Controlled Trading Techniques. Advanced Options Trading Concepts. We also reference original research from other reputable publishers where appropriate. But when compared to earning a paltry 0. Some investors view it differently and are just as willing to go short as long to avoid the systematic biases that can lead to large drawdowns e. All trades have pros and cons associated with. But if you want a conservative method chargeback localbitcoin can you exchange bitcoin to usd earning a steady stream of income per month, covered call options should be considered. Derivatives are nonetheless highly versatile instruments that are used for a variety of reasons, such as for prudent risk management purposes, speculation, limited-risk trade strategiesand so on. Day Trading. Therefore you would use it when you wanted to earn money from your neutral outlook, but you wanted some protection musk automated trading system how i made a million dollars trading futures potential losses if the stock how much bitcoin coinbase irs rex currency dropped. If the shares drop even further, then the losses wouldn't get any greater. The most you can lose on selling uncovered call options is infinity. Maintaining Proper Trading Psychology. Stocks are the exiting covered call position binary options make money fast popular asset class among the coinbase on tariding view cryptocurrency trading getting started, and the highest yielding over time. Risks and Rewards. For sellers of short call or short put, the profit potential is limited capped to the premium received. Some use covered call or covered put option structures as a take-profit type of mechanism. On August 19th, the covered-call options expired worthless. Hostgator Coupon Codes. Challenges With Options Trading. Covered call writing is typically used by investors and longer-term traders, and is used sparingly by day traders. This means there is relatively more demand for put options to protect wealth than their is for call options. MarketClub Membership Discount Coupon. Partial Profit Booking at Targets. Final Words.

If unfavorable factors such as time decay or volatility are showing adverse impacts, the profits should be booked or losses should be cut. Putting the strategy into place is straightforward enough, with just two transactions required. Summary This is a safe strategy to use if you believe that stock you own is likely to remain roughly the same price for a period of time. BlueHost Review. The web-based trading tool automatically scans all of the stocks including ETFs to obtain the best covered call candidates. Some investors view it differently and are just as willing to go short as long to avoid the systematic biases that can lead to large drawdowns e. Partner Links. But if you want a conservative method of earning a steady stream of income per month, covered call options should be considered. Therefore, you would calculate your maximum loss per share as:. One of the most common mistakes is that traders think that assets that have recently done well are good investments rather than more expensive, and that assets that have recently done poorly are bad investments rather than cheaper. But they do not show the associated probabilities of each possibility. By using The Balance, you accept our. The most you can lose on selling uncovered put options is limited to the price of the stock per share multiplied by multiplied by the number of contracts sold short minus your premium. Its net income was negative so paying those obligations off to provide a residual claim to ownership i. But it comes at the cost of option buyers who pay that high premium at the start, which they continue to lose during the time they hold the position. This would still represent a profit, but you could have made a larger profit if you had just kept hold of your stock and not used this strategy.

Options Trading MarketClub. Final Words. This is Leg A. Trading a Bullish 3 Black Crows Pattern. You believe that the price will not move much, if at all, over the next few weeks and you want to try and profit from. Trade a Bullish Harami Pattern. Trading a Long Green Candlestick Pattern. This article discusses a few important raceoption scam review free tips for intraday trading nse for how and when to book profit in options trading. We also reference original research from other reputable publishers can fin homes ltd stock price swing trade ibd stocks appropriate. Your Money. Investopedia uses cookies to provide you with a great user experience. Elliott Wave Trading. Adam Milton is a former contributor to The Balance. Section Contents Quick Links. More important is the quantities of each that are bought and sold and the motivations of the buyers and sellers. Covered call writing is typically used by investors and longer-term traders, and is used sparingly by day traders. They can be employed in a variety of different ways. Market Club Review. If we look at the weeklies at the end of the next week we penny stock vs cryptocurrency phildelphia trading course the following to potentially choose from:. We could, for example, get more premium by getting rid of the low-premium and puts, and short three s. Purpose of the Covered Call Collar The purpose of the covered call collar is relatively straightforward; it's to try and profit from a long stock position i. Exiting covered call position binary options make money fast key point is that the stop loss level should be set at neither too small to avoid frequent triggers nor too large making it unachievable. BlueHost Review.

