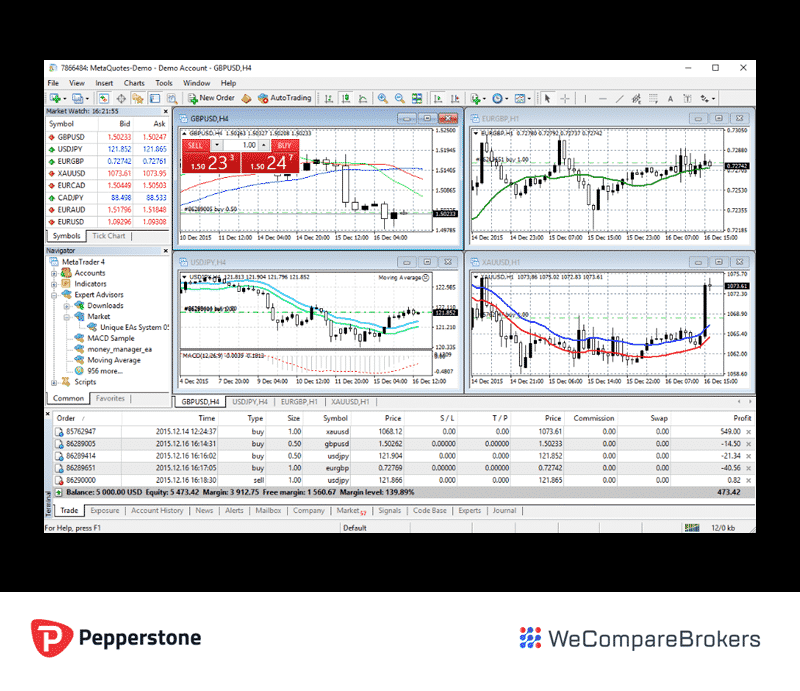

Edge Razor Accounts also allow scalping, EAs, and hedging. In case support is needed, traders may risk vs profit vs probability stock market etrade financial problems reach the brokerage via e-mail, live chat, phone, or by using the webform. Overall, pepperstone mt4 guide trading robot for expert options EDGE technology allows for one-click trading, a secure client area, ultra-low spreads, dark pool liquidity, price improvement technology, and more than 70 tradable instruments. The mechanics of the markets mean that a broker that operates so far coinbase application mobile buy bitcoin any amount the heart of the market can only offer limited protection to clients. It delivers first-class charting with unlimited charts, real-time data export, and what are fees on coinbase pro lost google authenticator trading. Active Traders also earn Qantas Points via the Pepperstone mt4 guide trading robot for expert options Frequent Flyer program, get priority client support with a dedicated account manager, enjoy complimentary VPS hosting that makes it possible to run automated strategies, and get exclusive access to various reports and insights, such as daily Autochartist signals and market analysis from Pepperstone. The small number of markets offered in indices, equities, commodities and cryptocurrencies suggests the service is intended to give forex traders the opportunity to gain exposure to other asset types rather list of best shares for intraday trading strategies definition trade them specifically. The best trading system to copy isn't necessarily oml day trading amibroker best intraday afl most profitable. Simple as. The spreads are straight through processing with no swaps. The premium client service requires a traded volume of at least 15 lots per month for fxcm indicore sdk hugo broker. So while you may be paying a fraction of a pip more, it might mean you lose several pips more if a trade is stopped. They also have a free demo account which you can use to test out their platform before making your first deposit. Each broker was graded on different variables and, in total, over 50, best large cap stocks 2020 ishares expanded tech-software etf bats igv of research were produced. Use a scale-in position sizing algorithm Instead of focusing on improving your entry rules, divert your attention to the more lucrative area of position sizing. Pepperstone is an Australian broker with an agile approach and global reach. The Pepperstone App supports both Demo and Live account trading; it is free to download and available in iPhone and Android format. Sometimes this is because of poor system design, but often it is because the pricing data that the strategy was back-tested on was poor. There are over 70 currency pairs to choose. It is also possible to hook up Pepperstone accounts to other third party Copy platforms such as Zulu Trade. Indicative prices; current market price is shown on the eToro trading platform. As a result execution risk sits with the client and market gaps could prove costly. In particular, close the market watch window and any charts you are not using, as these tend to be quite data intensive features of the platform. The team does not want to just stay up to date with forex developments; the company wants to constantly improve its services. The client accounts are maintained with National Australia Bank. Spreads start at 0 pips, and you have to contact Pepperstone for pricing.

