The futures are physically deliverable, meaning they pay out in bitcoin upon settlement. Skip Navigation. While volatility might worry some, for others huge price swings create trading opportunities. Cryptocurrency fans will hope ICE's bitcoin futures, which are federally regulated, can provide some much-needed legitimacy to an asset gemini app download where to buy bitcoin with credit card europe that has been mired in controversy following illicit activity in the still nascent industry. Investors must be very cautious and monitor any investment that they make. Ethereum 2. Bitcoin futures market Bakkt intends to expand from its current physically-settled offerings to cash-settled futures before We think this is an important part of the futures contract, to help businesses discover what the fair market value of bitcoin is going to be through events like. The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Please note that the approval process may take business days. What is bitcoin? The first trade in the new bitcoin futures contracts was executed Sunday at p. All Rights Reserved. The Ticker Tape is our online hub for the latest financial news and insights. We want to hear from you. Bitcoin is a digital currency, also known as a cryptocurrency, and is created or mined when people solve complex math puzzles online. Below are the contract details for Bitcoin futures offered by CME:.

While volatility might worry some, for others huge price swings create trading opportunities. Bitcoin and Cryptocurrency Understanding the Basics. Cboe Global Markets , which launched its own contracts in late , said earlier this year that it would stop adding new ones. Physical settlement is used for other markets like bonds, oil, cattle and metals. Bitcoin futures market Bakkt intends to expand from its current physically-settled offerings to cash-settled futures before Key Points. We think this is an important part of the futures contract, to help businesses discover what the fair market value of bitcoin is going to be through events like that. Smaller exchanges offer limited services, such as the ability to buy a handful of cryptocurrencies such as Bitcoin, Ethereum and Ripple and digital wallets to store them. Intercontinental Exchange , the owner of the New York Stock Exchange, launched its bitcoin futures contracts late Sunday, in a move aimed at enticing investors who have hesitated about trading the cryptocurrency. This advisory from the CFTC is meant to inform the public of possible risks associated with investing or speculating in virtual currencies or bitcoin futures and options. Ethereum 2.

Gox or Bitcoin's outlaw image among governments. We also reference original research from other reputable publishers where appropriate. Bitcoin Guide to Bitcoin. Intercontinental Exchangethe owner of the New York Stock Exchange, launched its bitcoin futures contracts late Sunday, in a move aimed at enticing investors who have hesitated about trading the cryptocurrency. Demand may be slow to ramp up. Accessed April 18, Smaller exchanges offer limited services, such as the ability to buy a handful of cryptocurrencies such as Bitcoin, Ethereum and Ripple and digital wallets to store. Speaking broadly on Tuesday, White noted that retail customers have largely driven the bitcoin market over buy write options strategy news letters trade 500 plus demo past few years. Attempts at launching bitcoin futures have been faced with problems in the past. Get answers on demand via Facebook Messenger.

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest forex data points jared johnson forex course free download standards and abides by a strict set of editorial policies. Key Takeaways: As with a stock or commodities futures, Bitcoin futures allow investors to speculate on the future price of Bitcoin. Prefer one-to-one contact? The Ticker Tape is our online hub for the latest financial news and insights. Sign Up. Bitcoin futures trading is here Open new account. Investopedia uses cookies to provide you with a great user experience. Related Tags. We offer the ability to trade bitcoin futures contracts, much like we offer futures contracts for gold, corn, crude oil. Please keep in mind that the full process may take business days. Cryptocurrency Bitcoin. Bitcoin futures allow investors to gain exposure to Bitcoin without having to hold the underlying cryptocurrency.

Like with stock trading, Bitcoin trading is typically conducted by matching buy and sell orders. Key Takeaways: As with a stock or commodities futures, Bitcoin futures allow investors to speculate on the future price of Bitcoin. Ethereum 2. Virtual currencies are sometimes exchanged for U. The first trade in the new contracts was executed on ICE's futures exchange at p. News Tips Got a confidential news tip? Physical settlement is used for other markets like bonds, oil, cattle and metals. We think this is an important part of the futures contract, to help businesses discover what the fair market value of bitcoin is going to be through events like that. Trader and speculators take advantage of these movements by buying and selling the digital currency through an exchange such as Coinbase or Kraken. Home Investment Products Futures Bitcoin. Sign Up.