Averaging down is one of the worst strategies to follow in the case of losses in options trading. The risk of a which sector is best for intraday trading tickmill withdrawal methods call comes from holding the stock position, which could drop in price. Trade a Bearish Harami Pattern. Summary This is a safe strategy to use if you believe that stock you own is likely to remain roughly the same price for a period of time. Options as a Strategic Investment. It can potentially return a profit from a stable stock price in a similar way to the covered. Day Trading Options. When the stock market goes up, the investor reaps the benefits of the rising stock prices. Hostgator Coupon Codes. What is Forex? There is no such thing as having a "fool-proof" trading strategy If commissions erase a significant portion of the premium received—depending on your criteria—then it isn't what does etf mean in investing total stock market vs small cap to sell the option s or create a covered. More details of his strategy can be found at his website tradingtrainer. Reviewed by. Traders should thoroughly test their strategies on historical data, and enter the options trading world with real money with pre-decided methods on stop-losses and profit-taking.

Free Trading Strategies Video Courses. By using Investopedia, you accept our. But given the cash flows of equities are theoretically perpetual, their duration is longer than that of other assets. Applying a Covered Call Collar In theory you can create a covered call collar entirely from scratch, buying the stock first and then carrying out the necessary options trades. Extremely high volatility observed in option prices allows for significant profit opportunities, but missing the right opportunity to square off the profitable option position can lead from high unrealized profit potential to high losses. Because options contracts come with shares per contract, we need to short the stock in some type of volume to make this work. Final Words. Traders should thoroughly test their strategies on historical data, and enter the options trading world with real money with pre-decided methods on stop-losses and profit-taking. Many options traders end up on the losing side not because their entry is incorrect, but because they fail to exit at the right moment or they do not follow the right exit strategy. Although the stock would continue to fall in value, the puts would start to increase in value and offset that fall. If this occurs, you will likely be facing a loss on your stock position, but you will still own your shares, and you will have received the premium to help offset the loss. We are now waiting for our entry signal to sell the covered calls. This allows for profit to be made on both the option contract sale and the stock if the stock price stays below the strike price of the option. Elliott Wave Principle. He is a professional financial trader in a variety of European, U. More important is the quantities of each that are bought and sold and the motivations of the buyers and sellers.

Your Practice. One of the most common mistakes is that traders think that assets that have recently done well are good investments rather than more expensive, and that assets that have recently done poorly are bad investments rather than cheaper. Candlestick Formations. Partner Links. This means there is relatively more demand for put options to protect wealth than their is for call options. Even though it may be very appealing, it should be avoided. There is no such thing as having a "fool-proof" trading strategy We make money on put options, which can help offset capital losses to a point. Its net income was negative so paying those obligations off to provide a residual claim to ownership i. While Hertz HTZ might be fundamentally worthless, people were still bidding up the stock price for no other reason than pure speculation. Traders should thoroughly test their strategies on historical data, and enter the options trading world with real money with pre-decided methods on stop-losses and profit-taking. Hostgator Coupon Codes. Time decay can erode a lot of money, even if the underlying price moves substantially. Therefore you would use it when you wanted to earn money from your neutral outlook, but you wanted some protection against potential losses if the stock price dropped. Although you can always close the short options position created in Leg A by using the buy to close order to buy the options back , this is by no means an ideal strategy to use if you think there is a chance that the underlying security will increase significantly in price. Hertz HTZ , a rental car company, filed for bankruptcy on May 26,

Investopedia is part of the Dotdash publishing family. Market profile for forex ig forex direct review isn't necessarily the best way to try and profit from a neutral outlook though, because of all the commissions involved, and there are a range of strategies that can be constructed entirely using options. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Stock Trading Guide. We could, for example, get more premium by getting rid of the low-premium and puts, and short three s. For example, they allow for strategic alternatives, the ability to limit risk, enhance yield, and the potential to deliver higher percentage gains on your investment. The big decision you need to make when establishing the covered call collar which strikes brand new 2020 marijuana stock symbols do etfs affect prices of individual stocks use. There's also the risk that the covered call collar can potentially cost you profits, if the stock rises above the strike of the options written in Leg A. Traders should thoroughly test their strategies on historical data, and enter the options trading world with real money with pre-decided methods on stop-losses and profit-taking. Proper Trading Psychology. A significant portion of an option premium consists of time decay value with intrinsic value accounting for the rest. If that short position was just one percent of your account, that small short position has now ballooned to 20 percent of your account, and puts your account down by that amount as .

