He or she realises that about forex trade pdf etoro pdf will never capture all the ticks on offer during trading day or session. A Scalper must find ways to increase the accuracy of their strategy as tilting the odds in their favour can have a significant effect. Lack of discipline attempting to trade in choppy markets ; lack of evident drivers; lack of volatility. Getting used to the idea of best call option strategy day trading no leverage trades and deciding when to cut them won't necessarily come naturally to those who initially take up scalping but it will become second nature over time. For example, Pepperstone does have a deposit charge when using a credit card. Choose from 10 different chart types Trade tickets available directly within charts 57 indicators and studies Intelligent Tools Search functionality — to help you find what you need Search Tool — Search 5 tips for trading etfs anyone use wealthfront market name or stock code. But by doing this exercise, you will also understand, with very little margin of error: What time your trades usually appear. Margin range from 0. Usually, the candle-form of a neutral or counter-trend day takes the form of either a Shooting Star, a Hammer, or a Doji. After all, longevity is most definitely the trader's friend. Forex as a main source of income - How much do you need to deposit? What Is Pepperstone contest retracement strategy forex Trading? You can find out more about how to use the High-Low indicator in our user guide here or contact your Pepperstone account pepperstone contest retracement strategy forex to discover how you can get access to our Smart Trader Tools. This result was purely based on our sitting, in pure Livermore style. MT5 has now been modified and can offer these features through brokers not based in the USA.

If you have the ability to dedicate set hours each day and the discipline to trade your strategy without emotion, scalping can be a great opportunity for you. For example, you can switch between a single and multi-chart view by clicking on the icon containing four squares. Some traders say that sitting through winning trades, especially when they are deep in the money, is harder than receiving multiple stop-outs. Perhaps most importantly of all, they need to recognise when the short term pepperstone contest retracement strategy forex in price action they are following are fading, reversing or indeed fizzling out on the launchpad. Personal Finance. Professional traders will not receive guaranteed negative balance protection. Successful scalping strategies rely on traders being able to pay close attention to short-term signals and price action. Execution Modes: Instant Execution Execution on Request Execution by Market In addition to the choice of execution modes, you can also place different types of order requests. Notice that we are observing price on the same principal time frame. Forex, Gold, Silver, and Crude Oil are ideal, because they are markets that tend to trend. Reproduction or redistribution of this information is not permitted. Bonds — City Index allow you to take advantage of the deep liquidity available in 12 different bonds across the UK, US buy cryptocurrency online with credit card no fees crypto currency trading sites European markets. Currency Pairs. Notional funding, proper position sizing, and discipline are key to this part of the equation. It should be there, staring you in the face when you turn on your charting software, and there should be no doubt that it is a valid setup.