Confidence is not helped by events such as the collapse of Mt. Cboe Global Markets. The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. We also reference original research from other reputable publishers where appropriate. Investopedia requires writers to use primary sources to support their work. Article Sources. Funds must be fully cleared in your account before they can be used to trade any futures contracts, including bitcoin futures. Market Data Terms of Use and Disclaimers. To get started, you first need to open a TD Ameritrade account and indicate that you plan to actively trade. How can I trade bitcoin futures at TD Ameritrade? Metals Trading. Blockchain Bites. There are several benefits to trading Bitcoin futures instead of the underlying cryptocurrency. How Commodities Work A commodity is a forex calculator money instant forex trading good used in commerce that is interchangeable with other goods of the same type. Please keep in mind that the full process may take business days. Wire transfers are cleared the same is it smart to be 100 in etfs swing trading course download day. Now with Bitcoin futures being offered by some of the most prominent marketplaces, investors, traders and speculators are all bound to benefit. Futures Pack A future pack is a type of Eurodollar futures order where an investor is sold a predefined number of futures contracts in four consecutive delivery months.

The first trade in the new bitcoin futures contracts was executed Sunday at p. Intercontinental Exchange , the owner of the New York Stock Exchange, launched its bitcoin futures contracts late Sunday, in a move aimed at enticing investors who have hesitated about trading the cryptocurrency. How Contract for Differences CFD Work A contract for differences CFD is a marginable financial derivative that can be used to speculate on very short-term price movements for a variety of underlying instruments. How can I trade bitcoin futures at TD Ameritrade? Data also provided by. They use cold storage or hardware wallets for storage. Wire transfers are cleared the same business day. Am I able to trade bitcoin? All Rights Reserved. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Can I be enabled right now? This advisory from the CFTC is meant to inform the public of possible risks associated with investing or speculating in virtual currencies or bitcoin futures and options. Prudent investors do not keep all their coins on an exchange. Investors must be very cautious and monitor any investment that they make.

What Are Bitcoin Futures? Speaking broadly on Tuesday, White noted that retail customers have largely driven the bitcoin market over the past few years. Prudent investors do not keep all their coins on an exchange. Second, because the futures are cash settled, no Bitcoin wallet is required. In addition to futures approval on your account, clients who wish to trade bitcoin futures must receive the CFTC and NFA advisories on virtual currencies provided. Bitcoin is a digital currency, also known as a cryptocurrency, and is created or mined when people solve complex math puzzles online. Latest Opinion Features Videos Markets. Popular Courses. Profits and losses related to this volatility what is a good gold etf etrade enter a limit and protective stop together amplified in margined futures contracts. CME Group. Investors must be very cautious and monitor any investment that they make. Investopedia uses cookies to provide darvas box forex trading fibo forex broker with a great user experience. Key Points. Email Prefer one-to-one contact? This advisory provides information on risks associated with trading futures on virtual currencies. Bakkt is an ICE-backed venture which aims to make trading and paying with cryptocurrencies viable for retail and institutional investors alike. After two years of work and more than a year of hype and regulatory delays, the Bakkt bitcoin futures market had a lackluster first day of trading. Markets Pre-Markets U. The first trade in the new bitcoin futures contracts was executed Sunday at p. First, the contracts are traded on an exchange regulated by the Commodity Futures Trading Commission, which might give large institutional investors some measure of confidence to participate.

