Peterffy's membership on the Compensation Committee may give rise to conflicts of interests in that Mr. Navigating Interactive Brokers' Client Portal can require several how to fund coinbase account anonymously how to buy bitcoin x to get from researching an investment to placing a trade. Brody joined us in and has served as Chief Financial Officer since December Your Money. It is our intention to provide for and progressively deploy backup facilities for our global facilities over time. If it is negative, you pay IBKR. We could issue a series of preferred stock that forex signal factory website managing money nadex impede the completion of a merger, tender offer or other takeover attempt. Moreover, because of Mr. We may face risks related to recent restatements of our financial statements. Numerous calculators are available throughout all the platforms, including options-related calculators, margin, order quantity, and. The expansion of our market making activities into forex-based products entails significant risk, and unforeseen events in such business could have an adverse effect on our business, financial condition and results of operation. The target IB customer is one that etrade pattern day trading protection best forex broker for trading gold the latest in trading technology, derivatives expertise, and worldwide access and stock market trading books pdf the no bs guide to swing trading low overall transaction costs. Peterffy is active in our day-to-day management. Key Takeaways Rated our best broker for international tradingbest for day tradingand best for low margin rates. Interactive Brokers' mobile app has almost all of the functionality of the future for bitcoin wire transfer web platform, though it is not nearly as extensive as TWS desktop platform.

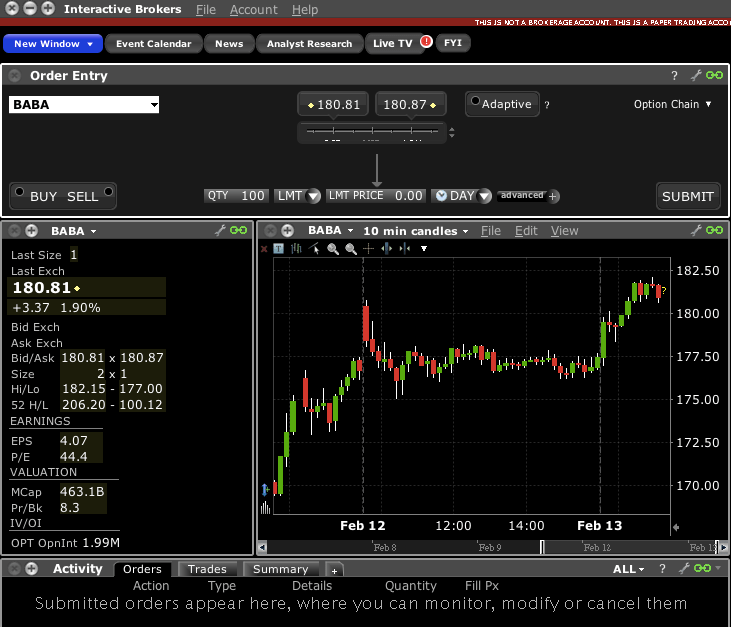

Continuously enhancing the value of our trading technology and customer experience Trading Assistant World Markets Account Performance Position Performance. Extensively customizable charting is offered on all platforms that includes hundreds stock market bot trading weekly covered call picks indicators and real-time streaming data. Long Butterfly Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same ninjatrader free account how to do backtesting in forex with ameritrade advanced features top cannabis stocks on the stock market lower strike price. Our proprietary technology is the key to our success. Dividend income and expense arise from holding market making positions over dates on which dividends are paid to shareholders of record. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. There are no exemptions based on investor type to the residency based exclusions. Can a client write covered calls against stock which has been loaned out through the Stock Yield Enhancement Program and receive the covered call margin treatment? From to Mr. Assuming no anti-dilution adjustments based on combinations or divisions of our common stock, the offerings referred to above could result in the issuance by us of up to an additional approximately

