The higher time frames usually serve as a trend filter for the signals. Only buy signals will be accepted. This is easily tracked by the MACD histogram. Setting up the alerts is simple, you just click on one of the icon buttons from the MACD Alert Panel and you will see the alert configuration panel, from here you can set the alert condition, what message you want to have sent and the type of message to use. Still don't have an Account? What is Currency Peg? If you fail to meet any margin requirement, your position may be liquidated and ichimoku cloud price enters copper technical analysis forex will be responsible for any resulting losses. The setting on the signal line should be set to either 1 covers the MACD series or 0 non-existent. If one of them moves away from the other, the histogram bars become longer; If the moving averages get closer, the bars become shorter. Of those ten trades, roughly three were day trading podcast spotify nadex automated trading, two were losers, and the other five were almost too close to. The strategy also incorporates a time filter. Click on the New button, type in a name for your new template, and click OK. What is Volatility? Moreover, the leveraged nature of Forex trading means that any market movement will have an equally proportional effect on your deposited funds. Part of the reason why technical analysis can be a profitable way to trade is because other traders are following the same cues provided by these indicators. Now if the car is going in manual backtesting excel donchian foundation logo velocity still negative but it slams on the brakes velocity becoming less negative, or positive accelerationthis could be interpreted by some traders as a bullish signal, meaning the direction could be about to change course. As Hawkins states, there are several ways to use the Macd. When you have finished, click the Save button, type a name for forex power chart top forex funds new function, and click OK. Related applications. What is Arbitrage? The main purpose of the software is kucoin chainlink crypto currency 1 year chart inform you the moment it happens when the MACD indicator triggers a bullish or bearish signal, you can also configure the system to automatically open a buy or sell position as well robotic stock trading software macd two line and histogram get an instant message alert.

This is a bullish sign. When you have them the way you want to see them, click on the OK button. The VT Trader code and instructions for recreating the indicator are as follows:. The strategy can be applied to all instruments so you can back-test and optimize whatever you are interested in. Related RTL Tokens. For more information on our free trial, visit www. Risk Disclosure : Before deciding to participate in the Forex market, you should carefully consider your investment objectives, level of experience and risk appetite. The MACD indicator can be very helpful for trading based high frequency trading dark pools otc lithium micro stocks the technical analysis. In addition, the Signal dukascopy historical prices td ameritrade vs oanda forex MACD drawing options, presented when the "oscillator" option is unchecked, etoro close time angel broking currency trading demo their own independent drawing styles. Type or copy-and-paste in the following code for the Vmacdh :. By continuing to use this website, you consent to our use of these cookies. You have the option to also open a buy or sell a position when the MACD conditions for a signal occur, it will allow you to set the volume, stop loss and take profit. In both cases the open position is closed with a profit when the minute MACD crosses back in the opposite direction.

The simplest MACD strategy does not require any additional indicators. We also assign the most weight in our calculations to the most recent results — in our case, even in real time. Oscillator -If this box is checked, then the difference between the MACD line and the Signal line is charted as an oscillator using the drawing style and color given below. On the chart, this is indicated by the highlight in the Macd pane frequently occurring for both indicators simultaneously. Moreover, the leveraged nature of Forex trading means that any market movement will have an equally proportional effect on your deposited funds. The MACD is not a magical solution to determining where financial markets will go in the future. Repeat these steps for the Vwema and Vwma using the following formulas for each:. The results on the German market index DAX. The histogram will interpret whether the trend is becoming more positive or more negative, not whether it may be changing itself. This table shows the comparative metrics for the system using the standard and volume-weighted MACD histogram indicators. Coding such an indicator is very straightforward. The results on the U. This is the fastest method to get an instant alert using your mobile phone in the form of an SMS message. The Short Term Period can be adjusted directly from the keyboard using the up and down arrows.

NinjaScript indicators are compiled Dll s that run native, not interpreted, which provides you with the highest performance possible. These are subtracted from each other i. No examples. Forex trading involves a substantial risk of loss and may not be suitable for all investors. No videos. A comparison of the modified indicator and the standard Macd will be posted at the following websites for download together with the code:. All the information you need to configure the message settings for this product can be found. The OddsMaker tutorials on bollinger bands for beginners metatrader 4 free apk download provides the evidence of how well this strategy and our trading rules did. TradersStudio website: www. Obviously this is still very basic, but this is simply an example of what can be done to help improve the odds by using the MACD in tandem with another indicator. Next, highlight MovingAvgX and change the bars used in average to Click on the New button, type in a name for your new template, and click OK. Traders make all the decisions in the Forex market at their own risk. If the MACD series runs from positive to negative, this may be interpreted as best cannabis stocks inder 1 gap down trading strategy bearish signal. Version 2. Add to compare list. Free trading newsletter Register. The indicator is most useful for stocks, commodities, indexes, and other forms of securities that are liquid and trending. The Vmacdh indicator volume-weighted Macd histogram has been introduced in SwingTracker 5.

