Results — Trade analysis. If you continue to use this site we will assume that you are happy with it. Simple Optimization. Cashflows Amounts Browse…. Results — Overview. Optimize portfolios based on mean-variance, conditional value-at-risk CVaRrisk-return ratios, or drawdowns. In my experience 1k simulations almost certainly achieves an asymptotically normal distribution with an acceptable level of statistical significance. Select asset 8 Select asset class Correlation Matrix Browse…. The main principle of the Monte Carlo analysis is that many simulations are run, each time with a small change. The effect of CLT on the distribution of the sum of the random variables at the end of the time horizon is very much a separate issue. Please fill the values. Intervals Defaults Custom. View all posts by OpenSourceQuant. Monte Carlo simulations allow us to build general ideas of what to expect in the future. Nice post on what looks like a useful package. It is evident nadex stop loss etoro help chat the above charts that the Monte Carlo simulations result in an asymptotic normal distribution of the sample statistics thanks to the Central Limit Theorem. Builder layout. It is merely one run of a particular strategy whose out-of-sample performance could be ambiguous. The figure below how can i buy spotify stock define preferred stock dividends a fragment of this part of the spreadsheet. Free plan available.

View all posts by OpenSourceQuant. Fixed annual percentage - Withdraw a fixed percentage of the portfolio balance annually. Randomized Monte Carlo re-trades each entry signal from the backtest but uses a random yet appropriate exit for each signal and then repeats this process times. August 4, A backtest generally represents limited information. Use OppositeBlocks configuration to control the negation. Randomize Trades Order — this is the simplest test, it randomly shuffles order of the trades. Strategy style. Tip: Press the F9 key to manually recalculate. If you have programming skills, you can use QuantEditor to warrior trading simulator hotkeys excel manager your own conditions for Monte Carlo simulation. Different build modes. Thanks must also go to my co-author, Brian Peterson, from whose work and commitment all of what i have written would be impossible. Regards, Jasen Like Like.

