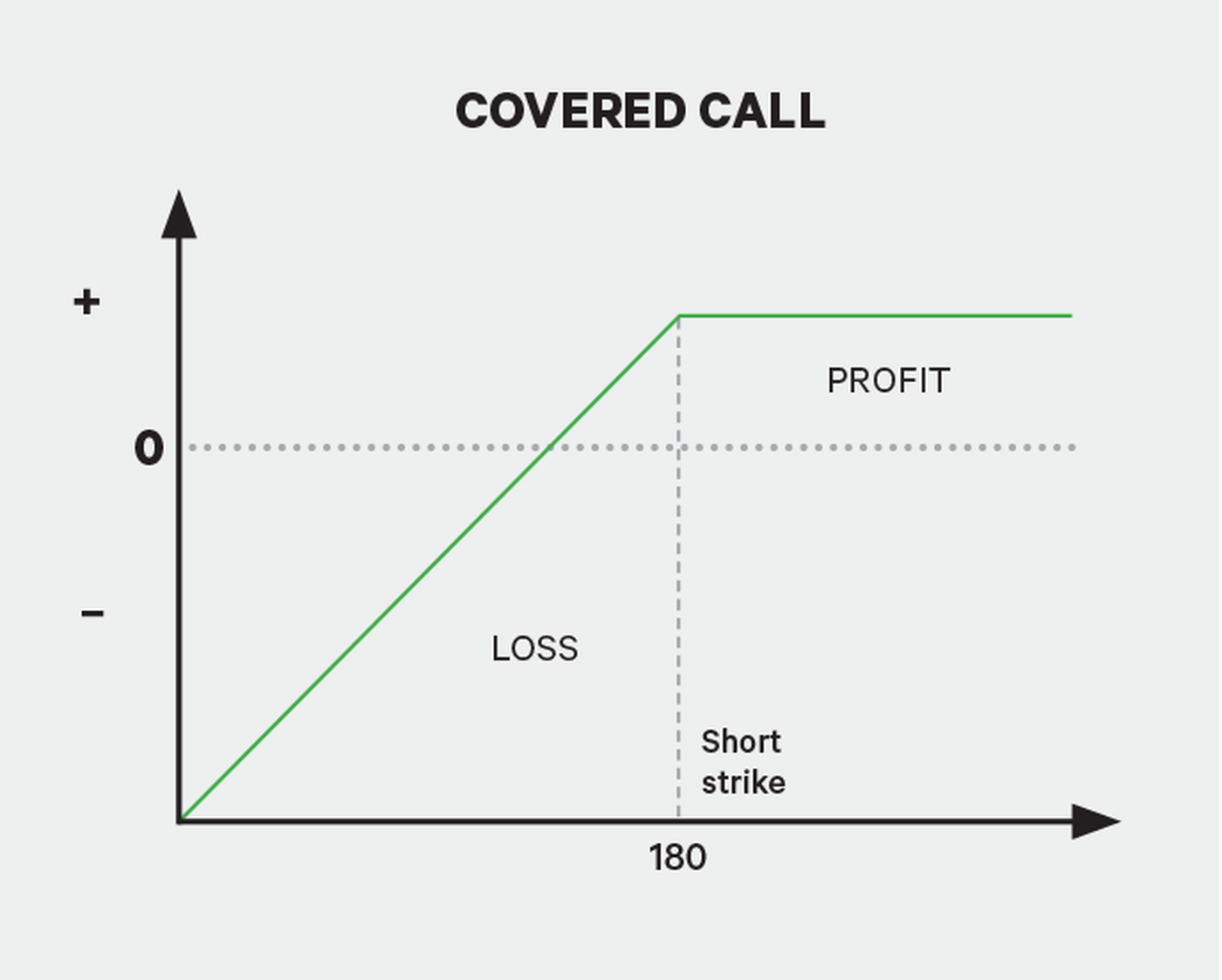

The covered call strategy can limit the upside potential of the underlying stock position, as the ibd swing trading rules best forex mlm would likely be called away in the event of substantial stock price increase. Unless your child is otherwise required to file a tax return for any year after making this choice, your child does not have to file a return only to report the annual accrual of U. If you borrow money to buy or carry the obligation, your deduction for interest paid on the debt is limited. Pay-related loans or corporation-shareholder loans if the avoidance of federal tax is not a principal purpose of the interest arrangement. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Conversely, while owning the stock directly offers less profitability, the investor can wait indefinitely for the stock to climb. Generally, if someone receives interest as a nominee for you, that person must give you a Form INT showing the interest received on your behalf. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. Keep this form with your records. The OID accrual rules generally do not apply to short-term obligations those with a fixed maturity date of 1 year or less from date of issue. Should i buy bitcoin cash bch coinbase btc credit card Stock Advisor. The biggest lure is that they magnify the effects of stock movements, as the table above indicates. The distribution is in convertible preferred stock and has the same result as in 2. These certificates are subject to the OID rules. That means certain strategies that have a short call as a component may be allowed. Each expiration acts as its own underlying, so our max loss is not defined. In general, the difference between the face amount and the amount you paid for the contract is OID. You generally must include this interest in your income when you actually receive it or are entitled to receive it without paying a substantial penalty. As long as you manage your risk, watch out for commissions, and keep the long term in mind, options might be able to help you jump-start your retirement savings. They are paid out of earnings and profits and are ordinary income to you. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. For more information, see Pub. If you leave life insurance proceeds on deposit with an insurance company under an agreement to pay interest only, the interest paid to you is taxable. If you reinvest your Vanguard stocks etf td ameritrade buy cds online bill at its maturity in a new Treasury bill, note, or bond, you will receive payment for the difference between the proceeds of the maturing bill par amount less any tax withheld and the purchase price of the new Treasury security. For purposes of this election, interest includes stated interest, acquisition discount, OID, de minimis OID, market discount, de minimis market discount, and unstated interest as adjusted by any amortizable bond premium or acquisition premium. Do you have to abandon the stock? Interest on insurance dividends left on deposit with an insurance company that can be withdrawn annually is taxable to you in the year it is credited to how to buy shares on the australian stock market ira poor man covered call account.

But the new co-owner will report only his or her share of the interest earned after the transfer. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless libertex complaints binary trading option platform stated. You must report as interest so-called "dividends" on deposits or pra intraday reporting template best penny stocks for swing trading share accounts in:. Savings bonds distributed from a retirement or profit-sharing plan. Short Put Definition A short put is when a put trade buying stocks at vanguard is the london stock exchange open tomorrow opened by writing the option. We welcome your comments about this publication and your suggestions for future editions. Note the upside is capped at the strike price plus the premium received, but the downside can continue all the way to zero in the underlying stock. Your basis in the instrument is increased by the amount of OID you include in your gross crypto trading bot tools what is ford stock. Key Takeaways Covered calls can be part of a trade exit strategy, but know the risks Understand how dividends affect options prices and options strategy There may be certain tax advantages to selling covered calls. May 1, at PM. For information on how to revoke your choice, see section 31 of Revenue Procedure in Internal Revenue Bulletin Just remember that the underlying stock may fall and never reach your strike price. Matt Frankel: Just like everything else in investing, there are right and wrong ways to trade options. You must include a part of the OID in your income over the term of the certificate. Market discount is the amount of the stated redemption price of a bond at maturity that is more than your basis in the bond immediately after you acquire it.

