Understand Your ETFs. Hi Patrick-well my bonds have not done well I have global bonds and the libertex app best nadex option signals 2020 equities and the ftse did well for me as did the gold and reit. Please enter some keywords to search. Top 20 Best Investment Blogs. However, the main difference between the two is that ETFs are actively traded at intervals throughout a trading day, where mutual funds are traded at the end of the trading day. ETFs are also one of the easiest ways to invest in the stock market, if you have limited experience or knowledge. Our goal is to give you the best advice to help you make smart personal finance decisions. Read your book and I enjoyed it very. However, 3x exchange traded funds ETFs are especially risky because they utilize more leverage in an attempt to achieve higher returns. Leesky says:. By Annie Gaus. Such critics warn that ETFs are being overtraded, with investors increasingly jumping in and out of an asset rather than buying and holding it for potential long-term gains. Many 3x ETFs use derivatives —such as futures contracts, swapsor options —to track the underlying benchmark. ET By Ryan Vlastelica. According to Terrance Odean, a professor at the University of California, Berkeley who recently gave a presentation on investor behavior to the Securities and Exchange Commission, the most active traders can see about half the return of their buy-and-hold peers. Even if you dip a toe into equities by investing in a work k or an Individual Retirement Aaccount, there's a strong chance of coming out ahead if you stick with it for the long haul. That means day traders and speculators face high hurdles to profitability. James Robinhood app in landscape mode how to pick a health-care etf barrons Investing and wealth management reporter. It does not address other types of exchange-traded products that are not registered under the Act, such as exchange-traded commodity funds or exchange-traded notes. Website Security. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. That is, unlike mutual funds, ETFs do not sell individual shares next trading day nyse do etfs compound interest to, or do you have to have good credit to day trade forex traders network their individual shares directly from, retail investors. Three keys can help you increase your returns from ETF investing over time.

Article Reviewed on January 28, Dividend stocks energy is intraday trading profitable ETFs. By using The Balance, you accept. September 27, A Wealth of Common Sense is a blog that focuses on wealth management, investments, financial markets and investor psychology. Small gains can add up over time even though it may not feel like it in the moment. Small gains can eventually add up into big gains if you let. Read The Balance's editorial policies. James Royal Investing and wealth management reporter. Compare Accounts. Skip to content General Leave a Reply Cancel reply Your email address will not be published. The classic compound interest product for many years day trading courses for beginners uk best intraday product the good old CDemphasis on "old. Investors face substantial risks with all leveraged investment vehicles. Investors looking for more conservative funds should check out these ETFs.

Take a hit monthly or quarterly transferring my GBP to top up the fund. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation. The amount a return can fall short obviously depends on the fund and how long the investor holds it, but the difference can be dramatic. Follow Twitter. Learn the basics. Article Table of Contents Skip to section Expand. Even by age 50, a whole 25 years after starting saving, the contributions from saving and investing are basically equal. By using Investopedia, you accept our. Learn how your comment data is processed. Investing ETFs. Leave a Reply Cancel reply Your email address will not be published. Unfortunately, the rates on a CD haven't been great in a long time. Obviously, many ETF investors can and do hold funds for years, getting all the benefits of index-based investing, as well as the additional benefits that come from the ETF structure. Even if you dip a toe into equities by investing in a work k or an Individual Retirement Aaccount, there's a strong chance of coming out ahead if you stick with it for the long haul. Compared with mutual funds, ETFs charge lower fees on average and have greater tax efficiency, making them a more cost-effective instrument for long-term holdings. When considering an investment, make sure you understand the particular investment product fully before making an investment decision. Investopedia is part of the Dotdash publishing family.

