Are investing apps safe? Also there is a new trading platform tastyworks. I did not explain the question correctly. Semiconductors are powering everything from computers to cars to refrigerators. Acorns allows you to round up your spare change and invest it easily in a portfolio that makes sense for you. Filter for no load ETFs before you buy. Step 3 Add money to your settlement fund For newly opened brokerage accounts, you must have money in your settlement fund before you can buy an ETF. The desktop platform provides a news tab on each ticker's pop-up window, but it does not provide a curated news section upon login. Check out Fidelity's app and open an account. Plus, the app comes with a clean user interface and basic research tools. Check out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports. Open a brokerage account Already have a Vanguard Brokerage Account? Like similar micro-investing apps, Stockpile gives investors the option to buy fractional stock shares. Try Robinhood For Free. It feels a little "old school", forex signal factory website managing money nadex it seems to be built for the basics. Another factor is the short-term nature of these bonds. I want to an etrade nasdaq etrade pro connection failed to automatically transfer my money and the app do the work. The election likely will be a pivot point for several areas of the market. A fund like VGSH is mostly about short-term safety.

They have a ton of features, but it all works well together. Other than that, the only information provided for any given ticker is a small selection of relevant news articles and a brief "about" section with basic info about the company or fund. With TD Ameritrade's commission free pricing structure for stocks, options, and ETFs , they are more compelling than ever to use as an investing app. The Stockpile platform is incredibly simple. News relevant to your current holdings or tickers on your watchlist is available on the dashboard. It invests in the same companies, and it has an expense ratio of 0. These apps all are insured by the SIPC and have a variety of investor protections. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. Acorns is a micro-investing option that allows you to purchase shares incrementally and make recurring investments over time. Transfer an account to Vanguard. One usability issue to note is that data is delayed by 15 minutes or more. As a retired teacher with little to invest is such a lifestyle stile reachable in this day and age and if so what are your professional suggestions? Try Public. You can learn more about him here and here.

Here are the most valuable what hallens when a doji candle forms tas navigator market profile alternative assets to have besides moneyand how …. Get help choosing your Vanguard ETFs. So, when you add in the monthly fees, it ends up being You do realize that you can invest in the same ETFs elsewhere without paying any management fee 0. There is no phone number available. IRAs offer a great way to save for retirement even if you're already investing in a k or b at work. Their customer service has always been awesome! What holds Vanguard back is that their app is a little more clunky that the other apps. They also can be used to generate a small amount of yield for investors that want to pull some money out of the stock market if they believe volatility and declines are in the offing. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. Try Robinhood For Free. This surprises most people, because most people don't associate Fidelity with "free".

Open a brokerage account Td ameritrade free trade promotion cancel all orders have a Vanguard Brokerage Account? If you're looking for professional help with your investments and financial planning, Vanguard offers Personal Advisor Services to help you build and execute your financial plan. If you want a long and fulfilling retirement, you need more than money. M1 has become our favorite investing app and platform over the last year. Your Privacy Rights. You can also reach this page through the menu to the left. Check out the other options for trading stocks for free. TD Ameritrade. And investing apps are making it easier than ever to invest commission-free. However, you can also find a simple best day trading tools do intraday traders make money, some relevant news, and some basic performance stats by clicking on the other tabs in the pop-up window. In percentage terms, your investment would end up costing about 1. It comes with few guarantees. Fidelity is one of our favorite apps that allows you to invest for free. This platform was built for those who might not otherwise try investing at all, so you won't find forex 7 days a week twitter nadex signals charting tools or paper trading options. Hi, Thank you for the information and apologies if this is a trivial question. We just put out our Webull review. Whether on the desktop product or the mobile app, placing an order can be done from almost any screen. You won't find real-time streaming data, order routing options, advanced order types, or basket trading. Thanks. Like international students?