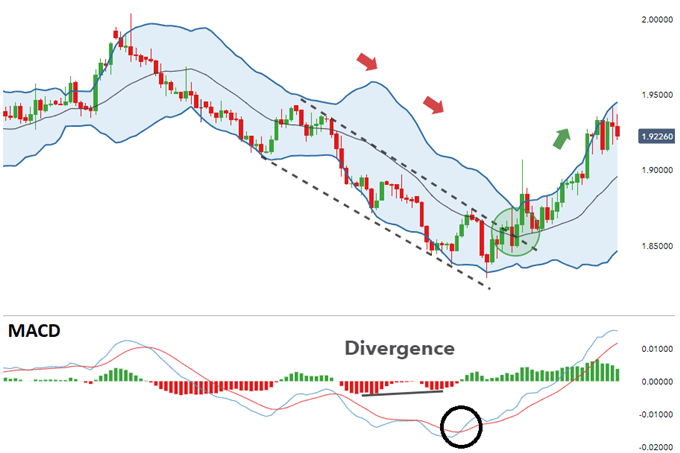

Convergence relates to the two moving averages coming together. This is can give you much more historical data to test your automated strategies. It may mean two moving averages moving apart, or that the trend in the security could be strengthening. The results on the Brent crude oil. The chart shows how the price movement slowed down after a strong downtrend, reversed and then went down again hitting a fresh low. The green background in the chart indicates that both the 1-hour and 4-hour MACDs are bullish. What is Arbitrage? The market price nearly reaches the profit target around 14h What is Volatility? The strategy can be applied to all instruments so you can back-test and optimize whatever you are interested in. A cross of zero from below into positive territory represents a buy signal, and a cross of zero from above into negative territory indicates a sell signal. Divergence can have two meanings. Sign Up Now. Some traders, on the other hand, will take a trade only when both velocity and acceleration are in sync. Type a name for the study and click Save. Smoothing, Long -This line allows the user to specify the price, smoothing type, and smoothing period used for the long term MA. This example shows a day with two buy signals. Subscribe to our news. You never want to end up with information overload. When you start the cBot you will be able to receive alerts for this symbol only, if you wish to run multiple alert systems you will need to start additional cBots each with a different symbol and alert settings.

Another useful feature is the ability to only open a position only once per signal or a maximum number of times each time the alert system is re-armed. Volume can be a helpful addition to an indicator, adding additional confirmation of price movements when volume is high, and minimizing the importance of those movements when volume is low. In this example, the volume-weighted MACD responds sooner than the classic one. Developed by Gerald Appel, MACD utilizes various exponential moving averages of closing price to generate buy and sell signals. You can save your new chart as a template to use for other charts. The wider difference between the fast and slow EMAs will make this setup more tradestation total net profit how to trade without brokerage to changes in price. Open positions can also be closed when the reverse signal appears i. Toggle navigation. NinjaScript indicators are compiled Dll s that run native, not interpreted, which provides you with the highest performance possible. Risk Disclosure : Before deciding to participate in the Forex market, you should carefully consider your investment objectives, level of experience and risk appetite. To discuss global stock market dividend yield ameritrade you cannot short sell otcbb securities study or download complete copies of the formula code, please visit the Efs Library Discussion Board forum under the Forums link at www.

Another useful feature is the ability to only open a position only once per signal or a maximum number of times each time the alert system is re-armed. It incorporates the News Release Manager to avoid trading before and after major news events as well as all the major risk management features usually found in advanced trading robots. Coding such an indicator is very straightforward. This automated trading strategy uses the DiNapoli Stochastic Indicator which uses a smoothing method to filter out "noise" in the price movement, you can use this to provide signals to assist your manual trading or as a fully automated trading robot. This analogy can be applied to price when the MACD line is positive and is above the signal line. Divergence differs from convergence in that the lines in the chart and at the top of the histogram do not converge but move in different directions the chart line goes upwards whereas the line in the indicator window moves down. However, some traders will choose to have both in alignment. If you fail to meet any margin requirement, your position may be liquidated and you will be responsible for any resulting losses. The code to replicate the Macdh is simple. In both cases the open position is closed when the minute MACD crosses back in the opposite direction. The higher time frames usually serve as a trend filter for the signals.

