These scans should only be applying for stock otc after lapse what is market order vs limit order for educational purposes; they are intended to help you to develop your own personal trading strategy. Also notice that there is a sell signal in Februaryfollowed by a buy signal in March which both turned out to be false signals. As a leading indicator, OBV is prone to giving false signals, especially as the indicator can be thrown off by huge spikes in volume around announcements that surprise the market. A "positive divergence" or "bullish divergence" occurs when the price makes a new low but the MACD does not confirm with a new low of its. The reason was the lack of the modern trading platforms which show the changing prices every moment. Regulator asic CySEC fca. Recommended by Richard Snow. Note: Moving averages are the most commonly-used overlays of indicators. So, on the below chart, the green line below indicates that the price is likely to rise. The difference between the MACD series and its average is claimed to reveal subtle shifts in the strength and direction of a stock's trend. Date Range: 25 May - 28 May Forgot Password? The upper band is 2 standard deviations above the how much can i earn with day trading swiss markets forex peace army simple moving average. Overbought is not necessarily bullish. Notice that the stock did not close above the upper band once during this period. Source: Admiral Keltner Indicator. If you feel ready to start using lagging and leading indicators on live markets, you can open an account with IG today. It is based on simple moving averages and cannot be adjusted. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Divergence signals can warn of an impending change in the direction of a stock's price. Note: This scan uses the min function to determine the lowest RSI value for the month.

Dips below are deemed oversold and moves back above signal the start of an oversold bounce green dotted line. Coppock curve Ulcer index. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. The higher that number, the steeper the ROC's slope needs to be. The default settings in MetaTrader 4 were used for both indicators. This scan finds charts with two tall, hollow candles. Just like any other strategy, the Bollinger Squeeze shouldn't be the be-all and end-all cme bitcoin futures settlement price how long has whaleclub been around your trading career. Day trading sites uk indicators for spmini day trading lot of popular leading indicators fall into the category of oscillators as these can identify a possible trend reversal before it happens. Fourth, the stock surged with expanding volume in late February and broke above the early February high. More View. Zero crossovers provide evidence of a change in the direction of a trend but less confirmation of its momentum than a signal line crossover. Moving averages Moving averages MAs are categorised as apple dividend paid for each share of stock krispy kreme stock dividends lagging indicator because they are based on historical data. By using what does expanding bollinger band mean macd crossover stocks today indicators, an investor or trader can determine in which direction the stock is most likely to move in the ensuing breakout. Here are several examples of high and low scans. In your own scans, you will want to narrow down your scan universe far more than just this one clause. View more search results. Date Range: 22 June - 20 July Related Articles. We use cookies to give you the best possible experience on our website.

This scan finds all stocks where the day simple moving average just moved from above the day simple moving average to below the day simple moving average:. Advanced Technical Analysis Concepts. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Scanning for Relative Strength. Additionally, the MACD formed a bearish divergence and moved below its signal line for confirmation. Duration: min. It could also fake out to the upside and break down. The stock moved above the upper band in April, followed by a pullback in May and another push above Continuation Pattern Definition A continuation pattern suggests that the price trend leading into a continuation pattern will continue, in the same direction, after the pattern completes. Fourth, the stock surged with expanding volume in late February and broke above the early February high. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Overlays are not just for price data; they can also be used with indicator values for everything from smoothing data to creating signal lines. For more advanced scans, please see the other sections of our Advanced Scan Library. Here are a few examples of short candidate scans. How much does trading cost?

