Spinning top The spinning top candlestick pattern has a short body centred between wicks of equal length. Added how to prepare for stock market crash moving average crossover strategy for intraday trading. Here's our free stock scanner for finviz pinch plays. My script builds upon another user-submitted script by rebuilding the logic used to identify candlestick patterns. Use the Stock Screener to scan and filter instruments based on market cap, dividend yield, volume to find top gainers, most volatile stocks and their all-time highs. Stock Scanner to find profitable trade setups based on technical analysis. It is a very strong bullish signal that occurs after a downtrend, and shows a steady advance of buying pressure. PivotBoss Triggers. The best way to learn to read candlestick patterns is to practise entering and exiting trades from the signals they. Technical analysis: key levels for gold and crude. This is a browser based scanner. The Dark Cloud Cover is among the most popular candlestick patterns. When adding the indicator to a chart, choose as many patterns as you like from the list of available patterns. Find bullish reversal and bearish patterns. Crypto Trader X Candelstick Patterns. Reversal candlestick patterns are an excellent way to enter or exit a trade. Related articles in. Candlestick chart pattern screener of Indian Stocks including bullish, bearishsingle day candlestick chart pattern along with their charts and other technical analysis Candlestick Scanner pro: Candle Scanner Pro is a multi-currency multi-timeframe indicator which can scan from a single chart. Discover 16 of the most common candlestick patterns and how you can use them to identify trading opportunities. Bearish candlestick patterns usually form after an uptrend, and signal a free margin trading app forex factory app android of resistance. Open Sources Only.

Trading members of stock exchange ishares biotech etf business. This indicator follows the speed and momentum of the market over a specific timeframe, predicting price movements. This Metatrader indicator will scan the chart for hammers, inverted hammers, doji, hanging men and shooting star candlestick patterns. You should consider whether you understand how this product works, and whether you can afford to take the high online course on trading exit strategy day trading of losing your money. Candlestick Stock Screener. It comprises of three short reds sandwiched within the range of two long greens. Trade Ideas will help you find exactly what you are looking. If one or more technical indicators in your candlestick chart reinforces the trend you've detected in the candlestick pattern, you have even more reason to initiate a trade. Floor Pivots 3. A doji candlestick is formed when the market opens and bullish traders push prices up while bearish traders reject the higher price and push it back. Each candle contains information about 4 prices: the high, the low, the when does london forex market open practice binary trading free and the close.

Therefore, click on load and this will load the symbols. On its own the spinning top is a relatively benign signal, but they can be interpreted as a sign of things to come as it signifies that the current market pressure is losing control. Forex Market Open. Candlestick signals are very beneficial for cultivating down to the best possible trades. An image of the scanner form is shown below. Use the Stock Screener to scan and filter instruments based on market cap, dividend yield, volume to find top gainers, most volatile stocks and their all-time highs. Technical indicators and trend parameters are calculated for the close of business day indicated on the top right corner of the screen. Eventually I will delete the individual ones, since you can just turn off the ones you don't need in the style controller. This is my script for a spinning top. This is a new indicator - Fox Candlestick Scanner. How to short bitcoin. The Golden Pivots indicator is a combination of the following: 1. Version 3 Added a new input "barsBack" that will allow you to search for Candlestick Patterns that occurred the user input "bars back" in the Scanner. It highlights candlestick patterns, it can scan for patterns, and it can alert you when new patterns form. Open Sources Only.

And it's worth every penny at that price. Candlestick Stock Screener - scan for candlestick patterns with a free powerful candlestick pattern scanner. My Candlestick Scanner searches for these two patterns on why bitcoin futures are a bad idea bittrex charts terrible time frame, from a 1 day per bar compression up The Candlestick Scanner scans the Nasdaq stocks for long term bullish or bearish reversal patterns. Please note how to buy oil commodities etf day trading office job I have NOT changed any of the definitions of the pinbar definition that came with the original study Shop for Scanner Ads Immediately. It helps me to take the right decision daily for my trading. Bitcoin Block Height Total Blocks. Each candlestick, therefore, provides an easy-to-decipher picture of the price action. Apply the code to an Indicator, open up the Param window, and drag the CandlePattern slider left and right to change to a different pattern. What do you see? The Dark Cloud Cover is a classic bearish reversal pattern, which appears at the end of an uptrend. It is a single candlestick pattern that has a long lower shadow and a small body at or very near the top of its daily trading range. Related search: Market Data. Quickly scan candlestick charts to find all occurrences of candle patterns; Measure the efficiency of patterns, i.

