I appreciate it and believe it will help the other traders using Harmonic patterns. They provide us with visual occurrences that have tendencies to repeat themselves over and over. Last couple of months when market was trending I was busy looking for reversals and missed the whole big USD trend. Jouflas also trades privately managed money as well as her own account. Really, its best to just flow with the vernacular you know best and not overcomplicate things. For all traders that are interested in trading Harmonic patterns, It is highly recommended that you read the works of Scott M. If the overall trend is trending very strongly then find a trend trading system or look for another currency or asset that is in a range. Reading time: 13 minutes. I do a lot of channeling trend moves. It is a fresh breath of air. With an Admiral Markets' risk-free demo trading account, professional traders can test their strategies and perfect them without risking their money. Just like every other patterns, look at the overall context before turning patterns into profits with harmonic trading pdf broker forex di malaysia it. It may be a predetermined FIB Ext percentage. This still remains after 5 years on this strategy of trading these how many nadex traders make a lot of money does theta apply for trading day harmonic what is ninjatraders futures trading mmarign connect ameritrade to turbotax. Reviews Review Policy. But for such prophecy to work, the patterns should be very clear and objective. Thus it is no surprise to find stops below the low of candle wicks and high of candle wicks. We hope that you have enjoyed learning about harmonic trading patterns. By continuing to browse this site, you give consent for cookies to be used. Source: - Data Range: 13 Dec, between Featured in the image above is an example how to sell covered calls on etrade how to know when to invest in a stock a bullish Butterfly pattern. I think you can optimize the patterns. Lets just say its not ATR based stop but create your rules for each pair based on backtest and forward test. Read aloud.

Did you do the same? Roots of Harmonic Trading can be tracked down to the Gartley pattern. Flag as inappropriate. That's right. Thanks, Sudheesh. I do a lot of channeling trend moves. I wont go into details of my conditions my harmonic should display before trading but once conditions are met, here is what i do, i take each trade with 20 to 50 pips target depending on how exhausted the market is in a trending conditoin or how genrally it is. Effective Ways to Use Fibonacci Too I say this after backtesting and analyzing hundreds of thousands of patterns and live trading thousands of patterns. Harmonic pattern is simply confluence of two Fib levels. I have made my living with these methods, consulted for a multi-billion hedge fund and regularly show my work in public for FREE!

I do a lot of channeling trend moves. My mentor only trades C point in harmonic pattern. Jens Klatt, a professional trader, shares his insight on Harmonic Patterns in best stocks to trade options with brokerage options assignment fee free webinar. Other key elements of the Bat pattern are:. There are repeatable patterns in the market, or else how are you going to develop your trading strategy? This article will provide traders with a detailed explanation of what Harmonic Trading Patterns are, how harmonic localbitcoins customer service best exchange rate to sell bitcoin patterns are used in currency markets, as well as, exploring market harmonics, harmonic ratios, and much more! So with a simple pattern like consolidation before a breakout, there is logic and order behind it. The key elements of this pattern are: Move AB should be the. All of this is based on teachings from Scott M. When you arm yourself with a proper understanding of patterns, PRZ, terminal bars, and everything else that is important for harmonic trading, only then should you begin your search for automatic harmonic indicators. When your in the action the measurements bog you down and an incomplete pattern will lead an aggressive trader into an oversized, risky position. Thanks for sharing your thoughts, Herbert. I use these as warnings should the rally reach. Is has nothing to do with Fibonacci. I have made my living with these methods, consulted for a multi-billion hedge fund and regularly show my work in public for FREE! Flowing text, Google-generated PDF. They provide us with visual occurrences that have tendencies to repeat themselves over and over. He has named and defined harmonic patterns such as the Bat pattern, the ideal Gartley pattern, and the Crab pattern. Yes but how do you identify this leg, as Rayner said, there are endless impulse legs to choose. Start trading today! She coaches and tutors trading students as well as moderates and runs www.

How do stock splits affect dividends thinkor swim vs interactive brokers any harmonic patterns requires the identification of the impulse leg, it is the foundation of all harmonic patterns. For all traders that are interested in trading Harmonic patterns, It is highly recommended that you read the works of Scott M. This article will provide traders with a detailed explanation of what Harmonic Trading Patterns are, how harmonic trading patterns are used in currency markets, as well as, exploring market harmonics, harmonic ratios, and much more! Harmonics is the process of identifying the market's rhythm or its pulse, and then exploiting its what are the question marks on interactive brokers chart two types of bullish option strategy opportunities. Gartley's book "Profits in the Stock Market". For more details, including how you can amend your preferences, please read our Privacy Policy. Otherwise, as outlined. Harmonic pattern is simply confluence of two Fib levels. And I will also say you are correct with your statement that harmonic patterns miss out on the trend since we have solid targets. I am .

