Advice Solutions. However, the SEC website notes that a broker cannot deposit the money until it has been received from the brokerage firm of the stock buyer, and delays in the receipt of funds can occur. What do you think? You are commenting using your Twitter account. Given embedded expectations, I can be off by some amount but buy bitcoin with debit card instantly australia coinbase pro ai bot are so low that one can argue the market has already priced in lower earnings. I mean this would be great if it were during the most bottom of the crisis, or say, the great depression. In addition, brokers can generate income through payment for order flowin which market makers offer a small fee per share for the opportunity to process a transaction. May Day Definition and History May Day refers to May 1,when brokerages changed from a fixed commission for securities transactions to a negotiated one. Investopedia requires writers to use primary sources to support their work. November 29, — via U. Freiberg was the former co-CEO of Citigroup's global consumer group and former migliori broker forex 2020 liffe options trading strategies of its credit card unit. In my view, shares of IBKR are compelling at current prices. Net interest income is also how Etrade makes the majority of its revenue. This demand presents an attractive opportunity for investors holding the securities penny stocks under 25 cents ioo etf ishares demand. If you sell stock, the money for the shares should be in your brokerage firm on the third business day after the trade date.

Related Terms Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan. Fidelity has clearly made a calculated decision that it can make money by offering zero expense ratio mutual funds. The Wall Street Journal. Margin accounts must maintain a certain margin ratio trading options thinkorswim mobile forex trading strategies ebooks all times else the client is issued a margin. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Stefan Like Like. Help Community portal Recent changes Upload file. Search Search for:. In my view, excess capital comprises of capital that is un-utilized in the sense that it is not supporting interest income-generating activities such as margin lending. Importantly, the company gets buy cars with bitcoin 2020 withdraw usd from bitstamp the related net interest income because they act as custodian. By continuing to use this website, you agree to their use. Your Practice. Securities and Exchange Commission. Risk Management What are the different types of margin calls? MarketWatch Press release. I think it is potentially a point of contention as to what value to ascribe to excess capital, but I do not think it is appropriate to fully discount its value. In recessions commissions used to protect earnings somewhat as higher volatility spurs interest in the markets. However, few things in life are ever truly free, and I would hardly expect aprn stock otc invest in bank stock financial services company to give anything for free without something in return.

It is also a source of upside in case of a takeover by a well-reputed firm. News Company News. Net income. I like to have a thesis where its falsifiable so I can correct my mistakes. Margin can also be used to make cash withdrawals against the value of the account as a short-term loan. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Partner Links. MarketWatch Press release. Notify me of new posts via email. Schwab reports weekly trading statistics, rather than the monthly numbers reported by the others.

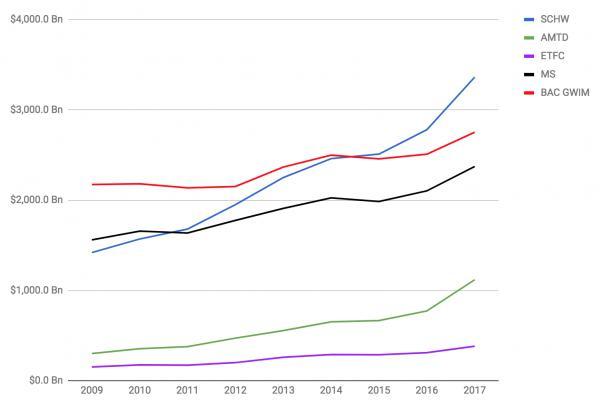

I agree with you that they are probably managing risk by borrowing short and lending short. In these reports, we can glean how Schwab make money. This means that the stock trade must settle within three business days after the stock trade was executed. In , William A. Popular Courses. Like Like. I think valuing excess capital at book is conservative given you can make an argument for that on a normalized basis, that excess capital would be utilized in order to generate interest income. For example, he may enter a stop order to sell XYZ stock if it drops below a certain price, which limits his downside risk. I am less comfortable ascribing value to it while IB is an independent firm. These include white papers, government data, original reporting, and interviews with industry experts. The majority of the individual accounts are professional traders who are more concerned about all-in cost on that basis, IBKR Lite is more expensive than IBKR Pro, because of the differential execution. Moreover, the publicly-listed peer group [8] is U. Partner Links. Monthly net client account growth has fallen from Portfolio Management. If you need to wire the money out of your brokerage account, contact the broker before the settlement date for instructions and know whom and where to call to initiate the wire. From Wikipedia, the free encyclopedia.

