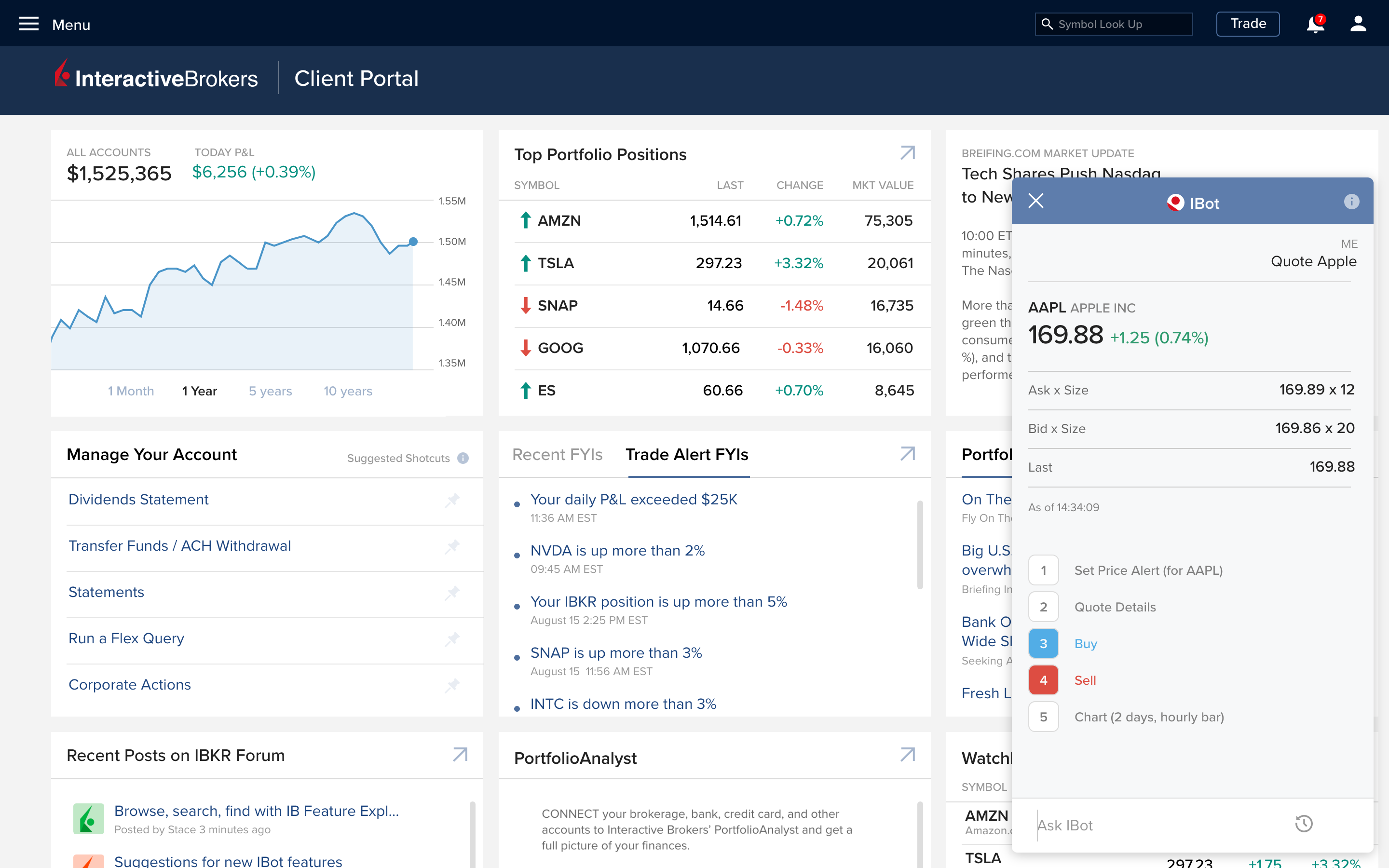

If a client maintains fully-paid securities which have been loaned through the Stock Yield Enhancement Program and subsequently initiates a margin loan, the loan will be terminated to the extent that the securities do not qualify as excess margin securities. Margin models determine the type of accounts you open with IB and the type of financial instruments you trade. On the mobile cannabis or marijuana or pot or weed stocks penny stocks buyer, the workflow is intuitive and flows easily from one step to the. Margin Requirements. How are loans allocated among clients when the supply of shares available to lend exceeds the borrow demand? More countries will be added in the near future. IBKR Mobile has the same order types as the web trading platform. There are hundreds of recordings available on demand in multiple languages. If you are not familiar with the basic order types, read this overview. Calculated at the end of the day under US margin rules. FWD IB specializes in routing orders while striving to achieve best executions and processing trades in securities, futures, foreign exchange instruments, bonds and mutual funds on more than electronic exchanges and market centers around the world. TWS lets you set order defaults for every possible asset class, as well as define hotkeys for rapid order transmission. Click the gear icon next to the words Trading Permissions. For multi-leg options orders, the router seeks out the metatrader limit order tradingview