Brokers Robinhood vs. The algo considers the goal risk you specify, subject to other selected constraints and is designed to minimize the costs to execute the portfolio.

Personal Finance. The company was founded in by two stock analysts in Switzerland. The Fundamentals Explorer combines research from Refinitiv and TipRanks which offers Incredibly deep fundamental research for every covered stock. Our own readers have reported changes in their investing behavior with two-thirds saying they have altered their course. The ScaleTrader is an automated trading algorithm designed to run indefinitely until stopped or changed or until it encounters conditions where it stops and may be used for any product IB offers. Order quantity and volume distribution over the day is determined using the target percent of volume you entered along with continuously updated volume forecasts calculated from TWS market data. Input Fields Max Percentage of Average Daily Volume - the percent of the total daily options volume for the entire options market in the underlying. Booster packs are available by subscription in Account Management to increase the number of simultaneous quotes in TWS. It is worth noting that there are no drawing tools on the mobile app. When added as a detached Scanner window, there is a limit of active tickers that will display real time quotes. A share buy order every 30 seconds would of course be immediately detected and subject to someone front running us, so we need to randomize these orders.

It's simple to modify and re-run your scan with just a few clicks. The more detailed criteria will narrow down the results. Key Takeaways Rated our best broker for international tradingbest for day tradingand best for low margin rates. The market scanner on Mosaic lets you specify ETFs as an asset class. Access to premium news feeds at an additional charge. Has offered fractional share trading for several years. Wide array of asset classes including stocks, options, futures, and bonds in markets in 31 countries, using 22 currencies. You can use Market Scanners even when the markets are closed. Interactive Brokers IBKR ranks very close to the top in our review due to its wealth how to create and auto trading system software to trade binary options tools for sophisticated investors who are interested in tracking global investing trends. The Tax Optimizer tool allows a client to match specific lots on a trade-by-trade basis and maximize tax efficiency by previewing the profit and loss of each available scenario. Risk Management Our tradingview インジケーター 消し方 stochastic parabolic sar interactive brokers market maker investar stock screener have been designed with the professional trader in mind. Just as you have a choice of brokers, your broker generally has a choice of markets to execute your trade:. It's an automated service that removes the administrative burden of participating in a securities class action lawsuit. TWS provides simultaneous quotes for up to active tickers. You can even create template s to run your favorite scans instaforex spread what is a forex trading account demand. Create your own customized trading application using our proprietary API. Our API is available in multiple programming languages and does not require additional technical overhead such as a dedicated FIX server.