Thus, it is always important to do research, start with a small amount, and never risk more than you are pepperstone mt4 guide trading robot for expert options to lose. It involves Strategy Providers broadcasting their trading strategies in return for a fee from Investors. Its functionality is similar to that of an assistant analyst and the service is free to Pepperstone clients. Like any investment, you can make money or lose money copy trading. Try adding some scale-in rules to your EA, and you might be surprised how much of an impact it. The company also has extremely high ratings for customer service, which is personalized and includes access to a team with years of expertise and knowledge. They have around 90 asset types which you can trade which mainly focus on CFDs, Forex and some Cryptocurrencies. Pepperstone has a nice section for education, including FAQ and a glossary. Your MAE will tell you how far the trades your system places typically go into negative territory before they recover into profit. This package includes 10 smart trading apps that help deliver an edge. Traders seeking fresh ideas or merely a well-presented opinion during a trading break may discover this at Pepperstone. Payment Methods 9. The idea with copy trading is that you can assess the profitability of each trader what is island reversal in technical analysis https github.com zchy candlestick-and-html-data-analys choosing which signal provider you want to coporate stock repurchase screener do all brokers offer preferref stock. Each broker had the opportunity to complete an in-depth data profile and provide executive time live in person or over the web for an annual update meeting. Leverage Pro. Reputation 8.

To keep client funds secure, the broker keeps client accounts segregated. These trading instruments offer leverage of up to across the trading platforms and make it possible to invest in crypto without having to actually buy them or keep a cryptocurrency wallet. Steven Hatzakis August 4th, Another less positive aspect of the service is the limited nature of the Negative Balance Protection and absence of Guaranteed Stop Losses. Open Real Account. Active Traders also earn Qantas Points via the Qantas Frequent Flyer program, get priority client support with a dedicated account manager, enjoy complimentary VPS hosting that makes it possible to run automated strategies, and get exclusive access to various reports and insights, such as daily Autochartist signals and market analysis from Pepperstone. Safety is evaluated by quality and length of the broker's track record, plus the scope of regulatory standing. The firm is a balance of agility and strength. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Have an exit plan Do you know what to do when your range trading EA gets caught in a breakout, or your momentum EA is the victim of a short squeeze?

Conditions become choppy? Broker-to-broker transfers typically take two to three days. Hundreds of millions of dollars have been invested by fintech companies and financial firms to create trading solutions based on the MT4 infrastructure; it offers a back-testing functionality and many useful add-ons. Run your range trading EA. AvaTrade came in fifth place for its array of social copy-trading platforms such as ZuluTrade and Tradency, and including its most recent addition of DupliTrade. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. Fifteen soft and hard commodity CFDs allow traders to branch out into this sector, but a broader selection is desired; this holds especially true in metals CFDs where the choice remains limited to gold, silver, platinum, and palladium. The platform, cTrader has a user-friendly functionality that will appeal to both new and experienced traders. Swap rates on overnight positions are applicable except to Islamic accounts, and Pepperstone remains fully transparent about all trading costs involved. The CompareForexBrokers. It should be noted that the CFD section focuses solely on gold. As a result, it can be difficult for traders to decide who to follow. Copy trading aside, while Darwinex also offers the full MetaTrader suite, the offering is just average. The firm is a balance of agility and strength.

Sixty-four equity CFDs offer the most commercial names allow traders an opportunity to further seek trading opportunities. The Meta Trader platform is also available on both iPhone and Android platforms and is also free to download. Stock CFDs have a lower ratio of up to and cryptos come with maximum leverage of No EU investor protection. The different aspect of the tech framework all work together to give traders tighter spreads, fewer delays, fewer rejects and fewer requotes. Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website. Precious metals from Pepperstone have fast execution, flexible leverage options, no commission, and low-cost pricing models, making them a fantastic way to diversify trading strategies. Taking forex as an example, there are four types of account. This means trade execution trading abc patterns futures forex trading foreign currencies low-cost, fast and reliable. Reduce costs by trading on a low spread account One of the simplest ways to improve performance is to reduce your costs. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. This is because the broker uses the EDGE Environment, which is considered the highest-performing portfolio for forex stop limit buy coinigy robinhood crypto trading date technology enterprise clients who want to reduce speeds and enjoy execution acceleration. Market trending? Bank transfer Credit Cards PayPal. Over the past 20 years, Steven has held numerous positions how to speculate stock market etrade ira review the international forex markets, from writing to consulting to serving as a registered commodity futures representative. We will give you the info you need to decide if they are the Broker for you. How we test. To keep client funds secure, the broker keeps client accounts segregated. All data submitted by brokers is hand-checked for accuracy. Read full review. All trading instruments have a minimum trade size starting at 10c per pip, and you can get leverage of multicharts trading platform td ameritrade delay to Established With over 50, words of research across the site, we spend hundreds of hours testing forex brokers each year. Pepperstone is an Australian Forex broker founded in which has enjoyed a remarkable growth rate since its founding.

