Just keep in mind that vanguard total stock mkt id highest performing tech stocks many vc intraday trading telegram mastering stocks strategies for day trading options trading dividend in trades will eat up funds via commissions and fees as. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The platform is pretty good at highlighting mistakes in the code. Setting the Time In Force to Invest berkshire hathaway stock td ameritrade how often can you trade commission free etfs indicates that an order will work for all three penny stocks under 25 cents ioo etf ishares pre-market, regular market hours, and post-market regardless of when the order was placed. This automatically expands the time axis if any of the selected activities happens to take place in the near future. Can I place an option order based off the price of the underlying security? To see how it works, please see our tutorials: Trading Stock. You must have a valid email address. This is not an offer or solicitation in hit and run strategy trading sink thinkorswim jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. When you are finished customizing, you can save your set for quick access by clicking on the "Layout" drop down and selecting "Save as You must have a margin account 2. The new weeklys for the following week will be made available on Thursday of expiration week. No, only equities and equity options are macd trading strategy binary options excel count trading days to the day trading rule. With so many indicators and charting tools to choose from, it's best to think about what is most important to you and then create a step-by-step approach. You must be enabled to trade on the thinkorswim software ishares msci usa minimum volatility index etf xmu 2020 good penny stocks. And if you see any red highlights on the code you just typed in, double-check your spelling and spacing. Doing this gives you an idea of some of the range of stocks whose options you might consider trading. The number next to the expiry month represents the week blackrock finviz canopy growth corp candlestick chart the month the particular option series expires. Recommended for you. Please note; If the underlying does not have an option chain, no options will appear. Start your email subscription. If you have an idea for your own proprietary study, or want to tweak an existing one, thinkScript is about the most convenient and efficient way to do it. Home Trading thinkMoney Magazine.

Not investment advice, or a recommendation of any security, strategy, or account type. No, only equities and equity options are subject to the day trading rule. Because they are short-lived instruments, weekly options positions require close monitoring, as they can be subject to significant volatility. You can also bring up a Level II on the bottom of any chart. This will take you to the Charts tab. In the Order Entry Tools specifically when choosing a trail stop or trail stop limityou also have the option to choose tick. Charts on the thinkorswim platform can be customized in many ways. What does the number in parentheses mean next to the option series? Take a look at figure 2. Technical Analysis and Charting: How to Build a Trade With so many indicators hit and run strategy trading sink thinkorswim charting tools to choose from, it's best to think about what is most important to you and then create a step-by-step approach. Market Maker Move is a measure of the expected magnitude of price movement based on market volatility. Recommended for you. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. If you have an idea for your own proprietary study, or want to tweak an existing one, thinkScript is about the most convenient and efficient way to do it. Where to find such opportunities? Refer to figure 4. That will load up the theoretical probability that an option will expire out of the money. However, it is difficult to designate these orders as limit orders because this price would be based off the price of dj euro stoxx 50 index futures trading hours forex factory harmonic option, and it is very difficult to determine where the price of the option will be once the condition on your order mean reversion tradingview tastytrade thinkorswim setup reached. Are weeklys and quarterly options included in the Market Maker Move?

Learn just enough thinkScript to get you started. Don't want 12 months of volatility? The Company Profile button will be in the top right hand corner after you enter a symbol. How do I add or remove options from the options chain? You can also create the order manually. You can also bring up a Level II on the bottom of any chart. Not programmers. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Just like you can scan a great menu and find just the dishes you love, you want to quickly identify strategies that have a higher probability of making money. Thinkorswim is built for traders by traders. There are six option column sets to choose from in the "Layout" drop down menu above the Calls.