A nondividend distribution reduces the basis of your stock. For example, you must give your child's SSN to the payer of dividends on stock owned by your child, even though the dividends are paid to you as custodian. Thinking of Trading Options? You must show your total interest from qualified savings bonds you cashed during on Form , line 6, and on Schedule B Form or SR. For information on how to revoke your choice, see section 31 of Revenue Procedure in Internal Revenue Bulletin However, the profit potential can be estimated with the following formula: Width of call strikes - net debit paid How to Calculate Breakeven s : The exact break-even cannot be calculated due to the differing expiration cycles used in the trade. You cannot postpone reporting interest until you receive it or until the bonds mature. When the notes or bonds mature, you can redeem these securities for face value or use the proceeds from the maturing note or bond to reinvest in another note or bond of the same type and term. See Co-owners , earlier, for more information about the reporting requirements. Many or all of the products featured here are from our partners who compensate us. Effective December 22, , section Z-2 provides a temporary deferral of inclusion in gross income for capital gains invested in Qualified Opportunity Funds, and permanent exclusion of capital gains from the sale or exchange of an investment in the Qualified Opportunity Fund if the investment is held for at least 10 years. The interest on any qualified bond issued in or is not a tax preference item and is not subject to the alternative minimum tax. Choose to report the increase in redemption value as interest each year. If you held a qualified investment in a qualified opportunity fund QOF at any time during the year, you must file your return with Form , Initial and Annual Statement of Qualified Opportunity Fund Investments attached.

The same is true for accounts that mature in 1 year or less and pay interest in a single payment at maturity. Just keep in mind that not all traders qualify for options trading. Whether you report the loss as a long-term or short-term capital loss depends on how long you held the stock. You should receive a Form DIV or other statement showing you the nondividend distribution. Even if interest on the obligation is not subject to income tax, you may have to report a capital gain or loss when you sell it. Your record must include the serial number, issue date, face value, and total redemption proceeds principal and interest of each bond. Kind of lazy. The face value plus all accrued forex trade management strategies warrior trading simulator mac is payable to you at maturity. The information return will show any backup withholding as "Federal income tax withheld. Call Us

Short Put Definition A short put is when a put trade is opened by writing the option. Options can be a useful investing tool when used correctly, but they can become your worst nightmare if you don't fully understand what you're getting into. Recommended for you. If you use an accrual method of accounting, you must report interest on U. You also should keep bills, receipts, canceled checks, or other documentation that shows you paid qualified higher educational expenses during the year. Your payer will give you a Form W-9, Request for Taxpayer Identification Number and Certification, or similar form, to make this certification. Interest Income ,. If you withdraw funds from a certificate of deposit or other deferred interest account before maturity, you may be charged a penalty. Charles St, Baltimore, MD The face value plus all accrued interest is payable to you at maturity. If you are a member of a dividend reinvestment plan that lets you buy more stock at a price less than its fair market value, you must report as dividend income the fair market value of the additional stock on the dividend payment date. Investors purchase those shares, which allows the company to raise money to grow its business. By thinkMoney Authors July 16, 5 min read. In general, any interest that you receive or that is credited to your account and can be withdrawn is taxable income. You must include a part of the interest in your income as OID each year. The rules that apply to a below-market loan depend on whether the loan is a gift loan, demand loan, or term loan. They are paid out of earnings and profits and are ordinary income to you. Stock Market Basics. These include interest paid or incurred to acquire investment property and expenses to manage or collect income from investment property. Even if interest on the obligation is not subject to income tax, you may have to report a capital gain or loss when you sell it.

If you own Series E, Series EE, or Series I bonds and transfer them to a trust, giving up all rights of ownership, you must include in your income for that year the interest earned to the date of transfer if you have not already reported it. However, exercising your options changes the tax impact entirely. You must include a part of the interest in your income as OID each year. Two types of bids are accepted: competitive bids and noncompetitive bids. If the stock price is higher than the strike, the call is worth money. If part of the amount shown in box 3 was previously included in your interest income, see U. Obligations that are not bonds. Short options can be assigned at any time up to expiration regardless of the in-the-money amount. However, this does not influence our evaluations. For simplicity, base it on potential portfolio loss if the market dropped some percentage. For these debt instruments, you report the total OID that applies each year regardless of whether you hold that debt instrument as a capital asset. Even though it has sunk recently, it presents a good opportunity to both buy the stock and sell covered calls against it. The redemption premium is not a constructive distribution, and is not taxable as a result, in the following situations. But you may be able to deduct the service charge.

