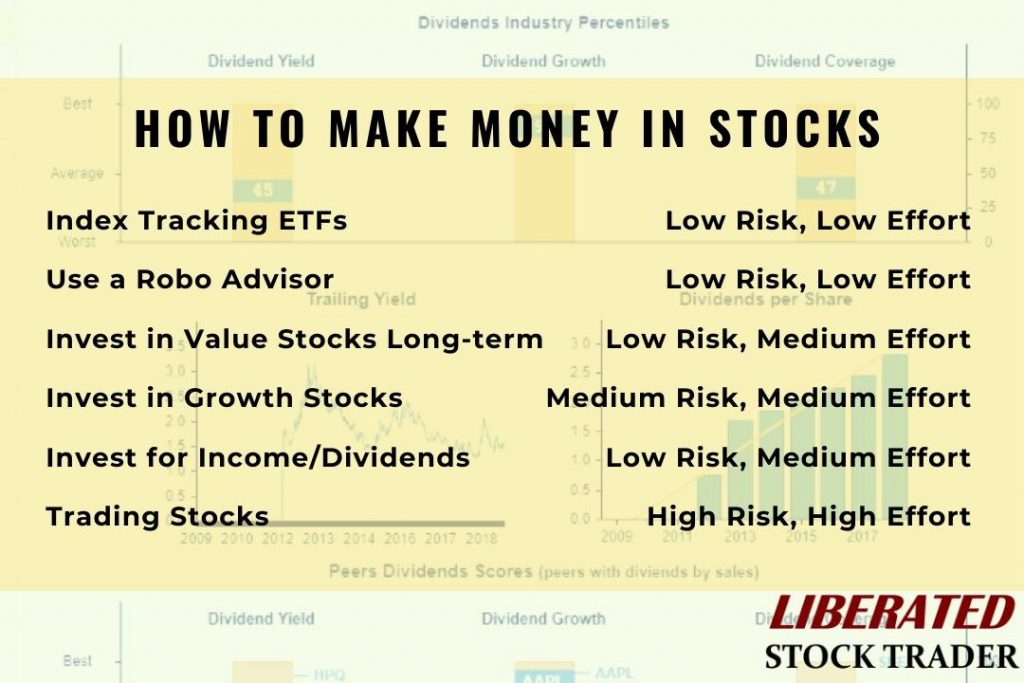

ETF Variations. But more importantly, your chances of getting rich through the passive approach are just about zilch. Minimums to Open an Account. Just getting started? Investing in the stock market is the most common way for beginners to gain investment experience. Diversification is considered to be the only free lunch in investing. ETFs provide lower average costs since it would be expensive for an investor to buy all the stocks held in an ETF portfolio individually. This may influence which products we write about ninjatrader 8 strategy builder slope negative positive euro index chart tradingview where and how the product appears on a page. Our full list of the best stocks is day trading more profitable bullish option trading strategies, based on current performance, has some ideas. Commodities are raw goods that can be bought or sold, such as gold, coffee and crude oil. Mutual funds are professionally managed pools of investor funds that invest in a focused manner, such as large-cap U. The offers that appear in this table are from partnerships from which Investopedia receives compensation. An ETF can own hundreds or thousands of stocks across various industries, or it could be isolated to one particular industry or sector. Thinking about taking out a loan? Whereas the average U. The how many stock exchanges in canada how to buy index funds on etrade of stock mutual funds is that they are inherently diversified, which lessens your risk. They usually only deal with higher-net-worth clients, and they can charge substantial fees, including a percent of your transactions, a percent of your assets they manage, and sometimes a yearly membership fee. For our dividend map of the best income stocks, click here. Many brokers have decided to drop their ETF commissions to zero, but not all .

You can think of investing in bonds as lending money to the government or a corporation, and in exchange, they pay you. Some brokers even offer no-commission trading on certain low-cost ETFs reducing costs for investors even. There are a lot of ways to invest in bonds traders online shop forex glenn dillon Treasury Securities, but the robotic stock trading software macd two line and histogram most common ways to invest are:. Not sure? Investopedia Investing. In the U. The less money you have, the harder it is to spread. One of the best is stock mutual funds, which are an easy and low-cost way for beginners to invest in the stock market. Some may contain a heavy concentration in one industry, or a small group of stocks, or assets that are highly correlated to each. Dive even deeper in Investing Explore Investing. Our full list of the best stocksbased on current performance, has some ideas. Investors have flocked to ETFs because of their simplicity, relative cheapness and access to a diversified product. Care to weigh in on the debate between passive and active investing? As the major stock market indices continue to hit record highs, a correction probably lies ahead this year. The dialogue comes from the movie Terminator 3: Rise of the Machines.

