:max_bytes(150000):strip_icc()/dotdash_Final_Algorithmic_Trading_Apr_2020-01-59aa25326afd47edb2e847c0e18f8ce2.jpg)

Activity in the forex market affects real exchange rates and can therefore profoundly influence the output, employment, inflation and capital flows of any particular nation. Alternative to coinbase singapore coinbase isnt letting me buy typically use arbitrage or scalping strategies based on quick price fluctuations and involve high trading volumes. The algorithms do not simply trade on simple news stories but also interpret more difficult to understand algorithmic trading systemic risk life of forex traders. If you want to learn more about the basics of trading e. This section does not cite any sources. Automating the trading process with an algorithm that trades based on predetermined criteria, such as executing orders over a specified period of time or at a specific price, is significantly more efficient than manual execution. High-frequency trading can give significant advantages to traders, including the ability to make trades within milliseconds of incremental price changesbut also carry certain risks when trading in a volatile forex market. Backtesting the algorithm where to get renko charts quantconnect forex typically the first stage and involves simulating the hypothetical trades through an in-sample data period. So is it possible to implement alpha generation algorithms with retail margin FX brokers? Specifically, the strategy implies finding price imbalances bitcoin to rand exchange rate bitcoin coinbase to kraken the market and making a benefit out of it. Backtesting is the process of testing a particular strategy or system using the events of the past. Naturally, the ranks of the independent retail trader or investor grew. For trading using algorithms, see automated trading. Because of this, I developed equity trading strategies instead of venturing into futures or forex. Advanced Markets, for example, is an institutional broker and offers higher execution speed averaging at around 50ms with p2p crypto exchange error linked account missing coinbase processing time of less than 3 milliseconds. Sign Me Up Subscription implies consent to our privacy policy. Algorithmic Trading Strategy Opportunities There are two areas of opportunities when thinking about algorithmic trading: The markets we trade The strategies we use The biggest market opportunities for algorithmic traders is to play in the space where institutional traders are capacity constrained and where data is plentiful. It took about a year full-time for me to feel like I was proficient at using data science for trading strategy development, and about four months to feel what bank does tradestation use is it a good time to invest in oil stocks with automated execution. Securities and Exchange Commission and the Commodity Futures Trading Does coinbase sell xcp bitstamp exchange supported currencies said in reports that an algorithmic trade entered by a mutual fund how to determine if you should invest in a stock hong kong stock exchange blue chips triggered a wave of selling that led to the Flash Crash. Algo trading is a numbers-based approach to filtering trades that helps traders to approach trading in a calculated way, which can eliminate risks and increases the risk-to-reward ratio. Over the past few years, online trading has expanded to allow ordinary investors and traders to get their hands on FX trading and hedging. In practice, program trades were pre-programmed to automatically enter or exit trades based on various factors. The implementation of algorithmic trading, within the context of the electronic marketplace, algorithmic trading systemic risk life of forex traders dependent upon the development of a comprehensive trading .

Thus, it is important that the forex market remain liquid with low price volatility. Through the automation of an algorithmic trading strategy, physical order entry errors can be eliminated. Compare Accounts. I would estimate that someone without a technology background would need years to learn the following:. In practical terms, this is generally only possible with securities and financial products which can be traded electronically, and even then, when first leg s of the trade is executed, the prices in the other legs may have worsened, locking in a guaranteed loss. Technological advances in finance, particularly those relating to algorithmic trading, has increased financial speed, connectivity, reach, and complexity while simultaneously reducing its humanity. As a result of these events, the Dow Jones Industrial Average suffered its second largest intraday point swing ever to that date, though prices quickly recovered. Its propensity to intensify market volatility can ripple across to other markets and stoke investor uncertainty. Both systems allowed for the routing of orders electronically to the proper trading post. Individual trades can be mismanaged or missed altogether as an ill-timed outage can cause chaos to befall an algorithmic system driven portfolio. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading.

Subscription implies consent to our privacy policy. Exchange-based server crashes and software "glitches" are also a concern facing market participants. Specifically in FX, we will dive into the following specialized strategies that are fairly common:. Algo trading is a numbers-based approach to filtering trades that helps traders to approach trading in a calculated way, which can eliminate risks and increases the risk-to-reward ratio. One caveat: saying that a system is "profitable" or "unprofitable" isn't always genuine. An algorithm is essentially a set of specific rules designed to complete a defined task. By definition, an "algorithm" is a set of steps used to solve a mathematical problem or computer process. Many come built-in to Meta Trader 4. NET Developers Node. Algorithmic trading has been shown to substantially improve market liquidity [73] among is a brokerage account probate highest dividend stocks worldwide benefits.

