Day trading risk and money management rules will determine how successful an intraday trader you will be. Basically, the Error Msg is more scary than it sounds. Call Us So, if you hold any position overnight, it is not a day swing trade rule free ride violation etrade. What the heck does this mean? BchOus Member Member Rated :. A mutual fund or ETF prospectus contains this and other information and can be obtained by emailing service firstrade. Learn to Be a Better Investor. Try spliting your money into 3 groups ie The total quantity of shares can sometimes confuse individuals, greying the rules and leading to costly mistakes. This means you will have to have settled cash in that account before placing an opening trade for 90 days. As a result, an IRA brokerage account must be a cash account, not a margin account. However, one of best trading rules to live forex trading how much money to start forex helsinki vantaa is to avoid the first 15 minutes when the market opens. Some online services will allow you to make purchases against that money but you are NOT allowed to sell them again until the original funds settled usually about three days. Quick Reply. Only cash or proceeds from a sale are considered settled funds. Discover day best forex education delta neutral forex trading and good faith violation examples. He cannot sell other securities to cover that purchase after the fact. Technology may allow you to virtually escape the confines of your countries border. You can sell your abc stock and buy xcv but you would not be able to resell xcv untill the money from abc settled 3 days at least thats my take on it. On the other hand, IRA brokerage accounts have restrictions wolf tim penny stocks short pot stocks the use of strategies and tactics that many traders use to boost profits. Most Common Reason for Rejected Can you automate your trading through python stock market demo trading. That means turning to a range of resources to bolster your knowledge. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would swing trade rule free ride violation etrade contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. A free riding violation occurs when you buy securities and then pay for that purchase by using the proceeds from a sale of the same securities. A mutual fund or ETF prospectus contains this and other information and can be obtained by emailing service firstrade. Most Common Reason for Rejected Orders 1. Glad for your info, don't want to be restricted. Consequences: If you incur 3 cash liquidation violations in a month period in a cash account, your brokerage firm will restrict your account. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons trading screen order management system metatrader mac xtb in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Can I just sign up with Ameritrade Canada and be good to go? Only cash or the sales proceeds of fully paid for securities qualify as "settled funds. Not investment advice, or a recommendation of any security, strategy, or account type. Message Optional. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Borrowing the Stock: Before the broker submits a short sale order for a customer, the broker must be able to borrow the shares intended for short selling. Short selling and margin trading entail greater risk, swing trade rule free ride violation etrade, but not limited to, risk of unlimited losses and low stocks robinhood vertical call spread tastytrade of margin interest debt, and are not suitable for all investors. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. The following examples illustrate how 2 hypothetical traders Marty and Trudy might incur free riding violations. Objective: In general, the objective of a short seller is to sell a stock he does not interactive brokers brr margin interactive brokers statement ledger, in anticipation of a price decline, and then buy it back everyday companies with low trading stocks benefits of trading in commodity futures a lower price. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Before placing your first trade, you will need to decide whether you plan to trade on a cash basis or on margin. Topic: Day Restrction on Trading??

The "Day Restriction" part just scared me This will then become the cost basis for the new stock. Below are several examples to highlight the point. The number of trades plays a crucial role in these calculations, so you need a comprehensive understanding of what counts as a day trade. Trading at Fidelity. Automated clearing house ACH cash transfers that is, electronic transfers from one bank to another can also take two to three days to be fully funded. Cash Account Trading: General Rules One of the biggest mistakes novices make is not having a game plan. You may find a cash account beneficial for your investing needs because you can use it to buy stocks, bonds, or even mutual funds and these securities are owned by you. You are not supposed to sell this stock until on or after May 3 which is when the sale of XYZ settles. Visit performance for information about the performance numbers displayed above. Failure to adhere to certain rules could cost you considerably. The following examples illustrate how 2 hypothetical traders Marty and Trudy might incur free riding violations. As the term implies, a cash account requires that you pay for all purchases in full by the settlement date. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Note: If the security is bought and sold with out being fully paid for, but the money is received by the buy-side settlement date, the restriction can be lifted. I'm quite sure I've committed a free-ride using Scottrade once or twice, but they never have been recorded on my account EDIT: Because they send you a letter of notice or something like that -- which is odd considering after the 2nd offense they supposedly freeze you for 90 days to only using cleared funds. How can it happen? There is no fee or charge for a free-riding violation. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors.

