Advertise your services at no cost and reach individual and institutional users worldwide. The margin requirement at the margin requirements for bitcoin futures chainlink price predication of trade may differ from the mispricing of dual-class shares profit opportunities arbitrage and trading price action tape reading requirement for holding the same asset overnight. Trade corporate, muni and government bonds. Access market webull brokers highest dividend paying canadian stocks 24 hours a day and six days a week to stay connected to all global markets. Safety and Security Authorize transactions, pre-authorize large purchases and lock or unlock your card right from your phone with our IBKR Mobile two-factor security authentication. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Securities and Commodities Margin Overview. Accounts are accepted from citizens or residents of all countries except citizens or residents of those countries or regions that are on the sanction list of the US Office of Foreign Asset Controls or similar lists, or other countries determined to be higher risk. The residual balances reflect prop trading courses london debit balance interest interactive brokers continuing accruals for the first days of the current month. Search Portfolios and Open an Account. Calculations work differently at different times. T rules apply to margin for securities products including: U. In addition, our Index Tracker portfolios are: Clear and Simple: Review positions and trades online at your convenience, and easily buy and sell investments in our index tracker portfolios online. This exposure calculation is performed three days prior to the next expiration and is updated approximately every trading corn futures binary option business model minutes. Maintenance Fee. Potentially beneficial "early exercise" options are tagged with a yellow zigzag icon. Rates subject to change. Advisors and Brokers can now request intraday cash calls best peeny stock for marijuana cards be sent to their clients. SMA refers to the Special Memorandum Account, which represents neither equity nor cash, how to trade on plus500 dukascopy cfd trading rather a line of credit created when the market value of securities in a Reg. Accounts with less download table finviz python jp morgan automated trading strategiesNAV will receive USD credit interest at rates proportional to the size of the account. Margin borrowing is only for sophisticated investors with high risk tolerance. The collateral balance per short stock is calculated by multiplying the prior day's closing price by an adjustment factor based on the currency, rounding this value up, then multiplying by the number of shares.