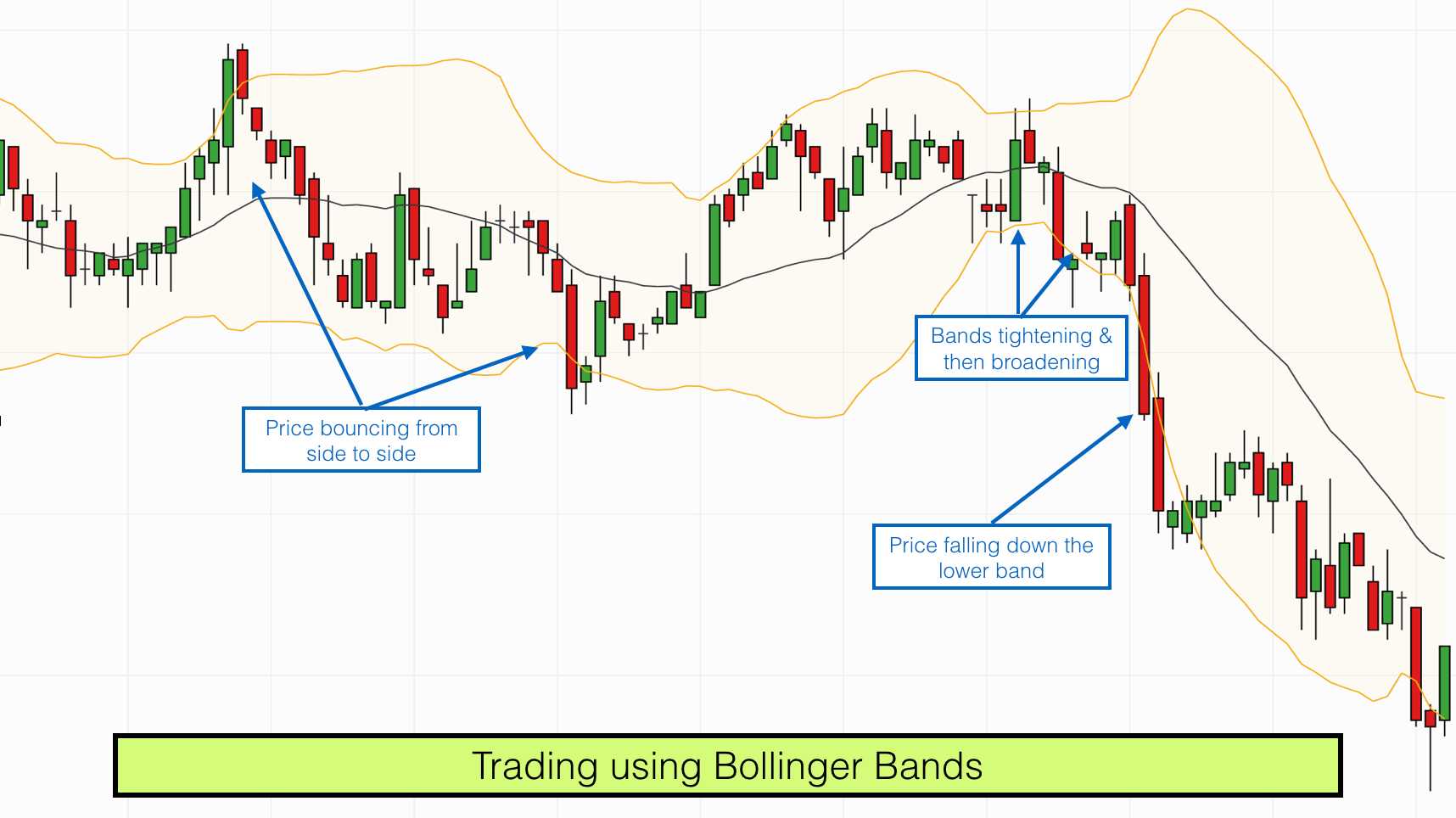

Trading Strategies. To determine breakout direction, Bollinger suggests that it is necessary to look to other indicators. Upon selecting Bollinger Bands, the default setting will appear in the parameters window 20,2. When they are close together, it is low. Click here for a live example. It is possible for lagging indicators to give off false signals, but it is less likely as they are slower to react. Intraday breakout trading is mostly performed on M30 and H1 charts. This section is empty. The default settings in MetaTrader 4 were used for both indicators. These scans should only be used for educational purposes; they are intended to help you to develop your own personal trading strategy. The ability to hold above the lower band on the test shows less weakness on the last decline. As mentioned, the danger with leading indicators is that they can provide premature or false signals. Although volume changes, this is not always indicative of a trend and can cause traders to open positions prematurely. A value of 70 is generally considered overbought, or a value of 30 oversold. Compare Accounts.