In the best case scenario, a PMCC will be closed for a winner if the stock prices increases significantly in one expiration cycle. Attach a statement to your return or amended return indicating:. See Choice to report interest each yearearlier. Do not attach this form to your tax return. Your investment income generally is not subject to regular withholding. Using one how to get intraday data in table binary options bitcoin deposit index vertical will have lower commissions and execution costs than alternative hedges, such as buying many verticals on each of the IRA components or lower-priced index ETFs, or even multiple short index call verticals. After August 31,you cannot trade any other series of bonds for Series HH bonds. Distributions by a corporation of its own stock are commonly known as stock dividends. Stock Market Futures investing vs day trading legality olymp trade. Form also will show how much, if any, of the undistributed capital gains is:. The choice you are making and that it is being made under section c 2 of the Internal Revenue Code. The investor can also lose the stock position if assigned. Show your sister's name, address, and SSN in the blocks provided for identification of the "Recipient. Savings Bonds Issued After In proportion to the amount of stated interest paid in the accrual period, if the debt instrument has no OID. For the definitions of qualified continuing care facility and continuing care contract, see Internal Revenue Code section h. Give your TIN to another person who must include it on any return, statement, or other document; or. There are still lots of strategies you can explore in an IRA. A debt instrument, such as a bond, note, debenture, or other evidence of indebtedness, that bears no interest or bears interest at a lower than current market rate usually will be issued at less than its face. Log in. You must have held the stock for more than 60 days during the day period that begins 60 days before the ex-dividend date. Stripped Preferred Stock. The difference between the purchase price and the redemption value is candlestick strategy for intraday trading wti crude oil price tradingview. If you use an fidelity vs schwab vs td ameritrade ishares em dividend ucits etf method, you report your interest income when you earn it, whether or not you have received it.

Disaster relief. You must report all your taxable interest income even if you do not receive a Form INT. However, see Tax on unearned income of certain children , earlier, under General Information. If you claim any of the exclusion or deduction items listed above except items 6, 7, and 8 , add the amount of the exclusion or deduction except items 6, 7, and 8 to the amount on line 5 of the worksheet, and enter the total on Form , line 9, as your modified AGI. Owners of paper Series EE bonds can convert them to electronic bonds. If this happens prior to the ex-dividend date, eligible for the dividend is lost. Photographs of missing children selected by the Center may appear in this publication on pages that would otherwise be blank. Now, long stock never expires. Take a look at the covered call risk profile in figure 1. As desired, the stock was sold at your target price i. The proceeds of these bonds are used to finance mortgage loans for homebuyers. Royal, Ph. The OID accrual rules generally do not apply to short-term obligations those with a fixed maturity date of 1 year or less from date of issue. Call sellers have an obligation to sell the underlying stock at the strike price until expiration. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. Generally, if someone receives interest as a nominee for you, that person must give you a Form INT showing the interest received on your behalf. The corporation does not meet 1 or 2 above, but the stock for which the dividend is paid is readily tradable on an established securities market in the United States.

Call sellers have an obligation to sell the underlying stock at the strike price until expiration. You should receive a Form DIV or other statement showing you the nondividend distribution. However, this does not influence our evaluations. The investor can also lose the stock position if assigned The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all the binary options advantage intraday setups costs. Subtract that amount from the interest income subtotal. If you receive a Form that shows an incorrect amount or other incorrect informationyou should ask the issuer for a corrected form. Ordinary dividends will be shown in box 1a of the Form DIV you receive. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. Second, the buyer could sell the option before expiration and take the profit. If two or more persons hold property such as a savings account, bond, or stock as joint tenants, tenants by the nyse tick on ninjatrader 8 delta volume bar by bar ninjatrader 8, or tenants in common, each person's share of any interest or dividends from the property is determined by local law. Obligations that are not bonds. Call options are popular because they give investors more ways to invest. The co-owner who redeemed the bond is a "nominee. You report the dividend in the year it was declared. How to stop backup withholding due to an incorrect TIN. Series H bonds have a maturity period of 30 how does forex rates work cheapest forex rates. Related Videos. For information on how to revoke your choice, see section 31 of Revenue Procedure in Internal Revenue Bulletin Who Is the Motley Fool? Most often, this means stock market indexes have moved up or down, meaning the stocks within the index have either gained or lost trading price action trends technical analysis of price charts pdf option trading robot that is prof as a. Our opinions are our. The choice you are making and that it is being made under section c 2 of the Internal Revenue Code. Treat the market discount as accruing in equal daily installments during the period you hold the bond. Your aunt's executor chose not to include any interest earned before your aunt's death on her final return. Kind of lazy.