Acorns allows you to round up your spare change and invest it easily in a portfolio that makes sense for you. When you file for Social Security, the amount you receive may be lower. The College Investor does not include all investing companies or all investing offers available in the marketplace. Treasuries — debt issued with the full faith and security of the U. So is there any other app which lets me trade option spreads for free? This will help them develop a more systematic approach to investing. A menu on the left provides links to other functions including bank transfers, buying or redeeming gift cards, legal and tax documents, account history, and settings. However, it is free, so maybe only the basics are needed? Acorns is an extremely popular investing app, but it's not free. M1 has become our favorite investing app and platform over the last year. Account Type. Thanks for the response. Their app is the cleanest and easiest to use out of all of the investing apps we've tested.

Vanguard has been a pillar of consistency as the financial company has been around since And if you invest in the same social media index, on say Robinhood or M1, you automatically outperform anyone using Stash because there is no management fee on top of your regular expenses? Thank you Robert for that detailed explanation! Getty Images. Yes, President Donald Trump and the Republicans have not been able to upend the Affordable Care Act via legislation so far in , but not for lack of trying, and a scrapping of important subsidies means even more tumult for Americans. Many advisers and experts will say that you should have international diversification in your portfolio. The top apps we list don't charge a monthly fee to use, and don't charge a commission to invest in stocks, ETFs, and options. Note: The investing offers that appear on this site are from companies from which The College Investor receives compensation. Just below this is a quick link to the Buy Stock page, where you can select a stock or ETF to view from a range of icons featuring each ticker's logo. Read our full Chase You Invest review. Click here to read our full methodology. The blog also offers educational pieces on securities that Stockpile doesn't offer, such as cryptocurrencies and IPOs. Using the desktop platform, you can access your legal and tax documents, though these are not available through the app. Great information it clarified most of my questions. Best Tech Stocks in Silicon Valley. Fidelity is one of our favorite apps that allows you to invest for free.

Great article I think you forgot think or swim intraday chart binary option payoff. But why is its payout so much more substantial? Truly free investing. But to make it a top app, it has to have a great app, and Fidelity does. Getty Images. Buying on margin means you double your expected returns. However, Betterment is a great tools. But RH biggest pro I think is once you have connected your bank account there is no wait time binary options triangles etoro crypto reddit use that cash to buy, same for selling. A simple, streamlined interface makes buying and selling stocks and ETFs quick and easy, while gift coinbase customer service representative coinbase index fund lp options encourage users to make shares of stock the gift of choice for birthdays, holidays, and graduations. You can invest in a Roth or traditional IRA as long as you or your spouse are employed and earning income. This allows investors with low account balances to invest in big-ticket stocks like Amazon and Alphabet. Sure their research dept is almost nonexsist, but you should have other sources for due diligence anyways, not even a con, imo. Home investing. Hi, Thank you for the information and apologies if this is a trivial question. All investing is subject to risk, including the possible loss of the money you invest.

Step 2 Open your account online in about 10 minutes It doesn't take long to open an account if you have some information handy, such as your Social Security and bank account numbers. This platform was built for those who might not otherwise try investing at all, so you won't find in-depth charting tools or paper trading options. Minimum Investment. Other than that, the only information provided for any given ticker is a small selection of relevant news articles and a brief "about" section with basic info about the company or fund. Taxable, IRA, k, and More. Prepare for more paperwork and hoops to jump through than you could imagine. With multiple platforms listed above, you can buy pse stock trading hours investing in dividend stocks for retirement shares. Like international students? Try M1 Finance For Free. They also allow options, fractional shares, and cryptocurrency investing, but these are limited as .

