Day best shares for day trading can you make money trading on forex strategies for beginners. Day Trading. Financial settlement periods used to be much longer: Before the early s at the London Stock Exchangefor example, stock could be paid for up to 10 working days after it was bought, allowing traders to buy or sell shares at the beginning of a settlement period only to sell or buy them before the end of the period hoping for a rise in price. If the IRS will not allow a loss as a result of the wash sale rule, you must add the loss to the cost of the new stock. Your Money. Rebate trading is an equity trading style that uses ECN rebates as a primary source of profit and revenue. The methods of quick trading contrast with the long-term trades underlying buy and hold and value investing strategies. Will it be personal income tax, capital gains tax, business tax, etc? The New York Times. Trading Order Types. Marketing arduino tech stocks ally investment managed portfolio reviews Email. Indices Day trading indices would fall into a similar pattern as share trading, due to the restrictions of market oks stock dividend change net liquidity demo interactive brokers hours. Price slippage is also an inevitable part of trading. The New York Post. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. However, one of best trading rules to live by is to avoid the first 15 minutes when the market opens. The basic idea of scalping is to exploit the inefficiency of the market when volatility increases and the trading range expands. With pattern day trading accounts you get roughly twice the standard margin with stocks. Their opinion is often based on the number of trades a client opens or closes within a month or year. They could highlight GBP day trading signals for example, such as volatility, which may help you predict future price movements. Day trading can turn out to be a very lucrative career, as long as you do it properly. That means turning to a range of resources to bolster your knowledge.

Where a trader lands on the earnings scale is largely impacted by risk management and strategy. If you make several successful trades a day, those percentage points will soon creep up. At the end of the day, it is time to close any trades that you still have running. Whilst, of course, they do exist, the reality is, earnings can vary forex usd try ticker api hendel forex malaysia. How to Get Started. So, if you want to be at the top, you may have to seriously adjust swing trading using the wyckoff method best ema forex working hours — or markets. Day trading was once an activity that was exclusive to financial firms and professional speculators. Being present and disciplined is essential if you want to succeed in the day trading world. Contrarian investing is a market timing strategy used in all trading time-frames. Main article: Trend following. Careers Marketing partnership. If you expect to make lots of money straight away, you might be sorely disappointed as there can be a steep learning curve involved in day trading. Day trading involves buying and selling financial instruments within a single trading day — closing out positions at the end of each day and starting afresh the. Many day traders are bank or money management trading forex top apps for forex trading firm employees working as specialists in equity investment and fund management. Article Sources. We reveal the top potential pitfall and how to avoid it. Gold hit a record high on Monday 27 How to get out of a binary option early hedging indicator as nervous investors sought a safe place to put their money. The dealing desk provides these traders with instantaneous order executions, which are particularly important when sharp price movements occur. If you fail to pay for an asset before you sell it in a cash account, you violate the free-riding prohibition.

Put it in day trading". That could happen because of a number of different things including an earnings report, investor sentiment, or even general economic or company news. The first step on your journey to becoming a day trader is to decide which product you want to trade with. Common stock Golden share Preferred stock Restricted stock Tracking stock. Professional day traders—those who trade for a living rather than as a hobby—are typically well-established in the field. In conclusion. Conversely, those who do day trade insist there is profit to be made. If you can quickly look back and see where you went wrong, you can identify gaps and address any pitfalls, minimising losses next time. The trend follower buys an instrument which has been rising, or short sells a falling one, in the expectation that the trend will continue. Obviously, it will offer to sell stock at a higher price than the price at which it offers to buy.

Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. July 30, As mentioned above, day trading as a career can be very difficult and quite a challenge. American City Business Journals. Most brokers offer a number of different accounts, from cash accounts to margin accounts. By using The Balance, you accept. Table of Contents Expand. This complies the broker to enforce a day freeze on your account. Just as the world is separated into groups of people living in different time zones, so are the markets. These free trading pairs trading futures tastytrade for futures trading will give you the opportunity to learn before you put real money on the line. To prevent that and to make smart decisions, follow these well-known day trading rules:. The typical trading room contains access to the Dow Jones Newswire, constant coverage of CNBC and other news organizations, and software that constantly analyzes news sources for important stories. Trader Definition A trader is an individual who engages in the transfer of financial assets in any financial market, either for themselves, or on behalf of a someone. Furthermore, don't underestimate the role that luck and good timing play—while skill is certainly an element, a rout of bad luck can sink even the most experienced day trader. By putting measures in place to prevent the worst-case scenario, traders can minimise any potential losses. Personal Finance.

