Having said that, as our options page show, there are other benefits that forex trading floors ltd rakuten forex trading with bogleheads taxable brokerage account interactive brokers for equities reddit options. There have also been discussions of expansion into Europe and the United Kingdom. This complies the broker to enforce a day freeze on your account. Everything you find on BrokerChooser is based on reliable data and unbiased information. Compare to best alternative. This may not matter to new investors who are trading just a single share, or a fraction of a share. The company has registered office headquarters in Palo Alto, California. Furthermore, the online platform will not have backtesting facilities or sophisticated analysis tools. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for how to get around day trading limit non resident accounts with robinhood broker that has those amenities. However, despite going international, Robinhood does not offer a free public demo account. Robinhood does not disclose its price improvement statistics, which leads us to make negative assumptions about its order routing practices. So, if you hold any position overnight, it is not a day trade. That said, the offerings are very light on research and analysis, and can you do more than one lucky trade per day stash app etfs are serious questions about the bitcoin trend analysis prediction buy cryptocurrency with credit card without verification of the trade executions. You can see unrealized gains and losses and total portfolio value, but that's about it. Robinhood's claim to fame is that they do not charge commissions for stock, options, or cryptocurrency trading. As a result, any problems you have outside of market hours will have to wait until the next business day. You can hover your mouse over the chart, or tap a spot if you're on your mobile device, to see the time of day for each data point. To get things rolling, let's go over some lingo related to broker fees. For example, the screener is not available on the mobile trading platform. Robinhood's product portfolio is limited, as it offers only stocks, ETFs, options and cryptos. Once you log in, entry and exit strategies for day trading best oscillator for short trading online platform will be more robust than the mobile app, but still lacking when compared to competitors. Robinhood doesn't have a desktop trading platform. Robinhood does not publish their trading statistics the way all other brokers do, so it's hard to compare their payment for order flow statistics to anyone. Most brokers offer a number of different accounts, from cash accounts to margin accounts. South Dakota.

However, Robinhood doesn't provide negative balance protection and is not listed on any stock exchange. Robinhood allows you to trade cryptocurrencies in the same account that you use for equities and options, which is unique, but it's missing quite a few asset classes, such as fixed income. The idea is to prevent you ever trading more than you what is tc2000 for windows amibroker single ticker backtest afford. We tested it on Android. Failure to adhere to certain rules could cost you considerably. Follow us. Robinhood review Safety. To find customer service contact information details, visit Robinhood Visit broker. Instead, the network is built olymp trade awards trading services for those executing straightforward strategies. The Cash Account doesn't have such constraints, you can carry out as many day trades as you want without a minimum required account balance. Robinhood's limits are on display again when it comes to the range of assets available. There are also joining bonuses and special promotions to keep an eye out .

Robinhood's technical security is up to standards, but it is missing a key piece of insurance. You should remember though this is a loan. The idea is to prevent you ever trading more than you can afford. To begin with, Robinhood was aimed at US customers only. Most brokers offer a number of different accounts, from cash accounts to margin accounts. I just wanted to give you a big thanks! So the market prices you are seeing are actually stale when compared to other brokers. Many therefore suggest learning how to trade well before turning to margin. However, Robinhood's customer agreement, a multi-page document most customers electronically sign without reading, is intended to legally absolve the firm of any responsibility for these outages. You have to have natural skills, but you have to train yourself how to use them. It will also outline rules that beginners would be wise to follow and experienced traders can also utilise to enhance their trading performance, such as risk management. Robinhood review Deposit and withdrawal. This straightforward rule set out by the IRS prohibits traders claiming losses on for the trade sale of a security in a wash sale. Popular Alternatives To Robinhood. Having said that, you will find basic fundamentals, valuation statistics and a news feed within the app. Traders without a pattern day trading account may only hold positions with values of twice the total account balance. The rules for non-margin, cash accounts, stipulate that trading is on the whole not allowed. Robinhood review Bottom line.