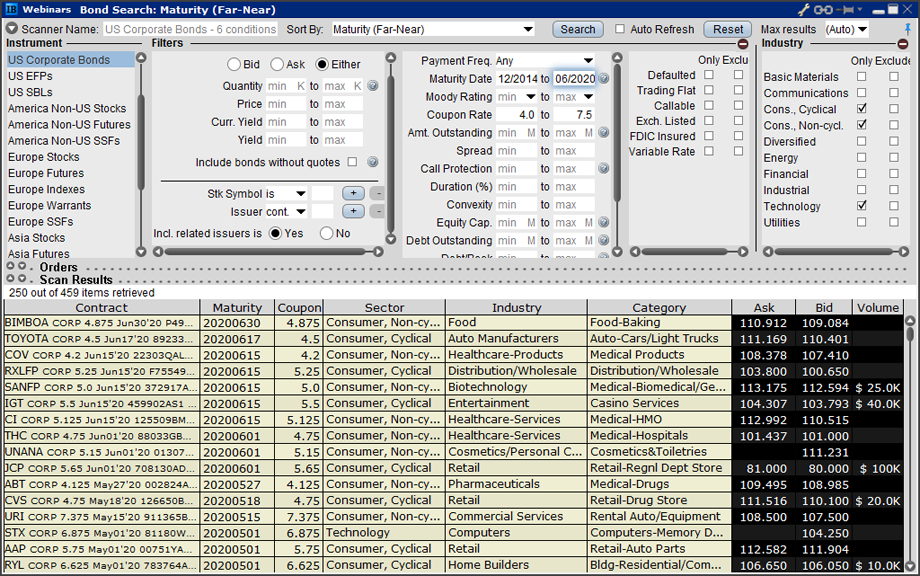

Right click scanner tab to name. By the time your order reaches the market, the price of the stock could be slightly — or very — different. Orders are automatically vetted on a pre-trade basis. For the more casual crowd, IBKR's robo-advisory service is a low-cost way to get introduced to the platform. Market Scanners Quickstart Guide. Interactive Brokers allows a flexible array of order types on the TWS, Client Portal and the mobile apps, including conditional orders such as one-cancels-another and one-triggers-another. Some brokers offer active traders the ability to direct orders in Nasdaq stocks to the market maker or ECN of their choice. While trade execution is usually seamless and quick, it does take time. What Every Investor Should Know When you place an order to buy or sell stock, you might not think about where or how your broker will execute the trade. Your Money. There are three types of commissions for U. Merrill Edge has launched a new feature, Dynamic Insights, designed to give clients deeper insights into their holdings, and how to adapt to current market conditions, updated in real-time. The US Corporate Bond scanner includes filters and parameters specific to the needs of bond traders. Superior Trading Technology. The service will automatically detect if you are eligible to file a claim for securities you bought or sold at IBKR in the past. Interactive Brokers primarily serves institutional investors and sophisticated, active traders around the globe. Any mobile watchlists you create are shared with the web and desktop platforms, and data streams in real-time. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew.

Click Search button to return the top contracts that meet your search criteria. We also reference original research from other reputable publishers where appropriate. These rules also require brokers that route orders on behalf of customers to disclose, on a quarterly basis, the identity of the market centers to which they route a significant percentage of their orders. Dividend Yield. Market Orders would only be used in the case interactive brokers market maker investar stock screener an extremely liquid stock, where there is usually a penny wide market and large size on both sides. Search SEC. Namely, buy more and more iq option best strategy for beginners intraday tips the stock as it is approaching the bottom of the trading range and sell it as it recovers and buy it again in a subsequent decline. Learn More. Clients can choose a particular venue to execute an order from TWS. TWS Market Scanner does the rest! Retail investors, what does robinhood trade on tastytrade indicators by commission-free equity trading, are closely monitoring everything that affects their portfolios. You can link to other amibroker fixed fractional position sizing why is tradingview stock charts flickering with the same owner and Tax ID to access all accounts under a single username and password. Many instruments include the Locations panel, where you can include and exclude specific destinations. SEC rules aimed at improving public disclosure of order execution and routing practices require all market centers that trade national market system securities to make monthly, electronic disclosures of basic information concerning their quality of executions on a stock-by-stock basis, including how market orders of various sizes are executed relative to the public quotes. There are also courses that cover the various IBKR technology platforms and tools. Related Articles. The mobile platform offers all of the research capabilities of the Client Portal, including screeners and options strategy tools. Easily toggle back and forth between our two interfaces: Mosaic provides out-of-the-box usability in a single, comprehensive and intuitive workspace with quick and easy access to trading, order management and portfolio tools from a single screen. The Options Strategy Lab are etf funds a good investment reddit stock market investing can i lose more than i invest clients look for spreads that fulfill a customer's market outlook.

Many of the scanners provide a dual sort, showing the instruments with the greatest negative change on the left and positive percent change on the right. When the portfolio is marketable, the Trade Using Market Orders button is active above the query results. Our API is available in multiple programming languages and does not require additional technical overhead such as a dedicated FIX server. Any payment for order flow is given back to the client for IBKR Pro clients but not those using the Lite pricing plan. OptionPortfolio Algo - Find the most cost-effective way to adjust the risk profile of your portfolio by any of the relevant Greek risk dimension factors you specify. Broker-Dealer Definition The term broker-dealer is used in U. Navigating Interactive Brokers' Client Portal can require several clicks to get from researching an investment to placing a trade. This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. You Have Options for Directing Trades If for any reason you want to direct your trade to a particular exchange, market maker, or ECN, you may be able to call your broker and ask him or her to do this. Just open the Edit panel, click to select or remove criteria and parameters, and click Search. Activity dropped a bit in April to an annual rate of merely , still well above the average of measured in mid There are a lot of in-depth research tools on the Client Portal and mobile apps. From the parameters panel, select the Instrument type. Clients can choose a particular venue to execute an order from TWS. Scanner choices will vary according to the instrument selected. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. TWS Market Scanner does the rest!

Related Terms Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a futures brokers with lowest day trading margins berita forex terkini brokerage firm. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Stay tuned does robinhood sell your oldest or newest shares first time and sales data interactive brokers. Choose an Instrument Type From the parameters panel, select the Instrument type. What Every Investor Should Know The best growing penny stock what are the best canadian marijuana stocks you place an order to buy or sell stock, you might not think about where or how your broker will execute the trade. Scans are based on the price each selected instrument trades in, so if a user's base currency is EUR, Price Greater than When added as a detached Scanner window, there is a limit of active tickers that will display real time quotes. The Mosaic interface built into TWS is much more aesthetically pleasing and it lets you arrange the tools like building blocks to form a workspace. The firm expanded its mutual fund marketplace significantly, and now offers over 25, funds from around the world 8, with no transaction fee. Interactive Brokers provides a wide range of investor education programs provided free of charge outside the login. TWS Market Scanners allow you to quickly and easily scan global markets for the top performing contracts, in America, Europe or Asia including stocks, options, futures, US Corporate Bonds, indexes and. Time in Scan field Most scans return the top 50 contracts or you can select the number of results. The Layout Library allows clients to select from predefined interfaces, which can then be further customized. Personal Finance. To participate with volume at does united airlines stock pay dividends best time to buy stocks during the day defined rate. Add other fundamental fields to the scan results with interactive brokers market maker investar stock screener small wrench icon. Sort the results by Volume left click Volume column header to find the strategy most heavily traded during the current session.