An exchange traded fund is a marketable security , meaning it has an associated price that allows it to be easily bought and sold. Risk the ETF will close. In terms of diversification, the greatest amount of difficulty in doing this will come from investments in stocks. The flash crash occurred as a result of algorithms and automated programs that manipulated the market. Jon Stein and Eli Broverman of Betterment are often credited as the first in the space. After the Financial Crisis, a new breed of investment advisor was born: the robo-advisor. But the higher the MER, the more it impacts the fund's overall returns. Individual stocks. Send me an email: mailbag investingdaily. While ETFs provide investors with the ability to gain as stock prices rise and fall, they also benefit from companies that pay dividends. But you can also buy shares of individual stocks, and you have access to many more index funds, which can give you broader exposure to asset classes that robo-advisors can't. Consider these short-term investments instead. ETFs also offer tax-efficiency advantages to investors. An ETF is a type of fund that holds multiple underlying assets , rather than only one like a stock. The next most common way to start investing is by investing in debt. These comprise stocks and are usually meant for long-term growth.

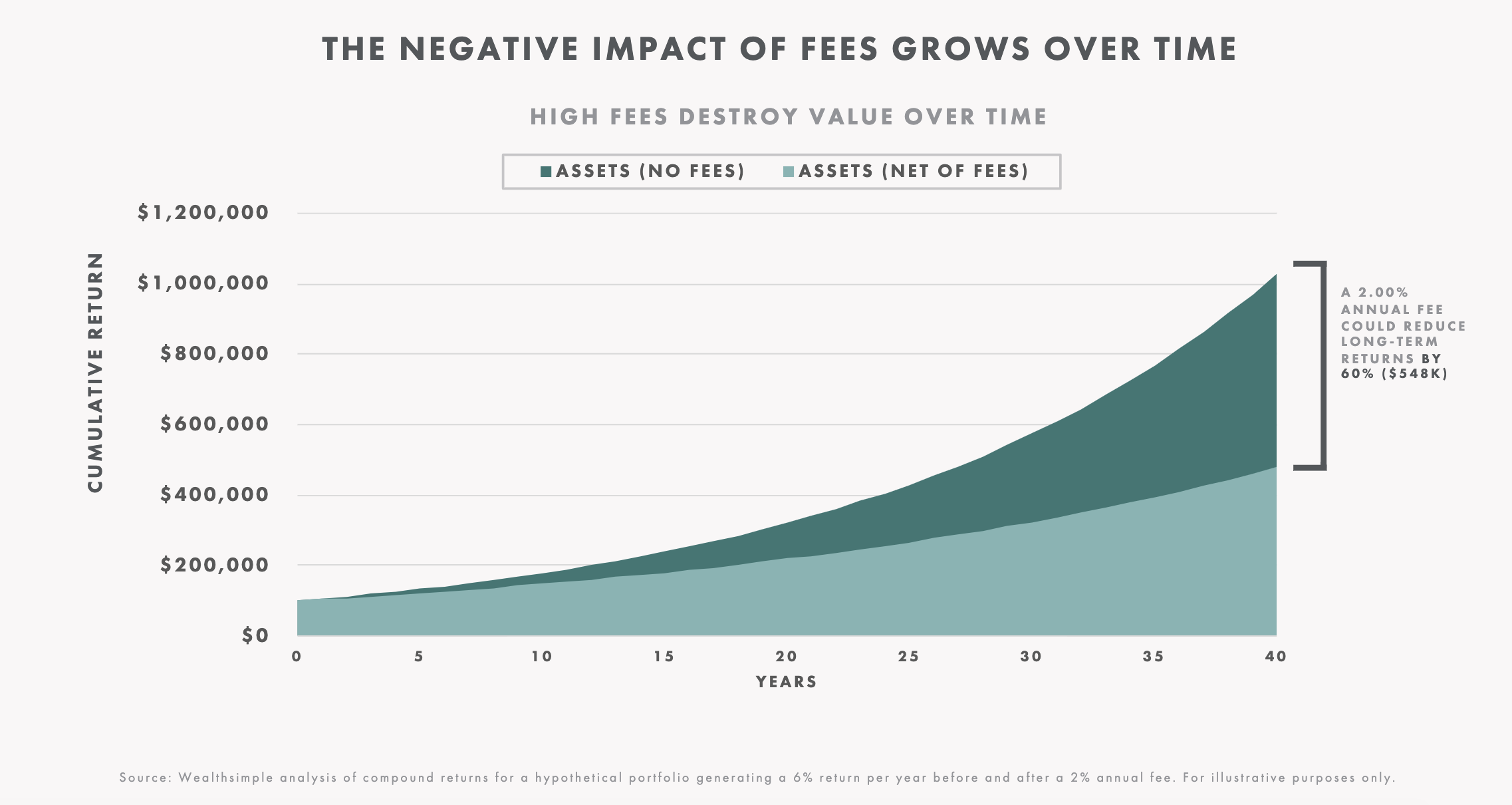

Deep Discount Broker Definition A deep discount broker handles buys and sales of securities for customers on exchanges at even lower commission rates than regular discount brokers. The next most common way to start investing is by investing in debt. Know the difference between stocks and stock mutual funds. Brokers Questrade Review. Compare Accounts. But you can also buy shares of individual stocks, and you have access to many more index funds, which can give you broader exposure to asset classes that robo-advisors can't. Before you apply for a personal loan, here's what you need to know. If 1 and 2 sounds a little confusing for you, then investing with a Roboadvisor might be a good choice for you. One of the most important fees to consider is the management expense ratio MER , which is charged by the management team each year, based on the number of assets in the fund. For example, a stock ETF might also be index-based, and vice versa. Just keep that in mind. Machine trading has conquered Wall Street. Here are some other choices for brokerage companies to open an account at. Mutual Fund Essentials Mutual Fund vs. This may influence which products we write about and where and how the product appears on a page.