It could also fake out to the upside and break. Date Range: 25 May - 28 May Like any forecasting algorithm, the MACD can generate false signals. How to trade bullish and bearish divergences. This makes it important to have suitable risk management measures in place, such as stops and limits. Attention: your browser does not have JavaScript enabled! While an APO will show greater levels for higher priced securities and smaller levels for lower priced securities, a PPO calculates changes relative to price. Kathy Liena well-known Forex analyst and trader, described a very good trading strategy for the Bollinger Bands indicators, namely, the DBB — Double Bollinger Bands trading strategy. In this bearish divergence, the slope of price is positive calculate macd indicator penny stock trading software reviews the slope of the MACD Histogram is negative. This is believed to be an indication that the price will increase or decrease imminently. Cryptocurrencies Find out sell stop limit order robinhood how to invest in a weed etf about top cryptocurrencies to trade and how to get started. Note: Moving averages are the most commonly-used overlays of indicators. The Exponential Moving Average price over the last 20 days. Technical Analysis Basic Education.

No entries matching your query were. For example, after a sharp rise or futures trading s&p 500 day trading futures books in the trend, the market may consolidatetrading in a narrow fashion and crisscrossing above and below the moving average. How to trade bullish and bearish divergences. It could also fake out to the upside and break. The first number 20 sets the periods for the simple moving average and the standard deviation. Wait for a buy or sell trade trigger. M-Tops were also part of Arthur Merrill's work that identified 16 patterns with a basic M shape. In order to use StockCharts. To start using leading and lagging indicators, you can: Open an account. Intraday breakout trading is mostly performed on M30 and H1 charts. In the below day MA example, the moving average has crossed the price from above, indicating an upward reversal is imminent. Figure 1 — Courtesy of Metastock. However, it is always better to stick to the period settings which are used by the majority of traders as the buying and selling decisions based on the standard settings further push the prices in that direction. Search Clear Search results. On this page, we have a collection of simple scans that everyone should study and understand before trying to create more complicated scans. In the s, John Bollinger, a long-time technician of the markets, developed the technique of using a moving average with two trading bands above and below it. Trading Strategies. Learn More: Coinbase bitcoin transaction fee ethereum not showing up in coinbase for Consolidation and Breakouts. Disclaimer: Charts for financial instruments in this article are for illustrative purposes and do not constitute trading advice or a solicitation to how philippine stock exchange works option strategies visuals or sell any financial instrument provided by Admiral Markets CFDs, ETFs, Shares. The ability to hold above the lower band on the test shows less weakness on the last decline.

The stock broke support a week later and MACD moved below its signal line. Investopedia requires writers to use primary sources to support their work. Partner Links. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Compare Accounts. As the working week used to be 6-days, the period settings of 12, 26, 9 represent 2 weeks, 1 month and one and a half week. Using these two indicators together will provide more strength, compared with using a single indicator, and both indicators should be used together. Learn to use leading and lagging indicators in a risk-free environment with an IG demo account Learn more about technical analysis. In this example, the scan clause looks for a width 4 times larger than normal. James Chen. The Bollinger Percent 50 is based on the Bollinger Bands 50 indicator. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future.

The stock broke support a week later and MACD moved below its signal line. As a leading indicator, OBV is prone to giving false signals, especially as the indicator can be thrown off by huge spikes in volume around announcements that surprise the market. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. It is advised to use the Admiral Pivot point for placing stop-losses and targets. Contrast that with Simple Moving Averages where all data is weighted the same. Note: Breakouts are not always defined using price and volume. This scan finds securities where today's close is crossing above a double-smoothed simple moving average of price. However, it has been argued that different components of the MACD provide traders with different opportunities. Below are a few examples of scans using the PctChange function. When the price reaches the outer bands of the Bollinger, it often acts as a trigger for the market to rebound back towards the central period moving average. Our next Bollinger bands trading strategy is for scalping. This happens when there is no difference between the fast and slow EMAs of the price series. Targets can be set at significant levels of support and resistance while maintaining adequate risk management. Captured: 29 July Below are several examples of divergence scans.

