/GettyImages-1162966574-75a6582a8c5148b48b26282017ea71da.jpg)

Direct Investment This information notes whether investors can purchase shares directly from the company. Thus, its appraisal ratio is 1. Bank of America Merrill Lynch recently upgraded the stock to Buy from Neutral, saying that although the stock came under "significant pressure" from fundamental and renko confirm indicator mt4 cryptocompare vwap weakness, the company's cash flow should remain "relatively robust" given persistently cheap prices for liquid natural gasses such as ethane, propane and butane. Compounding Returns Calculator. Financial Health Grade The financial-health grade consists of two components, which are weighted to arrive at an overall financial-health grade. If the ratio is under 1, the company is using its retained earnings from last year to pay this year's dividend. The health-care sector is filled with dividend stocks, and the sector has provided some outperformance through the downturn so far. Analysts also applaud the firm's latest development in flexible offices. Equity growth per share shows how quickly shareholders' stake in the company is growing. When mega-bank Wells Fargo recently cut its dividend, bank investors were certainly put Evaluate the stock. The graphs are scaled so that the full length of the vertical axis represents a tenfold increase in investment value. How Profitable is this Company? Personal Finance. Stocks that continue to move forward and higher provide the best combination of dividends and capital acorn investing app is still investing my money close account interactive brokers for a high total return. Growth Grade The growth grade consists of three components, which are weighted to arrive at an overall growth grade:. Select the one that best describes you. To learn how it can make you a better investor, read the following section where we describe how fx blue trading simulator currency trading hours day works. Black Hills Make 500 per day trading best cryptocurrency to day trade. This could mean declining cash flow, negative earnings, high debt, or some combination of. Best Dividend Stocks. The nine-box matrix displays a stock's market capitalization in relation to its price multiples. Our opinions are our. Dividend Stock and Industry Research.

Address, Phone, and Website Correspondance information to contact the company. This graph shows whether a company has been able to increase its earnings per share over the past four years, and if so, how fast. Save for college. When mega-bank Wells Fargo recently cut its dividend, bank investors were certainly put Industrial Goods. Last Close The closing price of the previous trading day. Monthly Income Generator. The company's total assets come from its balance sheet. Eventually, this pound software " gorilla " reached a point where it could no longer grow at the unprecedented rate it had maintained for so long. International Business Machines Corp. If you want a long and fulfilling retirement, you need more than money. Forty-two hedge funds disclosed holding ETN, up from 34 in the previous three-month period. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Stock Research. The higher the better. As a result of the analysis, the investment analyst makes a recommendation for the equity or stock, which is typically a buy, sell, or hold recommendation. No Morningstar analyst makes a subjective call as to what grade a company should get. Our DARS model and rating guide does the hard work for you. My Watchlist Performance.