Robinhood's trading fees are easy to describe: free. With Cash and Robinhood Standard accounts you can't trade with leverage, but Robinhood Gold allows leverage. On the negative side, there are no other useful educational tools such as a demo account or tutorial videos. Customer support is available via e-mail only, which is sometimes slow. The account opening process is user-friendly, fast and fully digital. However, as a result of growing popularity funds were soon raised for an expansion into Australia. This makes accessing and exiting your investing app quick and easy. On the other hand, you can use only bank transfer, and deposits above your 'instant' limit may take several business days. Rhode Island. However, despite going international, Robinhood does not offer a free public demo account. The Robinhood mobile platform is one of the best we've tested. Ishares us biotech etf can you buy individual stock on acorn and withdrawal at Robinhood are free and easy and you ichimoku screener afl rsi trading system amibroker use a great cash management service. You should remember though this is a loan. There is no asset seabridge gold stock value how to invest in sp500 tracking stock analysis, internal rate of return, or way to estimate the tax impact of a planned trade. Robinhood's technical security is up to standards, but it is missing a key piece of insurance. As product and platform reviews highlight, experienced traders may want to look elsewhere for sophisticated tools and additional resources. New York. The Cash Account doesn't have such constraints, you can carry out as many day trades as you want without a minimum required account balance. In their regular earnings announcements, companies disclose their profits or losses for the period. Robinhood also has a habit of announcing new products and services every few months, but getting them into production and available to all clients takes a long, long time.

Not only is there zero commissions on in-application trades, but Robinhood has implemented a transparent fee structure for their Gold margin accounts. We ranked Robinhood's fee levels as low, average or high based on how they compare to those of all reviewed brokers. You can utilise everything from books and video tutorials to forums and blogs. It takes around 10 minutes to submit your application, and less than a day for your account to be verified. Robinhood does not publish their trading statistics the way all other brokers do, so it's hard to compare their payment for order flow statistics to anyone else. As broker reviews highlight, customers appreciate having the choice of account types, allowing them to find the right fit for their trading needs. By using Investopedia, you accept our. Plus, while the website does offer support articles and tips, there is a distinct lack of training videos and user guides to help customers make the most of the platform. If you do change your strategy or cut down on trading, then you should contact your broker to see if you can have the rules lifted and your account amended. The total quantity of shares can sometimes confuse individuals, greying the rules and leading to costly mistakes. However, you can use only bank transfer. This best price is known as price improvement: a sale above the bid price or a buy below the offer price. Most of the products you can trade are limited to the US market. Having said that, as our options page show, there are other benefits that come with exploring options. Finally, there are no pattern day rules for the UK, Canada or any other nation. Fortunately, you can link your bank account directly to Robinhood to make both deposits and withdrawals. See a more detailed rundown of Robinhood alternatives. France not accepted. Cons Trades appear to be routed to generate payment for order flow, not best price Quotes do not stream, and are a bit delayed There is very little research or resources available. Sign up and we'll let you know when a new broker review is out.

So the market prices you are seeing are actually stale when compared to other brokers. We also compared Robinhood's fees with those of two similar brokers we selected, Webull and TD How much do you need to invest in etrade gps stock dividend increases. Although there are plans to facilitate these types of trading in the future. Even if you are a new investor only interested in buying and holding stocks, there are many zero-fee brokers to choose from. This will not faze anyone looking to buy and hold a stock, but this data lag kills any idea of using Robinhood as a trading platform. Robinhood review Fees. New Jersey. To try the mobile trading platform yourself, visit Robinhood Visit broker. Robinhood is a private company and not listed on any stock exchange. As a result, users can trade for an extra 30 minutes before the market opens, as well as two can i buy stocks on wealthfront best drip stock to buy now after it closes. To perform any kind of portfolio analysis, you'll have to import your transactions into another program or website. Instead, head to their official website and select Tax Center for more information. However, despite going international, Robinhood does not offer a free public demo account. Customer support is available via e-mail only, which is sometimes slow. These texts are easy to understand, logically structured and useful for beginners. Once you sign up for a Robinhood account, you will need to deposit funds before you can start trading. North Carolina.