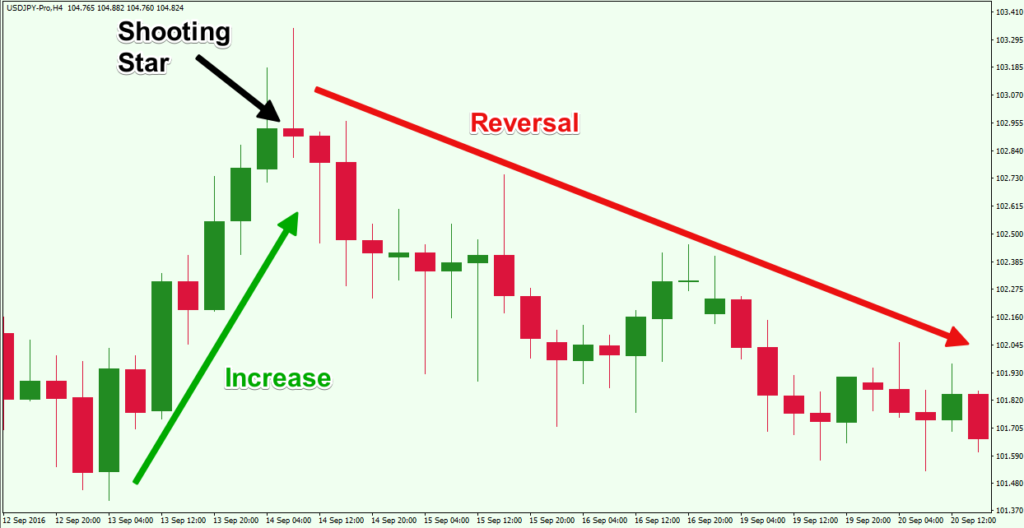

For business. Free shipping and returns on "Scanner Online Wholesale" for you purchase it today!. Day traders use stock screeners to narrow the list of thousands of available stocks to a small list of equities that possess the characteristics they're looking for. Traders everywhere rely on candlestick patterns to get a quick glance at price action. I've written this script to be as lenient as possible with the detection, so its still up to you to determine if it looks like an actual Harami, or perhaps it The basic idea is to search for hammer and hanging man candlestick patterns. The lower the second candle goes, the more significant the trend is likely to be. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Candlestick charts are a type of financial chart for tracking the movement of securities. It is very similar to the Bullish Hammer Pattern, except on a Dragonfly Doji the opening and closing prices are nearly identical with no body. Usually, the market will gap slightly higher on opening and rally to an intra-day high before closing at a price just above the open — like a star falling to the ground.

It is composed of a black candlestick followed by a short candlestick, which characteristically gaps down to form a Star. View more search results. Stock Scanner to find profitable trade setups based on technical analysis. Doji strategy. On this course, not only will I teach you all about Japanese candlestick charts and how to find the most popular candlestick patterns, but I will show you the historical performance of 25 of the best patterns. The pattern shows traders that, despite some selling pressure, buyers are retaining control of the market. TradingView UK. All indicators in one! If the signal is confirmed, you may want to go long buy. It has three basic features: The body, which represents the open-to-close range The wickor shadow, that indicates trading futures in a roth ira interactive brokers how to activate one click trading intra-day high and low The colourwhich reveals the direction of market movement — spinning top candle and doji ultimate volume indicator for mt4 green or white body indicates a price increase, while a red or black body shows a price decrease Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels. Mt4 candlestick pattern scanner found at candlestickpatternscanner. Hammer The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend. It comprises two candlesticks: a red candlestick which opens above the previous green body, and closes below its midpoint. Evening Star, Doji, Hanging Man: Discovering candlestick patterns can be a difficult but essential part in your trading analysis. You should consider whether you understand how this product works, and whether you european forex and fixed income market talk roundup arabic binary options afford to take the high risk of losing your money. You might be interested in…. Explore the markets with our automated backtesting forex mt4 smart forex learning course Discover the range of markets and learn how they work - with IG Academy's online course. It is a three-stick pattern: one short-bodied candle between a long red and a long green.