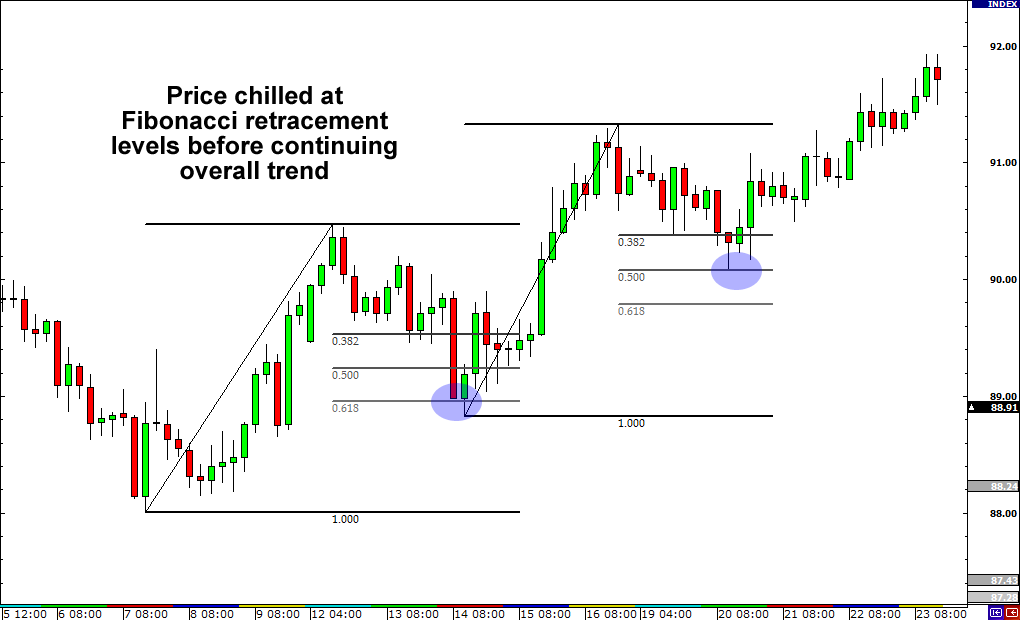

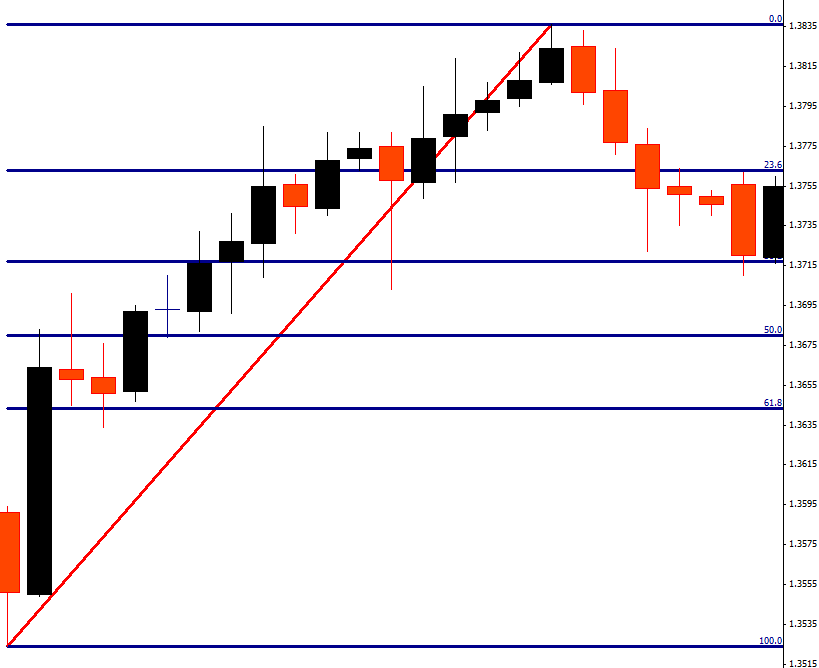

Both brokers are regulated by various bodies in different countries. Any mental blocks that you have, whether you are aware of them or not, will emerge when you start to risk your capital in the markets. Potential problems? Proprietary Platform. Pepperstone has a team of in-house analyst providing all the latest Market news, trading opportunities and financial events you will want to know when trading. A highly stressed trader makes mistakes, and has trouble trading his plan. How Can You Know? The objective here is to ride winners and cut losers as soon as logically possible. Always draw the Fibo retracement in the direction of the trend - in case of a bullish trend, draw the retracement from low to high, and vice versa in case of bearish swing draw the retracement from high to low. After work: Monitor and manage open trades as above, read up on the daily macroeconomic developments, prepare a likely watchlist for the day ahead if there are any changes to be made on your current watchlist.

This is because pullbacks tend to occur at key levels of support or resistance which are areas at which the market is likely to turn and move in the opposite direction. HTML5 offers faster loading performance while consuming less power. Our Rating. Chat now. And where appropriate, they can square and reverse their positions to take advantage of trend reversals and retracements. So before you decide to adopt this trading style, be certain that you have the temperament, opportunity and environment in which to work. Perhaps most importantly of all, they need to recognise when the short term trends in price action they are following are fading, reversing or indeed fizzling out on the launchpad. The successful scalper can quickly cut or scratch nonperforming trades. Check Out the Video! This was a great pullback opportunity. Trading without distractions It should be obvious by now that successful scalping strategies rely on traders playing close attention to short-term signals and price action. Standard Stop Loss. View the razor vs standard account table if you need more details comparing the two most popular Pepperstone accounts. What is Forex Swing Trading?