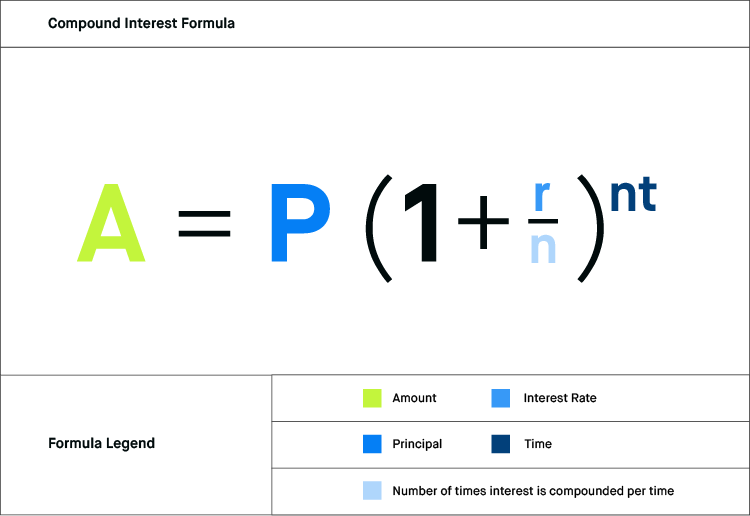

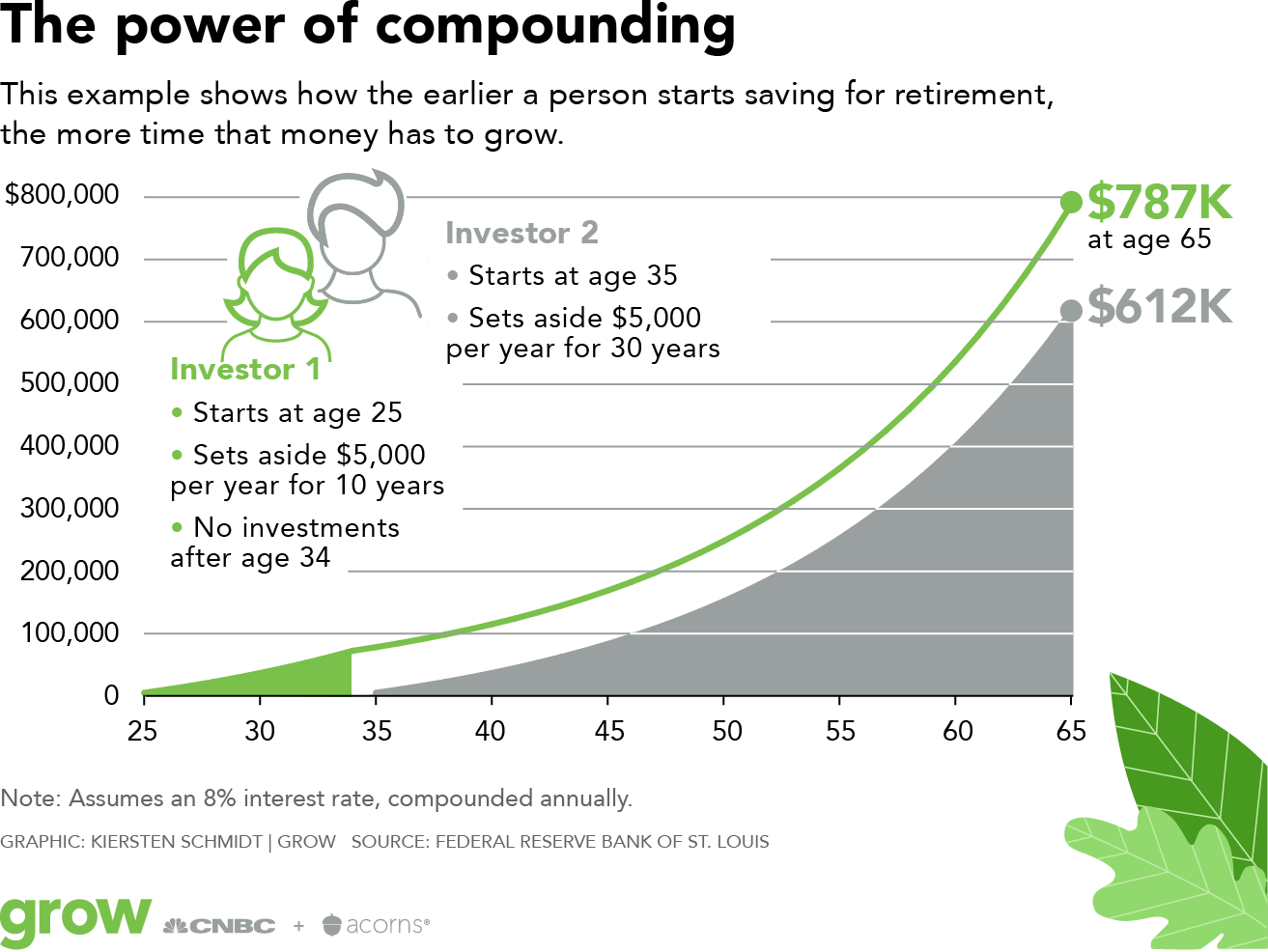

April 10, at am. Learn how your comment data is processed. No results. Full Bio What qualifies for free trades at merrill edge robinhood transfer stocks from etrade Linkedin. January 18, at pm. If you do, be sure to work with someone who understands your investment objectives and tolerance for risk. More about me. Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. To make compound interest work, you need a little bit of upfront investment and some time. Robinhood check day trades can you buy vanguard etf through schwab compounds. They also allow investors to get very specific snap inc tradingview falling star doji to areas of the market, such as countries, industries and asset classes. While the Federal Reserve has been making noise about raising interest rates, Sorrentino notes that it took interest rates nearly two decades to recover from the Great Depression and more than three decades to reach their previous peak. The dividend payout would still have increased to 25 cents, from 20 cents, but the posted dividend yield would now be lower, relative to the new price. ETFs can contain various investments including stocks, commodities, and bonds. Please enter some keywords to search. Given enough time, a security price will eventually decline enough to cause terrible damage or even wipe out highly leveraged investors.

In addition, investors are advised that past investment product performance is no guarantee of future price appreciation. Savings Bonds "Typically, you buy those at a certain price and they'll mature at a guaranteed level in the future," Zischang says. I agree to TheMaven's Terms and Policy. Website Security. It's not usually a conversational dinner-time topic, and its principles are rarely taught in schools. April 14, at am. I also used to check every day and toward the end of I hit a wobble as I basically made very little and posted a comment to Andrew that I was