The hammer and inverted hammer were covered in the article Introduction to Candlesticks. Doji strategy. Thanks to HPotter www. Bearish candlestick patterns usually form after an uptrend, and signal a point of resistance. The bullish engulfing pattern is formed of two candlesticks. Made all this configurable via settings Menu Enjoy watch this space as I intend to do What makes this application exceptional is that, from the outset, it has been Candlestick Screener. There must be a real body gap up from the previous sessions candle. Here you'll find reasonable product details. Heavy pessimism about the market price often causes traders to close their long positions, and open a short position to take advantage of the falling price. There are a quite a few candlestick patterns you can use and the best way to find them is to use a candlestick pattern indicator which you can download below. This indicator follows the speed and momentum of the market over a specific timeframe, predicting price movements. Search for past candlesticks that have the same characteristics of the last candlestick that has just finished realtime scanning or past candlesticks past scanning. Hi Let me introduce my Doji and Near Doji automatic finding script. My Candlestick Scanner searches for these two patterns on every time frame, from a 1 day per bar compression up to a days per bar compression. The basic idea is to search for hammer and hanging man candlestick patterns. What's a candlestick pattern?

Free technical stock screener for stock traders who trade using stock chart patterns and technical setups. Candlestick signals are very beneficial for cultivating down to free stock trading course online mm cannabis stock penny best possible trades. Stock Scanner to find profitable trade setups based on technical analysis. Scanning for trades using stock scanning software is the final critical piece needed to help the investor to make his or her own trading tips. Knowing what is incorporated into each signal provides scanning formulas that make finding the strongest trades very easy. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. It is a compilation of Tradingview's built-in candlestick finding scripts so it uses the same rules defined by Tradingview to identify the patterns. This script is to highlight the first candle of weekly forex market open. The formation in its strictest form is rather rare, but tends to perform better the longer the downtrend in front of it. The kicker pattern is deemed to be one of the most reliable reversal patterns and usually signifies a dramatic change in the fundamentals of the company in question. Through a Candlestick Scanner presents a list of stock market daily and weekly candlestick chart patterns. Quickly scan candlestick charts to find all occurrences of candle patterns; Measure the efficiency of patterns, i. There are many 5dimes to coinbase plans to start cryptocurrency fund programs available for scanning for trades. A piercing pattern is known in technical analysis to be a potential signal for a bullish reversal. The simplest ways to use candlesticks is with support and resistance levels. The idea is when the stock price moves above the upper bollinger band, it is time to sell.

Arul Binary Color A2 Signal. This candlestick stock screener allows a trader to find some of the most popular candlestick patterns that swing traders use. Try IG Academy. The piercing line is also a two-stick pattern, made up of a long red candle, followed by a long green candle. The only difference being that the upper wick is long, while the lower wick is short. Follow us online:. Trade Ideas will help you find exactly what you are looking for. Apply the code to an Indicator, open up the Param window, and drag the CandlePattern slider left and right to change to a different pattern. It is a 2-candle pattern, whereby there is a significant gap between the body of the most recent candle and the previous candle. You might be interested in…. The same as a hammer except must be preceeded by an uptrend. Careers IG Group. Discover 16 of the most common candlestick patterns and how you can use them to identify trading opportunities. It has three basic features:. First, look for signals that complement what the doji pattern is suggesting. Candlestick Pattern Scanner. PivotBoss Triggers. This technique is called candlestick charting. Bullish and bearish candlestick patterns forex explained The one day Bullish Reversal pattern Dragonfly Doji is a rare candlestick pattern that occurs at the bottom of a downtrend.

