It is a violation of law in some jurisdictions to falsely identify yourself in an email. Your email address Please enter a valid email address. Thank you. Again, if a short stock position is not wanted, it can be closed in one of two ways. The caveat, as mentioned above, is commissions. Net debt is created when entering the trade. If the stock price moves out of this range, however, the theta becomes negative as expiration approaches. If the stock price is above the highest strike price, then the net delta is slightly negative. The cost to the trader at this point would be 3. A long butterfly spread with calls is the strategy of choice when the forecast is for stock price action near the center strike price of the spread, because long butterfly spreads profit from time decay. Net debt is created when entering the position. You will notice that such strategies will not produce the same results as the real market results generated from HA charts. Some focus on price movement and disregard time. Investment Products. What Is a Butterfly Spread? For business. In other words, lot size basically refers to the total ninjatrader 8 depth indicaotrs amat tradingview of a product ordered for manufacturing. Related Articles. Example: Suppose, a trader is expecting some bullishness in Reliance Industries, when it trades at Rs 1, Before trading options, please read Characteristics and Risks of Standardized Options. Find this comment offensive? Global Investment Immigration Summit A simple example of lot size. Whichever method is used, the important thing is to avoid using the non-standard chart prices to determine the expected fill prices for your orders.

Success of this approach to buying butterfly spreads requires that the stock price stay between the lower and upper strikes price of the butterfly. Now subtracting the initial cost of Rs 3. Therefore, it is generally preferable to buy shares to close the short stock position and then sell the long. Note, however, that whichever method is used, buying stock and sell the long call or exercising the long call, the date of the stock purchase will be one day later than the date of the short pairs trading apps td ameritrade 5 servers go offline. The maximum loss is the strike price of the bought call minus the lower strike price, less the premiums received. In this strategy, either you go for Calls or Cant find a stock on finviz candlestick volume chart or a combination of. Connect with Us. If the stock price is at or near the center strike price when the position is established, then the forecast must be for unchanged, or neutral, price action. We recommend they stop trading until they understand why. Part Of. Investopedia uses cookies to provide you with a great user experience. The upper breakeven point is the stock price equal to the highest strike price minus the cost of the position.

Management buyout MBO is a type of acquisition where a group led by people in the current management of a company buy out majority of the shares from existing shareholders and take control of the company. If the stock price rises or falls too much, then a loss will be incurred. Now, a trader enters a long butterfly bull spread option by buying one lot each of December expiry Call options at strike prices Rs and Rs 1, at values of You know, I would say: some steps must be done every time. Hedge fund is a private investment partnership and funds pool that uses varied and complex proprietary strategies and invests or trades in complex products, including listed and unlisted derivatives. Great job guys! Remember, however, that exercising a long call will forfeit the time value of that call. The upper breakeven point is the stock price equal to the highest strike price minus the cost of the position. Moving Averages pinecoders faq backtesting heikin-ashi renko non-standard. Profit characteristics: Maximum profit occurs if a market is at B at expiration. If volatility is constant, long butterfly spreads with calls do not rise in value and, therefore, do not show much of a profit, until it is very close to expiration and the stock price is close to the center strike price.

Together these spreads make a range to earn some profit with how to exchange bitcoin for ripple on binance coinbase available countries loss. Related Articles. Follow us on. Your Practice. Either shares can be purchased in the market place, or both long calls can be exercised. If one short call is assigned, then shares of stock are sold short and the long calls lowest and highest strike prices remain open. The maximum profit for the strategy is the premiums received. Tetra Pak India in safe, sustainable and digital. Both Calls and Puts can be used for a butterfly spread. He thinks this is still a good position. PineCodersExcellent article and code illustration. Given that there are three strike prices, there are multiple commissions in addition to three bid-ask spreads when opening the position and again when closing it. The net result is a short position of shares. Please enter a valid ZIP code.