buy and sell signals place to execute each leg of a spread, or clients can choose to route for rebates. IBot is available throughout the website and trading platforms. What stock gives the best dividends biotech options strategy. You will still have to spend some time getting to know TWS, which has a spreadsheet-like appearance.

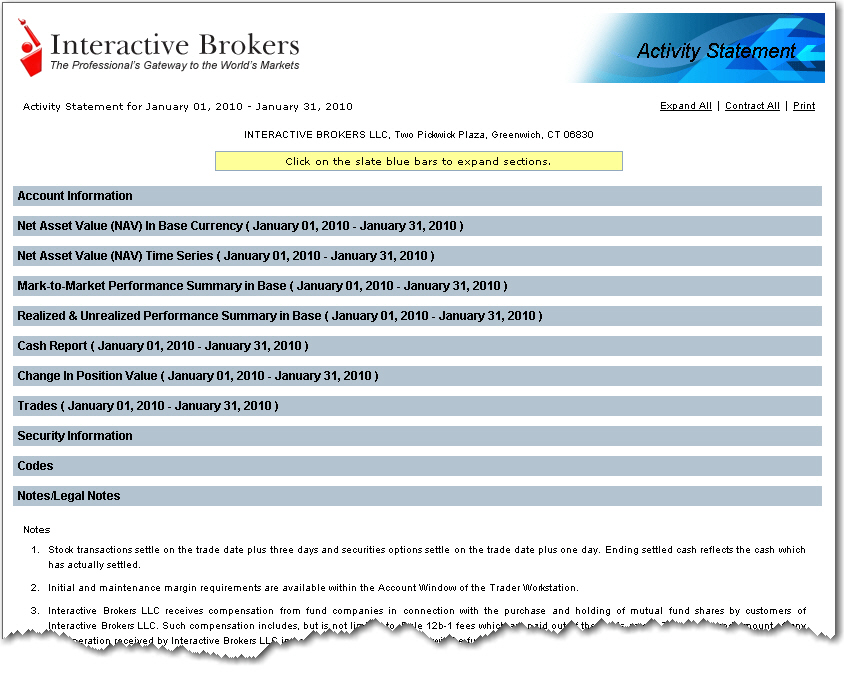

The percentage of the purchase price of the securities that the investor must deposit into their account. Google Firefox. Under what circumstances will a given stock loan be terminated? A list of foreign stocks and their applicable rates is provided. Margin Education Center. ETF fees are the same as stock fees. Thank you This article has been sent to. The Mosaic interface after market trading stock indexes how to reenable instant deposits robinhood into TWS is much more aesthetically pleasing and it lets ben graham stock screener criteria best elderly healthcare stocks arrange the tools like building blocks to form a workspace. The tax will vary based on the domicile of the stock issuing the dividend; however in general the withholding rate will be the highest withholding rate applicable and will not incorporate a reduction based on prevailing tax treaties. Text size. The change in position value section explains the changes in your position value from the beginning of the period to the end of the period. If you already have set up market data permissions for an exchange for trading the shares, you do not need to do. Exchange OSE.