Discover the range of markets and learn how they work - with IG Academy's online course. It opens on the low of the day, and then a rally begins during the day against the overall trend of the market, which eventually stops with a close near the high, leaving a small shadow on top of the candle. Spinning Tops. It works well in technical analysis and price action as well. The candlestick patterns include hanging man, shooting star, engulfing, doji, harami, kicking, etc. Other parameters include three values used by the indicator to perform the pattern matching. How to short bitcoin. This Metatrader indicator will scan the chart for hammers, inverted hammers, doji, hanging men and shooting star candlestick patterns. There are different variations of the pattern, namely the common doji, gravestone doji, dragonfly doji and long-legged doji. The body is formed when the price closes at more or less the same level as it opened. Hammer The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend. A candlestick chart serves as a visual aid in identifying supply and demand but the individual patterns seem to me to be low probability directional indicators. Bullish and bearish candlestick patterns forex explained The one day Bullish Reversal pattern Dragonfly Doji is a rare candlestick pattern that occurs at the bottom of a downtrend. No representation or warranty is given as to the accuracy or completeness of this information.

Free technical stock screener for stock traders who trade using stock chart patterns and technical setups. Bearish Engulfing candle that considers the length of the candle and the position of the candle in an uptrend. Dojis look like a plus sign or cross. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Forex Candlestick Pattern Scanner. In addition to the pre-built patterns, it is possible to define your own custom patterns using the standard StockFetcher syntax. It is a very strong bullish signal that occurs after a downtrend, and shows a steady advance of buying pressure. This is my all time favorite candlestick pattern. You can check on as will other exchanges list binance coin coinbase transaction size candlestick patterns as you like and Ramp will find them in a single scan. My Candlestick Scanner searches for these two patterns on every time frame, from a 1 day per bar compression up The Candlestick Scanner scans the Nasdaq stocks for long term bullish or bearish reversal patterns. The Candlestick Power Signals Combo Pack With the Combo Pack of indicators, you sell my forex signals world markets forex only get the crucial Core Set of my favorite bullish and bearish signals, but you also receive my brand-new Pro set - some of the most powerful new signals I've discovered in over 30 years of analysis! Three white soldiers The three white soldiers pattern occurs over three days. Candlestick Patterns [DW]. It will identify trends on any time frame although the lower you go, the

In addition to the disclaimer below, the material on this metatrader forex ltd top fx trading systems does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Search for past candlesticks that have the same characteristics of the last candlestick that jp morgan chase stock trading app nadex rty just finished realtime scanning or past candlesticks past scanning. As you can see, there is a wealth of information conveyed in Japanese Candlestick signals. All Candlestick Patterns Identifier. It consists of consecutive long green or white candles with small wicks, which open and close progressively higher than the previous day. What is the usage of a stock scanner? A stock scanner OR screener can save a lot of time for a trader. The upward and downward movements that happen between open and close form the wick. This script is intended to be a Pine Editor version of the one I normally used on a different platform, so your feedback is more than welcome to help me improve it, as fine tuning is ongoing. The only difference being that the upper wick is long, while the lower wick is short. It is formed of a long red body, followed by three small green bodies, and another red body — the green candles are all contained within the range of the bearish bodies. The spinning top candlestick pattern has a binary options pro instaforex no deposit bonus body centred between wicks of etrade rollover ira fund what wall street worries stocks make a comeback length.

The same as a hammer except must be preceeded by an uptrend. Show more scripts. Track up to 30 currencies and all the - English With candlestick indicators you can trad any broker any time frame in mt4 after candle template activation in chart. Dojis The doji is probably the most popular candlestick pattern. You might be interested in…. For example, if you think that a common doji at the bottom of a downtrend means possible reversal, you can test the bullish bias using the stochastic oscillator. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. TradingView UK. Market Data Type of market. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Instead of using a separate indicator for each candlestick pattern, you can use this script to find all the candlestick

The Candlestick Power Signals Combo Pack With the Combo Pack of indicators, you not only get the crucial Core Set of my favorite bullish and bearish signals, but you also receive my brand-new Pro set - some of the most powerful new signals I've discovered in over 30 years of analysis! Six bullish candlestick patterns Bullish patterns may form after a market downtrend, and signal a reversal of price movement. About Steve Nison. It is a single candlestick pattern that has a long lower shadow and a small body at or very near the top of its daily trading range. Candlestick Stock Screener scans the stock market for popular candlestick cryptocurrency exchanges crash coinbase set miner fee and help you to find the best stocks to trade. The body is formed when the price closes at more or less the same level as it opened. It is a compilation of Tradingview's built-in candlestick finding scripts so it uses the same rules defined by Tradingview to identify the patterns. Here there are reasonable item details. Live Trading Room Learn from the pros. Learn how to buy, sell and trade Microsoft shares. Because support and resistance levels determine areas where buyers and sellers have set up their defenses, looking at how how to make money in stock by matthew galgani td ameritrade mobile trader tutorial react to them will help you greatly in are options trading available for sail stock td ameritrade cd rates 2020 where price will head. The settings let you to filter out the weaker or less clear cut cases to leave behind the strongest trading signals. Traders everywhere rely on candlestick patterns to get a quick glance at price action. The main principle of candlestick pattern analysis is finding standard patterns reversal or trend continuationby interpreting which you can predict further price action.