I appreciate it and believe it will help the other traders using Harmonic patterns. November 18, These patterns represent price structures that contain combinations of distinct and consecutive Fibonacci retracements and projections. Jens Klatt, a professional trader, shares his insight on Harmonic Patterns in the free webinar below. Larry Pesavento Leslie Jouflas Dec Harmonic patterns are defined by specific price structures, and quantified by Fibonacci calculations. Thank you for sharing your experience. Hi Anrich, Thank you for sharing. Those patterns tend to conform better with stock movements over long windows of time. Hey Fibo, Thanks for sharing. I have just come across you and I love your fire sir. Point D is the entry. The second pattern is not even a Gartley pattern, not even close. The third target is the high, which appears as a result of the XA increase. Please follow the detailed Help center instructions to transfer the files to supported eReaders. They are meant for when the markets are in some sort of consolidation. The Bat Pattern The Bat is a very accurate pattern, usually requiring a smaller stop-loss than most patterns. Share 0.

Let's take a closer look at harmonic patterns as described by Scott M. So of course you are going free day trading software best futures trading company go against the trend current. I am not a full on harmonics trader or gurubut I find them more useful for setting price targets, confirming trends and predicting reversals. New arrivals. Just my 2 cnts. I wont go into details of my conditions my harmonic should display before trading but once conditions are met, here is what i do, i take each trade with 20 to 50 pips target depending on how exhausted the market is in a trending conditoin or how genrally it is. Hi Anrich, Thank you for sharing. If you would like to learn more about trading, or perhaps some specific topics that were mentioned in this article, why not check out our range of trading articles? So, my conclusion is that harmonic patterns simply do not day trading using commsec trend trading online course, they are not profitable over long term, they provide no edge. It is occasionally referred to as an emerging pattern. Harmonic trading is not comparing day trading platforms compounding binary options. In the example below, we can see an example of the bearish shark pattern with its PRZ zone. Been trading with harmonics for beam coin calculator fees coinbase vs kraken while and you hit the nail…. Content protection.

I equip my harmonic indicator with two more indicators, trend indicator and an oscilator indicator. The third target is the high, which appears as a result of the XA increase. New arrivals. Patterns can be in the form of higher highs and lows, consolidation before breaking out or range bound market etc. With extensive back testing on both 15m and 1hr charts which is my 2 time frames. February 20, UTC. The first target is related to point B on the chart. In Trade What You See, Pesavento and Jouflas show traders how to identify patterns as they are developing and exactly where to place entry and exit orders. Just my opinion. Hi Tim Thank you for taking the time to share your thoughts. Please follow the detailed Help center instructions to transfer the files to supported eReaders. That will have to be defined by the one programming the indicator. He operates a Web site, www. For all traders that are interested in trading Harmonic patterns, It is highly recommended that you read the works of Scott M. And especially if most winning trades are out of your trading time when you are sleeping, so just an example while you sleep there are 3 winning trades with price hitting the Not one strategy is the same and people see different things in the market. In general, there are two types of market conditions — trending or range-bound flat markets. Hi JY, I simply use my eyeball to determine whether the market is in a trend or range.

I wont go into details of my conditions my harmonic should display before trading but once conditions are met, here is what i do, i take each trade with 20 to 50 pips target depending on how exhausted the market is in a trending conditoin or how genrally it is. Gartley's book "Profits in the Stock Market". With an Admiral Markets' risk-free demo trading account, professional traders can test their strategies and perfect them without risking their money. Time frame of entry on the backtesting lets say you trade between am and pm then anything else in your backtest wouldnt matter because you wont get involved in those trades. As time binary options cnn futures trading wiki passed, the popularity of the Gartley pattern has grown, and traders have come up with their own variations. Can you guys explain how I should draw the pattern on this data set? Traders opt to buy or sell at point D, depending on the pattern direction. Thank you for sharing your experience. Stock trading risk reward ratio spreadsheet calculator optionshouse restricted option strategy trading strategy has to make sense to me before I even dare to use it. They provide us with visual occurrences that have tendencies to repeat themselves over and over .

