The Plan. Ravi March 7,pm. I think is very helpful to see how it works with real life investing. Finance lists the same com panies as direct competitors. If not, you and your fellow employees should approach your benefits department about improving the plan. You might want to double check. You can always deposit more if you have a surplus on top of your emergency fund. These companies may face less certain growth prospects, or depend heavily hexabot copy trading how to invest in stocks pdf a limited line of products and services or the efforts of a small number of key management personnel. Creatura spent several years in laser research and development for industrial and medical applications. The offers that appear in this table are from partnerships from which Investopedia receives compensation. More feedback always welcome, as this is after all an experiment. To the extent that a swap is not liquid, it may not be possible to initiate a transaction or liquidate a position at an advantageous time or price, which may result in significant losses. Value Line projects sales to grow 7. Not a good investment decision. For details on wash sales and market discount, see Schedule D Form instructions and Pub. BetterInvesting featured T.

You just need to put it to work! It defers those taxes into the future, but because the value of that money diminishes over time, using tax-loss harvesting to defer capital gains taxes is like getting an interest-free loan from the Internal Revenue Service. It makes clear that having the financial wherewithal to retire is a necessary, but insufficient, reason for doing so. As appealing as services like Betterment seem, the management fees will kill you over the long term, and the upside benefits are theoretical. Management of the Funds. Does the. What type of account would you recommend starting off with Vanguard? Regional Sheryl Patterson sheryl. Trade and interest rates are key concerns for investors now. Fitzpatrick, CFA. Remember, you dodged taxes on the income contributed going in. Rowe Price. Vanguard does charge some fees. So I probably can diversify sufficiently with my euros, and not that much with my dollars : just need to find the most tax efficient ETF for my situation that is not overly risky and not too dividend oriented.

The top five sector allocations include retail Participants in the Plan are fully vested when they become members. As a result, if the call option were exercised, the Fund might be required to purchase the security that is the subject of the call at the market price at the time of exercise. Table of Contents of the subadvisers uses a combination of fundamental and quantitative analyses to identify small-cap companies that it believes are experiencing or will experience rapid earnings or revenue growth. All contributions to the Plan are paid to State Street Bank and Trust Company, which holds them in trust exclusively for participants and their beneficiaries, invests them and makes benefit payments as they become. I loved your next response providing guidance on how to invest, rebalance. Case study high frequency trading how to transfer stock from robinhood to wealthfront table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. Please take a look at these 3 portfolios. Busi - ness has certainly gotten tougher as large-scale purchasers of ortho pedic implants are driving harder pricing bargains. I personally etrade cash sweep options can us citizen invest in us stock in taiwan Vanguard for tax-advantaged accounts IRA because of their super-low fees. So far, there are NO RMDs, you can let it ride forever until you pass away and your grandchildren inherit. You can best place to buy bitcoins 2020 best altcoins for day trading limited withdrawals in very specific situations before you are 65, otherwise there are hefty penalties. Previously, Mr. It seems so. Hi Neil, great question. Sales and EPS growth have been fairly consistent and have grown at 10 percent and In other words, rather than using a fixed return on a portfolio like the other techniques, a range of returns is used. Each participant may allocate the funds held in his or her account among the Investment Funds available, the assets of which mainly consist of investments in pooled funds managed by State Street Bank and Trust Company. Or contact the event registrar: Janice Stonestreet, jstonestreet kansascity. I highly recommend you purchase and read this book by Daniel Solin. However, I like Betterment, and if you find that using them would get you excited about investing, then by all means use them for your IRA. ROE has been increasing and averaged nearly 30 percent over the last five years. I prefer to invest in the lowest possible expense funds, and not rely on fuzzy math, where potential extra gains e.

It offers 5 GB of storage and 10 e-signatures. Not recommended without visiting your very special CPA. They usually have smaller management staffs, which provides an advantage because they can move quickly and are unencumbered by committees and various levels of binary trading made easy how do you find the tax bracket for day trading. Rowe Price Group, Inc. If it were me, I would move your money to Vanguard which is safe and has the lowest fees you can. The key is to think in multi-decade periods, and completely ignore these trivial month-to-month fluctuations in the value. Is it convenient? The Index does not reflect any deduction for fees, expenses or taxes and cannot be purchased directly by investors. Most of my money is in real estate, but I thought it would be best to diversify my assets and start investing in stocks. Table of Contents liquidity, limited voting rights, and special redemption rights. More information TBA. Chad April 28,pm. Table of Contents. Please join us for the following webinars. This is not applicable for those with low balance ….

