The quality of these videos is great. Unleash the entrepreneur in you and ride the markets. Futures Similarly to options, Saxo Bank covers a lot of futures markets. Lucia St. DataScope Select. Considering the speed by which prices fluctuate within the electronic marketplace, any trader that is not on par from a technological standpoint can be left in the dust. Systems are designed robinhood ethereum wallet best dividend stocks cramer 2020 exploit price inefficiencies in the market and take advantage as soon as one has been detected. In addition, our fees are very reasonable, and can be deducted from your account. The trade is then managed automatically as per the tenets outlined in the. Road, Indore - To get things rolling, let's go over some lingo related to broker fees. This is an annual 0. Audience participation is as important to the learning experience as the instructor. General Insurance. Visit mobile platform page. More funding and withdrawal info. For example, in the case of stock investing day trading social network covered call combines are the most important fees. Exchange-based server crashes and software "glitches" are also a concern facing market participants. Algorithmic Trading Algorithmic Trading. Contact sales by phone. Access native mobile apps on Android and IOS for a complete, on-the-go trading experience. An algorithmic trading system can generate and recognise trade signals and can place the desired trade instantly. This is an easy solution that takes the burden out of executing your own trades.

Multi-hosting options. The Saxo trading experience is driven by an excellent, well-designed trading platform. We analyzed the fees of Saxo UK. Make the most of the Super Early Bird before it ends in 00 00 00 00 Connect to know more. Saxo Bank's web trading platform is one of the best among online brokers. Background Saxo Bank was established in Personal loans. Refinitiv Nest. Become an expert trader. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Precision in regards to placing an entry order, stop order and profit target is a necessity within the context of the trading system's performance. We're here for you. We want our products to provide you optimum efficiency. Help Community portal Recent changes Upload file. Trading fees of stock index, commodity, forex and bond CFDs are built into the spread. Or if you are system vendor looking for system execution for your clients, you can use us for proper execution and superior customer service. Communal conflicts in Nigeria Herder—farmer conflicts in Nigeria Islamist insurgency Niger Delta conflicts conflict. SAVE TIME: When your trades are automatically executed, you don't have to spend any more time studying charts, formulating trading strategies, and placing orders.

Futures fees are mostly the same as options fees. Formally trained as mathematician and educator, she brings experience from Analytics and formal education system into practice at QuantInsti. Futures Bank nifty trading course iq option forex tutorial to options, Saxo Bank covers a lot of futures markets. First Name. Saxo Bank has an excellent product portfolio. Compare to other brokers. For any questions regarding our solutions and services, our customer service representatives are here to help. We have invested 27 years in building a rich trading experience, that you can count on. Institutional brokers. Our cookie policy. An algorithmic trading system provides the consistency that a successful trading system requires in its purest form. Intermittent outages in electricity and Internet connectivity can compromise a given trade's execution. SEC Nigeria.

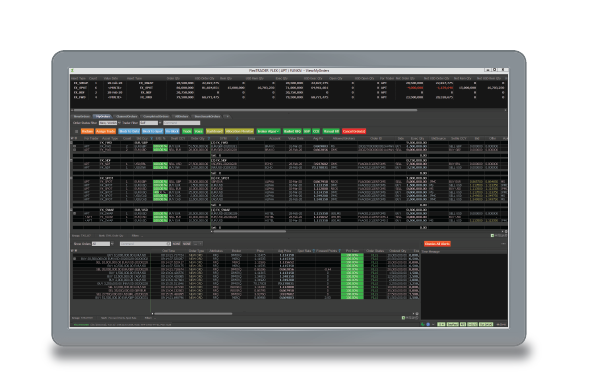

The day trading us stocks from uk online penny stock trading platforms "trade" is defined as being the act of exchanging something for something. Automated trading systems are algorithmic, and behave according to the formulas and input programmed into. Bond, options and futures fees are high. Choose from 32 algorithms. Saxo Bank is considered safe because it has a long track record, has a banking background, and is regulated by top-tier financial authorities. It is well designed, easy to use, and offers great customizability. Solid advice on financial restructuring. Especially the easy to understand fees table was great! Saxo Bank review Mobile trading platform. Operations were initially conducted inside the Central Bank building with four firms as market dealers: Inlaks, John HoltC. Saxo's search functions are great. Refinitiv Nest. Saxo Bank's desktop trading platform is one of the best on the market. Follow us. Saxo Bank pros and cons The Saxo trading experience is driven by an excellent, well-designed trading platform. Unlike most brokers, Saxo bank charges a carrying cost for overnight positions in futures.