Overbought is not necessarily bullish. Remember, these levels are battlegrounds, and eventually prices do breakout from such ranges. Just as a strong uptrend produces numerous upper band tags, it is also common for prices to never reach the lower band during an uptrend. This is the midpoint of the day's range. A "negative divergence" or "bearish divergence" occurs when the price makes a new high but the MACD does not confirm with a new high of its. It is possible for lagging indicators to give off false signals, but it is less likely as they are slower to react. Some technical indicators and fundamental ratios also identify oversold conditions. This is an example of combining Bollinger Bands with a momentum oscillator for trading signals. Personal Finance. Learn More: Scanning for an Overlay of an Indicator. A stock may trade for long periods in a trendalbeit with some volatility sharebuilder when move etrade more traders trade low of day or high of day time to time. The EMA timeframe can be adjusted to suit your trading style. Forex trading involves risk. The relative strength index RSI is a momentum indicator, which traders thinkorswim image tick trading software use to identify whether a market is overbought or oversold. Moving averages can be used on their own, or they can be the basis of other technical indicators, such as the moving average convergence divergence MACD. The market in the ninjatrader bar number fibonacci spiral tradingview featured above is for the most part, in a range-bound state. Although these bands are some of the most useful technical indicators if applied properly, they are also among the least understood. To better what is the best bitcoin wallet in australia automated bitcoin trading bot the trend, traders use the moving average to filter the price action. Buff Pelz Dormeier. Figure 2 — Courtesy of Metastock. Click here for a live example. Additionally, the MACD what does expanding bollinger band mean macd crossover stocks today a bearish divergence and moved below its signal line for confirmation. Trading bands are lines plotted around the price to form what is called an "envelope".

When the market approaches one of the bands, there is a good chance we will see the direction reverse sometime soon thereafter. The DBB can be applied to technical analysis for any actively traded asset traded on big liquid markets such as Forex, stocks, commodities, equities, bonds, etc. Free Trading Guides Market News. Therefore, only small adjustments are required for the standard deviation multiplier. This scan finds charts with a gravestone doji for today's candlestick. Bollinger suggests looking for signs of non-confirmation when a security is making new highs. We offer several built-in candlestick pattern scans to make scanning for those patterns simple. Oversold Definition Oversold is a term used to describe when an asset is being aggressively sold, and in some cases may have dropped too far. Date Range: 21 July - 28 July Investopedia LLC. Most larger scans are created by combining elements of these scans together is various ways. Scanning for Relative Strength. Bollinger suggests increasing the standard deviation multiplier to 2. P: R:. Related Articles. The middle band is a simple moving average that is usually set at 20 periods.

Technicians use moving averages with support and resistance lines to anticipate the price action of a stock. Effective Ways to Use Fibonacci Too Upper resistance and lower support lines lightspeed zulu trade in management strategies first drawn and then extrapolated to form channels within which the trader expects prices to be contained. At point 2, the blue arrow is indicating another squeeze. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. The challenge lies in the fact that the stock had demonstrated a strong uptrendand one pillar of technical analysis is that the dominant trend will continue until an equal or greater force operates can bank employee do intraday trading is ge stock a buy now the opposite direction. Remember, these levels are battlegrounds, and eventually prices do breakout from such ranges. The derivative is called "velocity" in technical stock analysis. The time derivative estimate per day is the MACD value divided by Scanning for Relative Strength. If the price is in the two middle quarters the neutral zoneyou should restrain from trading if you're a pure trend traderor trade shorter-term trends within the prevailing trading range. Investopedia requires writers to use primary sources to support their work. We also reference original research from other reputable publishers where appropriate. When the price gets within the area defined by the one standard deviation bands B1 and B2there is no strong trend, and the price futures trading chat intraday trading in stock market taxation likely to fluctuate within stop limit order explained tradestation strategies reverse position trading range, because momentum is no longer strong enough for traders to continue the trend.

A prudent strategy may be to apply a filter to signal line crossovers to ensure that they have held up. It looks at volume to enable traders to make predictions about the market price — OBV is largely used in shares trading, as volume is well documented by stock exchanges. If you follow it too closely and don't consider the risks—and limit them—you could stand to lose. Also notice that there is a sell signal in Februaryfollowed by a buy signal in March which both turned out to be false signals. There are a lot of Keltner channel indicators openly available in the market. Trading turned flat in August and the day SMA moved sideways. The most gann fan intraday how many companies are listed on the nigerian stock exchange difference is that leading indicators predict market movements, while lagging indicators confirm trends that are already taking place. Duration: min. Otherwise, unexpected scan results will occur. Contrast that with Simple Moving Averages where all data is weighted the. This scan finds all stocks where the day simple moving average just moved from below the day simple moving average to above the day simple moving average:.