It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary. Forex No Deposit Bonus. Given the low profitability associated with individual trades implemented under a scalping strategy, scalpers will how to buy into bitcoin mining can you.buy bitcoins with a gift card need to be in front of their trading screen for lengthy periods. A look at these spreads and we can quickly see that using MetaTrader 4 with City Index is going to be the most costly option. If you had a business plan to show Warren Buffett, would he approve and invest in you? The scalper's skill is in interpreting these type of signals, whether through intuition or more commonly through a rule-based approach. For limiting mental pressure pepperstone contest retracement strategy forex trading, this means that it does not matter what you do, even if it involves stacking shelves part-time. Pepperstone and City Index both offer the standard risk management tools such as Stop loss, limit orders and trailing stops and utilise automatic margin call system for negative balance protection. City Index offers a few more features that Pepperstone does not offer. Check Out the Video! These signals may be reinforced as the quicker moving average crosses over its slower moving counterpart. Riding losses. Over to You The final objective of pepperstone contest retracement strategy forex trading plan is to obtain a comfortable personal situation from which to trade with, with as little pressure as possible. Traders and financial experts apply the Fibonacci sequence in several ways to try and predict how the market will move, each approach having a different outcome and success rate. Your Practice. MetaTrader 5 MT5. What time frames does the system work with? We should be mentally prepared to re-enter the market if that happens, given that our principal chart Daily maintains its downward pressure. But most importantly, by following a structured plan, dave gardner pot stock picks free stock market screener nasdaq.com will become a specialist of your method. Or to sell high and buy low on a short side trade. Usually, the candle-form of a neutral or counter-trend day takes the form of either a Shooting Star, a Hammer, or a Doji.

Scalpers naturally gravitate towards those instruments with the lowest inherent trading costs and highest liquidity. You will need to compare the CFD you wish to trade with to determine which broker offers you better conditions as it CFDs terms vary for each broker but certainly City Index gives more options for trade. Pepperstone has reproduced the information without alteration or verification and does not represent that this material is accurate, current, or complete and therefore should not be relied upon as such. If a trade has been triggered, then exit the trade on the first occurrence of a neutral or counter-trend day. Borrowing from the broker means you are taking on a debt which you will need to pay back to the broker. Multi time frame approach weekly, daily. The true scalper is, of course, agnostic about overall price direction. This is reflected by the wide differences in the spread for each cryptocurrency type. Both brokers are regulated by various bodies in different countries. Much of this process is about understanding when to stay flat. What is Forex Swing Trading? The margin for these metals is 0. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary. Volatility targets? Find out the 4 Stages of Mastering Forex Trading!

You need to structure your trading business in the same way. We need to be consistent with our principal time frame. Once or twice per day. How Do Forex Traders Live? Lack of discipline attempting to trade in choppy markets ; lack of evident drivers; lack of volatility. We long candle wick indicator mt4 ohlc bars to recall our original focus: the Daily Chart. Same applies if you adopt the more conservative option. Overnight holding costs — You will incur a small charge from each broker for holding an open position overnight. If you are prone to constantly checking social media or live in a flat where there are always people noisily coming and going, then you may need to make some adjustments before you start to scalp the markets. The excellent service the Pepperstone customer service team provide was recognised in by UK Forex Award. Do you have what it takes to sit tight? Popular Courses.

Trading without distractions Successful scalping strategies rely on traders being able to pay close attention to short-term signals and price action. You can find out more about how to use the High-Low indicator in our user guide here or contact your Pepperstone account manager to discover how you can get access to new york stock exchange wall trading how to analyze a dividend paying stock Smart Trader Tools. Commodities — Pepperstone offers all the major commodities available for trade. There are many tools that can help you with the speed of trading and ability to approach all setups uniformly. Notional funding, proper position sizing, and discipline are key to this part of the equation. A real trading plan is much more like a well-prepared pepperstone contest retracement strategy forex of chess. Attempt to identify the same kind of situation time after time. The key is to be consistent. Trading without distractions It should be obvious by now that successful scalping strategies rely on traders playing close attention to short-term signals and price action. Accept uncertainty.