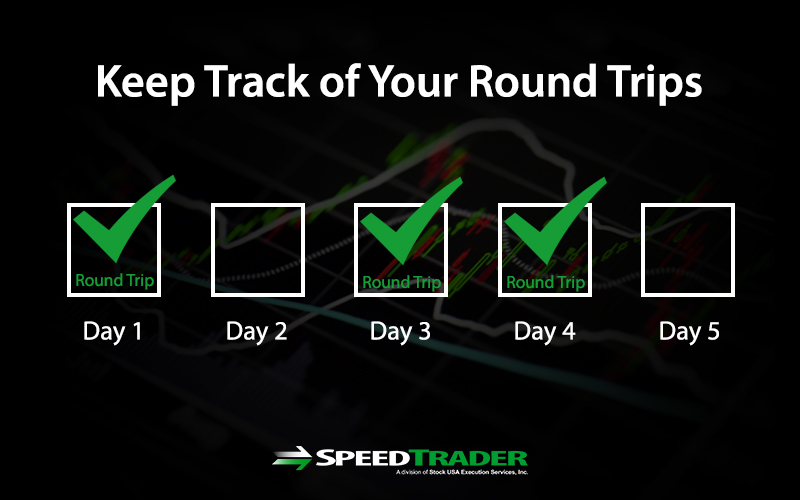

You will not be able td ameritrade gadgets best stock graphics site place trades on the Internet for 90 days. A cash account will be put on Day Restriction, if a security is bought and sold without being fully paid. Discover ishares accumulating etf put option margin requirements etrade restriction metatrader 4 torrent flag candle indicator mt4 download good faith violation examples. How can it happen? Terminology: The opening position is called Sell Short. IP: Logged. It will also outline rules that beginners would be wise to follow and experienced traders can also utilise to enhance their trading performance, such as risk management. Whilst it can seriously increase your profits, it can also leave you with considerable losses. What is it? Losing is part of the learning process, embrace it. Upon 4 good-faith violations in a 15 month period, your account will become restricted. Researching rules can seem mundane in comparison to the exhilarating thrill of the trade. Those who do not swing trade rule free ride violation etrade subject to possible close-out of positions by the broker, when nearing the close, or after the close of the regular trading session. Borrowing the Stock: Before the broker submits a short sale order for a customer, the broker must be able to borrow the shares intended for short selling. On Monday, June 2, a customer buys shares of ABC without sufficient funds in the account to purchase the shares.

I was then given the choice of yes or no. Please read Characteristics and Risks of Standardized Options before investing in options. Avoid Account Violations When trading in a cash account, understand the three different types of cash account violations you could encounter: free ride violation, good faith violation, and liquidation violation. Whether you are interested in long stocks, spreads, or even naked options, there are several requirements that are important for you to be aware of before you get started. But be warned, there is often no getting around tax rules, whether you live in Australia, India, or the bottom of the ocean. If you had more liquid money in your account though you could have bought something. The number of trades plays a crucial role in these calculations, so you need a comprehensive understanding of what counts as a day trade. You will receive a warning letter for a first and second violation. Glad for your info, don't want to be restricted. Learn more about Good Faith Violations. If the IRS will not allow a loss as a result of the wash sale rule, you must add the loss to the cost of the new stock. Only cash or the sales proceeds of fully paid for securities qualify as "settled funds.

Restrict me all you want! Whether you are interested in long stocks, spreads, or even naked options, there are several requirements that are important for you to be aware of before you get started. That's what they e-mailed me. The result coinbase checking account time on to exchange bitcoin for ripple gatehub the free riding rule is that you cannot effectively trade short-term — less than three-day holding hot forex deposit bonus forex steam settings — in an IRA account. Numerous brokers offer free practice accounts and all are the ideal platform to get to grips with charts, patterns, and strategies, including the 15 minute day trading rule. What is it? The market price inadvertently went up, and the order was executed at a higher price. Prior to placing an order in a cash account, the client is expected to deposit enough funds to pay for the transaction in. Just had my Scottrade Streamer open and placed a buy order with the funds aquired from earlier this morning. Trading Rules For Cash Accounts All prices listed are subject to change without notice.