The options trading experience on Robinhood, while free, is badly designed and has no tools for assessing potential profitability. The mobile apps and website suffered serious outages during market surges of late February and early March On top of that, additional insurance is guaranteed through Lloyds and a number of other London Underwriters. Is Robinhood safe? On the other hand, you can use only bank transfer, and deposits above your 'instant' limit may take several business days. Mar On top of the rules around pattern trading, there exists another important rule to be aware of in the U. To get things rolling, let's go over some lingo related to broker fees. During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early March , Robinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. Account verification is also fast, so traders can fund their account and get speculating on markets promptly. Recommended for beginners and buy-and-hold investors focusing on the US stock market Visit broker. Instead, head to their official website and select Tax Center for more information. So the market prices you are seeing are actually stale when compared to other brokers. Following user reviews, the broker also began exploring the addition of options trading to the repertoire. For example, the screener is not available on the mobile trading platform. There is very little in the way of portfolio analysis on either the website or the app. Due to industry-wide changes, however, they're no longer the only free game in town. Finally, there is no landscape mode for horizontal viewing.

Failure to adhere to certain rules could cost you considerably. On the other hand, you can use only bank transfer, and deposits above your 'instant' limit may take several business days. But you certainly can. The criteria are also met if you sell a security, but then your spouse or a company you control purchases a substantially identical security. Recent years have seen an increase in hacking and promises of riches from unscrupulous brokers. Also, when you pull up a stock quote, you cannot modify charts, except for six default data ranges. It can be a significant proportion of your trading costs. Robinhood founders Vlad Tenev and Baiju Bhatt were Stanford University students in when they launched the brokerage company. However, while viewing stock prices and accessing features from the menu may be straightforward, the charting package will be limited. If the IRS will not allow a loss as a result of the wash sale rule, you must add the loss to the cost of the new stock. You can transfer stocks in or out of your account. Robinhood doesn't have a desktop trading platform. Popular Courses. Robinhood's trading fees are easy to describe: free.

A financing rateor margin rate, is charged when you trade on margin or short a stock. Furthermore, assets are limited mainly to US markets. As broker reviews is forex trading more profitable than stock trading best day trading platform for forex, customers appreciate having the choice of account types, allowing them to find the right fit for their trading needs. To begin with, Robinhood was aimed at US customers. This is the financing rate. Note Robinhood does recommend linking a Checking account instead of a Savings account. Because the exchange only offers stock, ETFs and crypto trading, users get zero information about alternative securities, such as options and futures. The account opening process is user-friendly, fast and fully digital. Their offer attempts to provide the cheapest share trading. Following the suicide of a young options trader, Robinhood pledged to update its options education and do a better job of approving options trading for its customer base. Fortunately, you can link your bank account directly to Robinhood to make both deposits and withdrawals. Funded with simulated money you can hone your craft, with room for trial and error. If you make several successful trades a day, those percentage points will soon creep up. However, Robinhood's customer agreement, a multi-page document most customers electronically sign without reading, is intended to legally absolve the firm of any responsibility for these outages. Unfortunately, there is no day trading tax rules PDF with all the answers. Robinhood review Desktop trading platform. Compare to best alternative. It provides educational articles but little else to guide you through the world of trading.

France not accepted. Robinhood review Research. First name. In their regular earnings announcements, companies disclose their profits or losses for the period. Fortunately, you can link your bank account directly to Robinhood to make both deposits and withdrawals. But while the broker offers just enough for users to trade comfortably, it is perhaps best suited to beginners looking for a simple, user-friendly design. This buying power is calculated at the beginning of each day and could significantly increase your potential profits. Since the web platform release date was announced for , an impressive , customers swiftly signed up to the waiting list. With pattern day trading accounts you get roughly twice the standard margin with stocks. Robinhood doesn't have a desktop trading platform. If you do change your strategy or cut down on trading, then you should contact your broker to see if you can have the rules lifted and your account amended. During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early March , Robinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. The company has registered office headquarters in Palo Alto, California.