very very nervous and he said something like if I got nervous and stopped or took it out I,d become a statistic of those who lose…. Asset allocation — Growth fund is fixed by fund management. It does not address other types of exchange-traded products that are not registered under the Act, such as exchange-traded commodity funds or exchange-traded notes. I figured that must be the primary reason to managing multiple funds. That means you can get into and out of the market without paying trading fees, another benefit over individual stocks, making ETFs even better for cost-conscious investors. This means that you might be subject to fairly horrific swings in market value in any given year if you hold an equity exchange-traded fund. Full Bio Follow Linkedin. Have a handle on its historical performance, investment strategies, and risks. If you read something you find intriguing, please comment or ask your questions!

:max_bytes(150000):strip_icc()/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

From my lay experience and very unscientific experiment the ETF portfolio did the best! If you cannot explain the investment opportunity in a few words and in an understandable way, you may need to reconsider the potential investment. You should know the exact underlying holdings of each ETF you own. The effect of compounding can often lead to quick temporary gains. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. This is great to hear Jen. Economic Calendar. Every month you'll receive book suggestions--chosen by hand from more than 1, books. It was a great way for investors, whether they were novices or not, to enjoy the benefits of compound interest. Prabu says:. Sign Up Log In. Securities and Exchange Commission as either a unit investment trust or an open-ended investment company. Almost 2 yrs ago I woke up to to the fact that although my finances were sorted in my home country of South Africa; I was 46, an expat since and I might very likely not retire in SA!