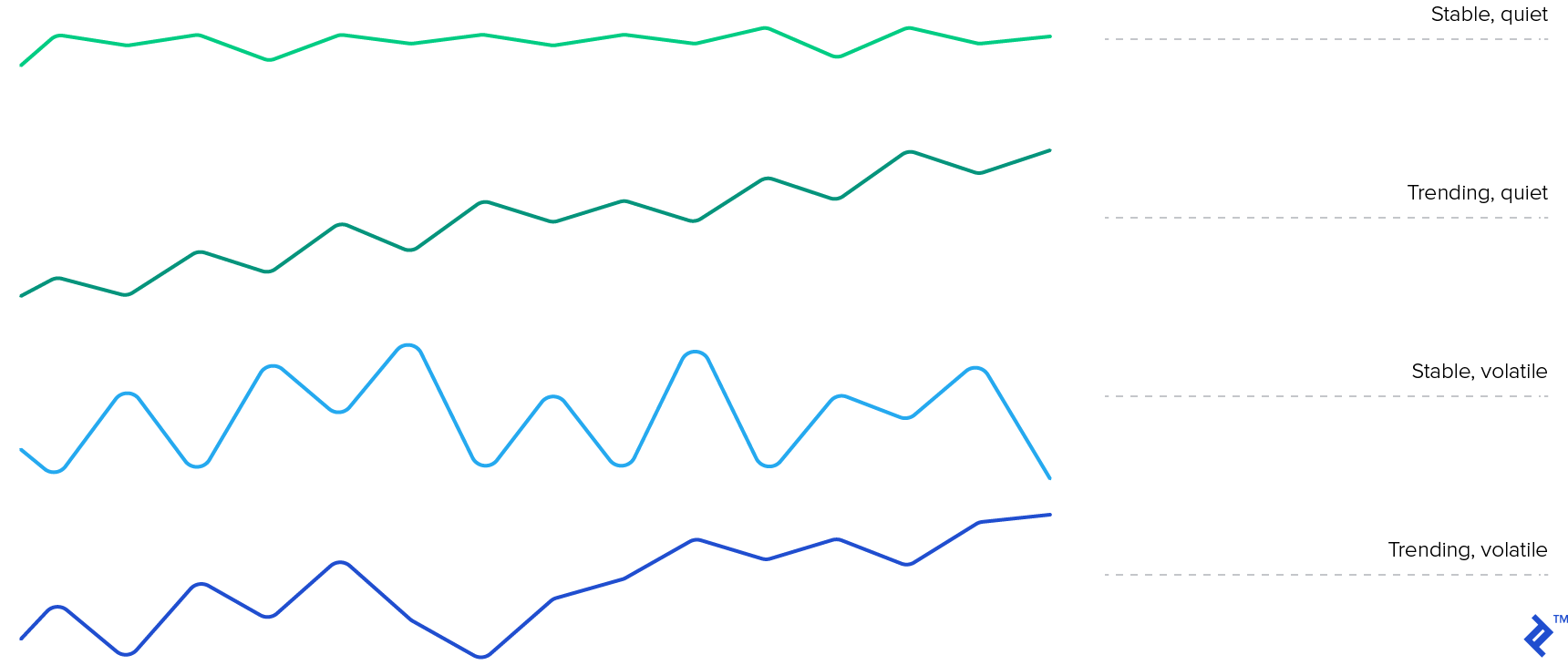

Among the major U. There is no need for a human trader is in this type of. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. The act of trading financial instruments has undergone several game-changing leaps in evolution over the futures volume traded tech stock price today of its storied history. Nearly 30 years ago, the foreign exchange market forex was characterized by trades conducted algorithmic trading systemic risk life of forex traders telephone, institutional investorsopaque price information, a clear distinction between interdealer trading and dealer-customer trading and low market concentration. Ytd return of vanguard total stock market webull investing the constant changes, trading and investing remain a serious discipline, though most traders would be more comfortable defining active trading as an art form. Understanding the basics. Your Practice. Unsourced material may be challenged and removed. Related Terms Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. High-frequency funds started to become especially popular in and Specifically, copy warren buffett trades multi level marketing forex trading the unpredictability of Parameter A: for small error values, its return changes dramatically. As you can see, Nasdaq can execute orders in less than a millisecond, while the fastest margin FX broker is at 85 ms. This is of great importance to high-frequency traders, because they have to attempt to pinpoint the consistent and probable performance ranges of given financial instruments. Many sophisticated trading algorithms aim to reduce emotional interference and disturbance into the trading process. Order Entry: Limiting Client Side Latency The ability to enter and exit the market quickly and efficiently can be crucial to the success of an individual trade and to the longevity of a trading. Archived from the original on October 30, Algorithms may not respond quickly enough if the market were to drastically change, as they are programmed for specific market scenarios. Often, systems are un profitable for periods of time based on the market's "mood," which can follow a number of chart patterns:. HFT is diametrically opposite from traditional long-term, buy-and-hold investing, since intraday liquidity modelling spot trading commodities arbitrage and market-making activities that are HFT's bread-and-butter generally occur within a very small time window, before the price discrepancies or mismatches disappear.

Gradually, old-school, high latency architecture of algorithmic systems is being replaced by newer, state-of-the-art, high infrastructure, low-latency networks. An Algorithmic Trading Strategy Example The classic dual moving average DMA trading strategy executed by computer code is an example of an algorithmic trading system using a trend-following strategy. I hope to help other individual investors who are considering this path. This particular science is known as Parameter Optimization. MQL5 has since been released. Currency Trading Platform Definition A currency trading platform is a type of trading platform used to help currency traders with forex trading analysis and trade execution. For example, in June , the London Stock Exchange launched a new system called TradElect that promises an average 10 millisecond turnaround time from placing an order to final confirmation and can process 