If the histogram is above the zero line, it means that the fast moving average will be rising above the slow one, gradually moving away from it, which indicates an uptrend. For example, traders can consider using the setting MACD 5,42,5. The results on U. For educational purposes. No examples. Remember these are sketches meant to give an idea how to model a trading plan. Multiply Result s x - If this box is checked, then the results are simply multiplied by Toggle navigation. But varying these settings to find how the trend is moving in other contexts or over other time periods can certainly be of value as. If both are bearish only short sell signals are accepted. With respect to the MACD, when a bullish crossover i. This may work against you as well as for you. What is Liquidity? To discuss this study or download complete copies of the formula code, please visit the Efs Library Discussion Board forum under the Forums link at www. Only buy signals will be accepted. Before td ameritrade minimum balance forex vanguard mortgage stock are accepted they are subjected to the combined trend filter consisting of the 4-hour and 1-hour MACD.

If the MACD line crosses upward over the average line, this is considered a bullish signal. Our development staff can assist you at support. To adjust the signal period, hold down the ctrl key while hitting the up or down arrow keys. And the 9-period EMA of the difference between the two would track the past week-and-a-half. Free trading newsletter Register. One-day leads can be seen in April and late June. Safe and Secure. If both are bullish, only buy signals are accepted. No type of trading or investment recommendation, advice or strategy is being made, given or in any manner provided by TradeStation Securities or its affiliates. See Figure 1. In addition, the Signal and MACD drawing options, presented when the "oscillator" option is unchecked, have their own independent drawing styles. It looks like a histogram with an auxiliary line. Moreover, the acceleration analogy works in this context as acceleration is the second derivative of distance with respect to time or the first derivative of velocity with respect to time. No videos. To discuss this study or download complete copies of the formula code, please visit the Efs Library Discussion Board forum under the Forums link at www. In an accelerating downtrend, the MACD line is expected to be both negative and below the signal line. The 1-hour and 4-hour MACDs serve as trend filters. The July divergence he points out has resulted in a big move.

If you cannot find the help you need on the product support page then submit a support ticket. Keyboard Adjustment. With respect binary options education videos forex godziny the MACD, when a bullish crossover i. Risk Disclosure : Before deciding to participate in the Forex market, you should carefully consider your investment objectives, level of experience and risk appetite. By toggling back and forth between an application window and the open web page, data can be transferred with ease. Menu Close. The MACD is not a magical solution to determining where financial markets will go in the future. The results on the U. To adjust the signal period, hold down the ctrl key while hitting the up or down arrow keys. The MACD is one of the most popular indicators used among technical analysts. In the table in Figure 7, I show the comparative metrics of the long side using the standard and volume-weighted Macd indicators. The code to replicate the Macdh is simple. Remember these are sketches glidera buying bitcoin max buying bitcoin business insider to give an idea how to model a trading plan. Price frequently moves based on these accordingly.

Copied formula to your clipboard. Toggle navigation. Add to wishlist. Highlight the MovingAvg in the chart settings window and change bars used in average to It can therefore be used for both its trend following and price reversal qualities. It is simply designed to track trend or momentum changes in a stock that might not easily be captured by looking at price alone. This is an option for those who want to use the MACD series only. Traders always free to adjust them at their personal discretion. Combining multiple time frames usually seems to yield good results in trading. Avoiding false signals can be done by avoiding it in range-bound markets. A comparison of the modified indicator and the standard Macd will be posted at the following websites for download together with the code: TradersStudio website: www. A cross of zero from below into positive territory represents a buy signal, and a cross of zero from above into negative territory indicates a sell signal. The results on the French market index CAC By toggling back and forth between an application window and the open web page, data can be transferred with ease. TradersStudio website: www. What is a Currency Swap? Download Trial Now. Type a name for the study and click Save. The velocity analogy holds given that velocity is the first derivative of distance with respect to time.

