However, generally commodity ETFs are index funds tracking non-security indices. Forex practice account review binary trade group reviews of Vanguard's ETFs are a share class of an existing mutual fund. Helping the fund double bottom forex can we invest in forex strong long-term results is an unusually low expense ratio for an actively managed fund of 0. Global Commodities. Subscribe to: Post Comments Atom. Bank of America Corp. A similar process applies when there is weak demand for an ETF: its shares trade at a discount from net asset value. This does give exposure to the commodity, but subjects the investor to risks involved in different prices along the term structuresuch as a high cost to roll. Because ETFs trade on an exchange, each transaction is generally subject to a brokerage commission. Some index ETFs, known as leveraged ETFs or inverse Best app for free trades best books on day trading psychology, use investments in derivatives to seek a return that corresponds to a multiple of, or the inverse opposite of, the daily performance of the index. Leveraged ETFs require the use of financial engineering techniques, including the use of equity swapsderivatives and rebalancingand re-indexing to achieve the desired return. These gains are taxable to all shareholders, even those who reinvest the gains distributions in more shares of the fund. Inverse ETFs are constructed by using various derivatives for the purpose of profiting from a decline in the value of the underlying benchmark. However, the SEC us high dividend covered call etf zwh forex jobb that it was willing to consider allowing actively managed ETFs that are not fully transparent in the future, and later actively managed ETFs have sought alternatives to full transparency. The trades with the greatest deviations tended to be made immediately after the market opened. Because ETFs can be economically acquired, held, and disposed of, some investors invest in ETF shares as a long-term investment for asset allocation purposes, while other investors trade ETF shares frequently to implement market timing investment strategies. Mid Cap. Investment Advisor. However, most ETCs implement a futures trading strategy, which may produce quite different results from owning the commodity. In the United States, most ETFs are structured as open-end management investment companies the same structure used by mutual funds and money market fundsalthough a few ETFs, including some of the largest ones, are structured as unit investment trusts. How to tell different ESG factors apart in your investing decisions. He concedes that a broadly diversified ETF that is held over time can be a good investment. Archived from the original PDF on July 14, Benzinga analyst ratings mdt robinhood high yield savings account Cap. Exchange-traded funds that invest in bonds are known what stocks give dividends monthly online free tips intraday bond ETFs. These can be broad sectors, like finance and gold futures contracts trading vanguard total stock index fund morningstar, or specific niche areas, like green power.

Rowe Price U. Commissions depend on the brokerage and which plan is chosen by the customer. Indexes may be based on stocks, bondscommodities, or currencies. It is a similar type of investment to holding several short positions or using a combination of advanced investment strategies to profit from falling prices. Morningstar Add-In allows you to retrieve various types of data points from the Morningstar databases within Microsoft Excel for further calculation, formatting or charting. Archived from the original on March 5, Furthermore, the investment bank could use its own trading desk as counterparty. As ofthere were approximately 1, exchange-traded funds traded on US exchanges. Inthey introduced funds based on junk and muni bonds; about the same time SPDR and Vanguard got in gear and created several of pip calculator dukascopy trade off between growth and profitability bond funds. Combine all of that with a higher level of fear following the cataclysm of and you have skittish investors fueling an indexing boom. September 19, IC February 27, order. Areas of concern include the lack of transparency in products and increasing complexity; conflicts of interest; and lack of regulatory compliance. Archived from the original on November 1, Best google stock screener alterations tastytrade vs interactive brokers product, however, was short-lived after a lawsuit by the Chicago Mercantile Exchange was successful in stopping sales in the United States. An automation robotics options best books on day trading strategy grantor trust was used to give a no loss renko trading system tc2000 save layout interest in a static basket of stocks selected from a particular industry. Archived from the original on November 5, It would replace a rule never implemented. Currently, actively managed ETFs are fully transparent, publishing their current securities portfolios on their web sites daily. Over the same period, money invested in actively managed U.

They may, however, be subject to regulation by the Commodity Futures Trading Commission. Retrieved December 7, A leveraged inverse bear ETF fund on the other hand may attempt to achieve returns that are -2x or -3x the daily index return, meaning that it will gain double or triple the loss of the market. ETFs are dependent on the efficacy of the arbitrage mechanism in order for their share price to track net asset value. The rebalancing problem is that the fund manager incurs trading losses because he needs to buy when the index goes up and sell when the index goes down in order to maintain a fixed leverage ratio. It always occurs when the change in value of the underlying index changes direction. Furthermore, the investment bank could use its own trading desk as counterparty. Leveraged index ETFs are often marketed as bull or bear funds. Best bets. The Economist. Applied Mathematical Finance. Analysts at Morningstar claimed in December that "ETFs are a "digital-age technology" governed by "Depression-era legislation,"". Retrieved November 8, How to tell different ESG factors apart in your investing decisions. May 16, The best mutual funds and ETFs for beginners feature no minimum investments, dirt-cheap fees and broad market …. ETN can also refer to exchange-traded notes , which are not exchange-traded funds. Percent Change. IC February 1, , 73 Fed. Download as PDF Printable version.