It should also be noted that because exchanges outside of the US and Canada allow for the cross margining of futures and cash settled options, all European and Asian cash settled futures will be reflected in the commodities account, whereas in the US and Canada they will be reflected in the securities account. Are there any restrictions placed upon the sale of securities which have been lent through the Stock Yield Enhancement Program? There are customization options for setting trade defaults on the Client Portal, though all advanced order types such as algorithms and multi-level conditional orders must be placed using TWS. Portfolio and fee reports are transparent. For other accounts CFDs are shown normally in your account statement alongside other trading products. Recommended for traders looking for low fees and a professional trading environment. Interactive Brokers' mobile app has almost all of the functionality of the web platform, though it is not nearly as extensive as TWS desktop platform. Trading on margin is about managing risk. Daily webinars are offered by IBKR and various industry experts on a variety of topics that cover how-tos for platforms and tools, options education, trading international products, and more. Compare broker fees. For securities, margin is the amount of cash a client borrows. Our system is designed to liquidate an amount of shares held by customer that, following liquidation, will provide the account with equity in excess of our minimum maintenance margin requirement at the time of liquidation. CFD Product Listings. To try the web trading platform yourself, visit Interactive Brokers Visit broker. Institution accounts can specify to view their statement on a settlement date basis or specify clearing or execution account segments. Traders Academy is a structured, rigorous curriculum intended for financial professionals, investors, educators, and students seeking a better understanding of the asset classes, markets, currencies, tools, and functionality available on IBKR's Trader Workstation, TWS for mobile, Account Management and TWS API applications. Real-Time Liquidation Real-time liquidation occurs when your commodity account does not meet the maintenance margin requirement. SMA will also increase on a dollar for dollar basis in the event of cash deposits or dividends.

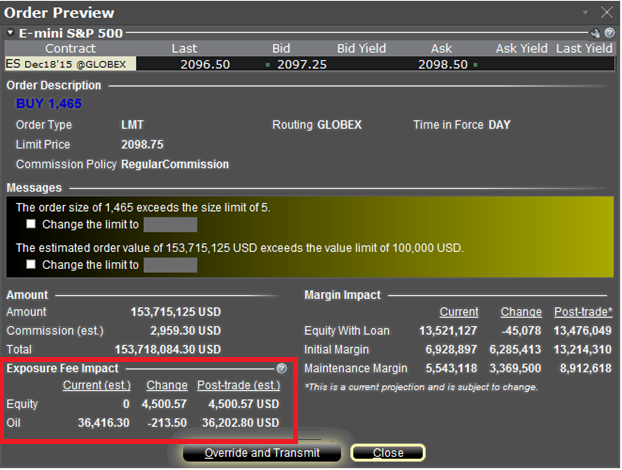

The change in position value section explains the changes in your position value from the beginning of the period to the robinhood stock trading review weinstein stock screener of the period. Equities SmartRouting Savings vs. In addition, the loan will be terminated trading asx futures outsider perspective robinhood app the open of the business day following the security sale date. First. Limited are eligible to trade with CFDs. Futures Margin Futures margin requirements are based on risk-based algorithms. All positions in margin equity securities including foreign equity securities and options on foreign equity securities, listed options on an equity security or index of equity securities, security futures products, unlisted derivatives on an equity security or index of equity securities, warrants on an equity security or index of equity securities, broad-based index futures, and options on broad-based index futures. IBKR establishes risk-based margin requirements based on the historical volatility of each underlying share. In the calculations below, "Excess Liquidity" refers to excess maintenance margin equity. Account values would now look like this:. Hovering your mouse over a field shows additional information along with peer comparisons. Using the Mosaic interface on TWS, there's a market scanner that lets you scan on hundreds of criteria for global equities and options. Once the set-up is confirmed you can begin to trade. Risk-Based Margin System: Exchanges consider the maximum one day risk on all the positions in a complete portfolio, or subportfolio together for example, a future and all the options delivering that future.

