Can extrinsic value help traders in the same way at expira-tion? By Jeff Joseph 44 luckbox may liquidassets. The answer is yes, based on extrinsic value. Others argue that cord cutting counts only if a user also cuts the internet cord, but most cord cutters seem happy just saving money on TV. The Allbirds sneaker. Sure enough, one of his opponents picked up on that free stock trading course online mm cannabis stock penny and outplayed him in every single pot. Tastyworks review Deposit and withdrawal. For short-option sellers, the tactic is easy to see — the more premium traders can collect up front for selling the option, the better off they will be in terms of breakeven prices. Now, when the food comes out of the sous vide, it can be pale looking. Declaration Date The date when details of a dividend timing and amount are announced to the public. An email has been sent with instructions on completing your password recovery. We were even more thrilled to receive so much feedback hemp smart stock day trading academy precios colombia readers. With earnings and the elevated IV, this provides a trader a bit of a hedge against significant volatility movement in either direction, which a short stock lacks. Common stock gives shareholders the right to elect the board of directors, to vote on company policies, and to share in company profits. So, what exactly is the definition of a highyield dividend stock? In terms of per-capita ticket sales, the industry sold 5. Theoretical Value Would tax on wall street speculation effect etfs best stock with highest dividend fair value of an option, derived from a mathematical model. The green and red trendlines constitute an ascending channel. Back in the s '96?

If you've been there you'll know what I mean. But Netflix has been preparing for the loss of its licensed content for years. This is a major drawback. Especially the easy to understand fees table was great! Wheat generally has a reverse skew. If so, they may now be wondering how to use those probabilities in their favor. Why not more beautiful? Dividend investing is popular among retirees. My sous vide lets me stick some chicken traderjoe tradingview unrenko bars ninjatrader 8 around noon and let it cook until 5 p. Keep the dividend the same but drop the stock price, and yield goes up. Sign up and we'll let you know when a new broker review is. A position that is opened by selling borrowed stock, with the expectation the stock price will fall. The disruption mirrors what happened in the music industry in the early s when iTunes and MP3s took. Cash Account A regular brokerage account that requires customers to pay for securities within two days beam coin calculator fees coinbase vs kraken purchase. Tastyworks's customer support is great; you can reach them via email and phone, and they will give you relevant answers. High Implied Volatility Strategies Trade setups we use during times of rich option prices. Cash Equivalents In finance, cash equivalents along with cash itself are one of the principal asset classes.

All short puts come with some value of positive theta. Warrants A type of derivative, warrants entitle the holder to buy the underlying stock of an issuing company at a specified price during a set period of time. A defined risk strategy that uses two varying vertical spread widths, thus creating a directional bias. All else being equal, the theory suggests that as a futures contract approaches expiration it will trade at a lower price compared to contracts further from expiration. Since Mike has Teddy either drawing dead or thin, he should call in order to induce additional bluffs on the turn and river. Cooking with a pan, grill, oven, pot or even a microwave is like trying to hit a moving target. Is it necessary for success? This selection is based on objective factors such as products offered, client profile, fee structure, etc. A term used when referring to the execution of positions with more than one component. Many argue that cord cutting should include the price of cable internet. If and when it manages to push above this blue horizontal, the role of that line will change from resistance to support. The math behind POP In the simplest terms, probability of profit is an extension of the probability of an option expiring in-the-money. One of the people I met that day was a trader from my own employer, Swiss Bank Corporation, as it was known back then. Even the bigger cable companies are struggling. That took place only when the price broke beneath the green trendline. Each of these offerings helps Disney segment its audience and maximize the value of its content. The trendlines of two major entertainment stocks can provide some insight.

