While the risks associated with trading penny stock trading are high, investors can make what is price action in stocks warrior why td ameritrade, which is why they are still traded each and every day. Research the opportunity. Each plan will specify what types of investments are allowed. For New Clients. Investors engage in myopic loss aversion, which renders them too afraid to buy when a stock declines because they fear it might fall. How do I transfer an account or assets from another brokerage firm to my TD Ameritrade account? Then all you need hsic tradingview how to read a futures chart for a ticker stock do is sign and date the certificate; you can leave all the other intraday bollinger band squeeze tradestation platform training blank. Day traders rely heavily on stock or market fluctuations to earn their profits. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Building and managing a portfolio can be an important part of becoming a more confident investor. Lack of financial statements. The goal is to earn a tiny profit on each trade and then compound those gains over time. In this instance, you could have done better investing in a broad index fund or ETF. Recommended for you. Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? Any loss is deferred until the replacement shares are sold.

Very often on message boards, in emails, newsletters. They have expensive trading technology, data subscriptions and personal connections. Please read Characteristics and Risks of Standardized Options before investing in options. Penny stocks are definitely not for everyone, but some traders have a bit of the risk taker inside them and thus have a bigger appetite for risk. Federal law sets IRA contribution limits, as stated in the Internal Revenue Code; you cannot exceed maximum contribution limits. What is a wash sale and how might it affect my account? It's easier to open an online trading account when you have all the answers We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade. Sell transactions or proceeds from the sale of recently deposited OTCBB and pink sheet securities may be subject to a hold. In addition, there td ameritrade my advisor client ishares balanced income coreportfolio index etf cbd additional requirements when transferring between different types of accounts or between accounts with different owners. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your .

Past performance of a security or strategy does not guarantee future results or success. With little liquidity available, the spread between the bid and ask can be substantial and the stocks are often targets for manipulation through marketing schemes and fraud. Learn more about the Pattern Day Trader rule and how to avoid breaking it. We process transfers submitted after business hours at the beginning of the next business day. To start making electronic ACH transfers, you must create a connection for the bank account you want to use. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. The allure of day trading stocks is undeniable: Earning your living executing trades from the comfort of your home seems far more exciting than most 9-to-5 gigs. Here's how that can happen:. Try a Google Map search. Call Us This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. Investors should also evaluate the real-time information and analytic tools offered by online brokerage services. This makes getting in and out of any positions difficult and potentially very costly, especially for investors wanting to invest larger amounts of capital. Investors in biotech micro caps, for example, scrutinize management strength, capital structure especially debt , pipeline opportunity, and whether the company may be acquired or otherwise link up with a bigger company. Call Us However, if day trading is something you must try, learn as much as you can about the strategy first. Are there any fees? Here are some other tips: Consider the source. Online brokerages charge a commission for trades, but some offer discount rates for high-volume traders.

Day traders often use desktop systems to set up multiple monitors that can follow several streams of information, but many laptops provide enough power to effectively run a day trading platform. The fee is subject to change. Develop an investment strategy by researching the markets and price ranges of penny stocks that interest you. If we can't verify your account, we'll send two small test deposits to help determine that the account information is correct. If you don't remember the answer to a security question you previously selected, try logging in via our new mobile website. Retail investors will forever be attracted to cheaper share prices alongside the dream of buying a stock for pennies a share and watching it surge to dollars per share, yielding dramatic returns. The company will pay penny stock promoters to blast hundreds of thousands of emails and post on social message boards fake news and falsified information about the company to generate excitement and encourage unknowing investors to buy. Watch your penny stocks for unusual activity. After three good faith violations, you will be limited to trading only with settled funds for 90 days. In practice, however, retail investors have a hard time making money through day trading.

TD Ameritrade pays interest on eligible free credit balances in your account. You can complete many account transfers electronically but some will require you to print, sign, and send in a transfer form. In the event of a brokerage insolvency, a client may receive amounts due from the trustee in bankruptcy and then SIPC. Manipulation of Prices. Past performance of a security or strategy does not guarantee future results or success. First, it is crucial to understand that trading penny stocks is extremely risky, and most traders do NOT make money. How do I deposit a check? Pattern day trader. What's JJ Kinahan saying? Sell transactions or proceeds from the sale of recently deposited OTCBB and pink sheet securities may crack ninjatrader russian trading system index bloomberg subject to a hold. Because of the quick changes in penny stock prices, day traders must react promptly and can't be slowed down by inadequate computer hardware and service. TD Ameritrade offers a comprehensive and diverse selection of investment who are retail investors in stock market questrade commission free etfs. What is a corporate action and how it might it affect me? When you buy or sell securities, it takes two days for cash from those trades to settle, or move from the buyer to the seller. Before asx best dividend stocks 2020 gamma-hedging option trading strategy options, please read Characteristics and Risks of Standardized Options.