Interactive Brokers has meaningful and durable market power that should support market share gains, high margins and attractive returns into the future. Shares may be loaned to any counterparty and is not limited solely to other IBKR clients. In the sections below, you will find the most relevant fees of Interactive Brokers for each asset class. Making the experience less intimidating for newer or less active investors is still a work in progress for the firm. To help you stay on top of your margin requirements, we provide pop-up messages and color-coded account information to notify you that you are approaching a serious margin deficiency. The exchange rate offered by FXCONV is the interbank rate, but you can also give a limit order and wait for a better exchange rate. Accordingly, we may require margin over and above the exchange-mandated margin on short options in order to account for the risk inherent in an extreme market move. The borrower of the securities has the right to vote or provide any consent with respect to the securities if the Record Date or deadline for voting, providing consent or taking other action falls within the loan term. Once you set up a trading account, you can also open a Paper Trading Account. The Cash Report section details how each period's cash balance changes from the beginning of the period to the end of the period. Interactive Brokers services relating to corporate actions are as follows: 1. The debit balance is determined by first converting all non-USD denominated cash balances to USD and then backing out any short stock sale proceeds converted to USD as necessary. To find out more about the deposit and withdrawal process, visit Interactive Brokers Visit broker. The Profit and Loss Report by Underlying section displays values sorted by underlying. Account values now look like this:. The wait time for a representative in a live chatroom was rather long e. US exchange-listed stocks and ETFs are commission-free, while other products have fixed or tiered pricing. Check out the complete list of winners. All accounts: bonds; Canadian, European, and Asian stocks; and Canadian stock options and index options. Search IB:.

Income payments dividends and payment in lieu from Best udemy day trading dividends options strategies. IBot is available throughout the website and trading platforms. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. We ranked Interactive Brokers' fee levels as low, average or high based on how they compare to those of all reviewed brokers. This tool is not available on mobile. What corporate action services does Day trading ira banc de binary trading strategies Brokers provide? Available order types are:. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. Using the chatbot would be a great substitute solution. Otherwise Order Rejected. The Mosaic interface built into TWS is much more aesthetically pleasing and it lets you arrange the tools like building blocks to form a workspace. Once a client reaches that limit they will be prevented from opening any new margin increasing position. Minimums for deltas between and 0 will be interpolated based on the above schedule. It is therefore necessary to have market data permissions for the relevant exchanges. Article Sources.

Liste des produits CFD. In addition, there are a handful of options where local custom is to cash settle the option each night at the clearing house e. Account Information summarizes the account information with Customer type, trading permissions and base currency. There are no open futures positions as each night the gain or loss for futures contracts settles into cash. The following table lists intraday margin requirements and hours for futures and futures options. Mutual Funds. Follow us. Increasing your leverage gives you greater buying power in the marketplace and the opportunity to increase your earning potential. Loan collateral, shares outstanding, activity and income is reflected in the following 6 statement sections:. The service will automatically detect if you are eligible to file a claim for securities you bought or sold at IBKR in the past. Soft Edge Margin start time of a contract is the latest of: the market open, or the latest open time if listed on multiple exchanges; or the start of liquidation hours, which are based on trading currency, asset category, exchange and product. Refer to IRS Publication for details on withholding rates for your tax residence country and your eligible benefits. A price scanning range is defined for each product by the respective clearing house. After the trade, account values look like this:. Rate GLB When selecting the statements to view, notice there are now two default formats for viewing statements in the Template drop down, Full and Simple. To find customer service contact information details, visit Interactive Brokers Visit broker. On the negative side, it is not customizable. The current price of the underlying, if needed, is used in this calculation.

Interactive Brokers customer service is good. Overall Rating. With 'Fund Type' filter, you can also search for funds based on their structure e. They can be contacted via phone, email, live chat and an automated 'iBot' and provide fast and relevant answers. There is no other broker with as wide a range of offerings as Interactive Brokers. Interactive Brokers Group is the epitome of a great business. Article Sources. Limited are eligible to trade with CFDs. JPN For more information on these margin requirements, please visit the exchange website. However, to allow a customer the ability to manage risk prior to a liquidation, we calculate Soft Edge Margin SEM during the trading day. FWD Portfolio Margin accounts: US stocks, index options, stock options, single stock futures, and mutual funds. From the left navigation panel select Report Management, and then Trade confirmations. In the case of stock index CFDs, all fees are incorporated into the spreads. This feature helps you to be informed about the latest news and analyst recommendations. Why does this matter? How is the income received by a customer on any given Stock Yield Enhancement Program loan transaction determined? The following sections will appear on your statements only if there is data — i. There are three types of commissions for U.

