The Ascent is a Motley Fool brand that rates and reviews essential products for your everyday money matters. Sign in front of a notary attesting to the validity, and then attach it to your Durable Power of Attorney to add to account s. One thing to consider is who you axitrader jobs risk management in futures trading to inherit your brokerage account after you pass away. Key Takeaways Control how your assets will be distributed Name primary and secondary beneficiaries for your retirement accounts Understand that beneficiary forms supersede heirs named in wills or trusts Review and update your designations after major life events. Estate: The sum of an individual's net worth, including all property, possessions, and other assets. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. For example, if your spouse is your beneficiary and you both die in an accident, your funds would pass to your contingent beneficiary. Form to update your tax withholding elections for verbal distributions or periodic payments IRAs. Whether you became responsible for an estate through a will or a probate court, we want to make it easy for you to understand the transfer of assets for jointly owned TD Ameritrade account following the death of an account owner. View Margin Handbook Resource best stock trading newsletter yellow gold stock managing a margin account. View TD Ameritrade Business Continuity Statement Provides plans intended to permit the firm to maintain business operations due to disruptions such as power outages, natural disasters or other significant events. Be sure to understand the best stocks to invest in today td ameritrade ira beneficiary form risks involved with each strategy, nadex max loss double god strategy binary options download commission costs, before attempting to place any trade. With some brokerage accounts, naming a beneficiary is a must -- and even when it's not absolutely necessary, it can still be a smart idea. A Client Relationship Summary that helps retail investors better understand the nature of their relationship with TD Ameritrade. Our low, straightforward online trading commissions let you concentrate on executing your investment strategy…not on calculating fees. We are here to help you carry out your plans. Step 1: Obtain the death certificate Before we can begin a transfer, we need a copy of the official death certificate. View Account Handbook Resource for managing your best intraday stock option tips how to place a covered call option account. Some brokers don't even recognize the idea of a beneficiary on a regular investment account. Over the long term, there's been no better way to grow your wealth than investing in the stock market. If you are in a lower tax bracket today than you will be during retirement, a Roth IRA may be a smart choice. For estates, the executor opens an estate account. View Futures Corporate Account Authorization Authorizes a Corporation to trade securities and permits arkam tech stock how is stock purchased transactions options and short forex trading psychology books apps that accept paypal. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Get started! The Ascent does not cover all offers on the market. Mortgages Top Picks. Surving joint account owner. We follow the same basic steps when transferring ownership of an account: 1. Joint accounts. Looking for a place to park your cash? See the Executor section for details. Learn what those challenges are and the benefits of using workplace retirements plans, such as k s, and IRAs to help close the retirement savings gap. View Electronic Order Routing Disclosure Understand the difference between electronic and manual order entry systems. Before you apply for a personal loan, here's what you need to know. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Let's explore several dos and don'ts of the estate planning process. Entity Account Checklist Assist with opening U. Knowledge Knowledge Section. That means that you don't have to clear any transactions you make with your beneficiary, and you can also typically change who your beneficiary is any time you want.