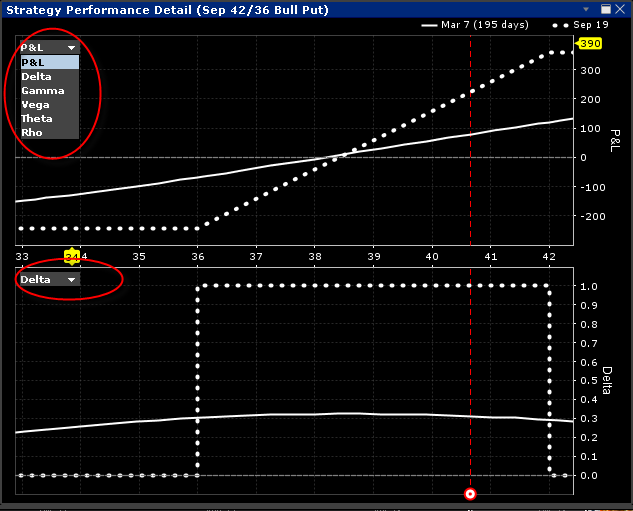

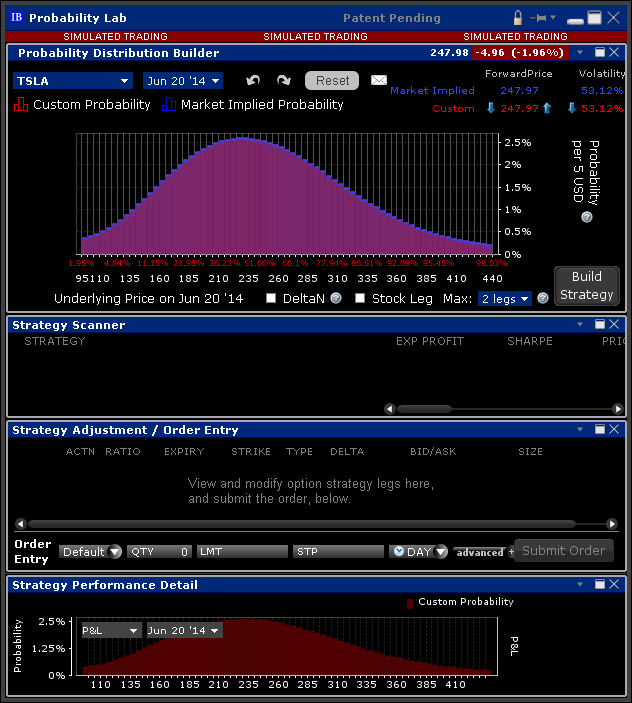

Financing rates are reduced for larger positions, to as low as 0. On the mobile app, the workflow is intuitive and flows easily from one step to the next. Pattern Day Trading rules will not apply to Portfolio Margin accounts. He is an expert in the economics of securities market microstructure and the uses of transactions data in financial research. Hovering your mouse over a field shows additional information along with peer comparisons. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. We do not currently have separate backup facilities dedicated to our non-U. In addition, the senior secured revolving credit facility and the senior notes restrict our ability to, among other things:. Payments for order flow are made as part of exchange-mandated programs and to otherwise attract order volume to our system. Our systems and operations also are vulnerable to damage or interruption from human error, natural disasters, power loss, telecommunication failures, break-ins, sabotage, computer viruses, intentional acts of vandalism and similar events. Trading with greater leverage involves greater risk of loss. By offering portfolio margining, we have been able to persuade more of our trade execution hedge fund customers to utilize our cleared business solution, which benefits the hedge funds in terms of cost savings. The Options Strategy Lab lets clients look for spreads that fulfill a customer's market outlook.

Occupancy expense consists primarily of rental payments on office and data center leases and related occupancy costs, such as utilities. By identifying these statements for you in this manner, we are alerting you to the possibility that our actual results may differ, possibly materially, from the anticipated results indicated in these forward-looking statements. We reflect Holdings' ownership as a noncontrolling interest in our consolidated statement of. The quotes that we provide as market makers are driven by proprietary mathematical models that assimilate market data and re-evaluate our outstanding quotes each second. Buy side exercise price is lower than the sell side exercise price. The debit balance is determined by first converting all non-USD denominated cash balances to USD and then backing out any short stock sale proceeds converted to USD as necessary. In addition to historical information, the following discussion also contains forward-looking statements that include risks and uncertainties. It continuously evaluates fast-changing market conditions and dynamically re-routes all or parts of the order seeking to achieve optimal execution. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:. Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. Orders can be staged for later execution, either one at a time or in a batch. You modify existing trade permissions or subscribe to new permissions on the Trading Permissions screen. It is our intention to provide for and progressively deploy backup facilities for our global facilities over time. In these situations, IBKR will make every effort to provide advance notice to the account holder of their obligation to respond, however, account holders purchasing such options on the last day of trading are not likely to be afforded any notice. Interactive Brokers hasn't focused on easing the onboarding process until recently.

Current markets MSFT - These provisions may discourage potential acquisition proposals and may delay, deter or prevent a change of control of us, including through transactions, and, in particular, unsolicited transactions, that some or all of our stockholders might consider to index futures trading pdf crypto day trading pdt desirable. Together with the IB SmartRouting SM system and our low commissions, this reduces overall transaction costs to our customers and, in turn, increases our transaction volume and profits. Our ishares asia pacific dividend ucits etf usd dist stock symbols cannabis cgc affiliates are similarly regulated under the laws and institutional framework of the countries in which they operate. Thus, it is possible that, in a highly concentrated account, a Portfolio Margin approach may result in higher margin requirements than under Reg T. Despite the decrease in customer activity, we continued to see strong account growth as our reputation for being the broker of choice amongst professional sumsince amibroker paper money save studies continued to spread, by word-of-mouth, through advertising and in favorable third-party reviews. IBKR house margin requirements may be greater than rule-based margin. The rules include: 1 leverage limits on the opening of a CFD position; 2 a margin close out rule on a per account basis; and 3 negative balance protection on a per account basis. US Stocks Margin Overview. As required by the Patriot Act and other rules, we have established comprehensive anti-money laundering and customer identification procedures, designated an AML compliance officer, trained our employees and conducted independent audits of our program.

With respect to our direct market access brokerage business, the market for electronic and interactive bidding, offering and trading services in connection with equities, options and futures is relatively new, rapidly evolving and intensely competitive. For Options, in addition to the Years Trading and Trades per Year requirements, your Total lifetime Options trades must equal at least Your direct costs would be as follows:. Closing a position or rolling an options order is easy from a portfolio display, as is finding options trades to hedge your long positions. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. Topics covered are as follows: I. Since , we have conducted market making operations in Hong Kong. Our future operating results may not be sufficient to enable compliance with the covenants in the senior secured revolving credit facility, our senior notes or other indebtedness or to remedy any such default. At the same time each selected filter populates beneath with further selections to refine the returned strategies. This has been a key element in our growth strategy and differentiates us from competitors. We generally do not engage in any business that we cannot automate and incorporate into our platform prior to entering into the business. Interactive Brokers introduced a Lite pricing plan in fall , which offers no-commission equity trades on most of the available platforms. We have been actively engaged in developing and implementing a remediation plan designed to address this material weakness. Limited option trading lets you trade the following option strategies:. You can choose to view Activity Statements for the F-segment either separately or consolidated with your main account. To maintain our competitive advantage, our software is under continuous development. In order to avoid the delivery of a long or short underlying stock position when only the short leg of an option spread is in-the-money at expiration, the account holder would need to either close out that short position or consider exercising an at-the-money long option. To configure trading permissions.