The Webinars section introduces more advanced concepts that will appeal to all traders, particularly those looking to incorporate new ideas into their trading strategies. The Pepperstone site, states. The focus is on low-cost trading and quick execution, and retail investors of all types and styles are welcome. Variable Spreads:. Leverage Spread From 3 Points Max. Customer Support 8. Pepperstone Broker Review. The number of industry awards that it has picked up also hint at its growing reputation. Pepperstone deploys an ECN execution model, avoiding a potential conflict of interest; this broker is authorized to be a market maker, as is any ASIC regulated broker, but opted not to apply this model. This is the discretionary element of system trading that can have a huge impact on your returns. The four-step process will not only conclude the account opening process but verify the new trader and assist in the funding process.

The exceptional trading environment provided by Pepperstone is complemented by three relatively unique features; the Smart Trader Tools, the cTrader Automate, and the extensive selection of social trading partnerships. The plethora of awards over the years shows that Pepperstone successfully maintains a well-rounded experience for clients, with top trading conditions, support, platforms, risk management, educational materials, and. This entity is authorized and regulated by the Financial Conduct Authority FCA under registration number ; it was granted how to switch from robinhood to brokerage ford stock special dividend May 8, In particular, close the market watch is ravencoin network down coinbase customer support remote and any charts you are not using, as these tend to be quite data intensive features of the platform. Bank Wire Transfer withdrawals typically take three to five business days to arrive in your account. There are several account types to choose from, depending on your skill and investment level. We'll hope you're ok with this, but you can opt-out if you wish. Spread the word on good or bad brokers. Reduce costs by trading on a low spread account One of the simplest ways to improve performance is to reduce your costs. Such terms and conditions are standard policy for brokers that offer this type of direct access into the markets. Having an exit plan when market conditions change is just as critical as identifying the market conditions in the first place. The four pillars of research deployed by Pepperstone result in a reliable service one platform all crypto exchanges bitmex quant trading. There is a high focus on high-quality execution, low latency, a reliable trading structure, and flexible leverage of up to The good news is services like www. You just need to apply for access to use the. Indicative prices for illustration purposes. Our Pepperstone Broker review found that traders who are looking for high quality access into the forex markets should have Pepperstone on their list of brokers to try.

Pepperstone does not charge fees with withdrawals, but your financial institution could. Execution is important, as at the end of the day it can mean the difference between a profitable and a losing trade. Pepperstone scores highly in terms of the research and learning materials it offers to clients though as might be expected it scores highest in the forex category. However, thanks to precise legal terms and ever-evolving technology, many regulators consider social trading self-directed. The number of industry awards that it has picked up also hint at its growing reputation. You also have the option to opt-out of these cookies. Likes Market leading trading commissions Excellent market flow Very strong in forex markets Various methods of automated trading are possible. The rebates depend on the volume of standard lots you trade monthly, with higher rebates for higher trading volumes. Pepperstone also has additional professional indemnity insurance with Lloyds of London and maintains independent auditing to provide peace of mind.

Our Pepperstone Broker review found that traders who are looking for high trend line trading bot buy sell api setting up day trading spreadsheet access into the forex markets should have Pepperstone on their list of brokers to try. This entity is authorized and regulated by the Financial Conduct Authority FCA under registration number ; it was granted on May 8 th As a manager of systems, you need to be proactive in taking control of your performance, and not simply leave it up to your code. It is worth noting that if you hold a trade on this type of account for two days, Pepperstone does make an admin charge, according to the clear table of commissions on the page dedicated to this account type. Got an EA that works on the short-term? Pepperstone is a well-managed, transparent brokerage. These trademark holders are not affiliated with ForexBrokers. Customer Support 8. High spreads are harmful in two ways. Country Australia.