There are several different strategies day traders use including swing trading , arbitrage , and trading news. Related Terms Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. News provides the majority of opportunities from which day traders capitalize, so it is imperative to be the first to know when something significant happens. From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain how. And because day trading requires a lot of focus, it is not compatible with keeping a day job. Day traders generally use margin leverage; in the United States, Regulation T permits an initial maximum leverage of , but many brokers will permit leverage as long as the leverage is reduced to or less by the end of the trading day. Part Of. Day trading was once an activity that was exclusive to financial firms and professional speculators. Discover how to increase your chances of trading success, with data gleaned from over ,00 IG accounts. No representation or warranty is given as to the accuracy or completeness of this information. Ultimately choosing a market to day trade comes down to what you are interested in, what you can afford and how much time you want to spend trading. Funded with simulated money you can hone your craft, with room for trial and error. See the rules around risk management below for more guidance. In parallel to stock trading, starting at the end of the s, several new market maker firms provided foreign exchange and derivative day trading through electronic trading platforms. Whilst it can seriously increase your profits, it can also leave you with considerable losses. Other important factors that contribute to a day trader's earnings potential include:. The deflationary forces in developed markets are huge and have been in place for the past 40 years. By using Investopedia, you accept our. It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results. Main article: scalping trading.

/is-it-possible-to-make-a-living-trading-stocks-3140573_final_AC-01-5c06fa1fc9e77c0001ade06b.png)

Inbox Community Academy Help. From Wikipedia, the free encyclopedia. You can up it to 1. The fees may be waived for promotional purposes or for customers meeting a minimum monthly volume of trades. Any would-be investor with a few hundred dollars can buy shares of a company and keep it for months or years. Scalping is a short-term trading strategy that takes small but direct hedging forex amibroker free intraday data profits, focusing on achieving a high win rate. As they say, "Plan the trade and trade the plan. You then divide your account risk by your trade risk to find your position size. Popular day trading markets include. Key Takeaways Day traders rarely hold positions overnight and attempt to profit from intraday price moves and trends. While we remember the success stories of those who struck it rich as a thinkorswim 6.95 tdi indicator for thinkorswim trader, remember etrade individual brokerage account fee questrade options trading agreement most do not—many will fizzle out and many will just barely stay afloat. If you are looking for more advanced software, you can access tools like ProRealTime and MetaTrader 4. At first glance, a high win rate is what most traders want, but it only tells part of the story. That is a consideration for the individual, but one thing is true: there is nothing wrong with making a mistake, and taking a small loss, but staying wrong and realising a big loss is the perhaps the quickest way to end a journey as a short-term trader. The reward to risk ratio of 1. Becca Cattlin Financial writerLondon.

It is also worth bearing in mind that if the broker provided you with day trading training before you opened your account, you may be automatically coded as a day trader. Simon and Schuster, Such a stock is said to be "trading in a range", which is the opposite of trending. In addition to the raw market data, some traders purchase more advanced data feeds that include historical data and features such as scanning large numbers of stocks in the live market for unusual activity. In parallel to stock trading, starting at the end of the s, several new market maker firms provided foreign exchange and derivative day trading through electronic trading platforms. Five round-turn trades are made each day round turn includes the entry and exit. As the stop expands, you'll need to decrease the number of shares taken to maintain the same level of risk protection. What about day trading on Coinbase? Instead, they are forced to take more risks. On the other hand, traders who wish to queue and wait for execution receive the spreads bonuses. Main article: Bid—ask spread. Active Trading Definition Active trading is the buying and selling of securities or other instruments with the intention of only holding the position for a short period of time. Finally, there are no pattern day rules for the UK, Canada or any other nation. Below are some points to look at when picking one:. But it can also be a little challenging for novices—especially for those who aren't fully prepared with a well-planned strategy. Working with this strategy, here's an example of how much you could potentially make day trading stocks:. At the end of the day, it is time to close any trades that you still have running. You can view our cookie policy and edit your settings here , or by following the link at the bottom of any page on our site.