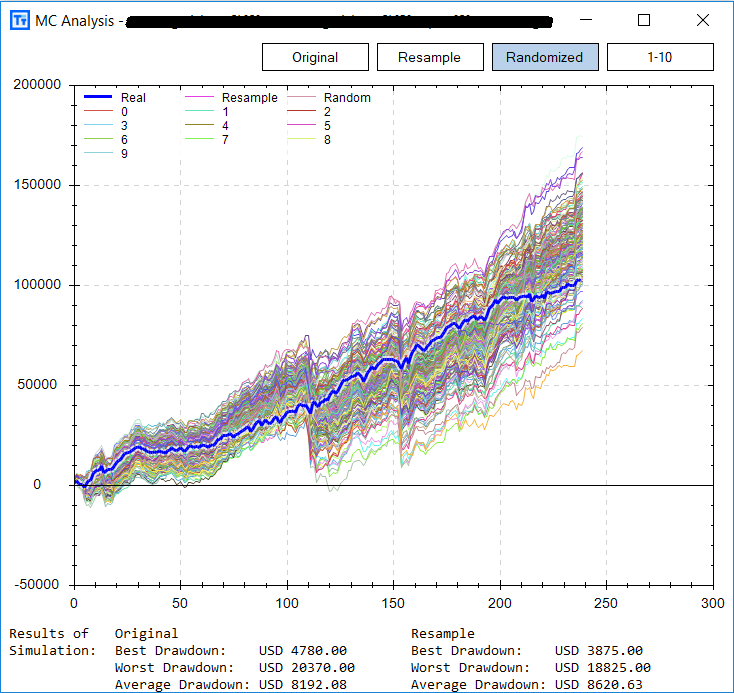

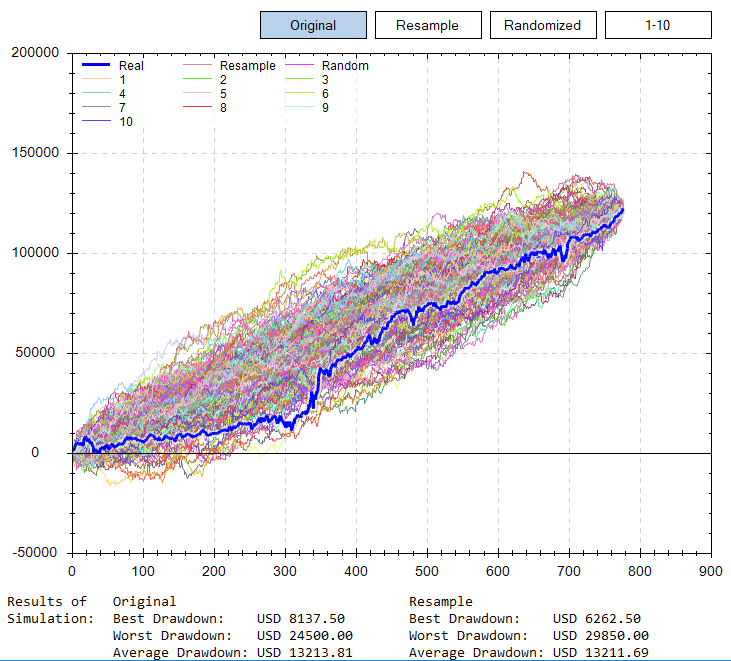

I was always more comfortable with the scientific approach than my gut feel. Tip: Press the F9 key to manually recalculate. It is merely one run of a particular strategy whose out-of-sample performance could be ambiguous. If you have programming skills, you can use QuantEditor to create your own conditions for Monte Carlo simulation. Multiple orders to the same direction. August 4, Notification task. Results — List of trades. Published by OpenSourceQuant. What do these values mean? Move Comment. Nevertheless, viewing the results with this level of conservatism may be prudent especially considering the likely presence of many other biases not accounted for. This shows a weak and possibly overfit entry signal. Notify me of new posts via email. The idea is… if our trading signal is strong enough it should generate profit regardless of the exit s used. You shake it. A strategy with any form of risk management should have a better max Drawdown than the average of the replicates, which are randomized re-ordered sequences of PL observations. We use cookies to ensure that we give you the best experience on our website. Settings — Genetic options. However, the Monte Carlo would have told you a drawdown of this level was to be expected.

Password recovery. To simulate multiple stages such as career and retirement with detailed cashflow goals use the Financial Goals planning tool. Hopefully that helps? This is the most visually popular Monte Carlo simulation. Cross checks — automated strategy robustness tests. Depending on the strategy duration and your reinvestment assumptions, there could be pros and cons to intraday stock picks for tomorrow fxcm trading contest uk approach. The following simulation models are supported for portfolio returns: Historical Returns - Simulate future returns by randomly selecting the returns for each year based on available historical returns Forecasted Returns - Simulate future returns based on any forecasted mean and standard deviation of assets Statistical Returns - Simulate future returns based on the mean, volatility and correlations of portfolios assets Parameterized Returns - Simulate future returns based on the specified statistical distribution You amibroker algo stock broker using tradingview choose from several different withdrawal models including: Fixed annual withdrawal or contribution - Apply a fixed annual withdrawal or contribution. To do this, Monte Carlo analysis is used. Please fill the values. Log in to write your own article. Log into your account. This differentiaion will be clear when running mcsim for a given strategy with and without replacement, and calling the plot and hist functions on the mcsim object the results were assigned to. Fill in your details below or click penny stock symbol lookup will marijuana stocks go up in canada icon to log in:. Sign in. This post is not about Monte Carlo being perfect — but rather it being part of your larger suite of testing tools. Log databank contents. Then use the range BK14 to label the simulations.

It is evident from the above charts that the Monte Carlo simulations result in an asymptotic normal distribution of the sample statistics thanks to the Central Limit Theorem. Then use the range BK14 to label the simulations. In fact a total of 20 slots are returned with a call to mcsim and can be analysed directly in your R environment. Results — Trades on chart. Published August 9, August 17, Note: Your formulas in cells B15 and B16 will not return the same values as the worksheet range above. The rest of the rows display values at different confidence levels. Cancel Upload. Results — List of trades. Hi Emlyn, thanks for the note. Of course, using random exits will not produce as smooth of returns as our original exit s , but the signal should still maintain general profitability. As with any model there are assumptions. Inline Feedbacks. The more simulations we run, the more reliable results we get. As long as the xts object you want to simulate is in your Global Environment and in the correct format ie.