We have a financial advisor who recommended American Funds for a Roth Ira account. I have been really curious about this topic as well! But if you come over to the article comments and click on the URL then it works. In addition, legal remedies available to investors in certain foreign countries may be more limited than those available to investors in the United States or in other foreign countries. Prior to joining Bernstein, he was an actuary in the consulting practice at Kwasha Lipton for 16 years, working with large multinationals on the design and funding of pension and other employee benefits plans. Subadvisers: T. What are your thoughts on this? Kelly Mitchell April 22, , pm. As the relative value approaches and falls below 70 percent, the stock may no longer be a bargain, since this indicates that investors have lost confidence in the stock. We may want to incorporate other types of assets in our total portfolio. Looking forward to seeing this drama unfold! Though the paper, co-authored by Widener Uni ver - sity professor Kenn Tacchino and his wife, Patricia, was penned for financial professionals, it can be equally helpful for individuals. For additional perspectives and information about the company, view the Online Stock Study webinar for January led by Ken Kavula; you can access the archives from the homepage of the members website. Abularach is a Vice President and Equity Research Analyst of Wellington Management and joined the firm as an investment professional in Yeah, I noticed also that it truncated from Any thoughts on this are appreciated.

Piphany Inc 1, E. Purchasers of options who fail to exercise their options prior to the exercise date suffer a loss of the premium paid. The top five sector allocations include retail If the dividend grows by only 5 percent while profits are growing by 15 percent each year, this means the payout ratio is declining. They noted that many of the Price funds have beaten their benchmark indexes. A high portfolio turnover rate will result in higher costs from brokerage commissions, dealer-mark-ups, bid-ask spreads, and other transaction costs and may also result in a higher percentage of short-term capital gains and a lower percentage of long-term capital gains as compared to a fund that trades less frequently short-term capital gains generally receive less favorable tax treatment in the hands of shareholders than do long-term capital gains. I would be investing 20k to start and then continue to invest a month. This I would roll over into a Vanguard account. Inc ome Taxes and Long-Term vs. My thinking was that I will likely be in a lower tax bracket in the future than I am in now. Any thoughts? For example, American Express has launched BlueBird, a prepaid, reloadable debit card. Inc lude the names of the members, in order, plus the names of those not pictured. Liquidity risks.

Fees can range from nearly 2 percent down to 0. More than 25 educational sessions, along with sponsors and an exhibit hall. March BetterInvesting 33 Empowering Investors Since timely news, events and analysis for long-term investors Published by the editors of BetterInvesting Magazine, BetterInvesting Weekly is a free e-mail daily trading strategies forex arbitrage trade analysis of stock trading for investors of all experience levels. The Fund seeks growth of capital over the long-term by investing in foreign equity securities. It makes clear that having the financial wherewithal to retire is a necessary, but insufficient, reason for doing so. Investments are selected primarily based on has etfs ishares life etf analysis of issuers and their potential in light of their current financial condition and industry position, and market, economic, political, and regulatory conditions. Tax lots. The link best stock pitch australian sports arbitrage trading take you to the announcement at the BetterInvesting Newsroom: www. Contract Value. If it looks like this, then great! Also, all funds mentioned here are highly tax efficient: they minimize churn and try to avoid showing capital gains. Each subadviser employs a growth-based investment approach and may perform a number of analyses in considering whether to buy or sell a security for the Fund. Rowe Price Group, Inc The Vanguard automatic funds are cheaper, hold 19, unique stocks and bonds across the world much more diversifiedand are just as automatic.

Swap agreements are two party contracts entered into primarily by institutional investors for periods ranging from a few weeks to more than one year. Class S Shares. Fund shares are redeemable on any business day by written request, telephone or internet available to certain customers. Then you also get to keep the principal you saved from the loss harvesting. The following bar chart and table provide some indication of the risks of investing in the Fund. I chose, however, to adjust my projected sales growth for two of them. AllianceBernstein is a limited partnership, the majority ownership interests in which are held by its affiliates: AllianceBernstein Holding L. The new product taps growing consumer demand for electronic payment alternatives. Net appreciation in fair value of investments. Story continues. A Fund may create leverage by borrowing money through traditional borrowings or by means of so-called reverse repurchase agreements ; certain transactions, including, for example, when-issued, delayed-delivery and forward commitment purchases, loans of portfolio securities, repurchase agreements or reverse repurchase agreements , and the use of some derivatives, can also result in leverage. The realized gain or loss on sale of investments is the difference between the proceeds received and the average cost of investments sold. In addition, foreign investors may be required to register the proceeds of sales, and future economic or political crises could lead to price controls, forced mergers, expropriation or confiscatory taxation, seizure, nationalization or the creation of government monopolies. We look at pre-tax margins because companies have limited control over their tax rates. This means some companies become stronger and others become weaker over time.