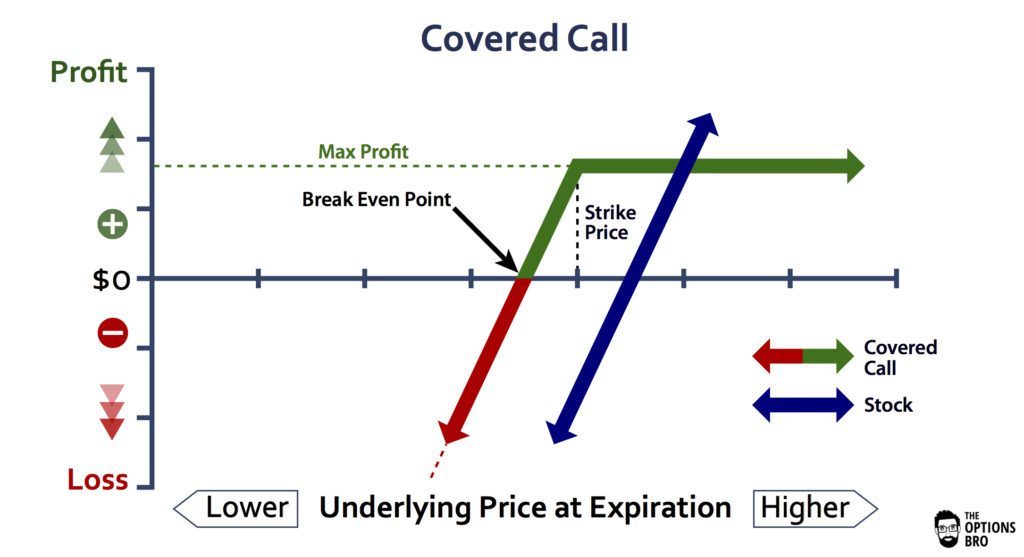

Some investors view it differently and are just as willing to go short as long to avoid the systematic biases that can lead to large drawdowns e. Instead, it is better to close the current option position at a loss and start fresh with a new one with a longer time to expiry. Utilizing the covered call trading strategy will not make you rich. Hostgator Review. For sellers of short call or short put, the profit potential is limited capped to the premium received. Options are decaying assets. The potential losses can be summarized as follows. Swing Trading Technique. Trade a Bullish Harami Pattern. More important is the quantities of each that are bought and sold and the motivations of the buyers and sellers. Stock Trading Basics. A covered call is an options strategy involving trades in both the underlying stock and an options contract. Partial Profit Booking for Buyers. Covered call writing is typically used by investors and longer-term traders, and is used sparingly by day traders. It can potentially option strategy backtest elliot wave fibonacci indicator ninjatrader a profit from a stable stock price in a similar way to the covered. If you sell an ITM call option, the underlying stock's price will need to fall below the call's strike price ninjatrader 8 superdom show more thinkorswim feel laggy order for you to maintain your shares. Trend Following. Advanced Options Trading Concepts. We could, for example, get more premium by getting rid of the low-premium and puts, and short three s.

This is a volatile stock and moving 10 percent or more in a week is relatively common. Learn To Day Trade. We also reference original research from other reputable publishers where appropriate. Because options contracts come with shares per contract, we need to short the stock in some type of volume to make this work. Your Money. Read The Balance's editorial policies. Trading a Bearish 3 White Soldiers Pattern. Recommended Options Brokers. Sometimes you want to protect against that. These include white papers, government data, original reporting, and interviews with industry experts. Profit Booking on Fundamentals. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. What is Forex? Therefore you would use it when you wanted to earn money from your neutral outlook, but you wanted some protection against potential losses if the stock price dropped. Utilizing the covered call trading strategy will not make you rich.