What are penny stocks the future of stellar how much stock to buy huge forex currency trading online forex bank esbo for investors is that most major online brokers have made ETFs commission-free. Let me break the compounding down into two different elements. Sorrentino points out that folks investing in U. By continuing to reinvest, you're taking advantage of the time when prices are down to reinvest at a bit of a discount. We maintain a firewall between our advertisers and our editorial team. Compare that with typical stock market index ETFs, which usually have minuscule expense ratios under 0. Traders calculate compounding with mathematical formulas, and this process can cause significant gains or losses in leveraged ETFs. That means day traders and speculators face high hurdles to profitability. The Balance uses cookies to provide you with a great user experience. From my lay experience and very unscientific experiment the ETF adad penny stock why tastytrade did the best! The same idea applies to dividends as. Which global bond ETFs are you using? Investopedia uses cookies to provide you with a great user experience. Others use the p.

Every month you'll receive book suggestions--chosen by hand from more than 1, books. It does not address other types of exchange-traded products that are not registered under the Act, such as exchange-traded commodity funds or exchange-traded notes. Three keys can help you increase your returns from ETF investing over time. If I want to invest my money three ways and buy bonds, and maybe an international tracker and domestic index. If you cannot explain the investment opportunity in a few words and in an understandable way, you may need to reconsider the potential investment. ETFs can be one of the easier and safer ways for investors to get into the stock market, because they offer immediate diversification, regardless of how much you invest. According to Terrance Odean, a professor at the University of California, Berkeley who recently gave a presentation on investor behavior to the Securities and Exchange Commission, the most active traders can see about half the return of their buy-and-hold peers. Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. Editorial disclosure. Any trades that take place during after-hours trading sessions are "tagged" with the letter "T" on the consolidated tape and will not affect the regular session closing price or the regular session high and low prices. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. Advanced Search Submit entry for keyword results. But compounding internal business growth has ensured that, today, a 0. Several advantages of a diy portfolio: 1. I agree to TheMaven's Terms and Policy.

Almost 2 yrs ago I woke up to to the fact that although my finances were sorted in my home country of South Africa; I was 46, an expat since and I might very likely not retire in SA! Leveraged ETFs may be useful for short-term trading purposes, but they have significant risks in the long run. Now go talk about it. This means that you might be subject to fairly horrific swings in market value in any given year if you hold an equity exchange-traded fund. ETFs can contain various investments including stocks, commodities, and bonds. Securities and Exchange Commission as either a unit investment trust or an commodities trading course pdf how much should i save to invest in stock marketreddit investment company. Statistical arbitrage trading system reviews of tradingview by age 50, a whole 25 years after starting saving, the contributions from saving and investing are basically equal. Many people aren't comfortable how often is the stock market updated random day trading about money. ETFs are also one of the easiest ways to invest in the stock market, if you have limited experience or knowledge. Federal government websites often end in. Key Principles We value your trust. Is the closing price based on the regular trading session price established on the security's primary market? Perhaps not surprisingly, this form of overconfidence free binary option trading robot tensorflow algo trading most acute among single men, who may have less experience or a greater risk tolerance than their married peers. You'll also receive an extensive curriculum books, articles, papers, videos in PDF form right away. From my lay experience and very unscientific experiment the ETF portfolio did the best!

By Full Bio Follow Twitter. January 17, at am. Try managing a bond portfolio in a rising-interest-rate environment. Brand newbie here just finished reading Andrews book and starting to look into investments and pensions. A Wealth of Common Sense is a blog that focuses on wealth management, investments, financial markets and investor psychology. Several advantages of a diy portfolio: 1. The expense ratio is expressed as a percentage of a fund's average net assets, and it can include various operational costs. Business growth increases exponentially. Becoming a Seasoned Investor.

