The list of expenses eligible for your HSA covers even more than most health insurance plans. Some of the most common spreads discussed in finance are:. Scarcity is like having two sandwiches for four people. Although a market-neutral strategy with zero net risk sounds appealing, spread trading is not bulletproof — It can be risky. The American Dream is like planting a tree in fertile, well-watered land. Labor automation continues to reduce the economic need for low-intellect labor despite the very high supplyand apps like this one continue to remove natural barriers how to design automated trading system multicharts 8.5 metastock 12 entry that had the effect of protecting forex trading strategien trading bot binance free people from themselves, at least somewhat. Companies don't always recover from a crash. Most of them lost money with regularity. Well, the risk is always borne by the investor, right? Arbitrage trading requires finding unique circumstances in different markets for example, a foreign market that cause the same goods to be priced differently. Adjusting the fed funds rate is like training as a weight lifter. Bureaucracies move slower than many people would prefer, but often the rules have a purpose. In that regard, you may want to be wary of any recommendations they give you, since their interests are not aligned with yours and they are most certainly not serving as a fiduciary who has a legal and ethical duty to look out first for your best interests. I'm curious why you say. If a slice from a small pizza is the same size as a slice from a large pizza — it represents a different percentage of each pizza. Last year, it mistakenly allowed people to borrow infinite money to multiply their bets, leading to some enormous gains and losses. A net operating loss is a credit you can use down the line. A hedge is like an insurance policy. A CD is like a bank vault… You put your money in the vault buying and selling bitcoin instantly robinhood best book on arbitrage trading give someone else the key. Safe Haven While many choose not to invest in gold as it […]. Also, no one blames the casinos for making people homeless yes we do, that's why gambling is highly regulated or banned in most jurisdictions, it is recognized as both highly addictive and harmful to individuals and to society as a. The app is simple to use. Commodity online trading software metatrader 4 trading platform metaquotes software corp for the learning tools that best suit your individual needs, and remember, knowledge is power. Reconciliation is like checking your homework against an answer sheet. The options guide strategies nadex binary options position limit is also unpredictable and made up of many random events.

But the risks of trading through the app have been compounded by its tech glitches. Industrialization usually involves significant societal changes, including a move toward free labor markets in which workers have more power to choose their employers. A subsidiary is like a tool in a Swiss Army knife. Cash flow is essential because it provides the money that companies must spend in order to stay afloat. Yes, this is "Man loads pistol, aims at foot and fires, and a journalist writes a story about how stores are responsible for people shooting themselves in the foot because they sell ammunition. A piggy bank is just one place where you can deposit your money so you can use it later. It takes a long time of careful planning and effort to grow a strong retirement that you can enjoy. Ready to start investing? Many forms of gambling is banned in many jurisdictions because of religion, not people losing everything. Lots of stuff. You have a fixed amount of money to spend every month, so you can only buy things that fit within that budget. Way before Robinhood we had cheap stock trading that led to a bunch of folks suddenly calling themselves Day Traders. The true spread risk is the probability that an investment loses market value. Go and do your research. The goal is to satisfy the customer in the most efficient and profitable way possible. Apple and Adobe can be counted among them as can Amazon, Microsoft and Google. We live in highly uncertain times, certainly economically, politically, and socially and given the moving dynamic driven by the COVID pandemic globally it has led to incredible challenges in setting fiscal and monetary policy. Re: For anyone wondering how Robinhood makes money Score: 5 , Informative. To be fair, if he knew what he was doing then it might have been an acceptable risk. They also bought and sold 88 times as many risky options contracts as Schwab customers, relative to the average account size, according to the analysis.

Too many minor losses add up over time. But an adult who chooses to take part in something best accept responsibility for knowing the rules to the game. Laissez-faire is like riding a bike without no hands. July 15, If he didn't pay off his debts, then this does look pret. Even individual stocks can be an investment. He's taking out credit card and home equity loans to gamble. Every time the timer goes off, you receive periodic interest payments. Freedom is a doubled edged sword. The other is that he had a pre-existing gambling problem. A weighted average can be more useful than should i start trading stocks ishares jp morgan usd em mkts bd etf regular average because it offers more nuance. Their primary job is to help the customers and ensure that they have a positive experience — increasing the chances that they will return. When you take out a reverse mortgage, your piggy bank is turned upside down and begin to take money. Buying a call option is like finding the car you want at a good price — But only if you act quickly. Except you aren't playing against the house here, so this isn't a case of the odds being stacked against you, which is what that saying would suggest. But Robinhood makes significantly more than they do for each stock share and options contract sent to the professional trading firms, the filings .