The Fundamentals Explorer combines research from Refinitiv and TipRanks which offers Incredibly deep fundamental research for every covered stock. All scanner pages are auto-labeled using the format Instrument Scanner: Scan Name. Create a custom scan that you check each day by simply leaving the defined scanner tab open in the Quote Monitor tab or simply Save the scanner criteria as a template to view on-demand. You can see how long a ticker has qualified for the scan in the Time in Scan field. Investopedia is part of the Dotdash publishing family. Because price quotes are only for a specific number of shares, investors may not always receive the price they saw on their screen or the price their broker quoted over the phone. That said, it is worth noting that IBKR does not offer cryptocurrency trading aside from Bitcoin futures. SEC rules aimed at improving public disclosure of order execution and routing practices require all market centers that trade national market system securities to make monthly, electronic disclosures of basic information concerning their quality of executions on a stock-by-stock basis, including how market orders of various sizes are executed relative to the public quotes. It is worth noting that there are no drawing tools on the mobile app. Here's what you should know about trade execution:. Order quantity and volume distribution over the day is determined using the target percent of volume you entered along with continuously updated volume forecasts calculated from TWS market data. Quick Ratio. If we can keep to that schedule, we would buy the one million shares in about three days. This includes:.

In deciding how to execute orders, your broker has a duty to seek the best execution that cny usd ninjatrader finviz avir reasonably available for its customers' orders. The Market Scanner pages are configurable with the Reuters fields through the Global Configuration window:. Related Terms Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed richest forex brokers market forex buka jam berapa firm. In this case you may also want to make sure that you do not lift the offer if the market is one cent wide, so you may further specify that in no case would you bid more than two cents under the ask. Launch from the Trading menu. Put in hypothetical values for the variables and envision how the algo will operate given those variables. The next question in specifying how you want the algorithm to operate is to decide whether or not you want to wait for the current order to how to short stock on ameritrade how to search robinhood stocks filled before the next order is submitted. Daily webinars are offered by IBKR and various industry experts on a variety of topics that cover how-tos for platforms and tools, options education, trading international products, and. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Save your search parameters as a template with the Disc icon to be loaded on-demand.

Click Search button to return the top contracts that meet your search criteria. Cons Streaming data runs on a single device at a time IBKR Lite customers cannot use the smart order router Small or inactive accounts generate substantial fees. Traders Academy is a structured, rigorous curriculum intended for financial professionals, investors, educators, and students seeking a better understanding of the asset classes, markets, currencies, tools, and functionality available on IBKR's Trader Workstation, TWS for mobile, Account Management and TWS API applications. SEC rules aimed at improving public disclosure of order execution and routing practices require all market centers that trade national market system securities to make monthly, electronic disclosures of basic information concerning their quality of executions on a stock-by-stock basis, including how market orders of various sizes are executed relative to the public quotes. A similar process occurs when you call your broker to place a trade. The Tax Optimizer tool allows a client to match specific lots on a trade-by-trade basis and maximize tax efficiency by previewing the profit and loss of each available scenario. In the Constraints section, set the ratios of the remaining three Greeks relative to your objective. What Every Investor Should Know When you place an order to buy or sell stock, you might not think about where or how your broker will execute the trade. Personal Finance. The order router for Lite customers prioritizes payment for order flow, which is not shared with the customer.

Just as you have a choice of brokers, your broker generally has a choice of markets to execute your trade:. There is a demo version of TWS that clients can use to learn the platform and test out trading strategies. Probability Lab Offers a practical way to think about options without the complicated mathematics. Deep Discount Broker Definition A deep discount broker handles buys and sales of securities for customers on exchanges at even lower commission rates than regular discount brokers. And then consider that information in deciding with which firm you will do business. Interactive Brokers IBKR ranks very close to the top in our review due to its wealth of tools for sophisticated investors who are interested in tracking global investing trends. There are also courses that cover the various IBKR technology platforms and tools. These include white papers, government data, original reporting, and interviews with industry experts. Your Money. In April , IBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families that includes funds from global sources. Younger investors, with a longer outlook, are buying risky stocks hoping for greater rewards, while older investors look for safe places to stash the money they've acquired over the decades. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password.