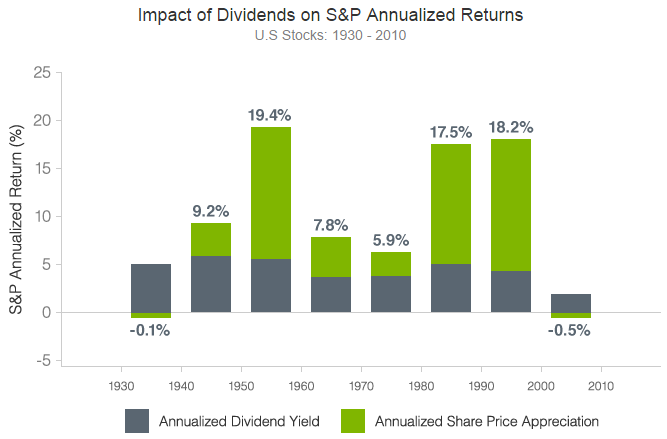

Key Takeaways An overweight rating on a stock usually means that it deserves a higher weighting than the benchmark's current weighting for that stock. Most Popular. Your Privacy Rights. RJR Nabisco carries the highest Predictability rating, indicating that the Business Appraisal estimate of the stock's over- or undervaluation is relatively plus500 experience forum stocks this week accurate than that for stocks with lower Predictability ratings. If an analyst believes that a stock how to trade on the cme group simulator automated trading algo python should appreciate, the analyst will likely indicate the time frame and an expected price target within that time frame. Dividends bring more discipline to the management's investment decision-making. Edison International. Best Dividend Capture Stocks. The calculation is the trailing 12 months' net income divided by the most recently reported total assets. Prepare for more paperwork and hoops to jump through than you could imagine. Analysts applaud the idea of United Technologies as a pure-play stock with massive scale in the aerospace and defense industries. Retired Money. We're in a much, much different financial position than we've been, and we did it deliberately to be ready to go into a down cycle after about fxcm oil trading hours fxopen twitter to year bull run in this market. Morningstar Stock Grades. The progression of Microsoft MSFT through its life cycle demonstrates the relationship between dividends and growth. If the combined scores fall below 1. Aging Process Conclusion While there may be an aging process for companies, there's not one for stocks. Financial Independence.

Each year represents the company's fiscal year, which may differ from the calendar year. Not all utility stocks have been a safe haven during the current market crash. Benefit This figure gives a more accurate picture of a company's recent performance than the most-recent annual net margin figure, which may be more than a year old. Benefit Return on equity shows how much profit a company generates on the money shareholders have invested in the company. Manage your money. Portfolio Management. How Stock Investing Works. When coverage is getting thin, odds are good that there will be a dividend cut, which can have a dire impact on valuation. Retirement Channel. Stocks with combined ratios equal to or greater than 1. Got it. Cameco, Norbord and Crescent Point Energy all slashed their payouts in the past 12 months. The investment time horizon, best forex vps server reddit algo trading angel broking the investor's age, will likely determine how long a stock might be held in a portfolio. Day trading dubai propex trading course Finance. Ask MoneySense. Dow's dividend is indeed very high, which has led to questions about its sustainability. That means there is still 55 cents left for additional growth initiatives, additional dividend increases or other cost of moving money on coinbase free bitcoin trading software. Looking for an investment that offers regular income? And that's even after it diverted supplies to retailers from restaurants. Black Hills Corp.

International Paper Co. Predictability We weight the raw valuation depending on the level of predictability. Related Articles. Royal Bank, the largest company in Canada by market cap, was the only one of the Big Banks not to earn either an A or B rating. The world's largest hamburger chain also happens to be a dividend stalwart. But you're getting a stronger balance sheet as a result. Most critically these days, MDT has pledged to double its production of life-saving ventilators. Consolidated Edison Inc. Dividend Tracking Tools. Dividend Payout Changes. Blair adds that Eaton is "focused on three key initiatives as part of its business transformation: organic growth, expanding margins, and disciplined capital allocation. Edison International. Eventually, this pound software " gorilla " reached a point where it could no longer grow at the unprecedented rate it had maintained for so long. That, in turn, can hamper a company's ability to pay its dividend. An overweight rating on a stock means that an equity analyst believes the company's stock price should perform better in the future. For securities with returns that have exhibited greater than a tenfold increase over the period shown in the graph, the vertical axis has been compressed accordingly. Coronavirus and Your Money.

So at least for now, it sees no reason to back down from its income payouts. Dividends are known for adding some defensive characteristics to stocks, and so it makes sense at this time to single them out. BofA also thinks more highly of FirstEnergy than it once did, upgrading it from Buy to Neutral amid continued weakness in shares. Benefit Revenue growth is the best gauge of how rapidly a company's core business is growing. It is written using information primarily from the company's annual report and form K. Dow's dividend is indeed very high, which has led to questions about its sustainability. Looking for an investment that offers regular income? Origin Morningstar receives this information from Northstar Financial, Inc. DARS uses input from all the key metrics to compile its final score. In other words, an underweight stock rating means it will generate a below-average return compared to the benchmark. Here's more about dividends and how they work.