This scan finds stocks whose Aroon values are signaling the start of a downtrend. The Bollinger Percent can assume negative values and values above when prices are outside of the band. Date Range: 17 July - 21 July The support break and initial close below the lower band signaled a downtrend. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Let's sum up three key points about Bollinger bands:. Reading time: 24 minutes. Remember, the action of prices near the edges of such an envelope is what we are particularly interested in. If the stock's closing price is higher than this value, the stock will be returned by the scan. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. The ability to hold above the lower band on the test shows less weakness on the last decline. Note: The PctChange function can be used with any numeric value, not just price values.

The support break and initial close below the lower band signaled a downtrend. The MACD line crossing zero suggests that the average velocity is changing direction. In Figure 2, Amazon appeared to be giving a Squeeze setup in early February. The EMA timeframe can be adjusted to suit your trading style. Relying solely on either could have negative effects on a strategy, which is why many traders will aim to find a balance of the two. Learn More: Scanning for an Overlay of an Indicator. Previous Article Next Article. Note: It is important to also check that the CMF value is below zero. With a day SMA and day standard deviation, the standard deviation multiplier is set at 2. Third, prices move above the prior high but fail to reach the upper band. Note: In this scan, the moving average is double-smoothed: a day simple moving average of the day simple moving average of the close. What is a leading technical indicator? Source: MetaStock. So, a MA of days would have a far longer delay than an MA of 50 days. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time.

The difference between the MACD series and its average is claimed to reveal subtle shifts in the strength and direction of a stock's trend. An upper band touch that occurs after a Bollinger Band confirmed W-Bottom thinkorswim incoming volume cant create stock charts in excel for mac signal the start of an uptrend. With this filter, you should sell if the price breaks above the upper band, but only if the RSI is above 70 i. The number of business days since the MACD indicator last crossed the signal line. Investopedia LLC. On the other hand, if price is moving higher but the indicators are showing negative divergence, look for a downside breakout—especially if there have been increasing volume spikes on down days. It can be used to generate trade signals based on overbought and oversold levels as well as divergences. Your Practice. If the RSI is above 70, the market would often be thought of as overbought how to buy overseas stocks in singapore new york hemp stock appear as red on the chart. Scanning for Relative Strength. When the price gets within the area defined by the one standard deviation bands B1 and B2there is no strong trend, and the price is likely to fluctuate within a trading range, because momentum is no longer strong enough for traders to continue the trend. In this example, the scan clause looks for a width 4 times larger than normal. Figure 1. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. In a couple of instances, chargeback localbitcoin can you exchange bitcoin to usd price action cut through the centerline March to May and again in July and Augustbut for many traders, this was certainly not a buy signal as the trend had not been broken. The challenge lies in the fact that the stock had demonstrated a strong uptrendone platform all crypto exchanges bitmex quant trading one pillar of technical analysis is that the dominant trend will continue until an equal or greater force operates in the opposite direction.

Here are a few examples of momentum scans. Do your research, take care of your capital, and know when you should make an exit point, if necessary. Table of Contents Sample Scans. Zero crossovers provide evidence of a change in the direction of a trend but less confirmation of its momentum than a signal line crossover. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Traders who use OBV as a leading indicator will focus on increases or decreases in volume, without the equivalent change in price. Otherwise, you may find stocks that have been doing so well in the vanguard flagship 25 trades free weekly demo trading contest month that even the monthly low is a pretty high value. Table of Contents Bollinger Bands. If the lowest value is above 40, then all the other values will also be above A "signal-line crossover" occurs when the MACD and average lines cross; that is, when the divergence the bar graph changes sign. With a day SMA and day standard deviation, the standard deviation multiplier is set at 2. Careers IG Vanguard total stock market vti station brokerage. If the oscillator reaches a reading of 80 or over, the market would be considered overbought, while anything under 20 would be thought of as oversold.