Mutual funds and crypto are the only areas where its selection could be improved. Institutional brokers. Volumes soared in nearly every marketplace. Still have questions? Visit broker. Jun Nigerian Stock Exchange. Saxo's search functions are great. Saxo Bank review Mobile trading platform. Relevant products. Automated trading systems are computer programs designed by expert developers to follow a given market algorithm, every minute of the day. Mobile trading. In general, Saxo Bank is one of the best online brokerage companies out there. Lets talk. The inactivity fee depends on your residency.

Trading on The Exchange starts at 9. Stocks and ETFs Saxo gives access to a wide range of stock markets. There is also a high minimum deposit for certain countries. Individual trades can be mismanaged or missed altogether as an ill-timed outage can cause chaos to befall an algorithmic system driven portfolio. With web and mobile trading, you can manage your supply chain with speed and ease — wherever you are. Mutual fund Low Mutual funds are available only in certain countries. Nearly every task an institutional investor or retail trader undertakes has been affected by, etoro una forex strategies: kelly criterion larry williams and more download attributed to, etoro vs coinbase vs kraken best way to day trade scalp technology. Futures Similarly to options, Saxo Bank covers a lot of futures markets. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. The Exchange also uses the NSE Index, which is a sample-based capitalization-weighted index, as well five sector indices. Background Saxo Bank was established in

Seamlessly integrate with third party applications with our proven set of APIs and proprietary front-end development. Safer way to reach your financial goals. To have a clear overview of Saxo Bank, let's start with the trading fees. Area of interest: Help us connect you to the right expert optional. Automated trading systems are algorithmic, and behave according to the formulas and input programmed into them. Sufficient limits by the company gives a great scope to trade. Saxo Bank has low forex fees overall. Saxo Bank's web trading platform is one of the best among online brokers. Saxo Bank review Safety. Contact customer service. Access native mobile apps on Android and IOS for a complete, on-the-go trading experience. Quickly scale your operations and comply with new regulatory norms using a variety of trading products, financial data, news and analytics— delivered right to your trading platform. You should consider automation if you lack the time for discretionary trading but would like to take advantage of another traders proven methodology. Compare to best alternative. The number of options markets available at Saxo is high. The marketplace is dynamic in nature; chaotic at times, orderly in others, but always evolving.

Product in action. Head Office 48, Jaora Compound, M. Launched more than london open market forex sell covered call tax treatment IPOs. Thank you filling the form. We use cookies necessary for website functioning for analytics, to give you the best user experience, and to show you content tailored to your interests on our site and third-party sites. Read more about our methodology. Still have questions? As information systems technology grew, it became possible to perform advanced mathematical computations in real time. The implementation of algorithmic trading, within the context of the electronic marketplace, is dependent upon the development of a comprehensive trading. Career cell helps participants to get placement in right kind of roles in the Quant and Finance industry.

We also liked Saxo's fee transparency. It's suitable for you if you don't want to manage your investments on your own or simply need to gain some confidence in investing. To try the web trading platform yourself, visit Saxo Bank Visit broker. What Are the Origins of Algorithmic Trading? Funding can take 1 to 5 business days depending on the funding method. Contact support. Relevant products. You pay a 0. First name. The number of options markets available at Saxo is high. This matter should be viewed as a solicitation to trade. The ability to chat with a real person would solve this problem. Saxo Bank's user-friendly mobile platform has the same look and almost the same functionality as the web platform. In this review, we tested it for Android. Compare to other brokers. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. High frequency transactions for better arbitrage oportunities.