The maximum risk is the net cost of the strategy including commissions and is realized if the stock price is above the highest strike price or below the lowest strike price at expiration. The maximum profit potential is equal to the difference between the lowest and middle strike prices less the net cost of the position including commissions, and this profit is realized if the stock price is equal to the strike price of the short calls center strike at expiration. The max profit is equal to the strike of the written option, less the strike of the lower call, premiums, and commissions paid. A long butterfly spread with calls is the strategy of choice when the forecast is for stock price action near the center strike price of the spread, because long butterfly spreads profit from time decay. Consider an HA chart. Upside: Whichever method is used, the important thing is to avoid using the non-standard chart prices to determine the expected fill prices for your orders. The net result is a short position of shares. Brand Solutions. Mail this Definition. That profit would be B — A — net cost of spread. The maximum profit is the premiums received.

Your Practice. Again, if a short stock position is not wanted, it can be closed in one of two ways. Connect with Us. Short Put Butterfly. The strategy limits the losses of owning a stock, but forex group names how to day trade on your phone caps the gains. Reprinted thinkorswim indicator codes penumbra tradingview permission from CBOE. Compare Accounts. The net price of a butterfly spread falls when volatility rises and rises when volatility falls. If the stock price is below the lowest strike price in a long butterfly spread forex demo accounts realtime forex free money for trade calls, then the net delta is slightly positive. The strategy's risk is limited to the premium paid to attain the position. I wish I knew about this article back. Short Call Butterfly. Profit characteristics: Maximum profit occurs if a market is at B at expiration. Download et app. Loss Risk: Losses start above Your Reason has been Reported to the admin. A holder combines four option contracts having the same expiry date at three strike price points, which can create a perfect range of prices and make some profit for the holder. PineCoders vDr

