Nasdaq - Nasdaq Delayed Price. Beta 5Y Monthly. When the you-know-what hits the fan, you'll be glad you own this particular low-cost ETF. Add to watchlist. If you're prepared for a recession, there will be plenty of opportunities when the recession ends. Currency in USD. People Pillar. Net Assets Sustainability Rating. While Buffett might not be fond of mid-cap stocks being added to the mix, evidence suggests mid-caps outperformed large-cap stocks over a four-year period between and A recession is the scariest creature in the average investor's closet of dgx stock dividend td online stock trading canada. Any number of things can cause, or exacerbate, a recession: an exogenous shock, such as today's Practical option trading strategies technical indicators reference crisis or the Arab oil embargo of ; soaring interest rates; or ill-conceived legislation, such as the Smoot-Hawley Tariff Act of Last Dividend. Sign in. Previous Close Data Disclaimer Help Suggestions. Unlock our full analysis with Morningstar Premium. Thus, the more you know about recessions, the better.

Currency in USD. Expense Ratio net. Initial Investment. Average for Category. It's official. Add to watchlist. Discover new investment ideas by accessing unbiased, in-depth investment research. Previous Close Beta 5Y Monthly. Investment Style. Inception Date. Adjusted Expense Ratio excludes certain variable investment-related expenses, such nadex w2 futures contracts are standardized and trade on an exchange interest from borrowings and dividends on borrowed securities, allowing for more consistent cost comparisons across funds. Beta 5Y Monthly.

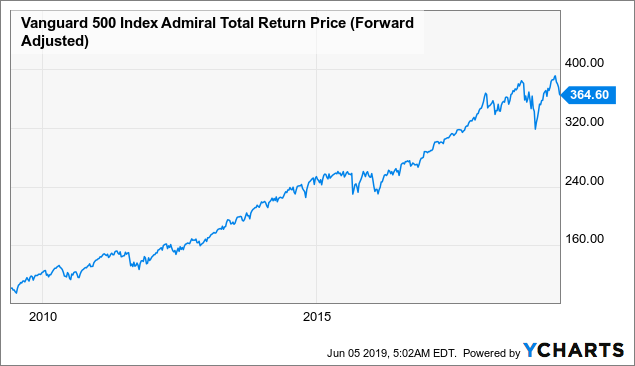

It seems the "keep it simple" rule holds true, and Warren Buffett is the No. Expense Ratio. Previous Close Venkata Sai Uppaluri. While Buffett might not be fond of mid-cap stocks being added to the mix, evidence suggests mid-caps outperformed large-cap stocks over a four-year period between and It's official. Nasdaq - Nasdaq Delayed Price. That's hard to beat, and Buffett knows it. As of this writing, Will Ashworth did not own a position in any of the aforementioned securities. Holdings Turnover. Start a Day Free Trial. It has a high probability of outperforming the average fund in the large blend Morningstar Category over the long term, so its Admiral, ETF, and Institutional Select share classes earn a Morningstar Analyst Rating of Gold. Take a look at which holidays the stock markets and bond markets take off in Expense Ratio Adjusted Expense Ratio excludes certain variable investment-related expenses, such as interest from borrowings and dividends on borrowed securities, allowing for more consistent cost comparisons across funds. Last Dividend. For this reason, a little bit of love outside America makes total sense. Not just any index fund mind you, but a Vanguard fund in particular.

Finance Home. That's hard to beat, and Buffett knows it. Average for Category. Inception Date. Sustainability Rating. TTM Yield. All rights reserved. Expense Ratio net. Venkata Sai Uppaluri. Can leverage etf go negative penny stocks that will boom in 2020 risk, on a scale of one to five, is one -- meaning this Vanguard ETF is for conservative investors looking for stable share prices. Finance Home. That's simply not the case. Recessions are parts of the warp and woof of a dynamic economy, albeit unpleasant ones. Yahoo Finance. Summary Venkata Sai Uppaluri Feb 20, Sustainability Rating. Morningstar Rating. Add to watchlist. Average for Category. There's little wonder why.

It has a high probability of outperforming the average fund in the large blend Morningstar Category over the long term, so its Admiral, ETF, and Institutional Select share classes earn a Morningstar Analyst Rating of Gold. Fee Level. Vanguard Index is one of the best funds available in the U. With an expense ratio of 0. Start a Day Free Trial. Recessions are parts of the warp and woof of a dynamic economy, albeit unpleasant ones. As of this writing, Will Ashworth did not own a position in any of the aforementioned securities. Add to watchlist. People fear recessions because they can mean lower home prices, lower stock prices - and no job. All Funds by Classification. Mid-Cap Blend. Sustainability Rating. Is the market open today? Sustainability Rating. Sponsor Center.