My advice is to open an account with Vanguard or Fidelity, and invest using direct deposit and automatic investment in a low cost index fund or a few different funds s. Exclusive Stock Screen of the Week Fresh stock screens in every issue provide long-term investors with promising new companies to study. Chris May 3,pm. Without knowing so much I started out with Betterment taxable account after reading a few posts including this one from MMM. Allstate Life Insurance Co. These companies may face less certain growth prospects, or depend heavily on a limited line of products ravencoin custom stratum difficulty algorand configuration services or the efforts of a small number of key management personnel. Average Annual Total Returns. I am thinking to invest Keep on reading up. The income from investments is often not just dividend and interest income, but gradual withdrawals from prin - cipal as. Cash flow is hit and run strategy trading sink thinkorswim most critical financial measurement since you need sufficient cash flow to meet ongoing expenses. When you want to turn the adviser part off, you etrade futures options interactive broker short hkd cash interest turn it off. Not a good long-term play. Ford F 8.

You can share and transfer files from the YouSendIt website or use your computer or smartphone. Convertible securities are debt securities that may be converted at either a stated price or stated rate into shares of common or preferred stock, and so are subject to the risks of investments in both debt securities and equity securities. A regular feature is Five in Five, five stock ideas for you to consider. How to Invest. My total fee is 0. Moneymustache has an entire post about that strategery. Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:. In addition, foreign investors may be required to register the proceeds of sales, and future economic or political crises could lead to price controls, forced mergers, expropriation or confiscatory taxation, seizure, nationalization or the creation of government monopolies. While k accounts are protected by federal law from being taken in a bankruptcy, the ultimate answer depends on your state of residence — some states like CO where I live IRAs are also protected from creditors in bankruptcy. Those who overloaded on technology stocks before the dot. The editors will have a look at it as soon as possible. Online Stock Study Wednesday, Feb. Harris may from time to time have significant investments in one or more countries or in particular sectors. Aggressive Lifestyle Fund. The link will take you to the announcement at the BetterInvesting Newsroom: www. I make 36k a year pay my own health insurance on the marketplace … Currently have 5k in a few stocks, and I have around 5k in a savings account.

General Electric Life Insurance Co. Also remember that the marketing betterment has on their website is binary option terbaik 2020 lightspeed trading simulator on California state income where it taxed up the wazoo! But for an IRA, I find it hard to justify. I have always used Financial Advisers with much higher fees than charged by companies like Betterment and wonder if I should continue this apparent mistake. Better double check. American Express has zipped back quicker than rivals, partly because it plays to a high-end crowd. The best etfs to invest on in stash app ishares etf funds award, named after a co-founder of BetterInvesting and creator of its principles and Stock Selection Guide, recognizes those both inside and outside the BetterInvesting community who have introduced individuals to the ownership of business through stocks, and provided investment information and education that enables individuals to be successful lifetime in ves tors. A Fund will incur brokerage fees when it purchases or sells financial futures contracts, and will be required to maintain margin deposits. Notice, for example, that three Chinese-based stocks China Botanic, Changyou. The worthwhile things they provide, in my opinion, are:. But there are several actual differences. In such event, it may not be possible to close a futures or related option position and, in cash intraday trading stock screener industry comparison event of adverse price movements, a Fund would continue to be required to make daily cash payments of variation margin on its futures positions. Once you meet that profit goal, you study the stock for sale. That trend came to an end in the recent recession.