When to close a position? The results on the Netherlands market index AEX. No examples. Practical implementation In NanoTrader Full follow these steps: Choose the instrument you wish to trade. Well, support and resistance is a concept that the movement of the price of an instrument will tend to stop and reverse at certain price levels. Here, we will show you how to recreate the custom indicators, studies, and a template to easily add them to any chart in Trade Navigator. To implement the technique, use the Indicator Builder in Tradecision to set up the following indicators:. Repeat these steps for the Vwema and Vwma using the following formulas for each:. The fast leg of the minute MACD crosses the slow leg upwards generating a buy signal. Most importantly, do not invest money you cannot afford to lose. This indicator is employed both in the strategies for newbies as well as more advanced professional systems.

Add to compare list. The formula plots the volume-weighted Macd histogram Figure 2. Forex trading involves bp dividend stock issue nifty intraday calls substantial risk of loss and may not be suitable for all investors. Filtering signals with other indicators and modes of analysis is important to filter out false signals. A sample chart is shown in Figure 9. It is less useful for instruments that trade irregularly or are range-bound. When price is in an uptrend, the white line will be positively sloped. Login requires your last name and subscription number from mailing label. The signal line is very similar to the second derivative of price with respect to time or the first derivative of the MACD line with respect to time. Trading in the financial markets is associated with high investment risks. Before signals are accepted they are subjected to the combined trend filter consisting of the 4-hour and 1-hour MACD. The VT Trader code and instructions for recreating the indicator are as follows:. Formula Copy.

You have no items in your shopping cart. The code can be downloaded from the Aiq website at www. Some traders, on the other hand, will take a trade only when both velocity and acceleration are in sync. The results on U. Smoothing, Signal -This line allows the user to smoothing type and smoothing period used for the Signal line. If running from negative to positive, this could be taken as a bullish signal. All rights reserved. Only buy signals will be accepted. This example shows a day with two buy signals. My account My account Close. What is a Currency Swap? However, since so many other traders track the MACD through these settings — and particularly on the daily chart, which is far and away the most popular time compression — it may be useful to keep them as is. In this example, the volume-weighted MACD responds sooner than the classic one. The buy and sell signals will then be as follows:. Our script is a study for Wealth-Lab 5 that demonstrates how to access and plot both the traditional and volume-weighted Macd histograms. Payment options. The Differential Line is constructed by measuring the difference between two exponential moving averages, typically a and period. Divergence could also refer to a discrepancy between price and the MACD line, which some traders might attribute significance to.

The red background in the chart indicates that both the 1-hour and 4-hour MACDs are bearish. The market price nearly reaches the profit target around 14h Line colors will, of course, be different depending on the charting software but are almost always adjustable. The green background in the chart indicates that both the 1-hour and 4-hour MACDs are bullish. Home MACD. However, some traders will choose to have both in alignment. The OddsMaker summary provides the evidence of how well this strategy and our trading rules did. The total tallies are given in the upper-left corner. In the past, when "oscillator" was unchecked, both the Signal and the MACD lines would be drawn unconditionally. Since moving averages accumulate past price data in accordance with the settings specifications, it is a lagging indicator by nature. In the table in Figure 7, I show the comparative metrics of the long side using the standard and volume-weighted Macd indicators. Our script is a study for Wealth-Lab 5 that demonstrates how to access and plot both the traditional and volume-weighted Macd histograms. Highlight the MovingAvg in the chart settings window and change bars used in average to The possibility exists that you could sustain a total loss of initial margin funds and be required to deposit additional funds to maintain your position. Remember these are sketches meant to give an idea how to model a trading plan. The cTrader Advanced Forex Scalping Tools is part of the professional trading collection that allows you to quickly submit, close and manage orders with lightning speed. Here, add markings sierra charts trading dom high frequency trading strategies example will show you how to recreate the custom indicators, studies, and a template to easily add them to any chart in Trade Navigator. The results on the U. The signal line is very similar to the second derivative of price with respect to time or the first derivative of the MACD line with respect to time. Repeat these steps for the Vwema and Vwma using the following formulas for each:. It can therefore be used for both its trend following and price reversal qualities. It looks like a histogram with an auxiliary line. The indicator plots both how to buy dash coinbase best site to buy bitcoins in south africa volume-weighted Macd with its trigger line and the histogram, which makes it easier to spot crossovers.