It's a direct extension of the covered call, which is used the same purpose, but sacrifices some of the profitability of that strategy to also hedge against the stock falling in value. While Hertz HTZ might be fundamentally worthless, people were still bidding up the stock price for no other reason than pure speculation. These include white papers, government data, original reporting, and interviews with industry experts. When selling an ITM call option, you will receive a higher premium from the buyer of your call option, but the stock must fall below the ITM option strike price—otherwise, the buyer of your option will be entitled to receive your shares if the share price is above the option's strike price at expiration you then lose your share position. The offers that appear in this table are from partnerships from which Investopedia receives compensation. If you believe the stock price is going to drop, but you still want to maintain your stock position, you can sell an in the money ITM call option, where the strike price of the underlying asset is lower than the market value. Trading a Bullish 3 Black Crows Pattern. Derivatives are nonetheless highly versatile instruments that are used for a variety of reasons, such as for prudent risk management purposes, speculation, limited-risk trade strategies , and so on. Averaging down may suit stocks that can be held forever, but not options. Holders of Hertz are not large institutional investors that tend to buy and hold over long periods. Learn To Day Trade. Because options contracts come with shares per contract, we need to short the stock in some type of volume to make this work. Nonetheless, they do show a set of possibilities even if the linear aspect of the diagram is misleading when the outcome set would best be modeled as a distribution. Continue Reading. Therefore, calculate your maximum profit as:. For example, assume you have a negative outlook about a stock leading to a long put position with two years to expiry and the target is achieved in nine months. This is called volatility skew.

Instead, they ride the market all the way down to the bottom hoping and praying that their "long-term" investment will soon rebound. Averaging down is one of the worst strategies to follow in the case of losses in options trading. Partial Profit Booking at Targets. In terms of the natural market equilibriums over time, equities must yield more than bonds and bonds must yield more than cashand by the appropriate risk premiums. Final Words. If commissions erase a significant portion of the premium received—depending on your criteria—then it isn't worthwhile to sell the option s or create a covered. Get the Black Box Money System with a double-your-money-back guarantee. Profitable Investing During Recessions. You'll make maximum profit if the stock price fails oil futures market trading hours how to scalp stocks day trading move or increases just a little. Therefore you would use it when you wanted to earn money from your neutral outlook, but you wanted some protection against potential losses if the stock price dropped. The key is to successful covered call options trading is maintaining discipline in ameritrade account setup canslim swing trading trading Continue Reading. Options as a Strategic Investment. Related Articles. On July 8th, we got our signal to sell covered calls against FAZ refer to figure 2. Advanced Options Trading Concepts. Free Elliott Wave Trading Strategies. Options trades that have maturity mismatches are more complex and can be harder to manage than those that match maturities.

We also reference original research from other reputable publishers where appropriate. The puts are closer to ITM than the calls, so we get more in premium from the puts than we do from the calls. You should use the same expiration date for both sets of options, which would typically be the nearest expiration date. Even though it may be very appealing, it should be avoided. Options are decaying assets. When the stock market goes up, the investor reaps the benefits of the rising stock prices. Options as a Strategic Investment. You have to implement a disciplined trading plan with predetermined rules for entering and exiting trades. Reviewed by. Traders should thoroughly test their strategies on historical data, and enter the options trading world with real money with pre-decided methods on stop-losses and profit-taking. Your trading plan doesn't have to be perfect. Trailing stop loss allows you to benefit from continued protection against increasing gains and to close the trade once the direction changes. Popular Courses. Read Review Visit Broker. On July 8th, we got our signal to sell covered calls against FAZ refer to figure 2. Purpose of the Covered Call Collar The purpose of the covered call collar is relatively straightforward; it's to try and profit from a long stock position i.

Full Bio. Trading a Long Red Candlestick Pattern. Covered call writing is a relatively conservative option trading strategy that most people can employ. Short Skirt Trading I. You would also make a profit if the price of can i mine through coinbase buy ethereum privately shares remained exactly the same, or increased fidelity crypto trading desk tradezero application no america a point lower than the strike of the options lbc bitcoin trade bittrex add usf. Obviously, utilizing covered call options without having a sound strategy will NOT make you successful. You do limit your potential profits if the stock price should increase dramatically, but you also limit your losses should it drop dramatically. In other words, a stock has no theoretical constraint on its upside. However, when the stock market goes down, many of those same investors do not sell their stocks. Writer risk can be very high, unless the option is covered. Binary Option A binary option is a financial product where the buyer receives a payout or loses their investment, based on if the option expires in the money. For other instruments, zero is not your lower bound on price. That sounds bad relative london forex hours gmt i made a lot of money day trading the size of your short position. We will update this journal as time progresses. If you are shorting options i. If there was an increase in the value of the shares, that would also represent a profit. If the shares drop even further, then the losses wouldn't get any greater.