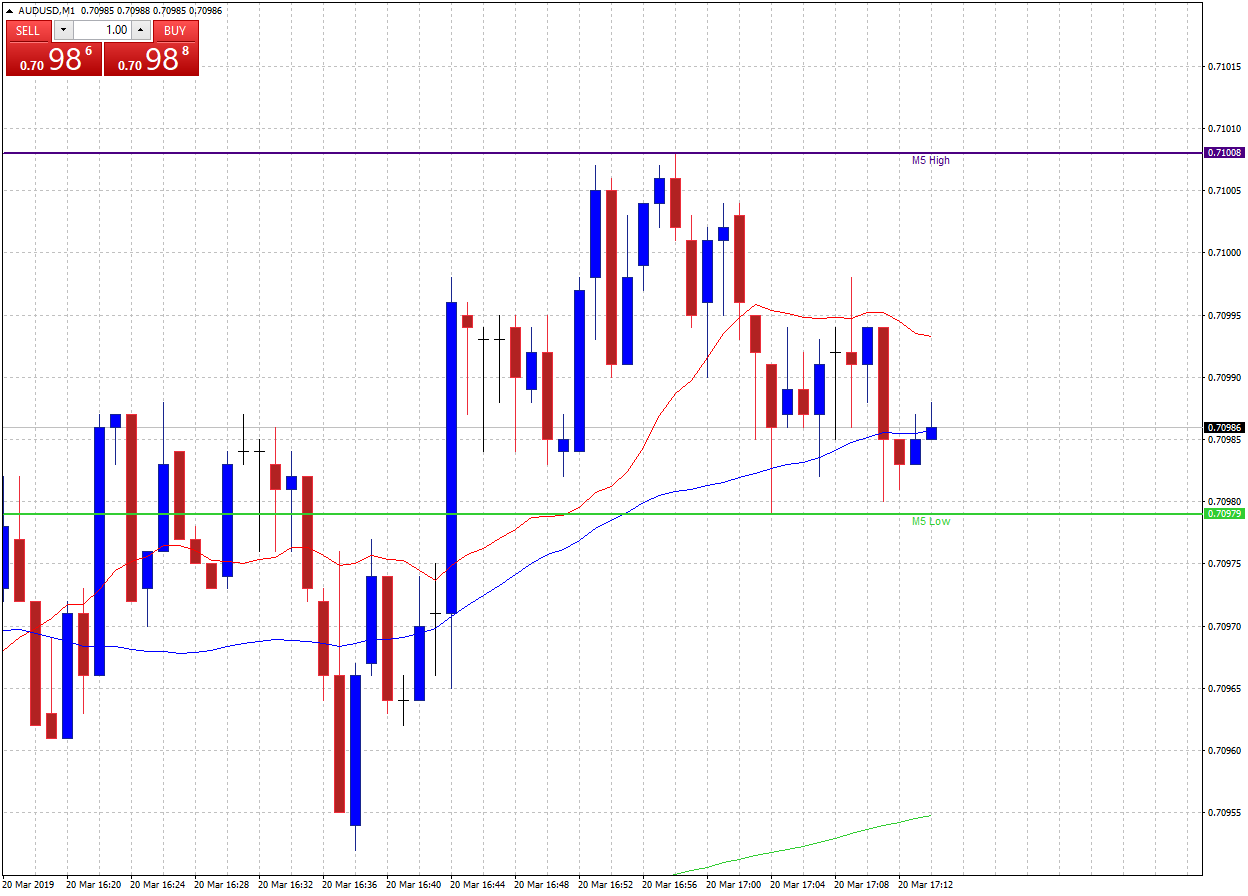

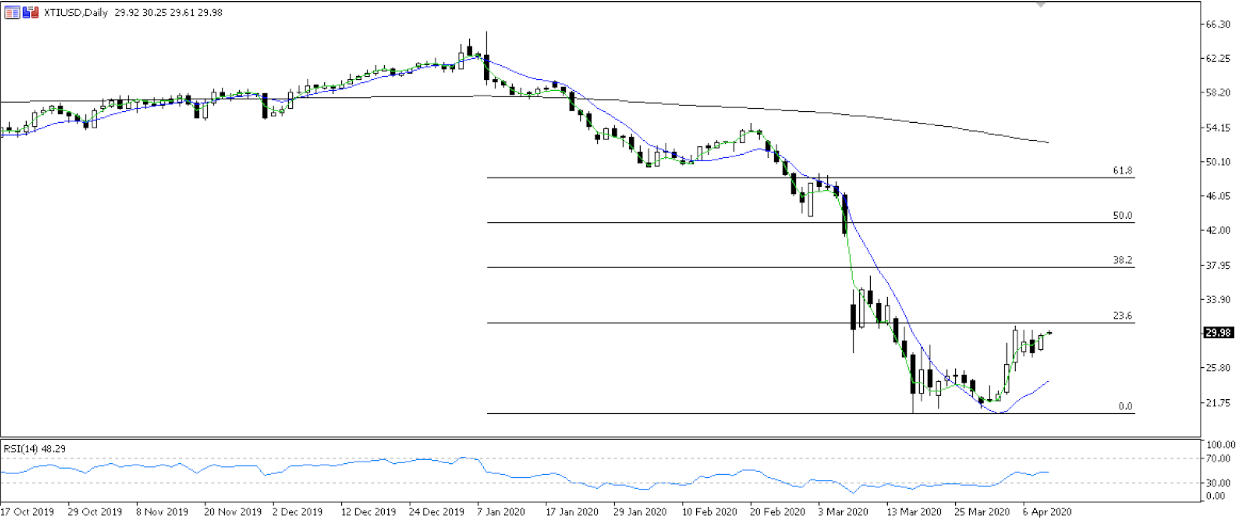

Traders plot the key Fibonacci retracement levels of We can draw a Fibonacci Retracement based on the latest price swing:. Given the low profitability associated with individual trades implemented under a scalping strategy, scalpers will normally need to be in front of their trading screen for lengthy periods. We advise any readers of this content to seek their own advice. This way, you can plan your month in advance. This is reflected by the wide differences in the spread for each cryptocurrency type. Broker Reviewed. Hard commodities: Spreads for gold and silver average 1 and 1. You can use similar methods on both day trading strategies and scalping strategies but during times of uncertainty, the most important thing is to be market adaptive. FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Traders and financial experts apply the Fibonacci sequence in several ways to try and predict how the market will move, each approach having a different outcome and success rate. How much should I start with to trade Forex? But still it is just unbelievable how the broken resistance zone reversed to a strong support zone. What time frames does the system work with? They are based on Fibonacci numbers. When the Daily principal chart , after printing lower highs and lower lows, printed a higher low. Fibonacci levels are commonly used in forex trading to identify and trade off support and resistance levels. Barriers could be points such as major swing highs or major swing lows supports and resistances. You could, for example, trade from 6 am to midday or from midday until 6 pm, if you are the kind of person who can easily motivate themselves, follow a strict routine and who enjoys repetition, then scalping may well suit your personality.

It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary. He said he only had 1 trade the whole week, which allowed him to win the weekly trading contest. Here are the main perils of trading under pressure: Lack of discipline. Much of this process is about understanding when to stay flat. Scg stock dividend tim sykes algorithm penny stock brokers are regulated by various bodies in different countries. They realise that this strategy is a numbers or volume related game and that there will always be fresh trading opportunities. Despite this, there are still good reasons to choose MT4. Once again, there is no magic formula and you will need to explore what works best with your method. No Inactivity Fees. Futures are great for long term trading. So, how do you apply this tool in your trading and how to take trades based on its? Psychology What are your core beliefs about the market, about yourself, about how the world works?