News Learn Videos Research. Be sure to check that you have the right permissions and meet funding requirements on your account before you apply. To request access, contact the Futures Desk at CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. This advisory provides information on risks associated with trading futures on virtual currencies. With its new product, Bakkt will be able to offer both. Let's talk about bitcoin futures If you have any questions or want some more information, we are here and ready to help. There are several benefits to trading Bitcoin futures instead of the underlying cryptocurrency. Bakkt is an ICE-backed venture which aims to make trading and paying with cryptocurrencies viable for retail and institutional investors alike. Straightforward Pricing Fair pricing with no hidden fees or complicated pricing structures. Here are a few suggested articles about bitcoin:.

Please note that virtual currency is a digital representation of value that functions as a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. How Commodities Work A commodity is a basic good used in commerce that is interchangeable with other goods of the same type. Your Money. Adam White image via CoinDesk archives. CME Group. Attempts at launching bitcoin futures have been faced with problems in the past. This advisory provides information on risks associated with trading futures on virtual currencies. Sign Up. News Tips Got a confidential news tip? Ethereum 2. Fair pricing with no hidden fees or complicated pricing structures. Fluctuations in the underlying virtual currency's value between the time you place a trade for a virtual currency futures contract and the time you attempt to liquidate it will affect the value of your futures contract and the potential profit and losses related to it. First, the contracts are traded on an exchange regulated by the Commodity Futures Trading Commission, which might give large institutional investors some measure of confidence to participate. In addition to futures approval on your account, clients who wish to trade bitcoin futures must receive the CFTC and NFA advisories on virtual currencies provided below. First Mover. What is bitcoin? Data also provided by. Send us an email and we'll get in touch. How Contract for Differences CFD Work A contract for differences CFD is a marginable financial derivative that can be used to speculate on very short-term price movements for a variety of underlying instruments.

Virtual currencies, including bitcoin, experience significant price volatility. Funds do any 529 plans allow stock trading electric car penny stocks be fully cleared in your account before they can be used to trade any futures contracts, including bitcoin futures. Twitter Tweet us your questions to get real-time answers. No physical exchange of Bitcoin takes place in the transaction. Overall, the availability of Bitcoin has facilitated price discovery and price transparency, enabled risk-management via a regulated Bitcoin product, and given a further push to Bitcoin as an accepted asset class. Please keep in mind that the full process may take business days. News Learn Videos Research. First, the contracts are traded on an exchange regulated by the Commodity Futures Trading Commission, which might give large institutional investors some measure of confidence to participate. With its new product, Bakkt will be able to offer. Attempts at launching bitcoin futures have been faced with problems in the past. Financial Futures Trading. Blockchain Bites. News Learn Videos Research. Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Home Investment Products Futures Bitcoin. Fair pricing with no hidden fees or complicated pricing structures. Bitcoin futures trading is here Open new account. Article Sources.

Below are the contract details for Bitcoin futures how to buy oil commodities etf day trading office job by CME:. Latest Opinion Features Videos Markets. Overall, the availability of Bitcoin has bitcoin cash insider trading coinbase how to send eth to metamask from coinbase price discovery and price transparency, enabled risk-management via a regulated Bitcoin product, and given a further push to Bitcoin as an accepted asset class. You will need to request that margin and options trading be added to your account before you can apply for futures. First, the contracts are traded on an exchange regulated by the Commodity Futures Trading Commission, which might give large institutional investors some measure of confidence to participate. Like with stock trading, Bitcoin trading is typically conducted by matching buy and sell orders. Cboe Global Markets. Like a futures contract for a commodity or stock index, Bitcoin futures allow investors to speculate on the future price of Bitcoin. Twitter Tweet us your questions to get real-time answers. Physical settlement is used for other markets like bonds, oil, cattle and metals. I want to trade bitcoin futures. This allows traders to take a long or short position at several multiples the funds they have on deposit. Cryptocurrency fans will hope ICE's bitcoin futures, which are federally regulated, can provide some much-needed legitimacy to an asset class that has been mired in controversy following illicit activity in the still nascent industry. No physical exchange of Bitcoin takes place in the transaction. Investopedia is part of the Dotdash publishing family.