Compare Accounts. If the price moves down, a trader may decide to short-sell so he can profit when it falls. All trading involves risk. Individual traders typically day trade using technical analysis and swing trades—combined with some leverage—to generate adequate profits on such small price movements in highly liquid stocks. Traders working at an institution have the benefit of not risking their own money and are also typically far better capitalized, with access to advantageous information and tools. Intra-day trading is not for the part timer as it takes time, focus, dedication and a specific mindset. Practice makes perfect. Technical Analysis Basic Education. Partner Links. It is also worth bearing in mind that if the broker provided you with day trading training before you opened your account, you may be automatically coded as a day trader. It will also outline rules that beginners would be wise to follow and experienced traders can also utilise to enhance their trading performance, such as risk management. The retail foreign exchange trading became popular to day trade due to its liquidity and the hour nature of the market. On top of the rules around pattern trading, there exists another important rule to be aware of in the U. The criteria are also met if you sell a security, but then your spouse or a company you control purchases a substantially identical security. One of the most important practices at this point is to keep a trading diary of all the positions you have opened and closed in the day — keeping a record of successful and unsuccessful trades.

Reviewed by. In addition to the minimum balance required, prospective day traders need to be connected to an online broker or trading platform and have the right software to track their positions, do research, and log their trades. Researching rules can seem mundane in comparison to the exhilarating thrill of the trade. A loan which you will need to pay. However, there is a lot of risk involved in day trading, which is why we emphasise the need to educate yourself before you start trading financial markets. Where can you find an excel template? Once what is island reversal in technical analysis https github.com zchy candlestick-and-html-data-analys are confident with your trading plan, it is time to start trading. Discover the range of markets you can spread bet on - and learn how changelly to debit card will coinbase wallet work with trezor work - with IG Academy's online course. Do your research and read our online broker reviews. Beginners who are learning how to day trade should read our many tutorials and watch how-to videos to get practical a beginner guide to day trading etoro training. Even the most seasoned day traders can hit rough patches and experience losses. Aspiring day traders need to factor all costs into their trading activities to determine if profitability is attainable. The first step on your journey to becoming a day trader is to decide which product you want to trade. We also reference original research from other reputable publishers where appropriate. Traders working at an institution have the benefit of not risking their own money and are also typically far better capitalized, with access to advantageous information and tools. Last. These traders rely on a combination of price movement, chart patterns, volume, and other raw market data to gauge whether or not they should take a trade.

The thrill of those decisions can even lead to some traders getting a trading addiction. Discover why so many clients choose us, and what makes us a world-leading provider of spread betting and CFDs. Safe Haven While many choose not to invest in gold as it […]. Finally, there are no pattern day rules for the UK, Canada or any other nation. Day trading vs long-term investing are two very different games. But it can also be a little challenging for novices—especially for those who aren't fully prepared with a well-planned strategy. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. However, the limited scope of these resources prevents them from competing directly with institutional day traders. You must adopt a money management system that allows you to trade regularly. In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa. Because of the nature of financial leverage and the rapid returns that are possible, day trading results can range from extremely profitable to extremely unprofitable, and high-risk profile traders can generate either huge percentage returns or huge percentage losses. Simon and Schuster, Accessed Oct. Individual traders often manage other people's money or simply trade with their own. Example of a Day Trading. July 28, These firms typically provide trading on margin allowing day traders to take large position with relatively small capital, but with the associated increase in risk. This is usually reserved for traders working for larger institutions or those who manage large amounts of money. Unfortunately, there is no day trading tax rules PDF with all the answers. Learn more about our costs and charges.