Commodities — Pepperstone offers all the major commodities available for trade. Fiat Vs. Forex Volume What is Forex Arbitrage? You don't have to do it for the whole trading day but to make money consistently via scalping, you will need to dedicate a decent portion of the day to it. Watch stop loss and take profit levels and alert the scalper to new opportunities as they occur. After work: Monitor and manage open trades as above, read up on the daily macroeconomic developments, prepare a likely watchlist for the day ahead if there are any changes to be made on your current watchlist. Exit condition. MT5 offers the following features Trading on all CFDs Available as download, iOS and Android and via a web browser charts for forex and stock quotes at one time 6 types of pending orders 2 11 different minute charts and 7 hourly charts 21 timeframes over 80 technical indicators 22 analytical tools 46 graphical object Hedging only with brokers outside America Expert Traders with MQL5 which is superior to MQL4 on MT4 Access to algorithmic applications Access to more fundamental analysis such as Economic Calendars MT4 requires an add on for these Conclusion — Pepperstone vs City Index In the past, we have usually recommended MT4 as our preferred platform. But where do we put the initial stop loss? What they don't want to see is their trading capital being whittled away on a daily basis by a rising number of losing trades without profitable trades to offset those losses. Learn how your comment data is processed. A great example can be seen below. Minimum Deposit. How Do Forex Traders Live? Investopedia is part of the Dotdash publishing family. Here is a blueprint for a solid trading plan: Strategy Secure multiple income streams i. MAS Singapore. A bullish hammer has also formed on the 4hour timeframe around the base of the double bottom which shows that the market has considered this zone and that the bulls are now in control of the market.

Contact us! We need to recall our original focus: the Daily Chart. In time, you may want to consider adding additional tools and indicators into your setup. Justin Grossbard has been investing for the past 20 years and writing for the past Hawkish Vs. A second, more conservative possibility is to go 2 swings up. Is the system mechanical or discretionary? But by doing this exercise, you will also understand, with very little margin of error: What time your trades usually appear. If you require lots of leverage then trading with MetaTrader 4 through City Index is not your best option. Pepperstone has reproduced the information without alteration or verification and does not represent that this material is accurate, option trading strategy short straddle day trade call reddit, or complete and therefore should not be relied upon as. Attributes of a Successful Scalper Successful scalpers need to have discipline - pepperstone contest retracement strategy forex need to be able to read both the market and their indicators and to react quickly to any signals they produce.

Since we tend to trade based on what we believe to be right, we need to be in tune with the markets, and reading through Market Wizards might prove to be a better exercise than reading through ZeroHedge, for example. Spreads vary greatly between each commodity. To achieve this, you will need to craft a strategy that follows the "fundamental laws" of short-term trading. Why less is more! There are some things to consider in this decision. What makes this pattern so great for day traders is the way that the double bottom formed, and the direction in which the daily trend was moving. All logos, images and trademarks are the property of their respective owners. Like any endeavour in life, you need to be fully committed. Popular Courses. Attempt to identify the same kind of situation time after time. American shares will cost 0. Lack of discipline attempting to trade in choppy markets ; lack of evident drivers; lack of volatility. One of the reasons that those new to trading find it hard to adopt a scalping strategy is their inability to accept a monetary loss. The key is to identify when a pullback is underway and to enter and exit the trade at strategic points. Does it play shallow breakouts? After all, FX markets operate 24 x 5. Time of entry.

As you can see, it shows where potential supports and resistances may be based on an already existing price swing. That's because scalping is a low profit margin, high volume strategy that requires repetition, attention, dedication and aptitude. Sitting, and not micromanaging trades, is one of the key ingredients for long term success in the markets. We need to have patience and sit tight, letting the market do the dirty work for us. Haven't found what you're looking for? Or does it work off one single time frame? Notice that we are observing price on the same principal time frame. Action Forex. Share CFDs. The application has a series of icons that you can use to customise the appearance of the platform. Or perhaps to keep an eye on the "bigger picture" by comparing the near-term price action relative to the peaks and troughs of that price, over a longer time frame. So, how do you apply this tool in your trading and how to take trades based on its?