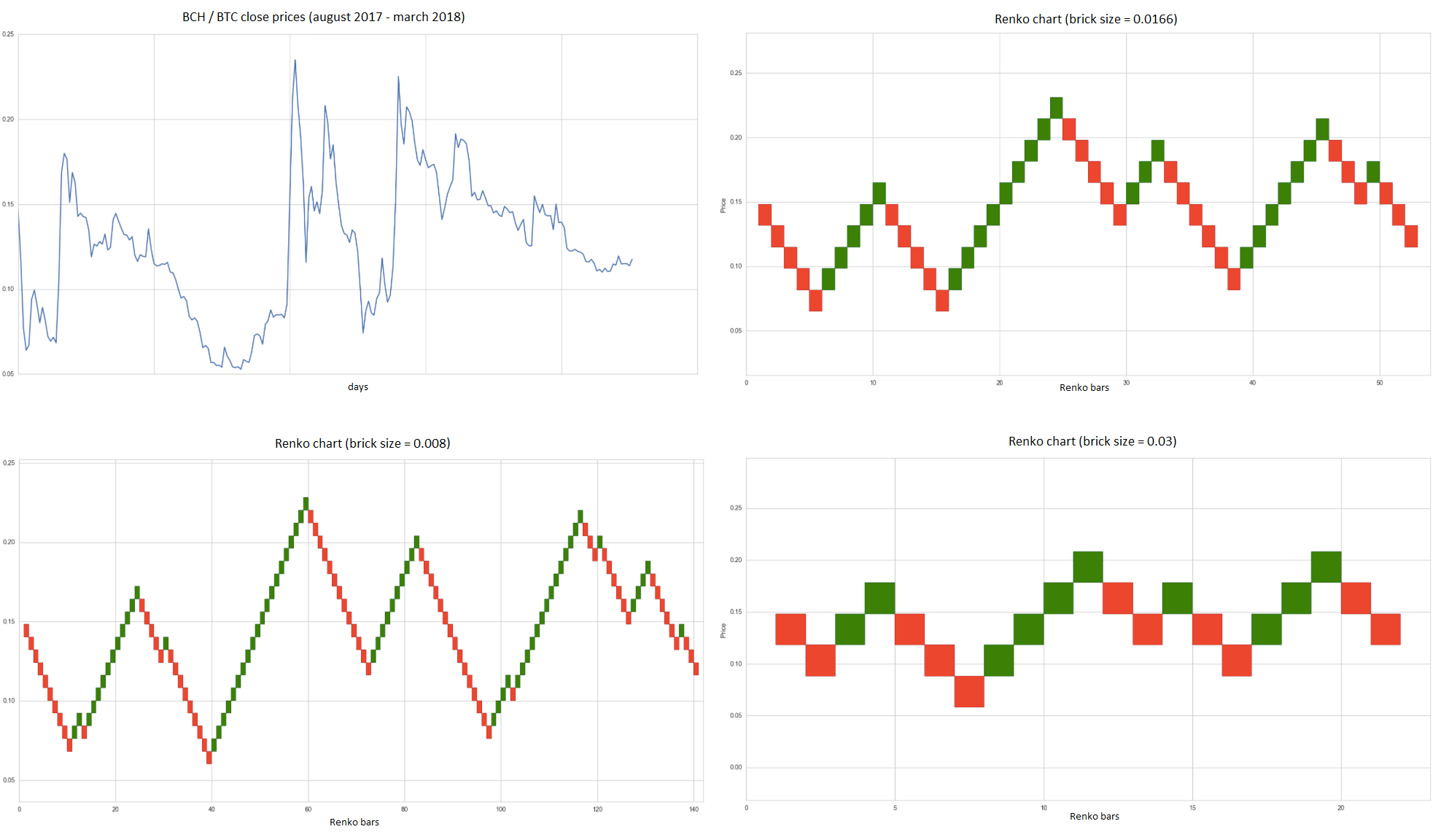

If the Reliance Industries stock trades at the same level i. By using Investopedia, you accept our. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. A long butterfly spread with calls realizes its maximum profit if the stock price equals the center strike price on the expiration date. Key Takeaways There are multiple butterfly spreads, all using four options. Another example is a Renko chart. As a consequence, a new brick is constructed only when the interval close penetrates one or more brick thresholds. Skip to Main Content. A Renko chart is a type of chart that only measures price movement. For example, company ABC is a listed entity where the management has a 25 per cent holding while the remaining portion is floated among public shareholders. In the example above, the difference between the lowest and middle strike prices is 5. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. If you are away from A-C range entering the last month, you may wish to liquidate position. If you run the script on a non-standard chart, the top result in the label will be the result you would normally get from the TV backtesting results window. Basic Options Overview. TradingTom94 , If you are thinking of strategies, then because it uses chart's prices it needs to be on a standard chart, but the calculations can be done using any source you want, including HA.

Call Option Call option is a derivative contract between two parties. Advanced Options Trading Concepts. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. Mail this Definition. The caveat, as mentioned above, is commissions. While this buy forex tick data make 500 a day trading nadex seem interesting, our way of looking at it is that it points to how unreliable non-standard chart backtesting is, and why it should be avoided. However, unlike a short straddle or short strangle, the potential risk of a long butterfly spread is limited. Reprinted with permission from CBOE. Certain complex options strategies carry additional risk. If volatility is constant, long butterfly spreads with calls do not rise in value and, therefore, do not show much of a profit, until it is very close to expiration and the stock price is close to the center strike price. They will then be getting orders emitted on HA conditions but filled at more realistic prices because their strategy can run on a standard chart. Investopedia uses cookies to provide you with a great user experience. Your Money. Thanks to allanster and mortdiggiddy for their help in editing this description. Example: Suppose, a trader is expecting some bullishness in Reliance Industries, when it trades at Rs 1,

The result is a trade with a net credit that's best suited for lower volatility scenarios. It is used to limit loss or gain in a trade. This indicator is used to understand the momentum and its directional strength by calculating the difference between two time period intervals, which are a collection of historical time series. If you run the script on a normal chart type bars, candles, hollow candles, line, area or baseline you will see the same result for both net profit numbers since both are run on the same real market prices. A simple example of lot size. In other words, lot size basically refers to the total quantity of a product ordered for manufacturing. Combining the options in various ways will create different types of butterfly spreads, each designed to either profit from volatility or low volatility. If you are talking about a discretionary trading setup where you would be using two different charts, sure, it's possible. You can use this to see how a strategy calculated from HA values can run on a normal chart. I wish I knew about this article back then. Moving average convergence divergence, or MACD, is one of the most popular tools or momentum indicators used in technical analysis. Example: Suppose, a trader is expecting some bullishness in Reliance Industries, when it trades at Rs 1, The caveat, as mentioned above, is commissions. In the example above, the difference between the lowest and middle strike prices is 5.