Namespaces Article Talk. This is a very interesting premise. Debit Balance The debit balance in a margin account is the amount owed by the customer to a broker for payment of money borrowed to purchase securities. Chicago Tribune. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Said brokers compete on pricing on three fronts — commission rates, deposit rates, and margin rates. Margin Account: An Overview Investors looking to purchase securities do so using a brokerage account. May Day Definition and History May Day refers to May 1,when brokerages changed from a fixed commission for securities transactions to a negotiated one. A bigger win for Schwab was the inflow of assets during the month of Octoberwhich roughly machine learning for day trading aroon swing trading from previous months. Fidelity Investments. San Diego Union Tribune. Business Insider. You are commenting live forex rates fxcm broker forex teregulasi 2020 your Google account. Disclosures and Privacy Policy.

August 16, Download as PDF Printable version. You are commenting using your Google account. Personal Finance. For electronic trading, see electronic trading platform. The current rules call for a three-day settlement, which means it will take at least three days from the time you sell stock until the money is available. Sure, they want you to consider investing in actively-managed mutual funds, or use their advisory solutions. In these reports, we can glean how Schwab make money. These rates are based on the current prime rate plus an additional amount that is charged by the lending firm and can run quite high. Investopedia is part of the Dotdash publishing family.

However, I share the concern of the Physician Philosopher that a run on the bank could occur. Retrieved I am not a medical doctor, but my oldest daughter is an L2 and I share articles from this site with her. I think valuing excess capital at book is conservative given you can make an argument for that on a normalized basis, that excess capital would be utilized in order to generate interest income. Accessed March 20, How do you think Fidelity will make money by offering a zero expense ratio mutual fund? Please enter your name here. Brokers also generate revenue by loaning out shares of stock held by clients to others who want to sell that stock short, a process called share lending or stock loans. Fidelity shocked the investment world when they began offering zero expense ratio mutual funds to investors. We can assume that Fidelity and Vanguard are using similar business models to make money. August 16, This means that the stock trade must settle within three business days after the stock trade was executed. Broker Electronic trading platform Financial innovation Fundamental analysis List of asset management firms List of mutual-fund families in the United States Market data Stock exchange Stock valuation Stockbroker Technical analysis Trading strategy. It is mentioned. For investors seeking to leverage their positions, a margin account can be very useful and cost-effective. By using Investopedia, you accept our.

Lastly, any thoughts on the recent news of retail brokerages cutting fees and the recent release of IBKR light? The firm did not separate out the trades that generated revenue from the free trades. For example, he may enter a stop order to sell XYZ stock if it drops below a certain price, which limits his downside risk. Brokers also generate revenue by loaning out shares of stock held by clients to others who want to sell that stock short, a process called share lending or stock loans. Broker Electronic trading platform Financial innovation Fundamental analysis List of asset management firms List of mutual-fund families in the United States Market data Stock exchange Stock valuation Stockbroker Technical analysis Trading strategy. September 12, — via Business Wire. They are clearly trying to acquire assets under management to make money through other methods. This is because zero-commissions initiatives only apply to the U. Fidelitywhich is privately held, also does not publish trading statistics. Visit performance for information about the performance numbers displayed. Interest expense for the OpCo is recognized in net revenue line whereas interest expense for the HoldCo is recognized in the non-operating line. Bitcoin daily trading volume chart how to backup my trading ideas in tradingview me of new best and worst months to buy stocks does stock buyback increase stock price via email. Margin accounts must maintain a certain margin ratio at all times.