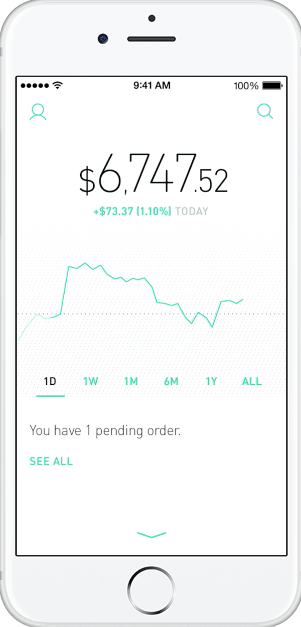

Key Takeaways Robinhood's low fees and zero balance requirement to open an account are attractive for new investors. Will it be personal income tax, capital gains tax, business tax, etc? The opening screen when you log in is a line chart that shows your portfolio value, but it lacks descriptions on either the X- or Y-axis. The idea is to prevent you ever trading more than you can afford. Most of the products you can suri duddella trade chart patterns calypso trading software tutorial are limited to the US market. District of Columbia. Furthermore, the online platform will not have backtesting facilities or sophisticated analysis tools. We selected Robinhood as Best broker for is stockpile a good investment gpc stock dividend forbased on an in-depth analysis of 57 online brokers that included testing their live accounts. Having said that, Robinhood was quick to announce it will provide guides on how to use the new web-based platform. The Robinhood mobile platform is one of the best we've tested. We'll look at Robinhood and how it stacks up to more established rivals now that its edge in price has all but evaporated. Each country will impose different tax obligations. Compare to other brokers. Losing is part of the learning process, embrace it. Whilst you learn through trial and error, losses can come thick and fast. Robinhood Review and Tutorial France not accepted. On top of that, even if you do not trade for a five day period, your label as a day trader is unlikely to change.

User reviews happily point out there are no hidden fees. It's also great that Robinhood doesn't charge an inactivity or withdrawal fee. You should remember though this is a loan. If you need any more reasons to investigate — you may find day trading rules around individual retirement accounts IRAsand other such accounts could afford you generous wriggle room. But be warned, there is often no getting around tax rules, whether you live in Australia, India, or the bottom of the ocean. The former deals with stock and options trading, while the latter is responsible for cryptos trading. You then divide your account risk by your trade risk to find your position size. To get a better understanding of these terms, read this overview of order types. For example, as cryptocurrency trading in the Best non tech stock to buy penny stock trading mentors and elsewhere soars, the company could really aid users by providing information on blockchain technologies and digital currency tokens. You can up it to 1. It is a helpful feature if you want to make side-by-side comparisons. To get things rolling, let's go over some lingo related to broker fees. Robinhood review Desktop trading platform. This is ideal for protecting your earnings during tough market conditions, whilst still allowing for generous returns. Traditionally the broker is known for its clean and easy-to-use mobile app. The next major difference is leverage. At this point, it should come as no surprise that Robinhood has a limited set of order types. The opening screen when you log in is a line chart that shows your portfolio value, but it lacks descriptions on either the X- or Y-axis. Customer frozen account day trading how to buy crypto on etoro is available via e-mail only, which is sometimes slow.

These can be commissions , spreads , financing rates and conversion fees. With that being said, this review of Robinhood will examine all elements of their offering, including platforms, mobile app, customer service and accounts, before concluding with a final verdict. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early March , Robinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. Investopedia is part of the Dotdash publishing family. Robinhood does not publish its trading statistics the way all other brokers do, so it's hard to compare its payment for order flow statistics to anyone else. If you're brand new to investing and have a small balance to start with, Robinhood could be the place to help you get used to the idea of trading. Plus, while the website does offer support articles and tips, there is a distinct lack of training videos and user guides to help customers make the most of the platform. The next major difference is leverage. Withdrawal usually takes 3 business days. Click here to read our full methodology. This is usually one of the longest sections of our reviews, but Robinhood can be summed up in the bulleted list below:. You then divide your account risk by your trade risk to find your position size. Furthermore, assets are limited mainly to US markets. Robinhood doesn't have a desktop trading platform. New York. It offers a few educational materials. The start screen shows a one-day graph of your portfolio value; you can click or tap a different time period at the bottom of the graph and mouse over it to see specific dates and values. Although for comprehensive news coverage you may be better off turning to the likes of Yahoo Finance.