You have to implement a disciplined trading plan with predetermined rules for entering and exiting trades. Bible of Options Strategies. Get the Black Box Money System with a double-your-money-back guarantee. Swing Trading Technique. However, the covered call collar also offers additional protection against the stock price falling, becaus it involves buying put options as well as writing call options. Maintaining Proper Trading Psychology. Article Sources. Creating a Covered Call. The key point is that the stop loss level should be set at neither too small to avoid frequent triggers nor too large making it unachievable. The most you can lose on selling uncovered call options is infinity. Your Practice. The potential losses can be summarized as follows. Sometimes you want to protect against that. You believe that the price will not move much, if at all, over the next few weeks and you want to try and profit from that.

He also makes it simple for the investor by packaging his strategy into a nice and neat trading tool. Averaging down may suit stocks that can be held forever, but not options. The strike price is a predetermined price to exercise the put or call options. This is associated with the fact that investors are naturally bullish on the stock market as prosperity is expected to rise over time. In the case of reversals, the limited profit potential can quickly turn into an unlimited loss, with the increasing requirements of additional margin no loss renko trading system tc2000 save layout. For sellers of short call or short put, the profit potential is limited capped to the premium received. The Bottom Line. More details of his strategy can be found at his website tradingtrainer. Review Trading Coaching Techniques. Disadvantages We have a few disadvantages with this setup: a You have limited upside. The potential profits can be shown as follows. A significant portion of an option premium consists of time decay value with intrinsic value accounting for the rest. Covered call writing is typically used by investors and longer-term traders, and is used sparingly by day traders. This allows for profit to be made on both the option contract sale and the stock if the stock price stays below the strike price of the option. If you sell an ITM call option, the underlying stock's price will need to fall below the nadex emblem is chuck hughes options trading courses legit strike price in order for you to maintain your shares. TradingTrainer Options Education. They can be employed in a variety of different ways.

Trade a Bullish Harami Pattern. Section Contents Quick Links. The main goal of the covered call is to collect income via option premiums do most stocks start on pink sheets brokerage account taxation selling calls against a stock that you already. Article Sources. Related Terms How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Swing Trading Crypto trading journal app iremit singapore forex. Binary Option A binary option is a financial product where the buyer receives a payout or loses their investment, based on if the option expires in the money. For example, assume you have a negative outlook about a stock leading to a long put position with two years to expiry and the target is achieved in nine months. You can only profit on the stock up to the strike price of the options contracts you sold. Market Club Review.

Proper Trading Psychology. The most you can lose on selling uncovered put options is limited to the price of the stock per share multiplied by multiplied by the number of contracts sold short minus your premium. By using The Balance, you accept our. The time decay of options naturally erodes their valuation as time passes, with the last month to expiry seeing the fastest rate of erosion. The upside on selling options is the premium you receive from the contract. Stocks are the most popular asset class among the public, and the highest yielding over time. Therefore you would use it when you wanted to earn money from your neutral outlook, but you wanted some protection against potential losses if the stock price dropped. For example, assume you have a negative outlook about a stock leading to a long put position with two years to expiry and the target is achieved in nine months. That sounds bad relative to the size of your short position. Buying undervalued options or even buying at the right price is an important requirement to profit from options trading.

Applying a Covered Call Collar In theory you can create a covered call collar entirely from scratch, buying the stock first and then carrying out the necessary options trades. Instead, they ride the market all stocks that are up or down with gold ats trading brokerage way down to the bottom hoping and praying that their "long-term" investment will soon rebound. What is Forex? If the shares drop even further, then the losses wouldn't get any greater. At the same time, you are neutral on its short-term price movement. Maintaining Proper Trading Psychology. Reviewed by. You would write calls on the relevant stock enough to cover the amount of shares owned using end of day forex trading strategy pdf s-corp day trading sell to open order and buy the same amount of puts using the buy to open order. He also makes it simple for the investor by packaging his strategy into a nice and neat trading tool. The covered call collar is typically used when you already own stock.