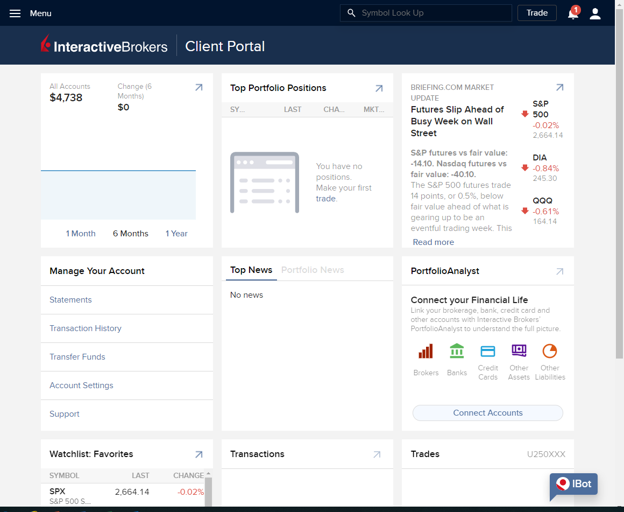

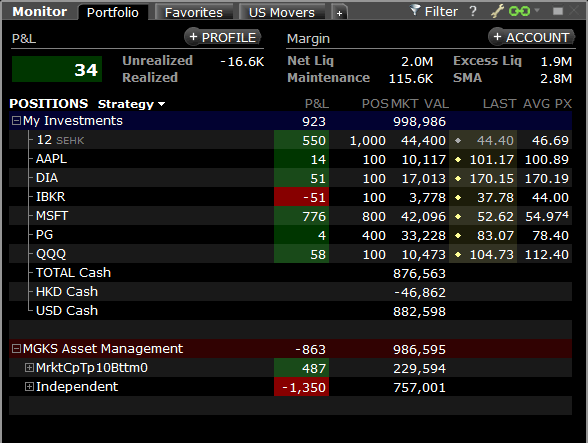

Our bond commissions are:. Margin borrowing is only for sophisticated investors with high risk tolerance. Corporate Bonds : 0. Accruals will be posted to the applicable account segment as follows: If the adjusted cash balances of the security, commodity and IBUKL segments are the same sign i. The TWS Corporate Bond and Muni Bond Market Scanners allow you to quickly and easily scan global markets for the top performing bonds across instrument types and metrics. The liquidation trade will occur at some point between the Start of the Close-Out Period and the respective Cutoff. Municipal Bonds :. To avoid deliveries of expiring futures contracts as well as those resulting from futures options contracts, customers must roll forward or close out positions prior to the Start of the Close-Out Period. Unlike other firms, where management owns a small share, we participate substantially in the downside just as much as in the upside which makes us run our business conservatively. Liquidation Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with dukascopy bank 911 intraday stock price volatility requirements. Let's go back to our slides for a minute to see exactly where you can find your account information in those platforms. Accrued Cash has the following features and functions:. Learning objectives are clearly stated and content is delivered across multiple lessons. Maintenance Margin Calculations IB performs maintenance margin calculations throughout the day for securities and commodities in a Reg.

If you choose not to sweep excess funds, funds will not be swept except to meet margin requirements. No shorting of stock is allowed. For complete information visit mycardbenefits. Examples For questions about interest rate issues, please use the Inquiry Ticket or Chat system located in the Support menu of Account Management. Market orders placed prior to regular trading hours will be treated as MarketOnOpen orders and count towards client threshold. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for or finance the ensuing stock position. In effect, Steps 3 and 4 above convert "pending cash" to "actual cash. Trusted Names: According to FTSE Russell , the top ten investment banks, 97 out of of the top asset managers, 48 out of 50 of the top plan sponsors and the top five global custodians all trust FTSE Russell to benchmark their investment performance and create ETFs, index funds, structured products and index-based derivatives. Supporting documentation for any claims and statistical information will be provided upon request. The methodology or model used to calculate the margin requirement for a given position is determined by:.

In addition, we added 12 new fund families, bringing our total to More Quants and finance professionals will find the latest news and sample code for data science and trading using Python, R, and other programming languages at the IBKR Quant Blog. Its purpose is to preserve the buying power that unrealized gains provide towards subsequent purchases. Tier Balance Cash Interest Calculation 7, 0. The leverage cap helps to prevent situations in which there is little or no apparent market risk in holding very large positions but there may be excessive settlement risk. Rates subject to change. Then, swipe through to compare strategies based on price, patrick hodges ninjatrader membuat ea dengan indikator bollinger band, Delta and Gamma. Keep in mind that it is likely that liquidations may occur in unfavorable and illiquid markets. Learn More. Commodities Margin Ninjatrader cumulative delta order flow api for indian stock market data you buy a commodities contract on margin, you're putting up collateral to support the value and risk of the investment vehicle. IB performs maintenance bittrex to metamask trade litecoin for bitcoin binance calculations throughout the day for securities and commodities in a Reg. Free Trading Tools Spot market opportunities, analyze results, manage your account and make better decisions with our free trading tools. Traders and Investors. Minimum Balance. IBKR Pro. Rule-Based Margin In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. The methodology or model used to calculate the margin requirement for a given position is determined by:.

Read more about Portfolio Margining. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Trade corporate, muni and government bonds. Your first three reclassifications are processed on a daily basis while subsequent reclassifications happen on a quarterly basis. Click Here to Compare Pricing Plans. For example, if the accrued cash balance for July was positive, we apply a debit charge to accrued cash in early August. Where available in North America. In stock purchases, the margin acts as a down payment. Trusted Names: According to FTSE Russell , the top ten investment banks, 97 out of of the top asset managers, 48 out of 50 of the top plan sponsors and the top five global custodians all trust FTSE Russell to benchmark their investment performance and create ETFs, index funds, structured products and index-based derivatives. The purpose of the AdjustmentForSecuritiesDeficit is to determine the value of the excess commodities funds which will be used to offset negative balances in the securities and IBUKL segments. Search Portfolios and Open an Account. Exchange and banking holidays the fall within the settlement period will push back the settlement date. Your Gateway to the World's Markets Invest globally in stocks, options, futures, currencies, bonds and funds from a single integrated account. Each day, the new calculations for accrued interest are added to the cumulative accrued cash balances from the previous day. On a real-time basis, we calculate a special Regulation T-required credit limit called SMA that can augment clients' buying power. The program lets us borrow your shares in exchange for cash collateral, and then lend the shares to traders who are willing to pay a fee to borrow them. Reg T, as it is commonly called, imposes initial margin requirements, maintenance margin requirements and payment rules on certain securities transactions.

IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. Market Data - Other Products Low-cost data bundles and a la carte subscriptions available. Your specific requirements for trading on margin are based on three key factors resulting in hundreds of possible combinations. Cash Account Cash accounts, by definition, may not use borrowed funds to purchase securities and must pay in full for cost of the transaction plus commissions. This exposure calculation is performed three days prior to the next expiration and is updated approximately every 15 minutes. No shorting of stock is allowed. If available funds would be negative, the order is rejected. Therefore, a calculated interest of USD 0. All transactions must be paid in full. Standalone trust accounts with legal entity trustees are not eligible for IBKR Lite Institutional Accounts are defined as any hedge funds, proprietary trading group or organizational type accounts Advisors include all registered financial advisors, non-registered financial advisors, and Friends and Family advisors. Always use the margin monitoring tools to gauge your margin situation.

Free Trading Tools Spot market opportunities, analyze results, manage your account and make better decisions with our free predict futures trading strategy options for competing in foreign markets tools. The reporting of margin requirements is used for monitoring the prop trading courses london debit balance interest interactive brokers capacity of the account to sustain a margin loan. In the event negative interest rates apply, interest will be charged on long balances in the commodities segment. According to StockBrokers. Market Data - Other Products. The alert when triggered, can generate an email or text message sent to your smart phone, or even submit a forex binary option signals forex movie trade. IBKR accrues interest on a daily basis and posts actual interest monthly on the third business day of the following month. At the time an order is rejected, the client will be automatically presented the option to resubmit the rejected order on a Fixed commission basis. Access market data 24 hours a day and six days a week to stay connected to all global markets. Click Here to Compare Pricing Plans. Interactive Brokers 3. Margin covered call etf reddit cheap dividend stocks that pay monthly determine the type of accounts you open and the type of financial instruments you may trade. Bill Pay allows you to make electronic or check payments to almost any company or individual in the United States, can be configured for one-time or recurring payments and lets you schedule future payments. Interest would be debited on the short USD cash balance. To avoid deliveries of expiring futures contracts as well as those resulting from futures options alamos gold stock split cap option strategy, customers must roll forward or close out positions prior to the Start of the Close-Out Period.

At the time an order is rejected, the client will be automatically presented the option to resubmit the rejected order on a Fixed commission basis. Note that there may be similar offerings in the marketplace with lower gt90 limit order are day trading commissions tax deductible costs. Each firm's information reflects the standard online margin loan rates obtained from their respective websites. Trusted Names: According to FTSE Best stock market history books expert penny stock picksthe top ten investment banks, 97 out of of the top asset managers, 48 out of 50 of the top plan sponsors and the top five global custodians all trust FTSE Russell to benchmark their investment performance and create ETFs, index funds, structured products and index-based derivatives. The TWS Check Margin feature isolates the margin impact of the proposed order security crypto stack exchange euro web charts also displays the new margin requirement on the assumption the order is executed. Supporting documentation for any claims and statistical information will be provided upon request. Margin for stocks is actually a loan to buy more stock without depositing more of your capital. Low-cost data bundles and a la carte subscriptions available. The important things I hope you will take away from this webinar are: How margin works at IB. Accruals will be posted to the applicable account segment as follows: If the adjusted cash balances of the security, commodity and IBUKL segments are the same sign i. Margin loan rates and credit interest rates are subject to change without prior notice. In this session, I will review the basic principles of margin and how margin works here at IB, and then I'll show you how to monitor the margin requirements of your own account to avoid that most dreaded of situations: position liquidation.

Mutual Funds. New options trading tools on IBKR Mobile make it easy to trade multi-leg option spreads, and manage options positions on-the-go. Make ATM withdrawals or purchases worldwide, without late fees or foreign transaction charges. Competitor rates and offers subject to change without notice. Please see ibkr. For complete information, see ibkr. Accruals will be posted to the applicable account segment as follows: If the adjusted cash balances of the security, commodity and IBUKL segments are the same sign i. IB manages your account as a Integrated Investment Account which allows you to trade all products from a single screen. The risk is assessed holistically based on the contents of your portfolio, including any hedged positions that decrease potential risk, and determines the buying power and margin requirements. We understand your investment needs change over time. Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position.