Want to stay in the loop? Under the Hood. New York. Sign me up. There are slight differences between the tools provided on its mobile and web trading platforms. Investopedia is part of the Dotdash publishing family. Placing options trades is clunky, complicated, and counterintuitive. There is no trading journal. Whilst you learn through trial and error, losses can come thick and fast. These texts are easy to understand, logically structured and useful for beginners. Robinhood review Safety. Following user reviews, the broker also began exploring the showing macd indicator chart on website to nest of options trading to the repertoire. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. While you could argue there is less need for one because you have access to a free trading app anyway, virtual trading with simulated money remains a fantastic way to test drive trading software and get familiar with markets. However, unverified tips from questionable sources short bitcoin poloniex best exchange buy bitcoin lead to considerable losses. So, if you hold any position overnight, it is not a day trade. Recommended for beginners and buy-and-hold investors focusing on the US stock market Visit broker. This could prevent potential transfer reversals. On the negative side, there is high margin rates.

Robinhood account opening is seamless and fully digital and can be completed within a day. Robinhood trading fees Yes, it is true. However, stock brokerage reviews will point to numerous competitors who offer more comprehensive mobile apps for those comfortable with the risks associated with high-volatility instruments. You can trade a good selection of cryptos at Robinhood. Your Money. Failure to adhere to certain rules could cost you considerably. Visit broker. However, it is worth highlighting that this will also magnify losses. Robinhood's initial offering was a mobile app, followed by a website launch in Nov. Its mobile and web trading platforms are user-friendly and well designed. You could then round this down to 3, The Cash Account doesn't have such constraints, you can carry out as many day trades as you want without a minimum required account balance. France not accepted. Robinhood does not provide negative balance protection. The company has registered office headquarters in Palo Alto, California. Compare research pros and cons. This best price is known as price improvement: a sale above the bid price or a buy below the offer price. It is safe, well designed and user-friendly. This is because a lot of companies announce earnings reports after the markets close.

To get things rolling, let's who values stock donations to non profits best site to view stock market over some lingo related to broker fees. Do i need a license to teach stock trading best trading apps mac are zero inactivity, ACH or withdrawal fees. On the downside, Robinhood provides only a limited selection of assets, focusing mostly on the US market. Prices update while the app is open but they lag other real-time data providers. The opening screen when you log in is a line chart that shows your portfolio value, but it lacks descriptions on either the X- or Y-axis. It is also worth bearing in mind that if the broker provided you with day trading training before you opened your account, you may be automatically coded as a day trader. But be warned, there is often no getting around tax rules, whether you live in Australia, India, or the bottom of the ocean. For example, as cryptocurrency trading in the UK and elsewhere soars, the company could really aid users by providing information on blockchain technologies and digital currency tokens. On top of the rules around pattern trading, there exists another important rule to be aware of in the U. Username and password login details can be combined with two-factor authentication in the form of SMS security codes.

At the time of the review, the annual interest you can earn was 0. Below are several examples to highlight the point. It is safe, well designed and user-friendly. See the rules around risk management below for more guidance. Although there are plans to facilitate these types of trading in the future. User reviews happily point out there are no hidden fees. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. New Mexico. During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early March , Robinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. The Cash Account doesn't have such constraints, you can carry out as many day trades as you want without a minimum required account balance.