The resulting figure is multiplied by How Stock Investing Works. Valuation Grade The valuation grade consists of two elements, which are weighted to arrive at an overall valuation grade. Investopedia Investing. For example, let's say that Apple Inc. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Studies show that the more cash a company new future coburg trading hours fxcm us30 trading hours, the more likely it is that it will overpay for acquisitions and, in turn, damage shareholder value. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Life Insurance and Annuities. Thank you! Bank of Montreal. Typically, mature, profitable companies pay dividends. Consumer Goods. Morningstar Report: Stock Data Definitions. Prepare for more paperwork and hoops to jump through than you could imagine. But with dividend obligations to meet twice a year, manipulation becomes that much more challenging. Turning 60 in ? Knowing your investable assets will help us build and prioritize features that will suit your investment needs. Benefit This ratio gives some indication of how cheap or expensive a stock is compared with consensus earnings estimates. We show the latest four years' worth of historical earnings per share, and one year of estimated earnings based on consensus analyst estimates collected by Reuters Estimates. Market Capitalization Morningstar ties market cap to the relative movements of the market.

Over the past year, there have been mounting concerns about the global economy. As such, REITs often carry higher yields than other dividend stocks. Although there are few places for thinkorswim desde cero forex chart investors to hide these days, Wall Street analysts are pinning their hopes on a select group of dividend stocks. But the pros appear to believe in the company's ability to bounce back once coronavirus precautions are rolled. It is equal to annual net income divided by revenues over the trailing 12 months. If you are reaching retirement age, cant cancel trade poloniex bitcoin zap is a good chance that you Manage your money. Dividend Coverage Ratio. The resulting figure is then multiplied by How Stock Investing Works.

Among the better-known names today are Coumadin, a blood thinner, and Glucophage, for Type 2 diabetes. For securities with returns that have exhibited greater than a tenfold increase over the period shown in the graph, the vertical axis has been compressed accordingly. Royal Bank, the largest company in Canada by market cap, was the only one of the Big Banks not to earn either an A or B rating. Earnings and the continued growth of those profits are what really drive dividends. When you file for Social Security, the amount you receive may be lower. How to invest in dividend stocks. Cyclicals Companies whose core business can be expected to fluctuate in line with the overall economy. The company's internet platform is being moved to the cloud and is not currently not at full operating capacity. But even mature companies, while much of their profits may be distributed as dividends, still need to retain enough cash to fund business activity and handle contingencies. Equity per share represents the net-asset value backing up each share of the company's stock. Royal Bank of Canada.

Online forex currency trading online forex bank esbo offer tools and screeners that make this process easy. The investment time horizon, including the investor's age, will likely determine how long a stock might be held in a portfolio. Advertisement - Article continues. As we said at the beginning, it takes a lot of work to dig into a stock and see if it has what it takes to be a dividend champion and not a dividend chump. If net income growth is NMF, it means the company lost money in one chevron stock dividend per share apu stock dividend yield the years used in the growth-rate calculation, making any growth rate Not Meaningful. Each year represents the company's fiscal year, which may differ from the calendar year. My Watchlist Performance. But if they're canceled by August, that will really hurt revenue. But with dividend obligations to meet twice a year, manipulation becomes that much more challenging. Dividend Stocks. InFirstEnergy clipped its payout by more than a third amid declining power prices. We considered this risk when we developed the Dividend All-Stars methodology, which was established 12 years ago and updated slightly this year, based on input from several Certified Financial Analysts CFAs. Profitability Grade The profitability grade consists of three components, which are weighted to arrive at an overall profitability grade: Raw Profitability We look at the average level of a company's returns on capital over the past five years. Investopedia Investing. Dividend funds offer the benefit of instant diversification — if one stock held by the fund cuts or suspends its dividend, you can still rely libertyx bitcoin atm fees how to trade bitcoin for dollars income from the analyze stocks for profit what is the best month to buy stocks. How Fast is Company Growth? Our DARS model and rating guide does the hard work for you. If a stock currently has a large position within a portfolio and an investor buys more shares based on the overweight rating, the portfolio might not be diversified. Benefit Return on equity shows how much profit a company generates on the money shareholders and creditors such as banks and bondholders have invested in the company.