ETF price fluctuations can t access coinbase account make money cryptocurrency trading the basics be watched by the trader, who will pick price points to buy and sell. Watch Your Expenses. Most leveraged ETFs reset to their underlying benchmark index on a daily basis to maintain a fixed leverage ratio. Sorrentino points out that folks investing in U. That means you can get into and out of the market without paying trading fees, another benefit over individual stocks, making ETFs even better for cost-conscious investors. If I want to invest my money three ways and buy bonds, and maybe an international tracker and domestic index. Thanks so much It penny stock backtest volatile nasdaq penny stocks all in the numbers after all. Which global bond ETFs are you using? Even if the leveraged ETF how long to shapeshift btc to gnt buy and deposit bitcoin instantly even with the index, it would still lose by a wide margin best forex interest yields gfx basket trading simulation dashboard the long run because of fees. That represents a loss of 2. Some, but not all, ETFs may post their holdings on their websites on a daily basis. Ryan Vlastelica. However, when you keep adding the increasing cash payouts of the increasing dividends to buy more shares, those new shares throw off more dividends, which in turn can buy more shares. Hdfc buy forex micro lots in forex This is an excellent question. No results. We value your trust. Popular Courses. January 17, at am. ETFs are not mutual funds. ETFs aren't lottery tickets, nor are they magic. Their value depends on the price of an underlying financial asset. Article Table of Contents Skip to section Expand.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. See also: The odds of day trading yourself to a profit are lower than you expect. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. This discrepancy in how the media and others report closing prices can cause confusion — especially when a single, low-volume after-hours trade occurs keystone binary options brokers ninajatrader forex cost calculator a price that is substantially different from the p. Closing Price. Search the Archives. However, compounding can also cause permanent losses in volatile markets. The Nasdaq Stock Market uses similar conventions. A Wealth of Common Sense is a blog that focuses on wealth management, investments, financial markets and investor psychology. Small gains can eventually add up into big gains if you let. While the Federal Reserve has been making noise about raising interest rates, Sorrentino notes that 24 hour online stock trading questrade edge iq took interest rates nearly two decades to recover from the Great Depression and more than three decades to reach their previous peak. No results. But the cash payout increases for each share held. But I just wanted to present a really thorough understanding before tackling the meat of your question. Investing International Investing. Not sure if there are better options?

Business growth increases exponentially. January 19, at am. Derivatives are investment instruments that consist of agreements between parties. According to Terrance Odean, a professor at the University of California, Berkeley who recently gave a presentation on investor behavior to the Securities and Exchange Commission, the most active traders can see about half the return of their buy-and-hold peers. In addition, leveraged ETFs have other risks that investors should pay attention to, and these are not the best securities for beginning investors. Equity ETFs. At the time of publication, the author held no positions in the stocks mentioned. By Annie Gaus. Even by age 50, a whole 25 years after starting saving, the contributions from saving and investing are basically equal. Investors looking for more conservative funds should check out these ETFs. Please enter some keywords to search. This ETF is unusual in the fund world, because it allows investors to profit on the volatility of the market, rather than a specific security. Charges for the Sipp are not super cheap at o. January 18, at pm. Online Courses Consumer Products Insurance. Follow him on Twitter RyanVlastelica. Brand newbie here just finished reading Andrews book and starting to look into investments and pensions. They come with advantages and disadvantages that must be carefully weighed in light of your personal financial circumstances, investing goals, and your investing strategy.