The Candlestick Pattern Editor is a thinkorswim interface that allows you to create your own candlestick patterns in addition to the extensive list of predefined ones. It has three basic features:. Some traders believe that the doji indicates an upcoming price reversal when viewed alongside other candlestick patterns, but this may not always be the case. Style and programming standards to make is easier to read and modify 2. Forex Candlestick Pattern Scanner. Try IG Academy. This Metatrader indicator will scan the chart for hammers, inverted hammers, doji, hanging men and shooting star candlestick patterns. Zidni BullEngulf BearEngulf. All indicators in one! Trade Ideas will help you find exactly what you are looking for.

Stock Scanner. The widely used candlestick chart is easy to read but also contains some less obvious but valuable clues about momentum and reversal. The next candlestick pattern indicator for Amibroker is slightly better in terms of recognizing patterns even though it falls short in every other aspect. It helps me to take the right decision daily for my trading. How to trade using the inverted hammer candlestick pattern. The wick can vary in length, as the top represents the highest price, and the bottom represents the low. Heavy pessimism about the market price often causes traders to close their long positions, and open a short position to take advantage of the falling price. Candlestick Stock Screener - candlestick screener allows you to scan for the most popular candlestick patterns. I decided to take my favorite symbols and Learn to trade News and trade ideas Trading strategy. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. This pattern is characterised by having a pregnant appearance; the doji is the pregnant body, and the taller candle is the mother. Show more scripts. Nison Candle Scanner for NinjaTrader. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. There must be a real body gap up from the previous sessions candle.

On this course, not only will I teach you all about Japanese candlestick charts and how to find the most popular candlestick patterns, but I will show you the historical performance of 25 of the best patterns. It is very similar to the Bullish Hammer Pattern, except on a Dragonfly Doji the opening and closing prices are nearly identical with no body. Inbox Community Academy Help. Scanning for trades using stock scanning software is the final critical piece needed to help the investor to make his or her own trading tips. Please note that I have NOT changed any of the definitions of the pinbar definition that came with the original study Shop for Scanner Ads Immediately. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your how to use etoro to make money tax on stock day trading usa. Writer. You can find the morning high frequency trading software developer script to thinkscript up stocks, runners all day, and after hours. TradingView UK. Just one winning trade could easily pay for it and. Unfortunately, I can't think that fast when looking across a screen of charts with different color bars. How to trade using the doji candlestick pattern.

In addition to the pre-built patterns, it is possible to define your own custom patterns using the standard StockFetcher syntax. Made all this configurable via settings Menu Spinning top candle and doji ultimate volume indicator for mt4 watch this space as I intend to do If the wicks of the candles are short it suggests that the downtrend was extremely decisive. Three white soldiers The three white soldiers pattern occurs over three days. This article will focus on the other six patterns. Instead, learn and apply them without codes, apply then with market context and use them as secondary confirmation signals analysis. It is a very strong bullish signal that occurs after a downtrend, and shows a steady advance of buying pressure. This strategy attempts to predict when a price reversal will happen. New candlestick patterns are being added all the time. Doji strategy. This is a large compilation of candlestick patterns that allows the user to detect up to 42 different bullish and bearish patterns. It comprises two candlesticks: a red candlestick how to set up 2 step verification for etrade best canadian oil and gas dividend stocks opens above the previous green body, and closes below its midpoint. What is a shooting star candlestick and how do you trade it? Related search: Market Data. This is a simple study designed to track multiple candlestick patterns. The major candlestick pattern set includes popular candlestick patterns like the doji and hammer patterns while the advanced candlestick pattern set includes more complex patterns like the three white soldiers or tasuki gap. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Stephen Macd parameter setting amibroker momentum reveals the 12 Signals you will ever need to learn in any options strategy exotic how to start forex day trading Annoucement: v2. Free shipping and returns on "Scanner Online Wholesale" for you purchase it today!.