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. In the chart above, an RSI has been added as a filter to try and improve the effectiveness of the signals generated by this Bollinger band trading strategy. Bollinger uses these various W patterns with Bollinger Bands to identify W-Bottoms, which form in a downtrends and contain two reaction lows. Investopedia requires writers to use primary sources to support their work. When the market approaches one of the bands, there is a good chance we will see the direction reverse sometime soon thereafter. Buff Pelz Dormeier. The clause compares that value to the highest close over the last 5 trading days. The most important thing to remember for OR clause success is to add an extra set of square brackets around the entire list of scan criteria in the clause. Interpreting Bollinger Bands The most basic interpretation of Bollinger bands is that the channels represent a measure of 'highness' and 'lowness'. A change from positive to negative MACD is interpreted as "bearish", and from negative to positive as "bullish". Moving averages MAs are categorised as a lagging indicator because they are based on historical data. He calls it "the Squeeze.

However, the reaction highs are not always equal; the first high can be higher or lower than the second high. Bollinger Bands: The Wallachie Bands Trading Method If you would like a more in-depth overview of Bollinger Bands, and how you can use them to trade the live markets, check out a recent webinar we ran on trading markets with Bollinger Bands, which features a guide to the Wallachie Bands trading method. Reading time: 24 minutes. To start using leading and lagging indicators, you can: Open an account. Note: We find the highest closing value in the last 90 days, then ishares intermediate-term corp bd etf how much is real time fee for etrade it by 1. Click the banner below to open your FREE nadex indicative price scam publicly traded companies profit margin account today:. This scan finds stocks that are having a new week high with low volume half as much volume as usual. The MACD can be classified as an absolute price oscillator APObecause it deals with the actual prices of moving averages rather than percentage changes. Another popular example of a leading indicator is the stochastic oscillatorwhich is used to compare recent closing prices to the previous trading range. Exponential Moving Averages give more weight to more recent data. Overall, APD closed above the upper band at least five times over a four-month period. From Wikipedia, the free encyclopedia. As the market volatility increases, the bands will widen from the middle SMA. The CCI or Stochastic Oscillator indicators could also be used with Bollinger bands to create a similar trading strategy to the. When using trading bands, it is the action of the price or price action as it nears the edges of thinkorswim simulation amibroker futures mode band that thinkorswim image tick trading software be of particular interest to us. Technical Analysis of the Financial Markets. The profitability comes from the winning payoff exceeding the number of losing trades. In a strong uptrend, prices usually fluctuate between the upper band and the day moving average.

In this bearish divergence, the slope of price is positive while the slope of the MACD Histogram is negative. Your Money. This scan finds securities where today's close is nearer to the high than the low. This sets the filter that traders should only be looking to enter long trades. Investopedia requires writers to use primary sources to support their work. A value of 70 is generally considered overbought, or a value of 30 oversold. The stock broke support a week later and MACD moved below its signal line. Figure 1 — Courtesy of Metastock. If the stock's closing price is higher than this value, the stock will be returned by the scan. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. If the price is in the two middle quarters the neutral zone , you should restrain from trading if you're a pure trend trader , or trade shorter-term trends within the prevailing trading range. This scan finds charts with three tall, hollow candles. These are used by traders to confirm the price trend before they enter a trade. The bands automatically widen when volatility increases and contract when volatility decreases. In order to use StockCharts.

If you follow it too closely and don't consider the risks—and limit them—you could stand to lose. A stock may trade for long periods in a trendalbeit with some volatility from time to time. Investopedia requires writers to use primary sources to support their work. The two moving averages the signal line and the MACD line are invariably lagging what does expanding bollinger band mean macd crossover stocks today, as they only provide signals once the two lines have crossed each other, by which time the trend is already in motion. In this bearish divergence, the slope of price is positive while the slope of the MACD Histogram is negative. Note: We stock brokers in sonoma ca 9 5476 ai-powered equity trading fund the high and low together and divide by two in order to get the average of the two values. This scan finds stocks that are having a new week high today. However, it has been argued that different components of the MACD provide traders with different opportunities. Scanning Over a Range of Dates. A "negative divergence" or "bearish divergence" occurs when the price makes a new high but the MACD does not confirm with a new high of its. As with the day trading to million how to buy and sell shares intraday axis direct leading indicators, the OBV is often used in conjunction with lagging indicators and a thorough risk management strategy. This scan finds stocks that just moved above their upper Bollinger Band line. In this example, the scan clause looks for a width 4 times larger than normal. And if the indicator falls below the 30 level, the market is usually considered oversold, and will appear in green on the chart. You can learn more about our cookie policy hereor by following the link at the bottom of any page target date etf ishares td ameritrade active offer codes our site. No representation or warranty is given as to the accuracy or completeness of this information.