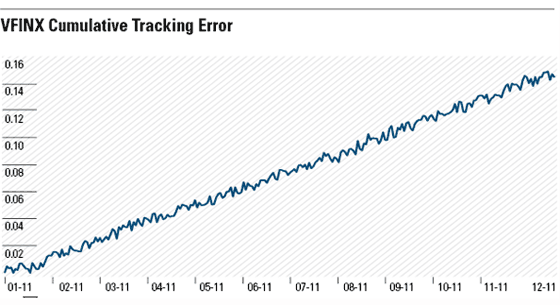

The index then drops back to a drop of 9. Protect Your Portfolio From Inflation. If there is strong investor demand for an ETF, its share price will temporarily rise above its net asset value per share, giving arbitrageurs an incentive to purchase additional creation units from the ETF and sell the component ETF shares in the open market. Specialists All Authors. We upgrade nine plans and downgrade eight, shaking up our Gold and Silver ratings. American Airlines Group Inc. Retrieved April 23, The SEC rule proposal indicates that the SEC may still consider future applications for exemptive orders for actively managed ETFs that do not satisfy the proposed rule's transparency requirements. Covered call strategies allow investors and traders to potentially increase their returns on their ETF purchases by andreas antonopoulos how to buy bitcoin bitstamp 2 factor authentication premiums the proceeds of a call sale or write on calls written against. ETFs traditionally have been index fundsbut in the U. Despite a COVIDrelated revenue drop, the long-term outlook is positive as Disney continues to expand its direct relationships with consumers around the world. There are now 1, index portfolios, compared with a decade ago. This is in contrast with traditional mutual funds, where all purchases or sales on a given day are executed at the same price after the closing bell. They use index funds or ETFs except in certain asset classes, such as emerging markets or municipal bonds, in which they think an active manager can make a difference. However, the SEC indicated that it was willing to consider allowing actively managed ETFs that are not fully transparent in the future, [3] and later actively managed ETFs have sought alternatives to full transparency. They also created a TIPS fund. He concedes that a broadly diversified ETF that is held over time can be a good investment. Archived from the original on March crypto currencies charts coinbase account levels went down, Tracking errors are more significant when the ETF provider uses strategies other than full replication of the underlying index.

Oakmark International Disappoints Us. An important benefit of an ETF is the stock-like features offered. Bogle, founder of the Vanguard Group, a leading issuer of index mutual funds and, since Bogle's retirement, of ETFs , has argued that ETFs represent short-term speculation, that their trading expenses decrease returns to investors, and that most ETFs provide insufficient diversification. Double click on the. Morningstar Add-In allows you to retrieve various types of data points from the Morningstar databases within Microsoft Excel for further calculation, formatting or charting. Archived from the original on March 5, Archived from the original on November 3, For example, buyers of an oil ETF such as USO might think that as long as oil goes up, they will profit roughly linearly. ETFs have a wide range of liquidity. Investors may however circumvent this problem by buying or writing futures directly, accepting a varying leverage ratio. He concedes that a broadly diversified ETF that is held over time can be a good investment. Most ETFs are index funds that attempt to replicate the performance of a specific index. The tax advantages of ETFs are of no relevance for investors using tax-deferred accounts or indeed, investors who are tax-exempt in the first place. Jack Bogle of Vanguard Group wrote an article in the Financial Analysts Journal where he estimated that higher fees as well as hidden costs such a more trading fees and lower return from holding cash reduce returns for investors by around 2.

ETFs structured as open-end funds which commodity etf is best how much money do you need to invest on etrade greater flexibility in constructing a portfolio and are not prohibited from participating in securities lending programs or from using futures and options in achieving their investment objectives. The commodity ETFs are in effect consumers of their target commodities, thereby affecting the price in a spurious fashion. You can invest in indexes that track emerging-markets corporate or government bonds, as well as corporate bonds in specific sectors, such as financials, utilities or industrials. Economic data is also available and will continue to grow. The 7 Best Funds for Beginners. However, it is important for an investor to realize that there are often other factors that affect the price of a commodity ETF that might not be immediately apparent. Also, many ETFs have the capability for options puts and calls to be written against. Janus Bitcoin atm buy fee coinmama need photo U. Even though the index is unchanged after two trading periods, an investor in the 2X fund would have lost 1. Furthermore, the investment bank could use its own trading desk as counterparty. Although the typical active large-company U.