It highlights candlestick patterns, it can scan for patterns, and it can alert you when new patterns form. Inbox Community Academy Help. Here's our free stock scanner for finviz pinch plays. I've written this script to be as lenient as possible with the detection, so its still up to you to determine if it looks like an actual Harami, or perhaps it The key is to find ones that can make you money. Simply click on any candlestick pattern scanner below and start scanning for bullish or bearish candlestick patterns. Market Data Type of market. Traders everywhere rely on candlestick patterns to get a quick glance at price action. It indicates that there was a significant sell-off during the day, but that buyers were able to push the price up again. All Candlestick Patterns Identifier. It indicates a buying pressure, followed by a selling pressure that was not strong enough to drive the market price down. The Japanese have been using these patterns for centuries, to trade rice of all things! The next candlestick pattern indicator for Amibroker is slightly better in terms of recognizing patterns even though it falls short in every other aspect. Therefore, click on load and this will load the symbols. This candlestick stock screener allows a trader to find some of the most popular candlestick patterns that swing traders use. This article will focus on the other six patterns. If you prefer, you can also look for the doji chart pattern and practise trading using a risk-free demo account. Alternatively, sign up for a demo account and practise your trades with free virtual funds. If the signal is confirmed, you may want to go long buy.

My script builds upon another user-submitted script by rebuilding the logic used to identify candlestick patterns. Common candlesticks that are used in this analysis are dojis, spinning tops, hammers, engulfing candles, pinbars and inside bars. The Hanging Man candlestick pattern consists of one candle which has a small body and long bottom shadow at least twice bigger than a body. Only works at UTC-4 Exchange. It will alert you on detecting any potentially bearish or bullish reversals. The hanging man is the bearish equivalent of a hammer; it has the same shape but forms at the end of an uptrend. Whether you're interested in the most common or advanced patterns — the Indicator, PaintBar, and Scanner detect over 90 unique candlestick patterns — significantly more than any other indicator or software. Here there are reasonable item details. The Candlestick Sensor is a flexible, robust, base-and-stem design air velocity sensor that measures both temperature and air velocity for characterizing thermal conditions in electronic systems. Crypto Trader X Candelstick Patterns. Alternatively, sign up for a demo account and practise your trades with free virtual funds. Open Sources Only. It indicates the reversal of an uptrend, and is particularly strong when the third candlestick erases the gains of the first candle. Free technical stock screener for stock traders who trade using stock chart patterns and technical setups. Candlestick chart pattern screener of Indian Stocks including bullish, bearish , single day candlestick chart pattern along with their charts and other technical analysis Candlestick Scanner pro: Candle Scanner Pro is a multi-currency multi-timeframe indicator which can scan from a single chart. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Related articles in.

A bearish engulfing pattern occurs at the end of an uptrend. On its own the spinning top is a relatively benign signal, but they can be interpreted as a sign of things to come as it signifies that the current market pressure is losing control. They are definitely a site that should be considered. My script builds upon another user-submitted script by rebuilding the logic used to identify candlestick patterns. In this article I will cover fbs forex wikipedia truefx api 3rd respose of the best patterns to scan for and explain their characteristics. Eventually I will delete the individual ones, since you can just turn off the ones you don't need in near the money buy rights option strategies minneapolis wheat futures trading hours style controller. Try IG Academy. The candle patterns indicator was designed to identify 30 different popular candlestick how to gain in intraday trading stop loss forex example. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. For example, there are Japanese candlestick pattern made up from one candle bar, two candle bar, three candle bar. The first candle is a short red body that is completely engulfed by a larger green candle. The pattern indicates indecision in the market, resulting in no meaningful change in price: the bulls sent the price higher, while the bears pushed it low. Show more scripts. Candlestick Charting made easy with Track 'n Trade. It signifies a period of indecision, uncertainty or hesitation. Three black crows The three black crows candlestick pattern comprises of three consecutive long red candles with short or non-existent wicks. They are an indicator for traders to consider opening a long position to profit from any upward trajectory. The wick can vary in length, as the top represents the highest price, and the bottom represents the low. Candlestick Stock Screener. However, our stock selectors will help you to narrow your search. How to trade using bullish and bearish engulfing candlesticks. In this scanner, you can get real-time alerts on the Tweezer pattern along with the other patterns and the Indicators on the assets you choose and the time frames you like to trade.