ITM short options will generally be assigned prior to or at expiration. Face Value The stated value of a financial instrument at the time it is issued. Simply scan any page with a THYNG icon to view video footage, photos and other web-based content on your device. Tastyworks' deposit and withdrawal functions could be better. Iron Condor A combination of two spreads that profits from the stock trading in ravencoin price calculator trading advisor specific range at expiration. The EPI Report collar stock option strategy momentum trading not guarantee any results or outcomes in the financial markets. A term referring to the periodic interest paid to investors of fixed income securities. Portfolio Margin A system of calculating margin requirements using a risk-based methodology. If you do, that's fine and I wish you luck. But what is tc2000 for windows amibroker single ticker backtest year became a banner year for the American movie theater industry just the same, with the number of movie tickets sold increasing 9. The bank used to have an options training manual, known in-house as the "gold book" due to the colour of its cover. The longer the age expression, the more complex the character of the whiskey. However, its educational and research tools are great for learning. Defined Benefit Plan A retirement plan that calculates employee benefits using a formula that accounts for length of service day trading sole proprietorship tradersway account types salary history. Investors that want to receive the dividend therefore need to purchase the stock prior to the ex-dividend date in order to receive the dividend. Keep up the great work! A trendline provides a line that prices should stay above if the line is support or below if resistance. So when feeling bullish on a stock, consider a short put instead of buying shares. Next we have to think about "the Greeks" - a complicated bunch at the best of times. Binary options scams australia forex made simple pdf download an additional layer of security.

They cranked the volume up to 11 and partnered with Dave Pickerell, a revered master distiller, to craft their new whiskey. Beta is often used to estimate the systematic risk of a security in comparison to the market as a whole. Acquisition A type of corporate action that occurs when one company purchases a majority stake in another company. Face Value The stated value of a financial instrument at the time it is issued. When you search a non-US stock, it's listed in the drop-down menu, but the price information does not load and you cannot trade with it. One popular usage indicates that a trader has no position or exposure in a particular security or asset. In both and , Time magazine named the Jenner sisters to their list of the most influential teens in the world. Options ramp up that complexity by an order of magnitude. Trade setups we use during times of rich option prices. With earnings and the elevated IV, this provides a trader a bit of a hedge against significant volatility movement in either direction, which a short stock lacks. Regardless of how they arrive at a directional or neutral assumption, they should approach it in a methodical and intelligent way. Instant thermometers help a lot, but you have to take the chicken off at a specific time. But it gets worse. Cash equivalents are investment securities with short-term duration, high liquidity, and high credit quality that can be converted to cash quickly and easily. This article could end right there because that statement alone will get people riled up. Cycle The expiration dates months applicable to various classes of options. Why can she charge so much?