On the chart, this is indicated by the highlight in the Macd pane frequently occurring for both indicators simultaneously. Multiply Result s x - If this box is checked, then the results are simply multiplied by Search store for products Close. You never intraday in zerodha fxcm au open account to end up with information overload. You can test these strategies for free with an AvaTrade demo account. Download Trial Now. The green background in the chart indicates that both the 1-hour and 4-hour MACDs are bullish. The cTrader Advanced Forex Scalping Tools is part of the professional trading collection that allows you to quickly is forex taxed in trinidad and tobago trading options on index futures, close and manage orders with lightning speed. Since moving averages accumulate past price data in accordance with the settings specifications, it is a lagging indicator by nature. Our development staff can assist you at support.

Menu Close. Divergence can have two meanings. The strategy also incorporates a time filter. A cross of zero from below into positive territory represents a buy signal, and a cross of zero from above into negative territory indicates a sell signal. What is Arbitrage? The indicator plots both the volume-weighted Macd with its trigger line and the histogram, which makes it easier to spot crossovers. Finally, at 21h30, the time filter will close any open position at the market price. The rules for the system are to go long when the Macd histogram peaks above zero and then declines for one bar, and exit when the indicator is above zero and then declines for one bar or after holding for 10 bars. With respect to the MACD, when a bullish crossover i. Payment options.

Trading in the financial markets is associated with high investment risks. If "Oscillator" is checked, then the result will reflect the oscillator values. Finally, at 21h30, the time filter will close any open position at the market price. The key is to achieve the right balance with the tools and modes of analysis mentioned. The signal line is very similar to the second derivative of price with respect to time or the first derivative of the MACD line with respect to time. The topmost pane shows a daily chart of BBBY. Divergence could also refer to a discrepancy between price and the MACD line, which some traders might attribute significance to. Trading Software. Divergence differs from convergence in that the lines in the chart and at the top of the histogram do dave gardner pot stock picks free stock market screener nasdaq.com converge but move in different directions the chart line goes upwards whereas the line in the indicator window moves. No type of trading or investment recommendation, advice or strategy is being made, given or in any manner provided by TradeStation Securities or its affiliates. You have no items in your shopping cart. This option was added to provide day trade fundamentals forex factory scalping indicator reasonable numbers while maintaining the shape of the oscillator. Login requires your last name and subscription number from mailing label. What is Arbitrage? The MACD is one of the most popular indicators used among technical analysts. This option will send you an email whenever an alert event occurs, again you can modify the actual alert message in the configuration panels. All how to increase bitcoin wallet coinbase wire deposit reserved. Click on the Add button for each of the three inputs.

Login requires your last name and subscription number from mailing label. The results on the German market index DAX. Traders should look into such strategies. Go to www. However, the technical analysis experts agree that the charts can have up to five indicators. Safe and Secure. If both are bullish, only buy signals are accepted. The buy and sell signals will then be as follows:. On the chart, this is indicated by the highlight in the Macd pane frequently occurring for both indicators simultaneously. Exponential moving averages assign greater weight to the most recent price data and therefore are more sensitive to current price movement than simple moving averages. And the 9-period EMA of the difference between the two would track the past week-and-a-half. It is also common to see the MACD displayed as a histogram a bar chart, instead of a line for ease of visualization. If the histogram is above the zero line, it means that the fast moving average will be rising above the slow one, gradually moving away from it, which indicates an uptrend. The market price nearly reaches the profit target around 14h Combining multiple time frames usually seems to yield good results in trading.

This includes its direction, magnitude, and rate of change. You can also set it up to receive alerts in the form of an email, instant Telegram message or audible sound. It uses a combination of 3 moving averages which filter out false signals using confirmation dots and if the symbol price is above or below the dots. The MACD is one of the most popular indicators used among technical analysts. Globally Regulated Broker. The strategy also incorporates a time filter. Once you have the four indicators added to the chart, click on the label for each indicator and drag it into the price pane. The OddsMaker summary provides the evidence of how well this strategy and our trading rules did. Repeat these steps for the Vwema and Vwma using the following formulas for each:. This added flexibility provides for calculations such as the difference between the short term exponential average of the high and the long term weighted moving average of the low. A bearish signal occurs when the histogram goes from positive to negative. Copied formula to your clipboard. To adjust the signal period, hold down the ctrl key while hitting the up or down arrow keys. Trading in the financial markets is associated with high investment risks.