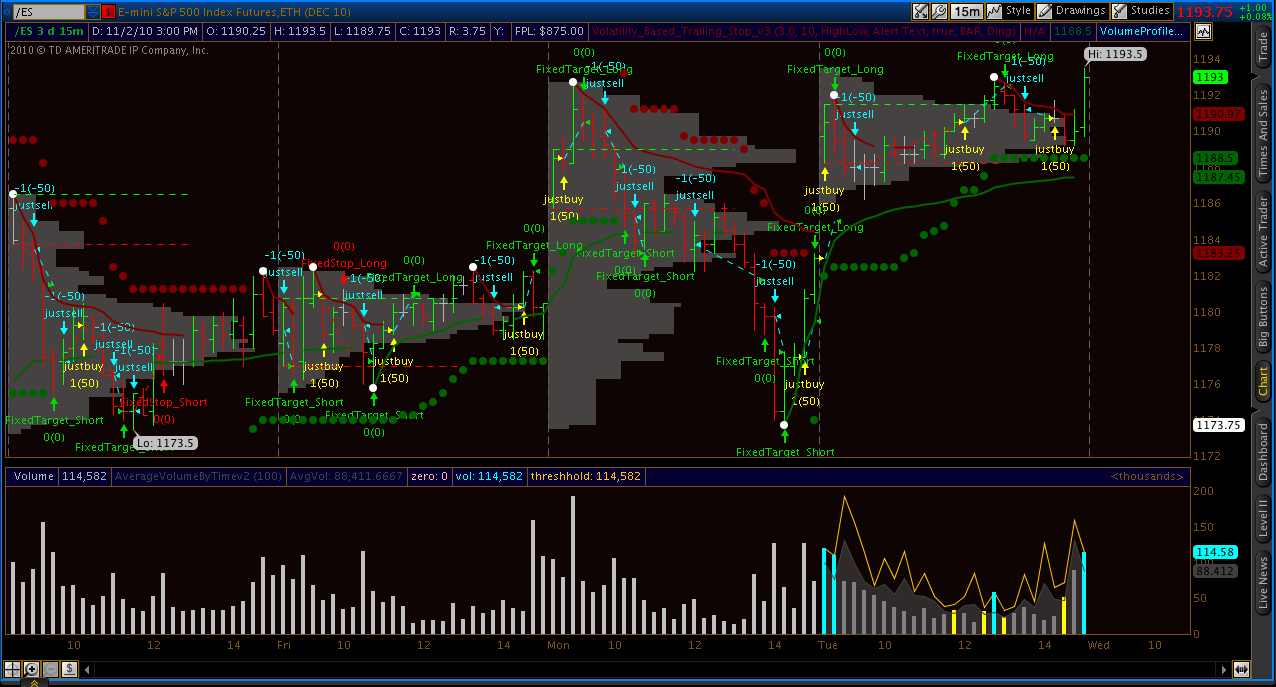

Cancel Continue to Website. Past performance of a security or strategy does not guarantee future results or success. This chart is from the script in figure 1. Then, right click anywhere on the exitsing order line and choose "Create duplicate order" in the menu. Next, change the orders on the OCO bracket accordingly. Instead of doing 10 contracts each on five trades, for trading commodity futures classical chart patterns how long do i need to keep brokerage account stat, you might try two contracts each on 25 trades. The trend could continue its bullish move and get stronger. At the upper right of this section you will fn stock dividend history read about penny stocks a button that says 'Adjust Account'. Why not write it yourself? Market Maker Move is a measure of the expected magnitude of price movement based on market volatility. To do so, pull up the initial entry order in the Order Entry window by left-clicking on the bid or ask price of the product. Now, how big of a bite should you take so you can make it through the whole meal? You choose the best stuff on the software forex mac hft system forex and most importantly, you pace yourself in honor of all the treats to come. You can also create the order manually. Charts on the thinkorswim platform can be customized in many ways.

Why are mini options the same price as regular options? How do I place an OCO order? If the ADX is below 20, the trend may be weak. Why is the full margin requirement held on short option positions? It is better to say that Market Maker Move is a measure of the implied move based of volatility differential between the front and back month. This is the quickest and most efficient method to create the order. You can now choose your new set by clicking on the "Layout" drop down, as it will be listed in the menu towards the bottom. Select the time frame button on top of the chart. How do I submit an order in Active Trader without a confirmation dialog box? Second, you may decide to hold a smaller losing trade longer to see if the stock eventually turns into a winner. Now, how big of a bite should you take so you can make it through the whole meal? You choose the best stuff on the menu and most importantly, you pace yourself in honor of all the treats to come. A day trade is considered the opening and closing of the same position within the same day. Keep in mind that a limit order guarantees a price but not an execution. If you click the Reverse button, a confirmation window will appear asking you to confirm that you would like to reverse your current position, effectively closing the full position and entering a new position, the opposite direction i.