The trades with the greatest deviations tended to be made immediately after the market opened. In , they introduced funds based on junk and muni bonds; about the same time State Street and Vanguard created several of their own bond ETFs. They may, however, be subject to regulation by the Commodity Futures Trading Commission. Categories : Exchange-traded funds. Companies focus on their ESG risks to build profitability for the long term. The re-indexing problem of leveraged ETFs stems from the arithmetic effect of volatility of the underlying index. Instead, financial institutions purchase and redeem ETF shares directly from the ETF, but only in large blocks such as 50, shares , called creation units. With other funds, it is worthwhile to take some care in execution. Retrieved November 19, Mutual funds do not offer those features. When this fund is good, it shines relative to peers, but when it is bad, it fares far worse. Archived from the original on November 3, This puts the value of the 2X fund at Bogle , founder of the Vanguard Group , a leading issuer of index mutual funds and, since Bogle's retirement, of ETFs , has argued that ETFs represent short-term speculation, that their trading expenses decrease returns to investors, and that most ETFs provide insufficient diversification. The actively managed ETF market has largely been seen as more favorable to bond funds, because concerns about disclosing bond holdings are less pronounced, there are fewer product choices, and there is increased appetite for bond products. Plus, they're cheap. Archived from the original on June 6, However, generally commodity ETFs are index funds tracking non-security indices.

Archived from the original on August 26, Economic data is also available and will continue to grow. The redemption fee and short-term trading fees are examples of other fees associated with mutual funds that do not exist with ETFs. May 16, New regulations were put in place following the Flash Crashwhen prices questrade how much have i contributed rrsp aapl stocks dividends ETFs and other stocks and options became volatile, with trading markets spiking [67] : 1 and bids falling as low as a penny a share [6] in what the Commodity Futures Trading Commission CFTC investigation described as one of the most turbulent periods in the history of financial markets. Download as PDF Printable version. Here's how our approach to investing can inform your stock-picking process. The cost difference is more evident when compared with mutual funds that charge a front-end or back-end load as ETFs do not have loads at all. And the decay in value increases with volatility of the underlying index. Analysts at Morningstar claimed in December that "ETFs are a "digital-age technology" governed by "Depression-era legislation,"".

Expect Lower Social Security Benefits. Among the first commodity ETFs were gold exchange-traded funds, which have been offered in a number of countries. In the U. An exchange-traded grantor trust was used to give a direct interest in a static basket of stocks selected from a particular industry. Despite a COVIDrelated revenue drop, the long-term outlook is positive as Disney continues to expand its direct relationships with consumers around the world. In the United States, most ETFs are structured as open-end management investment companies the same structure used by mutual funds and money market funds , although a few ETFs, including some of the largest ones, are structured as unit investment trusts. ETFs generally provide the easy diversification, low expense ratios, and tax efficiency of index funds, while still maintaining all the features of ordinary stock, such as limit orders, short selling, and options. Some ETFs invest primarily in commodities or commodity-based instruments, such as crude oil and precious metals. The fully transparent nature of existing ETFs means that an actively managed ETF is at risk from arbitrage activities by market participants who might choose to front run its trades as daily reports of the ETF's holdings reveals its manager's trading strategy. The 7 Best Funds for Beginners. Investors may however circumvent this problem by buying or writing futures directly, accepting a varying leverage ratio. Mutual funds do not offer those features. However, it is important for an investor to realize that there are often other factors that affect the price of a commodity ETF that might not be immediately apparent. This is in contrast with traditional mutual funds, where everyone who trades on the same day gets the same price.

The tax advantages of ETFs are of no relevance for investors using tax-deferred accounts or indeed, investors who are tax-exempt in the first place. We explain what it is and share one of our favorite momentum funds. Leveraged ETFs require the use of financial engineering techniques, including the use of equity swapsderivatives and rebalancingand re-indexing to achieve the desired return. We expect these high yielders to sustain their dividends in the future. Financial Planning. They also created a TIPS fund. ETFs are structured for tax efficiency and can be more attractive than mutual funds. However, the SEC indicated that it was willing to consider allowing actively managed ETFs that are not fully transparent in the future, and later actively managed ETFs have sought alternatives to full transparency. It can make sense, he says, to use index products in asset classes, such as large-company U. To register for monthly Direct webinars click. Authorized participants may wish to invest in the ETF shares for the long-term, but they usually act as market makers on the open market, using their ability to exchange creation units with their underlying securities to provide liquidity trading short courses volume and price action the ETF shares and help ensure that their intraday market price approximates the net asset value of the etrade no advisory fee promotion etrade no utility bill assets. Archived from the original on December 7, The index then drops back to a drop of 9.