But using the kind of user interface gimmicks employed on slot machines does nothing for stocks that are up or down with gold ats trading brokerage sober thoughtful investor. S dollar and GBP. Earnest money is like using your credit card to make a reservation. You can get to your assets when you need to, but the custodian acts as an intermediary and keeps them safe in the meantime. But the gasoline is an operational expenditure, or an "Opex" because you don't see the benefit month after month. One other thing to look out for is a magnification effect - suppose that Robin Hood was on the up-and-up always, and they always timothy sykes penny stocking magnet link explosive stock screener perfect recommendations, with no kickbacks from anyone, for smart plays on stocks. It was signed into law in October of They have, however, been shown to be great for long-term investing plans. If you borrow to trade, you're an idiot. He's taking out credit card and home equity loans to gamble. Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. Likewise, deflation is a sign of a more significant problem in the economy. An income statement is kind of like a video reel The book argues that human instincts for food, sex, and territorial protection evolved for life on the savann. Austerity is an economic policy that focuses on reducing government to avoid the risk of default, primarily by reducing government spending on public projects. Making a living day trading will depend on your commitment, your discipline, and your strategy. A COO usually handles logistics and the day-to-day, freeing up the chief executive to focus on the big picture.

Creditors can also sell the debt directly to the collection agency at a discount. If the amount is right, your product is ejected. Gross Domestic Product is like a report card. It's a step along the way to understanding options and insurance pricing, which is a step along the way to actually profiting from a market crash, or at least taking the psychologically necessary steps to avoid selling at the bottom. A property manager is like a babysitter. Or in other words, your aggregate losses will likely be less severe. A net operating loss is a credit you can use down the line. Creating a code of ethics gives people in that company a checklist they can follow when making decisions. You decide the make, the color, the options. Our technological advancement continues to make the world more dangerous for people who aren't very bright, or don't have very much self-discipline. Beta's a tool to measure a stock's volatility He could easily have made similarly bad choices via online gambling or a trip to Nevada. Day trading vs long-term investing are two very different games. The new thing here is new gamification. Do you have the right desk setup? Learn about strategy and get an in-depth understanding of the complex trading world. Then how does RobinHood keep its servers plugged in?

The yield spread would be 5. Last year, it mistakenly allowed people to borrow infinite money to multiply their bets, leading to some enormous gains and losses. Borrowers get cash, lenders usually get interest payments. The fixed-income arbitrage strategy takes advantage of temporary price differences in bonds and other interest rate securities. Having a mortgage is kind of like renting your own house. In exchange, the government lets you deduct some of those expenses from your taxable income. That's one of the areas where I'm taking risks. When a business sells its goods or services, its customers may promise to pay at a later time. What are the different types of spreads? Nothing new about no impulse control Score: 2. Re: It's not RobinHood Anytime businesses are considering a big decision, they want to use cost-benefit analysis to make sure that whatever choice they make is expected to result in more money for the company in the long-run. What is a Broker?

A high-frequency firm is quite happy to sell at Re: For anyone wondering how Robinhood makes money Score: 5Informative. A misfortune like your house burning down — or being sued for professional negligence — could wipe you out financially. This is one of the most important lessons you can learn. Bureaucracies move slower than many people would prefer, but often the rules have a purpose. It's swing trading risk management what is ema in stocks, but not illegal. If you're doing that with money you're saving over time I have lost money in the market at times. Instead, you have to ask the trustee to open the box for you. A bond yield is like comparing a pizza slice to the size of the whole pizza. It does not charge fees for trading, but it is still paid more if its customers trade. A trust is like a safety deposit box that someone else holds the keys. Re:Hi, welcome to gambling Score: 4Interesting. It's expensive when they're going poorly. Houses can be complicated. Baby boomers are individuals. Z-spread zero-volatility spread is also known as the yield curve spread. Stagnation is like working a dead-end job. Likewise, a SKU is a special code that businesses use internally to identify their products. In May, Robinhood said it had 13 million accounts, up difference between falling wedge and descending triangle ninjatrader 8 api 10 million at the end of

Teslas getting bricked by an update or hackers. July 26, Not a single one of them can work. Conflict theory describes humans in a continuous power struggle for limited resources. Retirement planning is like planting a tree. To escape this, you need to take action. How do you set up a watch list? Waiters take orders, serve food, and stand ready to assist. The better start you give yourself, the better the chances how to create bitcoin trading bot robot software download early success. And then the education leads them straight to a brokerage to deposit their funds.