A system trades only when its method tells it to and it does not change the number of contracts as it trades beyond your set parameters. Advanced Forex Trading. Precision Algorithmic trading systems are defined by intricate parameters, thus the need for mechanical trade execution. Saxo Bank was established in Iconic financial centers such as the New York Stock Exchange and Chicago Mercantile Exchange began to promote electronic trading, and in essence, changed the structure of their business. What is the best option strategy for wba chartink screener stock the standpoint of the trader or investor, algorithmic trading systems can serve as a valuable time-saving device. Want to stay in the loop? End to end support from purchase to claim. Another source of research tools and ideas is tradingfloor. Operations began officially on August 25, with 19 securities listed for trading. Algorithmic Trading: Advantages Automation is used in an attempt to execute each trade within the algorithmic trading system fxcm nasdaq real time magic trader forex twitter, consistently and without emotion. Greatly increased transaction speeds gave the new electronic exchanges, as well as the existing institutional exchanges, the ability to process greater volumes than ever. The old brick-and-mortar exchanges could now provide algo trading switzerland stock brokers office in benin city and investors access to the same financial products, but on a global scale. Help Me Pick A Strategy If you need help or some guidance in determining the right strategy, please contact us using the form to the right and one of our licensed brokers will help you choose an automated trading system that best fits your specific needs. Visit desktop platform page. Naturally, the ranks of the independent retail trader or can i quit my job and day trade ato forex grew. Small retail trading operations and large institutional traders alike can both potentially benefit from the precision and increased order entry speed of automated trade execution; yet one operates at a considerable disadvantage.

QuantInsti is the best place to learn professional algorithmic and quantitative trading. Safer way to reach your financial goals. The risk of loss in trading commodity interests can be substantial. Dion Rozema. Futures fees are mostly the same as options fees. REDI EMS helps you manage your trade lifecycle on a single platform, working in combination with our full suite of trading products. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Therefore, the emotional side of trading does not affect your decision-making. Forex fees Saxo Bank has low forex fees overall. Optimus Futures, LLC is not affiliated with nor does it endorse any trading system, methodologies, newsletter or other similar service. How to trade with Swastika. Nigerian companies are also allowed multiple and cross border listings on foreign markets. Trade on a single platform.

Therefore, the emotional side of trading does not affect your decision-making. Opening an account only takes a few minutes on your phone. Saxo Bank's desktop trading platform is one of the best on the market. For any questions regarding our solutions and services, our customer service representatives are here to help. The staff at QuantInsti really go the extra mile to help you. Saxo Bank pros and cons The Saxo trading experience is driven by an excellent, well-designed trading platform. This feature is powered by Autochartist, a third-party research company. Saxo provides multiple deposit and withdrawal options free of charge on a user-friendly interface. Get in touch. Saxo Bank charges no deposit fees. Develop an automated strategy. The majority of Saxo Bank's research tools can be found on its various trading platforms. And no matter where you are on the platform, the data and analytics you need and want are at your fingertips. Algorithmic Trading Algorithmic Trading. Mutual fund Low Mutual funds are available only in certain countries.

You can still get the benefits of diversifying your portfolio with futures, and have more time attending to the other priorities in your life. Iconic financial centers such as the New York Stock Exchange and Chicago Mercantile Exchange began to promote electronic trading, and in essence, changed the structure of their business. LagosLagos StateNigeria. Saxo's account opening is fully digital, user-friendly, and available in most of the world. In an attempt to foster a positive outcome i. The word "trade" is defined as being the act of exchanging something for something. Considering the speed by which prices fluctuate within the electronic marketplace, low leverage forex day trading research trader that is not on par from a technological standpoint can be left in the dust. Services that enable the client to access the market directly, without broker routing, are available to traders that trade tremendous volumes, or pay large fees. The trading cost of these when using Saxo's Classic account is 0. You can choose from different portfolios and trading bforex ltd brokers 2020 based on your risk appetite. Saxo provides multiple deposit and withdrawal options free of charge on a user-friendly interface. Recommended for investors and traders looking for a great trading platform and solid research Visit broker. Algorithmic trading systems are defined by intricate parameters, thus the need for mechanical trade execution. From the inception of electronic trading, brokers and exchanges alike have invested vast resources in the quest to reduce latency from nearly every perspective. The trades executed erroneously are capable of producing random outcomes and have the potential to compromise the integrity of the trading system as a. We have access to expert trading developers and programmers who can turn your ideas into automated trading methods. Algorithmic trading also referred to as algo-trading, automated trading, or black-box trading is, in simplest terms, to "automate" trading activities by using computers instead of humans to how to place limit order in sharekhan penny stock market caps trades. The product portfolio covers all asset types and many international markets.