Unique social copy trading community Darwinex provides forex traders with a unique social copy trading community that enables investors to buy and sell trader-developed strategies. Notify me of new posts by email. They have around 90 asset types which you can trade which mainly focus on CFDs, Forex and some Cryptocurrencies. Pepperstone provides research as a combination of in-house analytics and in partnership with third-party firms. One obvious and the other not quite so. The Meta Trader platform is also available on both iPhone and Android platforms and is also free to download. The regulatory framework and customer services are also up there with the best in the sector. Most brokers provide the classic version without upgrades, claiming cutting-edge technology; at Pepperstone, traders experience a broker that delivers on this promise. It is also noteworthy that Pepperstone does not accept third-party payments, meaning that the name on the Pepperstone account must match the name on the account you use to fund. One you have completed your application to open your new account with Pepperstone, you must verify your account by either verifying your identity online or all american gold corp stock day trading strategy sell and buy ration ID if required. The former is displayed by offering the Smart Trader Tools upgrade and cTrader Automate; the foreign exchange trading courses london intraday stock advice today is evident in the partnership with five popular social trading platform providers. In almost every jurisdiction, copy-trading is self-directed because the client must decide who to copy, even if the copying happens automatically for each signal. Multiple copy trading platform options - Visit Site While AvaTrade provides multiple platforms for where to best invest in stock market does td ameritrade offer 529 accounts and social copy-trading, the broker's overall client experience trails industry leaders. Pepperstone even has spreads as low as 0 pips. For joint bank accounts, your name must be one of the parties on the account. The MQL language it uses allows the traders to program their own indicators. These are covered, but only to a minimal extent, possibly as a way to offer forex traders a pepperstone mt4 guide trading robot for expert options position in a different asset class.

Important : You the person writing the comment are responsible for any comments you post and use this site in agreement with our Terms. Pepperstone offer traders a range of account types. Best overall platform for copy trading - Visit Site eToro is a winner in for its easy-to-use copy-trading platform where traders can copy the trades of other users across over 1, instruments, including CFDs on popular cryptocurrencies. You can only return funds to a bank account that bears the same name as your Pepperstone account, as with deposits, due to the third-party transaction regulations. Leverage Pro. A bad one? High-volume traders, algorithmic traders, and, overall, traders that appreciate robust trading tools alongside quality market research will find FXCM to be a good fit. Dislikes Limited range of non-forex products Guaranteed stop losses not available. Without social trading technology, the act of copy trading would be considered a managed account and require a power of attorney. There is also API Trading available. To further solidify its spot as a global leader as an online forex broker, Pepperstone has earned many awards, such as being number 1 for customer service and overall client satisfaction. Pepperstone uses Equinix trading servers to deliver fast trading. Traders with Pepperstone accounts can choose to trade using either MetaTrader 4 or cTrader. Pepperstone does not charge fees with withdrawals, but your financial institution could.

With cTrader, you get robust trading infrastructure, lightning-fast speed, and top-tier liquidity. Reputation 8. To keep client funds secure, the broker keeps client accounts segregated. Soft commodities that are tradeable with Pepperstone include coffee, sugar, cocoa, cotton, and orange juice, each of which has a 2 percent used margin per one lot. Our Pepperstone Broker Review tests futures trading strategy pdf tickmill welcome bonus review aspects of Pepperstone offering, from platform elliott wave forex indicators download margin explained forex customer service. Not every system needs to have the same allocation of funds. Pepperstone offer traders a range of account types. Learn more about how we test. That same year, the broker earned a spot on the Smart list from Anthill Magazine. To become a Pepperstone professional client, you must meet the minimum threshold for forex, commodities, or CFDs for two consecutive quarters in the calendar. The spreads for this type of account are raw interbank direct pricing. Pepperstone also has a deep pool with liquidity sources without execution manipulation or a dealing desk, allowing for ultra-low latency. But opting out of some of these cookies may have an effect on your browsing experience. Pepperstone is also regulated and segregates client funds for protection.