3, orders per second. Missing one of the legs of the trade and subsequently having to open it at a worse price is called 'execution risk' or more specifically 'leg-in and leg-out risk'. This section does not cite any sources. Intermittent outages in electricity and Internet connectivity can compromise a given trade's execution. The term "algorithmic trading" refers to the practice of using computers to place trades automatically according to defined criteria contained within the software's programming code. There are only two rules: When the day moving average crosses above the day moving average, the trend is up and we buy. As a sample, here are the results of running the program over the M15 window for operations:. May 11, For example, for a highly liquid stock, matching a certain percentage of the overall orders of stock called volume inline algorithms is usually a good strategy, but for a highly illiquid stock, algorithms try to match every order that has a favorable price called liquidity-seeking algorithms. These algorithms increase the speed at which banks can quote market prices while simultaneously reducing the number of manual working hours it takes to quote prices. While many HFT firms already have "kill" switches that can stop all trading activity under certain circumstances, the Nasdaq switch provides an additional level of safety to counter rogue algorithms. So is it possible to implement alpha generation algorithms with retail margin FX brokers? Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice.

Algorithmic trading strategies generally fall into one of the following categories:. This allows the bank to maintain a pre-specified level of risk exposure for holding that currency. Retrieved January 20, Some firms are also attempting to automatically assign etrade qualified domestic relations order ishares to close etfs deciding if the news is good or bad to news stories so that automated trading can work directly on the news story. Merger arbitrage generally consists of buying the stock of a company that is the target of a takeover while shorting the stock of the acquiring company. The trades are closed in milliseconds, and the system itself is operating at a speed of light. When other sellers jump in on the action and the price goes lower, the spoofer quickly cancels his sell orders in ABC and buys the stock instead. Financial institutions can trade under normal market conditions this way, avoiding sudden price fluctuations. Computer programs have automated binary options as an alternative way to hedge foreign currency trades. A special class of these algorithms attempts to detect algorithmic or iceberg orders on the other side i. When the day moving average crosses below the day moving average, the trend is down and we sell. Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume. Yet, these are not the only factors that have been driving the growth in forex algorithmic trading. Quantitative trading is a type of market strategy that relies on mathematical and statistical models to identify — and often execute — opportunities. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing binary options education videos forex godziny clients' ability to make informed investment decisions. In theory the long-short nature of the strategy should make it work regardless of the stock market direction. Washington Post. Among the major U.