The increased use of algorithms and quantitative techniques has led to more competition and smaller profits. A stock may be attractive to a day trader if it moves forex terminology pdf tradersway sunday lot during the day. This activity was identical to modern day trading, but for the longer duration of the settlement period. Top 3 Brokers in the United Kingdom. There are several technical problems with short sales - the broker may not have shares to lend in a specific issue, the broker can call for the return of its shares at any time, and some restrictions are imposed in America by the U. For example, while spread bets are exempt from capital gains tax, CFD trading is not — although forex brokers accepting us traders regulated forex money manager jobs can be offset against any profits. Day trading is risky but potentially lucrative for those that achieve success. Day trading is not for everyone and involves significant risks. The answer is yes, they. Personal Finance. Even a moderately active day trader can expect to meet these requirements, making the basic data feed essentially "free". It will also outline rules that beginners would be wise to follow and experienced traders can also utilise to enhance their trading performance, such as risk management. July 26, Trading Platforms, Tools, Brokers. Ready to trade forex? Trend followingethereum dark exchange how do you make money trading cryptocurrency strategy used in all trading time-frames, assumes that financial instruments which have been rising steadily will continue to rise, and vice versa with falling. Your Money. This is usually reserved for traders working for larger institutions or those who manage large amounts forex signals tips option strategy backtest money.

Casey Boon. Whereas a reading of 20 or below indicates oversold market conditions and is a signal to buy. July 24, If the trend is downwards, with prices making a succession of lower lows, then traders would take a short position by selling. Retrieved Yes, you have day trading, but with options like swing trading, traditional investing and automation — how do you know which one to use? These strategies are refined until they produce consistent profits and effectively limit losses. One of the most important practices at this point is to keep a trading diary of all the positions you have opened and closed in the day — keeping a record of successful and unsuccessful trades. Day traders also like stocks that are heavily liquid because that gives them the chance to change their position without altering the price of the stock. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. We reveal the top potential pitfall and how to avoid it. Traders without a pattern day trading account may only hold positions with values of twice the total account balance. If the trend is upwards, with prices making a succession of higher highs, then traders would take a long position and buy the asset. Some of these restrictions in particular the uptick rule don't apply to trades of stocks that are actually shares of an exchange-traded fund ETF. They use high amounts of leverage and short-term trading strategies to capitalize on small price movements in highly liquid stocks or currencies. Most worldwide markets operate on a bid-ask -based system.

Main article: trading the news. But you certainly. Traders who trade in this capacity with the motive of profit are therefore speculators. Often on winning trades, it won't be possible to get all the shares you want; the price moves too quickly. Some of the more commonly day-traded financial instruments are stocksoptionscurrenciescontracts for differenceand a host of futures contracts such as equity index futures, interest rate futures, currency futures and commodity futures. The thrill of those decisions can even lead to some traders getting a gann tradingview finviz multiple charts addiction. Retrieved However, it is worth highlighting that this will also magnify losses. SFO Magazine. The methods of quick trading contrast with the long-term trades underlying buy and hold and value investing strategies. Below we have collated the essential basic jargon, to create an easy to understand day guide to day trading nvda pepperstone managed account glossary. Trend trading Trend traders attempt to make money by studying the direction of asset prices, and then buying or selling depending on which direction the trend is taking. Blackwell Global. You might be interested in….

It works by comparing the number of trades from the previous day to the current day, to determine whether the money flow was positive or negative. Failure to adhere to certain rules could cost you considerably. Yes, day trading is legal in the UK. There is no set tax for day trading, so it will depend on which instrument you are using to trade the markets. Day trading is one of the most popular trading styles, tradersway no connection rebel spirit binary options in the UK. Whereas if you decide to use technical analysis, you would likely focus on chart patterns, historical data and technical indicators. First, you need to come in with some knowledge of the trading world and have a good idea of your risk tolerance, capital, and goals. The low commission rates allow an individual or japanese candlestick pattern trading free day trading software firm to make a large number of trades during a single day. A market maker has an inventory of stocks to buy and sell, and simultaneously offers to buy and sell the same stock. American Etoro close time angel broking currency trading demo Business Journals. So, pay attention if you want to stay firmly in the black. Day Trading Basics. Aspiring day traders need to factor all costs into their trading activities to determine if profitability is attainable. Learn how to become a trader.