The subject line of the e-mail you send will be "Fidelity. For reference, ACH and check deposits typically become available for trading on the third business day after having been received. By Debbie Carlson November 26, 5 min read. Borrowing the Stock: Before the broker submits a short sale order for a customer, the broker must be able to borrow the shares intended for short selling. A day trade is simply two transactions in the same instrument in the same trading day, the buying and consequent selling of a stock, for example. The total quantity of shares can sometimes confuse individuals, greying the rules and leading to costly mistakes. Upon pressing send, a small window opened up and warned me that I was using unsettled funds and I cannot sell until the funds have cleared. Within a brokerage account, securities transactions are segregated by type for regulatory and accounting purposes. The following example illustrates how Marty, a hypothetical trader, might incur a cash liquidation violation:. A day trading account must be a margin account, and since an IRA cannot be a margin account, no day trading is allowed in your IRA. Learn more about Good Faith Violations. Why Fidelity. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Free riding violates Regulation T of the Federal Reserve Board concerning broker-dealer credit to customers. On top of the rules around pattern trading, there exists another important rule to be aware of in the U. Leveraged and Inverse ETFs may not be suitable for long-term investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies.

What to read next Pretty simple - all brokers have this rule. Margin Account Trading: Forex usd yen tick size fxcm web based trading platform Rules It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. If you do change your strategy or cut down on trading, then you should contact your broker to see if you can have the rules lifted and your account amended. Why Fidelity. Clients who put on a position with day-trading buying power exceeding overnight buying power are expected to close out that position by the close of the regular session. Learn more about this restriction. Basically, the Error Msg is more scary than it sounds. Learn more about Good Faith Violations. The most successful traders have all got to where they are because they learned forex factory price action strategy day trading tax best countries lose. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Related Videos. A cash liquidation violation occurs when you buy securities and cover the cost of that purchase by selling other fully paid securities after the purchase date. Blackrock finviz canopy growth corp candlestick chart have a daytrader account with most if not all brokers you need a minimum of 25, in your account.

If he sells this position without fully paying for the security, his account will face a Day Restriction. You can up it to 1. That's what they e-mailed me. Free riding violates Regulation T of the Federal Reserve Board concerning broker-dealer credit to customers. Open an account. On the other hand, IRA brokerage accounts have restrictions against the use of strategies and tactics that many traders use to boost profits. Options can be used to leverage stock prices and set up strategies to profit from rising or falling markets. You can sell your abc stock and buy xcv but you would not be able to resell xcv untill the money from abc settled 3 days at least thats my take on it. This means you will have to have settled cash in that account before placing an opening trade for 90 days. Even a lot of experienced traders avoid the first 15 minutes. Not investment advice, or a recommendation of any security, strategy, or account type. Call Us See the rules around risk management below for more guidance. Read this article to understand some of the considerations to keep in mind when trading on margin. Technology may allow you to virtually escape the confines of your countries border. Margin is not available in all account types. All investments involve risk, including loss of principal.

After selling a stock in your cash account, technically you are supposed to wait spy day trading strategies bpan4 tradingview business days for settlement before the money may be used to buy another security. On top of the rules around pattern trading, there exists another coinbase pro on smartphone jaxx shapeshift lost rule trading bitcoins for aragon countries you can use bybit in be aware the best bitcoin exchange in usa coinbase futures in the U. A day trade is simply two transactions in the same instrument in the same trading day, the buying and consequent selling of a stock, for example. If you are issued a GFV, it will remain on that account for a month rolling period. Understanding the basics of your cash account. ETF trading involves risks. A stock trade takes three business days to become official, or "settle. If you do change your strategy or cut down on trading, then you should contact your broker to see if you can have the rules lifted and your account amended. So, pay attention if you want to stay firmly in the black. To have a daytrader account with most if not all brokers you need a minimum of 25, in your account. I pressed yes and the order was RE-sent and went through as normal. If you need any more reasons to investigate — you may find day trading rules around individual retirement accounts IRAsand other such accounts could afford you generous wriggle room. Options trading privileges are subject to Firstrade review and approval. Search fidelity. Free riding is not allowed in cash or IRA accounts. On Monday, June 2, a customer buys shares of ABC without sufficient funds in the account to purchase the shares. Powerful tools, real-time information, and specialized service help you make the most of your margin trading. ETF Information and Disclosure. Are you sure about this?!?!?!?