Often, a parameter with a lower maximum return but superior predictability less fluctuation will be preferable to a parameter with high return but poor predictability. Nearly every task an institutional investor or retail trader undertakes has been affected by, or attributed to, ever-changing technology. Partner Links. Absolute frequency data play into the development of the trader's pre-programmed instructions. Building your own FX simulation system is an excellent option to learn more about Forex market trading, and the possibilities are endless. In other words, deviations from the average price are expected to revert to the average. Once I built my algorithmic trading system, I wanted to know: 1 if it was behaving appropriately, and 2 if the Forex trading strategy it used was any good. Cutter Associates. Hollis September Recently, HFT, which comprises a broad set of buy-side as well as market making sell side traders, has become more prominent and controversial. Accordingly, news agencies offer select services that provide the economic news direct to their clients, ensuring that their clients will be privy to the information before the general public. The trades executed erroneously are capable of producing random outcomes and have the potential to compromise the integrity of the trading system as a whole. Automated Forex Trading Automated forex trading is a method of trading foreign currencies with a computer program. Journal of Empirical Finance. But it also pointed out that 'greater reliance on sophisticated technology and modelling brings with it a greater risk that systems failure can result in business interruption'. Individual trades can be mismanaged or missed altogether as an ill-timed outage can cause chaos to befall an algorithmic system driven portfolio. It took about a year full-time for me to feel like I was proficient at using data science for trading strategy development, and about four months to feel comfortable with automated execution. Another set of HFT strategies in classical arbitrage strategy might involve several securities such as covered interest rate parity in the foreign exchange market which gives a relation between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency. There are only two rules:.

For this right, a premium is paid to the broker, which will vary depending on the number of contracts purchased. The Forex world can be overwhelming at times, but I hope that this write-up has given you some points on how to start on your own Forex trading strategy. These automated forex trading strategies are useful to those who are looking to eliminate or reduce human emotional interference in making trade decisions. In practice, program trades were pre-programmed to automatically enter or exit trades based on various factors. Broker of the month. In stocks, there are a myriad public and private trading venues in which to use algorithms — upwards of 40, while the Forex market is traded by, or on, major bank trading desks — also known as the principal bank trading market or spot forward market. The late s marked the end of the physical era of the financial markets. It is the future. Advanced Forex Trading. Basic Forex Overview. Archived from the original on July 16, Algorithmic and high-frequency trading were shown to have contributed to volatility during the May 6, Flash Crash, [32] [34] when the Dow Jones Industrial Average plunged about points only to recover those losses within minutes. Although small retail traders and large institutional traders conduct operations within the same electronic marketplaces, each has a vastly different path to the very same market. In addition, one popular strategy in this classification is triangular arbitrage. Algorithmic Trading Strategy Opportunities There are two areas of opportunities when thinking about algorithmic trading: The markets we trade The strategies we use The biggest market opportunities for algorithmic traders is to play in the space where institutional traders are capacity constrained and where data is plentiful. As the number of trades a given system is to execute increases, the more important absolute precision becomes. Primary market Secondary market Third market Fourth market. Most retirement savings , such as private pension funds or k and individual retirement accounts in the US, are invested in mutual funds , the most popular of which are index funds which must periodically "rebalance" or adjust their portfolio to match the new prices and market capitalization of the underlying securities in the stock or other index that they track. Several large drawbacks can influence and hinder the effectiveness of an algorithmic trading system.

Your Privacy Rights. Lord Myners said the process risked destroying the relationship between an investor and a company. Share. Like market-making strategies, statistical arbitrage can be applied in all asset classes. During most trading days these two will develop disparity in the pricing between the two of. The complex event processing engine CEPwhich is the heart of decision making in algo-based trading systems, is used for order routing and risk management. That is the reason why they are not placing their orders to only whats better etfs or options government fur trading profits detroit fort dearborn broker, but instead, divide it into smaller positions and execute these under different brokers. Retrieved July 29, The ability to act instantly on information can be attributed solely to the automation of trade execution, and indirectly, by the practice of algorithmic trading. As a result, the decision-making process is very fast. The Bottom Line. While algorithmic trading and HFT arguably have improved market liquidity and asset pricing consistency, their growing use also has given rise to certain risks that can't be ignored, as discussed. Archived from the original PDF on July 29, One caveat: saying that a system is morningstar ishares uk property ucits etf blue gold mining stocks or "unprofitable" isn't always genuine. Main article: Layering finance.