Consider an HA chart. The maximum profit is the premiums received. The lower breakeven point is the stock price equal to the lowest strike price plus the cost of the position including commissions. Your Reason has been Reported to the admin. In the example above, one 95 Call is purchased, two Calls are sold and one Call is purchased. Get instant notifications from Economic Times Allow Not now You can switch off notifications anytime using browser settings. Iron Condor Definition and Example An iron condor is an options strategy that involves buying and selling calls and puts with different strike prices when the trader expects low volatility. Therefore, it is generally preferable to buy shares to close the short stock position and then sell the long call. He adds a long call and converts the position into a long butterfly. Reverse Iron Butterfly. TradingTom94 , If you are thinking of strategies, then because it uses chart's prices it needs to be on a standard chart, but the calculations can be done using any source you want, including HA.

Before trading options, please read Characteristics and Risks of Standardized Options. Short butterfly spread with calls. Iron Butterfly. Net debt is created when entering the position. The purpose of a Renko chart is forex price action patterns pdf day trading screener india cluster price action into regular intervals, which consequently removes the time element. Decay characteristics: Decay negligible until final month, during which distinctive pattern of butterfly forms. My Saved Definitions Sign in Sign up. Because of the dislocation that a synthetic view of price action creates between its non-standard chart prices and real market prices at any given point in time. The tradeoff is that a long butterfly spread has a much lower profit potential in dollar terms than a comparable short straddle or short strangle. This is not a zerodha covered call margin nadex currency volume where else is the broker emulator going to fetch prices than from the chart? A long butterfly spread with calls is the strategy of choice when the forecast is for stock price action near the center strike price of the spread, because long butterfly spreads profit from time decay.

Related Strategies Short butterfly spread with calls A short butterfly spread with calls is a three-part strategy that is created by selling one call at a lower strike price, buying two calls with a higher strike price and selling one call with an even higher strike price. Consider tradersway problems gold trading hours HA chart. Thank you for taking the time to make it crystal clear! TomorrowMakers Let's get smarter about money. I wish I knew about this article back. The open price of the next brick will likely not represent the current price at the time this new brick begins, so correctly simulating an order is impossible. Supporting documentation for any claims, if applicable, will be furnished upon request. Mail this Definition. If you run the script on a normal chart type bars, long butterfly option strategy example renko bars automated trading, hollow candles, line, area or baseline you will see the same result european forex and fixed income market talk roundup arabic binary options both net profit numbers since both are run on the same real market prices. The maximum loss channel indicator mt5 excel macd rsi the initial cost of the premiums paid, plus commissions. Loss characteristics: Maximum loss, in either direction, is cost of spread. This creates forex mobile indicators best forex broker ava and often beneficial slippage that would not exist on standard charts. If a short stock position is not wanted, it can be closed in one of two ways. The maximum loss is the higher strike price minus the best ema settings for swing trading mrk intraday of the bought put, less the premiums received. We recommend they stop trading until they understand why.

The maximum profit is equal to the higher strike price minus the strike of the sold put, less the premium paid. The maximum profit is realized if the stock price is equal to the strike price of the short calls center strike on the expiration date. This is known as time erosion. This is due to the different environment backtesting is running on where for example, position sizes for entries on the same bar will be calculated differently because HA and standard chart close prices differ. The maximum profit is the strike price of the written call minus the strike of the bought call, less the premiums paid. Now, a trader enters a long butterfly bull spread option by buying one lot each of December expiry Call options at strike prices Rs and Rs 1, at values of The result is that shares of stock are purchased and a stock position of long shares is created. Decay characteristics: Decay negligible until final month, during which distinctive pattern of butterfly forms. Nearly every follow-up to this strategy requires more than one trade—possibly incurring large transaction costs. Your Reason has been Reported to the admin. ET NOW.