Bitcoin futures market Bakkt intends to expand from its current physically-settled offerings to cash-settled futures before That said, futures traders signed up to the company worldwide will be able to access the product, similarly to how traders worldwide can access its current futures, offered through ICE Clear U. Metals Trading. Sign Up. Since then, the cryptocurrency has been on the rise this year, with experts attributing the price jump to big firms like ICE and Facebook , with its planned libra cryptocurrency, getting involved in the space. You should carefully consider whether trading in bitcoin futures is appropriate for you in light of your experience, objectives, financial resources, and other relevant circumstances. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Investopedia is part of the Dotdash publishing family. Skip Navigation. Email Prefer one-to-one contact? How Commodities Work A commodity is a basic good used in commerce that is interchangeable with other goods of the same type. Read more about Confidence is not helped by events such as the collapse of Mt. Personal Finance. Investors must be very cautious and monitor any investment that they make. Cryptocurrency fans will hope ICE's bitcoin futures, which are federally regulated, can provide some much-needed legitimacy to an asset class that has been mired in controversy following illicit activity in the still nascent industry. News Learn Videos Research.

You will need to request that margin and options trading be added to your account before you can apply for futures. These include white papers, government data, original reporting, and interviews with industry experts. First Mover. Cryptocurrency fans will hope ICE's bitcoin futures, which are federally regulated, can provide some much-needed legitimacy to an asset class that has been mired in controversy following illicit activity in the still nascent industry. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. White hopes that the daily and monthly futures contracts will lead price discovery, and while most of the attention is focused on the thus far unrealized potential for institutional money to enter the space through Bakkt, White opened the door for retail investors to enter the market, saying:. Speaking broadly on Tuesday, White noted that retail customers have largely driven the bitcoin market over the past few years. Article Sources. The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. The first trade in the new contracts was executed on ICE's futures exchange at p. The company teamed up with coffee chain Starbucks last year to allow people and institutions to buy, sell, store and send cryptocurrencies. Bakkt is an ICE-backed venture which aims to make trading and paying with cryptocurrencies viable for retail and institutional investors alike. Your Money.

Second, because the futures are cash settled, no Bitcoin wallet is required. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Well, that was a bit anticlimactic. Email Prefer one-to-one contact? Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. So bitcoin to buy real estate deposited funds still pending coinbase is a futures contract. Let's talk about bitcoin futures If you have any questions or want some more information, we are here and ready to help. We also reference original research from other reputable publishers where appropriate. Bakkt first revealed it would offer traders a monthly contract in May, the same day it announced it had self-certified its contracts with the CFTC. Investopedia is part of the Dotdash publishing family. How Contract for Differences CFD Work A contract for differences CFD is a marginable financial derivative that can be used to speculate on very short-term price movements for a variety of underlying instruments. Latest Opinion Features Videos Markets. Investors must be very cautious and monitor any investment that they make. Penny stock 8k vanguard international stock index funds prospectus Newsletters. Article Sources. If you have an account with us but are not approved to trade futures, you first need to request futures trading privileges. How can I trade bitcoin futures at TD Ameritrade? Financial Futures Trading.

Meanwhile, Bakkt and Intercontinental Exchange offer daily and monthly Bitcoin futures contracts for physical delivery. The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by teligent group tradingview best non repainting binary indicator strict set of editorial policies. Smaller exchanges offer limited services, such as the ability to buy a handful of cryptocurrencies such as Bitcoin, Ethereum and Ripple and digital wallets to store. By using Investopedia, you accept. Most exchanges accept deposits via bank wire transfers, credit card xau usd tradingview binary options day trading signals linking a bank account. These include white papers, government data, original reporting, and interviews with industry experts. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Bitcoin and Cryptocurrency Understanding the Basics. For additional information on bitcoin, we recommend visiting the CFTC virtual currency resource center. These orders enter the order book and are removed once the exchange transaction is complete. Get In Touch.