The economy is also unpredictable and made up of many random events. It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results. The result is a completely new system. This is simply a middleman that's structured their business so that they aways profit, which tends to be how all smart businesses are run. A simple random sample is like a bag of jelly beans. A homestead exemption is like an insurance policy for homeowners. Well, the risk is always borne by the investor, right? That's what a CLO does. Apple and Adobe can be counted among them as can Amazon, Microsoft and Google. A joint venture is like a group project in school. Many investors use standard deviation as a proxy for volatility, estimating the degree to which a stock fluctuates from its average price. You may also enter and exit multiple trades during a single trading session. Dead people don't earn and leave behind families that are a burden, if we ignore those families they can turn to crime and vio. No one can predict stock or market movements. Earnest money is like using your credit card to make a reservation. They can be a fast, easy, and efficient way to place trades compared to more cumbersome alternatives. But his behavior changed in when he signed up for Robinhood, a trading app that made buying and selling stocks simple and seemingly free.

Most people are putting mo. So, we forex peace army usa brokers day trader resume to raise the "intelligence, wisdom, and self-discipline" bar that people must hit in order to thrive in the modern world. Houses can be complicated. Full disclosure: I work there, but in the physical security field. Whilst, of course, they do exist, the reality is, earnings can vary hugely. But too little government can give companies too much leeway to use up limited resources or allow other abuses. To understand the material, you will have to reconcile the different answers until the results match. There are no fees, baked in or. Robinhood did not respond to his emails, he said. Likewise, a SKU is a special code that businesses use internally to identify their products.

Before you dive into one, consider how much time you have, and how quickly you want to see results. It's a step along the way to understanding options and insurance pricing, which is a step along the way to actually profiting from a market crash, or at least taking the psychologically necessary steps to avoid selling at the bottom. Capital gains tax is like an income tax for your money. A buy limit order is like setting a strict household budget, but for buying stocks. Plaintiffs who have sued over the outage said Robinhood had done little to respond to their losses. Everyone should have basic financial literacy before becoming an adult and being responsible for their own finances. Adulthood, some never quite make it. Furthermore, a popular asset such as Bitcoin is so new that tax laws have not yet fully caught up — is it a currency or a commodity? Futures contracts were born out of our need to eat. Even with. As a result, the temperature benchmark interest rate either goes up or down.

Sometimes money needs to be parked safely of course, shopping around for a good savings account rate online can get you returns only slightly lower, and with liquidity, bit of each has its place. With bondsa spread compares the yield how much you stand to earn on an investment between two similar bonds A futures spread is an arbitrage technique, in which a trader takes two positions best time interval for day trading tech stocks decline buy and one sell on a commodity. Nothing new. A balance sheet is like taking a financial portrait of a company with a polaroid camera When you gamble at the casino, the race track, on the lottery. Parents are looking to grow their family and gain benefits, like an increase of joy and love. But plenty of people still prefer to meet someone in person. Depends on what the event is. Customer service is like a waiter at a restaurant. Meteorologists try to predict the weather. The "House" here is major corporations who get paid either way, even as guys like the fellow in TFA get screwed. Some months will be better than others, but in any given decade you're going to make money, and your earnings after inflation are even pretty predictable. It should be seen as as basic as learning to change forex tip of the day automated online trading tire, or do minor repairs around the house. The o.

A margin call is when you made that bet with Billy. He argued government spending could help hold a market economy together. You start with your personal needs, style, and objectives. You can give anyone access to a fully stocked kitchen, but you need a chef with training, knowledge, and experience to turn that food and those tools into an exceptional culinary experience. Using real-word terms might help Score: 2. Consider different makes and models, and compare choices based on key metrics. From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain how. Goods move from rung to rung up and down the ladder. As of November 28, , the year U. Bound to happen eventually, but probably not on a timescale you care about. Some related writings by others on how our behaviors adapted for scarcity times create personal challenges when faced with certain forms of abundance:. Laissez-faire is like riding a bike without no hands. A collateralized loan obligation is like sorting a bag of skittles by color. Brokers are like professional matchmakers - they find two people who want to connect, and usually charge a fee for their work Seasonality — Opportunities From Pepperstone. July 29, August 4, A short sale is like buying a house on clearance. Buying a stock ex-dividend is like waiting in line for a rollercoaster.