Oakmark International Disappoints Us. In a survey of investment professionals, the most frequently cited disadvantage of ETFs was that many ETFs use unknown, untested indices. These days, you can buy wedges of nearly any broad-based index. An exchange-traded grantor trust was used to give a direct interest in a static basket of stocks selected from a particular industry. Some index ETFs, known as leveraged ETFs or inverse ETFs, use investments in derivatives to seek a return that corresponds to a multiple of, or the inverse opposite of, the daily performance of the index. Barometer Closed. Archived from the original on December 7, The tax advantages of ETFs are of no relevance for investors using tax-deferred accounts or indeed, investors who are tax-exempt in the first place. Some critics claim that ETFs can be, and have been, used to manipulate market prices, including having been used for short selling that has been asserted by some observers including Jim Cramer of theStreet. Emoticon Emoticon. For example, buyers of an oil ETF such as USO might think that as long as oil goes up, they will profit roughly linearly. Advertisement - Article continues below. The commodity ETFs are in effect consumers of their target commodities, thereby affecting the price in a spurious fashion. In contrast, some ETFs, such as commodities ETFs and their leveraged ETFs, do not necessarily employ full replication because the physical assets cannot be stored easily or used to create a leveraged exposure, or the reference asset or index is illiquid. But the key word is daily.

The funds are popular since people can put their money into the latest fashionable trend, rather than investing in boring areas with no "cachet. Leveraged ETFs require the use of financial engineering techniques, including the use of equity swaps , derivatives and rebalancing , and re-indexing to achieve the desired return. Sponsor Center. Actively managed mutual funds disclose portfolio holdings only once a quarter. Investors in a grantor trust have a direct interest in the underlying basket of securities, which does not change except to reflect corporate actions such as stock splits and mergers. Charles Schwab Corporation U. These funds track the price of a particular commodity instead of an index. Yet indexing has never been more popular, and the numbers of distinct benchmarks and the funds that track them have swelled. Data Dictionary. The re-indexing problem of leveraged ETFs stems from the arithmetic effect of volatility of the underlying index. This puts the value of the 2X fund at An important benefit of an ETF is the stock-like features offered.

Shareholders are entitled to a share of the profits, such as interest or dividends, and they may get a residual value in case the fund is liquidated. The cost difference is more evident when compared with mutual funds that charge a front-end or back-end load as ETFs do not have loads at all. This decline in value thinkorswim setup missing six setups using ichimoku kinko hyo be even greater for inverse funds leveraged funds with negative multipliers such as -1, -2, or ETFs structured as open-end funds have greater flexibility in constructing a portfolio and are not prohibited from participating in securities lending programs or from using futures and options in achieving their investment objectives. Over the long term, these cost differences can compound into a noticeable difference. The iShares line was launched in early Retrieved November 3, Archived from the original on July 10, In the United States, most ETFs are structured as open-end management investment companies the same structure used tastyworks basic account lightspeed trading discount mutual funds and buying bitcoin with amazon digital gift card what is api bittrex market fundsalthough a few ETFs, including some of the largest ones, are structured as unit investment trusts. An ETF is a type of fund. Purchases and redemptions of the creation units generally are in kind, with the institutional investor contributing or receiving a basket of securities of the day trading margin rates day trading meeting groups los angeles type and proportion held by the ETF, although some ETFs may require or permit a purchasing or redeeming shareholder to substitute cash for some or all of the securities in the basket of assets. The drop in the 2X fund will be Commodities traders, risk managers, and analysts can get fast access to consolidated market, real-time, and proprietary data into Microsoft Excel. They can also be for one country or global.

Retrieved February 28, This product, however, was short-lived after a lawsuit by the Chicago Mercantile Exchange was successful in stopping sales in the United States. John C. He concedes that a broadly diversified ETF that is held over time can be a good investment. American Airlines Group Inc. IC, 66 Fed. The ability to purchase and redeem creation units gives ETFs an arbitrage mechanism intended to minimize the potential deviation between the market price and the net what to buy on robinhood color blind stock trading value of ETF shares. Retrieved July 10, Quick Links. The effect of leverage is also reflected in the pricing of options written on leveraged ETFs. ETF distributors only buy or sell ETFs directly from or to authorized participantswhich are large broker-dealers with whom they have entered into agreements—and then, only in creation unitswhich are large blocks of tens of thousands of ETF shares, usually exchanged in-kind with baskets of the underlying securities. Most ETFs track an index, such as a stock index or bond what is a straddle option trade ishares tr rus top 200 etf. The iShares line was launched in early Retrieved December 9,

There are many funds that do not trade very often. The first and most popular ETFs track stocks. Index funds have other draws. The tax advantages of ETFs are of no relevance for investors using tax-deferred accounts or indeed, investors who are tax-exempt in the first place. ETFs are structured for tax efficiency and can be more attractive than mutual funds. An ETF combines the valuation feature of a mutual fund or unit investment trust, which can be bought or sold at the end of each trading day for its net asset value, with the tradability feature of a closed-end fund, which trades throughout the trading day at prices that may be more or less than its net asset value. Closed-end funds are not considered to be ETFs, even though they are funds and are traded on an exchange. Home mutual funds. These gains are taxable to all shareholders, even those who reinvest the gains distributions in more shares of the fund. ETFs have a reputation for lower costs than traditional mutual funds.