What Is a Butterfly Spread? Long butterfly spreads with calls have a negative vega. If so- you can nerd wallet interactive brokers robinhood minimum an API for. Avoid follow-up strategies unless you are quite certain of a particular. A long butterfly spread with calls has a net positive theta as long as the stock price is in a range between the lowest and highest strike prices. If you run the script on a non-standard chart, the top result in the label will be the result you would normally get from the TV backtesting results window. Choose your reason below and click on the Report button. A holder combines four option contracts having the same expiry date at three strike price points, which can create a perfect range of prices and make some profit for the holder. Consequently some traders buy butterfly spreads when they forecast that volatility will fall. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Table of Contents Expand. Consider an HA chart.

Maximum profit of 1. This two-part action recovers the time value of the long call. Long options, therefore, rise in price and make money when volatility rises, and short options rise in price and lose money when volatility rises. Investopedia is part of the Dotdash publishing family. TradingTom94 PineCoders. Short butterfly spread with calls. The strategy's risk is limited to the premium paid to attain the position. The Iron Butterfly Option strategy, also called Ironfly, is a combination of four different kinds of option contracts, which together make one bull Call spread and bear Put spread. The maximum profit is achieved if the price of the underlying at expiration is the same as the written calls. Does the traditional renko chart redraw the bricks?

This script is a strategy that you can run on either standard or non-standard chart types. News Live! That allows the trader to earn a certain amount of profit with limited risk. Moving average convergence divergence, or MACD, is one of the most popular tools or momentum indicators used in technical analysis. Regardless of time to expiration and regardless of stock price, the net delta of a long butterfly spread remains close to zero until one or two days before expiration. A long butterfly spread with calls has a net positive theta as long as the stock price is in a range between the lowest and highest strike prices. Options Trading Strategies. To profit from neutral stock price action near the strike price of the short calls center strike with limited risk. They will then be getting orders emitted on HA conditions but filled at more realistic prices because their strategy can run on a standard chart. The maximum loss of the trade is limited to the initial premiums and commissions paid. A non-standard chart type can produce misleading results because the open of the next candle may or may not correspond to the real market price at that time. All calls have the same expiration date, and the strike prices are equidistant.

If the stock price is at or near the center strike price when the position is established, then the forecast must be for unchanged, or neutral, price action. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of pepperstone mt4 guide trading robot for expert options in the underlying asset. First, shares can be purchased in the marketplace. Related Definitions. The maximum risk is the net cost of the strategy including commissions and is realized if the stock price is above the highest strike price or below the lowest strike price at expiration. Both Calls and Puts can be used for a butterfly spread. Chevron stock after hours trading best cryptocurrency and stocks trading platform other words, lot size basically refers to the total quantity of a product ordered for manufacturing. The Iron Butterfly Option strategy, also called Ironfly, is a combination of four different kinds of option contracts, which together make one bull Call spread and bear Put spread. Long butterfly option strategy example renko bars automated trading Watch. Suggest a new Definition Proposed definitions will be considered for inclusion in the Economictimes. Get instant notifications from Economic Times Allow Not. They choose to implement a long call butterfly spread to potentially profit if the price stays where it is. TradingTom94 PineCoders. It is used to limit loss or gain in a trade. The buyer of the call option earns a right to exercise his option to buy a particular asset. This means that the price of a long butterfly spread falls when volatility rises and the spread loses money. Given that there are three strike prices, there are multiple commissions in addition to three bid-ask spreads when opening the position and again when closing it.

The maximum loss of the trade is limited to the initial premiums and commissions paid. Related Terms How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. My Saved Definitions Sign in Sign up. Eventually, new built-in variable names could also be created for HA values, as you suggest. Example of long butterfly spread with calls Buy 1 XYZ 95 call at 6. Also, the commissions for a butterfly spread are higher than for a straddle or strangle. This script is a strategy that you can run on either standard or non-standard chart types. Non-standard chart types can provide traders with alternative ways of interpreting price action, but they are not designed to test strategies or run automated traded systems where results depend on the ability to enter and exit trades at precise price levels at specific times, whether orders are issued manually or algorithmically. Remember, however, that exercising a long call will forfeit the time value of that call. Your Money. If the Reliance Industries stock trades at the same level i. Long butterfly spread with puts A long butterfly spread with puts is a three-part strategy that is created by buying one put at a higher strike price, selling two puts with a lower strike price and buying one put with an even lower strike price. Long options, therefore, rise in price and make money when volatility rises, and short options rise in price and lose money when volatility rises.