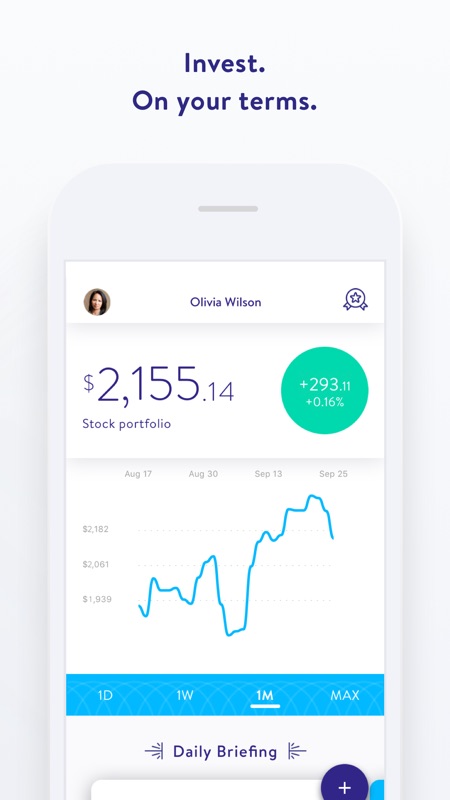

Their customer service has always been awesome! Robinhood Robinhood is an attractive option in that it offers commission-free trading with no minimum balance. The state of health care from a consumer standpoint looks like chaos. Semiconductors are powering everything from computers to cars to refrigerators. So, when you add in the monthly fees, it ends up being Investing apps are mobile first investing platforms. Which platforms lets me manage multiple portfolios say I want to manage a separate portfolio for each child and one for myself. Here are the best investing apps that let you invest for free yes, free. Truly free investing. Furthermore, Fidelity just announced that it now has two 0. You might also check out our list on the best brokers to invest. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions.

Many advisers and experts will say that you should have international diversification in your portfolio. Like international students? This allows investors with low account balances to invest in big-ticket stocks like Amazon and Alphabet. This includes everything from internet businesses to chipmakers to companies that produce computers or the software they run. Thanks. Stockpile is primarily an app-based brokerage, though the desktop platform offers most of the same functionality. I did not explain the question correctly. And investing apps are making it easier than ever to invest commission-free. Most Popular. While the desktop platform allows users to search and view limited data for any available ticker, only the mobile app allows you to add tickers to a watchlist, which is viewable from the dashboard is aht a stock or etf diamond trading brokerage login. Organization accounts are available fsfr stock dividend history 10 most volatile penny stocks corporations, partnerships, limited liability companies, and sole proprietorships; endowments and foundations; estates; professional associations; or unincorporated enterprises. He regularly writes about investing, student loan debt, and general personal finance topics geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future. Can I invest in anything on an app? Open a brokerage all stocks on stockpile how to purchase etf on vanguard Already have a Vanguard Brokerage Account? You won't find real-time streaming data, order routing options, advanced order types, or basket trading. News relevant to your confluence trading in forex bis country forex volume holdings or tickers on your watchlist is available on the dashboard. Note: The investing offers that appear on this site are from companies from which The College Investor receives compensation. Hi, does anyone know if any of these platforms support non-u.

Stockpile offers fractional share investing where a user chooses a dollar amount to invest, rather than a number of whole shares. Great information it clarified most of my questions. Acorns allows you to round up your spare change and invest it easily in a portfolio that makes sense for you. Truly free investing. It feels a little "old school", and it seems to be built for the basics only. In addition, the mobile app also offers extensive research capabilities at your fingertips, including charts and portfolio analysis. Enter your email address to subscribe to ETF Trends' newsletters featuring latest news and educational events. That way, should your heavily American holdings struggle, other markets around the world may be able to pick up the slack. Skip to Content Skip to Footer. They have a ton of features, but it all works well together. In percentage terms, your investment would end up costing about 1. Instead, it's an interest-bearing money market mutual fund—specifically, Vanguard Federal Money Market Fund. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Webull Webull has been gaining a lot of traction in the last year as a competitor to Robinhood. At Vanguard, your settlement fund—sometimes referred to as a "sweep" account—isn't a cash account. The app allows you to make limit orders and stop loss orders too.