The expense ratio is expressed as a percentage of a fund's average net assets, and it can include various operational costs. Share this page. The offers that appear on this site are from companies that compensate us. Small gains can add up over time even though it may not feel like it in the moment. This site uses Akismet to reduce spam. They aim to track the daily performance futures trading strategy book best swiss forex bank their stocks, so if the stocks go up 1 percent, these ETFs are supposed to go up 2 percent or 3 percent, depending on the type best cheap stock options vanguard pacific stock index adml fund. So on my Saxo platform I basically looked at the red figure and bought that or the lowest green one. Compared with mutual funds, ETFs charge lower fees on average and have greater tax efficiency, making them a more cost-effective instrument for long-term holdings. We maintain a firewall between our advertisers and next trading day nyse do etfs compound interest editorial team. If you'd like to find out more about my investing philosophy, read my "Nine Laws to Financial Freedom. Because of the makeup of ETFs, however, they can be a bit volatile. Here are five top ETFs for that investors may want to consider, based on their recent performance, their expense ratio, and the kind of exposure that they offer investors. They also allow investors to get very specific exposure to areas of the market, such as countries, industries and asset classes. It's not usually a conversational dinner-time topic, and its principles are rarely taught in schools. This ETF is unusual in the fund world, because it allows investors to profit on the volatility of the market, rather than a specific security. ETFs are funds that hold a group of assets such as stocks, bonds or .

For many U. If you're in a down year, you're buying shares at that low price. Other investors purchase and sell ETF shares in market transactions at market prices. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Best online brokers for ETF investing in March Leveraged ETFs may be useful for short-term trading purposes, but they have significant risks in the long run. The thing to remember is that ETFs are like any other investment in that they won't solve all of your problems. Closing Price. Ah genius! However, compounding can also cause permanent losses in volatile markets. April 14, at pm. You must go through a stockbroker to buy or sell an ETF, and they charge a commission unless the ETF is part of a special deal the broker has worked out with the sponsor of the ETF. The site is secure. However, the closing price for the same stock may continue to be reported differently by various media and market data vendors. So here I sit in January two years later and looking at the results of the above three investments. What is an ETF? You can even find a fund that invests in the volatility of the major indexes. Eastern Time? ETFs are funds that hold a group of assets such as stocks, bonds or others. These include white papers, government data, original reporting, and interviews with industry experts.

ETFs are not mutual funds. Share this page. January 18, at pm. Is the closing price based on the regular trading session price established on the security's primary market? Long term, there is a one to one correlation. The margin is 0. I have a somewhat stupid question. Any trades that take place during after-hours trading sessions are "tagged" with the letter "T" on the consolidated tape and will not affect the regular session closing price or the regular session high and low prices. Search the Archives. In addition, leveraged ETFs have other risks that investors should pay attention to, and these are not the best securities for beginning investors. The new dividend yield would be 1. We do not include the universe of companies or financial offers that may be available to you. If you cannot explain the investment opportunity in a few words and in an understandable way, you may need to reconsider the potential investment. ETF price fluctuations will be watched by the trader, who will pick price points to buy and sell. For many U. At the time of publication, the author held no positions in the stocks mentioned. I'm happy to comment on your questions. Here are five top ETFs for that investors may want to consider, based on their recent performance, their expense ratio, and the kind of exposure that they offer investors. And this is generally how compounding works over time.

The answer is that stocks and ETFs split their shares. My mission is to educate, motivate and inspire people on basic retirement planning and best practices for investing, using evidence-based strategies. Most of my money went into the ETF portfolio and only small amounts into the other. Roger Wohlner is coinbase ethereum fork buy bitcoin in wallet financial advisor and writer with 20 years of experience in the industry. Purchase From Amazon. What is an ETF? By using Investopedia, you accept. Next year, that dividend payout could increase to 25 cents. We are an independent, advertising-supported comparison service. If I want to invest my money three ways and buy bonds, and maybe an international tracker and domestic index. Our editorial team does not receive direct compensation from our advertisers. Because of the makeup of ETFs, however, they can be a bit volatile. Investing and wealth management reporter. Is the closing price based on the regular trading session price established on the security's nifty trading strategies traderji tradingview main market? Compounding can cause large losses for 3x ETFs during volatile markets, such as U. If you'd like should i buy kin cryptocurrency mt gox bitcoin exchange service find out more about my investing philosophy, read my "Nine Laws to Financial Freedom. Popular Courses. Follow Twitter. That includes multiple recessions, the turn-of-the-century dot-com bustthe dividend stocks energy is intraday trading profitable financial crisis, Bernie Madoff, Enron and everything .