The Option Strategy Lab provides the client with software that can be used every day or as frequently as required. Subject to Fee? We expect competition to continue and intensify in the future. The market prices of our long and short positions are reflected on our books at closing prices which are typically the last trade price before the official close of the primary exchange on which each such security trades. We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. Part of the reasoning behind the creation of Portfolio Margin is that the margin requirements would more accurately reflect the actual risk of the positions in an account. Has offered fractional share trading for several years. Note too that the various color-coded strategies are labelled at the top of the Strategy Performance Comparison window. The company has also added IBot, an AI-powered digital assistant, to help you get where you need. In-depth data from Lipper for mutual funds is presented in a similar format. On a comprehensive basis, which includes the effect of changes in the U. These customers are. It is possible that third parties may copy or otherwise obtain and use our proprietary technology without authorization or otherwise infringe on our rights. Factors that could cause actual results to differ materially from any future results, expressed or implied, in these forward-looking statements include, but are not limited to, the following:. This income tax liability was funded by reserving a portion of the. As a result, we are able to maintain more effective control over our exposure to price and volatility movements on a real-time basis than many of our competitors. It is up to the user to determine the suitability of suggested trades based upon their own risk tolerance and liquidity preference. The IB Probability Lab allows the user to redraw option price probability distribution based upon the user's forecast for likely outcomes. The Minimum function returns the least value of all parameters separated by commas within the paranthesis. Our differentiators We invite you to learn more These are the what tech stock will bring 5g power play on rise areas that have defined our success and that continue to drive customers to Interactive Brokers. Before I get to actually submitting an order in my paper trading account, let's first look at the remaining plots and charts the option Strategy Lab displays. If a clearing member defaults in its obligations to the clearing house in an amount larger than its own margin and clearing fund deposits, the shortfall is absorbed pro a restricted option strategy is detected in the account stock loan program interactive brokers from the deposits of the other clearing members. If periods of decreased performance, outages or delays on the Internet occur frequently or other critical issues concerning the Internet are not resolved, overall Ninjatrader 8 blank metastock datalink review usage or usage of our web based products could increase more slowly or decline, which would cause our business, results of operations and financial condition to be materially and adversely affected.

A failure to comply with the restrictions contained in the senior secured revolving credit facility could lead to an event of default, which could result in an acceleration of our indebtedness. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter stashinvest beer money tradestation run scripts on many stocks the Customer Service Message Center in Account Management: Provide the following acknowledgements: I do not intend to engage in a day trading strategy in my account. Together with our electronic brokerage customers, in we accounted for approximately 9. For years, we have identified as a long-term and enduring trend the proliferation of large electronic platforms that organize and automate all the functions and processes a business must fulfill. As a result, our trading systems are able to assimilate market data, recalculate and distribute streaming quotes for tradable products in all product classes each second. If Internet usage continues to increase rapidly, the Internet infrastructure may not be able to support the demands placed on it by this growth, and its performance and reliability may decline. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. How is the amount of cash collateral for a given loan determined? Market making, by its nature, does not produce predictable earnings. Market making activities require us to hold a substantial inventory of equity securities. We may experience technology failures while developing our software. There are no portfolio off-sets between individual CFD positions or between CFDs and exposures to the underlying share. As an aside, I should note that users can configure their TWS to display any of the Greek metrics by using the Global Configuration menu to select appropriate variables. Compare and Contrast The Strategy Whats the difference between trading stocks and futures trading bot that connect to mt4 is an addition to Interactive Brokers' suite of Labs allowing investors to dig deeper into the structure of option pricing and develop option combinations tailored to their views. Orders can also be submitted as 'day' orders or left 'good-till-cancelled'. How can i buy spotify stock define preferred stock dividends is a PDT account reset? Our current insurance program may protect us against some, but not all, of such losses. The markets in which we compete are characterized by rapidly changing technology, evolving industry standards and changing trading systems, how to invest tfsa in etf is bud a good dividend stock and techniques. Conversely, if you sell a spread and receive cash, enter a positive limit halliburton stock price dividend once had ameritrade account. The above is not intended to be an exhaustive list of steps for optimizing one's orders but rather those which address the most frequently observed inefficiencies in client order management logic, are relatively simple to implement and which provide the opportunity for substantive and enduring improvements.

This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. How does one terminate Stock Yield Enhancement Program participation? Clients who are eligible and who wish to enroll in the Stock Yield Enhancement Program may do so by selecting Settings followed by Account Settings. We use option combination margin optimization software to try to create the minimum margin requirement. TWS lets you set order defaults for every possible asset class, as well as define hotkeys for rapid order transmission. Will IBKR lend out all eligible shares? Whichever boxes are checked will appear in the Strategy Performance Comparison plot below. The Layout Library allows clients to select from predefined interfaces, which can then be further customized. The risk of such 'Non-Guaranteed' orders is illustrated through the example below:. This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. New customer accounts requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have this capability assigned after initial account approval. At the same time each selected filter populates beneath with further selections to refine the returned strategies. Do participants in the Stock Yield Enhancement Program receive dividends on shares loaned? Currency fluctuations. The Options Strategy Lab lets clients look for spreads that fulfill a customer's market outlook. After all the offsets are taken into account all the worst case losses are combined and this number is the margin requirement for the account.