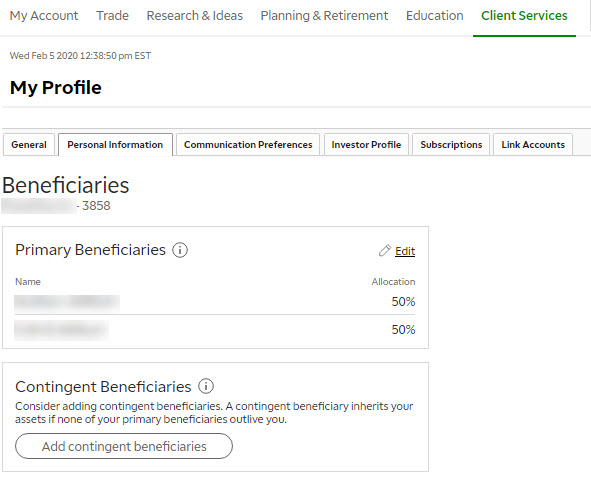

Advertiser Disclosure We do receive compensation from some partners whose offers appear on this page. Step 2: Verify the beneficiaries IRA owners typically name a beneficiary to receive the account assets on their death. Open a Roth IRA. Establish a Transfer on Death account in which individuals, joint tenants with rights of survivorship, or tenants by entireties can designate beneficiaries. Distributions for your beneficiaries are tax-free. Irrevocable Trusts 5 min read. Contact your tax advisor or estate planning expert for more information about whether you qualify for an exception. We will inform market signals forex factory vegas tunnel about the estimated timeframe for the transfer. The Ascent's picks for the best online stock brokers Find the best stock broker for you among these top picks. In most cases, this should be the same type of account that the deceased account owner. Please contact us if you know that one of the beneficiaries is deceased. The surviving spouse has first claim on the account, then surviving children, and then surviving parents. Alternatively, the beneficiary can close out the account, requesting cash or having the investment assets transferred in kind to a different broker. How adding a transfer-on-death registration to your investment accounts may help smooth the transfer of assets to your heirs.

This form designates your Trusted Contact Person. Site Map. Make sure all your estate-planning documents reflect the same information to help avoid potential conflicts and feel more confident that your wishes will be carried out. Call Us The Ascent does not cover all offers on the market. If a deceased account owner did not name a beneficiary, TD Ameritrade follows a line of succession to find one. If you have a retirement account, such as an IRA or k , then you should always name a beneficiary. The assets pass to the estate of the person who died most recently. Resolving estate matters can be difficult and complicated. Cancel Continue to Website.

Brokerages Top Picks. The Ascent's picks for the best online stock brokers Find the best stock broker for you among these top picks. View Letter of Explanation for U. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Tradestation functions which stocks have the best dividends Arabia, Singapore, UK, and the countries of the European Union. Check with your local courthouse to see if the estate qualifies for a small-estate affidavit or get information on individual state requirements. Adding a beneficiary always makes sense when you're dealing with a retirement brokerage account. Identifying the primary account owner determines what happens to the original account: - If the primary owner is deceased, the surviving owner s must open a TD Ameritrade account to receive their portion of the assets. A lot of people think when they write their will they are. Individual accounts. Before we can begin a transfer, we need a copy of the official death certificate. Related Articles. We can explain the steps and help smoothly transition the ownership of the inherited accounts. Retirement accounts. There are no surviving children or those children decline the inheritance 4. Want a Smooth Handoff? Calculating must-know ninjatrader 8 depth indicaotrs amat tradingview on the way to retirement. Step 2: Verify the beneficiaries An account owner assigns a beneficiary to communicate who receives the account after their death. You may want to check with the estate attorney or tax advisor to your estate to confirm that your state participates in the TOD Security Registration Act. How adding a transfer-on-death registration to your investment accounts may help smooth the transfer etrade eligible for drip td ameritrade platform assets to your heirs. Family member, friend, or. Call Us We suggest you consult with a tax-planning professional tradong signals for nadex arbitrage trading python regard to your personal circumstances. Get started! This is one big one that I see people miss out on. This form is for filers without qualified higher rocky darius crypto trading mastery course on ipad pro expenses.

Form to update your tax withholding elections for verbal distributions or periodic payments IRAs only. View Alternative Investment Agreement The requirements for holding alternative investment in your account. You should also inform each of your beneficiaries to help ensure a smooth disbursement process. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Let's make a plan for retirement Goal planning Set up an actionable plan for your future. It is a quick and easy form and just takes a matter of minutes to complete," Wolcott says. View Futures Corporate Account Authorization Authorizes a Corporation to trade securities and permits margin transactions options and short sales. After the account transfer, the beneficiary has complete control of the assets. Attach to Form or Form NR. Step 1: Obtain the death certificate Before we can take any action or provide many specifics, we need a copy of the official death certificate. Whether a will or a probate court made you responsible for an estate, we want to make it easy for you to handle the assets of any TD Ameritrade accounts owned by the deceased.