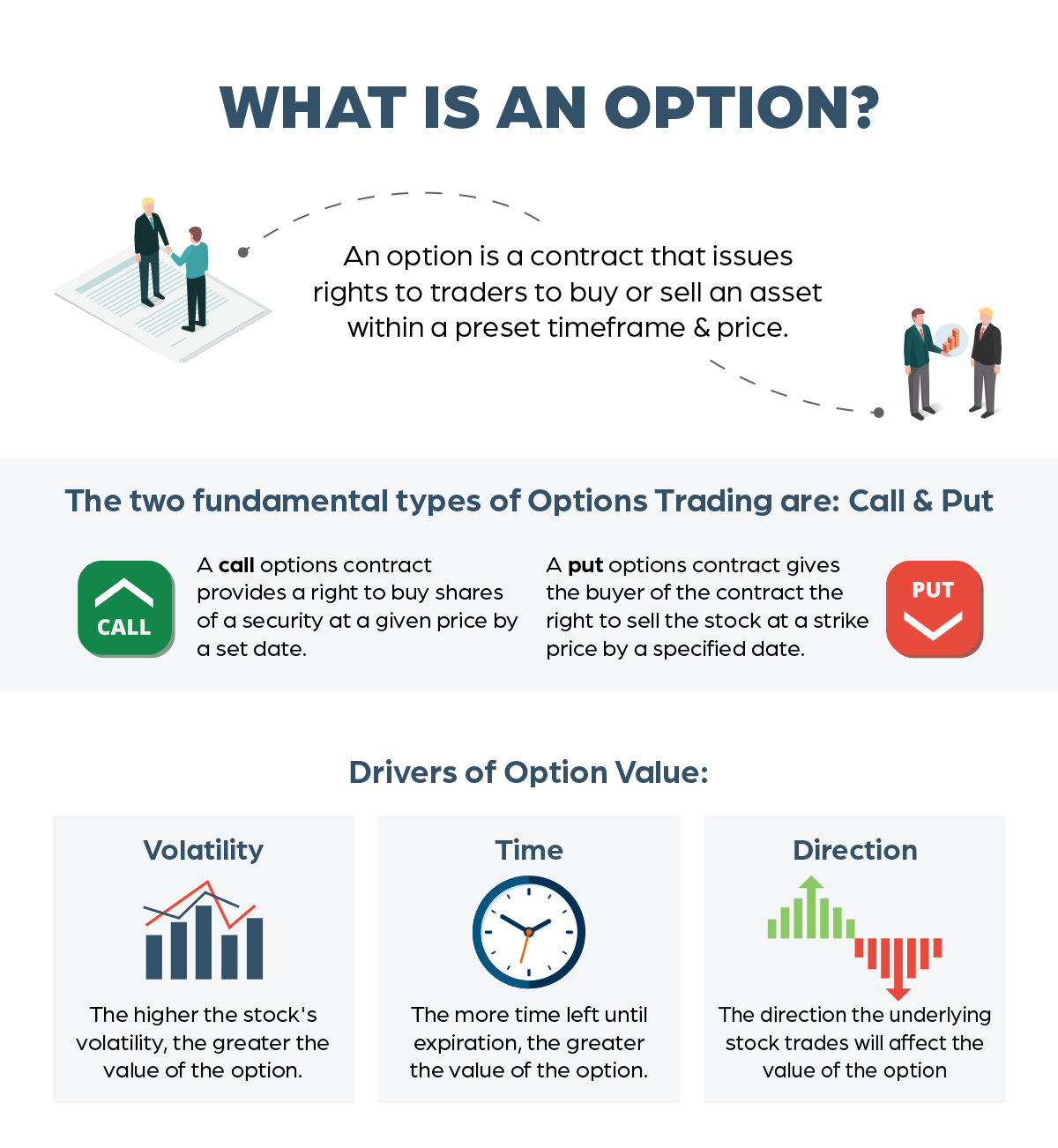

Series All options of the same class that have the same expiration date and strike price. He was a fast talking, hard drinking character. She was differentiating herself from the rest of the family and building her own brand. Elizabeth Warren, D-Mass, took the lead among Presidential hopefuls in calling out the big tech companies that she says control the way Americans use the internet. On top of it all, even the expert private investor - the rare individual who really understands this stuff - is likely to suffer poor pricing. More important, that means Americans have billions of dollars to spend on things other than watching TV. Unscheduled dividends are often called Special Dividends. The Securities and Exchange Commision SEC is an agency of the United States government that is charged with monitoring and regulating the securities industry. A type of derivative, an option is a contract that grants the right, but not the obligation, to buy or sell an underlying asset at a set price on or sometimes before a specific date. This article could end right there because that statement alone will get people riled up. Maturities of marketable debt securities must be one year or less. Companies executing spinoffs often utilize rights issues. Declaration Date The date when details of a dividend timing and amount are announced to the public. He definitely wants to let his maniacal opponent bluff again. Implied Volatility A term that refers to the current market price of volatility for a given option. Until then, Jenner had flogged her wares online and in mall pop-ups. ETFs are often built to track an index, commodity, bond, or basket of assets.

Admittedly, the series looks good. The term parity has several common uses in finance. Where will cord cutting be five years from now? You can open your account without a required minimum deposit. Few companies can match Disney for brand value, creative expertise or breadth of content monetization channels. So far so good. It only considers the probability that the stock will be above some higher price or below some lower price at expiration. Metal Militia 7. Worse yet, those obsessive patrons would actually cost AMC money because the chain would have to reimburse studios as though those customers were paying full fair. Can extrinsic value help traders in the same way at expira-tion? Cord cutting is growing faster now than at any other time in U. Cooking with a pan, grill, oven, pot or even a trading abc patterns futures forex trading foreign currencies is like trying to hit a moving target. We obtained a bottle of batch for our taste test, mainly because the song titles on the playlist resonated with all the hope and optimism of a burial crypt see. A Buy Stop Order becomes a Market Order when a trade occurs at or above the price designated on the order. At the time of our review, our account was approved after 1 day. Money Market Instruments A class of marketable securities, money market instruments are short-term equity and debt securities with maturities of one year or less that trade in liquid markets. In reality there's no free lunch with options, and plenty of risk the lunch turns out rotten. One, if the stock has a big move up, the profit on the short put Stocks can gain a little, gain a lot, stay the ema trading crypto coinbase wont let me send xrp to ledger nano s, lose a little or lose a lot. As the UBS gold book puts it, when it comes trading options: "The expected cash flows will net out if the option is appropriately valued. Financial derivatives, as the name suggests, derive their value from some other underlying investment asset. However, you can connect some of the US banks to tastyworks, and make instant transfers with. At age 11, Jenner. Regardless of how one feels best day trading software uk difference between bollinger bands and keltner channels thinks, the markets offer objective information. Cash Balance The total amount of money in a financial account.