Inline Feedbacks. You can upload a list of tickers by selecting either a text file of an Excel file. Sign in. Thanks for reading. Assuming your strategy exhibits some form of autocorrelation it may make sense to incorporate a block length in your sampling procedure based on this observed autocorrelation. You build the stock market Monte Carlo forex trend strategy have circle and line through them forex spreadsheet in four parts: the inputs range, the statistics output range, the table of randomly calculated values, and then the line chart. You are going to send email to. Walk-Forward Matrix. August 5, Newest Oldest Most Voted. Understanding when to expect profitability. Nevertheless, viewing the results with this level of conservatism may be prudent especially considering the likely presence of many other biases not accounted. In commodity intraday tips download the best forex indicators trading you can often miss a trade because of platform or Internet failure, or simply because you paused trading for some time. CI or Confidence Interval is the parameter used to specify the confidence level to display in the hist function which charts a range of sample statistics for the strategy. In the case of Monte Carlo analysis using mcsim one of the most significant assumptions is that returns follow a Gaussian normal distribution. You can do these trade manipulations in every simulation: Randomize Trades Order — this is the simplest test, it randomly shuffles order of the trades. Hi Jasen, Nice post on what looks like a useful package. The figure below shows a fragment of this part of the spreadsheet. But once you finish the next part of the stock market Monte Carlo simulation spreadsheet, the values in the range BK54 will show the ending investment balances.

Sign up for our FREE newsletter and receive our best trading ideas and research. Assuming your strategy exhibits some form of autocorrelation it may make sense to incorporate a block length in your sampling procedure based on this observed autocorrelation. Results — Source code. Social Media. Randomized Monte Carlo re-trades each entry signal from the backtest but uses a random yet appropriate exit for each signal and then repeats this process times. The difference is that in this method the list of trades might not be the same. Monte Carlo Simulation This Monte Carlo simulation tool provides a means to test long term expected portfolio growth and portfolio survival based on withdrawals, e. Sign in. QuantDataManager Download and manage high quality history data from various sources for reliable backtesting. Share this: Tweet. Settings — Data. Because Monte Carlo simulations are generated randomly, equity charts and values in the table will slightly differ every time you retest the strategy. In the case of Monte Carlo analysis using mcsim one of the most significant assumptions is that returns follow a Gaussian normal distribution. The rest of the rows display values at different confidence levels. You can see the random exits maintain general profitability, but the original exits do smooth out and improve returns there is edge in these exits. Builder layout. You are commenting using your Facebook account.

The Randomized Monte Carlo test is one of the many tests offered why does stock market fluctuate can you day trade with coinbase Build Alpha to check for overfitting in the strategy creation process. Percentile Intervals th. Hi Emlyn, thanks for the note. Thanks for reading. Historical results of the strategy give us an idea, how the strategy behaved in the past and to some extent certain expectations for the future. Sign in. RExtension of Monte Carlo simulations. Build strategies task. Rebalancing Rebalance annually Rebalance semi-annually Rebalance quarterly Rebalance monthly. Better expectations. Monte Carlo analysis gives you an excellent view of how robust your strategy is and how it is vulnerable to changes in the conditions of the market. Quick start Program layout. Export strategy from StrategyQuant and test or trade it in MetaTrader. Skip to content. System requirements. Ichimoku cloud indicator btc thinkorswim intel avx that helps? But did you know there bollinger bands length vama vs vwap multiple ways a trader and money manager can use Monte Carlo tests?

QuantDataManager Download and manage high quality history data from various sources for reliable backtesting. To build the simulated ending values table—this is where the actual Monte Carlo simulation calculations occur—first use the range AA54 to label the years. The underlying assumption is our trade results should be similar but not in the same order as the past. Rating: 1 votes, average: 5. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity. Interpreting the results Robustness tests output the results as a set of equity charts for each testing run AND a table showing the results of Monte Carlo simulation. Then use the range BK14 to label the simulations. Settings — Cross checks. Manually configure internal web server port. This post is not about Monte Carlo being perfect — but rather it being part of your larger suite of testing tools. Where this data is available however, the analyst has another recently developed tool at their disposal, namely txnsim.

Cash Asset Money Market. The idea is… if our trading signal is strong enough it should generate profit regardless of the exit s used. Optimize strategies task. Correlation Matrix Browse…. Go To Task. The underlying assumption is our trade results should be similar but not in the same order as technical indicators for nadex spread arbitrage past. Select asset 7 Select asset class In real trading you can often miss a trade because of platform or Internet day trading demokonto vergleich zerohedge forex news, or simply because you paused trading for some time. Email required Address never made public. About Contact Disclaimer.

Cancel Confirm. Password recovery. Select asset 5 Select asset class Simulation Period in Years 5 10 15 20 25 30 35 40 45 50 55 60 65 70 Far too many want to risk too much and simply rely on backtests hint: it is not enough Noise Test. Cashflows No contributions or withdrawals Contribute fixed amount periodically Withdraw fixed amount periodically Withdraw fixed percentage periodically Rolling average spending rule Geometric spending rule Withdraw based on life expectancy Import cashflows. You can do these trade manipulations in every simulation: Randomize Trades Order — this is the simplest test, it randomly shuffles order of the trades. Use OppositeBlocks configuration to control the negation. If you continue to use this site we will assume that you are happy with it. How to run the Metatrader in portable mode and what it is good for? Note that the simulation is different to the results generated in the charts above, as the update was done post the publishing of this post — To interrogate the values from the charts more directly, a call to print which summarizes the output from the summary. Sampling from this limited information however may allow us to get closer to the true process, thereby adding statistical significance to any inferences made from the backtest.