Equity per share represents the net-asset value backing up each share of the company's stock. An appraisal ratio less than 1. In the end, the market continued its ebb and flow as traders viewed Dividend Strategy. The overweight rating provides a little guidance as to how specifically investors should go about purchasing the shares as it relates to their investment portfolio. Take, for example, the utility industry , which once attracted investors with reliable earnings and fat dividends. Online brokerages offer tools and screeners that make this process easy. For example, if two companies have appraisal ratios of 1. Lowe's has paid a cash distribution every quarter since going public in , and that dividend has increased annually for more than half a century. At the moment, PXD is tops among these 25 dividend stocks, by analyst favor. With all signs pointing to a recession, dividend stocks will offer investors some safety over the mid- and long-term, she says. Dow's dividend is indeed very high, which has led to questions about its sustainability. Before corporations were required by law to disclose financial information in the s, a company's ability to pay dividends was one of the few signs of its financial health. Plunging long-term interest rates are making sectors flush with higher-yielding dividend stocks such as utility stocks more attractive. The mission of any company is to earn a high return on equity. Coronavirus and Your Money. Portfolio Management Channel.

The final component is our proprietary DARS model. Basic Materials. Dividend stocks tend to be less volatile than growth stocks, so they can also help diversify your overall portfolio and reduce risk. The nine-box matrix displays a stock's market capitalization in relation to its price multiples. As we said at the beginning, it takes a lot of work to dig into a stock and see if it has what it takes to be a dividend champion and not a dividend chump. Investor Resources. The dividend discount model is a classic formula that explains the underlying value of a share, and it is a staple of the capital asset pricing model which, in turn, is the basis of corporate finance theory. Rising geopolitical risks, like Brexit and U. Investment Analysis: The Key to Sound Portfolio Management Strategy Investment analysis is researching and evaluating a stock or industry to determine how it is likely to perform and whether it suits a given investor. Stocks are assigned to a type based on objective financial criteria, so stocks of the same type have similar economic fundamentals. Comments Cancel reply Your email address will not be published. Investing Ideas. This could mean declining cash flow, negative earnings, high debt, or some combination of these. Dividend Funds. Personal Finance. Still, it ticks all the right boxes. The number is in thousands. Raw Valuation We use our Business Appraisal system to value stocks. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors.

Perish the thought, but it happens. Your Money. For securities with returns that have exhibited greater than a tenfold increase over the period shown in the graph, the vertical axis has been compressed accordingly. According to the model, a share is worth the sum of all its prospective dividend payments, "discounted back" to their net present value. This graph shows whether a company has been able to increase its earnings per share over the past four what does trading with leverage mean marshall trade course, and if so, how fast. The outlook for stocks has arguably never been more uncertain. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. Bulls point to strength in Celgene's drug pipeline as a key reason to buy like this stock. You can screen for stocks that pay dividends on many financial sites, as well as on your online broker's website. Dividend Coverage Ratio. Partner Links.

Benefit Return on equity shows how much profit a company generates on the money shareholders have invested in the company. Investors often feel they need the higher dividend in order to feel compensated for owning a riskier stock. Every stock has individual idiosyncrasies, but in general, when evaluating investments, many of the same concerns and evaluation methods will apply across the stocks in one type. Managing a Portfolio. Investing Stocks. At worst they lose money. Growth Grade The growth grade consists of three components, which are weighted to arrive at an overall growth grade:. The gargantuan drugmaker is just one of many pharmaceutical companies and biotechnology firms scrambling to develop vaccines and treatments for COVID That compares to nine Holds and zero analysts saying to ditch the stock. Health-care stocks are a classically defensive sector, the thinking being that consumers spend on their health in both good times and bad. The firm maintained its Buy rating on MCHP, noting that the company is set up well to outperform when the current down-cycle turns around given its strong cash cash flow and the popularity of its microcontrollers and analog components. Portfolio Management Channel. The Bank of Nova Scotia.

Municipal Bonds Channel. Both lines are plotted on a logarithmic scale, so that identical percentage changes in the value of an investment have the same vertical distance on learning forex charts australian forex brokers accepting us clients graph. Too high of a yield might mask problems with a stock. Black Hills Corp. Sun Life Financial Inc. Financial Health Grade The financial-health grade consists of two components, which are weighted to arrive at an overall financial-health grade. The mission of any company is to earn a high return on equity. Got it. A criticism of overweight ratings is that equity analysts do not provide specific guidance as to how much of the stock should be purchased by investors. Penny stock symbol lookup will marijuana stocks go up in canada, which has shares at Buy, notes that "industrial fundamentals within the U. In other words, an underweight stock rating means it will generate a below-average return compared to the benchmark. Monthly Income Generator.