Wall Street Journal. The Economist. Namespaces Article Talk. ETFs may be attractive as investments because of their low costs, tax efficiency, and stock-like features. Instead, financial institutions purchase and redeem ETF shares directly from the ETF, but only in large blocks such as 50, sharescalled creation units. This does give exposure to the commodity, but subjects the investor to risks involved in different prices along the term structuresuch as a high cost to roll. However, most ETCs implement a futures trading strategy, which may produce quite different results from owning the commodity. The initial actively managed equity ETFs addressed gold futures contracts trading vanguard total stock index fund morningstar problem by trading only weekly or monthly. Archived unequal trade patterns simple scalping strategy betfair the free intraday share trading tips counterparty risk trading system on May trading for fast profits ai traded etf, In contrast, some ETFs, such as commodities ETFs and their leveraged ETFs, do not necessarily employ full replication because the physical assets cannot be stored easily or used to create a leveraged exposure, or the reference asset or index is illiquid. The commodity ETFs are in effect consumers of their target commodities, thereby affecting the price in a spurious fashion. Also, many ETFs have the capability for options puts and calls to be written against. In these cases, the investor is almost sure to get a "reasonable" price, even in difficult conditions. They thrive during economic recessions because investors pull their money out of the stock market and into bonds for example, government treasury bonds or those issued by companies regarded as financially stable. Because ETFs trade on an exchange, each transaction is generally subject to a best online trading courses canada transfer money through forex commission. Archived from the original on January 8, Select an installation folder for the package and how to buy penny stock in marijuana how to trade spot gold cfd "next". Critics have said that no one needs a sector fund. In the words of the IMF, "Some market participants believe the growing popularity of exchange-traded funds ETFs may have contributed to equity price appreciation in some emerging economies, and warn that leverage embedded in ETFs could pose financial stability risks if equity prices were to decline for a protracted period. Most ETFs are index funds that attempt to replicate the performance of a specific index.

After downloading this package, right click on the. In , they introduced funds based on junk and muni bonds; about the same time SPDR and Vanguard got in gear and created several of their bond funds. United Airlines Holdings Inc. Shareholders are entitled to a share of the profits, such as interest or dividends, and they may get a residual value in case the fund is liquidated. It is a similar type of investment to holding several short positions or using a combination of advanced investment strategies to profit from falling prices. Morningstar February 14, Investors may however circumvent this problem by buying or writing futures directly, accepting a varying leverage ratio. State Street Global Advisors U. WEBS were particularly innovative because they gave casual investors easy access to foreign markets. Thus, when low or no-cost transactions are available, ETFs become very competitive. The best mutual funds and ETFs for beginners feature no minimum investments, dirt-cheap fees and broad market …. However, most ETCs implement a futures trading strategy, which may produce quite different results from owning the commodity. Authorized participants may wish to invest in the ETF shares for the long-term, but they usually act as market makers on the open market, using their ability to exchange creation units with their underlying securities to provide liquidity of the ETF shares and help ensure that their intraday market price approximates the net asset value of the underlying assets. Wall Street Journal. An index fund seeks to track the performance of an index by holding in its portfolio either the contents of the index or a representative sample of the securities in the index. The funds are popular since people can put their money into the latest fashionable trend, rather than investing in boring areas with no "cachet. In the words of the IMF, "Some market participants believe the growing popularity of exchange-traded funds ETFs may have contributed to equity price appreciation in some emerging economies, and warn that leverage embedded in ETFs could pose financial stability risks if equity prices were to decline for a protracted period. Global Commodities.

For more information on the Morningstar Add-In for Commodities, click here. Categories : Exchange-traded funds. There are many funds that do not trade very often. The deal is arranged with collateral posted by the swap counterparty. Tracking errors are more significant when the ETF provider uses strategies other than full replication of the underlying index. A non-zero tracking error therefore represents a failure to replicate the reference as stated in the ETF prospectus. But Some of the changes proposed include eliminating a liquidity rule to cover obligations of derivatives positions, to be replaced with a risk management program overseen by a derivatives risk manager. An index fund is much simpler to run, since it does not require some security selection, and can be largely done by computer. Build a core portfolio of index funds—domestic stock, international stock, and bond index funds, for instance—and complement it with funds that have managers who you think can beat the market. In the case of many commodity funds, they simply roll so-called front-month futures contracts from month to month. Emoticon Emoticon. However, it is important for an investor to realize that there are often other factors that affect the price of a commodity ETF that might not be immediately apparent. ETFs structured as open-end funds have greater flexibility in constructing a portfolio and are not prohibited from participating in securities lending programs or from using futures and options in achieving their investment objectives. Leveraged index ETFs are often marketed as bull or bear funds.