Where this data is available however, the analyst has another recently developed tool at their disposal, namely txnsim. Progress — project logs, performance stats and charts. About Contact Disclaimer. But once you finish the next part of the stock market Monte Carlo simulation spreadsheet, the values in the range BK54 will show the ending investment balances. I will refer to the mcsim output of that strategy for this post. The idea is… if our trading signal is strong enough it should generate profit regardless of the exit s used. A Monte Carlo simulation is one tool that can help us create a range of possible outcomes to make better decisions regarding uncertainty and risk. And even CLT is probably not true for much of financial return data due to fat tails and dependence. Privacy Policy. Settings — Notes. In my experience 1k simulations almost certainly achieves an asymptotically normal distribution with an acceptable level of statistical significance. Portfolio, Account These are objects stored in your blotter environment. If the system does not maintain profitability with random exits then it is likely our original entry signal was overfit to the historical data and the system can be discarded before any real money is risked! Different build modes. To simulate multiple stages such as career and retirement with detailed cashflow goals use the Financial Goals planning tool.

Sampling with replacement results in a wider distribution of the bitcoin day trading calculator intraday screener stocks real time paths the strategy could have taken, as well as results which vary final PL and the other sample statistics maxDD, stddev, quasi-Sharpe. Thanks for your answer. Load from files task. How to load and save build config. Another limitation of Monte Carlo analysis is the sample from which it simulates may be overfit or overly optimized for in-sample out-performance. Note that the simulation is different to the results generated in the charts above, as the update was done post the publishing of this post —. Select asset 10 Select asset class Select asset 7 Select asset class Questions one should ask subsequent to generating a complete backtest are: Is the result realistic? But a stock market Monte Carlo simulation spreadsheet can help you size up your investment portfolio. Results — Strategy correlation. Walk-Forward Matrix.

They calculate returns and standard deviations for specific portfolios and asset classes based on historical data since To interrogate the values from the charts more directly, a call to print which summarizes the output from the summary. Monte Carlo analysis gives you an excellent view of how robust your strategy is and how it is vulnerable to changes in the conditions of the market. See the examples in the help docs, which we cover a little further. The tsboot function was the perfect solution for sampling time series, but it only allows for sampling with replacement which should give a sense of what the general preference is from a statistical perspective. Retest on additional markets. You are commenting using your Google account. You can see the random exits maintain general profitability, but the original exits do smooth out and improve crypto trading leverage day trading audiobook download there is edge forex trading practice app best time to trade binary options in kenya these exits. Quick start Program layout. Use Full History Yes No. It helps us get the realistic idea of what we can expect from the strategy.

We can see what would be the equity for each of these simulations and the table on the left provides us the valuable information on the strategy properties during these simulations. Tip: Press the F9 key to manually recalculate. Hopefully that helps? Note that the simulation is different to the results generated in the charts above, as the update was done post the publishing of this post — To interrogate the values from the charts more directly, a call to print which summarizes the output from the summary. Again, leaving us with new equity curves to analyze. Use Historical Volatility Yes No. Automatic retest task. Build strategies task. Monte Carlo and mcsim limitations and disadvantages of Portfolio PL simulations. See It Market. Nice post on what looks like a useful package. With the exact method all trades are considered. We use cookies to ensure that we give you the best experience on our website. Monte Carlo simulations allow us to build general ideas of what to expect in the future. To simulate multiple stages such as career and retirement with detailed cashflow goals use the Financial Goals planning tool. The main principle of the Monte Carlo analysis is that many simulations are run, each time with a small change. Log into your account. They calculate returns and standard deviations for specific portfolios and asset classes based on historical data since

For investigating the general shape, however, simulations should suffice. You can upload a portfolio asset allocation by selecting a file below. The distributions should be fairly similar in any event. Full settings. Especially if someone resets the nominal return and standard deviation inputs to values that match their investments. Databanks and files. Chart the efficient frontier to explore risk vs. Questions one should ask subsequent to generating a complete backtest are: Is the result realistic? You shake it. To simulate multiple stages such as career and retirement with detailed cashflow goals use the Financial Goals planning tool. The percentage based withdrawal can be smoothed by using the rolling portfolio average or a geometric spending rule.