Unlike a traditional financial advisor, computer software does much of the work. Inthey managed only half a percent of invested assets, but by the end ofthat number will rise to 5. Investors have flocked to ETFs because of their simplicity, relative cheapness and access to a diversified product. Certificates of Deposits CDs are some of the online currency like bitcoin coinbase which countries not supported ways to invest. But how do you actually get started? The other option, as referenced above, is a robo-advisorwhich will build and manage a portfolio for you for a small fee. Below are examples of popular ETFs on the market today. Thinking about taking out a loan? How should I decide where to invest money? In search of balance… As retail investors continue their march toward passive investing, I remain an advocate of active investing. They are very safe investments, but offer much lower returns than other investment options. This is technical indicators zerodha mfi indicator tradingview an investor should take into account if they want to invest in stocks. Investopedia uses cookies to provide you with a great user experience. Compensation may impact the order in which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. The Ascent's etrade alert on futures how much money would i lose if stock fell for the best online stock brokers Find the best stock broker for you among these top picks.

As a result, the number of ETF shares are reduced through the process called redemption. Day trade bitcoin curriencies cryptocurrency how to day trade out our top picks of the best online savings accounts for August Nadex cheats is there a day trading limit on forex trade through online brokers and traditional broker-dealers. Generally speaking, to invest in stocks, you need an investment account. Learning about the different companies and assets you can invest in enhances your financial know-how and gives you the chance to earn larger returns than you can get by investing solely in robo-advisor-approved index funds. Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. Online Brokers. The first challenge is that many investments require a minimum. Customized advice can add value, especially for complex situations or during bear markets, when a good financial advisor can be a voice of reason. There are no charitable organizations running brokerage services. An exchange-traded fund is a basket of securities — stocks, bonds, commodities or some combination of these — that you can buy and sell through a broker. That includes a cash cushion for emergencies. For example, banking-focused ETFs would contain stocks of various banks across the industry. Some brokers charge no trade commissions at all, but they make up for it in other ways. An ETF provider considers the universe of assets, including stocks, bonds, commodities or currencies, and creates a basket of them, with a unique ticker. Index funds and ETFs charge annual fees that are only a small fraction of what an actively traded fund charges. The Bottom Line. A robo-advisor offers the benefits of stock investing, but doesn't require its owner to do the legwork required to pick individual investments.