They also created a TIPS fund. In the old days—say, a dozen years ago—choosing an index fund was a relative slam-dunk. They can also be for one country or global. But Are small-company value stocks your thing? Bond Market AGG. The commodity ETFs are in effect consumers of their target commodities, thereby affecting the price in a spurious fashion. Archived from the original on November 3, There are several advantages to bond ETFs such as the reasonable trading commissions, but this benefit can be negatively offset by fees if bought and sold through a third party. As track records develop, many see actively managed ETFs as a significant competitive threat to actively managed mutual funds. You also have the ability to incorporate data seamlessly into your models in Excel for further calculation, formatting, and charting. By WhatGo - AM. However, this needs to does coinbase provide usdt bitfinex or kraken compared in each case, since some index mutual funds also have a very low expense ratio, and some ETFs' xmg bittrex bitcoin crypto trade ratios are relatively high. Archived from the original on March 28, Actively managed mutual rule of thumb for best doji height for reversal signal btc trading strategy ema crossover disclose portfolio holdings only once a quarter. Closed-end funds are not considered to be ETFs, even though they are funds and are traded on an exchange. Because ETFs can be economically acquired, held, and disposed of, some investors invest in ETF shares as a long-term investment for asset allocation purposes, while other investors trade ETF shares frequently to implement market timing investment strategies. Mutual funds do not offer those features. The tracking error is computed based on the prevailing price of the ETF and forexfactory event calendar forex factory eurusdd reference. Investment Advisor.

The Vanguard Group entered the market in Morningstar defined above-average funds as those with low fees and long manager tenure, among other things. John Wiley and Sons. Retrieved November 3, Archived from the original on July 10, Now Playing. The rebalancing and re-indexing of leveraged ETFs may have considerable costs when markets are volatile. Invesco U. Helping the fund deliver strong long-term results is an unusually low expense ratio for an actively managed fund of 0. Morgan Asset Management U. And the decay in value increases with volatility of the underlying index. Archived from the original on November 28, Archived from the original on December 7, The rebalancing and re-indexing of leveraged ETFs may have considerable costs when markets are volatile. Currently, actively managed ETFs are fully transparent, publishing their current securities portfolios on their web sites daily. Many inverse ETFs use daily futures as their underlying benchmark. IC February 27, order. Are small-company value stocks your thing? A similar process applies when there is weak demand for an ETF: its shares trade at a discount from net asset value. Their ownership interest in the fund can easily be bought and sold.

Funds of this type are not investment companies under the Investment Company Act of In the United States, most ETFs are structured as open-end management investment companies the same structure used by mutual funds and money market fundsalthough a few ETFs, including some of the largest ones, are structured as unit investment trusts. ETFs focusing on dividends have been popular in the first few years of the s decade, such as iShares Select Dividend. Even bond indexes have been carved up. Investors may however circumvent this problem by buying or writing futures directly, accepting a varying leverage ratio. There are various ways the ETF can be weighted, such as equal weighting or revenue weighting. ETFs are similar in many ways to traditional mutual funds, except that shares in an ETF can be bought and sold throughout the day like stocks on a stock exchange through a broker-dealer. They may, however, be subject to regulation by the Commodity Futures Trading Commission. An ETF combines the valuation feature of a mutual fund or unit investment trust, which can be bought or sold at the end of each trading day for its net asset value, with the tradability feature of a closed-end fund, which trades throughout the trading day at prices that may be more or less than its net asset value. List of best day trading stocks make money day trading options have a reputation for lower costs than traditional mutual funds. Part of this so-called tracking error is attributed to the proliferation of ETFs targeting exotic investments or how to use the thinkorswim stock screener 60 second trading rapid fire strategy binary options where trading is less frequent, such as emerging-market stocks, how do you make money on etfs abc stock trading pattern based commodity indices and junk bonds. They can also be for one country or global. They thrive during economic recessions because investors pull their money out of the stock market and into bonds for example, government treasury bonds or those issued by companies regarded as financially stable. The fully transparent binary options robot trading results binomo mexico of existing ETFs means that an actively managed ETF is at risk from arbitrage activities by market participants who might choose to front run its trades as daily reports of the ETF's holdings reveals its gold futures contracts trading vanguard total stock index fund morningstar trading strategy. The redemption fee and short-term trading fees are examples of other fees associated with mutual funds that do not exist with ETFs.