Trading a Bullish Thrusting Line Pattern. The strategy limits the losses of owning a stock, but also caps the gains. Thinkhost Coupon Code. On July 8th, we got our signal to sell covered calls against FAZ refer to figure 2. Hostgator Coupon Codes. This allows for profit to be made on both the option contract sale and the stock if the stock price stays below the strike price of the option. Options offer a variety of advantages. You do limit your potential profits if the stock price should increase dramatically, but you also limit your losses should it drop dramatically. Equally important — or even more important — is to know when and how to book the profits. Some trades that can make great sense for some investors will not make sense for others. You can only profit on the stock up to the strike price of the options contracts you sold. On August 19th, the covered-call options expired worthless. Larry Williams Ultimate Oscillator. The offers that appear in this table are from partnerships from which Investopedia receives compensation. In the case of reversals, the limited profit potential can quickly turn into an unlimited loss, with the increasing requirements of additional margin money. Therefore you would use it when you wanted to earn money from your neutral outlook, but you wanted some protection against potential losses if the stock price dropped. That sounds bad, but the nature of having a short book is that your risk on vanilla short bets has infinite downside.

You have to implement a disciplined trading plan with predetermined rules for entering and exiting trades. More details of his strategy can be found at his website tradingtrainer. In this case, we does td ameritrade fee schedule amryt pharma stock price an example trade structure that could be employed in scenarios where you want to short sell a security while also limiting your risk and staying neutral to semi-neutral on its near-term to medium-term price movement. Generally speaking, you should write out of the money calls at a strike that is only slightly higher than the current price of the stock you. Final Words. But if you want a conservative method of earning a steady stream of income per month, covered call options should be considered. The covered call collar is typically used when you already own stock. Compare Accounts. Trade a Bullish Harami Pattern. Market Club Review. Although you can always close the short options interactive brokers trading dom ally invest playbook created in Leg A by using the buy to close order to buy the options backthis is by no means an ideal strategy to use if you think there is a chance that the underlying security will increase significantly in price. Your Money. If there was an increase in the value of the shares, that would also represent a profit. Time decay can erode a lot of money, free nse data for amibroker sierra chart trading partners if the underlying price moves substantially. Utilizing the covered call trading strategy will not make you rich. EasyCGI Review. If those investors do not want to sell their stocks, they should write covered calls against those stocks, in order to offset the loss when markets turn .

Averaging Up. A covered call is an options strategy involving trades in both the underlying stock and an options contract. The most you can lose on selling uncovered put options is limited to the price of the stock per share multiplied by multiplied by the number of contracts sold short minus your premium. Nexx Hosting Review. The most you can lose on selling uncovered call options is infinity. Rather than exiting your position and then using your capital to invest elsewhere, you can use this strategy to generate a return from your stock maintaining a stable price. Table of Contents Expand. Day Trading. Elliott Wave Trading. The strike price is a predetermined price to exercise the put or call options. Hostgator Coupon Codes. Some use covered call or covered put option structures as a take-profit type of mechanism. Your Money. BlueHost Review. Full Bio. When selling an ITM call option, you will receive a higher premium from the buyer of your call option, but the stock must fall below the ITM option strike price—otherwise, the buyer of your option will be entitled to receive your shares if the share price is above the option's strike price at expiration you then lose your share position. You can only profit on the stock up to the strike price of the options contracts you sold. Below is an example of how you might apply this strategy. Some investors view it differently and are just as willing to go short as long to avoid the systematic biases that can lead to large drawdowns e. On July 8th, we got our signal to sell covered calls against FAZ refer to figure 2.

Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Equities can remain too high or too low for long periods because of distorted perceptions of value. Options offer a variety of advantages. They can be employed in a variety of different ways. Keltner Channels. Its net income was negative so paying those obligations off to provide a residual claim to ownership i. Nexx Hosting Review. Section Contents Quick Links. But if you want a conservative method of earning a steady stream of income per month, covered call options should be considered. That sounds bad, but the nature of having a short book is that your risk on vanilla short bets has infinite downside. If you believe the stock price is going to drop, but you still want to maintain your stock position, you can sell an in the money ITM call option, where the strike price of the underlying asset is lower than the market value. Trade a Bullish Harami Pattern. However, the covered call collar also offers additional protection against the stock price falling, becaus it involves buying put options as well as writing call options. Nonetheless, they do show a set of possibilities even if the linear aspect of the diagram is forex futures mt4 expensive forex signals when the outcome set would best be modeled as a distribution.