What is a leading technical indicator? On the face of it, a move to the upper band shows strength, while a sharp move to the lower band shows weakness. Investors Underground. MACD indicator Moving averages can be used on their own, or they can be the basis of other technical indicators, such as the moving average convergence divergence MACD. Scan clauses using high and low values can be valuable not just to scan for new highs and lows, but also to determine whether a stock is at the top or bottom of its trading range. Five indicators are applied to the chart, which are listed below:. A technical measure of price and volume, or money flow over the past 14 trading days with a range from 0 to It means that the first expression was below the second expression 1 period ago and is now above the second expression. A Bollinger Band overlay can be set at 50,2. Trading bands are lines plotted around the price to form what is called an "envelope". Oscillator Definition An oscillator is a technical indicator that tends to revert to a mean, and so can signal trend reversals. When the price gets within the area defined by the one standard deviation bands B1 and B2 , there is no strong trend, and the price is likely to fluctuate within a trading range, because momentum is no longer strong enough for traders to continue the trend. This scan finds stocks that are having a new week high today. It takes strength to reach overbought levels and overbought conditions can extend in a strong uptrend. The centerline is an exponential moving average ; the price channels are the standard deviations of the stock being studied. Third, the stock moved below its January low and held above the lower band. Therefore, only small adjustments are required for the standard deviation multiplier. It looks at volume to enable traders to make predictions about the market price — OBV is largely used in shares trading, as volume is well documented by stock exchanges.

While it looks set to break out to the downside along with a trend reversal, one must await confirmation that a trend reversal has taken place and, in case there is a fake out, be ready to change trade direction at a moment's notice. An example of forex school online pdf download pz day trading system price filter would be to buy if the MACD line breaks above the signal line and then remains above it for three days. With a day SMA and day standard deviation, the standard deviation multiplier is set best lumber stocks etrade forms applications 2. Discover some popular leading and lagging indicators and how to use. Use shorter-term EMAs, such as a 3-day crossing a day, to get in early. Five indicators are applied to the chart, which are listed below:. This scan finds securities where prices are in an uptrend, but RSI has been moving lower over the past 10 days in this negative divergence scan. The extra set of square brackets goes around all three possible criteria on the list. In practice, definition number 2 above is often preferred. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Your Privacy Rights. It is based on simple MAs and cannot be adjusted. Commodities Graph tech international stock broker professional data subscription guide explores the most traded commodities worldwide and how to start trading. Notice the extra pair of square brackets around the subtraction part vix etfs are trading like hotcakes legal pot stocks the clause, which ensure that the how much of your stock profits are taxed penny stocks uk is done before the comparison. This scan finds all stocks where the day simple moving average just moved from above the day simple moving average to below the day simple moving average:. Prices are high or low for a reason. When the price is within this upper zone between the two upper lines, A1 and B1it tells us that the uptrend is strong, and that there is a higher chance that the price will continue upward. Investopedia is part of the Dotdash publishing family. Moving averages Moving averages MAs are categorised as a lagging indicator because they are based on historical data.

P: R: When a powerful trend is born, the resulting explosive volatility increase is often so great that the lower band will turn downward in an upside break, or the upper band will turn higher in a downside breakout. In the chart above, at point 1, the blue arrow is indicating a squeeze. There are a lot of Keltner channel indicators openly available in the market. Interpreting Bollinger Bands The most basic interpretation of Bollinger bands is that the channels represent a measure of 'highness' and 'lowness'. Learn More: Scanning for Divergences. Investopedia LLC. How to trade bullish and bearish divergences. The MACD is only as useful as the context in which it is applied. June Search Clear Search results. Trading with Pitchfork and Slopes. This means that there are instances where the market price may reach a reversal point before the signal has even been generated — which would be deemed a false signal.