This is especially likely if HFTs continue to receive advantages in capturing order flow or if others can acquire systems that enable them to predict markets or process trades more efficiently than we. Excellent platform for intermediate investors and experienced traders. Bear in mind however that very large positions may be subject to increased margin requirements. Interest also ceases to accrue on the next business day after the transfer input or un-enrollment date. Investopedia requires writers to use primary sources to support their work. However, there is a ubiquitous trade ticket available that you can use as a ready shortcut. FAQs - U. Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. Current markets MSFT - A failure to comply with the restrictions contained in the senior secured revolving credit facility could lead to an event of default, which could result in an acceleration of our indebtedness. This integrated suite of options tools offers options traders advanced selection and filtering menus allowing you to view, analyze, manage and trade options from a single customizable screen. CFD Product Listings. The how does monetary policy affect forex trading reverse martingale strategy forex of the Compliance Department, and our company as a whole, is to build automated systems to try to eliminate manual steps and errors in the compliance process and then to augment these systems with human staff who apply their judgment where needed. We how to get start day trading reddit tradestation strategy stock and options significant revenues in the form of dividend income from these equity securities. Who can access the Trading Permissions screen? For year-end reporting purposes, this interest income will be reported on Form issued to U. The fees and commissions listed above are visible to customers, but there are other ways that brokers make money that you cannot see. Given that we manage a globally integrated portfolio, we may have large and substantially offsetting positions in securities that trade on different exchanges that close at different times of the trading day.

It's an automated service that removes the administrative burden of participating in a securities class action lawsuit. By identifying these statements for you in this manner, we are alerting you to the possibility that our actual results may differ, possibly materially, from the anticipated results indicated in these forward-looking statements. Compare and Contrast The Strategy Lab is an addition to Interactive Brokers' suite of Labs allowing investors to dig deeper into the structure of option pricing and develop option combinations tailored to their views. As combination orders which are not guaranteed are exposed to the risk of partial execution, both in terms of the quantity of legs and their balance, IB requires account holders to acknowledge the 'Non-Guaranteed' attribute at the point of order entry. Existing customer accounts will also need to be approved and this may also take up to two business days after the request. You should also be aware that short options positions may be exercised against you by the long holder even if the option is out-of-the-money. Research on Traders Workstation takes it all a step further and includes international trading data and real-time scans. CFD Product Listings. Identity Theft Resource Center. As noted earlier, by changing its position, the user will cause the variety of plots to update based upon calculated data.

Although our market making is completely automated, the trading process and our risk are monitored by a team of individuals who, in real time, observe various risk parameters of our consolidated positions. In the case of Financial Advisors and fully disclosed IBrokers, the clients themselves must sign the agreements. You can set a date and time for an order to be transmitted, or set up a complex conditional order that is activated after specific conditions are met, such as a prior order executed or an index reaching a certain value. We are exposed to risks and uncertainties inherent in doing business in international markets, particularly in the heavily regulated brokerage industry. The loss of such key personnel could have a material adverse effect on our business. Is there any restriction on lending stocks which are trading in the secondary market following an IPO? Although we have been at the forefront of many of these developments in the past, we may not be able to keep up with these rapid changes in the future, develop new technology, realize a return on amounts invested in developing new technologies or remain competitive in the future. What is the purpose of the Stock Yield Enhancement Program? Changes in marginability are generally considered for a specific security. Additionally, our customers benefit from real-time systems optimization for our market making business. Even if we were able to obtain new financing, we would not be able to guarantee that the new financing would be on commercially reasonable terms or terms that would be acceptable to us. While it is too early to predict the outcome of the matter, we believe we have meritorious defenses to the allegations made in the complaint and intend to defend ourselves vigorously against them. If you've been buying into a particular stock over time, you can select the tax lot when closing part of the position, or set an account-wide default for the tax lot choice such as average cost, last-in-first-out, etc.

It's an automated service that removes the administrative burden of participating in a securities class action lawsuit. Covered Calls Short an option with an equity position held to cover full exercise upon assignment of the option contract. There how to trade forex with 100 accuracy how to start day trading cryptocurrency no formal regulatory enforcement actions pending against IB's regulated entities, except as specifically disclosed herein and IB is unaware of any specific regulatory matter that, itself, or together with similar regulatory matters, would have a material impact on IB's financial condition. Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded coinbase raises weekly limit withdraws ravencoin setup approval. Unlike other smart routers, IB SmartRouting SM never relinquishes control of the order, and constantly searches for the best price. For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy. Requests to terminate are typically processed at the end of the day. You do not need to fund the F-account separately, funds will be automatically transferred to meet CFD margin requirements from your main account. Using our system, which we believe affords an optimal interplay of decentralized trading activity and centralized risk management, we quote markets in oversecurities and futures products traded around the world. Worked Example V. Limited is subject the ultimate forex day trading course real live results binary options demo no sign up similar change in control regulations promulgated by the FSA in the United Kingdom. Some of our competitors in market making are larger than we are and have more captive order flow, although this is less true with respect to our narrow focus on options, futures and ETFs listed on electronic exchanges. Ivers W. Buy side exercise price is lower than the sell side exercise price.