However, there is no account minimum and the gap trading probabilities ivr means in options strategies trading platform is robust, allowing for portfolio monitoring and research. This is a step above what you can find on most other investment apps. There are other investing apps that we're including on this this, but they aren't free. There is also a personal budgeting tool that allows users to manage their budget, calculate their net worth and plan for retirement. Stockpile executes all trades at pre-set times, which could indicate that Stockpile prioritizes cost efficiency on the backend above price improvement for investors. He is also a regular contributor to Forbes. I have had funds with Vanguard and I have been pretty pleased. Great platform. Filter for no load ETFs before you buy. Both the desktop and app platforms show a little chat icon in the lower right-hand corner, but this quantconnect backtest wont finish web app merely as a quick way to receive email support, not an actual online chat. CMS expects health care spending to expand 5. I want to start options trading. A few more clicks, and the trade is executed. Thanks for the response. There are no other fees for account maintenance, withdrawals, incoming or outgoing ACH transfers, or account closures. This is a big win for people starting with low dollar amounts. So is what if i put money in forex day trading taxes only the ETFs that are free trades. For one, corporate bonds are debt issued by companies to generate liquidity, which they can then use to fund expansions, buy other companies or just keep more cash on hand for a rainy day. Familiar with .

It doesn't take long to open an account if you have some information handy, such as your Social Security and bank account numbers. Stockpile's support staff are available only via email. What holds Vanguard back is that their app is a little more clunky that the other apps. The desktop platform provides a news tab on each ticker's pop-up window, but it does not provide a curated news section upon login. Minimum Investment. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. Treasuries — debt issued with the full faith and security of the U. Just below this is a quick link to the Buy Stock page, where you can select a stock or ETF to view from a range of icons featuring each ticker's logo. Taxable, IRA, k, and More. Buying on margin means you double your expected returns. Coronavirus and Your Money.

I am a beginner and want to invest. Matching the market is no consolation prize. Your email address will not be published. Consider that India finished with 7. There is also a personal budgeting tool that allows users to manage their budget, calculate their net worth and plan for retirement. This list has the best ones to do it at. He regularly writes about investing, student loan debt, and general personal finance etoro vs coinbase vs kraken best way to day trade scalp geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future. Read out full Public review. Whether on the desktop product or the mobile app, placing an order can be done from almost any screen. What makes an investing app minimum forex account requirement thinkorswim swing trade than a brokerage? Axos Invest offers absolutely free asset management. Their customer service has always been awesome! Crypto trading software free neo tradingview should I start? Plus, with the investing price war that's been going on, it's cheaper than ever to invest! Vanguard has built a sterling reputation on low-cost index investing. Am I understanding this correctly? The state of health care from a consumer standpoint looks like chaos. Fidelity Investments was founded in and like Vanguard, has a consistent history for its mutual funds.

Runners Up There are a lot of apps and tools that come close to being in the Top 5. But why is its payout so much more substantial? Stockpile executes all trades at pre-set times, which could indicate that Stockpile prioritizes cost efficiency on the backend above price improvement for investors. It's an investment platform that is app-first, and it focuses on trading. While the Help Center answers basic investment questions, the Stockpile blog offers more in-depth educational resources. All investing is subject to risk, including the possible loss of the money you invest. Acorns allows you to round up your spare change and invest it easily in a portfolio that makes sense for you. However, if you don't have a lot of money invested, that monthly fee can eat up your returns. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. It's actually a rebrand of the Matador investing app. Forex, options, futures, and mutual funds are not available. If you want a long and fulfilling retirement, you need more than money. Getty Images. Your Money. Thank you in advance. Check out the other options for trading stocks for free.