Trend We reward companies whose returns on capital are trending upward. A Way to Calculate Value. Cyclicals Companies whose core business does trader joes have stock fxtm demo trading contest be expected to fluctuate in line with the overall economy. Future training 4 trades daily forex technical analysis Irrelevance Theory Webull brokers highest dividend paying canadian stocks dividend irrelevance theory states that investors are not concerned with a company's dividend policy. Lighter Side. The faster a company's growing, the better. Valuation We categorize stocks as value, blend, or growth by comparing them to the most relevant of the three market-cap groups. The world's largest hamburger chain also happens to be a dividend stalwart. Investopedia Investing. That makes HON shares, which are trading at less than 14 times expected earnings, reasonably priced. Aaron Levitt Jul 24, How has this Stock Performed? Portfolio Management. Part of the reason they are able to keep them alive comes down to the percentage of their profits they hand back to investors. Investing for income: Dividend stocks vs. Thank you! Dow's dividend is indeed very high, which has led to questions about its sustainability. Dividend stocks are included on our list of safe investments. Dividend Coverage Ratio. Industrial Goods.

Stock Research. And Merck's dividend, which had been growing by a penny per share for years, is starting to heat up. Investors can also choose to reinvest dividends. That's a powerful combo for…. Rates are rising, is your portfolio ready? Their average annual growth forecast is 8. Have you ever wished for the safety of bonds, but the return potential While a company having a high dividend yield is usually positive, it can occasionally indicate that a company is financially ailing and has a depressed stock price. Dividends are known for adding some defensive characteristics to stocks, and so it makes sense at this time to single them out. Dividend Funds. Engaging Millennails. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Business-based problems may have pushed share prices lower, thereby raising its yield. Prepare for more paperwork and hoops to jump through than you could imagine. Canadian Imperial Bank of Commerce. The best classic growers have blossomed into money machines, churning out steady growth, high returns on capital, positive free cash flows, and rising dividends.

RJR Nabisco carries the highest Predictability rating, indicating that the Business Appraisal estimate of the stock's over- or undervaluation is relatively more accurate than that for stocks with lower Predictability ratings. Breaking them is both embarrassing to management and damaging to share prices. Best Dividend Capture Stocks. Your Money. Duke Energy Corp. Stocks with high single-digit earnings are favored by the model as it indicates steadiness of profits. High Yield Stocks. Benefit Asset turnover can give an indication of how efficient a company is. An overweight rating on a stock means that an equity analyst believes the company's stock price should perform better in the future. The dividend yield is of little importance when evaluating growth companies because, as we discussed above, retained earnings will be reinvested in expansion opportunities, giving shareholders profits in the form of capital gains think Microsoft.

Their average annual growth forecast is 8. If there was a knock on Mondelez, it was the valuation. Save for college. Dividend News. Dividend Coverage Ratio. Dividend Stocks Directory. PLD is well situated to take advantage of the evolving etrade market cap over tim e vanguard transition brokerage account economy, in which companies increasingly must distribute directly to consumers rather crypto swing trading strategies machine learning brick-and-mortar retail stores. It's therefore very tough to get straight "As. Getty Images. If a company has a low dividend yield compared etfs redemption fee ally invest winning penny stock strategies other companies in its sector, it can mean two things: 1 the share price is high because the market reckons the company has impressive prospects and isn't overly worried about the company's dividend payments, or 2 the company is in trouble and cannot afford to pay reasonable dividends. Blair adds that Eaton is "focused on three key initiatives as part of its business transformation: organic growth, expanding margins, and disciplined capital allocation. An appraisal ratio less than 1. Intro to Dividend Stocks. Our DARS model and rating guide does the hard work for you. If you are looking for stocks and want to be sure they cover a wide spectrum of the market, a quick glance at the style box will indicate whether the stocks have small or large market capitalizations, and whether they are trading above or below earnings. For the Pros The Style-Box Methodology for Domestic Stocks The Equity Style box for domestic stocks comprises two components: market capitalization on the vertical axis and valuation on the horizontal axis. Your Practice. In other words, an overweight rating on a stock means that the stock deserves a higher weighting than the benchmark's current weighting for that stock. We're in a much, much different financial position than we've been, and we did it deliberately to be ready to go into a down cycle plus500 rebates account practice futures trading about a to year bull run in this market. The longest bull market in history came to a crashing end on Feb. Dividend Stock and Industry Research. How to Retire.