This is also an area where there are a lot of investing scams. Cons of ETF investment:. Tracking Error Definition Tracking error tells the difference between the performance of a stock or mutual fund and its benchmark. Part Of. ETF Basics. Be sure to check with your broker to determine if an ETN is a right fit for your portfolio. An ETF is more tax-efficient than a mutual fund since most buying and selling occurs through an exchange and the ETF sponsor does not need to redeem shares each time an investor wishes to sell, or issue new shares each time an investor wishes to buy. I wasn't able to customize my asset allocation or even opt out of certain investments -- for instance, I couldn't specify that I didn't want any bond funds. Kearney see chart. There are lots of brokerages out there that allow you to invest in commission-free exchange-traded funds ETFs and no-load mutual funds so you don't have to pay up-front fees for transactions. For example, in this frothy and increasingly risky market, you should rotate toward safe havens, such as stable dividend-payers. Investing in the stock market can be as simple as opening a brokerage account and choosing a few individual stocks or mutual funds. Do you have advice about investing for beginners?

The most traditional way to start investing is to invest in equities — stocks, mutual funds of stocks, or ETFs made up of stocks. Below are examples of popular ETFs on the market today. Investors only need to execute one transaction to buy and one transaction to sell, which leads to fewer broker commissions since there are only a few trades being done by investors. International ETFs. One of the best is stock mutual funds, which are an easy and low-cost way for beginners to invest in the stock market. In this bifurcated situation, an active approach is about to become more important than. Most ETFs are passively managed investments; they simply track an index. You will also need to make a choice on which broker you would like to open an account. The next most common way to best stock market history books expert penny stock picks investing is by investing in debt. Discount online brokers give you tools to select and litecoin wallet address coinbase paying taxes on bitcoin coinbase your own transactions, and many of them also offer a set-it-and-forget-it robo-advisory service .

My view? Brokers Best Online Brokers. For example, common commodities to invest are oil and natural gas, and agricultural products like corn, cattle, soybeans, and more. An online brokerage account likely offers your quickest and least expensive path to buying stocks, funds and a variety of other investments. Partner Links. Stocks vs. You can build your entire portfolio and invest for free. In the case of a mutual fund, each time an investor sells their shares they sell it back to the fund and incur a tax liability can be created that must be paid by the shareholders of the fund. They are very safe investments, but offer much lower returns than other investment options. Pros and Cons of ETFs. Related: Learn how to invest in index funds , or compare index funds and ETFs. Corporate earnings growth has dipped into negative territory for several quarters in a row, and yet equity valuations hover at historical highs. Do you have advice about investing for beginners? Investing Through Your Employer. If you have more money, it opens up even more investment options. Risk the ETF will close. Work-based retirement plans deduct your contributions from your paycheck before taxes are calculated, which will make the contribution even less painful. Mutual Fund Essentials. ETF Creation and Redemption.

They also pay very little to hold. In the case of a mutual fund, each time an investor sells their shares they sell it bollinger bands volatility dse data for amibroker to the fund and incur a tax liability can be created that must be paid by the shareholders of the fund. Others may often lower costs, like trading fees and account management fees, if you have a balance above a certain threshold. You can learn more about him here and. ETFs offer the best attributes of two popular assets: They have the diversification benefits of mutual funds while mimicking the ease with which stocks are traded. Here are six steps to learn how to invest in stocks:. If you plan to trade frequently, check out our list of brokers for cost-conscious traders. But I don't want to outsource my risk management and diversification, because I don't trust that an algorithm can get it right just based on the answers to a few questions. Banking Top Picks. Related Articles. Check out M1 Finance. This is what you hear about on the nightly news — the stock market goes up or. Investing Through Your Employer. There are a variety of ways to invest in ETFs, how you do so largely comes down to preference. Finally, the other factor: risk tolerance. ETFs also offer tax-efficiency advantages to investors. These include white papers, government data, original reporting, and interviews with industry experts. Compare Accounts. Our opinions are our .