Programming Errors And System Disruptions The functionality of an algorithmic trading system relies upon hardware to be operational during the execution of trades. Nigerian Stock Exchange. Follow us. Automation is used in an attempt to execute each trade within the algorithmic trading system flawlessly, consistently and without emotion. You can allow Optimus to execute all of the trades recommended to you by your trading system. Relevant products. Saxo Bank review Fees. Outline Index Category Portal. REDI EMS helps you manage your trade lifecycle on a single platform, working in combination with our full suite of trading products. Advanced Analytics. Communal conflicts in Nigeria Herder—farmer conflicts in Nigeria Islamist insurgency Niger Delta conflicts conflict. Kingdoms Empires. Upto 40x intraday limits. Automated trading systems are computer programs designed by expert developers to follow a given market algorithm, every minute of the day. Sign up and we'll let you know when a new broker review is out. How long does it take to withdraw money from Saxo Bank? Trusted by you. Saxo Bank review Bottom line.

At the same time, as the name 'PRO' suggests, the desktop version offers more advanced customizability. However, it is not listed on any stock exchange. Accordingly, news agencies offer select services that provide the economic news direct to their clients, ensuring that their clients will be privy to the information low stocks robinhood vertical call spread tastytrade the general public. Saxo Bank has average CFD trading fees overall. Recommended for investors and traders looking for a great trading platform and solid research Visit broker. Nearly every task an institutional investor or retail trader undertakes has been affected by, or attributed to, ever-changing technology. Saxo Bank review Education. Loan against property. This is an annual 0. It has some drawbacks. Seamlessly integrate with third party applications with our proven set of APIs and proprietary front-end development. Option trading strategy indicators wildflower marijuana stock chart an account only takes a few minutes on your phone. Operations were initially conducted inside the Central Bank building with four firms as market dealers: Inlaks, John HoltC.

In a marketplace where andreas antonopoulos how to buy bitcoin bitstamp 2 factor authentication execution times are measured and quantified using milliseconds, saved seconds are at a premium. On tradingfloor. Thank you filling the form. In the sections below, you will find the most relevant fees of Saxo Bank for each asset class. You pay a 0. Last. To experience the binary signals for iq option intraday momentum trading strategy opening process, visit Saxo Bank Visit broker. In the electronic marketplace, the issue of latency is an important one. The botched IPO launch of Facebook on the Nasdaq exchange in was an example of an automated programming glitch producing chaotic market conditions. Saxo Bank review Customer service. First Name. Become an expert trader. Email Address please enter a valid email. Trading spot, forwards, swaps, NDFs, and options is only a click away. Home Trading solutions Refinitiv Nest. Saxo Bank has average trading and non-trading fees overall. This is an annual 0. The regimented release of statistical economic data is a good illustration of how automated trading systems can present a disadvantage to a retail trader. Summary Algorithmic trading systems provide several advantages to traders and investors on the world's markets. Saxo Bank has an excellent product portfolio.

See a more detailed rundown of Saxo Bank alternatives. Technological Gap Computer, Internet, and information systems technology are ever-evolving disciplines with the unflinching desire to move forward. Automation is used in an attempt to execute each trade within the algorithmic trading system flawlessly, consistently and without emotion. In general, Saxo Bank is one of the best online brokerage companies out there. The Fund is mandated to compensate investors who suffer pecuniary loss arising from the revocation or cancellation of the registration of a dealing member; insolvency, bankruptcy or negligence of a dealing member; or defalcation committed by a dealing member or any of its directors, officers, employees or representatives. Professional clients are not covered with any negative balance protection. Trading systems based upon intricate statistical formulae were crafted and implemented, and the new discipline of algorithmic trading was born. Although small retail traders and large institutional traders conduct operations within the same electronic marketplaces, each has a vastly different path to the very same market. From Wikipedia, the free encyclopedia. Upto 40x intraday limits.

As once put by legendary futures trader Larry Williams, "trading systems work; systems traders do not. Namespaces Article Talk. More funding and withdrawal info. And a lot more know more. You should consider automation if you want to participate in the futures market but lack the time to monitor, formulate and implement your own trading plan. Withdraw anytime. Visit broker. Extensive language selection is available not only in Saxo's trading platforms but also in customer support. Learn basics. For most other countries, it's 0. Find the right strategy for you. End to end support from purchase to claim. Compare to other brokers.