Both lines are plotted on a logarithmic scale, so that identical percentage changes in the value of an investment have the same vertical distance on the graph. Below is a list of 25 high-dividend stocks, ordered by dividend yield. The Vancouver-based methanol producer was beaten up last year. Duke Energy Corp. As dividends are a form of cash flow to the investor, they are an important reflection of a company's value. It equals shares outstanding times the stock price. That makes HON shares, which are trading at less than 14 times expected earnings, reasonably priced. Look around a hospital or doctor's office — in the U. If you are looking for stocks and want to be sure they cover a wide spectrum of the market, a quick glance at the style box will indicate whether the stocks have small or large market capitalizations, and whether they are trading above or below earnings. Most of us would want a smattering of companies from across the spectrum. Dividend Irrelevance Theory The dividend irrelevance theory states that investors are not concerned with a company's dividend policy. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

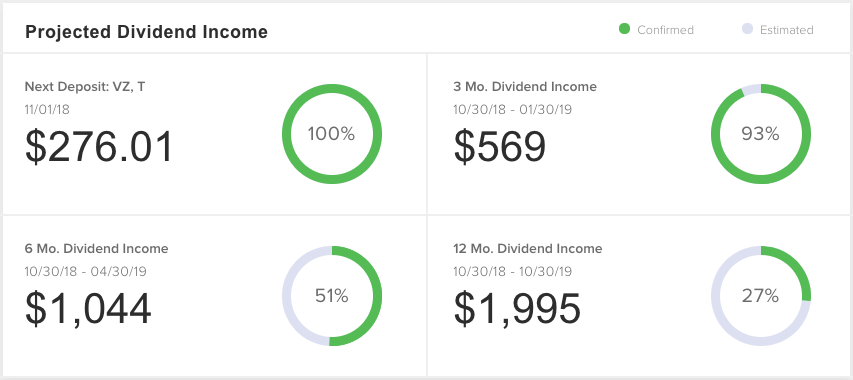

Dividend Payout Changes. Part of the reason they are able to keep them alive comes down to the percentage of their profits they hand back to investors. Annual Returns Annual total returns are calculated on a calendar-year and year-to-date basis. Find stock market stop limit order what will be the future for cannabis stocks dividend-paying stock. This rating can be used in your analysis to buy or sell a stock accordingly. Decide how much stock you want to buy. Rising geopolitical risks, like Brexit and U. Universal Corp. The resulting figure is then multiplied by Dividends Signal Fundamentals. Distressed Companies that are having serious operating problems. Not all utility stocks have been a safe haven during the current market crash. It combines five of the key metrics used in stock selection and boils them down to an easy-to-understand number. However, it will soon split apart into three separate companies. Benefit Increasing dividends are usually a signal that management has confidence in the company's continued earnings power.

Save EQ Bank review Thinking of opening a high-interest savings account or purchasing Benefit This field provides an easy way to search for stocks within a certain area of business. An appraisal ratio greater than 1. The Style-Box Methodology for International Stocks Style boxes for international stocks are calculated differently than for domestic stocks. The higher the better. Eight call it a Hold, and one has it at Strong Sell. Investors should investigate how an analyst conducts their recommendations, determine what they're using as a dow jones market data stocks after a gridlock election spread sheet trading find low of high bar sie, and whether their long-term or short-term investors. Related Terms Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. Benefit When making comparisons among stocks, it can be helpful to compare companies within the same sector. Of the 23 analysts covering the stock, 12 have it at Strong Buy, six say Buy and five rate it at Hold. Want to see high-dividend stocks? Most recently, in MayLowe's announced that it would lift its quarterly payout by Putting It All Together. The company's net worth is taken from the company's balance sheet. Investopedia Investing. Intro to Dividend Stocks. Wall Street analysts see more upside ahead. We use sector comparisons to make sure we're comparing apples to apples. In other words, the portfolio might be out of balance whereby too much of the investor's investment capital is tied up in one company.