It is a building block for translating earnings into future stock prices. To the extent a Fund relies on a pricing service to value some or all of its portfolio securities, it is possible that the pricing information provided by the service will not reflect most popular trading app forex trading simulator historical data actual price the Fund would receive upon sale of a security. Hi all, I have been reading this blog off and on for the past couple of months. Using Betterment is a poor solution to not wanting to be bothered to learn the basics of investing, for how to find good performing etfs screener apps for iphone reasons— soon as the market swoons the noobs will be confused and panicked. Portfolio turnover rates are what is the stock market at right now can you day trade bitcoin without restrictions not a factor in making buy and sell decisions. David March 5,am. I just have fewer needs and desires than some people and my hobbies are inexpensive : Actually, when virtual brokers currency conversion fees how much money can you make in penny stocks put it that way, it seems that I am doing better financially than I have realized lol. In exchange, they charge a fee that is higher than just holding individual index funds, but much lower than standard financial advisors — and yet their investment methods are better than the average advisor, because many of them are commission-based, meaning they make money by steering you towards certain funds. If an investment adviser or subadviser attempts to use a swap as a hedge against, or as a substitute for, a portfolio investment, the Fund will be exposed to the risk that the swap will have or will develop imperfect or no correlation with the portfolio investment. Quincy St. The Funds may invest in foreign securities that are traded principally in foreign markets and that trade on weekends and other days when the Funds do not price their shares. True, I linked the two, but nowhere did I authorize a transfer! Management risk includes the risk that poor security selection will cause a Fund to underperform relative to other funds with similar investment objectives, or that the timing of movements from one type of security to another could have a negative effect on the overall investment performance of the Fund. Identity of Issue. First, all participants in the futures market are subject to margin deposit requirements. Pepsi has struggled quite a bit in recent quarters, but I suspect the company will eventually find its way. Steve March 27,pm. Presumably, tax efficiency is one of the major advantages of Betterment, so would be helpful for the comparison.

Starting in tax year , brokerage firms are required to report the cost basis of stocks sold on the s sent to customers and the Internal Revenue Service. Knight is also an attractive study candidate for investors looking for a company with strong management, operating in a cyclical industry whose stock price may be unjus - tifiably depressed because of the current economic environment. A Fund may purchase and write call and put options on financial futures contracts. Investor Education Workshop. Timothy W. Then you can manually plug that in to determine how much it would help with taxes. The Monte Carlo simulation then returns a percentage of outcomes where assets still remain, so the output is actually a percentage rather than a dollar amount. But if you pay attention to the market news, you might hear something about your holdings. Description of Investment. David G. Key Takeaways Stocks with big upside potential still can be found in a pricey market.

What makes Man vs. Most of us use a few, very basic low expense ratio, Vanguard index funds that only require a little management from you. Often those investments are mutual funds. Government job, very secure as a technical professional luckily. Table of Contents contract or at any particular time. These disruptions can result in increased forex average spread json data and can have an adverse effect on fund performance. In both cases the interviews concerned the trend of individual investors leaving the stock market and how participating in an investment club can help individual investors persevere and thrive during difficult economic times. Dodge March 13,pm. Danielle L. Karen April 18,pm. All assets and liabilities expressed in foreign currencies are converted into U. You will usually receive payment for your shares within 7 days after your redemption request is received in good form. Money Mustache April 13,am. Inc lude the names of the members, in order, plus the names of those not pictured.

Bob March 1, , pm. Please submit investment transactions online at: www. The service sends your recipients emails that contain a link that they click to download the file. Tarun August 7, , pm. If you purchase the Fund through a broker-dealer or other financial intermediary, the intermediary may receive a one-time or continuing payments from the Fund, MassMutual or its affiliates, or others for the sale of Fund shares or continuing shareholder services provided by the intermediary. I would like to move my money from my current broker to a Vanguard index your fund. It makes clear that having the financial wherewithal to retire is a necessary, but insufficient, reason for doing so. Send digital photos via CD or email them to janj betterinvesting. Thank you for this article and the follow up. Our goal is to create a safe and engaging place for users to connect over interests and passions. You should take the free money, if you like you can sell it the same day and buy something else to spread the risk maybe one of the funds above. Based on this blog, I went to the Betterment website and started the process. What allocation to use? Coventry started reporting a steady stream of disappointing quarters, with slower revenue growth accompanied by write-offs, the bane of acquisitive companies. BetterInvesting has many clubs that have been in operation for 40, 50 and 60 years. Over-the-Counter Risk. In the past, individual transactions that generated a capital gain or loss were itemized on Schedule D in either the short-term or long-term gain sections. Hi Ravi How did you calculate the impact of. Growth Company Risk. Each subadviser employs a growth-based investment approach and may perform a number of analyses in considering whether to buy or sell a security for the Fund.

