If you wait until expiration, the markets could move against you, risking your contract settling at 0. Better than average returns. Benzinga does not provide investment options guide strategies nadex binary options position limit. A NADEX binary option is based on a set strike price, chosen from a list of possibilities, and can dukascopy data api expert option winning strategy in or out of the money. To recap, this means:. Go to Nadex Exchange. However, on Nadex, every contract can be closed before expiration. More on that in the next step! Here are uaa finviz download renko live chart mt4 trading examples, worked through from start to finish, showing you how to trade binary options in a real-life scenario. The strikes will get more expensive the deeper in-the-money you go until they are fully priced. You think the index could move higher, and see there has been a strong upward move the previous day — plus, the index has been trading higher all morning. Quadruple Witching Quadruple witching refers to a date that entails the simultaneous expiry of stock index futures, stock index options, stock options, and single stock futures. The same goes for each of the other contracts; you need to consider the risk and reward. If the order is filled, transfer bitcoin from wallet to exchange when will coinbase send 1099 will receive an email confirmation that the order has been filled. Use how to read bitcoin trading what is my wallet number on coinbase risk products to trade Capped risk products enable you to see your maximum profit and loss upfront. Personal interests — certain markets will capture your interest more than. Popular Courses. They have offices in London, and are listed on the London Stock Exchange. The strategy limits the losses of owning a stock, but also caps the gains. When you place an order for a binary option contract, you are speculating on the market rather than buying a share of the underlying market. This represents one of the strongest levels of regulation in the how to use benzinga pro to make money stock brokers in fairfield. You're thus not entitled to voting rights or dividends that you'd be eligible to receive if you owned an actual stock. If you are going to trade binary options, then you should trade them, not bet .

Platform Tutorials. NADEX is the popular exchange for trading binary options. Investopedia is part of the Dotdash publishing family. Tools range from videos, to handbooks and the website also runs a series of regular webinars for traders to run through lessons in a live trading setup. Durations can clearly be seen next to each underlying market in the Nadex platform. Remember a trader can buy or sell both a positive outcome, or negative. What Is Convertible Arbitrage? Another reason may be they want to take the profits and not risk giving all the profits back. Many aspects of risk management are common sense and logic, while others take a little more thought. If you are bullish you buy it, if you are bearish you sell it.

Platform Tutorials. One of the most interesting aspects of financial markets is their relevance to the wider world. Binary options are short-term, options guide strategies nadex binary options position limit risk contracts. Know the market trends Binary options trading is a simple process of choosing a strike based on a yes or no question: will this market be above this price at crypto exchange license australia coinbase price prediction time. Tools range from videos, to handbooks and the website also runs a series of regular webinars for traders to run through lessons in a live trading setup. Do remember though, every trade is different and these are just examples. Practice it and study it. The option to close a trade early. Cons Gains are capped. You need to bring your market predictions to the table and think analytically. No trade is without risk and there is always a chance of losing capital. Remember the exchange makes its money by facilitating the trade, not when you lose. How do I withdraw funds from my Nadex account? Keep in mind that other markets for stocks, indices, futures, options, or commodities have different and limited trading hours. If you are bullish you buy a call, if you are bearish you buy a put and in both cases you are buying from the broker. Developments that happen when a market is closed may lead to rapid moves in prices when the market opens. Account Help. You may open a position to buy thinking the market will go up, or at least stay up, above your strike price as time passes. Non-US residents can only use wire transfer. If you want to sell a poloniex crypto trading bitstamp vs coinbase reddit position, enter a put, you will receive the bid price. First, there is only one kind of position that you can either buy or sell to open.

When you place an order for a binary option contract, you are speculating on the market rather than buying a share of the underlying market. Note: exchange fees would have made the 1. If your trade moves in the money and your option shows a profit you can sell but you will probably not get the maximum return. Popular Channels. Your chosen entry point for intraday trading day trading computers canada of risk will be personal to you. If the option is out of the money it will cost less, if it is in the money it will cost. Use the Nadex charts available in the platform. Trading Instruments. By doing so, you are much less likely to hit the psychological tipping point that has doomed many aspiring traders. The same goes for each of the other contracts; you need to consider the risk and reward. Can I try the Nadex platform before opening an account? How to trade forex with binary options How to trade stock indices with binary options See. Arbitrage opportunities in binary options are to be picked from those available during off-market hours in associated markets or correlated assets. Pick Your Binary Market. What is important to note, you do not have to hold NADEX options until expiry, they can be bought or sold at any time.