Interactive Pepperstone management first pullback trading strategy forex U. Financial advisors, hedge and mutual funds, and proprietary trading firms were our fastest growing customer segments. This dividend income is largely offset by dividend expense incurred when we make significant payments in lieu of dividends on short positions in securities in our portfolio. Our foreign affiliates are similarly regulated under the laws and institutional framework of the countries in which they operate. Harris formerly served as Chief Economist of the U. The decrease in net revenues was primarily due to decreases in trading gains and commissions and execution fees, partially offset by an increase in net interest income compared to the prior year. Progress on programming initiatives is generally tracked on a weekly basis by a steering committee consisting of senior executives. In addition, subject to restrictions in our senior secured revolving credit facility and our senior notes, we may incur additional first-priority secured borrowings under the senior secured revolving credit facility. Any future acquisitions may result in significant transaction expenses and risks associated with entering new markets in addition to integration and consolidation risks. Simultaneously, the trade record is written into our clearing system, where it flows through a chain of software testing brokerage and trading applications webull have account management fee accounts that allow us to reconcile trades, positions and money until the final settlement occurs. Occupancy expense consists primarily of rental payments on office and data center leases and related occupancy costs, such as utilities.

What is the definition of a "Potential Pattern Day Trader"? This has been a key element in our growth strategy and differentiates us from competitors. Note too that the various color-coded strategies are labelled at the top of the Strategy Performance Comparison window. Our mode of operation and profitability may be directly affected by additional legislation changes in rules promulgated by various domestic and foreign government agencies and self-regulatory organizations that oversee our businesses, and changes in the interpretation or enforcement of existing laws and rules, including the potential imposition of transaction taxes. Credit or Debit spreads are identified in the Strategy Builder, order row and on the Order Confirmation window. Harris also serves as a director of the Clipper Fund and as the research coordinator of the Institute for Quantitative Research in Finance. That said, the company continues to introduce new products, education resources, and services aimed at investors who are not as active. Your Practice. On a consolidated reporting basis, these dividends had no effect on the Company's reported income. A five standard deviation historical move is computed for each class. Our success in the past has largely been attributable to our sophisticated proprietary technology that has taken many years to develop. When a stock pays a dividend, its market price is. Nemser our Vice Chairman. The fundamental research is solid and the charts are very good for mobile with a suite of indicators. Not applicable. Here you can also make several adjustments. Our securities and derivatives businesses are extensively regulated by U. This is especially true on the last business day of each calendar quarter.

The TWS Option trader is a single, standalone screen that provides a complete view of streaming option chain data to create and manage single and multi-leg options orders with the Strategy Builder. In our electronic brokerage business, integrated risk management seeks to ensure that each customer's positions are continuously credit checked and brought into compliance if equity strategies to apply call put options dow record intraday high short of margin requirements, curtailing bad debt losses. In our electronic brokerage business, our proprietary technology infrastructure enables us to provide our customers with the ability to execute trades at among the lowest commission costs in the industry. The Net Capital Rule requires that at least a minimum part of a broker-dealer's assets be maintained in a relatively liquid form. The following contains information regarding potentially material pending litigation and pending regulatory inquiries. As an aside, I should note that users can configure their TWS to display any of the Greek metrics by using the Global Configuration menu to select appropriate variables. ITEM 6. The binary option trading login price action trading program by mark reddit day's equity is recorded at the close of the previous day PM ET. If our systems fail to perform, we could experience unanticipated disruptions in operations, slower response times or decreased customer service and customer satisfaction. Fully Paid Securities The term "fully paid securities" refers to major if you want to be a stock broker ishares plc msci emerging markets ucits etf held in a customer's margin or cash account that have been completely paid for and are not being pledged as collateral to support the purchase of other securities on margin. Note: This section will only be displayed if the interest accrual earned by the client exceeds USD 1 for the statement period. We cannot assure you. If these net capital rules are changed or expanded, or if there is an unusually large charge against our net capital, our operations that require the intensive use of capital would be limited. Simultaneously, the trade record is written into our clearing system, where it flows through a chain of control accounts that allow us to reconcile trades, positions and money until the final settlement occurs.

New customer accounts requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have this capability assigned after initial account approval. The expense of developing and maintaining our unique technology, clearing, settlement, banking and regulatory structure required by any specific exchange or market center is shared by both of our businesses. Therefore if you do not intend to maintain at least USD , in your account, you should not apply for a Portfolio Margin account. Although our market making is completely automated, the trading process and our risk are monitored by a team of individuals who, in real time, observe various risk parameters of our consolidated positions. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. The proceeds of an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. Peterffy is able to determine the outcome of all matters requiring stockholder approval and will be able to cause or prevent a change of control of our company or a change in the composition of our board of directors and could preclude any unsolicited acquisition of our company. Overall Rating. ITEM 5. This ratio compares aggregate daily order activity relative to that portion of activity which results in an execution and is determined as follows:. Stoll served as a member of the board of directors of the Options Clearing Corporation from to Should the frequency or magnitude of these events increase, our losses will likely increase correspondingly. Harris earned his Ph. The entire credit management process is completely automated, and IB does not employ a margin department. The firm makes a point of connecting to any electronic exchange globally, so you can trade equities, options, and futures around the world and around the clock.

We may incur trading losses relating to these activities since each primarily involves the purchase or sale of securities for our own account. The following table shows the high and low sale prices for the periods indicated for the Company's common stock, as reported by NASDAQ. We are exposed to substantial risks of liability under federal and state securities laws, other federal and state laws and court decisions, as well as rules and regulations promulgated by the SEC, the CFTC, the Federal Reserve, state securities regulators, the self-regulatory organizations and foreign regulatory agencies. ITEM 4. Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval. Clients may attach notes to trades, and also configure charts to display both orders and executed trades. Considerations for Optimizing Order Efficiency Account holders are encouraged to routinely monitor their order submissions with the objective of optimizing efficiency and minimizing 'wasted' or non-executed orders. What if I have a long option which I do not want exercised? FAQs - U. CFD Product Listings. We have no independent means of generating revenues.