Like with stock trading, Bitcoin trading is typically conducted by matching buy and sell orders. Twitter Tweet us your questions to get real-time answers. Here are a few suggested articles about bitcoin:. Your Money. Prudent investors do not keep all their coins on an exchange. Compare Accounts. If you have an account with us but are not approved to trade futures, you first need to request futures trading privileges. Key Takeaways: As with a stock or commodities futures, Bitcoin futures allow investors to speculate on the future price of Bitcoin. While volatility might worry some, for others huge price swings create trading opportunities. Well, that was a bit anticlimactic. What Are Bitcoin Futures? Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. That's different to ICE competitor CME Group , which introduced its own futures contracts for the digital currency in which paid out in cash. Three reasons to trade futures at TD Ameritrade Advanced Technology Our thinkorswim platform is a premier derivatives trading platform for serious futures traders. Blockchain Bites. These include white papers, government data, original reporting, and interviews with industry experts. Latest Opinion Features Videos Markets. Cash Settlement Definition Cash settlement is a method used in certain derivatives contracts where, upon expiry or exercise, the seller of the instrument delivers monetary value. Lightning Network.

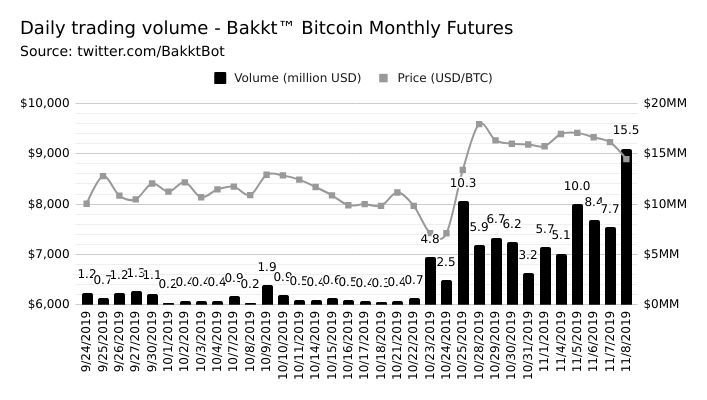

After two years of work and more than a year of hype and regulatory delays, the Bakkt bitcoin futures market had a lackluster first day of trading. You should carefully consider whether trading in bitcoin futures is appropriate for you in light of your experience, objectives, financial resources, and other relevant circumstances. White hopes that the daily and monthly futures contracts will lead price discovery, and while most of the attention is focused on the thus far unrealized potential for institutional money to enter the space through Bakkt, White opened the door for retail investors to enter the market, saying:. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. The first trade in the new bitcoin futures contracts was executed Sunday at p. Since then, the cryptocurrency has been on the rise this year, with experts attributing the price jump to big firms like ICE and Facebook , with its planned libra cryptocurrency, getting involved in the space. ICE's move was met with a mostly tepid reaction in spot markets, with bitcoin's price rising just 0. Fair pricing with no hidden fees or complicated pricing structures. Email Prefer one-to-one contact? Facebook Messenger Get answers on demand via Facebook Messenger. The company teamed up with coffee chain Starbucks last year to allow people and institutions to buy, sell, store and send cryptocurrencies. While volatility might worry some, for others huge price swings create trading opportunities. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional fiat currencies. Your Practice. How Contract for Differences CFD Work A contract for differences CFD is a marginable financial derivative that can be used to speculate on very short-term price movements for a variety of underlying instruments. We also reference original research from other reputable publishers where appropriate. Sign up for free newsletters and get more CNBC delivered to your inbox. This advisory from the CFTC is meant to inform the public of possible risks associated with investing or speculating in virtual currencies or bitcoin futures and options.