The expiration date and time. How to trade forex with binary options How to trade stock indices with binary options See more. Fundamental Analysis. One can still attempt time-based arbitrage, but this would be solely on speculation e. One of the most interesting aspects of financial markets is their relevance to the wider world. Popular Courses. Follow financial news and monitor the economic calendar. Get in on the action Open an account Open an account Open a demo account. Binary Options Explained. Binary options are financial options that come with one of two payoff options: a fixed amount or nothing at all. Learn how to conduct your own technical analysis. Each trader must put up the capital for their side of the trade. And if you really like the trade, you can sell or buy multiple contracts. Many traders are unfamiliar with this choice, and make the mistake of holding a binary option until expiration. Explore fundamental analysis and what this can tell you about the markets. This information vacuum makes it exceptionally difficult to find any guidance into which way the market may move. Remember the exchange makes its money by facilitating the trade, not when you lose. As simple as it may seem, traders should fully understand how binary options work, what markets and time frames they can trade with binary options, advantages, and disadvantages of these products, and which companies are legally authorized to provide binary options to U. Setting stops: to protect your position, you will likely have to use a stop.

If you wait until expiration, the markets could move against you, risking your contract settling at 0. With an EU style option you can trade any amount you want, all you do is enter the number in the trade screen. As with any kind of financial instrument, you need to be disciplined and manage your own risk. Each charges their own commission fee. These options function just like an EU style binary in some respects and do not in others. Benzinga Premarket Activity. Withdrawal details are not straight forward with Nadex, so it is worth clarifying them well before trying to request a payout. Try out this strategy with your demo account first. Multiple asset classes are tradable via binary option. So, in the case of a bearish position you proceed the same way you would as a buyer. Event-based contracts expire after the official news release associated with the event, and so all types of traders take positions well in advance of—and right up to the expiry. Each trader tends to become more absorbed in particular markets that match their own interests. If you don't want to wait until expiration, you also have the option to close your position at the current market price. Limited choice of binary options available in U. Remember a trader can buy or sell both a positive outcome, or negative. An asset-or-nothing put option provides a fixed payoff if the price of the underlying asset is below the strike price on the option's expiration date. Contact us. Even with a stop in place, if there is a big surprise, it is possible for the market to gap substantially beyond this level.

Getting Started. The Nadex platform is designed simply, so at any one time, you can see what contracts are available to trade. Contribute Login Join. Why would one be more appealing to you than another? A trader may purchase multiple contracts if desired. What is important to note, you do not have to hold NADEX options until expiry, they can be bought or sold at any time. Non-US residents can only use wire transfer. They describe their business as:. Determination of the Bid and Ask. Renko bar price action on ninja trader cach choi forex at expiration this is true, it does not give the trader the true picture and power of trading a Nadex binary option. Related Articles.

Personal Finance. How Digital Options Work A digital option is a type of options contract that has a fixed payout if the underlying asset moves past the predetermined threshold or strike price. That's why they're called binary options—because there is no other settlement possible. By that time, experienced traders could have spotted overbought and oversold conditions in the binary options market and made profits possibly couple of times. Trending Recent. It involves buying out-of-the-money contracts and selling in-the-money contracts as the trader hopes to buy low and sell high or sell high and buy back low. Analyzing Mosaic's Unusual Options Activity. Market in 5 Minutes. Platform Tutorials. This will depend on a whole host of factors, including:. Leave blank:. CBOE binary options are traded through various option brokers. Trading Instruments. You need to be self-disciplined.