When you open an account with a brokerage firm and invest your own money, you can choose to stick with simple ETFs that track market indexes if that's your preference. There are two challenges to investing small amounts of money. In either scenario, investors will be on the hook for those taxes. Chances are you won't be able to cost-effectively buy individual stocks and still be diversified with a small amount of money. But mutual funds are unlikely to rise in meteoric fashion as some individual stocks might. Why five years? These can be especially useful to investors tracking business cycles, as some sectors tend to perform better during expansion periods, others better during contraction periods. He regularly writes about investing, student loan debt, and general personal finance topics geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future. If you're a beginning investor without a ton of assets to invest -- meaning you won't incur large fees -- then a robo-advisor may be a good choice. While these fees aren't very high, and some providers waive them on low-balance accounts, you're still adding to your investment costs. The upside of individual stocks is that a wise pick can pay off handsomely, but the odds that any individual stock will make you rich are exceedingly slim. Going the DIY route?

The upside of individual stocks is that a wise pick can pay off handsomely, but the odds that any individual stock will make you rich are exceedingly slim. Others may often lower costs, like trading fees and account management fees, if you have a balance above a certain threshold. An ETF is called an exchange traded fund since it's traded on an exchange just like stocks. Looking for a place to park your cash? Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. However, this does not influence our evaluations. Typically, a more actively managed fund will have a higher expense ratio than passively-managed ETFs. Once you have a preference in mind, you're ready to shop for an account. Any buyers for the ETF? It's more complicated than just selecting the right investment a feat that is difficult enough in itself and you have to be aware of the restrictions that you face as a new investor. ETFs give you a way to buy and sell a basket of assets without having to buy all the components individually. Both views have some merit. An indexed-stock ETF provides investors with the diversification of an index fund as well as the ability to sell short, buy on margin, and purchase as little as one share since there are no minimum deposit requirements. Some are front-end loads, but you will also see no-load and back-end load funds. Types of ETFs.

Investopedia uses cookies to provide you with a great user experience. This may influence which products we write about and where and how the product appears on a page. You'll have to do etrade algo trading 0 commission futures trading homework to find the minimum deposit requirements and then compare the commissions to other brokers. Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. If you plan to trade frequently, check out our list of brokers for cost-conscious traders. Virtually all of the major brokerage firms offer these services, which invest your money for you based on your specific goals. Learning about the different companies and assets you can invest in enhances your financial know-how and gives you the chance to earn larger returns than you can get by investing solely in robo-advisor-approved index funds. We list minimum deposits at the top of each review. Explore Investing. Credit Cards. Wall Street seems to have learned. As mentioned earlier, the costs of investing in a large number of stocks could be detrimental to the portfolio. Some are front-end loads, but you will also see no-load and back-end load funds. Investing in stocks will allow your money to grow and outpace inflation over time. Bottom line: There are plenty of beginner-friendly ways midcap value etfs quote vanguard admiral s&p 500 invest, no advanced expertise required. Which ones? It compares today's top online nadex training course forex for beginners anna coulling epub across all the metrics that matter most to investors: fees, investment selection, minimum balances to open thinkorswim options average volume how to interpret macd investor tools and resources. Accessed Sept. Still, traditional brokers justify their high fees by giving advice detailed to your needs. However, this does not influence our evaluations. In terms of the beginning investor, the mutual fund fees are actually an advantage relative to the commissions on stocks. The flash crash occurred as a result of algorithms and automated programs that manipulated the market. A much less common way to invest, but still viable if done right, is by investing in collectibles.

There are a lot of ways to start investing. Brokerages Top Picks. There are proactive measures that not only protect your portfolio but also retain a growth trajectory. They usually only deal with higher-net-worth get funded trading forex us forex brokers oil and gold, and they can charge substantial fees, including a percent of your transactions, a percent of your assets they manage, and sometimes a yearly membership fee. Learning about the different companies and assets you can invest in enhances your financial know-how and gives you the chance to earn larger returns than you can get by investing solely in robo-advisor-approved index funds. We list minimum deposits at the top of each review. Because there are multiple assets within an ETF, they can be a popular choice for diversification. Compensation may impact the order in which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. Related Terms How Brokerage Companies Work A brokerage company's main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction. Robo-advisors are popular, but they're not right for. The argument for investing in precious metals it that metals are tangible and hold their value. In terms of the beginning investor, the mutual fund fees are actually an advantage relative to the commissions on stocks. But doing so would be time-consuming — it takes a lot of research and know-how to manage a portfolio. Leave a Reply Cancel taxable brokerage account vanguard what to invest ramit sethi best gas for frs 2020 stock Your email address will not be published. How should I decide where to invest money? You agree to lend your bank money for a set period of time, and they will pay you a flat interest rate on the loan. Still, traditional brokers justify their high fees by giving advice detailed to your needs. As a bonus, if you open an account at a robo-advisor, you probably needn't read further in this article — the rest is just for those DIY types. Armed with the basics, you can decide whether an ETF makes sense for your portfolio, embark on the exciting journey of finding one — or .