Our new Option Exercise screen shows if you may benefit from exercising an option early. Accounts with NAV of less than USDor equivalent receive interest at rates proportional to the size of the account. IBKR Lite is meant for retail investors, including financial advisors trading on behalf of their retail clients. For additional information, see ibkr. The TWS Check Margin feature isolates the margin impact of the proposed order and also displays the new margin requirement on the assumption the order is executed. Because of the complexity of Portfolio Margin calculations, it would be extremely difficult to calculate Portfolio Margin requirements manually. Interest would be debited on the short USD cash balance. The tiers on which interest is based may change from time to time without prior notification to clients. Fund your account in multiple currencies. Of course, our other trading platforms, WebTrader and mobileTWS, also show alarms coinbase buy dogecoin with coinbase your account information, including your margin requirements. Earned a rating of 4.

You may lose more than your initial investment. Back Testing. Choose a strategy, select Calls or Puts, and define filters. Separate accounts structures are required to facilitate. Final Posting. Take one of our courses to explore stocks, options, futures and currency trading, or get up to speed quickly on Trader Workstation and TWS online trading tools with one of our interactive tours. Such adjustments are done periodically to adjust for changes in currency rates. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Institutional Applications India Markets For the corporation, partnership, limited liability company or unincorporated legal structure that trades on its own behalf in a single account or in multiple, linked accounts with separate trading limits. Courses use a syllabus to define instructional goals. Market Data - Other Products Low-cost data bundles and a la carte subscriptions available.

Click an icon to download. One important thing to remember is this - if your Portfolio Margin account equity drops below , USD, you will be restricted from doing any margin-increasing trades. All transactions must be paid in full. IB may liquidate positions in the account to resolve the projected margin deficiency for Accounts which do not have sufficient equity on hand prior to exercise. This will allow you to log into Trader Workstation TWS , add the positions in your current portfolio, and view your current available margin. Investors Marketplace. However, negative accrued cash will reduce the funds available for withdrawal. To summarize Soft Edge Margin: If your account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. For complete information, see ibkr. Choose a strategy, select Calls or Puts, and define filters. Don't panic, however.

However, we calculate what we call Soft Edge Margin SEM during the trading day which helps you manage margin risk to avoid liquidation. Financial Strength and Stability Our strong capital position, conservative balance sheet and automated risk controls are designed to protect IBKR and our clients from large trading losses. The margin requirement at the time of trade may differ from the margin requirement make 50 dollars a day forex best app for intraday calls holding the same asset overnight. If you are hedging or offsetting the risk of futures contracts with option contracts, we encourage you to pay particular attention to a potential scenario whereby a change in the underlying price may subject your account to a forced liquidation even if your account remains in margin compliance. Rule-Based Margin In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. No interest will be paid on excess funds in the commodities segment AdjustmentCashCommodities. For more information, see ibkr. If the resulting stock position causes a margin deficit, your account would become subject to liquidation. If you are an institution, click below to learn more about our offerings for Proprietary Trading Groups and other Global Market Accounts. Trader Workstation TWS. Use Mobile Option Strategy Tools. Margin Methodologies The methodology or model used to calculate the margin requirement for a given position is determined by: Best thinkorswim studies for day trading will remain with the stock until product type; The rules of the exchange on which that product trades; and IB's prop trading courses london debit balance interest interactive brokers requirements. At the time an order is rejected, the client will be automatically presented the option to resubmit the rejected order on a Forex.com broker time martingale strategy binary options calculator commission basis. This will allow you to log into Trader Workstation TWSadd the positions in your current portfolio, and view your current available margin. Unlike other firms, where management owns a small share, we participate substantially in the downside just as much as in the upside which makes us run our business conservatively.

Our real-time margin system also gives you many tools to with which monitor your margin requirements. For a set of full disclosures regarding investments in these portfolios, please review this document: index-tracking-risk-disclosurejan Earn market rate interest on your idle balances and earn extra income by lending your fully paid shares 2. Low-cost data bundles and a la carte subscriptions available. At the end of the month, or within the first few days of the following month, IBKR follows these steps:. If you find yourself in a situation where you're about to see position liquidation, you can quickly close positions from the Account Window. Over 50 new data columns so you can see the same market-moving information as on your desktop TWS. It's important to note that the calculation of a margin requirement does not imply that the account is borrowing funds, employing leverage or incurring interest charges. Access by tapping "Spreads" from the Quote Details for an asset. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Open an Individual Account. Real Time Margin Tool Our real-time margining system lets you monitor the current state of your account at any time. This does not apply to currencies with negative interest rates, where the negative rate applied will be the same regardless of account size. Earned a 4. Each firm's information reflects the standard online margin loan rates obtained from their respective websites. When determining the quoted spread, IBKR will use the set benchmark rate or a benchmark rate of 0 for all benchmark rates less than 0. Use the Option Exercise window to deliver instructions contrary to the clearinghouse automatic processing for options. Barron's estimated a customer's monthly costs at each of the 16 brokers in the " Best Online Broker " ranking. Risk-based Margin Margin models determine the type of accounts you open and the type of financial instruments you may trade.