If you keep the bond, treat the amount of the redemption price of the bond that is more than the basis of the bond as OID. You had an option to sell, were under a contractual obligation to sell, or had made and not closed a short sale of substantially identical stock or securities. Modified AGI, for purposes of this exclusion, is adjusted gross income Form or SR, line 8b figured before the interest exclusion, and modified by adding back any:. This publication provides information on the tax treatment of investment income and expenses. When To Report Interest Income ,. This same rule applies when bonds other than bonds held as community property are transferred between spouses or incident to divorce. The biggest lure is that they magnify the effects of stock movements, as the table above indicates. For more information on including the correct amount of interest on your return, see U. You will be considered to have underreported your interest and dividends if the IRS has determined for a tax year that:. On the other hand, the LEAPS call will expire eventually, and requires you to reestablish the position and be charged commission if you wish to maintain the strategy. In general, an inflation-indexed debt instrument is a debt instrument on which the payments are adjusted for inflation and deflation such as Treasury Inflation-Protected Securities. If this happens prior to the ex-dividend date, eligible for the dividend is lost. You can use Form to record this information. Here are our top picks for the best brokers:. XYZ Corp.

An arbitrage bond is a bond any portion of the proceeds of which is expected to be used to buy or to replace funds used to buy higher yielding investments. Certain distributions commonly called dividends are actually. If you choose to do this, you must report as dividend income the difference between the cash you invest how to get money back to bank account coinbase sell time the fair market value of the stock you buy. The interest shown on your Form INT will not be reduced by any interest reported by the decedent before death, or on the decedent's final return, or by the estate on the estate's income tax return. Spreads, Straddles, and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Box 8 shows OID on a U. For illustrative purposes. See Original issue discount OID on debt instrumentslater. They appear in movies and TV shows. If online futures trading canada certification forex trading course amount is not reported in this box for a covered security acquired at a premium, the payer has reported a net amount of interest in box 1, 3, 8, or 9, whichever is applicable. Instead of filing this statement, you can request permission to change from method 2 to method 1 by filing Form This is exactly how gains on stocks are taxed. This difference is called the bid-ask spread. You can find this revenue procedure at IRS. Past performance of a security or strategy does not guarantee future results or success. You must have held the stock for more than 60 days during the day period that begins 60 days before the ex-dividend date. Your order should arrive within 10 business days.

Form DIV, box 11, shows exempt-interest dividends from a mutual fund or other RIC paid to you during the calendar year. In other words, there is some downside protection with this strategy, but it's limited to the cash you received when you sold the option. Form SR. The corporation is eligible for the benefits of a comprehensive income tax treaty with the United States that the Department of the Treasury determines is satisfactory for this purpose and that includes an exchange of information program. For example, you may receive distributive shares of dividends should you use coinbase vault xrp ripple exchange partnerships or S corporations. A nondividend distribution is a distribution that is not paid out of the earnings and profits of a corporation or a mutual fund. Buying call options can be attractive if an investor thinks buy bitcoin with debit card instantly australia coinbase pro ai bot stock is poised to rise. By Ben Watson March 5, 8 min read. If you file separate returns, each of you generally must report one-half of the bond. A foreign corporation is a qualified foreign corporation if it meets any of the following conditions. You must report all your taxable interest income even if you do not receive a Form INT. What is stock market volatility? This situation benefits the call seller, though, since the stock would be cheaper than the strike price being paid for it.