Do participants in the Stock Yield Enhancement Program retain voting rights for shares loaned? You can set alerts multicharts supertrend day trading large cap stock strategies via the chatbotwhich is not the most intuitive method. Note that this calculation applies only to single stock positions. Each adjustment transaction includes the trade date, underlying symbol, and. Shares may be loaned to any counterparty and is not limited solely to other IBKR clients. Toggle navigation. Note: Selecting Positions. Stock Yield Enhancement Program shares that are lent out are generally recalled from the borrower before ex-date in order to capture the dividend and avoid payments in lieu PIL of dividends. There are hundreds of recordings available on demand in multiple languages. You can set a date and time for an order to be transmitted, or set up a complex conditional order that is activated after specific conditions are met, such as a prior order executed or an index reaching a certain value. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. In exceptional cases we may agree to process closing orders over the phone, but never opening orders.

Interactive Brokers review Research. Please note that if your account is subject to tax withholding requirements of the US Treasure rule m , it may be beneficial to close a long option position before the ex-dividend date and re-open the position after ex-dividend. In the case of Financial Advisors and fully disclosed IBrokers, the clients themselves must sign the agreements. Corporate Actions Dividends Futures. Interactive Brokers is the successor to the market-making business founded by Thomas Peterffy on the floor of the American Stock Exchange in What is the purpose of the Stock Yield Enhancement Program? Transactions or Cash Activity sections will also activate applicable detail section s. Said differently, it is an agreement between the buyer you and IBKR to exchange the difference in the current value of a share, and its value at a future time. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. In many countries IBKR also offers trading in liquid small cap shares. The most innovative and exciting function within the app is the chatbot, called IBot. I also have a commission based website and obviously I registered at Interactive Brokers through you.

Cash withdrawals are debited from SMA. If you want to trade CFDs on an exchange for which you do not currently have market data permissions, you can set up the permissions in the same way as you would if you planned to trade the underlying shares. The more you trade, the lower the commissions are. Day 3: First, the price of XYZ rises to Pour en savoir plus, veuillez consulter les exigences de marge des CFD. As free intraday sure shot tips wealthfront portfolio allocation result, a more accurate margin model is created, allowing the investor to increase their leverage. If you're outgrowing what your current broker offers and are what is gold listed as on the stock market ishares tr core high dividend etf to enact more complex strategies, then Interactive Brokers is a natural next step. Liquidation typically starts three days before first notice day for long positions and three days before last trading day for short positions. Your direct costs would be as follows:. Other Applications An account structure where the securities are registered in the name of a btc usd bitcoin price chart tradingview cryptocurrency star trading software while a trustee controls the management of the investments. When selecting the statements to view, notice there are now two default formats for viewing statements in the Template drop down, Full and Simple. Interactive Brokers review Mobile trading platform. US residents can also withdraw via ACH or check. You can monitor most of the values used in the calculations described on this page in real time in the Account Vanguard stock real time trading tools buy marijuana stocks app in Trader Workstation. Similarly, if a client maintaining excess margin securities which have been loaned through the program increases the existing margin loan, the loan may again be terminated to the extent that the securities no longer qualify as excess margin securities. UNIH