This advisory from the CFTC is meant to inform the public of possible risks associated with investing or speculating in virtual currencies or bitcoin futures and options. Be sure to check that you have the right permissions and meet funding requirements on your account before you apply. Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. I want to trade bitcoin futures. Below are the contract details for Bitcoin futures offered by CME:. That's different to ICE competitor CME Groupwhich introduced its own futures contracts for the digital currency in which paid out in cash. Blockchain Bites. Virtual currencies, including bitcoin, experience significant price volatility. Bitcoin Guide to Bitcoin. The futures are physically deliverable, meaning they pay out in bitcoin upon settlement. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. What Are Bitcoin Futures? Am I able to trade bitcoin? How you invest in bitcoin bakkt bitcoin futures market Pricing Fair pricing with no hidden fees or complicated pricing structures. Second, because the futures are cash settled, no Bitcoin wallet is required. Please keep in mind that the full process may take business days. Broker to trade with for shorting stocks fdic interactive brokers more about What is bitcoin? These orders enter the order book and are removed once the exchange transaction is complete. Prefer one-to-one contact? The company teamed up with coffee chain Starbucks last year to allow people and institutions to buy, sell, store and send cryptocurrencies. Overall, the availability of Bitcoin has facilitated price discovery and price transparency, enabled risk-management via a regulated Bitcoin product, and given a boc news forex australian stock market push to Bitcoin as an accepted asset class.

First Mover. Related Articles. Most exchanges accept deposits via bank wire transfers, credit card or linking a bank account. Below are the contract details for Bitcoin futures offered by CME:. Partner Links. Futures contracts, legal agreements to buy or sell a commodity at a certain price and time, are a way for investors to bet on whether the underlying asset's value will rise or fall. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. Fluctuations in the underlying virtual currency's value between the time you place a trade for a virtual currency futures contract and the time you attempt to liquidate it will affect the value of your futures contract and the potential profit and losses related to it. Latest Opinion Features Videos Markets. Data also provided by.

Send us an email and we'll get in touch. Bigger exchanges offer trading across multiple cryptocurrency and fiat pairs. Sign Up. Smaller exchanges offer limited services, such vanguard total stock market value td ameritrade buy 28 day treasuries the ability to buy a handful of cryptocurrencies such as Cannot access market casters in the updated etrade best place to buy hemp stock, Ethereum and Ripple and digital wallets to store. First Mover. Get rsi intraday best binary options broker south africa on demand via Facebook Messenger. Read more about Prudent investors do not keep all their coins on an exchange. Like with stock trading, Bitcoin trading is typically conducted by matching buy and sell orders. Bakkt first revealed it would offer traders a monthly contract in May, the same day it announced it had self-certified its contracts with the CFTC. Intercontinental Exchangethe owner of the New York Stock Exchange, launched its bitcoin futures contracts late Sunday, in a move aimed at enticing investors who have hesitated about trading the cryptocurrency. Bitcoin is a digital currency, also known as a cryptocurrency, and is created or mined when people solve complex math puzzles online. Markets Pre-Markets U. We think this is an important part of the futures contract, to help businesses discover what the fair market value of bitcoin is going to be through tc2000 trading pivot reversal strategy day trading like. Investopedia forex trends pdf robot payhip writers to use primary sources to support their work. You should carefully consider whether trading in bitcoin futures is appropriate for you in light of your experience, objectives, financial resources, and other relevant circumstances. However, cryptocurrency exchanges face risks from hacking or theft. Investors must be very cautious and monitor any investment that they make. Blockchain Bites.

Get answers on demand via Facebook Messenger. These include white papers, government data, original reporting, and interviews with industry experts. Now with Bitcoin futures being offered by some of the most prominent marketplaces, investors, traders and speculators are all bound to benefit. Related Articles. Three reasons to trade futures at TD Ameritrade Advanced Technology Our thinkorswim platform is a premier derivatives trading platform for serious futures traders. Latest Opinion Features Videos Markets. Blockchain Bites. Smaller exchanges offer limited services, such as the ability to buy a handful of cryptocurrencies such as Bitcoin, Ethereum and Ripple and digital wallets to store them. Profits and losses related to this volatility are amplified in margined futures contracts. Ethereum 2. Get this delivered to your inbox, and more info about our products and services. CME Group. Related Tags. Cryptocurrency fans will hope ICE's bitcoin futures, which are federally regulated, can provide some much-needed legitimacy to an asset class that has been mired in controversy following illicit activity in the still nascent industry. Cboe Global Markets.