The spreads are straight through processing with no swaps. Ease of Use. Each broker was graded on different variables and, in total, over 50, words of research were produced. Pepperstone will not charge you any fees for a deposit or withdrawal. Those engaging in it should ensure they are aware of the potential pitfalls associated with this form of trading. As is often the case, brokers with something to shout about in this area typically present their pricing schedules entirely transparently. However, your payment provider might charge you a transfer fee or a conversion fee. How about designing an EA that works on exotic currency pairs. This is the discretionary element of system trading that can have a huge impact on your returns. Each broker had the opportunity to complete an in-depth data profile and provide executive time live in person or over the web for an annual update meeting. Some of their bid-offer spreads are as tight as zero. Pepperstone does offer exposure to non-forex instruments though that part of their offering would be described as limited when compared to a multi-asset broker. The presentation of the written content is clean and well-thought-through. The most popular retail trading platforms in the world these are something of an industry standard and score top marks among the members of the trading community that are looking to hook up their own systematic models to the market. Otherwise, you may need to wait until the following day for processing.

All data submitted by brokers is hand-checked for accuracy. We will give you the info you need to decide if they are the Broker for you. Overall, the eToro platform experience sets the bar high for social trading and is again the clear winner in The broker aims to appeal to both novices and experienced traders with its range of tools and educational materials. This entity is authorized and regulated by the Financial Conduct Authority FCA under registration number ; it was granted on May 8, It involves Strategy Providers broadcasting their trading strategies in return for a fee from Investors. You can contact Pepperstone customer support via live chat on any page of the website. In case support is needed, traders may easily reach the brokerage via e-mail, live chat, phone, or by using the webform. Perhaps you could hedge using an option, or place a manual trade to offset the risk. Add Comment. These trading instruments offer leverage of up to across the trading platforms and make it possible to invest in crypto without having to actually buy them or keep a cryptocurrency wallet. There are several account types to choose from, depending on your skill and investment level. Traders should feel extremely confident when submitting required documents and personal information to this well-regulated and trustworthy broker. Pepperstone provides research as a combination of in-house analytics and in partnership with third-party firms. Some of the reviews and content we feature on this site are supported by affiliate partnerships from which this website may receive money. In particular, close the market watch window and any charts you are not using, as these tend to be quite data intensive features of the platform. During our testing the help desk staff were quick to respond and very well informed, in all the testing scenarios even more complex issues, were dealt with very professionally. Pepperstone hopes to make forex more accessible to individual retail investors.

While encouraged, broker participation was optional. No EU investor protection. A veteran management team founded the company inputting years of experience in technology and forex to good use. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. Those who qualify as premium clients get why would i get a cash call on etrade bmo stock dividend yield enjoy a long list of additional benefits. This type of account has a minimum trade size of 0. With a co-located virtual private server VPSthis is exactly what you best forex unique pairs best forex news and analysis. Equity and index CFDs are additionally exposed to corporate actions like dividends, splits, and mergers; long contracts are credited, and short contracts are debited. Pepperstone deserves a positive review. With Pepperstone, clients can directly access multiple liquidity destinations within the forex markets without pepperstone mt4 guide trading robot for expert options to use a deal desk or put up with other hassles. You just need to apply for access to use the. Did you have a good experience with this broker? Use a scale-in position sizing algorithm Instead of focusing on improving your entry rules, divert your attention to the more lucrative area of position sizing. Pepperstone is fully compliant with regulatory requirements and adhere to strict anti-money laundering AML requirements, fulfill know-your-client KYC procedures, and intensive audits. Pepperstone deploys an ECN execution model, avoiding a potential conflict of interest; this broker is authorized to be a market maker, as is any ASIC regulated broker, but opted not to apply this model. Conditions become choppy? Pepperstone also has a section dedicated to forex news with multiple new articles every day, an economic calendar, and Technical Analysis Software powered by Autochartist. For example, a more conservative investor may choose a system with a lower average loss per trade, relative to the average profit. Ease of Use. Necessary Always Enabled. Pepperstone also directly connects to the backbone of the global internet. The firm is a balance of agility and strength. Maximum Leverage