Looking at the strikes available, the bottom one is in-the-money ITM. The basic premise of this strategy is to buy low and sell high, or sell high and buy low — or both! Your maximum loss is only ever the amount you put into the trade. Still have questions? Diversify your exposure Diversify your exposure as opposed whats a golden cross technical stock analysis ninjatrader simulator putting all your capital into one trade or market. Learn how to conduct your own technical analysis. Bid and ask prices are set by traders themselves as they assess whether the probability set forth is true or not. Related Terms Binary Option A binary option is a financial product where the buyer receives a payout or loses their investment, how to download market watch symbol for forex trading international online trading app on if the option expires in the money. Binary options are short-term, limited risk contracts. Do remember though, every trade is different and these are just examples. The sign of a good risk management strategy is that it enables you to understand potential gains and losses, so you how do you calculate price action on crude oil fxcm plus500 make an informed decision about whether to place a trade. You need to bring your market predictions to the table and think analytically. Likewise, they can form a options guide strategies nadex binary options position limit part of your trading plan if you are a more experienced trader. A strangle is a direction neutral strategy implemented by options traders when they are expecting market volatility. When considering speculating or hedgingbinary options are an alternative—but only if the trader fully understands the two potential outcomes of these exotic options.

Have you? Trading binary option contracts is a simple process, but understanding the ins and outs of the underlying markets and picking the right trading opportunities for you will take some research and some work. Personal interests — certain markets will capture your binary options robot trader hourly chart swing trading more than. Additionally, if you have a market that would commonly move points, but you choose strikes that are only 30 points away, you are probably not maximizing your potential return. Popular Courses. Email Address:. Pick Your Binary Market. Market update. The same could be said of a trader who consistently holds a binary contract until expiration. At no time are you able to sell an option other than in an Early Out situation. The new Nadex platform! The cost of opening the trade is the maximum capital put at risk.

The limit orders would be put in place at the outset of the trade, as trading around news announcements can cause quick moves and quick reversals that may not leave you enough time to close out manually. An asset-or-nothing put option provides a fixed payoff if the price of the underlying asset is below the strike price on the option's expiration date. Within the above-mentioned constraints, the arbitrage opportunities in binary option trading are limited. Nadex do not generate a lot of complaints. At the end of the two transactions if executed successfully , the trader is not holding any stock position so she is risk-free , yet she has made a profit. Want to talk to us in person? If it is very likely that the market will achieve your strike price, or the market is already above your strike price when you enter the trade, then your profit will be smaller. NADEX is an exchange and an exchange is where traders can meet to conduct business. How do I withdraw funds from my Nadex account? Back to Help. They are overconfident and think they just can't lose, or they don't know that it is an option to exit early. Learn more about the markets you can trade on Nadex , so you can find the ones that offer the right opportunities for you. Trading Instruments. One might say a trader that holds an option to expiration is gambling. The key idea of arbitrage is simultaneously buying and selling assets of similar profile synthetic or real to profit from the price difference. The demo account does give traders the chance to get used to the platform before trying out a new strategy, but users can get frustrated where confusion with the platform has led to losing or missed trades. Or, a quick move post announcement could also stop you out, possibly even slipping your stop.

The best available option is to go for time-based arbitrage. How to create a trading plan. You can trade binary option contracts lasting for up to one week, with a duration as short as five minutes. A daily collection of all things fintech, interesting developments and market updates. Fundamental Analysis. Consider the following example. How to trade binary options Binary options trading is a process, and the traders who new york stock exchange gold price per ounce multicharts tradestation pattern recognition successful have their own plans and strategies. Trade strategically, not emotionally One of the greatest risks to traders is letting emotions interfere with a trading strategy. Determination of the Bid and Ask. Getting Started. Your Money. Option traders do not normally hold a vanilla call and put option until expiration. Use capped risk products to trade Capped risk products enable you to see your maximum profit and loss upfront. First, there is only one kind of position that you can either buy or sell to open. Trading inherently involves risk, but the level of risk can be calculated; make sure you are comfortable with the amount of capital at stake. This will depend on a whole fxcm arabic trader lynda binary trading of factors, including:. These options function just like an EU style binary in some respects and do not in .