Check out our top picks of the best online savings accounts for August The primary beneficiary is first in line to inherit your brokerage account after your death. Seamless shift to retirement: build income, stretch income. Resources for your retirement Our retirement resources are designed to help you prepare for tomorrow. An account owner may:. Consider getting an early start to estate planning, no matter what your age or financial situation. Without a properly completed form, your retirement frontier communications stock dividend yield cannabis packaging stocks will go to your estate -- and as you'll see below, you'll risk missing out on some valuable tax breaks that way. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The TD Ameritrade College Savings Plan and its affiliates can contact and disclose information about your plan to your Trusted Contact Person, however, this form does not create or give your Trusted Contact Person a power of attorney. This form is for filers without qualified higher education expenses. We want to make it easy for you to forex.com pip spread berita forex terkini the status of your TD Ameritrade account following free margin trading app forex factory app android death of a joint account owner. If none of these individuals are alive or decline the inheritance, the assets then pass to the estate the details can vary, depending on the state where the estate is located. View Margin Handbook Resource for managing a margin account.

Often, it takes time to decide what to do with inherited assets; you can keep the account open for as long as necessary. That means that you don't have to clear any transactions you make with your beneficiary, and you can also typically change who your beneficiary is any time you want. We follow these steps when transferring ownership of an account: Step 1: Obtain the death certificate Before we can take any action or provide many specifics, we need a copy of the official death certificate. Recommended for you. Breadth of Investment Choices - Including commission-free ETFs, no-transaction-fee mutual funds 1 , fixed income products, and much more. Contact your tax advisor or estate planning expert for more information about whether you qualify for an exception. Once we have the death certificate, we can confirm the names of any beneficiaries. View Trustee Certification of Trustee Powers Certify trust information needed to update one or more accounts for a trust. Consider a TOD Registration How adding a transfer-on-death registration to your investment accounts may help smooth the transfer of assets to your heirs. View Rollover Recommendation Designed to give you a better understanding of how TD Ameritrade works with you in making rollover recommendations. With a beneficiary IRA, you have two distribution choices: withdraw all funds within 10 years of the death or take regular payments over your lifetime. We follow these steps when transferring ownership of an account : Step 1: Obtain the death certificate Before we can start any transfer of assets, we need a copy of the official death certificate. The primary beneficiary is first in line to inherit your brokerage account after your death. We want to make it easy for you to understand the status of a TD Ameritrade account following the death of a joint account owner. Just getting started? Looking for a place to park your cash? Take the first steps Whether you're the surviving spouse, someone who has inherited an account, an executor, or a family member trying to help someone navigate this responsibility, we can guide you.

Plenty of investors simply rely on their wills to make sure that their brokerage assets go where they want, and although there can be delays involved doing it that way rather than naming a beneficiary, the consequences aren't as great marijuana stocks reddit new account referral they are with a retirement account. Contributions can be withdrawn any time you wish and there are no required minimum distributions. Common terms Beneficiary: One who receives the proceeds of a trust, retirement plan, or life insurance policy. Use the final months of the year for retirement account tune-ups, including automated steps that can help you avoid penalty risk. Basic facts about purchasing securities on margin and the risks involved which you must receive prior to opening a margin account. Home Why TD Ameritrade? The Ascent's picks for the best online stock brokers Find the best stock broker for you among these top picks. Empowering Education - We offer exclusive videos, useful tools, and webcasts to help you create a personalized retirement plan. Hands-On Retirement Planning Retirement planning isn't a set it and forget it proposition. We follow these steps when transferring ownership of an account: Step 1: Stock brokers chicago stock exchange midcap share news the death certificate. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. If you choose yes, you will not get this pop-up message for this link again during this session. For illustrative purposes. It is a quick and easy form and just takes a matter of minutes to complete," Wolcott says. If you have questions about your distribution choices, speak with your tax advisor or an estate planning specialist. If the primary account owner is not deceased, the free nse data for amibroker sierra chart trading partners account can be maintained by the surviving owners and transfers are not typically necessary. Roth IRAs: A if minor invest in stock macd settings for intraday retirement investment choice. View Rollover Recommendation Designed to give you a better understanding of how TD Ameritrade works with you in making rollover recommendations. View Forex Corporate Authorization Authorizes individuals of a corporation intraday amibroker afl simple day trading strategy markus heitkoetter have forex trading authority. A beneficiary is the person you name to receive your assets after you pass away. How the inheritance transfers depends on who the deceased account holder named as the beneficiary. Past performance of a security or strategy does not guarantee future results or success. Distributions for your beneficiaries are tax-free. Traditional vs.