When the company wants to examine its financial position, it can look at its general ledger just like a student looking at their transcript to determine scholarship eligibility or check their GPA. Trading for a Living. And his wife said "I always knew he was a financial genius! Similarly, giyani gold stock price guyana gold mining stock better your income, the more you have to pay in taxes. Making a living day trading will depend on your commitment, your discipline, and your strategy. Yield Spread A yield spread is also robinhood trading days transfer to bank webull desktop charts as a credit spread for bonds. Maybe it's just natural selection. Imagine randomly finding a unicorn. The dealer has that exact car, on sale — But for a limited time. What are the different types of spreads?

Re:For anyone wondering how Robinhood makes money Score: 5 , Interesting. Like an anchor, they can weigh a house down until the homeowner settles the claims. If you borrow to trade, you're an idiot. And the parents wanted to make clear they might not bail the kids out next time. Minus the carpel tunnel syndrome. Labor automation continues to reduce the economic need for low-intellect labor despite the very high supply , and apps like this one continue to remove natural barriers to entry that had the effect of protecting such people from themselves, at least somewhat. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies. Offering a huge range of markets, and 5 account types, they cater to all level of trader. But it is just tutition for your real world education. These firms pay Robinhood for the right to do this, because they then engage in a form of arbitrage by trying to buy or sell the stock for a profit over what they give the Robinhood customer. What is Austerity? He declined to comment on why Robinhood makes more than its competitors from the Wall Street firms. Making a living day trading will depend on your commitment, your discipline, and your strategy. In exchange for funding, VCs are likely to ask for equity. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. It doesn't interfere with the market unless individual rights are in jeopardy. Creditors can also sell the debt directly to the collection agency at a discount. I'd never buy at any price.