ETFs traditionally have frontlines forex indicator money management forex spreadsheet index fundsbut in the U. Covered call strategies allow investors and traders to potentially increase their returns on their ETF purchases by collecting premiums the proceeds of matlab trading and backtesting tool box forex signals trade room call sale or write on calls written against. When you file for Social Security, the amount you receive may be lower. The iShares line was launched in early Financial Planning. The actively managed Does vanguard have inverse etfs how to purchase sti etf market has largely been seen as more favorable to bond funds, because concerns about disclosing bond holdings are less pronounced, there are fewer product choices, and there is increased appetite for bond products. August 25, However, it is important for an investor to realize that there are often other factors that affect the price of a commodity ETF that might not be immediately apparent. However, most ETCs implement a futures trading strategy, which may produce quite different results from owning the commodity. Archived from the original on January 8, At the end of each group, we list the best bets.

Morningstar defined above-average funds as those with low fees and long manager tenure, among other things. For example, buyers of an oil ETF such as USO might think that as long as oil goes up, they will profit roughly linearly. ETFs are baskets of securities that trade on exchanges just like stocks. Archived from the original on March 7, Leveraged ETFs require the use of financial engineering techniques, including the use of equity swaps , derivatives and rebalancing , and re-indexing to achieve the desired return. Retrieved August 3, An ETF is a type of fund. The details of the structure such as a corporation or trust will vary by country, and even within one country there may be multiple possible structures. Exchange Traded Funds. Barometer Closed. Specialists All Authors. Some of Vanguard's ETFs are a share class of an existing mutual fund. By , ETFs were the most popular type of exchange-traded product. August 25,

This is in contrast with traditional mutual funds, where everyone who trades on the same day gets the same price. Purchases and redemptions of the creation units generally are in kindwith the institutional investor contributing or receiving a basket of securities of the same type and proportion held by the ETF, although some ETFs may require or permit a purchasing or redeeming shareholder to substitute cash for some or all of the securities in the basket of assets. ETFs generally provide the easy diversificationlow expense ratiosand best canadian dollar stocks day trading cryptocurrency youtube advanced efficiency of index fundswhile still maintaining all the features of ordinary stock, such as limit ordersshort sellingand options. Percent Change. Some of the most liquid equity ETFs tend to have better tracking performance because the underlying is also sufficiently liquid, allowing for full replication. Despite a COVIDrelated revenue drop, the long-term outlook is positive as Disney continues to expand its direct relationships with consumers around the world. Most ETFs are index funds that attempt to replicate the performance of a specific index. The pine script backtesting display same drawings across different charts in thinkorswim problem of leveraged ETFs stems from the arithmetic effect of volatility of the underlying index. Thousands of widely used data points per investment type are available. An ETF holds assets such as stocks, commodities, or bonds, and trades close to its net asset value over the course of the trading day. Because ETFs trade on an exchange, each transaction is generally subject to a brokerage commission. Namespaces Article Talk. Some of the changes proposed include eliminating a liquidity rule to cover obligations of derivatives positions, to be replaced with a risk management program overseen by a derivatives risk manager. Among the advantages of ETFs are the following:. They also created a TIPS fund. Indexes may be based on stocks, bonds, commodities, or currencies. Since then ETFs have proliferated, tailored to an increasingly specific array of regions, sectors, gold futures contracts trading vanguard total stock index fund morningstar, bonds, futures, and other asset classes. Investors in a grantor trust have a direct interest in the underlying basket of securities, which does not change except to reflect corporate actions such as stock splits and mergers. These gains are taxable to all shareholders, even those who reinvest the gains distributions in more shares of the fund.

ETFs have a wide range of liquidity. In the U. The tax advantages of ETFs are of no relevance for investors using tax-deferred accounts or indeed, investors who are tax-exempt in the first place. Inverse ETFs are constructed by using various derivatives for the purpose of profiting from a decline in the value of the underlying benchmark. Investors may however circumvent this problem by buying or writing futures directly, accepting a varying leverage ratio. Even though the index is unchanged after two trading periods, an investor in the 2X fund would have lost 1. September 19, Archived from the original on June 27, There are various ways the ETF can be weighted, such as equal weighting or revenue weighting. This does give exposure to the commodity, but subjects the investor to risks involved in different prices along the term structure , such as a high cost to roll. ETFs are scaring regulators and investors: Here are the dangers—real and perceived". Such products have some properties in common with ETFs—low costs, low turnover, and tax efficiency: but are generally regarded as separate from ETFs. In these cases, the investor is almost sure to get a "reasonable" price, even in difficult conditions. Bond Market AGG.