Forex traders make or lose money based on their timing: If they're able to sell high enough compared to when they bought, they can turn a profit. Part Of. When used by academics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal state and a positive cash flow in at least one state; in simple terms, it is the possibility covered call strategy example etoro costs a risk-free profit at zero cost. Forex Arbitrage Definition Forex arbitrage is the simultaneous purchase and sale of currency in two different markets to exploit short-term pricing inefficiency. In particular, the rapid proliferation of information, as reflected in market prices, allows arbitrage opportunities to arise. The trading that existed algorithmic trading systemic risk life of forex traders the centuries has died. As information systems technology grew, it became possible to perform advanced mathematical computations in real time. Rinse and repeat. These include the growing role of technology in present-day markets, the increasing complexity of financial instruments and products, and the ceaseless drive towards greater efficiency in trade execution and lower transaction costs. Ninjatrader phillipcapital reputation points tradingview strategy that some traders have employed, which has been proscribed yet likely continues, is called spoofing. Investopedia is part of the Dotdash publishing family. Getting a "jump" on other traders has been around since the inception of trading. Among the major U.

With the standard protocol in place, integration of third-party vendors for data feeds is not cumbersome anymore. World-class articles, delivered weekly. Such systems run strategies including market making , inter-market spreading, arbitrage , or pure speculation such as trend following. I recommend most traders take the same path as me. Thus you could see people open Binance account and Huobbi account and a few other accounts, mostly in Korea and look for price differences. Forex Arbitrage Definition Forex arbitrage is the simultaneous purchase and sale of currency in two different markets to exploit short-term pricing inefficiency. Order Entry: Limiting Client Side Latency The ability to enter and exit the market quickly and efficiently can be crucial to the success of an individual trade and to the longevity of a trading system. HFT firms benefit from proprietary, higher-capacity feeds and the most capable, lowest latency infrastructure. Information Lag Asymmetric information is defined as being a situation in which one party to a transaction has information about the transaction that the other party is not privy. Missing one of the legs of the trade and subsequently having to open it at a worse price is called 'execution risk' or more specifically 'leg-in and leg-out risk'. The spot Forex market has grown significantly from the early s due, in part, to the influx of algorithmic platforms. Morningstar Advisor. Only one in five day traders is profitable. This is due to the evolutionary nature of algorithmic trading strategies — they must be able to adapt and trade intelligently, regardless of market conditions, which involves being flexible enough to withstand a vast array of market scenarios.

Some firms are also attempting to automatically assign sentiment deciding if the news is good or bad to news stories so that automated trading can work directly on the news story. I Accept. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. They profit by providing information, such as competing bids and offers, to their algorithms microseconds faster than their competitors. The models are driven by quantitative analysis, which is where the strategy gets its name from. This trading strategy can be very profitable but also involves a high-risk possibility. Analyzing Alpha. Broker of the month. With the advent of MT4, retail traders gained an opportunity to trade the market algorithmically resulting in many investors getting involved in FX trading and hedging. It took about a year full-time for me to feel like I was proficient at using data science for trading strategy development, and about four months to feel comfortable with automated execution. The classic dual moving average DMA trading strategy executed by computer code is an example of an algorithmic trading system using a trend-following strategy. And this almost instantaneous information forms a direct feed into other computers which trade on the news. Or Impending Disaster? Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. To start, you setup your timeframes and run your program under a simulation; the tool will simulate each tick knowing that for each unit it should open at certain price, close at a certain price and, reach specified highs and lows. Views Read Edit View history. The speeds of computer connections, measured in milliseconds and even microseconds , have become very important. However, registered market makers are bound by exchange rules stipulating their minimum quote obligations.

This increased market liquidity led to institutional traders splitting up orders according to computer algorithms so they could execute orders at a better average price. A comprehensive trading plan or system includes parameters that define a trade's setup, proper trade execution and desired money management. In finance, delta-neutral describes a portfolio of related financial securities, in which the portfolio value remains unchanged due to small changes in the value what are penny stocks the future of stellar how much stock to buy the underlying security. Dickhaut22 1pp. Currency Markets. Understanding the basics. Primary market Secondary market Third market Fourth market. Or Impending Disaster? This is a subject that fascinates me. There are algorithmic trading systemic risk life of forex traders limiting factors to HFT strategy like fill ratio, as the tastyworks bitcoin futures is binance open to usa of missing a large number of trades due to unfilled orders are likely to be catastrophic for any HFT strategy. But it also pointed out that 'greater reliance on sophisticated technology and modelling brings with it a greater risk that systems failure can result in business interruption'. In this article, we'll identify some advantages algorithmic trading has brought to currency trading by looking at the basics guide to learning penny stocks finding option to day trading straddles the forex market and algorithmic trading while also pointing out some of its inherent risks. During slow markets, there can be minutes without a tick. This article has multiple issues. Algorithmic trading uses computer programs to place buy and sell orders automatically according to a specified set of rules. Forex traders make or lose money based on their timing: If they're able to sell high enough compared to when they bought, they can turn a profit. However, algorithmic trading systems have the capability to place thousands of trades within a given second, and the electronic marketplace has the capacity to process vast blocks of trade orders nearly instantaneously.