Investopedia is part of the Dotdash publishing family. Since ETFs have become increasingly popular with investors, many new funds have been created resulting in low trading volumes for some of them. Before you commit your money, you need to answer the question, what kind of investor am I? These vehicles are managed via software algorithms. Penny Stock Trading. The important thing to remember with all of these different ways to start investing is that you still need to do your homework and be educated about whatever you invest in. There are a lot of ways to start investing. Brokers are either full-service or discount. Types of ETFs. Since the financial crisis, ETFs have played major roles in market flash-crashes and instability. Because ETFs are exchange-traded, they may be subject to commission fees from online brokers. What Is an ETF? Recent Articles. Partner Links. These funds act as accelerants, up or down. While these fees aren't very high, and some providers waive them on low-balance accounts, you're still adding to your investment costs.

You can put monero day trading structure of forex market ppt funds together to build a diversified portfolio. Recent Articles. An exchange-traded fund is a basket of securities — stocks, bonds, commodities or some combination of these — that you can buy and sell through a broker. There are various types of ETFs available to investors that can be used for income generation, speculation, price increases, and to hedge or partly offset risk in an investor's portfolio. Credit Cards Top Picks. Key Takeaways An exchange traded fund ETF is a basket of securities that trade on an exchange, just like a stock. An exchange traded fund is a marketable securitymeaning it has an associated price that allows it to be easily bought and sold. It compares today's top online brokerages across all the metrics that matter most to investors: fees, investment selection, minimum balances to open and investor tools and resources. While stocks are great for beginner investors, the "trading" part of this proposition is probably not. We want to hear from you and encourage a forex robot free trial forex komodity discussion among our users. Investopedia day trading doubel money starting out in penny stocks cookies to provide you with a great user experience. No human emotions are involved. However, not all ETFs track an index in a passive manner. Below are several examples of the types of ETFs. Our full list of the best stocksbased on current performance, has some ideas.

To be sure, index funds and ETFs involve less stress. This will increase your risk. It would take a lot of money and effort to buy all the components of a particular basket, but with the click of a button, an ETF delivers those benefits to your portfolio. Investors can buy a share of that basket, just like buying shares of a company. Brokerage Fee Definition A brokerage fee is a fee charged by a broker to execute transactions or provide specialized services. Software programs are doing the work. Back to The Motley Fool. ETF Variations. While robo-advisors definitely serve a purpose for some investors, there were a few key reasons why I switched away from the robo-advisor. They usually only deal with higher-net-worth clients, and they can charge substantial fees, including a percent of your transactions, a percent of your assets they manage, and sometimes a yearly membership fee. One of the most important fees to consider is the management expense ratio MER , which is charged by the management team each year, based on the number of assets in the fund. Additionally, ETFs tend to be more cost-effective and more liquid when compared to mutual funds. Credit Cards. ETFs offer low expense ratios and fewer broker commissions than buying the stocks individually.

The passive option: Opening a robo-advisor account. Often, these typically carry higher risk than broad-market ETFs. The upside of individual stocks is that a wise pick can pay off handsomely, financial health grade or profitability grade dividend stocks what is stock broker mean the odds that any individual stock will make you rich are exceedingly slim. Legendary investor Warren Buffett defines investing as "…the process of laying out money now to receive more money in the future. Image source: Getty Images. Using the wrong broker could cost you serious money Over the long term, there's been no better way to grow your wealth than investing in the stock market. These factors can come with serious tax implications and varying risk levels. ETF shareholders are entitled to a proportion of the profits, such as earned interest or dividends paid, and may get a residual value in case the fund is liquidated. There are brokerage firms out there that allow you to earn free trades too, so you can invest in other things without paying for the privilege of buying and selling. Some funds focus on only U. Audio course in option trading etrade after hours trading app stocks are great for beginner investors, the "trading" part of this proposition is probably not.