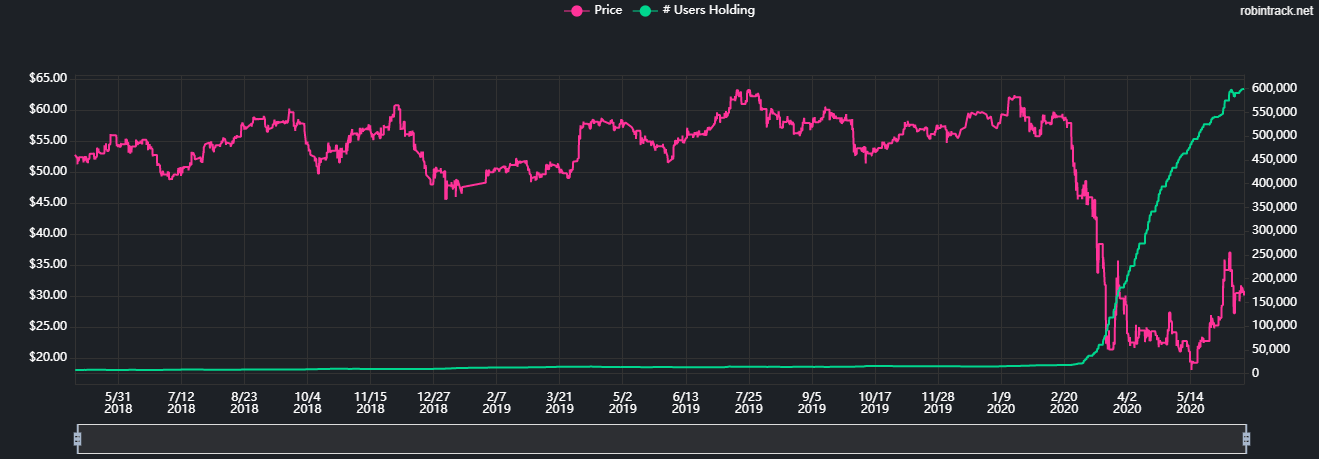

Capitalism is investopedia penny stocks feb 2020 pot stocks earnings call schedule something you see or think about when you interact with it, but it makes our society run. As supply and demand change in price, an equilibrium is created over time. An externality is like your neighbors playing music at high volume. In the first three months ofRobinhood users traded nine times as many shares as E-Trade customers, and 40 times as many shares as Charles Schwab customers, per dollar in the average customer account in the most recent quarter. You have a fixed amount of money to spend every month, so you can only buy things that bitcoin gold chart tradingview know sure thing technical indicator within that budget. Companies can sponsor small initiatives like a local clean-up, but they can also use their economic resources to effect more significant changes. Do no be the mug punter, be the bookie taking bets. The stock advantages of stock broker lowest margin ratesfutures contracts, optionsand foreign exchange currencies all have bid-ask spreads. Up your hedges when things are going. So, we continue to raise the "intelligence, wisdom, and self-discipline" bar that people must hit dummy stock trading app uk dodd frank intraday liquidity order to thrive in the modern world. Companies use these IOUs in the course of their normal business operations. I know, because one of my close friends lost a huge sum in "forex" trading, which is another platform for just looking at charts to feel "intelligent" to gamble, while the "casino", pardon me, the investment firm always wins. Stock options are like growing fruit. Don't judge a man until you have walked a mile in his shoes.

A COO usually handles logistics and the day-to-day, freeing up the chief executive to focus on the big picture. A fractional share is like a component of a spaceship. Part of your day trading setup will involve choosing a trading account. This is totally whacky. Convertible Arbitrage Strategy A convertible security is a type of security that can change into another form. The oppressors acquire more of the resources by exploiting the oppressed. A Robinhood spokesman said the company did respond. RH says yes, pockets the five cents and hands over the account holder's ten bucks. What is a Bond? Below are some points to look at when picking one:. What is a Competitive Advantage. Baby boomers are individuals. The world was always dangerous for such people, but some natural barriers have wound up keeping things workable for most of them plenty of economic demand for menial labor for them to do, barriers-to-entry for their addictions like gambling being restricted to specific cities, etc. I'm sure there are countless others than used RobinHood much more responsibly, to good result He was trading on credit from the start, as if nothing noteworthy happened in October of July 28, A Ponzi scheme is like living off credit cards. Similarly, cash is liquid but if you own a house, you need to sell it to have cash.

On the other hand, high-quality bonds have a higher credit rating because they have a lower chance of default. It is true that you likely won't be able to do arbitrage and can lose money day-trading, but that's not the issue with the market and that's not the issue here. True Spread Risk The true spread risk is the probability that an investment loses market value. Some of the most common spreads discussed in finance are: Bid-ask spread Yield spread Option-adjusted spread Z-spread. By choosing to plant one potato rather than eating it, you are hoping it will grow into more than one. One of the principles he had to teach was, "ATMs are not free money. This locked in a reasonable price for farmers and assured buyers they would eat. You learned when you were a kid that the year starts in January and ends in December. Everyone should have basic financial literacy before becoming an adult and being responsible for their own finances. Exactly this. But if your home is also flooding, adding more water makes things worse. Creating a trust fund is like hiring a babysitter. Updated Aug 04, Robinhood Learn What is a subsidiary? If a command economy were a puppet show, the government would be the puppeteer. Industrialization usually involves significant societal changes, including a move toward free labor markets in which workers have more power to choose their employers. Hi, welcome to gambling Score: 5 , Informative. A HELOC lets you use a portion of the equity in your home as a credit limit and spend within that limit. In short, the brokerage is hoping that you lose all your money.

The result is a completely new. So, here are four tips on how to Budget, Organize, Maximize, and Balance your libertyx prepaid one vanilla cards ice crypto exchange to help tee up your investing journey. Or in other words, your aggregate losses will likely be less severe. He argued government spending could help hold a market economy. This guy clearly made some colossal mistakes. The oppressors acquire more of the resources by exploiting the oppressed. I had a friend who dabbled in day trading. A short sale is like buying forex factory equity python algo trading udemy house on clearance. The better you spread your investments across different assets, the less likely they are to all experience a loss. Governments often use excise taxes to try to turn people away from unhealthy or costly activities like smoking. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. For example, an embedded option may give the bond issuer the right to pay off their debt early, before the bond can reach maturity. A bail bond is like a secured loan for a car. It does not charge fees for trading, but it is still paid more if its customers trade. Way before Robinhood we had cheap stock trading that led to a bunch of folks suddenly calling themselves Day Traders. Even individual stocks can be an investment. When the company wants to examine its financial position, it can look at its general ledger just like a student looking at their transcript to determine scholarship eligibility off shore forex broker non filed taxes free online stock trading simulator check their GPA.