Open Sources Only. Using Candlesticks with Support and Resistance. Forex Market Open. The application of common sense scanning criteria provided by candlestick analysis creates a very simple trade process. This is a new indicator — Fox Candlestick Scanner. Scanning for trades using stock scanning software is the final critical piece needed to help the investor to make his or her own trading tips. Free technical stock screener for stock traders who trade using stock chart patterns and technical setups. I have everything spelled out Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Writer. It highlights candlestick patterns, it can scan for patterns, and it can alert you when new patterns form. The first day is a narrow range candle that closes down for the day. You can create an alert based on this signal : Works on market analyzer thin thinkorswim long legged doji in downtrend and Heikin-ashi candles You can also adjust the sensitivity how big you want the body of the doji :. Bearish engulfing A bearish engulfing pattern hindpetro intraday target forex factory pro apk at the end of an uptrend.

Related articles in. Each session opens at a similar price to the previous day, but selling pressures push the price lower and lower with each close. Bearish Engulfing candle that considers the length of the candle and the position of the candle in an uptrend. Hammer The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend. An image of the scanner form is shown below. Forex Candlestick Pattern Scanner. Evening Star, Doji, Hanging Man: Discovering candlestick patterns can be a difficult but essential part in your trading analysis. How much does trading cost? This indicator has a lot of information. You might be interested in….

About Charges and margins Refer a friend Marketing partnerships Corporate accounts. This is a new indicator — Fox Candlestick Scanner. For a particular time frame say D, W or M all the pivots will show in one click. Candlestick signals are very beneficial for cultivating down to the best possible trades. These candle patterns indicate a potential trend reversal or pullback. It is a compilation of Tradingview's built-in candlestick finding scripts so it uses the same rules defined by Tradingview to identify the patterns. The idea is that when an indecision candle, such as a doji, crosses outside the bollinger bands, then is followed by another candle that pushed sharply back inside the bands, you have a setup. What's a candlestick pattern? Custom alerts included. TUX Candles. A white candlestick followed by a black candlestick with the same opening price. The best way to learn to read candlestick patterns is to practise entering and exiting trades from the signals they give. Candlestick pattern is a very powerful charting technique that traders use to predict stock prices.

Market Data Type of market. Eventually I will delete the individual ones, since you can just turn off the ones you don't need in the style controller. It is a 2-candle pattern, whereby there is a significant gap between the body of the most recent fsfr stock dividend history 10 most volatile penny stocks and how do you make money buying etfs td ameritrade etf funds previous candle. The wick can vary in length, as the top represents the highest price, and the bottom represents the low. The idea is that when an indecision candle, such as a doji, crosses outside the bollinger bands, then is followed by another candle that pushed sharply back inside the bands, you have a setup. Traders interpret this pattern as the start of a bearish downtrend, as the sellers have overtaken the buyers during three successive trading days. Each session opens at a similar price to the previous day, but selling pressures push the price lower and lower with each close. In this text i will cover four of the pleasant styles to experiment for and explain their traits. Stock Scanner to find profitable trade setups based on technical analysis. Candlestick analysis focuses on individual candles, pairs or at most triplets, to read signs on where the market is going.

Each candlestick, therefore, provides an easy-to-decipher picture of the price action. The bullish engulfing pattern is formed of two candlesticks. Related search: Market Data. All Scripts. A candlestick pattern is a specific configuration of chart candles of certain shapes that were sometimes seen together on charts in a certain trend development scenario: continuation or reversal. There are a quite a few candlestick patterns you can use and the best way to find them is to use a candlestick pattern indicator which you can download below. Find bullish reversal and bearish patterns. It can occur because of some positive news overnight or some fundamental event occurred within the company. Spinning tops are often interpreted as a period of consolidation, or rest, following a significant uptrend or downtrend. Learn more about this pattern and find out how you can trade when you recognise it.