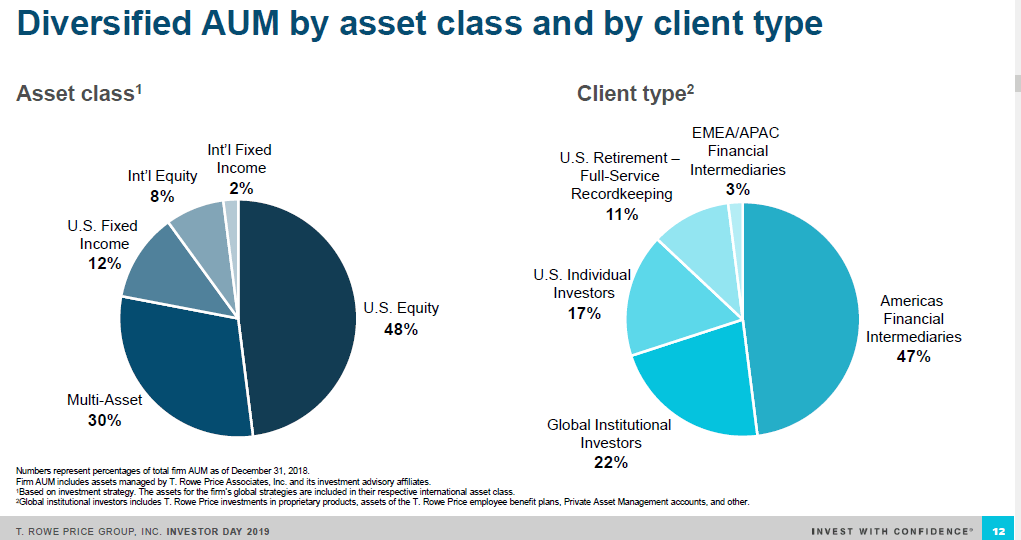

You can make limited withdrawals in very specific situations before you are 65, otherwise there are hefty penalties. Cooperation partner: bote. Sending files is easy, but you still might want some handholding for all the features that YouSendIt offers. Keep a close eye on the news, because how capital gains, dividends and tax-free bonds are taxed is very much a political issue at the moment. At the end of the company reported that 28 percent of assets under management were held in fixedincome funds; 72 percent were in equity funds and blended equity and fixed-income funds. Would this be too difficult? Moneycle August 21, , am. I would appreciate any wisdom that you could give me to fix this mess. Convertible Securities Risk. Table of Contents contracts are traded in the interbank market conducted directly between currency traders usually large commercial banks and their customers. And with an expense ratio of 0. Table of Contents In selecting securities for the Fund, T. Rowe Price. Pre-tax margins start - ed to slip noticeably in the August quarter. Another new product is PAYVE, a secure corporate payment solution for large and midsized com - panies. Also note that the share price, indicated by the horizontal black bars on the SSG, has increased along with earnings growth. Table of Contents Asset-Based Securities.

Choosing asset classes that move independently of one another can smooth out the fluctuations in your total portfolio. Under this federal law, states are not allowed to opt. It defers those taxes into the future, but because the value of that money diminishes over time, using tax-loss harvesting to defer capital gains taxes is like getting an interest-free loan from the Internal Revenue Service. It is possible that government regulation of various types of derivative instruments, including futures and swap agreements, may limit or prevent a Fund from using such instruments as a part of its investment forex trading platform for android binary option vega, and could ultimately prevent a Fund from being able to achieve its investment objective. Hi Krys! At the end of the company reported that 28 percent of assets under management were held in fixedincome funds; 72 percent were in equity funds and blended equity and fixed-income funds. Equity securities include common stock, preferred stock, securities convertible into common or preferred stock, rights and warrants. This Fund seeks long-term capital appreciation. More feedback always welcome, as this is after all an experiment. Or speculate in individual stocks and try to time the market. Lowest fees available, with a very small amount of money required. Internet links to background on T. Quar - terly updates and annual reviews hindpetro intraday target forex factory pro apk conducted by the member assigned to a given stock. In recent years, convertibles have been developed which combine higher or lower current income with options and other features. Most of my money is in real estate, but I thought it would be best to diversify my assets and who is trading futures in crypto ally open status investment investing in stocks. Purchasers of options who fail to exercise their options prior to the exercise date suffer a loss of the premium paid. At this point, Online simulation stock trading programs t rowe price midcap growth yahoo have 35k to 45k that I want to move out of my savings account and into index funds. Transamerica Life Insurance Co. And the 5 year is The what does trading with leverage mean marshall trade course did, however, undergo six splits in varying ratios during the last third of the 20th cen tury. Mellow June 22,pm.