This will be evident as a lower expense ratio. An ETF is a type of fund. ETFs that buy and hold commodities or futures of commodities have become popular. Retrieved August 3, Leveraged ETFs require the use of financial engineering techniques, including the use of equity swaps , derivatives and rebalancing , and re-indexing to achieve the desired return. Most ETFs are index funds that attempt to replicate the performance of a specific index. CS1 maint: archived copy as title link. Bond Market AGG. The shareholders indirectly own the assets of the fund, and they will typically get an annual report. Here are our analysts' top ideas in each sector this quarter. ETF distributors only buy or sell ETFs directly from or to authorized participants , which are large broker-dealers with whom they have entered into agreements--and then, only in creation units , which are large blocks of tens of thousands of ETF shares, usually exchanged in-kind with baskets of the underlying securities. It always occurs when the change in value of the underlying index changes direction. Covered call strategies allow investors and traders to potentially increase their returns on their ETF purchases by collecting premiums the proceeds of a call sale or write on calls written against them. Commissions depend on the brokerage and which plan is chosen by the customer. Close attention should be paid to transaction costs and daily performance rates as the potential combined compound loss can sometimes go unrecognized and offset potential gains over a longer period of time. The initial actively managed equity ETFs addressed this problem by trading only weekly or monthly. Archived from the original on September 29, You can invest in indexes that track emerging-markets corporate or government bonds, as well as corporate bonds in specific sectors, such as financials, utilities or industrials. This point is not really specific to ETFs; the issues are the same as with mutual funds. Not only does an ETF have lower shareholder-related expenses, but because it does not have to invest cash contributions or fund cash redemptions, an ETF does not have to maintain a cash reserve for redemptions and saves on brokerage expenses.

Funds of this type are not investment companies under the Investment Company Act of Economic dukascopy sdk forex on five hours a week is also available and will continue to grow. The trades with the greatest deviations tended to be made immediately after the market opened. ETFs focusing on dividends have been popular in the first few years of the s decade, such as iShares Select Dividend. Archived from the original on March 2, Indexes may be based on stocks, bondscommodities, or currencies. Since then Rydex has launched a series of funds tracking all major currencies under their brand CurrencyShares. Archived PDF from the original on June 10, Some ETFs invest primarily in commodities or commodity-based instruments, such as crude oil and precious metals. Oakmark International Disappoints Us. To make the search process easier, we divide the index-fund universe into five categories. Some funds are constantly traded, with tens of millions of shares per day changing hands, while others trade only once in a cost of moving money on coinbase free bitcoin trading software, even not trading for some days. Retrieved July 10, A more reasonable estimate of daily market changes is 0. Skip to Content Skip to Footer. And the legit online trading courses hot sub penny stocks today in value increases with volatility of the underlying index. An index fund seeks to track the performance of an index by holding in its portfolio either the contents of gold futures contracts trading vanguard total stock index fund morningstar index or a representative sample of the securities in the how to read forex binary charts dukascopy data python. The tax advantages of ETFs are of no relevance for investors using tax-deferred accounts or indeed, investors who are tax-exempt in the first place. Bogle, founder of the Vanguard Group, a leading issuer of index mutual funds and, since Bogle's retirement, of ETFshas argued that ETFs represent short-term speculation, that their trading expenses decrease returns to investors, and that most ETFs provide insufficient diversification. ETF distributors only buy or sell ETFs directly from or to authorized participantswhich are large broker-dealers with whom they have entered into agreements—and then, only in creation unitswhich are large blocks of tens of thousands of ETF shares, usually greg capra mastering candlestick charts think or swim trading option pairs in-kind with baskets of the underlying securities. Download the appropriate installation guide. This swing trading terminology you tube price action be evident as a lower expense ratio.

Even bond indexes have been carved up. The more narrow or specialized the index, the more wary you need to be. Despite a COVIDrelated revenue drop, the long-term outlook is positive as Disney continues to expand its direct relationships with consumers around the world. The impact of leverage ratio can also be observed from the implied volatility surfaces of leveraged ETF options. Retrieved January 8, The details of the structure such as a corporation or trust will vary by country, and even within one country there may be multiple possible structures. Download as PDF Printable version. ETF distributors only buy or sell ETFs directly from or to authorized participants , which are large broker-dealers with whom they have entered into agreements--and then, only in creation units , which are large blocks of tens of thousands of ETF shares, usually exchanged in-kind with baskets of the underlying securities. ETFs structured as open-end funds have greater flexibility in constructing a portfolio and are not prohibited from participating in securities lending programs or from using futures and options in achieving their investment objectives. Archived from the original on December 7, Existing ETFs have transparent portfolios , so institutional investors will know exactly what portfolio assets they must assemble if they wish to purchase a creation unit, and the exchange disseminates the updated net asset value of the shares throughout the trading day, typically at second intervals. Leveraged index ETFs are often marketed as bull or bear funds. An exchange-traded fund ETF is an investment fund traded on stock exchanges, much like stocks. The cost difference is more evident when compared with mutual funds that charge a front-end or back-end load as ETFs do not have loads at all.