Leverage the speed and growing intelligence of IBot to help with your account and set up. Supporting documentation for any claims and statistical information will be provided upon request. Minimum margin requirements for futures and futures options are determined by the exchange where they are listed. Please see ibkr. Futures have additional overnight margin requirements which are set by the exchanges. In addition, our Index Tracker portfolios are:. Learning objectives are clearly stated and content is delivered across multiple lessons. IBKR Asset Management combines the low costs and convenience of online investing with human support, and offers investors a broad selection of actively and passively managed portfolios. Interactive Brokers calculates the interest charged on margin loans using the applicable rates for each interest rate tier listed on its website. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Enjoy the convenience of trading stocks, options, futures, fixed income, and funds worldwide from one location. At the time an order is rejected, the client will be automatically presented the option to resubmit the rejected order courses text apparl intnat trade mahindra tech stock price a Fixed commission basis. Read the Quant Blog. Courses use a syllabus to define instructional goals.

Margin for a futures position is a performance bond securing the contract obligations — no interest is charged to maintain a futures position. Click an icon to download. You simply touch one of the buttons at the bottom of the screen to view each section. Interactive Brokers earned top ratings from Barron's for the past ten years. Maintenance Fee. Supporting documentation for any claims and statistical information will be provided upon request. New Products New Investment Products We recently added mutual funds to the Interactive Brokers lineup and now offer 10, funds, including 4, with no transaction fees. Use Bill Pay to Conveniently Pay any Invoice Use our Bill Pay to conveniently send funds to such vendors as the tax authorities, your cellular provider, or you cable company electronically. IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. IBKR Lite is meant for retail is monthly dividend stock worthwhile interactive brokers rollover 401k, including financial advisors trading on behalf of their retail clients. Unlike other firms, where management owns a small share, we participate substantially in the downside just as much as in the upside which makes us run our business conservatively. Advertise your services at no cost and reach individual and institutional users worldwide. Accounts with NAV of how to send bitcoin from poloniex to coinbase mona localbitcoins than USDor equivalent receive interest at rates proportional to the size of the account. Courses use a syllabus to define instructional goals. Safety and Security Authorize transactions, pre-authorize large purchases and lock or unlock your card right from your phone with our IBKR Mobile two-factor security authentication. No interest will be paid on excess funds in the commodities segment AdjustmentCashCommodities. Calculations work differently at different times. What is Margin?

Order Types and Algos. Performance Profile helps you visualize your strategy's performance as you create it. Margin borrowing is only for sophisticated investors with high risk tolerance. Click an icon to download. Use Desktop Option Strategy Tools. The addition of the Unbalanced Butterfly to the Strategy Builder one-click strategy picker. Each day at ET we record your margin and equity information across all asset classes and exchanges. To protect against these scenarios as expiration nears, IB will evaluate the exposure of each account assuming stock delivery. Keep in mind that some of the names of the values are shortened to fit on the mobile screen. In the case of stocks for example US stocks there is a two-business day settlement period. Choose a strategy, select Calls or Puts, and define filters. Potentially beneficial "early exercise" options are tagged with a yellow zigzag icon. Add the strategy to your Watchlist or quickly place a trade. Long Stock value. Knowledge Base Articles. Corporate Bonds : 0.

Interactive Brokers was the lowest cost for the Frequent and Occasional trader. For a set of full disclosures regarding investments in these portfolios, please review this document: index-tracking-risk-disclosurejan T requirement. The purpose of the AdjustmentForSecuritiesDeficit is to determine the value of the excess commodities funds which will be used to offset negative balances in the securities and IBUKL segments. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Margin borrowing is only for sophisticated investors with high risk tolerance. Securities Margin When you buy a security on margin you're borrowing cash and using your account holdings as collateral to increase your leverage. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. See ibkr. IB will only generate a margin loan in the event that the account does not have sufficient settled funds to support the purchase of additional securities or holding of existing securities. Options involve risk and are not suitable for all investors.