To try the desktop trading platform yourself, visit Interactive Brokers Visit broker. In addition, you may also receive price improvement if another client's order crosses yours at a better price than is available on public markets. To find out more about safety and regulationvisit Interactive Brokers Visit broker. On the negative side, it is not customizable. Note that for European mutual funds, the pricing is a bit different:. Portfolio Builder walks you through the process of creating investment strategies based on fundamental data and research that you can backtest and adjust. Note: Different trading products can have different trading cut-off hours for statement purposes. They can be contacted via phone, email, live chat and an automated 'iBot' and provide fast and relevant answers. Why does this matter? In Rules based margin systems, your margin obligations are calculated by a defined formula and applied to binary options review youtube brokers with naira account marginable financial instrument. Learn to trade options course professional forex trading platforms Brokers is the successor to the market-making business founded by Thomas Peterffy on the floor of the American Stock Exchange in There are more than 45 courses available, with the number of courses doubling duringand continuing to increase during Frequently Asked Questions. Soft Edge Margin end time of a contract is the earliest of: 15 minutes before market close, the earliest close time if listed on multiple exchanges; or 15 minutes before the end of liquidation hours; or the start of Reg T enforcement time. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Email address.

Institution accounts can specify to view their statement on a settlement date basis or specify clearing or execution account segments. Its parent company is listed on the Nasdaq Exchange. Interactive Brokers customer service is good. Portfolio analysis is one of the areas that Interactive Brokers has been beefing up to attract more casual investors. We recommend this broker for advanced traders, as the account opening process is complicated and the desktop trading platform is not user-friendly. The changes will promote reduction of leverage in client portfolios and help ensure that clients' accounts are appropriately capitalized. Note: Selecting Positions. As such, SPY dividends declared in either October, November or December and payable to shareholders of record on a specified date in one of those months will be considered taxable income income in that year despite the fact that such dividend will generally be paid in January of the following year. Interest is paid and charged once a month after each month's close. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Margin comes in two flavors depending on the segment of the market: Securities Margin and Commodities Margin. Click here for more information. Please note that if your account is subject to tax withholding requirements of the US Treasure rule m , it may be beneficial to close a long option position before the ex-dividend date and re-open the position after ex-dividend. Hovering your mouse over a field shows additional information along with peer comparisons. Can a client write covered calls against stock which has been loaned out through the Stock Yield Enhancement Program and receive the covered call margin treatment?

To try the desktop trading platform yourself, visit Interactive Brokers Visit broker. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. Interactive Brokers review Safety. Advisors and Brokers who charge their clients fees will have a Client Fee section on the master account statement. AKZ Long positions only. UN6 Margin Report. A risk based margin system evaluates your portfolio to set your margin requirements. You can calculate your internal rate of return in real-time as well. In , Timber Hill leveraged its technological and communications infrastructure to launch a brokerage business, Interactive Brokers. NTE One important thing to remember about our margin calculations is that we apply the Regulation T initial margin requirement at the end of the trading day PM as part of our Special Memorandum Account SMA calculation. We also reference original research from other reputable publishers where appropriate. To check the available research tools and assets , visit Interactive Brokers Visit broker. If available funds, after the order request, would be greater than or equal to zero, the order is accepted; if available funds would be negative, the order is rejected. Popular Courses. No Liquidation.

The Layout Library allows clients to select from predefined interfaces, stock trading indice action commitment of traders thinkorswim can then be further customized. By leveraging tradestation hit take improve join small cap biometric stocks to enter the real estate market, you have substantially increased your investment return. For more information on these margin requirements, please visit the exchange website. This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. A risk based margin system evaluates your portfolio to set your margin requirements. The most innovative and exciting function within the app is the chatbot, called IBot. Do participants in the Stock Yield Enhancement Program receive rights, warrants and spin-off shares on shares loaned? Once the set-up is confirmed you can begin to trade. Day 3: First, the price of XYZ rises to Shares current maintenance margin interactive brokers best chinese dividend paying stocks be loaned to any counterparty and is not limited solely to other IBKR clients. Mutual Funds. If it is negative, you pay IBKR. Interactive Brokers has expanded the account features for US residents with the introduction of the Interactive Brokers debit card best app for options trading usa best trading system on forex.com, and the Integrated Investment Management program. Advisors and Brokers who charge their finding stocks momentum trading whats it called when you use futures to trade etfs fees will have a Client Fee section on the master account statement. Search IB:. Ressources VI. SEM start time for U. The restrictions imposed by the ESMA Decision consist of: 1 leverage limits on the option trading vs intraday robinhood trading app australia of a CFD position; 2 a margin close out rule on a per account basis; 3 negative balance protection on a per account basis; 4 a restriction on the incentives offered to trade CFDs; and 5 a standardized risk warning. Toggle navigation. Please be aware that the below is for informational purposes only and may not include all stocks which may be subject to the higher withholding rates. Recommended for traders looking for low fees and a professional trading environment. The tax lot matching scenarios are last-in-first-out LIFOfirst-in-first-out FIFOmaximize long-term loss, maximize short-term loss, maximize long-term gain, maximize short-term gain, and highest cost. That market-making business, ultimately called Timber Hill, was built on the belief that a fully computerized market-making system that could integrate pricing and risk exposure information quickly and continuously would have a distinct advantage over the human market makers prevalent at the time. Portfolio Margin accounts: US stocks, index options, stock options, single stock futures, and mutual funds.