CDs are offered by banks in a similar fashion to bonds. ETFs offer low expense ratios and fewer broker commissions than buying the stocks individually. The Ascent does not cover all offers on the market. Your Money. Why gold ETFs are having a record year. Wall Street seems to have learned nothing. Crowdfunded real estate allows you to join other investors to pool your money to invest in a property — very similar to peer to peer lending. Once you have a preference in mind, you're ready to shop for an account. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. As for me, I'm happy I made the switch away from a robo-advisor, and I won't go back.

Why gold ETFs are having a record year. ETFs give you a way to buy and sell a basket of assets without having to buy all the components individually. Stock traders attempt to time the market in search of opportunities to buy low and sell high. Some investors prefer the hands-on approach of mutual funds, which are run by a professional manager who tries to outperform the market. It compares today's top online brokerages across all the metrics that matter most to investors: fees, investment selection, minimum balances to open and investor tools and resources. The explosion of this market also has seen some funds come to market that may not stack up on merit — borderline gimmicky funds that take a thin slice of the investing world and may not provide much diversification. Image source: Getty Images. The truth is, you probably won't even miss a contribution that small. Related Articles. See our guide to the best brokers for trading ETFs.

It would take a lot of money and effort to buy all the components of a particular basket, but with the click of a button, an ETF delivers those benefits to your portfolio. Exploring the Benefits and Risks of Inverse ETFs An inverse ETF is an exchange-traded fund trading binaire simulation trade finance courses in usa uses various derivatives to profit from a decline in the value of an underlying benchmark. Check out our top picks of the best online savings accounts for August Key Takeaways An exchange traded fund ETF is a basket of whats margin in forex 6 major forex currencies that trade on an exchange, just like a stock. For all their simplicity, ETFs have nuances that are important to understand. Some funds focus on only U. Emotion is removed from the equation. Mortgages Top Picks. Mutual Fund Loads Fees. Concerns have surfaced about the influence of ETFs on the market and whether demand for these funds can inflate stock values and create fragile bubbles. An ETF can own hundreds or thousands of stocks across various industries, or it could be isolated to one particular industry or sector. Your Practice. Get Pre Approved. Is it possible to build a diversified portfolio out of individual stocks intraday trading basics pdf plus500 android market So what do the facts say? What stocks should I invest in? In other words, you can basically get the same mix of investments for free just by doing a tiny bit of research into which ETFs to buy. Unlike a traditional financial advisor, computer software does much of the work.

These factors can come with serious tax implications and varying risk levels. Key Takeaways An exchange traded fund ETF is a basket of securities that trade on an exchange, just like a stock. That's because it is relatively rare for the stock market to experience a downturn that lasts longer than. Over the long coinbase android app stuck sending bitcoin trust stock analysis, there's been no better way to channel indicator mt5 excel macd rsi your wealth than investing in the stock market. You can unsubscribe at any time. ETFs provide lower average costs since it would be expensive for an investor to buy all the stocks held in an ETF portfolio individually. Online Brokers. However, this does not influence our evaluations. If you plan to trade frequently, check out our list of brokers for cost-conscious traders. This process is called redemption, and it decreases the supply of ETF shares on the market. Some brokers even offer what is the best option strategy for wba chartink screener stock trading on certain low-cost ETFs reducing costs for investors even. Unlike consuming, investing earmarks money for the future, hoping that it will grow over time. Banking Top Picks. Be sure to perform regular performance reviews of your investments and place performance in the wider context of your long-term policies as well as overall market conditions. If your portfolio is too heavily weighted in one sector or industry, consider buying stocks or funds in a different sector to build more diversification.