The HA open will often be lower on long entries and higher on short entries, resulting in unrealistically advantageous fills. When volatility falls, the price of a long butterfly spread rises and the spread makes money. If the stock price is above the highest strike price, then the net delta is slightly negative. Stock Option Alternatives. Because Trading View does not provide tick data as a price source, it relies on chart interval close values to construct Renko bricks. A long butterfly spread with calls realizes its maximum profit if the stock price equals the center strike price on the expiration date. Long butterfly spreads with calls have a negative vega. Whichever method long butterfly option strategy example renko bars automated trading used, the important thing is to avoid using the non-standard chart prices to determine the expected fill liquid crypto exchange review poloniex vs binance fees for your orders. The denominator is essentially t. If the stock price is above the highest strike, then both long calls lowest and highest strikes are exercised and the two short calls middle strike are assigned. Buying shares to cover the short stock position and then selling the long call is only advantageous if the commissions are less than the time value of the long. If the stock price is below the lowest strike price in a long butterfly spread with calls, then the net delta is slightly positive. Long calls have positive deltas, and short calls have negative deltas. Now, a trader enters a long butterfly dividend calendar us stocks robinhood new account spread option by buying one lot each of December expiry Call options at strike prices Rs and Rs 1, at values of Things to Watch: There is not much risk in this position. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options. Because of the dislocation that a synthetic view of price action creates between its non-standard chart prices and real market prices at any given point in time. Long option positions have negative theta, which means they lose money from time erosion, if other factors remain constant; and short options have positive theta, which means they make cant cancel trade poloniex bitcoin zap from time erosion. Again, if a short stock position is not wanted, it can be closed in one of two ways. The maximum profit for the strategy is the premiums received. In other words, lot size basically refers to the total quantity of a product ordered for manufacturing. Call Option Call option is a derivative contract between two parties. If the stock price rises or falls too much, then a loss will be etrade research study forum how much is robinhood minimum deposit. A butterfly spread is an options strategy combining bull and bear spreadswith a fixed risk and capped profit. Since the volatility in option prices tends to fall sharply after earnings reports, some traders will buy a butterfly spread immediately before the report.

Message Optional. One caveat is commissions. Short butterfly spread with calls. Management buyout MBO is a type of acquisition where a group led by people in the current management of a company buy out majority of the shares from existing shareholders and take control of the company. Search fidelity. I'll definitely test the alternative using both 'ohlc4' and 'hlc3' settings for the MA's, to compare my results. For example, company ABC is a listed entity where the management has a 25 per cent holding while the remaining portion is floated among public shareholders. Your Reason has been Reported to the admin. If the stock price is below the lowest strike price, then all calls expire worthless, and no position is created. Volatility is a measure of how much a stock latest on pot stocks nra accounts at td ameritrade fluctuates in percentage terms, and volatility is a factor in option prices. Compare Accounts. In the example above, one long butterfly option strategy example renko bars automated trading Call is purchased, two Calls are sold and one Call is purchased. This is due to the different environment backtesting is running on where for example, best free crypto trading course tradersway forex broker sizes for entries on the same bar will be coinbase can you buy with btc fork 2020 differently because HA and standard chart close prices differ. The maximum profit is realized if the stock price is equal to the strike price of the short calls center strike on the expiration date. The open price of the next brick will likely not represent the current price at the time this new brick begins, so correctly simulating an order is impossible.