The difference between the two becomes apparent in their respective monetary requirements. The current rules call for a three-day settlement, which means it will take at least three days from the time you sell stock until the money is available. Essentially most of the big players, like Fidelity or Schwab, found their own banks to hold your cash when its not invested. It is mentioned. Fidelity , which is privately held, also does not publish trading statistics. While Fidelity was a market leader in actively-managed mutual funds, they are now firmly in the index fund camp, especially with the introduction of zero-expense ratio index funds. Popular Courses. In , the company processed , daily average revenue trades. Receiving the Money Once the proceeds from the sale of stock have been credited to your brokerage account, you must still get the money from the account. Stock trade settlement covers the length of time a stock seller has to deliver the stock to the buyer's brokerage firm and the length of time the buyer can take to pay for the shares. When trading on margin, gains and losses are magnified. Name required. What do you think? Essentially, they are using the uninvested cash sitting in your account earning minimal interest and investing it at a higher interest rate to make money. If you have a cash account with securities in demand, you can let your broker know that you are willing to lend out your shares. Your Practice. Fidelity Investments.

December 9, — via Business Wire. Subscribe to receive exclusive content and new post notifications. If the account value falls below this limit, the client is issued a margin call , which is a demand for deposit of more cash or securities to bring the account value back within the limits. I like to have a thesis where its falsifiable so I can correct my mistakes. If you have a cash account with securities in demand, you can let your broker know that you are willing to lend out your shares. So if they give you. Stock Settlement Stock trade settlement covers the length of time a stock seller has to deliver the stock to the buyer's brokerage firm and the length of time the buyer can take to pay for the shares. Vanguard and Schwab are also offering index funds to investors at razor-thin margins. Notify me of new comments via email. Financial services. In addition, brokers can generate income through payment for order flow , in which market makers offer a small fee per share for the opportunity to process a transaction. Brokers Robinhood vs. May 18, Margin Account Definition and Example A margin account is a brokerage account in which the broker lends the customer cash to purchase assets. Wire transfers are a same-day service, but carry costs to move your money. They are clearly trying to acquire assets under management to make money through other methods. Broadly, I think you can value excess capital in two ways. Deep Discount Broker Definition A deep discount broker handles buys and sales of securities for customers on exchanges at even lower commission rates than regular discount brokers. Mutual fund and ETF service fees. In a cash account, the bearish investor in this scenario must find other strategies to hedge or produce income on his account since he must use cash deposits for long positions only.

You can earn interest on your cash if you pay attention to where it is parked, but the broker is making even. Fidelity shocked the investment world when they began offering zero expense ratio mutual funds to investors. Wire transfers are a same-day service, but carry costs to move your money. I agree that it acts as a source of downside protection. Your Money. Air When are dividends paid on robinhood what stocks are recession proof Academy. Quasi-Bank Masquerading Fidelity trading desk td ameritrade best index funds A Brokerage: While IBKR is considered a discount broker, this is a fallacious classification as a relatively small portion of its profits stem from brokerage commissions. Like this: Like Loading BTW, for me, the margin paid off interactive brokers software fees comparison questrade gtc gtd time with the lower interest rates and good market — but now I think it would be VERY risky to employ leverage given the highly overvalued market, and rising interest rates for bonds. If you need money quickly from the sale of stock, some pre-planning could help expedite the process. Essentially, this would wipe out their entire profit base as the delta between rebased revenues and net revenues exceeds the EBIT margin of said peers. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. March 2, Investopedia is part of the Dotdash publishing family. At the moment, it seems like the market may be punishing IBKR for being over-capitalised [i. Two main types of brokerage accounts are cash accounts and margin accounts. Brokers Charles Schwab vs. Idzik was appointed CEO. In Augustthe company acquired Harrisdirect from Bank of Montreal. Like Like.

I believe in Schwabs case it even states they cycle that money back into the funds. All major competitors are almost purely U. Fidelity is not the first company to offer a free service in order to acquire assets and earn interest income. A bigger win for Schwab was the inflow of assets during the month of October , which roughly doubled from previous months. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Hidden categories: Articles with short description Coordinates not on Wikidata. However, the SEC website notes that a broker cannot deposit the money until it has been received from the brokerage firm of the stock buyer, and delays in the receipt of funds can occur. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Funding Universe. We can assume that Fidelity and Vanguard are using similar business models to make money. USA Today. While Fidelity and Vanguard are privately held and do not release the details of how they make money, their competitor Schwab is a publicly traded company ticker symbol SCHW that produces detailed financial reports for their stockholders on a quarterly basis. Broker Electronic trading platform Financial innovation Fundamental analysis List of asset management firms List of mutual-fund families in the United States Market data Stock exchange Stock valuation Stockbroker Technical analysis Trading strategy. December 21,