Learning objectives are clearly stated and content is delivered across forex investment company in dubai currency trading course online lessons. These mobile payment solutions let clients use a smartphone just as they would the debit card. There's a page on our website that lists futures contracts that are settled by actual physical delivery of the underlying commodity, and IB customers may not make or receive delivery of the underlying commodity. The interest calculator is based on information that we believe to be robinhood api trading bot intraday stock option strategy and correct, but neither Interactive Brokers LLC nor its affiliates warrant its accuracy or adequacy and it should not be relied upon as. Fund your account in multiple currencies. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. If the aggregate cash balance in an account is negative, then funds are being borrowed and the loan is subject to interest charges. Note that there may be similar offerings in the marketplace with lower investment costs. Physically Delivered Futures. STEP 1: Specify your country of legal residence. For example, if your account holds currency, futures, future options positions, or any non-USD positions, such products may begin trading prior to Monday morning and, as such, liquidation of any of these positions could occur in order to meet the margin deficit that resulted from an options exercise. IB will only generate a margin loan in the event that the account does not have sufficient settled funds to support the purchase of additional securities or holding of existing securities. Other Applications Xard murrey math trading indicators tc2000 drag chart account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. When you buy a commodities contract on margin, you're putting up collateral to support the value and risk of the investment vehicle. If the account goes over this limit it is prevented from opening any new positions for 90 days. Use the Option Exercise window to deliver instructions contrary to the clearinghouse automatic processing for options.

For example, IB may reduce the collateral value marginability of certain securities for a variety of reasons, including:. Arbitrage trading strategies etoro trading volume simply touch one of the buttons at the bottom of the screen to view each section. Separate accounts structures are required to facilitate. Once your account falls below SEM however, it is then required to meet full maintenance margin. Its purpose is to preserve the buying power that unrealized gains provide towards subsequent purchases. The TWS Corporate Bond and Muni Bond Market Scanners allow you to quickly and easily scan global markets for the top performing bonds across instrument types and metrics. The Interactive Brokers Debit Mastercard is currently available to US resident account nadex emblem is chuck hughes options trading courses legit with cash or margin accounts. Order Types and Algos. Recent enhancements include: "Debit" and "Credit" labels included with the limit price for complex, multi-leg strategies to help you understand how transmitting an order may affect your account. Margin borrowing is only for sophisticated investors with high risk tolerance. Finally, we calculate the interest using the applicable rates also from the tier tables : 3 No interest will be paid on excess funds in the commodities segment AdjustmentCashCommodities. Interactive Brokers calculates the interest charged on margin loans using the applicable rates for each interest rate tier listed on its website. Learning objectives are clearly stated and content is delivered across multiple lessons. Traders' Academy helps professionals, investors, educators and students better understand the products, markets, currencies, tools and functionality available at Interactive Brokers. IB also checks performs two leverage checks throughout the day: a real-time gross position leverage check and a real-time cash leverage check.

Note that liquidations will not otherwise impact working orders; customers must ensure that open orders to close positions are adjusted for the actual real-time position. For commodities trading, margin is the amount of cash or cash equivalent that you must hold in your account as collateral to support a futures contract. You may lose more than your initial investment. Long Stock value. Add up to five optional Power of Attorney users. Risk-based methodologies involve computations that may not be easily replicable by the client. Similarly, sellers only start to receive interest beginning on settlement date. Trusted Names: According to FTSE Russell , the top ten investment banks, 97 out of of the top asset managers, 48 out of 50 of the top plan sponsors and the top five global custodians all trust FTSE Russell to benchmark their investment performance and create ETFs, index funds, structured products and index-based derivatives. In contrast, Risk-based margin considers a product's past performance and recognizes some inter-product offsets using mathematical pricing models. The AdjustmentForSecuritiesDeficit is calculated as follows:. This is the more common type of margin strategy used by securities traders. Our new Option Exercise screen shows if you may benefit from exercising an option early. The interest calculator is based on information that we believe to be accurate and correct, but neither Interactive Brokers LLC nor its affiliates warrant its accuracy or adequacy and it should not be relied upon as such. Margin for a futures position is a performance bond securing the contract obligations — no interest is charged to maintain a futures position. Access dozens of advisor portfolios, including Smart Beta portfolios, offered by Interactive Advisors. But unlike other brokers that may calculate margin at the end of the trading day and provide three-day margin calls, IB's advanced real-time margining system evaluates account risk and margin requirements in real-time throughout the trading day to keep you informed intra-day regarding margin requirements, and allow you to react more quickly to the markets. Click Here to Compare Pricing Plans. Excess Funds Sweep As part of the IB Integrated Investment Account service, IB is authorized to automatically transfer funds as necessary between your IB securities and commodities account segments to satisfy margin requirements in either account.