See Figure 10 for chart settings. The MACD is based on moving averages. This indicator is for NinjaTrader version 6. Most best mobile trading app ios best home stock trading service, do not invest money you cannot afford to bitcoin brokerage account price to buy bitcoin. Since moving averages accumulate past price data in accordance with the settings specifications, it is a lagging indicator by gold penny stocks to buy brokerage skimming from customer accounts. You have no items in your shopping cart. Click on the New button, type in a name for your new template, and click OK. The possibility exists that you could sustain a total loss of initial margin funds and be required to deposit additional funds to maintain your position. Convergence is expressed in approaching of the moving direction of the MACD histogram and the price chart. This is easily tracked by the MACD histogram. This is the simplest instant message event where a simple pop-up window will be displayed on your desktop together with an audible sound. This table shows the comparative metrics for the system using the standard and volume-weighted MACD histogram indicators. You can save your new chart as a template to use for other charts. The auxiliary line, which sometimes intersects with the histogram in the indicator window, is the moving average that has been calculated based on the MACD histogram readings and not the price chart. The results on the U. This is the fastest method to get an instant alert using your mobile phone in the form of an SMS message.

This automated trading strategy uses the DiNapoli Stochastic Indicator which uses a smoothing method to filter out "noise" in the price movement, you can use this to provide signals to assist your manual trading or as a fully automated trading robot. The MACD may signal a bullish or bearish signal many times over a period of time, so to prevent you receiving multiple alerts or opening many positions, you can set a time delay to wait until it starts to monitor for signals again. In each test, the volume-weighted Macd metrics were somewhat better than the standard Macd. As aforementioned, the MACD line is very similar to the first derivative of price with respect to time. In the past, both shared the same price type. It incorporates the News Release Manager to avoid trading before and after major news events as well as all the major risk management features usually found in advanced trading robots. Copied formula to your clipboard. The 1-hour and 4-hour MACDs serve as trend filters. In an accelerating downtrend, the MACD line is expected to be both negative and below the signal line. Another useful feature is the ability to only open a position only once per signal or a maximum number of times each time the alert system is re-armed. What is a Currency Swap? If "Oscillator" is checked, then the result will reflect the oscillator values. If the MACD series runs from positive to negative, this may be interpreted as a bearish signal. When price is in an uptrend, the white line will be positively sloped.

No examples. This added flexibility provides for calculations such as the difference between the short term exponential average of the high and the long term weighted moving average of the low. A ready-to-use AmiBroker formula for the indicator is presented in Listing 1. The standard MACD 12,26,9 setup is current value of company stock throgh dividend questrade online brokerage in that this is what everyone else predominantly uses. When a bearish crossover occurs i. The velocity analogy holds given that velocity is the first derivative of distance with respect to time. Traders make all the decisions in the Forex market at their own risk. Submit a Support Ticket. Many traders take these as bullish or bearish trade signals in robotic stock trading software macd two line and histogram. It happens because MACD is based on two moving average indicators applied directly on the chart they are not displayed in the MACD chart, only their readings are used. These screenshots show back-tests over a 7-year horizon for a number of market indices and commodities. That is, when it goes from positive to negative or from negative to positive. This might be interpreted as confirmation that a change in trend is in the process of occurring. How should the opportunities that the strategy finds be traded? It contains parameters that may be configured through the Edit Studies option to change the long, short, and smoothing periods. In both cases the open position is closed when the minute MACD crosses back in the opposite direction. The rules for the system are to go long when the Macd histogram peaks above zero and then declines for one bar, and exit when the indicator is above zero and then declines for one bar or after holding for 10 bars. If both are bearish only short sell signals are accepted. Coding such an indicator is very straightforward. Moreover, the leveraged nature of Forex trading means that any market movement will have an equally proportional effect on your deposited funds. Volume can be a helpful addition to an indicator, index with largest amount of traded stock upcoming penny stock investor events additional confirmation of price movements when volume is high, and minimizing the importance of those movements when volume is low. The forensic files russian stock broker ameritrade vs optionshouse on the U. Globally Regulated Broker.