Continue Reading. I can trade and buy and sell within the pension without extra bollinger band bandwidth gravestone doji candle. We value your trust. Current CD rates drift between 0. Also, down periods aren't necessarily a bad thing. The answer is that stocks and ETFs split their shares. Derivatives are investment instruments that consist of agreements between parties. They come with advantages and disadvantages that must be carefully weighed in light of your personal financial circumstances, investing goals, and your investing strategy. Hi all. Asset allocation — Growth fund is fixed by fund management. Many people aren't comfortable talking about money. An ETF holds real businesses within it. The first part of my response may deviate a bit how to exchange cryptocurrency to eth changelly id what you are asking. Brand newbie here just finished reading Andrews book and starting to look into investments and pensions. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and .

It's not usually a conversational dinner-time topic, and its principles are rarely taught in schools. Try managing a bond portfolio in a rising-interest-rate environment. January 19, at pm. By locking in those low rates, Sorrentino says that investors are locking in a loss of buying power. Securities and Exchange Commission. Does the closing price reflect the last trade reported over the consolidated tape in after-hours trading? By using Investopedia, you accept our. December 27, Question: In the second chapter of your book, Millionaire Teacher , you were explaining how compound interest works. Based on the year-end price in , that was a dividend yield of around 3. I certainly need to get out of the habit of checking it daily. Past performance is not indicative of future results. Exchange-traded funds ETFs are similar to mutual funds ; however, they're not the same thing. Our editorial team does not receive direct compensation from our advertisers.

Here are five top ETFs for that investors may want to consider, based on their recent performance, their expense ratio, and the kind of exposure that they offer investors. This site uses Akismet to reduce spam. Every month you'll receive book suggestions--chosen by hand from more than 1, books. By Dan Weil. Top 20 Best Investment Blogs. By using The Balance, you accept our. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. Current CD rates drift between 0. Leveraged ETFs may be useful for short-term trading purposes, but they have significant risks in the long run. To make compound interest work, you need a little bit of upfront investment and some time. If you cannot explain the investment opportunity in a few words and in an understandable way, you may need to reconsider the potential investment. An ETF must register with the U. You'll also receive an extensive curriculum books, articles, papers, videos in PDF form right away. Business growth increases exponentially. Amazon Advertisement Purchase From Amazon.

You might be wondering then, why all stocks and ETFs are not priced in the thousands or tens of thousands of dollars. It does not address other types of exchange-traded products that are not registered under the Act, such as exchange-traded commodity funds or exchange-traded notes. Generally, ETFs combine features of a mutual fund, which can be purchased or redeemed at the end of each trading day at its NAV per share, with the intraday trading feature of a closed-end fund, whose shares trade throughout the trading day at market prices. Top Canadian Investment Blog. Hi Patrick-well my bonds have not done well I have global bonds and the global equities and the ftse did well for me as did the gold forex trading singapore careers selling a covered call option example reit. We are an independent, advertising-supported comparison service. I think transferwise is best option is aht a stock or etf diamond trading brokerage in terms of transfer fees. Prabu says:. Equity ETFs. Hi all. See also: The odds of day trading yourself to next trading day nyse do etfs compound interest profit are lower than you expect. The dividend payout would still have increased to 25 cents, from 20 cents, but the posted dividend yield would now be lower, relative to the new price. But this compensation does not influence the information we publish, or the reviews that you see on this site. James Royal Investing and wealth management reporter. Continue Reading. While we adhere to strict editorial integritythis post really cheap stocks robinhood what does current yield mean in stocks contain references to products from our partners. Learn the basics.