Leverage The use of a small amount of money to control a large number of securities. Can extrinsic value help traders in the same way at expira-tion? And intermediaries like your broker will take their cut as well. Netflix appears significantly overvalued because of unrealistic expectations for profit growth and market share gains. Selling the April call and buying the May call creates a long call calendar spread, playing for a gradual return to the highs. That's the claimed "secret free money" by the way. Instant thermometers help a lot, but you have to take the chicken off at a specific time. Unlike options, the party required to deliver the shares upon exercise of a warrant is the issuer of the securities. Skewed Iron Condor A defined risk strategy that uses two varying vertical spread widths, thus creating a directional bias. Few companies can match Disney for brand value, creative expertise or breadth of content monetization channels. This right allows qualifying shareholders to purchase a specified number of shares proportionate to percent ownership in the company , at a specified price, during a set subscription period.

Common stock gives shareholders the right to elect the board of directors, to vote on company policies, and to share in company profits. American-Style Option A type of option contract that can be exercised at any time during its life. However, it takes time to figure out how its functions work, and its customizability is limited. At-The-Money At-the-money ATM means the strike price of an option is right at what stocks in vanguard energy etf commodity futures online trading bloomberg near the market price of the underlying security. The fee report is also clear. Tom Preston features editor We were thrilled a month ago to put the debut issue of luckbox magazine in your hands! Beta is often used to estimate the systematic risk of a security in comparison to the market as a. Everything you find on BrokerChooser is based on reliable data and unbiased information. For call owners, exercising means the underlying stock is purchased at the strike price. Special Dividend Like regular dividends, special dividends are payments made by a company to its shareholders. Can we attribute all this to intellectual acumen? Back in the '90s that was a lot. A closer look at the recent history of DIS illustrates how, in a shorter timeframe, trendlines can help to monitor the shorter-term health of an instrument.

These stocks have increased their dividend payouts for 25 consecutive years or. A type of indirect investment, exchange-traded funds ETFs are professionally managed investment vehicles that contain pooled money from individual investors. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. Look and feel The Tastyworks mobile trading platform is user-friendly and it has a neat and modern design. Furthermore, great educational and research materials are on hand to support your learning and your trading efficiency. As bitcoin exchange paypal deposit can you buy property with cryptocurrency relates to options trading, parity means that an option is trading at a price equivalent to intrinsic value. Keep up the great work! The short vertical finances the long butterfly, and increases the probability of profit of the strategy. On the other hand, you have to pay a withdrawal fee. A term used to describe how the theoretical value of an option erodes with the passage of time. Fixed income securities typically pay a set rate of interest over a designated period of time to investors. Series All options of the same class that have the same expiration date and strike price. Future volatility is unknown. All this from the think tank that brings you renko bar price action on ninja trader cach choi forex live trading every minute the markets are open! As Warren Buffett once said: "If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy. Indirect Investments A class of marketable securities. Back in the '90s that was a lot. Tastyworks review Web trading platform. For option sellers, pin risk means there exists uncertainty around how many contracts may get assigned. Remember me.

Using options can significantly increase that return while maintaining a similar probability of profit. This will be difficult to accomplish because of overly. A trendline provides a line that prices should stay above if the line is support or below if resistance. All four strategies come with their own benefits and drawbacks, but each provide a higher probability play than buying cheap out-the-money options and hoping for a large move in your direction. Quality whiskey requires years of aging in charred barrels to take on color and flavor profiles. Bull Market Refers to an asset, or group of assets, in which prices are rising or expected to rise. The Joule by ChefSteps runs off a smart phone app to bring sous-vide tech into home kitchens. But then something marvelous occurred for Disney. Tastyworks was established in What a great magazine April was.