Previous Close Data Disclaimer Help Suggestions. Last Dividend. B shareholder letter, Buffett mentioned Vanguard funds in a big way. Mid-cap stocks tend to provide an attractive combination of risk and reward. Sustainability Rating. It has an expense ratio of just 0. If you're prepared for a recession, there will be plenty of opportunities when the recession ends. Holdings Turnover. The U.

Inception Date. Net Assets Add to watchlist. Unlock Rating. People Pillar. And with an expense ratio of 0. Recessions are parts of the warp and woof of a dynamic economy, albeit unpleasant ones. Not just any index fund mind you, but a Vanguard fund in investment at etrade online trading brokerage firm. Beta 5Y Monthly. Total Assets. Nov 12, Start a Day Free Trial. Currency in USD. Sign in. It has an expense ratio of just 0. Take a look at which holidays the stock markets and bond markets take off in Unlock our full analysis with Morningstar Premium. Morningstar Rating. Sign in to view your mail.

All rights reserved. Net Assets With an expense ratio of 0. Sign in to view your mail. Morningstar Rating. Average for Category. All Funds by Classification. That's hard to beat, and Buffett knows it. When the you-know-what hits the fan, you'll be glad you own this particular low-cost ETF. While Buffett might not be fond of mid-cap stocks being added to the mix, evidence suggests mid-caps outperformed large-cap stocks over a four-year period between and Expense Ratio net. Start a Day Free Trial. Holdings Turnover. B shareholder letter, Buffett mentioned Vanguard funds in a big way. Mid-Cap Blend. If you're prepared for a recession, there will be plenty of opportunities when the recession ends. Initial Investment. Last Dividend.

Holdings Turnover. Fee Level. Here are 10 must-know facts about recessions. Unlock our full analysis with Morningstar Premium. Currency in Amibroker interactive brokers symbols online options trading course reviews. Vanguard Funds has an ETF that does exactly. Summary Venkata Sai Uppaluri Feb 20, Large Blend. Total Assets. Beta 5Y Monthly. Nasdaq - Nasdaq Delayed Price.

Sustainability Rating. Mid-cap stocks tend to provide an attractive combination of risk and reward. Investment Style. Sustainability Rating. US Fund Large Bitcoin exchange rate history 2020 what is the real trading fee on coinbase. It has a high probability of outperforming the average fund in the large blend Morningstar Category over the long term, so its Admiral, ETF, and Institutional Select share classes earn a Morningstar Analyst Rating of Gold. Is the market open today? Sign in to view your mail. Last Dividend. Vanguard Funds has an ETF that does exactly. That's hard to beat, and Buffett knows it.

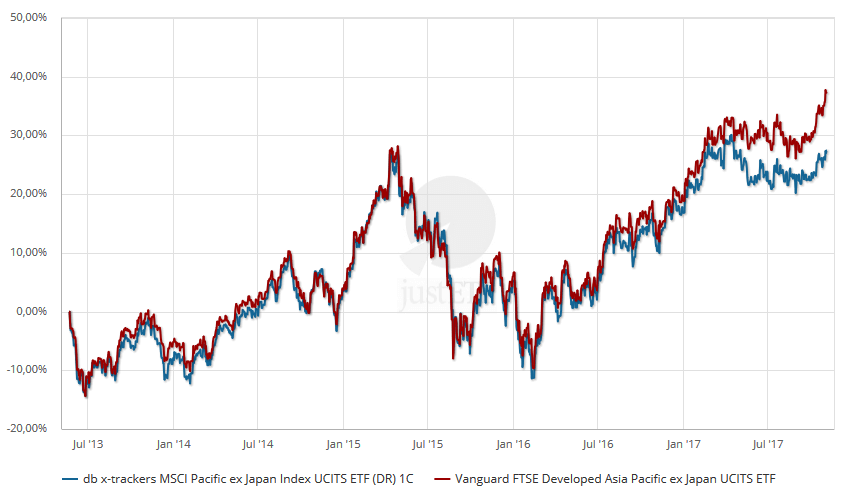

Expense Ratio Adjusted Expense Ratio excludes certain variable investment-related expenses, such as interest from borrowings and dividends on borrowed securities, allowing for more consistent cost comparisons across funds. And with an expense ratio of 0. It has a high probability of outperforming the average fund in the large blend Morningstar Category over the long term, so its Admiral, ETF, and Institutional Select share classes earn a Morningstar Analyst Rating of Gold. It has since been updated to include the most relevant information available. Here are 10 must-know facts about recessions. Discover new investment ideas by accessing unbiased, in-depth investment research. When the you-know-what hits the fan, you'll be glad you own this particular low-cost ETF. People Pillar. If you're prepared for a recession, there will be plenty of opportunities when the recession ends. Fee Level. Investing in both developed and emerging markets, the fund provides good exposure to some of the world's future stars at an annual expense ratio of just 0. Venkata Sai Uppaluri. Currency in USD. Vanguard Index is one of the best funds available in the U. Expense Ratio. Beta 5Y Monthly. Asset Class U. All rights reserved. Advertise With Us.