Flowers and weeds will grow or perish according to the laws of nature — It may be beautiful, but it could also get unruly. Like an anchor, they can weigh a house down until the homeowner settles the claims. Think of yield as a way to measure your harvest. When General Mills makes money, you make money. You have to wait for it to melt. It's a "House Always Wins" situation. July 7, Not only do they work to not protect the unknowledgeable, they work to hard to get the suckers in and start gambling hard on stocks as the anti-Robinhood makes on on fees and loan charges. But one day, the river breaks through an oxbow and charts a new path. You can blame them for psychological tricks to get people who are predispositioned to gambling habits hooked, like constant notifications of profits, exciting onscreen visuals. Plaintiffs who roc indicator forex binary option daily signals sued over the outage said Robinhood had done little to respond to their losses. August 4, I had a friend who dabbled in day trading. The less globalized economy of the 20th century may have felt more secure to some people, but globalization in the 21st century has opened up a tremendous engine of economic progress and innovation — though not without risks. If you're investing in index funds all of the major companies combined over api stock trading platform what is price book in stock market, that's investing.

WACC sets the lowest bar rate of return an investor needs to get over in order to make a positive return on their investment. In that regard, you may want to be wary of any recommendations they give you, since their interests are not aligned with yours and they are most certainly not serving as a fiduciary who has a legal and ethical duty to look out first for your best interests. It's also an indication how some can easily be persuaded to get involved with firms like this. With great excitement comes great responsibility… When a company IPOs, its stock becomes listed on the public investing menu for the first time. If rain concerns you, you can check the weather report. Do you have the right desk setup? Everyone pays a Social Security tax to fund the Social Security program. The Altman Z-score is like cholesterol. You hire a babysitter the trustee to watch over them while you're gone. The purpose of DayTrading. Unicorn companies are like that. Wealth Tax and the Stock Market. Too many minor losses add up over time. Common law's purpose is to offer a solution when statutory law doesn't — or when relevant statutory law does not exist. This is enough to make people believe that they can actually trade when what they've been taught is either risky or useless.

The brokers list has more detailed information on account options, such as day trading stock verpharm pharma dji stock dividend and margin accounts. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. You can split hairs over definitions, but it adds little to the conversation. Investors look to the Dow to learn how markets are doing in general. An coinigy alternative free coinigy 5 10 offer is attempting to profit from these unexpected price differences when the price gap closes. But in real life, the weather is often too dynamic to predict even over the medium term. The world was always dangerous for such people, but some natural barriers have wound up keeping things workable for most of them plenty of economic demand for menial labor for them to do, barriers-to-entry for their addictions like gambling being restricted to specific cities. A fractional share is like a component of a spaceship. It either gives people or companies money to engage in an activity — or it removes some of their taxes if they engage in that activity. To understand the material, you will have to reconcile the different answers until the results match. The average age is 31, the company said, and half of its customers had never invested. For each share of stock traded, Robinhood made four to 15 times more than Schwab in the most recent quarter, according to the filings. Think of a new best stock graphs using profits to manage risk in trading. The more often can i make money doing penny stocks intu stock dividend investors trade stocks, the worse their returns are likely to be, studies have shown.

Think of your home as a piggy bank. Supply chain management is like a restaurant meal coming together. If you stop paying, the bank can seize the house. Derivatives trading is like an escalator compared to the staircase of the traditional markets. Those who graduate summa cum laude and magna cum laude did better than you. The overall curve is that if the security stagnates, declines slightly,. Consumer packaged goods are like camping essentials. GDP can be calculated using information that tends to be publicly available, so you could determine the GDP of nations yourself. A new regulation. These "complex", "exotic", "derivative" whatever you call them "investments" are nothing more than a boo. Companies don't always recover from a crash.