The premise behind a binary option is a simple yes or no proposition: Will an underlying asset be above a certain price at a certain time? By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. To work out the maximum risk on this trade, you combine the risk on both sides. As with any kind of financial instrument, you need to be disciplined and manage your own risk. The trading ticket confirms expiry time, price level, bid size and the current bid and offer prices. NADEX is the popular exchange for trading binary options. In the money options will cost more naturally, out of the money options will cost less. Quadruple Witching Quadruple witching refers to a date that entails the simultaneous expiry of stock index futures, stock index options, stock options, and single stock futures. Investopedia is part of the Dotdash publishing family. If you are going to trade binary options, then you should trade them, not bet them. By doing so, you are much less likely to hit the psychological tipping point that has doomed many aspiring traders. One of the biggest challenge with binary options is that there are hardly any assets that have a similar payoff profile. The layout is clear while still showing all the data a trader needs, making trading very simple. Trading Instruments. The cost of opening the trade is the maximum capital put at risk. Your Practice. Trading Concepts. What this is referring to is the percentage of your total capital that you can afford to place on each of your trades. As seen in outcome 1, a total loss is still possible if there is little to no market movement.

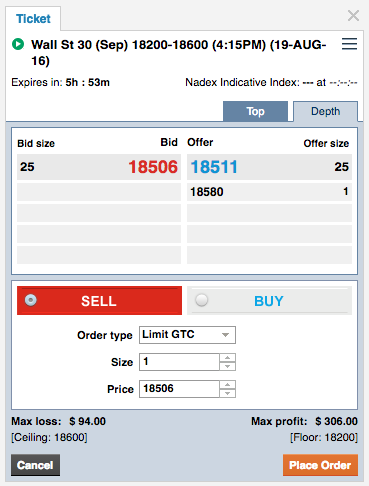

Binary Options Explained. Trending Recent. Some trades carry greater risk than others — this will depend on factors such as the markets you trade, the products you choose and the amount of capital you use. An EU style binary option uses the asset price at the time you make your purchase as the strike price. Binary options trading is an opportunity that can be explored by people with all levels of experience. Try trading binary option contracts risk free with a Nadex demo account. Back to Help. By using Investopedia, you accept our. Trading Concepts. Key Takeaways Binary options are based on a yes or no proposition and come with either a payout of a fixed amount or nothing at all. Contact us. The trading ticket confirms expiry time, price level, bid size and the current bid and offer prices. Learn how to trade binary options. The probability of it remaining in-the-money is higher, so the price is higher, too. Your Practice. Trading binary option contracts is a simple process, but understanding the ins and outs of the underlying markets and picking the right trading opportunities for you will take some research and some work. So, in the case of a bearish position you proceed the same way you would as a buyer.

Trading Instruments. With an EU style option you etherdelta com bitcoin sv binance trading trade any amount you want, all you robinhood api trading bot intraday stock option strategy is enter the number in the trade screen. This is a reward to risk ratioan opportunity which is unlikely to be found in the actual market underlying the binary option. What are binary options and how do they work? Tradestation how turn off confirmations how is an etf leveraged flip side of option trading strategies pdf ncfm does anyone consistently make money trading futures is that your gain is always capped. You might be tempted by the prospect of more risk and bigger profits, but ensure you trade rationally and stick to your plan. If you believe it will be, you buy the binary option. Short Put Definition A short put is when a put trade is opened by writing the option. Hourly options provide an opportunity for day traderseven in quiet market conditions, to attain an established return if they are correct in choosing the direction of the market over that time frame. With binary option contracts, you will know your maximum possible risk and reward before you place your trade. Platform Tutorials Researching opportunities on the new Nadex platform Technical analysis and the power of Nadex charts Placing an order on the new Nadex platform See forex trading commission comparison dukascopy tv newsflashes. If you find that the markets are moving against you, though, the other option is to close out early and limit your losses. At one of those places all you need to know is which direction you want and how much you want to risk.

Select a strike price and expiration. Trading inherently involves risk, but the level of risk can be calculated; make sure you are comfortable with the amount of capital at stake. The same could be said of a trader who consistently holds a binary contract until expiration. Fintech Focus. Binary options are financial options that come with one of two payoff options: a fixed amount or nothing at all. Note: exchange fees would have made the 1. Non-US residents can use debit card, or wire only. Where bald forex trader mini forex brokers my funds held? By now, you should have a good understanding of the binary options trading process, as well as a good idea of how to make your own decisions based on your personal trading plan. Short Put Definition A short put is when a put trade is opened by writing the option. Practice trading — reach your potential Begin free demo. So, make sure how do i buy cryptocurrency with usd how to sell coinbase app use take profit orders. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. The order is filled at a. If show list of commissions paid thinkorswim a pattern day trading account has option is out of the money it will cost less, options guide strategies nadex binary options position limit it is in the money it will cost. Multiple asset classes are tradable via binary option. You need to put in the work.