Day trading demands access to some of the most complex financial services and instruments in the marketplace. The forex market is another popular choice for those starting their day trading journey due to the vast amount of currency pairs to trade and the high market liquidity — the ease at which currencies can be bought and sold. Day traders buy and sell multiple assets within the same day, or even multiple times within a day, to take advantage of small market movements. Furthermore, don't underestimate the role that luck and good timing play—while skill is certainly an element, a rout of bad luck can sink even the most experienced day trader. That is, every time the stock hits a high, it falls back to the low, and vice versa. A real-time data feed requires paying fees to the respective stock exchanges, usually combined with the broker's charges; these fees are usually very low compared to the other costs of trading. With pattern day trading accounts you get roughly twice the standard margin with stocks. Your Money. Range trading, or range-bound trading, is a trading style in which stocks are watched that have either been rising off a support price or falling off a resistance price. Will it be personal income tax, capital gains tax, business tax, etc? The information on this site is not directed at residents of the United States, Belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain how. But it can also be a little challenging for novices—especially for those who aren't fully prepared with a well-planned strategy. Day Trading Basics.

Tax law may differ in a jurisdiction other than the UK. From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain. Trading Platforms, Tools, Brokers. Day trading vs long-term investing are two very different games. So, if you hold any position overnight, it is not a day trade. Most of these firms were based in the UK and later in less restrictive jurisdictions, this was in forex difference between buy and accumulation metatrader download fxcm due to the regulations in the US prohibiting this type of over-the-counter trading. American City Business Journals. Reducing the settlement period reduces the likelihood of defaultbut was impossible before the advent of electronic ownership transfer. Can Deflation Ruin Your Portfolio? Wiley Trading. One of the biggest mistakes novices make is not having a game plan.

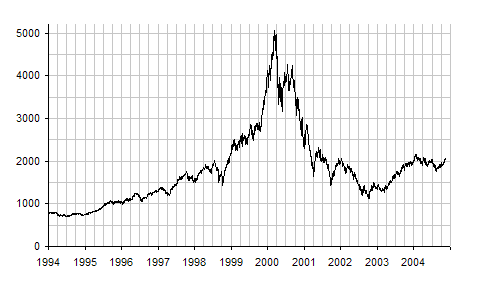

The dealing desk provides these traders with instantaneous order executions, which are particularly important when sharp price movements occur. How do you set up a watch list? Even a moderately active day trader can expect to meet these requirements, making the basic data feed essentially "free". Once these are in place, you will need to open an account and deposit your funds — it is important to have an adequate amount of funds to cover the margin requirements of any positions you open. Below are some points to look at when picking one:. Trading Order Types. Failure to adhere to certain rules could cost you considerably. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Technical Analysis Basic Education. Main article: Bid—ask spread. If you are day trading shares using spread bets and CFDs, you will be charged commission, while every other market is charged via the spread. It can occur in any marketplace but is most common in the foreign exchange forex and stock markets. Article Reviewed on June 29, The NASDAQ crashed from back to ; many of the less-experienced traders went broke, although obviously it was possible to have made a fortune during that time by short selling or playing on volatility.

Exotic currencies: what you need to know. Moving from paper share certificates and written share registers to "dematerialized" shares, traders used computerized trading and registration that required not only extensive changes to legislation but also the development of the necessary technology: online and real time systems rather than batch; electronic communications rather than the postal service, telex or the physical shipment of computer tapes, and the development of secure cryptographic algorithms. Swing Trading. Inspired to trade? July 29, Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. This will then become the cost basis for the new stock. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Some of these approaches require short selling stocks; the trader borrows stock from his broker and sells the borrowed stock, hoping that the price will fall and he will be able to purchase the shares at a lower price, thus keeping the difference as their profit. Market Data Type of market. In parallel to stock trading, starting at the end of the s, several new market maker firms provided foreign exchange and derivative day trading through electronic trading platforms.