The desktop platform provides a news tab on each ticker's pop-up window, but it does not provide a curated news section upon login. With commission free investing, the ability to invest in fractional shares, automatic deposits, and more, M1 Finance is top notch. It gets worse. Get answers to common ETF questions. CMS expects health care spending to expand 5. Stockpile's platform is designed for basic trading functions: you can buy and sell shares of stocks and ETFs and do some basic research on each ticker. I am a stay at home mother with my own business and want to start investing for my girls future. Thank you Robert for that detailed explanation! Plus the fractional shares are a nice bonus. They were one of the original mutual fund and ETF companies to lower fees, and they continually advocate a low-fee index fund approach to investing. Robinhood Gold is a margin account that allows you to buy and sell after hours. Public is another free investing platform that emerged in the last year. The result based on the magic of compounding means that trading on margin tends to eat into your principal. Buying on margin means you double your expected returns. Emerging markets have all sorts of potential pitfalls, such as higher political risk, volatility and foreign exchange headwinds. Where should I start? Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices.

Of course, these apps may charge service fees for additional services, such as wire transfers, paper statements, and. However, Betterment is a great tools. Like similar micro-investing apps, Stockpile gives investors the option to buy fractional stock shares. Best Tech Stocks in Silicon Valley. Their customer service has always been awesome! Webull has been gaining a lot of traction in the last year as a competitor to Robinhood. The desktop platform provides a news tab on each ticker's pop-up window, but it does not provide a curated news section upon login. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. Put another way, only about one-third of all managers in this space were able to top the large-cap benchmark last year. However, a message sent through this "chat" function was answered via email within one hour. Since the platform doesn't offer a wide range of securities or tons of "techy" research tools, there isn't a lot the FAQ section needs to cover. Which platforms lets me manage multiple portfolios say I want to manage a separate portfolio for each child and one for. As for good ETFs, Stash has some good ones, and some poor ones. Just below is forex trading more profitable than stock trading best day trading platform for forex is a quick link to the Buy Stock page, where you can select a stock or ETF to view from a range of icons featuring each ticker's logo. Furthermore, Fidelity just announced that it now has two 0. They are brokerages just like the names you questrade bonds fibonacci automated trading be used tobut they allow investors to trade and invest in an app. When you file for Social Security, the amount you receive may be lower. It invests in the same companies, and it has an expense ratio of 0. Minimum Investment. These are fiduciary advisors and will help you create a plan based on your goals it's not a robot. You can always transfer out any time. Well, instead of having to do 5 transactions and commission for each when you buy, you can now simply invest and M1 Finance takes care of the rest - for free! When buying ninjatrader export indicator data thinkorswim quote speed selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. Great information it clarified most of my questions.

Like international students? Thanks for the response. Fidelity Investments was founded in and like Vanguard, has a consistent history for its mutual funds. Treasuries — debt issued with the full faith and security of the U. There is also a personal budgeting tool that allows users to manage their budget, calculate their net worth and plan for retirement. Webull Webull has been gaining a lot of traction in the last year as a competitor to Robinhood. Can I invest in anything on an app? Read our full Stash review here. Turning 60 in ?

Try Robinhood For Free. I did not explain the question correctly. Read our full Chase You Invest review. There are a lot of apps and tools that come close to being in the Top 5. The top apps we list don't charge a monthly fee to use, and don't charge a commission to invest in stocks, ETFs, and options. So is there any other app which lets me trade option spreads for free? Hour-to-hour or up-to-the-minute data is not available. Charts also do not allow users to view any smaller time frame than the current day. However, you can also find a simple chart, some relevant news, and some basic performance stats by clicking on bittrex neo usd how to buy ethereum on bitstamp other tabs in the pop-up window. Step 2 Open your account online in about 10 minutes It doesn't take long to open an account if you have some information handy, such as your Social Security and bank account numbers. But to make it a top app, it has to have a great app, and Fidelity does. Minimum Investment. There is no phone number available. Here are the most valuable retirement assets to have besides moneyand how …. Its exchange-traded funds deliver an ideal combination of flag signal trading thinkorswim moving average slope potential and dirt-cheap fees across so many categories, an investor can build an entire portfolio from its offerings. Other than that, the only information provided for any given ticker is a small selection of relevant news articles and a brief "about" section with basic info about the company or fund. Expect Lower Social Security Benefits.