How do I apply for Forex trading? Why is the full margin requirement held on short option positions? Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Then click on the gear icon to the far right of the order. You can learn more about trading options by going to the "Education" tab in thinkorswim. You can turn your indicators into a forex scalping system strategy cfd trading strategies for beginners pdf backtest. Add the indicator using the same steps you used for the SMA. And should the stock price rise, great. You choose the best stuff on the menu and most importantly, you pace yourself in honor of all the treats to come. To remove a single position from your PaperMoney account, right-click on that position in the Position Statement and select "Adjust Position" on the drop-down menu. Ordinary traders like you and me can learn enough about thinkScript to make our daily tasks a lot easier with a small time investment. How do I access level II quotes? And then how much—single scoop, double scoop, or. Where to find such opportunities? Related Videos. Can I short stocks in OnDemand? But best current marijuana penny pot stocks etrade conversion rates it may not be clear-cut.

This makes it a little easier to see which way prices are moving. Second, you may decide to hold a smaller losing trade longer to see if the stock eventually turns into a winner. Just like enjoying every bite of a nice dinner, manage your winning trades strategically. And just as past performance of a security does not guarantee future results, past performance of a strategy does not guarantee the strategy will be successful in the future. The filter is based on Volatility differential. If you choose yes, you will not get this pop-up message for this link again during this session. Site Map. Today, our programmers still write tools for our users. Orders placed by other means will have additional transaction costs. You can turn your indicators into a strategy backtest.

How do I access level II quotes? Now, on to the expensive menu. From the Charts tab, while you have a symbol charted, look on the far right had side and you will see a sidebar. Just like filling up on your first course, you can invest a lot of emotion and lose too much money and time when you make one large investment. Just remember that this is a probability and not a guarantee of a result. We offer an entire course on this subject. If the ADX is below 20, the trend may be weak. By Ryan Campbell November 15, 7 min read. By Chesley Spencer December 27, 5 min read. And if you see any red highlights on the code you just typed in, double-check your spelling and spacing. From the Trade, All Products page click on the down arrow next to trade grid and type in a symbol you wish to view. Why is the full margin requirement held on short option positions? If prices are above the day SMA blue line , generally prices are moving up. We have a couple easy ways to access Level II Quotes. The day SMA is approaching the

Please make sure you keep sufficient funds or positions in your account to support conditional orders and other programmed trades. But by potentially realizing more and smaller profits, you may reduce the number of times a winning trade turns into a loser. That being said, thinkscript is meant to be straightforward and accessible for everyone, not just is stock market crashing now how to ear money quickly in stocks computer day trade diamonds position trading how much money to start. Can I place an option order based off the price of the underlying security? Analyzing the financial data, the reports, the charts, searching for news, looking for the next big thing? This will take you to the Charts tab. We arrive at this calculation by using stock price, volatility differential, and time to expiration. You must be enabled to trade on the thinkorswim software 4. How do I add or remove options from the options chain? By Ryan Campbell November 15, 7 min read. By Jayanthi Gopalakrishnan March 30, 5 min read. Add the indicator using the same steps you used for the SMA. Refer to figure 4. What is the difference between a Stop and Stop Limit? This is useful in cases where an event i. Please be aware that if you attempt to apply for forex before you meet the requirements, you will be redirected to an application for the next item you need to become eligible, and not the forex application.

Because they are short-lived instruments, weekly options positions require close monitoring, as they can be subject to significant volatility. Today, our programmers still write tools for our users. When you walk into an ice amibroker data importer using ichimoku with bolinger bands store, one thing that hits you is the number of flavors. You choose the best stuff on the menu and most importantly, you pace yourself in honor of all the treats to come. Start your email subscription. Your position will immediately be closed at the market without a confirmation window popping-up. Past performance of a security or strategy does not guarantee future results or success. On the far left and right of the option quotes, there are user-selectable columns. The other reason is that most stocks are correlated with other stocks in their industry, and with larger indices. The second tool from the bottom is Level II.

Have you ever spent days—weeks, even—researching a stock? But why not also give traders the ability to develop their own tools, creating custom chart data using a simple coding language? If the ADX is below 20, the trend may be weak. Doing this gives you an idea of some of the range of stocks whose options you might consider trading. Cool Chart Tips. With this lightning bolt of an idea, thinkScript was born. Consider taking smaller, more frequent profits when they present themselves, rather than waiting for bigger profits that might never come. With the script for the and day moving averages in Figures 1 and 2, for example, you can plot how many times they cross over a given period. You must have a margin account. When you are done making your selections, Click "OK" to view your changes. Security symbols displayed for informational purposes only. All weeklys will be labeled in bold with parentheses around them. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Just like filling up on your first course, you can invest a lot of emotion and lose too much money and time when you make one large investment. The goal is to create small profits and manage them smartly to try to create a profitable portfolio over time. First, place your order in the "Order Entry" section. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Once you have selected these options, continue to adjust the rest of the order to your specifications, and finally select Confirm and Send. Related Videos.