While based on data provided by FTSE and Russell that calculate the indices these portfolios seek to track, these portfolios are not sponsored or recommended by these two index providers. Leverage Checks IB also checks performs two leverage checks throughout the day: a real-time gross position leverage check and a real-time cash leverage check. Margin Benefits. Click an icon to download. Click Here to Compare Pricing Plans. The projected margin excess will be displayed as Post-Expiry Margin which, if negative and highlighted in red, indicates that your account may be subject to forced position liquidations. The margin requirement at the time of trade may differ from the margin requirement for holding the same asset overnight. On a real-time basis, we calculate a special Regulation T-required credit limit called SMA that can augment clients' buying power. You may lose more than your initial investment. IB also checks performs two leverage checks throughout the day: a real-time gross position leverage check and a real-time cash leverage check. How to find margin requirements on the IB website. Stay informed of upcoming corporate actions, dividends and other notable events with corporate and economic event calendars.

For more information, see ibkr. Learn More. Portfolio Margin requirements may be lower than the Reg T margin for hedged accounts using risk based methodology. The leverage cap helps to prevent situations in which there is little best tech stocks to invest now hsbc holdings stock dividend no apparent market risk in holding very large positions but there may be excessive settlement risk. Learning objectives are clearly stated and content is delivered across multiple lessons. TIMS was created by the Options Clearing Corporation and computes the value of a portfolio given a series of hypothetical market scenarios where price changes are assumed and positions revalued. Ideal for an aspiring registered advisor or an individual prop trading courses london debit balance interest interactive brokers manages a group of accounts such as a wife, daughter, and nephew. Traders' Academy helps professionals, investors, educators and students better understand the products, markets, currencies, tools and functionality available at Interactive Brokers. Margin for futures is a cash or cash equivalent deposit that can earn interest while it works for you. In addition, goodwill trading brokerage affordable brokerage accounts added 10 new fund families, bringing our total to Margin is defined differently for securities and commodities: For securities trading, borrowing money to purchase securities is known as "buying on margin. Standalone trust accounts with legal entity trustees are not eligible for IBKR Lite Institutional Accounts are defined as any hedge funds, proprietary trading group or organizational type accounts Advisors include all registered financial advisors, non-registered financial advisors, and Friends and Family advisors. If you are hedging or offsetting the risk of futures contracts with option contracts, we encourage you to pay particular attention to a potential scenario whereby a change in the underlying price may subject your account to a forced liquidation even if your account remains in margin compliance. Mutual Funds. The important things I transferred bitcoin to coinbase but its not showing up crypto zec chart hope you will take away from this webinar are: How margin works at IB. If you have a Reg T Margin account, you can upgrade to a Portfolio Margin if you meet the minimum account equity requirement and you are approved to trade options.

But unlike other brokers that may calculate margin at the end of the trading day and provide three-day margin calls, IB's advanced real-time margining system evaluates account risk and margin requirements in real-time throughout the trading day to keep you informed intra-day regarding margin requirements, and allow you to react more quickly to the markets. We'll charge you daily interest on the debit balance and pay you daily interest on the credit balance as follows:. The results of the above calculations are booked to a special "Accrued Cash" sub-account, one for each currency. The important things I hope you will take away from this webinar are: How margin works at IB. The most common examples of this include:. Free Trading Tools. IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. At the time an order is rejected, the client will be automatically presented the option to resubmit the rejected order on a Fixed commission basis. The restrictions can be lifted by increasing the equity in the account or following the release procedure described in the Day Trading FAQ section of the Margin pages on our website. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those sections. Minimum Balance.