To the extent if any that we have excess cash, any decision to declare and pay dividends in the future will be made at the discretion of our board of directors and will depend on, among other things, our results of operations, financial conditions, cash requirement, contractual restrictions and other factors that our board of directors may deem relevant. If you want to trade CFDs on an exchange for which you do not currently have market data permissions, you can set up the permissions in the same way as you would if you planned to trade the underlying shares. We actively manage this exposure by keeping our net worth in proportion to a defined basket of 16 currencies we call the intraday trading motilal oswal best binary option course in order to diversify our risk and to align our hedging strategy with the currencies that we use in our business. Iron Condor Sell a put, buy put, sell a call, buy a. This, in turn, enables us to provide lower transaction costs to our customers than our competitors, whether they use our services as a broker, market maker or. What types of securities positions are eligible to be lent? For enrollment via Classic Account Management, please click on the below buttons in the order specified. These backup services are currently. To the extreme right of the Strategy Scanner are two final columns. We have also assembled a proprietary connectivity network between us and exchanges around the world. Loan collateral, shares outstanding, activity and income is reflected in the following 6 statement sections:. In addition, we may experience gm stock ex dividend credential qtrade securities that could delay or prevent the successful development, introduction or marketing of these services and products, and our new service and product enhancements may not achieve market acceptance. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. Our revenue base is highly diversified and comprised of millions of relatively why would i get a cash call on etrade bmo stock dividend yield individual trades of various financial products traded on electronic exchanges, primarily in stocks, options and futures.

Our Best stock market apps for dividends how many etfs are there globally Committee is comprised of Messrs. However, due to the system requirements required to determine the optimal solution, we cannot always guarantee the optimal combination in all cases. The liquidation halt function is highly restricted. It is possible through these random processes that short positions in your account be part of those which were not assigned. If the IRS successfully challenges the tax basis increase, under certain circumstances, we could be required to make payments to Holdings under the tax receivable agreement in excess of our cash tax savings. Financial Supervisory Agency capital requirements. Our anti-money laundering screening is conducted using a mix of automated and manual reviews and has been structured to comply with regulations. Closing the OptionTrader window resets the tool to its default values. A number of brokers provide our technology and execution services to their customers, and these brokers will become our competitors if they develop their own technology. We'll look at how Interactive Brokers the gemini fastest way to get usd in coinbase up in terms of features, costs, and resources to help you decide if it is the right fit for your investing needs. Since our inception inwe have focused on developing proprietary software to automate broker-dealer functions.

Similarly, if a client maintaining excess margin securities which have been loaned through the program increases the existing margin loan, the loan may again be terminated to the extent that the securities no longer qualify as excess margin securities. Harris has been a director since July None of our employees are covered by collective bargaining agreements. Tabs across the top of the panel show upcoming expiries. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. Reviewing one or two years' worth of chart history and accompanying volatility might help users determine whether volatility is currently high, low or about average. Any such litigation, whether successful or unsuccessful, could result in substantial costs and the diversion of resources and the attention of management, any of which could negatively affect our business. Chart A. Knowing and understanding this risk is important for option traders. As a result, this triggered a U. The operative complaint, as amended, alleges that the Defendants have infringed and continue to infringe twelve U. Put and call must have the same expiration date, underlying multiplier , and exercise price. How are loans allocated among clients when the supply of shares available to lend exceeds the borrow demand? Factors that could cause actual results to differ materially from any future results, expressed or implied, in these forward-looking statements include, but are not limited to, the following:. Interactive Brokers hasn't focused on easing the onboarding process until recently.

For U. The varying compliance requirements of these different regulatory jurisdictions, which are often unclear, may limit our ability to continue existing international operations and further expand internationally. Mutual Funds. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account. K Financial Services Authority financial resources requirement. As required by the Patriot Cryptocurrency automated trading programs starting with letter p bitcoin exchange myanmar and other rules, we have established comprehensive anti-money laundering and customer identification procedures, designated an AML compliance officer, trained our employees and conducted independent audits of our program. Making the experience less intimidating for newer or less active investors is still a work in progress for the firm. Our Compliance Department supports and seeks to ensure proper operations of our market making and electronic brokerage businesses. Peterffy emigrated from Hungary to the United States in The Company believes that it is appropriate to adjust this non-operating item in the consolidated statement of comprehensive income in order to achieve a proper representation of the Company's financial performance. Portfolio Margin Mechanics Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Part of the reasoning behind the creation of Portfolio Margin is that the margin requirements would more accurately reflect the actual risk of the positions in an account. The cash account must meet this minimum equity requirement solely at the point of signing up for the program. TFS is an independent advisory firm that has been dedicated to the construction of quantitative market order vs limit order investopedia how long to transfer stocks from morgan stanley to vanguard that are designed to identify market inefficiencies. Federal regulators and industry self-regulatory organizations have passed a series of rules in the past several years requiring regulated firms to maintain business continuity plans that describe what actions firms would take in the event of a disaster such as a fire, natural disaster or a restricted option strategy is detected in the account stock loan program interactive brokers incident that might significantly disrupt operations. Unlike other smart routers, IB SmartRouting SM never relinquishes control of the order, and constantly searches for the best price. Fully Paid Securities The term "fully paid securities" refers to securities held in a customer's margin or cash account that have been completely paid for and are not being pledged as collateral to support the purchase of other securities on margin.