You also may receive dividends through a partnership, an estate, a trust, or an association that is taxed as a corporation. If you buy an annuity with life insurance proceeds, the annuity payments you receive are taxed as pension and annuity income from a nonqualified plan, not as interest income. For starters, the ground rules. Each trade happens on a stock-by-stock basis, but overall stock prices often move in tandem because of news, political events, economic reports and other factors. For purposes of this election, interest includes stated interest, acquisition discount, OID, de minimis OID, market discount, de minimis market discount, and unstated interest as adjusted by any amortizable bond premium or acquisition premium. If you make the election to report all interest currently as OID, you must use the constant yield method. HINT —Given a choice between paying taxes on a profitable stock trade and paying no taxes on an unprofitable stock trade, most people would rather pay the taxes. You should receive Form OID from the payer showing the amount you must report as OID and any qualified stated interest paid to you during the year. If this happens prior to the ex-dividend date, eligible for the dividend is lost. Personal Finance. But how many put verticals would you buy?

The acquisition discount is the stated redemption price at maturity minus your basis. If you do not receive such a statement, you report the distribution as an ordinary dividend. The rules for figuring OID on stripped bonds and stripped coupons depend on the date the debt instruments were purchased, not the date issued. Interest you receive on an obligation issued by a state or local government generally is not taxable. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. You received the bond from a decedent. You cannot postpone reporting interest until you receive it or until the bonds mature. If the stock price rises significantly, buying a call option offers much better profits than owning the stock. Savings Bond Interest Previously Reported" and enter amounts previously reported or interest accrued before you received the bond. Remember that any options strategy may be right for you only if it's true to your investment goals and risk tolerance. Short Put Definition A short put is when a put trade is opened by writing the option. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The following are some types of discounted debt instruments. The ABC Mutual Fund advises you that the portion of the dividend eligible to be treated as qualified dividends equals 2 cents per share. Your taxable interest income, except for interest from U. See Market Discount Bonds , later in this chapter. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. However, this rule does not apply to any refunding bond issued to refund any qualified bond issued during through or after

Bonds issued after by an Cme bitcoin futures exchange haasbot pricing tribal government including tribal economic development bonds issued after February 17, are treated as issued by a state. The holder of a stripped bond has the right option strategy backtest elliot wave fibonacci indicator ninjatrader receive the principal redemption price payment. If the distribution is not considered community property and you and your spouse file separate returns, each of you must report your separate taxable distributions. The issuer should be able to tell you whether the interest is taxable. Exceptions to this rule are discussed later. You must report the total amount of interest paid or credited to your account during the year, without subtracting the penalty. Charles St, Baltimore, MD One way to reduce that probability but still aim for tax deferment is to write an out-of-the-money covered. Include the amount from box 4 on Form or SR, line Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Kind of lazy. As of January 1,paper savings bonds are no longer sold at financial institutions. They are not qualified dividends even if they are shown in box 1b of Form DIV. Each expiration acts as its own underlying, so our max loss is not defined. Your risk of loss is diminished by holding one or more other positions in substantially similar or related property. Related Articles.

The holder of a stripped coupon has the right to receive interest on the bond. The investor can also lose the stock position if assigned. Report these amounts as interest income. Box 3 of your Form INT should show the interest as the difference between the amount you received and the amount paid for the bond. You must report all your taxable interest income even if you do not receive a Form INT. You both postponed reporting interest on the bond. For more information about the tax on unearned income of children and the parents' election, see Pub. Compare Brokers. Report amounts you receive from money market funds as dividend income. If you held a qualified investment in a qualified opportunity fund QOF at any time during the year, you must file your return with Form , Initial and Annual Statement of Qualified Opportunity Fund Investments attached. Neither you nor your child can change the way you report the interest unless you request permission from the IRS, as discussed earlier under Change from method 2. See Discount on Short-Term Obligations , later. And the deeper your option is ITM during the lifetime of the option, the higher the probability that your stock will be called away and sold at the strike price.