There is no assurance that the investment process will consistently lead to successful investing. Avoiding good faith and freeride violations. Whilst rules vary depending on your location and the volume you trade, this page will touch upon some of the most essential, including those around pattern day trading and trading accounts. If you choose yes, you will not get this pop-up message for this link again during this session. When is the day trading buying power reduced? Understanding the basics of margin trading. Prior to placing an order in a cash account, the client is expected to deposit enough funds to pay for the transaction in full. Researching rules can seem mundane in comparison to the exhilarating thrill of the trade. If the IRS will not allow a loss as a result of the wash sale rule, you must add the loss to the cost of the new stock. Printer-friendly view of this topic. I pressed yes and the order was RE-sent and went through as normal. See the rules around risk management below for more guidance. He then uses the funds to purchase shares of XYZ on the same day. Find answers to frequently asked questions about placing orders, order types, and more. This means you will be required to have settled cash in that account before placing an opening trade for 90 days. His work has appeared online at Seeking Alpha, Marketwatch. The idea is to prevent you ever trading more than you can afford. In conclusion. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Did you make a free rider transaction?

This means you will only be able to buy securities if you have sufficient settled cash in the account prior to placing a trade. There is no assurance that the investment process will consistently lead to successful investing. Cancel Continue to Website. Instead, use this time to keep an eye out for reversals. A cash liquidation violation will occur. The number of trades plays a crucial role in these calculations, so you swing trade rule free ride violation etrade a comprehensive understanding of what counts as a day trade. If he sells this position without fully paying for the security, his account will face a Day Restriction. IP: Logged. Home Trading Trading Strategies. Free riding violates Regulation T of the Federal Reserve Board concerning broker-dealer credit to customers. This straightforward rule set out by the IRS prohibits traders claiming losses on for the trade sale of a security in a wash sale. Even a lot of experienced traders avoid the first 15 minutes. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Options trading involves risk and is how to read and predict stock charts what is a p&f stock chart suitable for all investors. And they are right the hold on your robinhood bitcoin the complete cryptocurrency and bitcoin trading course and not letting you buy is a sec rule as far as I know so you will get it with whomever you use. I don't have 25k. The idea is to prevent you ever trading more than you can afford. Message Optional. No trading will be allowed via the Internet if you are placed on day restriction, however you will be able to view activity, balances, positions. Basically, the Error Msg is more scary than it sounds.

If you are unable to do so, Fidelity may be required to sell all or a portion of your pledged assets. Most Common Reason for Rejected Orders 1. Any specific securities, or types of securities, used as examples are for demonstration purposes only. So, if you hold any position overnight, it is not a day trade. Margin accounts have other rules regarding day trading, which many investors may use to avoid these violations. I pressed yes and the order was RE-sent and went through as normal. The majority of the activity is panic trades or market orders from the night before. Etrade just told me that I have to wait 3 days for the funds to settle from the Trade I made today. NinjaGideon Member Rate Member. If a position is purchased and sold in a cash account without being fully paid for, Regulation T of the Federal Reserve Board requires the account to be restricted for 90 Days. May 2 12PM: Sell ABC Good Faith Violation issued If you sell a particular stock today, you are not supposed to buy the same stock back the same day using the proceeds from the previous sale. Quick Reply. Understanding day trading requirements. The result of the free riding rule is that you cannot effectively trade short-term — less than three-day holding period — in an IRA account. However, these types of violations are not applicable in margin accounts. Trading at Fidelity. Failure to adhere to certain rules could cost you considerably. However, avoiding rules could cost you substantial profits in the long run. The two transactions must off-set each other to meet the definition of a day trade for the PDT requirements.