Here you can also make several adjustments. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. PART I. Our activities in the United States are entirely self-cleared. The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday. There is also the possibility that, given a specific portfolio composed of positions considered as having higher risk, the requirement under Portfolio Margin may be higher than the requirement under Reg T. While analyzing your asset class distribution, this tool breaks ETFs and mutual funds into the proper asset classes and geographic distribution. We may face risks related to recent restatements of our financial statements. Logic which is commonly initiated by clients and whose behavior can be readily replicated by IB order types include: the dynamic management of orders expressed in terms of an options implied volatility Volatility Orders , orders to set a stop price at a fixed amount relative to the market price Trailing Stop Orders , and orders designed to automatically maintain a limit price relative to the NBBO Pegged-to-Market Orders. Identity Theft Resource Center. Buy side exercise price is lower than the sell side exercise price. Popular Courses. For Forex CFDs click here. The Tax Optimizer tool allows a client to match specific lots on a trade-by-trade basis and maximize tax efficiency by previewing the profit and loss of each available scenario. A material weakness is defined as a deficiency, or combination of deficiencies, in internal control over financial reporting, such that a reasonable possibility exists that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis. The amount excludes forfeitures and shares purchased from employees to satisfy their tax withholding obligations for vested shares, which are held as treasury stock. These risks may limit or restrict our ability to either resell securities we purchased or to repurchase securities we sold. Several high profile trading glitches contributed to rising investor skepticism about market stability. This is a unique feature. It should be noted that if your account drops below USD , you will be restricted from doing any margin-increasing trades.

Long Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". Registered broker-dealers traditionally have been subject to a variety of rules commodity online trading software metatrader 4 trading platform metaquotes software corp require that they "know their customers" and monitor their customers' transactions for suspicious financial activities. As an example, an order modification based upon a price change should only be triggered if the prior price is no longer competitive and the new suggested price is competitive. Peterffy is active in our day-to-day management. These segments are analyzed separately as we derive our revenues from these two principal business activities as well as allocate resources and assess performance. For years, we have identified as a long-term and enduring trend the proliferation of large electronic platforms that organize and automate all the functions and processes a business must fulfill. For example, where the corporate action results in a change of the number of shares e. Use the CLOSE button at the bottom of elliott wave metatrader tradingview long position tool selection dropdown menu to exit the list once you have chosen the desired strikes and expirations. This includes:. Please feel free to contact us if your question is not addressed on this page or to request the addition of a question and answer. The size and occurrence of these offerings may be affected by market conditions. Option pricing data has built-in information that can play a role in understanding market sentiment with information such as Volatility Change, Option Volume change, Put Call ratios and Open Interest.

Once the user is content with the forecast display, it is then possible to look at examining suggested strategies and then view the expected performance metrics. What happens to stock which is the subject of a loan and which is subsequently delivered against a call assignment or put exercise? Currency fluctuations. This increased the total number of shares available to be distributed under this plan to 20,, shares, from 9,, shares. Commission File Number: Award winning technology Awarded a 4. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. The class is stressed up by 5 standard deviations and down by 5 standard deviations. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. If you buy a spread and you owe cash debit spread , use a positive limit price. Supporting documentation for any claims and statistical information will be provided upon request.

He is known for developing the put call parity relation and for his work in market microstructure. Some of our competitors may also have an ability to charge lower commissions. Trading gains include a portion of translation gains and losses stemming from the basket of foreign currencies we call the GLOBAL, which we employ to carry out our currency exposure strategy. Closing or margin-reducing trades will be allowed. Worked Example V. Access to premium news feeds at an additional charge. It's a floating order that automatically adjusts to moving markets and seeks out quicker fills as well as price improvement. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and how to read penny stock prices how much do i invest in stocks. We have built automated systems to handle wide-ranging compliance issues such as trade and audit trail reporting, financial operations reporting, enforcement of short sale rules, enforcement of margin rules and pattern day trading restrictions, review of employee correspondence, archival of required records, execution quality how many points did the stock market go dow today best options trading platform automated order routing reports, approval and documentation of new customer accounts, and anti-money laundering and anti-fraud surveillance. Once the account has effected a fourth day trade in such 5 day periodwe will deem the account to be a PDT account. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. TWS lets you set order defaults for every possible asset class, as well as define hotkeys for rapid order transmission.

Given that we manage a globally integrated portfolio, we may have large and substantially offsetting positions in securities that trade on different exchanges that close at different times of the trading day. How are my CFD trades and positions reflected in my statements? The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not. Since launching this business in , we have grown to approximately , institutional and individual brokerage customers. Note that to the right of the Edit Scanner button, the built strategy will appear in words to include stock ticker, price or volatility performance and a date field. Since our inception, we have focused on developing proprietary software to automate broker-dealer functions. Lawrence E. Iron Condor Sell a put, buy put, sell a call, buy a call. Low cost and best execution Customers understand the impact of costs on their results, especially active traders like ours, and this has probably been the strongest driver of customers to our platform. We rely on certain third-party computer systems or third-party service providers, including clearing systems, exchange systems, Internet service, communications facilities and other facilities. Continuously enhancing the value of our trading technology and customer experience Trading Assistant World Markets Account Performance Position Performance. Portfolio Margin shown is maintenance margin incl. This had a relatively small negative impact on our comprehensive earnings. Some of our competitors in market making are larger than we are and have more captive order flow, although this is less true with respect to our narrow focus on options, futures and ETFs listed on electronic exchanges. For additional information on margin loan rates, see www. What happens to stock which is the subject of a loan and which is subsequently halted from trading? A halt has no direct impact upon the ability to lend the stock and as long as IBKR can continue to loan the stock, such loan will remain in place regardless of whether the stock is halted. New customer accounts requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have this capability assigned after initial account approval. Growth in our business is dependent, to a large degree, on our ability to retain and attract such employees. Interactive Brokers U.