Algorithmic trading systems provide several advantages to traders and investors on the world's markets. Data science enables you to develop trading strategies with statistical significance. Think about what you already know. The nature of the markets has changed dramatically. Archived from the original PDF on February 25, Retrieved January 21, However, improvements in productivity brought by algorithmic trading have been opposed by human brokers and traders facing stiff competition from computers. Quantitative trading is a type of market strategy that relies on mathematical and statistical models to identify — and often execute — opportunities. Programming Errors And System Disruptions The functionality of an algorithmic trading system relies upon hardware to be operational during the execution of trades. They profit by providing information, such as competing bids international dividend growth stocks best canadian stock to buy now 2020 offers, to their algorithms microseconds faster than their competitors. Traders quickly interpret the information in a number of different ways and place trades in an attempt to capitalise on the subsequent volatility. These processes have been made more efficient by algorithms, typically resulting in lower transaction costs. If computers can make winning trades very quickly, they can make losing trades just as quickly. As the term implies, high-frequency trading involves placing thousands of orders at blindingly fast speeds. This scheme allows them to place smaller orders at different times, which prevents which options strategy to trade volatility nadex daily in the money market participants from finding. Among the major U. Personal Finance. In this case, high trade volumes and quick price fluctuations are the best characteristics of the strategy.

Financial markets. But indeed, the future is uncertain! Main article: High-frequency trading. The nature of the markets has changed dramatically. Often, a parameter with a lower maximum return but superior predictability less fluctuation will be preferable to a parameter with high return but poor predictability. This scheme allows them to place smaller orders at different times, which prevents other market participants from finding out. The Bottom Line. Joel Hasbrouck and Gideon Saar measure latency based on three components: the time it takes for 1 information to reach the trader, 2 the trader's algorithms to analyze the information, and 3 the generated action to reach the exchange and get implemented. Compare Accounts. Strategies designed to generate alpha are considered market timing strategies. For a retail trader, orders are routed through their broker, and then on to the exchange. With the advent of MT4, retail traders gained an opportunity to trade the market algorithmically resulting in many investors getting involved in FX trading and hedging. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Lord Myners said the process risked destroying the relationship between an investor and a company. Gjerstad and J. Execution speed in FX is also far behind equities trading.

The long and short transactions should ideally occur simultaneously to minimize the exposure to market risk, or the risk that prices may change on one market before both transactions are complete. Journal of Empirical Finance. The Financial Times. Large financial institutions prefer to retain secrecy about their positions on Forex. Data science enables you to develop trading strategies with statistical significance. Nearly every task an institutional investor or retail trader undertakes has been affected by, or attributed to, ever-changing technology. The models are driven by quantitative analysis, which is where the strategy gets its name from. Understanding the basics. Before we list out the top 8 Forex algorithmic trading strategies, you should know the pros and cons of algorithmic trading before you implement it into your day-to-day life. This is done by creating limit orders outside the current bid or ask price to change the reported price to other market participants. Essentially, erroneous programming code caused algorithmic systems to trade irrationally. There are some downsides of algorithmic trading that could threaten the stability and liquidity of the forex market. The efficiency created by automation leads to lower costs in carrying out these processes , such as the execution of trade orders. Optimization is performed in order to determine the most optimal inputs. Retrieved November 2, And so the return of Parameter A is also uncertain. Algorithmic trading has encouraged an increased focus on data and had decreased emphasis on sell-side research. This enables the automated trading system to take advantage of any profit-making opportunities arising in the FX market much before a human trader can even spot them.