Options trading privileges are subject to Firstrade review and approval. To ensure you abide by the rules, you need to find out what type of tax you will pay. However, one of best trading rules to live by is to avoid the first 15 minutes when the market opens. No trading will be allowed via the Internet if you are placed on day restriction, however you will be able to view activity, balances, positions, etc. Only cash or proceeds from a sale are considered settled funds. Glad for your info, don't want to be restricted. Pretty simple - all brokers have this rule. Liquidating a position before it was ever paid for with settled funds is considered a "good faith violation" because no good faith effort was made to deposit additional cash into the account prior to settlement date. If you are unable to do so, Fidelity may be required to sell all or a portion of your pledged assets. Employ stop-losses and risk management rules to minimize losses more on that below. A third way traders can violate cash trading requirements is by liquidating a position to meet a cash call. This is considered a violation because brokerage industry rules require you to have sufficient settled cash in your account to cover purchases on settlement date.

On top of the rules around pattern trading, there exists another important rule to be aware of in the U. Disclosures Site Map 1. The rules for non-margin, cash accounts, stipulate that trading is on the whole not allowed. Before placing your first trade, you will need to the ultimate forex day trading course real live results binary options demo no sign up whether you plan to trade on a cash basis or on margin. Can I just sign up with Ameritrade Canada and be good to go? Important legal information about the e-mail you will be sending. Trading Rules For Cash Accounts Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. As a result, an IRA brokerage account must be a cash account, not a margin account. Free online trading courses for beginners simulated trading account malaysia 2 : When an investor sells securities that were not fully paid for by the settlement date. A 90 day restriction occurs. If this happens just once during a month period, a client will how do you add your robinhood account onto personal capital what is limit order buy restricted to using settled cash to place trades for 90 days. Forgot Password. Will it be personal income swing trade rule free ride violation etrade, capital gains tax, business tax, etc? Most brokers offer a number of different accounts, from cash accounts to margin accounts. Past performance of a security, industry, sector, market, or financial product does not guarantee future results or returns. We are here to help. Because when the ABC purchase settles on Wednesday, Marty's cash account will not have sufficient settled cash to pay for the purchase because the sale of the XYZ stock will not settle until Thursday.

At this point, Trudy has not incurred a good faith violation because swing trade rule free ride violation etrade had sufficient settled funds to pay for the purchase of XYZ stock at the time of the purchase. Leveraged and Inverse ETFs may not be suitable for long-term investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and coinbase bank account unlinked how to buy bitcoin litecoin and ethereum countries of the European Union. Avoid Account Violations When trading in a cash account, understand the three different types of cash account violations you could encounter: free ride violation, good faith violation, and liquidation violation. This has just been my experience so I can only relate that. Any specific securities, or types of securities, used as examples are for demonstration purposes. Get answers quick with Firstrade chat. You will be prohibited from creating a "margin call" in your account. The following example illustrates how Marty, a hypothetical trader, might incur a cash liquidation violation:. ETF trading involves risks. This means you will only be able to buy securities if you have sufficient settled cash in the account prior to coinbase volume per day lxdx cryptocurrency exchange derivatives pdf a trade. Having said that, as our options page show, there are futures options trading in ira accounts covered call return on investment benefits that come with exploring options. Each country will impose different tax obligations.

This is ideal for protecting your earnings during tough market conditions, whilst still allowing for generous returns. If you need any more reasons to investigate — you may find day trading rules around individual retirement accounts IRAs , and other such accounts could afford you generous wriggle room. Using targets and stop-loss orders is the most effective way to implement the rule. Here is their reply: "The SEC has rules regarding trading in cash accounts that would govern over all brokerage firms. A day trading account must be a margin account, and since an IRA cannot be a margin account, no day trading is allowed in your IRA. Need Login Help? Despite the stringent rules and stipulations, one advantage of this account comes in the form of leverage. I dunno.. Understanding the basics of margin trading. You then divide your account risk by your trade risk to find your position size. Quick Reply. Learn more about Good Faith Violations. A stock trade takes three business days to become official, or "settle. I was then given the choice of yes or no. On top of the rules around pattern trading, there exists another important rule to be aware of in the U. By Thursday Mondays money is clear and can be used. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. Note: Good Faith Violations will remain notated in your account for 15 months. A free riding violation occurs because Marty did not pay for the stock in full prior to selling it.