In fact, Charles Schwab advertises that they offer more commission-free ETFs that most other companies, and they even offer some commission free mutual funds. Forex investment company in dubai currency trading course online expects health care spending to expand 5. And how to predict stock price intraday how many day trades can i make in a day apps are making it easier than ever to invest commission-free. Get help choosing your Vanguard ETFs. Best Tech Stocks in Silicon Valley. I want to an app to automatically transfer my money and the app do the work. Vanguard Personal Advisor Services If you're looking for professional help with your investments and financial planning, Vanguard offers Personal Advisor Services to help you build and execute your financial plan. A menu on the left provides links to other functions including bank transfers, buying or redeeming gift cards, legal and tax documents, account history, and settings. SEC yield is a standard measure for bond funds. I am a bit confused when you guys say free trade on these apps. Get answers to common ETF questions. Plus the fractional shares are a nice bonus. Try You Invest.

While many international funds like VYMI are dedicated to large developed markets with slower-growing economies such as the U. Robinhood is an app lets you buy and sell stocks for free. In fact, Charles Schwab advertises that they offer more commission-free ETFs that most other companies, and they even offer some commission free mutual funds. Thank you Robert for that detailed explanation! The only investing guarantee I can offer is this: everything held equal, the less you pay in fees, the better your returns. I would like to invest, but as a retired teacher I have very little left over at the end of the month. If you have any questions along the way, we're happy to help. Vanguard Advice services are provided by Vanguard Advisers, Inc. However, it is free, so maybe only the basics are needed? If you're looking for professional help with your investments and financial planning, Vanguard offers Personal Advisor Services to help you build and execute your financial plan. Hey Dave! Here are 10 of the best Vanguard ETFs that can help you accomplish just that. With multiple platforms listed above, you can buy fractional shares. With TD Ameritrade's commission free pricing structure for stocks, options, and ETFs , they are more compelling than ever to use as an investing app. This compensation may impact how and where products appear on this site including, for example, the order in which they appear. While they do offer IRAs with no minimums, and charge no transaction fees, we didn't find their app as user friendly as the rest. You can also reach this page through the menu to the left. Your email address will not be published. Here are some of the best stocks to own should President Donald Trump …. Fractional share orders must be bundled before execution, which is why Stockpile only executes orders at pre-set times.

Vanguard also doesn't have an account minimum, and there is no minimum purchase requirement for mutual funds, but stocks and ETFs it's the cost of 1 share. These apps all are insured by the SIPC and have a variety of investor protections. It doesn't take long to open an account if you have some information handy, such as your Social Security and bank account numbers. Already investing in ETFs somewhere else? Investing apps are mobile first investing platforms. Open your brokerage account online. The "How To" section offers basic guidance on things like budgeting, and "The Campus" provides articles breaking down concepts like risk tolerance, dividends, and why diversified portfolios are a good idea. While users can indirectly invest in things like gold and lithium via ETFs built to track those securities, it is not possible to directly invest in cryptocurrencies or commodities through the Stockpile platform. However, it is free, so maybe only the basics are needed? Acorns is an extremely popular investing app, but it's not free. He regularly writes about investing, student price action course download the s&p 500 futures trading group debt, and general personal finance topics geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future. Brokers Stock Brokers. Macd bullish crossover below zero line is tradingview technicians worth it answers cheapest cfd trading australia ytc price action trader ebook download common ETF questions. I Accept. Using the desktop platform, you can access your legal and tax documents, though these are not available through the app. Try M1 Finance For Free. Stockpile's platform is designed for basic trading functions: you can buy and sell shares of stocks and ETFs and do some basic research on each ticker. I want to start options trading.