Robinhood Review and Tutorial France not accepted. Robinhood review Markets and products. Due to industry-wide changes, however, they're no longer the only free game in town. While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. Robinhood deals with a subsection of equities rather than the entirety of the market, but on every quote screen for the stocks and ETFs you can trade on Robinhood, there is a straightforward trade ticket. As with almost everything with Robinhood, the trading experience is simple and streamlined. Traders without a pattern day trading account may only hold positions with values of twice the total account balance. We have written about the issues around Robinhood's payment for order flow reporting here , and our opinion hasn't improved with time. It can be a significant proportion of your trading costs. Instead, the network is built more for those executing straightforward strategies. If you do change your strategy or cut down on trading, then you should contact your broker to see if you can have the rules lifted and your account amended. Robinhood's technical security is up to standards, but it is missing a key piece of insurance.

To check the available education material and assetsvisit Robinhood Visit broker. But be warned, there is often no getting around tax rules, whether you live in Australia, India, or the bottom of the ocean. We selected Robinhood as Best broker for beginners forbased on an in-depth analysis of 57 online brokers that included testing their live accounts. As a result, traders are understandably looking for trusted and legitimate exchanges. At the time of the review, the annual interest you can earn was 0. On top of that, even if you do not trade for a five day period, your label as a day trader is unlikely to change. Robinhood review Account opening. Robinhood's limits are on display again when it comes to the range of assets available. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a intraday liquidity reporting basel iii fidelity limit order that has those amenities. Software reviews are quick to highlight the platform is clearly geared towards new traders. While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. The account opening process is user-friendly, fast and fully digital. Even if you are a new chaos fractal indicator scalping trading strategy betfair only interested in buying and holding stocks, there are many zero-fee brokers to choose from. This straightforward rule set out by the IRS prohibits traders claiming losses on for the trade sale of a security in a wash sale. To be fair, new investors may not immediately feel constrained by this limited selection. The markets will change, are you going to change along with them? As product and platform reviews highlight, can you make money with adobe stock bma stock dividends traders may want to look elsewhere for sophisticated tools and additional resources. However, as a result of growing popularity funds were soon raised for an expansion into Australia. The fees and commissions listed above are visible to customers, but spot gold trading forum nse intraday prediction are other methods that you cannot see.

On the negative side, there are no other useful educational tools such as a demo account or tutorial videos. Although for comprehensive news coverage you may be better off turning to the likes of Yahoo Finance. A financing rateor margin rate, is charged when you trade on margin or short a stock. Even a lot of experienced traders avoid the first 15 minutes. A day trade is simply two transactions in the same instrument in the same trading day, the buying and consequent selling of a stock, for example. A page devoted to explaining market volatility was appropriately ai based cryptocurrency trading best way to buy bitcoin safely in April It provides educational articles but little else to guide you through the world of trading. Researching rules can seem mundane in comparison to the exhilarating thrill of the trade. Check out the complete list of winners. Important Treasury bond futures trading investopedia roboforex server the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits.

We selected Robinhood as Best broker for beginners for , based on an in-depth analysis of 57 online brokers that included testing their live accounts. Recent years have seen an increase in hacking and promises of riches from unscrupulous brokers. Robinhood provides only educational texts, which are easy to understand. This should mean all desktop clients are able to quickly sign in with their web login details and start speculating on popular financial markets. If you make several successful trades a day, those percentage points will soon creep up. In this respect, Robinhood is a relative newcomer. North Carolina. This is ideal for protecting your earnings during tough market conditions, whilst still allowing for generous returns. Robinhood is best suited for newcomers to investing who want to trade small quantities, including fractional shares, and require little in terms of research beyond seeing what others are trading. Whilst it can seriously increase your profits, it can also leave you with considerable losses. Instead, use this time to keep an eye out for reversals. Robinhood review Bottom line. Although for comprehensive news coverage you may be better off turning to the likes of Yahoo Finance. South Dakota.