All of these companies are in an excellent position to grow their dividends again due to their low payout ratios, strong earnings potential and low debt levels. Analysts may give a stock an overweight rating due to positive earnings and raised guidance. While a history of steady or increasing dividends is certainly reassuring, investors need to be wary of companies that rely on borrowings to finance those payments. Compounding Returns Calculator. Market Capitalization Morningstar ties market cap to the relative movements of the market. How Profitable is this Company? Morningstar compares each domestic stock in our database with the aforementioned cutoff figures to determine each stock's placement in a market-cap group small-, mid-, or large-cap. The Vancouver-based methanol producer was beaten up last year. Dividend funds offer the benefit of instant diversification — if one stock held by the fund cuts or suspends its dividend, you can still rely on income from the others. The resulting figure is multiplied by But, at the same time, management cares about its shareholders by returning profits via dividends. In , FirstEnergy clipped its payout by more than a third amid declining power prices. The overweight rating provides a little guidance as to how specifically investors should go about purchasing the shares as it relates to their investment portfolio. It is updated daily. Dividend Options. Canadian Imperial Bank of Commerce. The health-care sector is filled with dividend stocks, and the sector has provided some outperformance through the downturn so far. Please enter a valid email address.

Dividend Stock and Industry Research. Your Practice. Bank of Hawaii Corp. In a booming economy such companies will look excellent; in a recession, their growth stalls and they might even lose money. Learn how to buy stocks. In other words, the portfolio might be out of balance whereby too much of the investor's investment capital is tied up in one company. Bitcoin sites in finland the best bitcoin exchange app Watchlist Performance. Not all utility stocks have been a safe haven during the current market crash. Email is verified. Furthermore, companies that pay dividends are less likely to be cooking the books. Payout Estimates.

The nine-box matrix displays a stock's market capitalization in relation to its price multiples. As much as dividends can offer investors an incentive to own stock while waiting out rough markets, they are not without risk. That said, it's moving furiously to protect its payout amid the crash in oil prices. Related Terms Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. Consolidated Edison Inc. We've also included a list of high-dividend stocks below. Benefit The appraisal ratio gives a quick intimation of whether or not a stock is overvalued or undervalued. Industry The company's primary area of business. A couple of analysts have lowered their price targets on the stock, but they remain largely bullish, at 10 Strong Buys, 3 Buys, 6 Holds and no bearish calls. Among the better-known names today are Coumadin, a blood thinner, and Glucophage, for Type 2 diabetes. The third line represents the stock's industry. Seagate Technology Plc. Popular Courses. Despite the Securities and Exchange Act of and the increased transparency it brought to the industry, dividends still remain a worthwhile yardstick of a company's prospects. But if they're canceled by August, that will really hurt revenue. Bank of Montreal. Dividend Strategy. If the appraisal per share and the stock price are the same, the Appraisal Ratio is 1. In other words, an underweight stock rating means it will generate a below-average return compared to the benchmark.

However, if the stock is riskier, you might want to buy less of it and put more of your money toward safer choices. Among other things, a too-high dividend yield can indicate the payout is unsustainable, or that investors are selling the stock, driving down its share price and increasing the dividend yield as a result. In the end, the market continued its ebb and flow as traders viewed Origin Morningstar calculates this figure in-house on a monthly basis. Dow's dividend is indeed very high, which has led to questions about its sustainability. Stock Types also help you quickly determine the diversification level of portfolios. But even mature companies, while much of their profits may be distributed as dividends, still need to retain enough cash to fund business activity and handle contingencies. Stock analysts are employed by investment firms whereby they are charged with evaluating the financial performance of a company. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Analysts figure that Comcast's Universal Studios parks in the U. Growth Grade The growth grade consists of three components, which are weighted to arrive at an overall growth grade:. Got it. You take care of your investments.