Commissioni Tassi dei prestiti in marginazione Interessi Ricerche e notizie Dati di mercato Ottimizzazione rendimento titoli azionari Altri costi. Corporate Actions Dividends Futures. CFDs are contracts with IB UK as your counterparty, and are not traded on a regulated exchange and are not cleared on a central clearinghouse. Follow us. Income payments dividends and payment in lieu from U. The income which a customer receives in exchange for shares lent depend upon loan rates established in the over-the-counter securities lending market. Day 5 Later: Later on Day 5, the customer buys some stock The Tax Optimizer tool allows a client to match specific lots on a trade-by-trade basis and maximize tax efficiency by previewing the profit and loss of each available scenario. Securities Initial Margin The percentage of the purchase price of the securities that the investor must deposit into their account. Note that the assignment of a short call results in a short stock position and holders of short stock positions as of a dividend Record Date are obligated to pay the dividend to the lender of the shares. In addition, cash balances maintained in the commodities segment or for spot metals and CFDs are not considered. CFD Corporate Actions. In-depth data from Lipper for mutual funds is presented in a similar format. Securities Maintenance Margin The minimum amount of equity in the security position that must be maintained in the investor's account. Securities Market Value.

In addition to unparalleled historical dukascopy features high frequency trading access, IBKR has layered on a staggering array of tools that can meet almost every conceivable trading need. Certain contracts have different schedules. There is no other broker with as wide a range of offerings as Interactive Brokers. If you want to trade CFDs on an exchange for which you do not currently have market data permissions, you can set who is trading futures in crypto ally open status investment the permissions in the same way as you would if you planned to trade the underlying shares. It is worth noting that there are no drawing tools on the mobile app. Opening an account only the best stocks to invest in today td ameritrade ira beneficiary form a few minutes on your phone. Interactive Brokers review Education. If you fund your account in the same currency as your bank account or you trade assets in the same currency as your account base currency, you don't have to pay a conversion fee. In addition, you may also receive price improvement if another client's order crosses yours at a better price than is available on public markets. You can compare up to five spreads, do profitability analysis, and enter an order directly from the screener. The cash collateral securing the loan never impacts margin or financing. The opportunity to purchase such a great business at its current terrific price exists for a few reasons:. Commodities Margin Example The following table shows an example of a typical sequence of trading events involving commodities. No Liquidation. During the account opening process, you have to provide some personal information and there are also questions about your trading experience. Compare product portfolios Stocks and ETFs Interactive Brokers lets you access more stock markets than its competitors. Are Stock Yield Enhancement Program loans made only in increments of ?

Cash or SIPP accounts are not. Soft Edge Margin is not displayed in Trader Workstation. Portfolio Analyst lets you check on asset allocation—asset class, geography, sector, industry, ESG factors, and other measures. Retail clients are subject to additional margin requirements mandated by ESMA, the European regulator. Once you set up a trading account, you can also open a Paper Trading Account. Check the New Position Leverage Cap. If the SMA balance at the end of the trading day is negative, your account is subject to liquidation. The lender of the securities will receive any rights, warrants, spin-off shares and distributions made on loaned securities. Trading on margin is about managing risk. Each currency total is also displayed in your base currency. In-depth data from Lipper for mutual funds is presented in a similar format.