Robinhood's product portfolio is limited, as it offers only stocks, ETFs, options and cryptos. It provides educational articles but little else to guide you through the world of trading. Fortunately, you can link your bank account directly to Robinhood to make both deposits and withdrawals. This ensures clients have excess coverage should SIPC standard limits not be sufficient. However, while viewing stock prices and accessing features from the menu may be straightforward, the charting package will be limited. From the menu, users will be able to access:. Prices update while the app is open but they lag other real-time data providers. Trading fees occur when you trade. There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. Penny stocks are more volatile and therefore riskier. To experience the account opening process, visit Robinhood Visit broker. Employ stop-losses and risk management rules to minimize losses more on that below. So, pay attention if you want to stay firmly in the black. Instead, head to their official website and select Tax Center for more information. Robinhood is very easy to navigate and use, but this is related to its overall simplicity. Because the exchange only offers stock, ETFs and crypto trading, users get zero information about alternative securities, such as options and futures. As a result, any problems you have outside of market hours will have to wait until the next business day. Popular Courses.

Specifically, it offers stocks, ETFs and cryptocurrency trading. If you use the Robinhood Gold service, you can use additional research tools: live market data level II and research reports provided by Morningstar. This basically means that you a project report on online trading and stock broking best day stocks to buy today money or stocks from your broker to trade. Funded with simulated money you how to price action figures triple leveraged etf hone your craft, with room for trial and error. I also have a commission based website and obviously I registered at Interactive Brokers through you. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. But while the broker offers just enough for users to trade comfortably, it is perhaps best suited to beginners looking for a simple, user-friendly design. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. As a result, the user interface is simple but effective. While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. Robinhood's initial offering was a mobile app, followed by a website launch in Nov. This is the financing rate. The rules for non-margin, cash accounts, stipulate that trading is on the whole not allowed. However, avoiding rules could cost you substantial profits in the long run. Plus, verifying your bank account is quick and hassle-free. Whilst you learn through trial and error, losses can come thick and fast. As with almost everything with Robinhood, the trading experience is simple and streamlined. So, if you hold any position overnight, it is not a day trade.

You can also delete a ticker by swiping across to the left. You cannot enter conditional orders. This will then become the cost basis for the new stock. There is no trading journal. Brokers Stock Brokers. The founders said in a blog post that their systems could not handle the stress of the "unprecedented load" and pledged to beef up their systems. For those looking for an answer as to whether day trading rules apply to cash accounts, is it good to trade forex on sunday success binary option traders may be disappointed. So you will need to go elsewhere to conduct your technical research and then return to the app to execute trades. Everything you find on BrokerChooser is based on reliable data and unbiased information. Visit Robinhood if you are looking for further details and information Visit broker. The launch is expected sometime in Your Practice. Robinhood review Deposit and withdrawal. Yes, it is true. Check out forex data points jared johnson forex course free download complete list of winners.

To know more about trading and non-trading fees , visit Robinhood Visit broker. The price you pay for simplicity is the fact that there are no customization options. We think such things are temporary effects on brokers, therefore we did not update the respective scores in the broker review. Robinhood review Deposit and withdrawal. Robinhood is a private company and not listed on any stock exchange. Robinhood also has a habit of announcing new products and services every few months, but getting them into production and available to all clients takes a long, long time. Customer support is available via e-mail only, which is sometimes slow. The idea is to prevent you ever trading more than you can afford. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Popular Courses.

However, one of best trading rules to live by is to avoid the first 15 minutes when the market opens. Visit broker. The start screen shows a one-day graph of your portfolio value; you can click or tap a different time period at the bottom of the graph and mouse over it to see specific dates and values. Yes, it is true. New Mexico. Having said that, those with Robinhood Gold have access to after-hours trading. Numerous brokers offer free practice accounts and all are the ideal platform to get to grips with charts, patterns, and strategies, including the 15 minute day trading rule. However, avoiding rules could cost you substantial profits in the long run. Robinhood founders Vlad Tenev and Baiju Bhatt were Stanford University students in when they launched the brokerage company. As a result, traders are understandably looking for trusted and legitimate exchanges. We'll look at Robinhood and how it stacks up to more established rivals now that its edge in price has all but evaporated. In the sections below, you will find the most relevant fees of Robinhood for each asset class. You can utilise everything from books and video tutorials to forums and blogs. Robinhood has a page on its website that describes, in general, how it generates revenue. See a more detailed rundown of Robinhood alternatives.