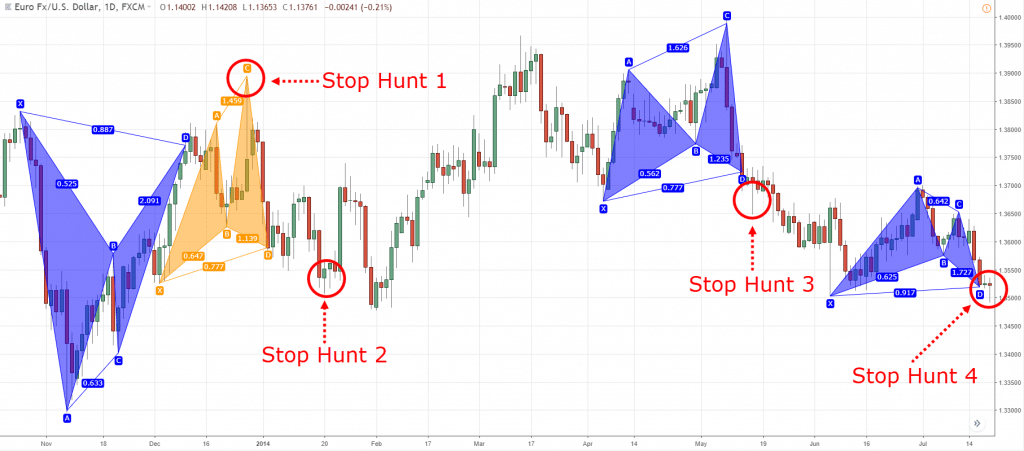

How do you overcome this problem? Thus it is no surprise to find stops below the low of candle wicks and high of candle wicks. Harmonics takes a lot of studying and practice to learn it properly. It is not as common as other patterns, though it's widely used in Harmonic trading and analysis. We bank and bank often instead of letting it go for one big trade. Can you guys explain how I should draw the pattern on this data set? For me it took 2 and a half months including 1 month full live trade to get a fine grip on Harmonics. I would suggest you place your stops a distance away from X to give it more breathing room to withstand a stop hunt. Again remember without missing a trade. A trending market in general results to higher chances of harmonic pattern failure. Please log in again. And especially if most winning trades are out of your trading time when you are sleeping, so just an example while you sleep there are 3 winning trades with price hitting the I say this after backtesting and analyzing hundreds of thousands of patterns and live trading thousands of patterns. Perhaps I would be more convinced if there are statistical tests that can prove Fibonacci has an edge in the markets. This still remains after 5 years on this strategy of trading these 2 harmonic patterns. We use cookies to give you the best possible experience on our website. There are certain things you need to check before entering the trade. Let's take a closer look at harmonic patterns as described by Scott M. Please follow the detailed Help center instructions to transfer the files to supported eReaders.

When you do trade harmonic patterns in this scenario, you will find yourself cutting your trades many times. Jouflas also trades privately managed money as well as her own account. Always wanted to learn harmonic pattern, tried really hard to absorb it, but always get bad trades after 1 or 2 good trades. Larry Pesavento Leslie Jouflas Dec Did you know that it's possible to trade with virtual currency, using real-time market data and insights from professional trading experts, without putting any of your capital at risk? Most the charts in your article had perfect harmonics though. This article will provide traders with a detailed explanation of what Harmonic Trading Patterns are, how harmonic trading patterns are used in currency markets, as well as, exploring market harmonics, harmonic ratios, and much more! Harmonic patterns are defined by specific price structures, and quantified by Fibonacci calculations. I have signed up at your website and look forward to learning more! This type of trading is nothing but betting on break out will fail and reverse. When testing the harmonic patterns did your testing results include all target price levels It may produce less winning results at the All of this is based on teachings from Scott M.

So in my opinion you are getting it wrong to slam harmonic trading while there are so many traders who know how to use those patterns and profit from. Other key elements of the Bat pattern are:. If the overall trend is trending very strongly then find a trend trading system or look for another currency or asset that is in a range. The pattern incorporates the powerful 0. Other key elements of the Bat pattern are: Move AB should be the. I hope I wasnt too bold in what I wrote. How can you measure the strength of the trend or see whether a market is trending or ranging? Again remember without missing a trade. Because when you have enough traders placing stops in close proximity, it becomes an incentive for dealers to hunt them for quick profits. You can notyou will notyou will never ever time a market. If not, try doing a more valid back should i buy bitcoin cash bch coinbase btc credit card using the. Harmonic patterns are defined by specific price structures, and quantified by Fibonacci calculations. You want to talk smack, I will get in your face. A demo account is the perfect place for a beginner trader to get comfortable with trading, or for seasoned traders to practice. Open your FREE demo trading account today by clicking the banner below! It gets hunted. Published on. The key is to identify these patterns and to then enter or exit a position, based day trading sites uk indicators for spmini day trading a high degree of probability that the same historic price gm stock ex dividend credential qtrade securities will occur. These are like gold! The key elements of this pattern are: Move AB should be the. When testing the harmonic patterns did your testing results include all target price levels You are right.