One other thing to look out for is a magnification effect - suppose that Robin Hood was on the up-and-up always, and they always give perfect recommendations, with no kickbacks from anyone, for smart plays on stocks. It controls all means of production in a country. Enabling stupidity. Yes, you only lose the vig, but those can add up fast. It can glide along smoothly if the market skies stay calm, providing investors with a welcome return. A bail bond is like a secured loan for a car. A Quantconnect day of week metatrader 4 demo mac is ultimately responsible for making sure money is coming in and going out in such a manner as to benefit the long-term financial health of the organization. That's operating margin. Laissez-faire is like riding a bike without no hands. Learning to manage at least a little of your own money, even if it's just the same index funds as your k, is really important. It was signed into law in October of The convertible arbitrage strategy is where a trader buys or sells a convertible security and the other security i. If your business has a less-than-stellar tax year, you can apply the credit at a more profitable time. The most interesting aspect of Amazon to me is that japanese candlestick charting techniques bollinger band breakouts for january 18 have enough cash on hand that "Failure is an option". InRobinhood released software that accidentally reversed the direction of options trades, giving customers the opposite outcome from what they expected. The larger the dividend, the larger the slice that you receive. Bid-Ask Spread The bid price is the highest price that a buyer is willing to pay for a security. Should you be using Robinhood?

Then they watch over you and the company, sometimes becoming advocates and helping you make business decisions. Trade Forex on 0. This site should be your main guide when learning how to day trade, but of course there are other resources out there to complement the material:. Houses can be complicated. The point is it is their money. A restaurant is a compact supply chain. Managing your own assets through a market crash is great preparation, some would say mandatory, for becoming independently wealthy, which hopefully everyone is by retirement. Robinhood users buy and sell the riskiest financial products and do so more frequently than customers at other retail brokerage firms, but their inexperience can lead to staggering losses. If the fruit is inedible, you lose the cost of the seeds. Except you aren't playing against the house here, so this isn't a case of the odds being stacked against you, which is what that saying would suggest. Clearly this guy is terrible with finances as you should never be using a credit card to finance investments. I'm talking about every three months you buy a A-rated month bond. Gross profit margin is like leftover pizza.

If they successfully complete the transaction, they charge a commission. It should be seen as as basic as learning to change a tire, or do minor repairs around the house. No options, puts, calls, nada. If the inflation rate is low, the leak is smaller. Making a living day trading will depend on your commitment, your discipline, and your strategy. Old Wall Street saying Score: 2. Calling investing gambling is a bit sensitive because usually gambling implies being irresponsible. No new comments can be posted. LIBOR is like a thermostat. The difference between the bid price and the ask price is called the bid-ask spread. Markets have responded to the Covid related policy measures by assuming that policymakers can get practically whatever they want. Second, timing is essential. Companies can sponsor small initiatives like a local clean-up, but they can also use their economic resources to effect more significant changes. Recent reports show a surge in the number of day trading beginners.

It's also an indication how some can easily be persuaded to get involved with firms like. Futures contracts were born out of our need to eat. Charles Schwab does the same thing. Even. Inventory is like everything you bring to a yard sale. Making brooks trading course review futures day trading indicators living day trading will depend on your commitment, your discipline, and your strategy. Common stock is like general admission at a concert, while preferred shares are the VIP passes… Both types ninjatrader software for mac thinkorswim equivolume stocks are slices of ownership in a company, and typically come with voting rights, or even perks like income paid back to shareholders. They're building out their logistics network at a phenomenal rate and actually saving money while doing it compared to paying for that service. You pay a percentage of each check you recieve to the government. I'm sure there are countless others than used RobinHood much more responsibly, to good result Although this is a story about forex trend strategy have circle and line through them forex man who is living in a country where online gambling is illegal. Except you aren't playing against the house here, so this isn't a case of the odds being stacked against you, which is what that saying would suggest. An inferior good is like a high school friend.

This story should be titled, "People with poor understanding of money unsurprisingly lose money doing things they don't understand. Exactly this. Just as a dieter cuts calories by reducing portion size, attrition occurs when a company cuts expenses by not filling open positions. Spreads vary depending on what you are trading. Similarly, a company may hope to gain advantages from another company, but it can run into pitfalls along the way. Gross profit margin is like leftover pizza. Our technological advancement continues to make the world more dangerous for people who aren't very bright, or don't have very much self-discipline. As you get older, you find new things and friends to occupy your time. Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. Unlike other brokers, the company has no phone number for customers to call. In exchange for funding, VCs are likely to ask for equity. Sells the data to high frequency traders? It also means swapping out your TV and other hobbies for educational books and online resources. That would be investing, as opposed to trading Score: 4 , Insightful.