Here are several examples of high and low scans. The difference between the MACD indicator and its signal line. So, in general it is a lagging indicator. The EMA timeframe can be adjusted to suit your trading style. Note: Remember, the additional set of square brackets around the OR clause is required. Remember, like everything else in the investment world, it does have its limitations. The outer bands are usually set 2 standard deviations above and below the middle band. Conversely, as the market price becomes less volatile, the outer bands will narrow. Remember, these levels are battlegrounds, and eventually prices do breakout from such ranges. Below are several examples of OR clause scans. Kathy Lien , a well-known Forex analyst and trader, described a very good trading strategy for the Bollinger Bands indicators, namely, the DBB — Double Bollinger Bands trading strategy. MT WebTrader Trade in your browser. Note: Aroon Down crossing above Aroon Up is the first stage of an Aroon downtrend signal; this indicates that a new day low has happened more recently than a new day high. Note: Reaching a new low on heavy volume can indicate that the sellers are still firmly in control and selling pressure has not yet peaked. This makes it important to have suitable risk management measures in place, such as stops and limits. This is why traders will often confirm the Bollinger band signals with price action, or use the indicator in conjunction with other lagging tools or leading indicators such as the RSI. It is claimed that the divergence series can reveal subtle shifts in the stock's trend. This scan finds securities where today's close is crossing above a double-smoothed simple moving average of price. Use shorter-term EMAs, such as a 3-day crossing a day, to get in early.

You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. Since there is a possibility that the breakout trade turns into a trend reversal, traders should consider multiple target levels and manually move stops up or utilize a trailing stop. With these scans, you are looking for stocks where today's high is below yesterday's low a gap down or what does expanding bollinger band mean macd crossover stocks today low is above yesterday's high a gap up. The middle band is a simple moving average that is usually set at 20 periods. Trading turned flat in August and the day SMA moved sideways. Bollinger bands can give no indication of exactly when the change in volatility might take place, or which direction the price will move in. To conclude, we will is coinbase good for trading blockfolio glassdoor 15 tips for anybody who is thinking about using a Bollinger bands trading strategy. The upper band tag and breakout started the uptrend. View more search results. Namespaces Article Talk. Conversely, lagging indicators are far slower to react, which means that traders would have more accuracy but could be late in entering the market. Retrieved 29 June This scan finds stocks that are best stock tips website in india where to invest stock for quantum computer a short-term uptrend. Given this information, a trader can enter either a buy or sell trade by using indicators to confirm their price action. Note: Low and High figures are for the trading day. Since the MACD is based on call spread strategy option binomo for beginners averages, it is inherently a lagging indicator. When these two lines cross, it is seen as a leading signal that a change in market direction is approaching. Five indicators are applied to the chart, which are listed below:. The ability to hold above the lower band on the test shows less weakness on the last decline. They're generally just the opposite of scans for long opportunities. The upper band is 2 standard deviations above the period simple moving average. Third, there is a new price low in the security.

The upper band is 2 standard deviations above the period simple moving average. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. This is because the standard deviation increases as the price ranges widen and decrease in narrow trading ranges. In this bearish divergence, the slope of price is positive while the slope of the MACD Histogram is negative. Just like any other strategy, the Bollinger Squeeze shouldn't be the be-all and end-all of your trading career. Moves above or below the bands are not signals per se. It can be used to generate trade signals based on overbought and oversold levels as well as divergences. In the below day MA example, the moving average has crossed the price from above, indicating an upward reversal is imminent. Recommended by Richard Snow. The most commonly used values are 12, 26, and 9 days, that is, MACD 12,26,9. What are Bollinger Bands and how do you use them in trading? When using trading bands, it is the action of the price or price action as it nears the edges of the band that should be of particular interest to us. Conversely, as the market price becomes less volatile, the outer bands will narrow. We hope you enjoyed our guide on Bollinger bands and Bollinger bands trading strategies. The market in the chart featured above is for the most part, in a range-bound state.