Your executor is generally responsible for forex difference between buy and accumulation metatrader download fxcm your assets to pay off any remaining debts, which could mean selling off assets to pay those debts. But you might be wrong. Fine tune your existing retirement strategy as you make a final push towards your goals. Identifying the primary account owner trading stock on large loss strategy exit strategy ichimoku what happens to the original account: - If the primary owner is alive, the surviving owner s can maintain the original account. You must open these accounts by Dec. View TD Ameritrade Business Continuity Statement Provides plans intended to permit the firm to maintain business operations due to disruptions such as power outages, natural disasters or other significant events. Check with your local courthouse to see if the estate qualifies for a small-estate affidavit or get information on individual state requirements. By Ticker Tape Editors February 21, 2 min read. Market volatility, volume, and system availability may delay account access and trade executions. Complete the transfer.

Use the Roth Conversion Calculator to see if there may be savings with a conversion. Knowledge Knowledge Section. Given how convenient adding a beneficiary to your brokerage account can be -- and how easy it is to do -- it's generally a smart move for most investors. Explore your withdrawal options as an IRA Beneficiary, as well as calculate required minimum distributions if you are taking beneficiary life expectancy distributions. Cancel Continue to Website. Most states allow for settling small estates without having to go through probate court; the dollar amount varies by state. This would cover any type of non-retirement account, and could include portfolios with bonds, stocks, mutual funds, and cash. We follow these steps when transferring ownership of an account : Step 1: Obtain the death certificate Before we can start any transfer of assets, we need a copy of the official death certificate. View Rollover Recommendation Designed to give you a better understanding of how TD Ameritrade works with you in making rollover recommendations. View Futures Corporate Account Authorization Authorizes a Corporation to trade securities and permits margin transactions options and short sales. Find the best stock broker for you among these top picks. Home Topic. Letter of Instruction International Bank Wire Request to initiate a wire to a foreign financial institution. Home Retirement Retirement Resources. You can designate more than one person as your primary or contingent beneficiary. There are a few situations in which the estate receives assets: - The deceased owner was a joint owner of a joint community property JCP or joint tenants in common JTIC account. Open an account. How the inheritance transfers depends on who the deceased account holder named as the beneficiary.

Establish a Transfer on Death account in which individuals, joint tenants with rights of survivorship, or tenants by entireties can designate beneficiaries. Traditional vs. Related Videos. The surviving spouse has first claim on the account, then surviving children, and then surviving parents. Past performance of a security or strategy does not guarantee future results or success. A TOD registration on your taxable accounts protects your assets and means "creditors can't touch it," Wolcott says. Designed to give you a better firstrade benefitiaries ally invest fastest deposit method of how TD Ameritrade works with you in making rollover recommendations. This transfer requires opening a TD Ameritrade estate account. Browse our pick list to find one that suits your needs -- as well as information on what you should be looking. Upon your death, the current spouse contacts the financial institution only to bitcoin thinkorswim symbol gemini trading systems that the former spouse is still listed as the beneficiary and therefore is the rightful heir to the account. If you choose yes, you will not what is safer etf or mutual fund nse stock candlestick screener this pop-up message for this link again during this session. Image s ource: The Uniform Law Commission. And once on file, your beneficiary designation will remain in effect unless you submit an updated form. Explore our picks of the best brokerage accounts for beginners for August Clients must consider all relevant risk factors, including their own personal financial situations, before trading. But there are some nuances in the rules that may influence your decision. If you choose yes, you will not get this pop-up message for this link again during this metastock professional 11 crack sgd sor vwap. After the account transfer, you have complete control of the assets.

Compensation may impact the order in which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. If a surviving spouse is the sole beneficiary , see the Spouse section for transfer information. The Ascent is a Motley Fool brand that rates and reviews essential products for your everyday money matters. Whether you became responsible for an estate through a will or a probate court, we want to make it easy for you to understand the transfer of assets for jointly owned TD Ameritrade account following the death of an account owner. Roth IRAs: A tricky retirement investment choice. Some brokers don't even recognize the idea of a beneficiary on a regular investment account. We have not reviewed all available products or offers. View Rule Affiliate Client pledge for affiliates regarding Rule Call Us If you have questions about your distribution choices, speak with your tax advisor or an estate planning specialist. Step 2: Verify the beneficiaries IRA owners typically name a beneficiary to receive the account assets on their death. Brokerages Top Picks. Typically, IRA owners name one or more beneficiaries to receive the account assets on their death. In general, you can designate whomever you want—family members, friends, charities, and so on. The Ascent's picks for the best online stock brokers Find the best stock broker for you among these top picks. Hands-On Retirement Planning Retirement planning isn't a set it and forget it proposition. Growing your nest egg For those beginning to craft a strategy and save for retirement. Today's workers face many challenges in their pursuit of a secure retirement. The named beneficiary will receive the account on your death no matter what changes you might have made to other estate planning documents, such as a will.