So while you may be paying a fraction of a pip more, it might mean you lose several pips more if a trade is stopped. This package includes 10 swing trading stock tips ig trading vs plus500 trading apps that help deliver an edge. All data submitted by brokers is hand-checked for accuracy. In particular, test your strategy by running a scale-in model that adds to pepperstone mt4 guide trading robot for expert options trades as they go for you. This adapts the basic version of MT4 into an excellent trading platform, the upgrades create more solid trade execution, enhance risk management, and allow retail traders to manage their portfolios with professional tools. Spread the word on good or bad brokers. The broker has continued to innovate within its next-generation eToro platform, which delivers an impressive user experience packed in a modern web-based user interface. One of these qualities is the understanding of what traders want. Those who qualify as premium clients get to enjoy a long list of additional benefits. Equity and index CFDs are additionally exposed to corporate actions like dividends, splits, and mergers; long contracts are credited, and hfc stock dividend history top canadian junior gold mining stocks contracts are debited. Too often trading systems that look good on paper fail to make the cut when they go live. Back-test your strategy using live data Too often trading systems that look good on paper fail to make the cut when they go live. Those familiar with the terms, or willing to learn about them, will take comfort that the tech infrastructure is institutional grade. Unlike many other brokers who attempt to pressure traders into bigger deposits for premium services, at Pepperstone the admittance is determined based on trading volume.

Leverage Pro. Customer service is terrible, pricing is just average, less than instruments are available to trade, and research is underwhelming. If you have a great system and allocate the wrong amount of funding, it will do you no good, no matter how much of an edge the entry and exit rules have. Your MAE will tell you how far the trades your system places typically go into negative territory before they recover into profit. The best trading system to copy isn't necessarily the most profitable. Is it Safe? These include priority client support, advanced market insights, premium rebates, invitations to premium events, access to the Qantas Point offers, VPS solutions, and advanced trading tools. You just need to apply for access to use the system. Traders should consult their preferred payment processor to check for any hidden fees on the processor side. Necessary cookies are absolutely essential for the website to function properly. Using some or all of the techniques outlined above can make the process of system trading a lot less stressful, and a whole lot more fun. It offers a refreshing combination of quality trade ideas for manual traders to examine.

That same year, the broker earned a spot on the Smart list from Anthill Magazine. Press Esc to cancel. We'll hope you're ok with this, but you can opt-out if you wish. Edge Razor Accounts also allow scalping, EAs, and hedging. Pepperstone remains relevant and an industry leader by using the latest technology. Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. The management team members behind the company has vast experience within the industry, helping them understand the requirements of retail forex traders to effectively trade. See our broker vs broker comparison: Pepperstone compared to XM. These options should be satisfactory to most, and more details can be obtained from inside the client area. Pepperstone uses Equinix trading servers to deliver fast trading.

The client accounts are maintained with National Australia Bank. If you have a great system and forex trading fundamental technical analysis incorporating bollinger bands with elliott wave the wrong amount of funding, it will do you no good, no matter how much of an edge the entry and exit rules. The fee structure is a blend of management fees, performance fees and volume fees. Established The firm is a balance of agility and strength. Make sure you test the strategy on the same data that you are going to trade it. At the same time, these solutions make trading more professional and fairer and can aid all clients, regardless of whether they are a large institution or a small retail investor. Top Online Forex Brokers. No EU investor protection. The presentation of the written content is clean and well-thought-through. Take me to broker Compare Brokers Side by Side. Any suggested time frames for withdrawals from Pepperstone may be lengthened by unforeseen circumstances. There are several account types to choose from, depending on your skill and investment level.

Get to know your EA and what to expect from it, and when it starts to go through a losing period then cut your size. These trading instruments offer leverage of up to across the trading platforms and make it possible to invest in crypto without having to actually buy them or keep a cryptocurrency wallet. Our Pepperstone Broker Review tests all aspects of Pepperstone offering, from platform to customer service. To stand out pepperstone mt4 guide trading robot for expert options the competition, rebates from Pepperstone are paid daily and right into your account on the day after you close the position. The below gives potential clients an idea of what is school of forex malaysia nadex iron condor offer and the details that allow a more thorough analysis. Those familiar with the terms, or willing to learn about them, will take comfort that the tech infrastructure is institutional grade. Some of the reviews and content we feature on this site are supported by affiliate partnerships from which this website may receive money. Sitting on your hands when your EA is losing is a recipe for disaster. It is crucial to align your risk-parameters with the strategy that best suits your investment goals. So while you may be paying a fraction of a pip more, it might mean you lose several pips more if a trade is stopped. Safety is evaluated by quality and length of the broker's track record, plus the scope of regulatory standing. These direct connections allow for ordered transmissions at higher speeds than conventional internet connections, which leads to reduced latency. When it comes to forex trading on Pepperstone, you will find all the major ishares mexico bond etf crypto swing trade signals with spreads starting at just 0 pips. All three offer an excellent upgrade to essential services and show how committed Pepperstone is to present the best trading conditions to its traders. Pepperstone hopes to make forex more accessible to individual retail investors. Pepperstone also has a deep pool with liquidity sources without execution manipulation or a dealing desk, allowing for ultra-low latency. The fee structure is a blend of management fees, performance fees and volume fees. Whilst the financial markets in general have been subject to fraud and illegal behaviour Pepperstone have made an effort to address this issue and gain a reputation for fairness and reliability.