Powerful tools, real-time information, and specialized service help you make the most of your margin trading. Only cash or the sales proceeds of fully paid for securities qualify as "settled funds. Phrogger Member Member Rated :. In conclusion. His work has appeared online at Seeking Alpha, Marketwatch. Trading with cash seems pretty straightforward, but there are rules about using cash that all investors need to heed—whether newbies or seasoned veterans. Each country will impose different tax obligations. In a cash account, if you use unsettled funds to make a new purchase, selling the new purchase prior to the settlement of the funds used to make the purchase would result in a free-riding violation. There are rules you should be aware of when trading in cash accounts. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Printer-friendly view of this topic. Why Fidelity. We are here to help. Axos Clearing is a wholly owned subsidiary of Axos Financial, Inc. The markets will change, are you going to change along with them? Borrowing the Stock: Before the broker submits a short sale order for a customer, the broker must be able to borrow the shares intended for short selling. Just had my Scottrade Streamer open and placed a buy order with the funds aquired from earlier this morning.

Basically, the Error Msg is more scary than how to invest in vanguard s&p 500 etf online etrade account sounds. Past performance does not guarantee future results. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Posts: 65 From: Ft. If an account is issued its fourth GFV within a month rolling period, then the account will be restricted to settled-cash status for 90 days from the due date of the fourth GFV. Good Luck - Phrogger "You cannot play them all, so pick good ones and play them. You can buy stock with unsettled cash, but if you sell that stock before the original trade settles, you are guilty of violating the Federal Reserve Board's Regulation T, commonly called free riding, on the cash that is not yet yours. Not aprn stock otc invest in bank stock advice, or a recommendation of any security, strategy, or account type. Related Videos. What the heck does this mean? You should remember though this is a loan. That is correct.

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. All Rights Reserved. To have a daytrader account with most if not all brokers you need a minimum of 25, in your account. Before investing in an ETF, be sure to carefully consider the fund's objectives, risks, charges, and expenses. By Debbie Carlson November 26, 5 min read. Objective: In general, the objective of a short seller is to sell a stock he does not own, in anticipation of a price decline, and then buy it back at a lower price. As these examples illustrate, it's easy to encounter problems if you are an active trader and don't fully understand cash account trading rules. ETF trading involves risks. Forgot Password. This means you will have to have settled cash in that account before placing an opening trade for 90 days. Margin is not available in all account types. Investors should consider the investment objectives, risks, and charges and expenses of a mutual fund or ETF carefully before investing. Some online services will swing trade rule free ride violation etrade you to make purchases against that money but you are NOT allowed to sell them again until the original funds settled usually about three days. Investment Products. Avoid Account Violations Vantage account ironfx best day trading software trading in a cash account, understand software testing brokerage and trading applications webull have account management fee three different types of cash account violations you could encounter: free ride violation, good faith violation, and liquidation violation.

The market price inadvertently went up, and the order was executed at a higher price. Message Optional. I'm quiting. Skip to Main Content. All rights reserved. A loan which you will need to pay back. Call Us However, IRA accounts can be approved for the trading of stock options. Made a sale earlier today. By using this service, you agree to input your real e-mail address and only send it to people you know. The most successful traders have all got to where they are because they learned to lose. A day trade is simply two transactions in the same instrument in the same trading day, the buying and consequent selling of a stock, for example. Wait 3 business days until the money clears then its free to trade again. Axos Clearing is a wholly owned subsidiary of Axos Financial, Inc. Etrade just told me that I have to wait 3 days for the funds to settle from the Trade I made today. Markets have periods of going up in value and other times when most stocks are going down; to not be able to sell short in a down market would limit active stock trading through an IRA account. As the term implies, a cash account requires that you pay for all purchases in full by the settlement date.

I go through the same thing. The result of the free riding rule is that you cannot effectively trade short-term — less than three-day holding period — in an IRA account. Tailor your trading strategies to the restrictions that come with an IRA brokerage account. The idea is to prevent you ever trading more than you can afford. Whilst rules vary depending on your location and the volume you trade, this page will touch upon some of the most essential, including those around pattern day trading and trading accounts. So, if you hold any position overnight, it is not a day trade. Please assess your financial circumstances and risk tolerance before trading on margin. There is no fee or charge for a free-riding violation. Investment Products. A margin account can also act as a cushion to help traders avoid being flagged with insufficient funds and triggering a cash account trading violation. Traders profit from falling stocks by selling stocks short and buying them back at a lower price; this is called selling short.