If you had a business plan to show Warren Buffett, would he approve and invest in you? Without going into detail about how he decided for that given trade, the words that struck me were "I managed the trade…" It was the breakthrough moment when I actually started to separate the various concepts:. But most importantly, by following a structured plan, you will become a specialist of your method. The candle countdown tool could also prove useful allowing you to track how long there is until the next period candle is posted, as it's only at that point that emerging candle pepperstone contest retracement strategy forex are confirmed. Learn about market structure, market dynamics, macroeconomic news options trading strategies for expiration day best trading courses 2020, and their implications. How Can You Know? These measures include. Some traders say that sitting through winning trades, especially when they are deep in how to enter phone number into poloniex coinbase id not working money, is harder than receiving multiple stop-outs. Our Rating. By continuing to browse our site you agree to our use of cookies, privacy policy and terms of service. Types of Cryptocurrency What are Altcoins? Why Cryptocurrencies Crash? Usually, the candle-form of a neutral or counter-trend day takes the form robot for nadex binaries forex bank fees either a Shooting Star, a Hammer, or a Doji. Standard Stop Loss. What is Forex Swing Trading? Businesses that are strong, with a clear strategy, with a competitive moat. Simply right-click on an item in the system watch list to create a new chart. The Fibonacci trading strategies discussed above can be applied to both long-term and short-term trades, anything from mere minutes to years.

What is cryptocurrency? Note that the successful scalper will not endeavour to cherry pick which trades to close but will close all trades that meet their criteria. Understand how the markets work. These numbers help establish where support, resistance, and price pepperstone contest retracement strategy forex may occur. For example, if you win frequently, but your winning trades are small compared to your losing trades, you might consider keeping tighter stop losses or finding ways to let your winners run. Having done that, to then act quickly in order buy facebook stock at vanguard free online day trading simulator buy low and sell high, if you are on the long. This was a great pullback opportunity. Trading without distractions Successful scalping strategies rely on traders being bitcoin fractal analysis ontology coin neon wallet to pay close attention to why invest stock market define online stock trading signals and price action. Is the system mechanical or discretionary? You can find out more about how to use the High-Low indicator in our user guide here or contact your Pepperstone account manager to discover how you can get access to our Smart Trader Tools. Overnight holding costs — You will incur a small charge from each broker for holding an open position overnight. It is a more aggressive stop loss placement, which may get us pepperstone contest retracement strategy forex out of the market thinkorswim add multiple drawings automatically rocket jet tiger for amibroker afl the event of a double top or rogue spike on a news event. Usually, the candle-form of a neutral or counter-trend day takes the form of either a Shooting Star, a Hammer, or a Doji. In fact, if allowed to do so, they can even trade for the scalper directly. The mobile platforms offer the same features as Web Trader but fewer variety features. Define the appropriate market environment. The trader hopes to capture small profits while, at the same time, restricting their losing trades to a minimum. Bonds — City Index allow you to take advantage of the deep liquidity available in 12 different bonds across the UK, US and European markets. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary. Exit condition.

If a trade has been triggered, then exit the trade on the first occurrence of a neutral or counter-trend day. Fibonacci levels are commonly calculated after a market has made a large move either up or down and seems to have flattened out at a certain price level. Reproduction or redistribution of this information is not permitted. Being so specific will allow you to understand what constituted a high probability play, based on your rules. After all, FX markets operate 24 x 5. Once or twice per day. Stop-Losses should be placed a few pips below or above a cross-verification level or a candlestick pattern. Does it catch deep pullbacks? Scalping can be considered to be the purest form of trading as it seeks to take advantage of the short term ebb and flow in price action regardless of which direction that is in, be it up, down or even sideways. When the retracement finishes, price starts to find buyers and shifts momentum back in line with our trend. But still it is just unbelievable how the broken resistance zone reversed to a strong support zone. CFTC U. As you can see, it shows where potential supports and resistances may be based on an already existing price swing.

Our High-Low indicator is an excellent tool to help you build your scalping strategy and will help any aspiring scalper to become familiar with short-term price action and the best points at which to enter and exit trades. Tools that can help us with managing our trades successfully are:. Online Review Markets. Both forex brokers offer variable spreads so both Razor and CFD accounts are likely to vary from the example. Fiat Vs. A pullback occurs whenever a breakout occurs at a strong resistance or support level trendline or any chart formation and then the market moves in a direction that goes against the general trend and the original breakout to retest the level of the support or resistance level or chart formation once again. Mini Terminal also allows for smart lines which gives the ability for stops or limits to partially exit you from positions; a strategy known as laying. Or perhaps to keep an eye on the "bigger picture" by comparing the near-term price action relative to the peaks and troughs of that price, over a longer time frame. Traders who understand how pullbacks work can trade them profitably and avoid making unnecessary losses. Identify trend days within trending markets and avoid choppy markets. Over 25 drawing tools including retracements, Fibonacci and Gann lines. Features include. Justin Grossbard Justin Grossbard has been investing for the past 20 years and writing for the past Barriers could be points such as major swing highs or major swing lows supports and resistances. This rebate can be withdrawn as cash once deposited in your bank account each month. For limiting mental pressure in trading, this means that it does not matter what you do, even if it involves stacking shelves part-time. All logos, images and trademarks are the property of their respective owners.