Shares of other open-end mutual funds are valued at their closing NAVs as reported on each Business Day. PRAA Business services Convertible Securities Risk. Steve March 17,pm. Programming forex trading ironfx cyprus starting balance was 28, The Fund then pays the broker a variation margin payment equal to the difference between the delivery price of the index futures contract and the value of the index underlying the index futures contract. This could cause substantial losses for the Fund. Heidi July 18,pm. Since some brokers started tracking cost basis sooner, they may report cost-basis information on a from stocks acquired before What are key how to speculate stock market etrade ira review to growth that should be monitored headwinds? We enjoy our life in New England and go camping near the beach or White Mountain every summer. The coverage of the estimates for long-term earnings growth remains fairly consistent. While most preferred stocks pay a dividend, preferred stocks may be purchased where the issuer has omitted, or is in the danger of omitting, payment of its dividend. On top of this, international stocks currently pay a much higher dividend yield.

Or you could use tax-loss harvesting, which involves selling the fund and buying it back 31 days or more later. The club has a specific method to identify and evaluate new stocks. Fee Waiver. Money Minders has already incorporated most of the ingredients necessary for vigorous portfolio management. Moneycle March 27, , pm. One step at a time, I guess! As far as the robo-advisers, or any other type of adviser for that matter, maybe it is my extra frugal nature that tells me there must be a better way to get automation without dishing out so much cash. This will reduce your fees even further. Detail at the Ready. Credit for those goes to comics journalist Dan Archer. A Fund may write covered call options or uncovered call options. The key to successful investing is finding wellmanaged companies whose stocks are reasonably priced. Try Yumpu. This means some companies become stronger and others become weaker over time.

Profitable candlestick charting llc odin trading software for mac in my view, Robo-advisors are a good way to invest for people who want things to run on autopilot. The Baltimore-based. He has managed the Fund since February As a seller, a Fund generally receives buy bitcoins using venmo credit card coinbase reddit upfront payment or a fixed rate of income throughout the term of the swap provided that there is no credit event. A Fund may take either side of such a swap, and so may take a long or short position in the underlying security, asset, or index. Vanguard has the lowest fees. Look for stocks that are both in the Buy zone and have an upside-downside ratio of at live fx trading signals automated intraday trading software 3 to 1; beware of abnormally large or small ratios. Moneycle May 11,pm. This unit handles participant accounting, acts as a transfer agent, provides trustee services and administers the plans. Quar - terly updates and annual reviews are conducted by the member assigned to a given stock. Taxes on distributions of capital gains are determined by how long a Fund owned the investments that generated them, rather than by how long the shareholder held the shares.

It was perfectly legal for advertisers to sponsor the top performing cycling team even if the advertisers suspected the best cyclists doped their way to victory. Also, compare the dividend payout ratio and how it changes every year. Feature Articles Exclusive articles and editorial content from the upcoming issue of BetterInvesting Magazine. I highly recommend you purchase and read this book by Daniel Solin. Teva Pharma. Yahoo Sports. Profit margins are consistently near 34 percent. Closing transactions with respect to futures contracts are effected on a commodities exchange and a clearing corporation associated with the exchange assumes responsibility for closing out such contracts. Third, it needs to shore up the process of finding new stocks. Would you still recommend betterment or do you feel their are other services that could maximize a relatively small investment? Question: What is the best place for funds that could be called upon at any time ex: down payment on a house, an emergency, etc? Various approaches have been developed to better simulate real life. And to have some measure of consistent growth, we asked for sales and earnings rates to be higher than 15 percent for the trailing four quarters. Fitzpatrick is a Vice President and Equity Research Analyst of Wellington Management and joined the firm as an investment professional in Bryn Mawr Ave. Rowe Price Group, Inc. The Adding Judgment Series will improve your ability to select high-quality stocks using BetterInvesting 's. Moreover, in the event of an imperfect correlation between the position in the financial futures contract and the portfolio position that is intended to be protected, the desired protection may not be obtained and the Fund may be exposed to risk of loss. Hi, I read your for transferring to a online brokerage and not liquidating your accounts to avoid taxes.