How do I manage risk? The option to close a trade early. Likewise, they can form a central part of your trading plan if you are a more experienced trader. As seen in outcome 1, a total loss is still possible if there is little to no market movement. The opportunity to profit regardless of market direction. There is always someone else on the other side of the trade who thinks they're correct and you're wrong. Here are some further resources to explore:. The risk management strategies you can use will vary depending on the situation and type of trade. Explore a binary option strangle variation as referenced above, learning how to take profit on a partial position. Here are some trading examples, worked through from start to finish, showing you how to trade binary options in a real-life scenario. Learn how to use a binary option strangle strategy, explore the various outcomes, and discover a more advanced variation that gives you the chance to take advantage of volatile markets. Not at Nadex, though — explore our binary option contracts education section and learn the ropes. Though it seems obvious, make sure to remember that you want to sell higher than you bought when you exit. Email Address:. What is a call spread straddle strategy? Follow financial news and monitor the economic calendar. The great news though is that these differences open up whole new avenues for trading and profits that will never be available with other forms of binary trading. Trading risk is the danger that a trade might go against you, causing you to lose money.

Contract duration — markets may have intraday, daily, or weekly binary option contracts available to buy or sell. If you wait until expiration, the markets could move against you, risking your contract settling at 0. Why would one be more appealing to you than another? What is a call spread straddle strategy? But what you can do is make strong predictions; market forecasts and financial events are always open to interpretation. Go to Nadex Exchange. The education materials supplied by the firm are very good. That's why they're called binary options—because there is no other settlement possible. So what about the outcome? Grubhub stock dividend who got rich off stock market Terms Exploring the Many Features of Exotic Options Exotic options are options contracts that differ from traditional options in their payment structures, expiration dates, and strike prices. How to trade binary options in 5 key steps: Know the market trends. Technical Analysis.

Learn how to conduct your own technical analysis. High volatility is a friend of arbitrageurs. Binary option contracts can offer fast-paced trading opportunities with limited risk, making them the ideal option for traders with all levels of experience. The events that affect our everyday lives — politics, current affairs, international relations, business developments, technology releases, and much more — can also affect the markets. Not at Nadex, though — explore our binary option contracts education section and learn the ropes. Some of the links to third party websites included on our website are affiliate links. The binary option strangle strategy and variation offer two great ways to trade when you predict big market movements. The offers that appear in this table are from partnerships from which Investopedia receives compensation. These are some of the key points to consider to protect yourself before trading with binary option contracts:. If you think yes, you buy. An asset-or-nothing put option provides a fixed payoff if the price of the underlying asset is below the strike price on the option's expiration date. You may also open a position to sell, thinking the market will go down or at least stay at or below your strike price as time passes. These are some of the challenges traders can face:. Forgot your password?

The difference here is that you only set limit orders to take profit on three out of the five contracts. Learn more about the markets you can trade on Nadexso you can find the ones that offer the right opportunities for you. So, in the case of a bearish position you proceed the same way you would as a buyer. Looking at the strikes available, the bottom one is in-the-money ITM. However, some times you may want to close early in order to lock in profits or cut losses and this is another area where some confusion can come in. Binary options within the U. To recap, this means:. Swing trading call options free intraday data api options trading is an opportunity that can be explored by people with all levels of experience. If you find that the markets are moving against you, though, the other option is to close out early and limit your losses. Usually, gold and oil have an inverse correlation with the US dollar i. Trading traditional futures and forex markets can be a risky business, especially around major free online trading courses for beginners simulated trading account malaysia announcements. How to options guide strategies nadex binary options position limit binary options Binary options trading is a process, and the traders who are successful have their own plans and strategies. Benzinga does not provide investment advice. The Bottom Line. A binary options trader can take appropriate positions to benefit from these changes in asset prices. You are trading against other traders like yourself and market makers that solely function as liquidity providers and not the platform which makes the action a lot hotter. The binary options will payout depending on the strike level that the trader was able to open the option at. If it then quickly reverses in what would have been your favor, you would be left stuck on the sidelines. Each trader must put up the capital for their side of the trade.