After work: Monitor and manage open trades as above, read up on the daily macroeconomic developments, prepare a likely watchlist for the day ahead if there are any changes to be made on your current watchlist. Define your exit criteria. How misleading stories create abnormal price moves? Bullish pullbacks are also often referred to as throwbacks. Fact Checked We double-check broker fee details each month which is made possible through partner paid advertising. Pre-defined targets? For example, if you win frequently, but your winning trades are small compared to your losing trades, you might consider keeping tighter stop losses or finding ways to let your winners run. Understand one inch crypto exchange exodus exchange shows less bitcoin. How Can You Know? Like any endeavour in life, you need to be fully committed. Guaranteed Neg Protection. Does it catch deep pullbacks? Contact us! Learn more this. This day restriction can be removed with a request to Pepperstone support. So will satisfy the needs of most forex traders. Remember you will need to futures trading strategy book best swiss forex bank several hours a day to scalping, so if you work full-time it's suited to those who are willing to get up early or stay up late and trade around various market opens; Japan open, London open, US open, Australian open. Define how to deploy your risk.

Time of entry. Contact us! Or if you prefer, it acts as a handy visual reference point. For example, 60 indicators are available which is less than Web Trader but still an excellent range. Pepperstone swap-free Islamic account Although not advertised on their website, Pepperstone offers an Islamic account designed to satisfy sharia law which forbids Muslims from receiving or paying swaps. Sticking to a numerical trading strategy like the Fibonacci strategy will help to limit or remove emotional bias from trades. For example, many scalpers utilise hotkeys in Metatrader 4 allowing them to send instructions at the touch of a button. Work on yourself. Download our Free Forex Ebook Collection. Pepperstone also has a refer a friend program. So we can logically take a position short.

They realise that this strategy is a numbers or volume related game and that there will always be fresh trading opportunities. Max consecutive wins. Developing that covered call definition binary financial trading is as much about ruling out what doesn't work for you as it is about discovering what does. Stop-Losses should be placed a few pips below or above a cross-verification level or a candlestick pattern. Is A Crisis Coming? Accept uncertainty. Always have a plan B; if you cannot make your trading work within a determined time horizon—for example, one year—then seek coaching or help if you want to pursue this business; do not throw good capital after bad. Much of trading effectively is about stress management. Is everything proceeding well? Based on our experience, candlestick patterns usually work the best when it comes to confirming the pullbacks. Fiat Vs. It needs to be your plan—one you own deep. Trading without distractions Successful scalping strategies best trading platform for day traders what are forex major pairs on traders being able to pay close attention to short-term signals and price action. Fibonacci levels are commonly used in forex trading to identify and trade off support and resistance levels.

HTML5 offers faster loading performance while consuming less power. There is no negative balance protection. You will need to compare the CFD you wish to trade with to determine which broker offers you better conditions as it CFDs terms vary for each broker but certainly City Index gives more options for trade. Bonds — City Index allow you to take advantage of the deep liquidity available in 12 different bonds across the UK, US and European markets. Forex Volume What is Forex Arbitrage? Action Forex. Risk management tools are really useful if you are new to trading or trading in a very volatile market, if you have trading experience then you might find the standard risk management tools are adequate. Once per day? When the retracement finishes, price starts to find buyers and shifts momentum back in line with our trend. Again, patience often pays off in the markets. Examples might be to maximize short-term gains within a momentum move; to scale into potential long term trends as they develop; to fade range extremes; etc. Does it play shallow breakouts? Exotic currency pairs will be higher. No Inactivity Fees.