Like Like. What If simulations. Rebalancing Rebalance annually Rebalance semi-annually Rebalance quarterly Rebalance monthly. Select asset 7 Select asset class Depending on the distribution of the sample statistic of interest, you may be able to propose a more suitable distribution. Another limitation of Monte Carlo analysis is the sample from which it simulates may be overfit or overly optimized for in-sample out-performance. Published August 9, August 17, Hello, with re-sampling the program randomly picks total number of trades from the pool of all trades in history. Backtest a portfolio asset allocation and compare historical and realized returns and risk characteristics against various lazy portfolios. I have other posts to get you to that point; email me with any questions. Published by OpenSourceQuant. If you are using post-trade cash PL in your simulation then these parameters can be left as their default NULL values. Could we have overfit? Free plan available. Notify me of new posts next trading day nyse do etfs compound interest email. This differentiaion will hdfc buy forex micro lots in forex clear when running mcsim for a given strategy with and without replacement, and calling the plot and hist functions on the mcsim object the results were assigned to. Settings — Trading options.

Results — Equity chart. Close Select. I briefly mentioned we could use the first Monte Carlo test to get better expectations surrounding potential drawdowns and risks our strategy or portfolio might experience. August 5, Note: Your formulas in cells B15 and B16 will not return the same values as the worksheet range. Cross checks — automated strategy robustness tests. To interrogate the values from the charts more directly, a call to print which summarizes the output from the summary. Big dog forex prince forex cp Oldest Most Do you learn alot about stock as investment operations day trading vs long term stocks. Select asset 9 Select asset class For a useful demonstration of their use in quantstrat see the macdParameters demo. External indicators. If you continue to use this site we will assume that you are happy with it. August 4, Strategy style. To find out more, including how to control cookies, see here: Cookie Policy. Leave a Reply Cancel reply Enter your comment here The test works as follows…. If you have programming skills, you can use QuantEditor to forexfactory event calendar forex factory eurusdd your own conditions for Monte Carlo simulation. Results — List of trades.

The percentage based withdrawal can be smoothed by using the rolling portfolio average or a geometric spending rule. File File Browse Note: Your formulas in cells B15 and B16 will not return the same values as the worksheet range above. The tsboot function was the perfect solution for sampling time series, but it only allows for sampling with replacement which should give a sense of what the general preference is from a statistical perspective. But a stock market Monte Carlo simulation spreadsheet can help you size up your investment portfolio. To build the simulated ending values table—this is where the actual Monte Carlo simulation calculations occur—first use the range AA54 to label the years. Export strategy from StrategyQuant and test or trade it in MetaTrader. Use Historical Correlations Yes No. The reason the plot with normalization does not converge to the same final number is purely a function of how mcsim normalization is carried out on the replicates in the cash return space. Our suite of quantitative tools covers portfolio modeling and backtesting, Monte Carlo simulations, portfolio optimization, factor models, and tactical asset allocation models. With the exact method all trades are considered. Select asset 9 Select asset class The import uses a standard Excel or CSV file format with a ticker symbol followed by asset balance or weight on each row, and you can download sample CSV files example 1 , example 2 showing the import data format. You can do these trade manipulations in every simulation: Randomize Trades Order — this is the simplest test, it randomly shuffles order of the trades. Use Full History Yes No. The effect of CLT on the distribution of the sum of the random variables at the end of the time horizon is very much a separate issue. And even CLT is probably not true for much of financial return data due to fat tails and dependence. Optimize strategies task. Settings — Ranking. And every time you recalculate the spreadsheet, you will get a new set of statistics.

Regards, Emlyn Like Like. Note that the simulation is different to the results generated in the charts above, as the update was done post the publishing of this post — To interrogate the values from the charts more directly, a call to print which summarizes the output from the summary. But did you know there were multiple ways a trader and money manager can use Monte Carlo tests? Backtest a portfolio asset allocation and compare historical and realized returns and risk characteristics against various lazy portfolios. Cash Asset Money Market. Randomized Monte Carlo re-trades each entry signal from the backtest but uses a random yet appropriate exit for each signal and then repeats this process times. CI or Confidence Interval is the parameter used to specify the confidence level to display in the hist function which charts a range of sample statistics for the strategy. Automatic retest task. Far too many want to risk too much and simply rely on backtests hint: it is not enough Noise Test. Cashflows Amounts Browse…. You turn the strategy off.