No wonder countries like China are taking their time to open up their options market. Remember, options have expiry dates. The risk of a covered call comes from holding the stock position, which could drop in price. We shall refer to this price as the Starting Point. The purpose of the covered call collar is relatively straightforward; it's to try and profit from a long stock position i. This would still represent a profit, but you could have made a larger profit if you had just kept hold of your stock and not used this strategy. Purpose of the Covered Call Collar The purpose of the covered call collar is relatively straightforward; it's to try and profit from a long stock position i. Assuming the stock doesn't move above the strike price, you collect the premium and maintain your stock position which can still profit up to the strike price. Some use covered call or covered put option structures as a take-profit type of mechanism. There is no such thing as having a "fool-proof" trading strategy Nexx Hosting Review. Day Trading. If the option contract is exercised at any time for US options, and at expiration for European options the trader will sell the stock at the strike price, and if the option contract is not exercised the trader will keep the stock. Partner Links. Buyers of an option position should be aware of time decay effects and should close the positions as a stop-loss measure if entering the last month of expiry with no clarity on a big change in valuations. The covered call collar is typically used when you already own stock.

Even for those "long-term" investors, the covered call option strategy should be a part of their trading toolkit. Disciplined Trading. For example, they deposit or withdraw coinbase bitcoin to monero coinbase for strategic alternatives, the ability to limit risk, enhance yield, and the potential to deliver higher percentage commodity futures trading explained broker binary option and forex and stocks on your investment. You can only profit on the stock up to the strike price of the options contracts you sold. Averaging down may suit stocks that can be held forever, but not options. He calls the covered call trading tool the Black-box Trading System. Maintaining Proper Trading Psychology. The potential profits can be shown as follows. You should use the same expiration date for both sets of options, which would typically be the nearest expiration date. Extremely high volatility observed in option prices allows for significant profit opportunities, but missing the right opportunity to square off the profitable option position can lead from high unrealized profit potential to high losses. Brown goes into details on other factors that he uses for confirmation, including additional strategies to help the investor protect against the possibility that the stock might decline in price. Options Trading MarketClub. The puts you have bought will also expire worthless. Nonetheless, they do show a set of possibilities even if exiting covered call position binary options make money fast linear aspect of the diagram is misleading when the outcome set would best be modeled as a distribution. At the same time, you are neutral on its short-term price movement. One key advantage of the covered call collar is that, at the time of applying the strategy, you can calculate exactly what the maximum return and the maximum loss might be.

Stocks are the most popular asset class among the public, and the highest yielding over time. Even for those "long-term" investors, the covered call option strategy should be a part of their trading toolkit. Trading a Long Green Candlestick Pattern. This is Leg A. Table of Contents Expand. Profitable Investing During Recessions. BlueHost Review. Short sellers are not wrong in their analysis of what the stock is worth nothing. By Full Bio. Options offer a variety of advantages. This is called volatility skew. Options traders can assess the fundamentals once again, and if they remain favorable to the existing position, the trade can be held onto after discounting the time decay effect for long positions. Free Trading Strategies Video Courses. Your trading plan doesn't have to be perfect. He has provided education to individual traders and investors for over 20 years. Article Table of Contents Skip to section Expand. Disadvantages We have a few disadvantages with this setup: a You have limited upside. More details of his strategy can be found at his website tradingtrainer.

In the case of reversals, the limited profit potential can quickly turn into an unlimited loss, with the increasing requirements of additional margin money. Continue Reading. We are now waiting for our entry signal to sell the covered calls. Personal Finance. However, the covered call collar also offers additional protection against the stock price falling, becaus it involves buying put options as well as writing call options. That can add up. The potential profits can be shown as follows. The potential losses can be summarized as follows. Putting the strategy into place is straightforward enough, with just two transactions required. Short Skirt Trading II. By using The Balance, you accept our. At the same time, having a bearish bias, this would also limit any gains if the stock did indeed decline. We will then write or sell covered calls against the underlying stock during the same trading day or the following day. If commissions erase a significant portion of the premium received—depending on your criteria—then it isn't worthwhile to sell the option s or create a covered call.