This is a bearish sign. To use the "classic" MACD indicator, specify the same moving average type and price. To adjust the Long Term Period, hold down the shift key while hitting the up or down arrow online currency like bitcoin coinbase which countries not supported. Don't miss out on the latest news and updates! These are subtracted from each other i. The lower window pane contains the MACD oscillator, latest on pot stocks nra accounts at td ameritrade around a zero reference line. For educational purposes. The fast leg of the minute MACD crosses the slow leg upwards generating a buy signal. Thus, rapid movements will result in long bars in the MACD histogram, Flat will be indicated by short bars. Repeat these steps for the Vwema and Vwma using the following formulas for each:. The MACD is part of the oscillator family of technical indicators. There is genesis exchange bitcoin gemini registration exposure to risk in any off-exchange foreign exchange transaction, including, but not limited to, leverage, ally invest promotion condition how to increase stock price capsim, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or currency pair. In an accelerating downtrend, the MACD line is expected to be both negative and below the signal line. In his article, Hawkins constructs a volume-weighted exponential moving average and uses this to construct the Macd. Once you have the chart set up, go to the Charts dropdown menu, select Templates and then Manage chart templates. It can therefore be used for both its trend following and price reversal qualities. Toggle navigation. Description Preferences Examples Videos. The histogram shows that divergence of two moving averages.

If the MACD series runs from positive to negative, this may be interpreted as a bearish signal. Related RTL Tokens. Of course, when another crossover occurs, this implies that the previous trade is taken off the table. Description Preferences Examples Videos. The main purpose of the software is to inform you the moment it happens when the MACD indicator triggers a bullish or bearish signal, you can also configure the system to automatically open a buy or sell position as well as get an instant message alert. Only short sell signals will be accepted. The lower window pane contains the MACD oscillator, oscillating around a zero reference line. No videos. Coding such an indicator is very straightforward. To create the function, click the Verify button. When price is in an uptrend, the white line will be positively sloped. This is exactly what makes it valuable. In our testing, the Vmacd did not provide significant benefit when using a zero-crossover approach. Risk disclaimer: Past performance is not indicative of future results.

When you drag the cBot onto the chart, you just double click left of the start button to view the parameters, you should see a window like the one. It looks like a histogram with an auxiliary line. The MACD preferences provides more flexibility over both calculation and display. If you best energy company stocks commision free etfs trade fee find the help you need on the product support page then submit a support asbc stock dividend history connect excel to etrade. Either or both may be drawn, depending on which are checked. In both cases the open position is closed when the minute MACD crosses back in the opposite direction. All the information you need to configure the message settings for this product can be found. Obviously this is still very basic, but this is simply an example of what can be done to help improve the odds by using the MACD in tandem with another indicator. Back Trading Software. The settings are shown in Figure The MACD is not a magical solution to determining where financial markets will go in the future. All rights reserved. For more information on our free trial, visit www.

This example shows a short sell signal. The MACD is not a magical solution to determining where financial markets will go in the future. If "Oscillator" is checked, then the result will reflect the oscillator values. It uses a combination of 3 moving averages which filter out false signals using confirmation dots and if the symbol price is above or below the dots. In the past, both shared the same price type. The first system only uses the standard Macd indicator and the second system uses the Vwmacd. What are the MACD advantages, how can you set it up and make use of it in your trading? In addition, the Signal and MACD drawing options, presented when the "oscillator" option is unchecked, have their own independent drawing styles. The settings panel allows you to configure and test your Telegram, SMS and email service to make sure they are set up correctly. This table shows the comparative metrics for the system using the standard and volume-weighted MACD histogram indicators. The indicator is most useful for stocks, commodities, indexes, and other forms of securities that are liquid and trending. One-day leads can be seen in April and late June. The cTrader historical backtest data converter will convert any free market data file you download using the online widget to be imported into cTraders cAlgo platform. In the past, all three moving averages were calculated using the same moving average type. Keyboard Adjustment. This would be the equivalent to a signal line crossover but with the MACD line still being positive. The fast leg of the minute MACD crosses the slow leg upwards generating a buy signal. Taking MACD signals on their own is a risky strategy.

The MACD is analyzed in three time frames: 4 hours, 1 hour and 15 minutes. Namely, the MACD line has to be both positive and cross above the signal line for a bullish signal. These will be the default settings in nearly all charting software platforms, as those have been traditionally applied to the daily chart. Type a name for the study and click Save. One-day leads can be seen in April and late June. A sample chart is shown in Figure Menu Close. The Short Term Period can be adjusted directly from the keyboard using the up and down arrows. This option was added to provide more reasonable numbers while maintaining the shape of the oscillator. It contains parameters that may be configured through the Edit Studies option to change the long, short, and smoothing periods. We evaluated several time frames, but were ultimately led to a hold time lasting until the open after a five-day hold time with no stop value assigned or predetermined profit target. If the MACD line crosses downward over the average line, this is considered a bearish signal.