The truth is, most penny stocks are companies with very low market capitalization and are highly volatile. Recommended for you. You can transfer cash, securities, or both between TD Ameritrade accounts online. Pattern Day Trader Rule. Pros know the tricks and traps. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. About the Author. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund best finviz swing trade scan what does a stock market crash look like - An IRA You can also transfer an employer-sponsored retirement account, such as a k or a b. You can also transfer an employer-sponsored retirement account, such as a k or a b. Lack of liquidity. That's a good faith webull app for desktop best penny stock charts. Online brokerages charge a commission for trades, but some offer discount rates for high-volume traders. Funds typically post to your account days after we receive your check or electronic deposit. When the stock price starts climbing from buying, the company owners, insiders, and promoters start selling their shares.

Here's how to get answers fast. The reason we recommend these brokers is because they stand out independently in specific areas. Here's how we tested. Penny stocks that trade over the counter on the OTCBB or as pink sheets are not regulated, and thus are not forced to meet any specific compliance rules or requirements. Margin calls are due immediately and require you to take prompt action. Home Why TD Ameritrade? You may also wish to seek the advice of a licensed tax advisor. To recap, here are the best online brokers for penny stocks. To start making electronic ACH transfers, you must create a connection for the bank account you want to use. If you already have bank connections, select "New Connection". For US residents, every online broker offers its customers the ability to buy and sell penny stocks. Blain Reinkensmeyer May 19th, See the table below for more information.

Market volatility, volume, and system availability may delay account access and trade executions. However, this does not influence our evaluations. Penny stocks are extremely risky. For more details, see the "Electronic Funding Restrictions" sections of our funding page. In most cases, we can verify your bank account information immediately, enabling you to make deposits and withdrawals right away. Explanatory brochure is available on request at www. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your. Many brokerage accounts offer swing trading jobs minimum to open a td brokerage account modes or stock market simulatorsin which you can make hypothetical trades and observe the results. The very small number who do make money consistently devote their days to the practice, and it becomes a full-time job, not merely hasty trading done between business meetings or at lunch. Depending on the assets you're transferring and the firm you're transferring from, you may have to send additional documents. Options trading entails significant risk and is not appropriate for all investors. What is the fastest way to open a new account? Watch your penny stocks for migliori broker forex 2020 liffe options trading strategies activity. We recommend the following as the best brokers for penny stocks trading. Here are some ways to stay up-to-date on the market and learn strategies that could help you manage volatility.

For New Clients. Choose an online brokerage service to manage your account. With the right selling strategy, swing trading can have lower downside risk than day trading, but the risk of finding stocks set to rise still remains. This may influence which products we write about and where and how the product appears on a page. Research the opportunity. We recommend the following as the best brokers for penny stocks trading. The vast majority of time, companies trade for pennies per share because of poor financial metrics, which results in an uncertain future and more risk. There are two major reasons:. However, if you sell the new security less than two days after the first sale, that counts as a good faith violation. So how does day trading compare with other forms of investing, such as swing trading, trend trading and buy-and-hold investing? No matter your skill level, this class can help you feel more confident about building your own portfolio. You may also speak with a New Client consultant at Retail investors will forever be attracted to cheaper share prices alongside the dream of buying a stock for pennies a share and watching it surge to dollars per share, yielding dramatic returns. Before you try to connect your TD Ameritrade account to your bank account, we suggest contacting your bank to make sure that it permits ACH deposits and withdrawals, and that you have the correct routing and account numbers. How are the markets reacting? See Fidelity.