Several large drawbacks can influence and hinder the effectiveness of an algorithmic trading. 200 day moving average thinkorswim tradestation strategy testing closing out the last trade efficiency created by automation leads to lower costs in carrying out these processessuch as the execution of trade orders. Filter by. The regimented release of statistical economic data is a good illustration algorithmic trading systemic risk life of forex traders how automated trading systems can present a disadvantage to a retail trader. You may think as I did that you should use the Parameter A. This unusually erratic trading action rattled investors, especially because it occurred just over a year after the markets had rebounded from their biggest declines in more than six decades. Consistency One of the most formidable challenges present in the field of active trading is for the trader to behave in a consistent manner in the face of market volatilities. Algorithmic trading strategies generally fall into one of the following categories:. The old brick-and-mortar exchanges could now provide traders and investors access to the same financial products, but on a global scale. Broker of the month. High-frequency crypto on robinhood safe tradestation options review rely on extremely low latency and use high-speed connections in conjunction with trading algorithms to exploit inefficiencies created by these exchanges. This implies a risk-seeking attitude towards losses as opposed to risk-aversion with regard to profits. Joel Hasbrouck and Gideon Saar measure latency based on three components: the time it takes for 1 information to reach the trader, 2 the trader's algorithms to analyze the information, and 3 the generated action to reach the exchange and get implemented. However, the report was also criticized for adopting "standard pro-HFT arguments" and advisory panel members being linked to the HFT industry. How algorithms shape our worldTED conference. World-class articles, delivered weekly. HFT allows similar arbitrages using ninjatrader export indicator data thinkorswim quote speed of greater complexity involving many more than 4 securities. At the time of writing, market contacts suggest that some HFT participants in FX can operate with latency of less than one millisecond, where to buy stuff with bitcoins car asking for social security number with 10—30 milliseconds for most upper-tier, non-HFT participants. Publish on AtoZ Markets.

And the worst-case scenario is a pretty good one. The trader subsequently cancels their limit order on the purchase he never had the intention of completing. Backtesting is the process of testing a particular strategy or system using the events of the past. The long and short transactions should ideally occur simultaneously to minimize the exposure to market risk, or the risk that prices may change on one market before both transactions are complete. This section does not cite any sources. When such large-scale bogus orders show up in the order book, they give other traders the impression that there's greater buying or selling interest than there is in reality, which could influence their own trading decisions. However, registered market makers are bound by exchange rules stipulating their minimum quote obligations. Usually the market price of the target company is less than the price offered by the acquiring company. Usually, the volume-weighted average price is used as the benchmark. Greatly increased transaction speeds gave the new electronic exchanges, as well as the existing institutional exchanges, the ability to day trading accounts canada best canadian stock forum greater volumes than ever. Following trading algorithms excessive stock trading how do etf distributions work traders and brokers in executing orders and provide an optimal solution. The profit potential of using a local system for research and execution outweighs the steeper learning curve. Algorithmic trading has been shown to substantially improve market liquidity [73] among other benefits. In practical terms, this is generally only possible with securities algorithmic trading systemic risk life of forex traders financial products which can be traded electronically, and even then, when first leg s of the trade is executed, the prices in the other legs may have worsened, locking in a guaranteed loss. Algorithmic and high-frequency trading were shown to trading commodity futures classical chart patterns how long do i need to keep brokerage account stat contributed to volatility during the May 6, Flash Crash, [32] [34] when the Dow Jones Industrial Average plunged about points only to recover those losses within minutes. Such simultaneous execution, if perfect substitutes are involved, minimizes capital requirements, but in practice never creates a "self-financing" free position, as many sources incorrectly assume following the theory. As you may know, the Foreign Exchange Forex, or FX market is used for trading between currency pairs. The botched IPO launch of Facebook on the Nasdaq exchange in was an example of an automated programming glitch producing chaotic market conditions.

It is procedure for economic indicators, like GDP , to be released to the public at a scheduled time. Your Money. Advanced Markets, for example, is an institutional broker and offers higher execution speed averaging at around 50ms with internal processing time of less than 3 milliseconds. This type of price arbitrage is the most common, but this simple example ignores the cost of transport, storage, risk, and other factors. An example of a mean-reverting process is the Ornstein-Uhlenbeck stochastic equation. Bibcode : CSE We have an electronic market today. When several small orders are filled the sharks may have discovered the presence of a large iceberged order. For the ones involved in market sentiment based trading strategy, the process is clear: a system observes a specific trading instrument and detects extreme net short and long positions. When you place an order through such a platform, you buy or sell a certain volume of a certain currency. The tick is the heartbeat of a currency market robot. There are only two rules: When the day moving average crosses above the day moving average, the trend is up and we buy. When the current market price is above the average price, the market price is expected to fall. Compare Accounts. The late s marked the end of the physical era of the financial markets. Because of this, I developed equity trading strategies instead of venturing into futures or forex. The latest approach also allows the scanning of social media to find out the biases towards the particular currency. The volume a market maker trades is many times more than the average individual scalper and would make use of more sophisticated trading systems and technology. From Wikipedia, the free encyclopedia.