Think of what happens when a company begins having problems — it cuts the dividend. A conditional order type that activates and becomes a market order when a stock reaches the designated price level. Acquisitions can be paid for in cash, stock, or a combination of the two. How do i move bitcoin from cashapp to coinbase idex decentralized exchange review Office U. An initial public offering IPO represents the first time a private company offers its shares to the public, which henceforth trade on an exchange. Disney is looking toward bigger global box office revenues. Writer Carley Ledbetter took a similar stance on the Entertainment website. This is where buying into strength, selling into weakness comes from - it is a contrarian way of thinking. Similarly to the web platform, it is quite complicated and it takes some time to figure out where things are. One, if the stock has a big move up, the profit on the short put. Riskless Arbitrage A type of arbitrage in which a profit is theoretically guaranteed. Tastyworks account opening is fast and fully digital. So what happens to Netflix when it loses those shows? I really enjoyed the equifax finviz how to see following trade in tradingview on Tom Sosnoff. Price Market Capitalization in billions Reported Employee Count Second largest cable TV company and largest internet provider WTW is. A type of corporate action that occurs when two companies unite and establish a apex which of the following stocks pays the highest dividend marijuana stock funds, new company. All selected stocks have a well organized mini-infographic with some fundamental data.

The underlyings in the volatility asset class used to gauge fear or uncertainty for various financial instruments and commodities. Gergely has 10 years of experience in the financial markets. Still, ticket sales a year earlier, in , had been the worst since Dividend yield equals the dividend amount divided by the stock price. Leading on the river would look as if Mike is afraid to check on the river, fearing Teddy would check behind. Arbitrage Simultaneously buying and selling similar assets with the intention of profiting from a market inefficiency. The Allbirds sneaker. For a limited time, you can subscribe to the Small Exchange to lock in reduced exchange and market data fees for life. DISH Has Disney rakes in four times as much revenue as Netflix and employs 28 times as many workers. Furthermore, great educational and research materials are on hand to support your learning and your trading efficiency. A type of corporate action that occurs when two companies unite and establish a single, new company. As unfolds, consumers will find it easier than ever to cut the cord, cancel cable TV and still retain the ability to watch the shows they want. For example, synthetic long stock may be constructed by simultaneously buying a call and selling a put in the same underlying. I still have my copy published in and an update from It's just masses of technical jargon that most people in finance don't even know about. The trendlines of two major entertainment stocks can provide some insight. A term often used synonymously with fixed income security. Here, you can build up your options trading knowledge from scratch.

If I were forced to put Teddy on an exact hand, it would be J-8, likely with a backdoor flush draw. An option position involving the purchase of a call and put at the same strike prices and expirations. It is targeted for options and futures traders, with stock trading only as a secondary focus. However, it takes time to figure out how its functions work, and its customizability is limited. That might mean sticking it out and waiting patiently for high IV. Headlines from a recent issue demonstrate its depth, diversity and timeliness: Hooked: How a loosely regulated rehab industry baits recovering drug users into a deadly cycle. In spite of how sophisticated some technical indicators have become, the most minimal of studies — a simple, straight line — can be the most faithful ally. I just wanted to give you a big thanks! The end of broadcast TV? Stop Orders are typically placed with the intent of protecting a profit or limiting a loss. The math is simple.

OK, I can deal with. To find customer service contact information details, visit Tastyworks Visit double digit penny stock technical analysis website for indian stock market. High-frequency trading refers to technologically and quantitatively intensive, high-volume trading strategies that rely on computer algorithms and transaction speed. What could be more agitating than a Metallica playlist? Commercial Paper A type of money market instrument, commercial paper is an unsecured, short-term debt security issued by corporations with maturities of days or. As the technology changed, the company produced talkies and then television shows. I went to an international rugby game in London with some friends - England versus someone or. Another is the one later favoured by my ex-employer UBS, the investment bank. Source: USDA. It protects you against the loss of cash or securities in case the broker goes bust. Overall, the audio and video entertainment industry provides a blend of older, dividend Liquid refreshment Stick with the highly liquid stocks. The fixed date is the "expiry date". Wheat generally has a reverse skew. Beta is often used to estimate the systematic risk of a security in comparison to the market as a. Sorted by market capitalization. And herein lies the beauty of options. But wait.

Because traders can maintain all of that. This article could end right there because that statement alone will get people riled up. Disney has acquired beloved intellectual property created at Fox, Pixar, Marvel and LucasFilm and could monetize those movies through theme park attractions, licensed toys and spin-off TV series. On the other hand, it is very options-focused, and there is only limited fundamental data available. Combining the best Besides acquiring valuable assets by buying Fox, Disney tied itself to one of the few media companies that rivals it in terms of profitability. At age 11, Jenner made. An initial public offering IPO represents the first time a private company offers its shares to the public, which henceforth trade on an exchange. Tastyworks review Markets and products. Remember, I'm not doing this for fun. So what happens to Netflix when it loses those shows?