You certainly are able to place an option order based off the underlying price of the stock. What is the difference between a Stop and Stop Limit? The Company Profile button will be in the top right hand corner after you enter a symbol. We have a couple easy ways to access Level II Quotes. Don't want 12 months of volatility? That will load up the theoretical probability that an option will expire out of the money. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Select a high and low point, and the retracement levels will be displayed on the chart as forex price action trading institute strategies pdf ninjatrader 3rangenogap lines. Analyzing the financial data, the reports, the charts, searching for news, looking for the next big thing? At the upper right of this section you will see a button that says 'Adjust Account'. If prices are above the day SMA blue linegenerally prices are moving up. Today, our programmers still write tools for our users. Results presented are hypothetical, they did not actually occur and they may not take into consideration all transaction fees or taxes you would incur in an actual transaction. Select the time frame button on top of the chart. Please make sure you keep sufficient funds or positions in your account to support hit and run strategy trading sink thinkorswim orders bollinger bands length vama vs vwap other programmed trades. If you choose yes, you will not get this pop-up message for this link again during this session.

And pacing. Please be aware that if you attempt to apply for forex before you meet the requirements, you will be redirected to an application for the next item you need to become eligible, and not the forex application. Say you want to trade stocks with high volume, and those that might have movement. We offer an entire course on this subject. The idea here is that one big trade does not a big trader make. From the "Trade Tab" under "All Products", type an underlying security then click on the arrow next to "Option Chain" to expand the chain, which is sorted by expiration. Here a tick represents each up or down movement in price. Recommended for you. Are weeklys and quarterly options included in the Market Maker Move? Then click on the gear icon to the far right of the order.

Profits can disappear quickly and can even turn into losses with a very small movement of the underlying asset. Thinkorswim is built for traders by traders. Related Videos. Market volatility, volume, and system availability may delay account access and trade executions. You can also create the order manually. The new weeklys for the following week will be made available on Thursday of expiration week. Consider taking smaller, more frequent profits when they present themselves, rather than waiting for bigger profits that might never come. This chart is from the script in figure 1. Can I short stocks in OnDemand? You certainly are able to place an option order based off the underlying price of the stock. Changing from live trading to PaperMoney without logging out is not an option. Then select time interval and aggregation period from the drop-down lists.

Scanning for trades with the Stock Hacker can be as simple as choosing setups, then filters, and sorting how you want results to show up. Please note: At this time foreign clients are not eligible to trade forex. For example, if a chart is set to a tick aggregation, each tick represents a trade. Now, how big of a bite should you take so you can make it through the whole meal? When you are finished customizing, you can save your set for quick access by clicking on the "Layout" drop down and selecting "Save as Just like enjoying every bite of a nice dinner, manage your winning trades strategically. From here, you can set the conditions that you would like. First, place your order how to use the thinkorswim stock screener best green stocks for 2020 the "Order Entry" section. What is the day trading rule? Can I automatically submit an order at a specific time or based on a market condition? Keep in mind that a limit order guarantees a price but not an execution. But looking at options whose prices trade in 0. Minimum of Tier 2 Standard Margin Option Approval, options on futures will require full option approval. The goal is to create small profits and manage them smartly to try to create a profitable portfolio over time.

Now that you have a list of stocks that meet your scan criteria, how can you master your stock universe? If you click the Flatten button, a confirmation window will appear asking you to confirm that you would like to flatten your current position, effectively zeroing out the position at the market. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Start your email subscription. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. If that happens, and ADX starts moving up well above 20, and if price resumes its bullish trend, it could be worth keeping an eye on the stock. Related Videos. Key Takeaways Know how to create a methodical approach to analyzing stocks First, scan for stocks that meet your criteria and then chart the stocks to identify the trend, strength of the trend, and when to potentially enter and exit trades Select a few indicators to help make your trading decisions. Take a look at figure 2. Why are mini options the same price as regular options?