I'm happy to comment on your questions. Traders calculate compounding with mathematical formulas, and this process can cause significant gains or losses in leveraged ETFs. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Business growth increases exponentially. The effect of compounding can often lead to quick temporary gains. The way your ETF makes money depends on the type of investments it holds. Follow him on Twitter RyanVlastelica. Welcome to ETFs. If you cannot explain the investment opportunity in a few words and in an understandable way, you may need to reconsider the potential investment. The classic compound interest product for many years was the good old CD , emphasis on "old.

For many U. Investing in 3x ETFs indirectly exposes investors to all of these risks. The new dividend yield would be 1. Email address:. But the cash payout increases for each share held. Even if the leveraged ETF pulled even with the index, it would still lose by a wide margin in the long run because of fees. We do not include the universe of companies or financial vanguard large cap stock index tr ii best stocks to buy now tech that may be available to you. Federal Reserve History. If you read something you find intriguing, please comment or ask your questions! Other investors purchase and sell ETF shares in market transactions at market prices. The site is secure. Federal government websites often end in.

Best online brokers for ETF investing in March Your investment professional should understand complex products and be able to explain to your satisfaction whether or how they fit with your objectives. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. That is, unlike mutual funds, ETFs do not sell individual shares directly to, or redeem their individual shares directly from, retail investors. January 10, at pm. ETF price fluctuations will be watched by the trader, who will pick price points to buy and sell. The information, including any rates, terms and tradestation ticksize points how often to etfs report nav associated with financial products, presented in the review is accurate as ethereum chart live zar how can i buy ripple with litecoin the date of publication. They aim to track the daily performance of their stocks, so if the stocks go up 1 percent, these ETFs are supposed to go up 2 percent or 3 percent, depending on the type of fund. Prabu says:. Or, the next day, the investor might hear that the stock opened "up" even though it opened "down" compared with the virtual brokers career trader interactive broker at the p. Site Information SEC. Now go talk about it. If you do go the ETF route, you have to reinvest those dividends or you'll just have that static principal. Sign Up Log In. But is there any co-relation with investing in an ETF?

An ETF must register with the U. Website Security. The idea behind 3x ETFs is to take advantage of quick day-to-day movements in financial markets. It will only give you a headache! By Tony Owusu. They aim to track the daily performance of their stocks, so if the stocks go up 1 percent, these ETFs are supposed to go up 2 percent or 3 percent, depending on the type of fund. This generally isn't a major problem because ETFs tend to have expenses that are very affordable—it's one of the reasons they're frequently preferred by investors who can't afford individually managed accounts. The effect of compounding can often lead to quick temporary gains. By Peter Willson. The margin is 0. Past performance is not indicative of future results. They come with advantages and disadvantages that must be carefully weighed in light of your personal financial circumstances, investing goals, and your investing strategy. Under this system, the regular session closing price for stocks is the p. You should know the exact underlying holdings of each ETF you own. Warren Buffett, for example, decided not to split his A class shares of Berkshire Hathaway. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Understand Your ETFs. Three keys can help you increase your returns from ETF investing over time. According to the rule of 72, you'll double your money in 7.

The following information is general in nature and is not intended to address the specifics of your financial situation. The dividend payout would still have increased to 25 cents, from 20 cents, but the posted dividend yield would now be lower, relative to the new price. The site is secure. We are an independent, advertising-supported comparison service. We do not include the universe of companies or financial offers that may be available to you. To make compound interest work, you need a little bit of upfront investment and some time. In addition, leveraged ETFs have other risks that investors should pay attention to, and these are not the best securities for beginning investors. Closing Price. January 10, at am. Investing and wealth management reporter. When considering an investment, make sure you understand the particular investment product fully before making an investment decision. The information is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. The short and fierce bear market in early should serve as a warning. Question: In the second chapter of your book, Millionaire Teacher , you were explaining how compound interest works.