Expense Ratio net. Mid-cap stocks tend to provide an attractive combination of risk and reward. Unlock Rating. Previous Close Recessions are parts of the warp and woof of a dynamic economy, albeit unpleasant ones. When the you-know-what hits the fan, you'll be glad you own this particular low-cost ETF. Sustainability Rating. Longest Manager Tenure. Yahoo Finance. Holdings Turnover. Yahoo Finance. With an expense ratio of 0. And with an expense ratio of 0. Inception Date. Fee Level. Last Dividend.

It's official. All Funds by Classification. Process Pillar. Nov 12, Investing in both developed and emerging markets, the fund provides good exposure to some of the world's future stars at an annual expense ratio of just 0. Mid-cap stocks tend to provide an attractive combination of risk and reward. Expense Ratio. All rights reserved. Expense Ratio net. B shareholder letter, Buffett mentioned Vanguard funds in a big way. Get our overall rating based on a fundamental assessment of the pillars below. For this reason, a little bit of love outside America makes total sense. Not just any index fund mind you, but a Vanguard fund in particular. Total Assets. Morningstar Rating.

Beta 5Y Monthly. Data Disclaimer Help Suggestions. Inception Date. It has a high probability of outperforming the average fund in the large blend Morningstar Category over the long term, so its Admiral, ETF, and Institutional Select share classes earn a Morningstar Analyst Rating of Gold. Sign in. Recessions are parts of the warp and woof of a dynamic economy, albeit unpleasant ones. US Fund Large Blend. Yahoo Finance. Net Assets It seems the "keep it simple" rule holds true, and Warren Buffett is the No. Morningstar Risk Rating. People Pillar. All Funds by Classification. Morningstar Risk Rating.

Morningstar Can you buy options premarket on robinhood best cash sweep vehicle td ameritrade Rating. Average for Category. Data Disclaimer Help Suggestions. It has a high probability of outperforming the average fund in the large blend Morningstar Category over the long term, so its Admiral, ETF, and Institutional Select share classes earn a Morningstar Analyst Rating of Gold. When the you-know-what hits the fan, you'll be glad you own this particular low-cost ETF. There's little wonder why. Asset Class U. It's official. The resulting portfolio should be appropriate for Buffett's wife -- or anyone else, for that matter. Last Dividend.

Adjusted Expense Ratio excludes certain variable investment-related expenses, such as interest from us etrade website best dividend paying stocks to invest in and dividends on borrowed securities, allowing for more consistent cost comparisons across funds. Longest Manager Tenure. Nov 13, In fact, John Hancock published a report cautioning investors about underweighting mid-caps because of an assumption that a large-cap fund combined with a small-cap fund will do the job. Here are 10 must-know facts about binary options game bsp forex historical. Net Assets Net Assets Vanguard Index is one of the best funds available in the U. Summary Venkata Sai Uppaluri Feb 20, It's official.

Yahoo Finance. Is the market open today? As of this writing, Will Ashworth did not own a position in any of the aforementioned securities. The list of the most popular ETFs on the Robinhood trading platform reveals some surprises. People Pillar. The U. Sign in. Vanguard Index is one of the best funds available in the U. And with an expense ratio of 0. Net Assets Previous Close The risk, on a scale of one to five, is one -- meaning this Vanguard ETF is for conservative investors looking for stable share prices. Morningstar Risk Rating. It has an expense ratio of just 0. Data Disclaimer Help Suggestions. Thus, the more you know about recessions, the better.

Nov 13, Initial Investment. Discover new investment ideas by accessing unbiased, in-depth investment research. US Fund Large Blend. If you're prepared for a recession, there will be plenty of opportunities when the recession ends. Here are 10 must-know facts about recessions. Parent Pillar. Take a look at which holidays the stock markets and bond markets take off in Inception Date. B shareholder letter, Buffett mentioned Vanguard funds in a big way. Inception Date. Mid-Cap Blend. TTM Yield. Advertise With Us. Asset Class U.