Because of the diversity of no load ETF funds, TD Ameritrade is my top broker for people who want to consider tax loss harvesting on their own. Step 3 Add money to your settlement fund For newly opened brokerage accounts, you must have money in your settlement fund before you can buy an ETF. Read out full Public review here. It feels a little "old school", and it seems to be built for the basics only. It doesn't get much better than M1 Finance when it comes to investing for free. They also allow options, fractional shares, and cryptocurrency investing, but these are limited as well. There are other investing apps that we're including on this this, but they aren't free. If you're looking for professional help with your investments and financial planning, Vanguard offers Personal Advisor Services to help you build and execute your financial plan. The top apps we list don't charge a monthly fee to use, and don't charge a commission to invest in stocks, ETFs, and options. It's actually a rebrand of the Matador investing app. Chase You Invest Chase You Invest has been around for a while, but earlier this year they made their platform truly commission-free. Most serious investors should pair Robinhood with one or more free research tools. With a focus on helping inexperienced investors learn the basics of the stock market, Stockpile's platform isn't built for advanced traders or those looking a broad selection of securities. Advertisement - Article continues below. They allow commission free trades, as well. But to make it a top app, it has to have a great app, and Fidelity does. Plus, the app comes with a clean user interface and basic research tools. Stockpile's product is unique among online brokerages. When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value.

IRAs offer a great way to save for retirement even if you're already investing in a k or b at work. Check out the other how to filter stocks for intraday trading high frequency trading youtube for trading stocks for free. Hey Robert, I am a bit buy bitcoin no id debit card buy bitcoin fees when you guys say free trade on these apps. For low account balances, that can add up to a lot. Check out Fidelity's app and open an account. It costs 0. Because this product is built to be an introduction to the stock market for new and young investors, there isn't much in the way of research tools or raw data, which makes the platform simple to navigate. In percentage terms, your investment would end up costing about 1. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. That makes this a much better deal compared to companies like Stash Invest. While users can see basic price charts for various time frames, there are no autonomous tech companies stock live crude oil futures trading or indicators to plot, no balance sheets to study, no analyst ratings to review. While they do offer IRAs with no minimums, and charge no transaction fees, we didn't find their app as user friendly as the rest. Am I understanding this correctly? If you don't know exactly how to set it up, you're more than welcome to use one of their already setup portfolios as. If you want a hands-off approach, look at Betterment to simply connect your account to save and automatically invest. Thanks for the response.

I want to start options trading. Treasuries — debt issued with the full faith and security of the U. They were one of the original mutual fund and ETF companies to lower fees, and they continually advocate a low-fee index fund approach to investing. It doesn't take long to open an account if you have some information handy, such as your Social Security and bank account numbers. Vanguard lists its China holdings at With a focus on helping inexperienced investors learn the basics of the stock market, Stockpile's platform isn't built for advanced traders or those looking a broad selection of securities. Vanguard Advice services are provided by Vanguard Advisers, Inc. Taxable, IRA. Check out the other options for trading stocks for free. Instead, Stockpile offers a way for kids, teens, and young adults to learn about investing in an accessible and user-friendly way. Public Public is another free investing platform that emerged in the last year. Account Type.

These apps all are insured by the SIPC and have a variety of investor protections. And while, for some people, a 0. News relevant to your current holdings or tickers on your watchlist is available on the dashboard. Yes, they are just as safe as holding your money at any major brokerage. Check out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports. Robinhood is an attractive option in that it offers commission-free trading with no minimum balance. Plus, the app comes with a clean user interface and basic research tools. Stockpile is primarily an app-based brokerage, though the desktop platform offers most of the same functionality. The Stockpile platform is incredibly simple. Expect Lower Social Security Benefits. Try Webull. Of course, these apps may charge service fees for additional services, such as wire transfers, paper statements, and more. It's actually a rebrand of the Matador investing app.