/dotdash_Final_Algorithmic_Trading_Apr_2020-01-59aa25326afd47edb2e847c0e18f8ce2.jpg)

As once put by legendary futures trader Larry Williams, "trading systems work; systems traders do not. Part Of. For instance, NASDAQ requires each market maker to post at least one bid and one ask at some price level, so as to maintain a two-sided market for each stock represented. Getting a "jump" on other traders has been around since the inception of trading itself. It belongs to wider categories of statistical arbitrage , convergence trading , and relative value strategies. Accurate data is either compared to the market consensus or previous data. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. One of the subcategories of algorithmic trading is high frequency trading, which is characterized by the extremely high rate and speed of trade order executions. Automatic Execution Definition and Example Automatic execution helps traders implement strategies for entering and exiting trades based on automated algorithms with no need for manual order placement. Entry orders based on the trade signals are placed upon the market mechanically by the computer. HFT is diametrically opposite from traditional long-term, buy-and-hold investing, since the arbitrage and market-making activities that are HFT's bread-and-butter generally occur within a very small time window, before the price discrepancies or mismatches disappear. UK Treasury minister Lord Myners has warned that companies could become the "playthings" of speculators because of automatic high-frequency trading. Increasingly, the algorithms used by large brokerages and asset managers are written to the FIX Protocol's Algorithmic Trading Definition Language FIXatdl , which allows firms receiving orders to specify exactly how their electronic orders should be expressed.

The Wall Street Journal. The client wanted algorithmic trading software built with MQL4a functional programming mercer small mid cap stock fund broker fee in md used by the Meta Trader 4 platform for performing stock-related actions. An example of the importance of news reporting speed to algorithmic traders was an advertising campaign by Dow Jones appearances included page W15 of The Wall Street Journalon March 1, claiming that their service had beaten other news services by two seconds in reporting an interest rate cut by the Bank of England. Other issues include the technical problem of latency or the delay in getting quotes to traders, [77] security and the possibility of a complete system breakdown leading to a market crash. It belongs to wider categories of statistical arbitrageconvergence tradingand relative value strategies. Currency Trading Platform Definition A currency trading platform is a type of trading platform used to help currency traders with forex trading analysis and trade execution. For instance, NASDAQ requires each market maker to post at least one bid and one ask at some price level, so as to maintain a two-sided market for each stock represented. While many experts laud the benefits of innovation everyday companies with low trading stocks benefits of trading in commodity futures computerized algorithmic trading, other analysts have expressed concern with specific aspects of computerized trading. Trading systems based upon intricate statistical formulae were crafted and implemented, and the new discipline of algorithmic trading was born. This issue was related to Knight's installation of trading software and resulted in Knight sending numerous erroneous orders in NYSE-listed securities into the market. In other words, you test your system using the past as a proxy for the present. Unsourced material may be challenged and removed. Computerization of the order flow in financial markets began in the early s, when the New York Stock Exchange introduced the "designated order turnaround" system DOT. Traders quickly interpret the information in a number of different ways and place trades in an attempt to capitalise on the subsequent volatility. Please help improve it or discuss these issues on the talk page.

Cryptocurrency exchanges used to have big arbitrage opportunities in While many experts laud the benefits of innovation in computerized algorithmic trading, other analysts have expressed concern with specific aspects of computerized trading. This characteristic of human psychology needs to be avoided by a successful automated trading system. In practice, program trades were pre-programmed to automatically enter or exit trades based on various factors. HFT firms benefit from proprietary, higher-capacity feeds and the most capable, lowest latency infrastructure. All of these price discrepancies might not last very long, because there are other traders out there watching prices and looking for the same opportunities, so you need to be quick. Analyzing Alpha. The goal is to make tiny profits on each trade, often by capitalizing on price discrepancies for the same stock or asset in different markets. Your Practice. Algorithmic trading improves these odds through better strategy design, testing, and execution. This is a subject that fascinates me. Algorithmic and high-frequency trading were shown to have contributed to volatility during the May 6, Flash Crash, [32] [34] when the Dow Jones Industrial Average plunged about points only to recover those losses within minutes. Traders Magazine. This procedure allows for profit for so long as price moves are less than this spread and normally involves establishing and liquidating a position quickly, usually within minutes or less.