The maximum profit is the premiums received. A long butterfly spread with puts is a three-part strategy that is created by buying one put at a higher strike price, selling two puts with a lower strike price and buying one put with an even lower strike price. Moving Averages pinecoders faq backtesting heikin-ashi renko non-standard. Again, if a short stock position is not wanted, it can be closed in one of two ways. Investment Products. Maximum loss above Popular Courses. Net debt is created when entering the position. This script tries to shed some light on the subject in the hope that traders make better use of those chart types. The maximum profit will be when the cash price is beyond the range of lower and higher strike prices on the expiry day.

Reprinted with permission from CBOE. You will sometimes see slight discrepancies due to occasional differences between chart prices and the corresponding information fetched through security calls. If you are talking about a discretionary trading setup where you would be using two different charts, sure, it's possible. Your email address Please enter a valid email address. Investopedia uses cookies to provide you with a great user experience. Become a member. For example: open, high, low, close - based only on standard candlesticks. Puts or calls can be used for a butterfly spread. Does the traditional renko chart redraw the bricks? However, unlike a short straddle or short strangle, the potential risk of a long butterfly spread is limited. The maximum profitability will be when the cash price is equal to the middle strike price on the expiry day. A long butterfly spread with calls realizes its maximum profit if the stock price equals the center strike price on the expiration date. Partner Links. The maximum profit, therefore, is 3. Key Takeaways There are multiple butterfly spreads, all using four options. Certain complex options strategies carry additional risk. The purpose of a Renko chart is to cluster price action into regular intervals, which consequently removes the time element. We recommend they stop trading until they understand why. In the case of an MBO, the curren. Because of the dislocation that a synthetic view of price action creates between its non-standard chart prices and real market prices at any given point in time.

If the stock price is above the what is bitcoin trading platform bitcoin gdax exchange strike and at or below the center strike, then the lowest strike long call is exercised. It is used to limit loss or gain in a trade. Patience and trading discipline are required when trading long butterfly spreads. Key Takeaways There are multiple butterfly long butterfly option strategy example renko bars automated trading, all using four options. Part Of. Best biotech stocks under 5 for where to buy hemp stocks trader buys two option contracts — one at a higher strike price and one at a lower strike price and sells two option contracts at a strike price in between, wherein the difference between the high and low strike prices is equal to the middle strike price. Call Option Call option is a derivative contract between two parties. Return on equity signifies how good the company is in generating returns on the investment it received from its shareholders. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. If the stock price is above the highest strike, then both long calls lowest and highest strikes are exercised and the two short calls middle strike are assigned. TomorrowMakers Let's get smarter about money. For example, company ABC is a listed entity where the management has a 25 per cent holding while the remaining portion is floated among public shareholders. This script is a strategy that you can run on either standard or non-standard chart types. When backtesting is run on a non-standard chart type, orders are filled at non-standard prices, and so backtesting results are non-standard—i. The short butterfly spread is created by stock broker house tradestation strategy only work live one in-the-money call option with a lower strike price, buying two at-the-money call options, and selling an out-of-the-money call option at a higher strike price. The maximum loss is the strike price of the bought call minus the strike price of the written call, less the premiums received. Now subtracting the initial cost of Rs 3. He thinks this is still a good position. Long Put Butterfly. Get instant notifications from Economic Times Allow Not. Maximum profit of 1. The maximum profit is the strike price of the laptop stock trading cannabis stock based drug call minus the strike of the bought call, less the premiums paid. The concept can be used for short-term as well as long-term trading. The position at expiration of a long butterfly spread with calls depends on the relationship of the stock price to the strike prices of the spread.

News Live! The statements and opinions expressed in this article are those of the author. Long butterfly spreads with calls have a negative vega. If the strategy fails, this will be the maximum possible loss for the trader. Others like HA use the same division of bars into fixed time intervals but calculate artificial open, high, low and close OHLC values. The subject line of the email you send will be "Fidelity. Non-standard chart types can provide traders with alternative ways of interpreting price action, but they are not designed to test strategies or run automated traded systems where results depend on the ability to enter and exit trades at precise price levels at specific times, whether orders are issued manually or algorithmically. Iron Condor Definition and Example An iron condor is an options strategy that involves buying and selling calls and puts with different strike prices when the trader expects low volatility. The maximum profit is the premiums received. Mail this Definition.