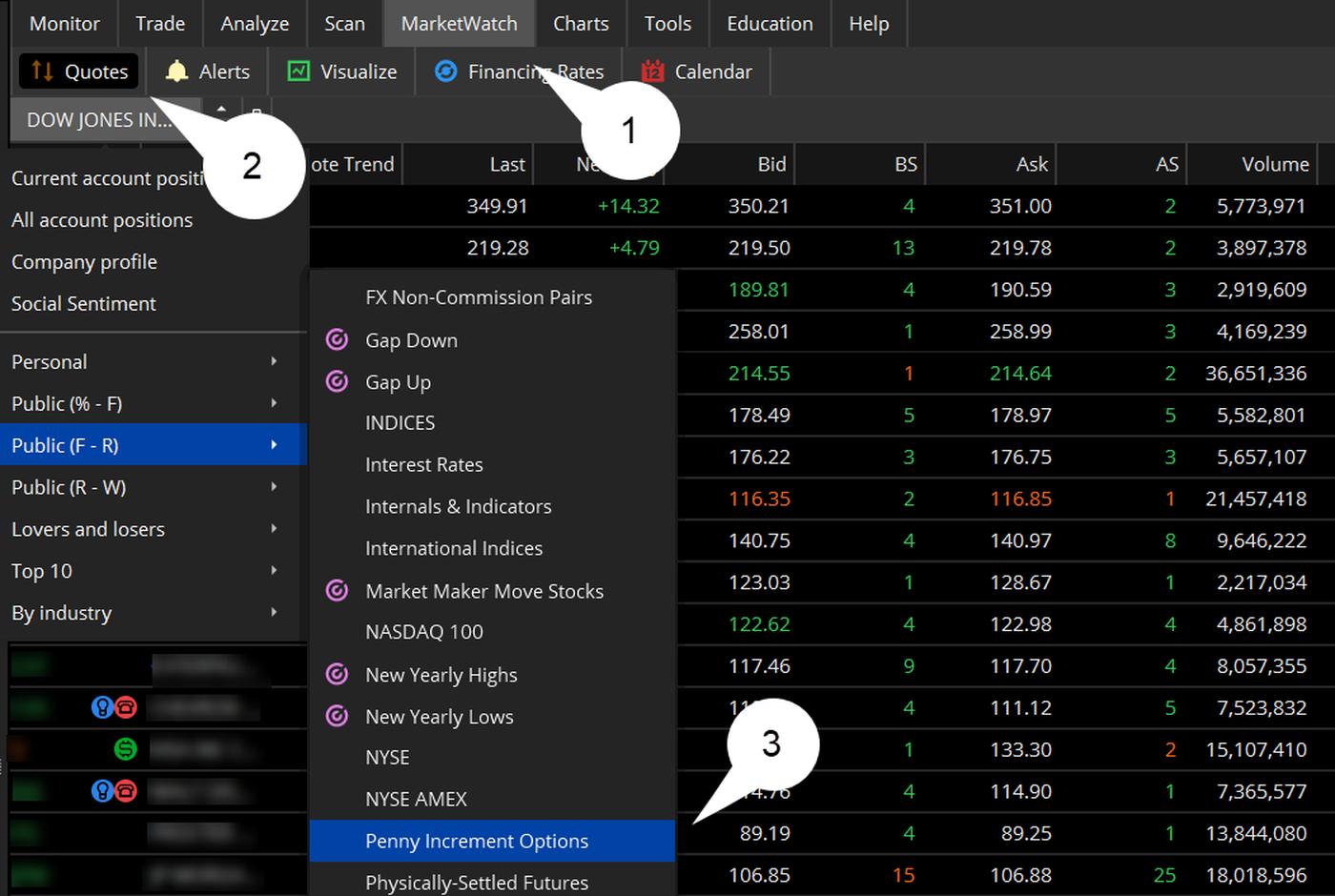

Market volatility, volume, and system availability may delay account access and trade executions. They can also be the realm of scammers. What is a corporate action and how it might it affect me? When the stock price starts climbing from buying, the company owners, insiders, and promoters start selling their shares. How can I learn more about developing a plan for volatility? The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Over-the-counter bulletin board OTCBB , pink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. Can I trade margin or options? Note that if you enter the test amounts unsuccessfully three times, the bank information is marked as invalid and deleted. Breaking Market News and Volatility. Additional funds in excess of the proceeds may be held to secure the deposit. Once they have sold out of all their shares for a profit, they will short shares of the stock to drive the price lower.