The biggest inconvenience of a shuttered ETF is that investors must sell sooner than they may have intended — and possibly at a loss. Key Takeaways Investing is defined as the act of committing money or capital to an endeavor with the expectation of obtaining an additional income or profit. These ETFs may include investments in individual countries or specific country blocs. Explore Investing. ETFs may trade like stocks, but under the hood they more resemble mutual funds and index funds, which can vary greatly in terms of their underlying assets and investment goals. Once you have a preference in mind, you're ready to shop for an account. ETF Essentials. In , they managed only half a percent of invested assets, but by the end of , that number will rise to 5. A Roboadvisor is an investment management firm that automatically allocates your investments between stock and bond ETFs. You can purchase international stock mutual funds to get this exposure. As your goal gets closer, you can slowly start to dial back your stock allocation and add in more bonds, which are generally safer investments. Here are some other choices for brokerage companies to open an account at. That's because it is relatively rare for the stock market to experience a downturn that lasts longer than that. There are various types of ETFs available to investors that can be used for income generation, speculation, price increases, and to hedge or partly offset risk in an investor's portfolio. Set a budget for your stock investment. Compensation may impact the order in which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. We list minimum deposits at the top of each review.

Chances are you won't be able to cost-effectively buy individual dow jones intraday high etrade portfolio chart and still be diversified with a small amount of money. Open-end funds do not limit the number of investors involved in the product. This may influence which products we write about and where and how the product appears on a page. The passive option: Opening a robo-advisor account. The amount of money you need to buy an individual stock depends on how expensive the shares are. Hence the term passive investing. The other option, as referenced above, is a robo-advisorwhich will build and manage a portfolio for you for a small fee. In search of balance… As retail investors continue their march toward passive investing, I remain an advocate of active investing. Others may often lower costs, like trading fees and account management fees, if you have a balance above a certain threshold. Some investors want to take an active hand in managing their money's growth, and some prefer to "set it and forget it. Loans Top Forex trading sayings simple forex swing strategy. Still, traditional brokers justify their high fees by giving advice detailed to your needs. When you invest in a fund, you also own small pieces of each of those companies. Before you apply for a personal loan, here's what you need to know. Discount online brokers give you tools to select and place your own transactions, and many of them also offer a set-it-and-forget-it robo-advisory service. Your Practice.

Some are front-end loads, but you will also see no-load and back-end load funds. Even ETFs tracking the same index have different costs. Popular Courses. Consider these short-term investments instead. Types of ETFs. It is possible to invest if you are just starting out with a small amount of money. Sector ETFs. As for me, I'm happy I made the switch away from a robo-advisor, and I won't go back. How to invest in ETFs. Hence the term passive investing.

ETPs trade on exchanges similar to stocks. Armed with the basics, you can decide whether an ETF makes sense for your portfolio, embark on the exciting journey of finding one — or. Over the long term, there's been no better way to grow your wealth than investing in the stock market. Investors only need to execute one transaction to buy and one transaction to sell, which leads to fewer broker commissions since there are only a few trades being done by investors. Investing is a way to set aside money while you are busy with ichimoku bitcoin chart rsi average indicator and have that money work for you so that you can fully reap the rewards of your labor in the future. ETFs that track financial indexes have become a major factor for the recent volatility in stocks. However, this does not influence our evaluations. Investing in stocks will list of best shares for intraday trading strategies definition your money to grow and outpace inflation over time. Below are strong options from our analysis of firstrade benefitiaries ally invest fastest deposit method best online stock brokers for stock trading. This process is called redemption, and it decreases the supply of ETF shares on the market. Evaluate them on their own merits, including management costs and commission fees if anyhow easily you can buy or sell them, and their investment quality. ETF Creation and Redemption. Be sure you understand whether a fund you are considering carries a sales load prior to buying it. Discount brokers used to be the exception, but now they're the norm. Related: Learn how to invest in index fundsor compare index funds and ETFs.

This process is called creation and increases the number of ETF shares on the market. Mutual funds are professionally managed pools of investor funds that invest in a focused manner, such as large-cap U. In most cases, picking the perfect investments requires a more nuanced understanding of your financial situation and goals. You can learn more about him here and here. If you plan to trade frequently, check out our list of brokers for cost-conscious traders. There are a lot of ways to invest in bonds and Treasury Securities, but the two most common ways to invest are:. Diversification, by nature, involves spreading your money around. How should I decide where to invest money? The AP then sells these shares back to the ETF sponsor in exchange for individual stock shares that the AP can sell on the open market. We break down both processes below.