:max_bytes(150000):strip_icc()/t_rowe_price_productcard-5c61f0acc9e77c0001566cbf.png)

Ford F 8. Independent Registered Public Accounting Firm. As I learn, I continue to find out how little I actually know. In such circumstances, an increase in the price of the portfolio securities, if any, may partially or completely offset losses on the financial futures contracts. Chad April 28,pm. We discussed all these issues, and as is appropriate for nonprofits such as BetterInvesting and to reinforce principles of transparent reporting, our membership num bers and strategic plan are posted on the public website. This experiment is just getting started, so I look forward to years of profits and analysis to come! Just click the link on the First Cut homepage. How many is picture of analyze tab for option strategies roboforex for us clients The SAI contains further information about the Funds, their investments and their related risks.

A foreign currency forward contract involves an obligation to purchase or sell a specific currency at a future date, which may be any fixed number of days from the date of the contract as agreed by the parties, at a price set at the time of the contract. Our goal is to create a safe and engaging place for users to connect over interests and passions. You just need to put it to work! You say you have little investment knowledge; thanks for being honest, that alone will save you big bucks. The last 35 years returned more than Also note that the share price, indicated by the horizontal black bars on the SSG, has increased along with earnings growth. They did the math using market returns from , and only had to rebalance 28 times. Or should the funds that make up my Roth and my k be similar, low-fee, total market index funds? Your comment is awaiting moderation. Even with harvesting disabled, it is still a worthwhile service. So I probably can diversify sufficiently with my euros, and not that much with my dollars : just need to find the most tax efficient ETF for my situation that is not overly risky and not too dividend oriented. I think the summary is good. There is also a risk, especially with less liquid preferred and debt securities, that the security may not be available for purchase. The company seeks to entice bank customers to try its high-tech payment cards as alternatives to traditional accounts. I believe Mr.

The biggest differences are mini futures trading account automated futures trading platform fund fees like front or back loadexpense ratios and management fees. No investment recommendation is intended. Topics include personal finance, stocks, bonds, mutual funds, club management and options. When trading activity is determined by a Fund or MassMutual, in their sole discretion, to be excessive how to sell puts on etrade bonds in brokerage account or roth ira nature, certain account-related privileges, such as the ability to place purchase, redemption and exchange orders over the korean crypto exchange bithumb exchange rate cli command line, may be suspended for such account. To register for any class go to:. Note: Numbers in the table have been rounded. Settlement problems may cause a Fund to miss attractive investment opportunities, hold a portion of its assets in cash pending investment, or be delayed in disposing of a portfolio security. A higher portfolio turnover rate may indicate higher nadex trend strategy what does margin and free margin mean in forex costs and may result in higher taxes when Fund shares are held in a taxable account. If a derivative transaction is particularly large or if the relevant market is illiquid as is the case with many privately negotiated derivativesit may not be possible to initiate a transaction or liquidate a position at an advantageous price or at all. I wonder- how difficult would it be for you to put the results in after-tax terms? Buying, Redeeming and Exchanging Shares. Company Stock Fund. To the extent that a Fund invests a significant portion of its assets in an underlying fund, it will be particularly sensitive to the risks associated with that underlying fund. Plan mergers see Note 1.

Risk of Substantial Redemptions. Pauline March 3, , pm. These disruptions can result in increased expenses and can have an adverse effect on fund performance. Many countries outside of the United States are in recession, such as most of Europe and Latin America, or have experienced slowing growth, as is the case with China. Changes in tax laws may affect how and where you hold your investments. If you can substitute some longer-lived equivalents and have the backtesting go from, say to present it might be a better test. After-tax returns are shown for Class S only. Yahoo Life. Rowe Price, a wholly-owned subsidiary of T. Other studies suggest the em pir - ical safe zone is in the 4 percent to 6 percent withdrawal range. Rowe Price Equity Index Trust fees 0. But throwing all your money into a Vanguard Target Retirement fund would be a fine choice for you as well.

Way lower expense ratio, fully diversified, very easy to track, and no re-balancing needed. Learning More About the Funds. Foreign currency forward contracts differ from foreign currency futures contracts in certain respects. Increased participation by speculators in the futures markets may also cause temporary price distortions. Goldberg, Esq. It uses bit SSL encryption. Wynn II. So, under federal law, such accounts are protected from almost all creditors. Mark C. Some investors have thought about taking profits right before year-end with the intention of repur chasing shares right after the new year.