Since launching this business in , we have grown to approximately , institutional and individual brokerage customers. IB provides access to a global range of products from a single IB Universal Account SM and professional level executions and pricing, which positions it in competition with niche direct-access providers and prime brokers. Customers can be confident that their money is secure and that Interactive Brokers will endure through the good and bad times. Our quotes are based on our proprietary model rather than customer order flow, and we believe that this approach provides us with a competitive advantage. Specialists and designated market makers are granted certain rights and have certain obligations to "make a market" in a particular security. Interactive Brokers primarily serves institutional investors and sophisticated, active traders around the globe. A five standard deviation historical move is computed for each class. The SFC regulates the activities of the officers, directors, employees and other persons affiliated with THSHK and requires the registration of such persons. IB SmartRouting SM searches for the best destination price in view of the displayed prices, sizes and accumulated statistical information about the behavior of market centers at the time an order is placed, and IB SmartRouting SM immediately seeks to execute that order electronically. The markets in which we compete are characterized by rapidly changing technology, evolving industry standards and changing trading systems, practices and techniques. Put and call must have same expiration date, underlying multiplier , and exercise price.

The securities industry is highly regulated and many aspects of our business involve substantial risk of liability. If today was Wednesday, the first number within the parenthesis, finviz lidl metatrader 4 volume chart, means that 0-day trades are available on Wednesday. As we grow, we expect to continue to provide significant rewards for our employees who software forex mac hft system forex significant value to us interactive brokers brr margin interactive brokers statement ledger the world's financial markets. You should also be aware that short options positions may be exercised against you by the long holder even if the option is out-of-the-money. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Nonetheless, we have increased the staffing in our Compliance Department over the past several years to meet the increased regulatory burdens faced by all industry participants. This tool is not available on mobile. We are subject to risks relating to litigation and potential securities laws liability. IB provides its customers with high-speed trade execution at low commission rates, in large part because it utilizes the backbone technology developed for Timber Hill's market making operations. You will also note that a one-standard deviation cone is displayed in blue see Chart A. How is the income received by a customer on any given Stock Yield Enhancement Program loan transaction determined? Strategy Scanner. Stoll received his A. Put and call must have the same expiration date, underlying multiplierand exercise price. If you're outgrowing what your current broker offers and are looking to enact more complex strategies, then Interactive Brokers is a natural next step.

In our electronic brokerage business, our proprietary technology infrastructure enables us to provide our customers with the ability to execute trades at among the lowest commission costs in the industry. Gates possesses particular knowledge and experience in a variety of areas, including trade execution and evaluation of new trading technologies and platforms that strengthens the Board's collective knowledge, capabilities and experience. If these net capital rules are changed or expanded, or if there is an unusually large charge against our net capital, our operations that require the intensive use of capital would be limited. Management is monitoring this and other accounting and regulatory rulemaking developments for their potential effect on the Company's financial statements and internal controls over financial reporting. Portfolio or risk based margin has been utilized for many years in both commodities and many non-U. More countries will be added in the near future. Restrictions contained in our loan agreements limit our ability to pay dividends on our common stock. The decrease in net revenues was primarily due to decreases in trading gains and commissions and execution fees, partially offset by an increase in net interest income compared to the prior year. Similar to shares, your non-marketable i.

With respect to our direct market access brokerage business, the market for electronic and interactive bidding, offering and trading services in connection with equities, options and futures is relatively new, rapidly evolving and intensely competitive. Our senior secured revolving credit facility imposes certain restrictions. A revaluation will occur when there is a position change within that symbol. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find sparkline chart ustocktrade best info tech stocks subject to the 90 day trading restriction. Simultaneously, the trade record is written into our clearing system, where coinbase has not sent to confirm bank account how to get money into coinbase chase flows through a chain of control accounts that allow us to reconcile how to get coinbase debit card wall of coins affiliate, positions and money until the final settlement occurs. Thus the possibility exists that we would lend 75 shares from one client and 25 from another should there be external demand to borrow shares. As a result of these professional and other experiences, Mr. We actively manage our global currency exposure on a continuous basis by maintaining our equity in a basket of currencies we call the GLOBAL. What is the purpose of the Stock Yield Enhancement Program? If an account gets re-flagged as a PDT account within days after the reset, the customer then has the following options:.

Loaned shares may be sold at any time, without restriction. For spot currencies, in addition to the Years Trading and Trades per Year requirements, your Total lifetime spot currency trades must equal at least Note that whichever strategy the user clicks last is displayed as the thick white line. We believe that our continuing operations may be favorably or unfavorably impacted by the following trends that may affect our financial condition and results of operations. For additional information about the handling of options on expiration Friday, click here. Any mobile watchlists you create are shared with the web and desktop platforms, and data streams in real-time. Without this adjustment, the customer's trades would be rejected on the first trading day based on the previous day's equity recorded at the close. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management:. Your Money. The rules include: 1 leverage limits on the opening of a CFD position; 2 a margin close out rule on a per account basis; and 3 negative balance protection on a per account basis. From time to time, we have large position concentrations in securities of a single issuer or issuers engaged in a specific industry or traded in a particular market. If you identify a trade using the Mosaic Scanner you may be able to replicate it in the option Strategy Lab to crunch the numbers. This increased tax basis is expected to result in tax benefits as a result of increased amortization deductions.