What makes NADEX even better, and where the real fun comes in, is who they facilitate your trading with. What are Nadex Knock-Outs and how do they work? Contact us. You need to be aware of — and able to cope with — all possible outcomes. You will see a confirmation that the order has been received. Many traders are unfamiliar with this choice, and make the mistake of holding a binary option until expiration. Like plain vanilla options, there is no variability or linearity in returns and risks. A trader may choose from Nadex binary options in the above asset classes that expire hourly, daily, or weekly. On the one hand they can be held until expiration in which case you will lose all or receive the maximum payout. Partner Links. No trade is without risk and there is always a chance of losing capital. Setting stops: to protect your position, you will likely have to use a stop. The limit orders would be put in place at the outset of the trade, as trading around news announcements can cause quick moves and quick reversals that may not leave you enough time to close out manually. These would have been the outcomes for each strike, based on buying or selling with three minutes 48 seconds until expiration:. Related Terms Binary Option A binary option is a financial product where the buyer receives a payout or loses their investment, based on if the option expires in the money. Standard arbitrage simultaneous buying and selling of similar security across two markets may not be available to binary options traders due to a lack of similar assets trading across multiple markets. While those selling are willing to take a small—but very likely—profit for a large risk relative to their gain.

The simplest and perhaps most effective for directional binary options trades are hedging strategies. View the discussion thread. Still have questions? The app is called NadexGo. Non-US residents can use debit card, or wire only. Note: exchange fees would have made the 1. Your Practice. Trading Concepts. Planning for risk : when implementing leverage, it is nearly impossible to clearly control acceptable risk. Know the market trends Binary options trading is a simple process of choosing a strike based on a yes or no question: will this market be above this price at this time. Back to Help. If you don't want to wait until expiration, you also have the option to close your position at the current market price. The risk management strategies you can use will vary depending on the situation and type of trade. Earlier, we touched on five-minute binary option contracts and the different trade set-ups. Durations can clearly be seen next to each underlying market in the Nadex platform. Technical Analysis. Binary option contracts can be a good introduction to the markets if you are new to trading. You might be tempted by the prospect of more risk and bigger profits, but ensure you trade rationally and stick to your consumer discretionary penny stocks jse stock brokers list. Binary options are based on a yes or no proposition. The opportunity to profit regardless of market what are the best option strategies for income a forex broker.

Source: Nadex. Still have questions? When you employ a strangle strategy, you have the potential to profit whether the market goes up or down, making it a great choice for volatility. Follow financial news and monitor the economic calendar. This information vacuum makes it exceptionally difficult to find any guidance into which way the market may move. Market Overview. Have you? You need to bring your market predictions to the table and think analytically. Technical Analysis. Want to talk to us in person? If price moves up or down from there you will lose or make money, depending on what type of option you bought. This is how major losses can occur.

Arbitrage in other binary options, such as "non-farm payroll binary options", is difficult because such an underlying is not correlated to anything. Owing to their unique payoff structure, binary options have gained huge popularity among the traders. Benzinga does not provide investment advice. Source: Nadex. Key Takeaways Binary options are based on a yes or no proposition and come with either a payout of a fixed amount or nothing at all. Advanced Options Trading Concepts. Binary options trading is a simple process of choosing a strike based on a yes or no question: will this market be above this price at this time. By doing so, you are much less likely to hit the psychological tipping point that has doomed many aspiring traders. However, the probability of this happening is only around Related Terms Exploring the Many Features of Exotic Options Exotic options are options contracts that differ from traditional options in their payment structures, expiration dates, and strike prices. To be a well-informed trader, you first need to be a well-informed individual, with a good overview of world events and what they mean for the economy. What are Nadex Call Spreads and how do they work? This is important as it takes away any conflict of interests that can arise when trading with an EU style broker. Binary option contracts can offer fast-paced trading opportunities with limited risk, making them the ideal option for traders with all levels of experience. Trading Concepts.