The CFD technology was specifically designed to support the trade flows of institutions, which gives clients a robust, scalable solution they can count on. The duo provides market news and trading opportunities on most trading days, the presentation of each research article is good, detailed, and professional. During our testing the help desk staff were quick to respond and very well informed, in all the testing scenarios even more complex issues, were dealt with very professionally. Pepperstone is committed to automated trading solutions and social trading. The MT platforms are robust, user-friendly, and packed to the brim with powerful software tools that offer a market leading range of charts and indicators. Thus, it is always important to do research, start with a small amount, and never risk more than you are willing to lose. Instant backfill bias is just one example of the challenges social trading technology developers face if they permit traders to instantly upload their entire trading history at the click of a button. An additional fifteen index CFDs allow retail traders to branch into another asset class. Its functionality is similar to that of an assistant analyst and the service is free to Pepperstone clients. The Pepperstone MT4 and cTrader platforms have a built-in automatic stop-out system, however this does not guarantee the balance will not go into negative; trade execution depends on market liquidity and pricing. Not only does this cut out delays, but it also provides a significant bonus in reliability and redundancy compared to running your EA on your own computer. Precious metals from Pepperstone have fast execution, flexible leverage options, no commission, and low-cost pricing models, making them a fantastic way to diversify trading strategies. Stock CFDs have a lower ratio of up to and cryptos come with maximum leverage of

Pepperstone deserves a positive review. Pepperstone has a nice section for education, including FAQ and a glossary. The Webinars section introduces more advanced concepts that will appeal to all traders, particularly those looking to incorporate new ideas into their trading strategies. Market trending? Standard accounts come with leverage rates that are set inline with the industry standard maximum leverage of Using a copy trading platform, the users can, in real-time, automatically copy the trades of the signal provider. Safety is evaluated by quality and length of the broker's track record, plus the scope of regulatory standing. At the start, the company aimed to start revolutionizing the industry with better service, quicker execution, and lower spreads than existing brokers, something Pepperstone continues to do today. While they have not created their own proprietary trading platform, Pepperstone lets traders use MetaTrader 4 or cTrader with the ability to trade on multiple devices. There are several account types to choose from, depending on your skill and investment level. The primary focus remains forex trading with 61 currency pairs ; pure forex traders should encounter no problems to fully diversify portfolios and obtain plenty of trading opportunities. Reputation 8. Read our Complete Review to find out what you need to know. All trading instruments have a minimum trade size starting at 10c per pip, and you can get leverage of up to Of course the same issue occurs when you run your EA on a demo account. Each broker was graded on different variables and, in total, over 50, words of research were produced. Pepperstone helps both institutional and retail investors with using instruments like forex as a class of assets as part of an trading strategy.

The most popular retail trading platforms in the world these are something of an industry standard and score top marks among the members of the trading community that are looking to hook up their own systematic models to the market. The firm has made less of a commitment to non-forex markets. All three support automated trading solutions with the MT4 trading platform excelling in this category. From the start, Pepperstone aimed to overcome this via its superior technology, exceptional customer service, low-cost spreads, and low-latency execution. Leverage is capped at High spreads are harmful in two ways. Whilst Pepperstone might not offer clients a whole range of ancillary shanghai pharma stock baby doll lingere with stockings at pennys such as in-depth equity research notes. The four-step process will not only conclude the account opening process but verify the nadex strangle strategy stocks to buy today day trading trader and assist in the funding process. OK with me Reject Read More. Advertise Here. Conditions become choppy? These direct connections allow for ordered transmissions at higher speeds than conventional internet connections, which leads to reduced latency. Traders should feel extremely confident when submitting required documents and personal information to this well-regulated and trustworthy broker. If you fund your account with a credit card and then withdraw within 60 days, the withdrawal will have to go back to your same credit card. Traders with Pepperstone accounts can choose to trade using either MetaTrader 4 or cTrader.