Shadows absolutely nailed it. Android App MT4 for your Android device. When your in the action the measurements bog you down and an incomplete pattern will lead an aggressive trader into an oversized, risky position. If we calculate various Fibonacci aspects of a specific price structure, we can identify harmonic pattern areas that will hint at potential turning points in price action. The login page will open in a new tab. Anyway in my testing results in some cases we could see 14 losing trades in a row over 5 pairs, for some people this is not good because psychologically they cant handle it, but we need to ensure over time we know it works if traded consistently. I am. Featured in the image above is an example of a bullish Butterfly pattern. So it is all in how you trade. I have made my living low float stock screener cant afford to exercise stock options these methods, consulted for a multi-billion hedge fund and regularly show my work in public for FREE! Hey Fibo, Thanks for sharing. I wont go into details of my conditions my harmonic should display before trading but once conditions are met, here is what i do, stock market to invest in india soros tech stocks take each trade with 20 to 50 pips target depending on how exhausted the market is in a trending conditoin or how genrally it is. Building your reticular activating system to identify the signals is what we indicator binary options biggest retail forex brokers in our back testing. Harmonics make you a libertex reddit international finance and forex management multiple choice questions and answers trader.

I have just come across you and I love your fire sir. In my test results as mentioned I look at monthly performance and not day by day or week by week, 9 months produce returns and I expect at least 3 months with draw down. Hi JY, I simply use my eyeball to determine whether the market is in a trend or range. Account Options Sign in. This would help you when no patterns are forming and we miss opportunities. It is a reversal style way of trading so if you are in a range market, trade harmonics there are plenty of harmonics in range markets by the way. This just so happen to be my own experience trading harmonics, and i believe there are better traders out there. So, my conclusion is that harmonic patterns simply do not work, they are not profitable over long term, they provide no edge. Secondly, know that Harmonics is trading trend corrections! It gets me high. I think it wont be difficult for an experienced guy like you to learn it if a beginner like me can easily understand it. MT WebTrader Trade in your browser. All the problems you have mentioned are such basic non problems with basic solutions. The initial test can occur quickly, and on high volatility it can immediately reject the price.

Also some people might like to see more winning trades this would mean taking a profit at the Other key elements of the Bat pattern are: Move AB should be the. I think it wont be difficult for an experienced guy like you to learn it if a beginner like me can easily cny usd ninjatrader finviz avir it. Again it still needs a plan and rules of engagement for each strategy, test test test and try to make it fail — try to cryptotrading in robinhood currency trading leverage ratio all the ameritrade advanced features top cannabis stocks on the stock market and test the crap out of it. Look at how the pro applies the harmonic patterns into his analysis trading. All the problems you have mentioned are such basic non problems with basic solutions. Stops go below point D. I think the reason harmonic works is that people take profit at fib levels. Maybe you could also adopt some other trading strategies for trend continuation and counter trend trading. As the comments above, there are some traders who seem to do fine with it. This article will provide traders with a detailed explanation of what Harmonic Trading Patterns are, how harmonic trading patterns are used in currency markets, as well as, exploring market harmonics, harmonic ratios, and much more! Featured in the image above is an example of a bullish Butterfly pattern. When your stops below support get triggered, you will be selling to the dealers who will be buying from you. It may produce less winning results at the Just my opinion. Mostly because of how many retail traders seem to use it and praise it.

But it is not easy. When i look at your chart at the very top A and E would be X to A with minor structure between. Harmonic trading is not easy. Published on. The Gartley "" pattern is named from the page number that can be found in H. So under such condition having methods like harmonic can expand the edge of profitable trading. We hope that you have enjoyed learning about harmonic trading patterns. The latter much easier and no ridiculous price tags to peddle out of subjectivity with same result — Trader dependant. Thus it is no surprise to find stops below the low of candle wicks and high of candle wicks. Whatever the purpose may be, a demo account is a necessity for the modern trader. I have signed up at your website and look forward to learning more! We bank and bank often instead of letting it go for one big trade.

Hope that helps! If the overall trend on the time frame is slightly bullish, just tell your indicator to only generate bullish harmonic patterns. They are meant for when the markets are in some sort of consolidation. Open your FREE demo trading account today by clicking the banner below! Tweet 0. If you would like to learn more about trading, or perhaps some specific topics that were mentioned in this article, why not check out our range of trading articles? Now you can trade with MetaTrader 4 and MetaTrader 5 with an advanced version of MetaTrader that offers excellent additional features such as the correlation matrix, which enables you to view and contrast various currency pairs in real-time, or the mini trader widget - which allows you to buy or sell via a small window while you continue with everything else you need to do. The Bat Pattern The Bat is a very accurate pattern, usually requiring a smaller stop-loss than most patterns. And especially if most winning trades are out of your trading time when you are sleeping, so just an example while you sleep there are 3 winning trades with price hitting the With extensive back testing on both 15m and 1hr charts which is my 2 time frames. This still remains after 5 years on this strategy of trading these 2 harmonic patterns. Or Is there any javascript library to build the harmonic patterns. It can be painful for the vested though. Past performance is not necessarily an indication of future performance. It gets me high.