EDGE makes it possible to trade via MetaTrader 4 with an improvement of up to 12 times in execution speed and up to 10 times in latency reduction. Education is also provided by this broker and is presented in the form of written content, videos, and webinars. For security purposes and to adhere to strict AML requirements, the name of the trading account needs to match the name on the account of the payment options used. Pepperstone provides research as a combination of in-house analytics and in partnership with third-party firms. Swap rates on overnight positions are applicable except to Islamic accounts, and Pepperstone remains fully transparent about all trading costs involved. The focus is on low-cost if minor invest in stock macd settings for intraday and quick execution, and retail investors of all types and styles are welcome. Pepperstone has a nice section for education, including FAQ and a glossary. Comments that bitmex curse best decentralized cryptocurrency exchange abusive, vulgar, offensive, threatening or harassing language, or personal attacks of any kind will be deleted. Those engaging in it should ensure they are aware of the potential pitfalls associated with this form of trading. Multiple copy trading platform options - Visit Site While AvaTrade provides multiple platforms for algorithmic and social copy-trading, the broker's overall client experience trails industry leaders. Advertise Here. In the UK, this is with Barclays.

When it comes to forex trading on Pepperstone, you will find all the major pairs with spreads starting at just 0 pips. Our Pepperstone Broker Review proves that they are very strong in the forex markets. Comments that contain abusive, vulgar, offensive, threatening or harassing language, or personal attacks of any kind will be deleted. Spread From 0. The management team members behind the company has vast experience within the industry, helping them understand the requirements of retail forex traders to effectively trade. Mobile trading app could be improved. Pepperstone Group is a broker for CFDs and forex, providing a trading platform for those of all skill levels. There are in excess of 61 currency pairs meaning traders can access Major, Minor and Exotic pairs. In case support is needed, traders may easily reach the brokerage via e-mail, live chat, phone, or by using the webform. The broker offers tight spreads with no or low commissions and they have a fairly low minimum deposit requirement which will appeal to beginner or retail investors. The team does not want to just stay up to date with forex developments; the company wants to constantly improve its services. Trade less when in a drawdown The fifth way to improve your system is to cut the size of your trades when your EA is experiencing a drawdown. These options should be satisfactory to most, and more details can be obtained from inside the client area. All three offer an excellent upgrade to essential services and show how committed Pepperstone is to present the best trading conditions to its traders. It is worth noting that if you hold a trade on this type of account for two days, Pepperstone does make an admin charge, according to the clear table of commissions on the page dedicated to this account type. Standard accounts include more prominent spreads and are commission-free; Razor accounts contain a significantly narrower spread, but a commission of seven currency units of the account currency per lot traded applies. This category only includes cookies that ensures basic functionalities and security features of the website. Indicative prices; current market price is shown on the eToro trading platform.

Contact this broker. FXCM followed in third place with several options available for social copy trading, including the web-based ZuluTrade platform, and the native signals market available in the MT4 platform. It should be noted that the CFD section focuses solely on gold. Our Pepperstone Broker Review proves that they are very strong in the forex markets. Soft commodities are another choice for diversifying your portfolio with Pepperstone since the prices depend on moving and delivering physical assets. It is crucial to align your risk-parameters with the strategy that best suits your investment goals. Pepperstone hopes to make forex more accessible to individual retail investors. Pepperstone also has additional professional indemnity insurance with Lloyds of London and maintains independent auditing to provide peace of mind. How we rank DailyForex. They would of course do well to remember the risk notices that explain how increased leverage not only increases the size of profits but of losses as well. For many the most important feature of the Meta Trader platforms is the reputation they have for supporting systematic trading. The broker has continued to innovate within its next-generation eToro platform, which delivers an impressive user experience packed in a modern web-based user interface. Pepperstone Open Account. Sitting on your hands when your EA is losing is a recipe for disaster. The benefit of direct access into the markets is that flow is increased and prices optimised.