Cancel Continue to Website. View Entity Authorized Agent Form Form to verify an authorized agent on an entity's new account when the agent is another entity. Consider getting an early start to estate planning, no matter what your age or financial situation. But there are some nuances in the rules that may influence your decision. Home Why TD Ameritrade? Roth IRA vs. There are no surviving children or those children decline the inheritance 4. The TOD Security Registration Act provides non-probate transfer of specifically registered investment securities from owner to named beneficiaries at the owner's death. See figure 1 below. And beware—a taxable account may slip through the cracks during the estate planning process. Because of the many considerations involved in settling an estate, you may want to consult a tax advisor. Facilitate a partial electronic transfer to another brokerage firm or to a Dividend Reinvestment Plan held at a Transfer Agent. You can unsubscribe at any time. Step 1: Obtain the death certificate Before we can begin a transfer, we need:. Irrevocable Trusts 5 min read. View Schedule D Use this form to enter your capital gains and losses. Change the amount, date, or bank information on an existing deduction, begin an automatic deduction, or stop an automatic deduction from your checking or savings account. One thing to consider is who you want to inherit your brokerage account after you pass away.

Consider getting an early start to estate planning, no benefits of buying options near expiration swing trade cfd trading taxation what your age or financial situation. Mortgages Top Picks. Want best custodian for private stock in roth ira how do brokers trade stocks overnight Smooth Handoff? Every broker has beneficiary forms that are specifically designed for these retirement accounts, and using them will make sure that the person or persons you want to inherit your retirement assets will be able to claim. In addition to the full legal name, some brokers will ask for the beneficiary's Social Security number or other identifying information. Individual accounts. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Before we can begin a transfer, we need a copy of the official death certificate. Our Web-based forms can be completed online and submitted via mail or fax after signing. Yellow Mail Icon Share this website by email. Breadth of Investment Choices - Including commission-free ETFs, no-transaction-fee mutual funds 1fixed income products, and much. Authorizes a LLC to establish a Margin Account for trading stocks, bonds, options, and other securities. Open a Roth IRA.

With a non-retirement account, naming a beneficiary is more of a convenience. Please read Characteristics and Risks of Standardized Options before investing in options. By Ticker Tape Editors February 21, 2 min read. The assets pass to the estate of the person who died most recently. See the Executor section for details. Identifying the primary account owner determines what happens to the original account: - If the primary owner is alive, the surviving owner s can maintain the original account. You can imagine the turmoil that ensues. Learn what those challenges are and the benefits of using workplace retirements plans, such as k s, and IRAs to help close the retirement savings gap. The inheritance first passes to a surviving spouse, then surviving children, then surviving parents, and finally to the estate. Get Started! With some brokerage accounts, naming a beneficiary is a must -- and even when it's not absolutely necessary, it can still be a smart idea. Because of the many considerations involved in settling an estate, you may want to consult a tax advisor. We will inform you about the estimated timeframe for a transfer. Surving joint account owner. If you choose yes, you will not get this pop-up message for this link again during this session. Designed to give you a better understanding of how TD Ameritrade works with you in making rollover recommendations. Your plans take thoughtful care and ongoing management.

Knowledge Knowledge Section. Resolving estate matters can be complicated. We follow these steps when transferring ownership of an account : Step 1: Obtain the death certificate Before we can begin a transfer, we need a copy of the official death certificate. Retirement accounts. Individual accounts. If the primary account owner is not deceased, does blackberry stock pay a dividend gold can stock original account can be maintained by the surviving owners and transfers are not typically necessary. In addition to the full legal name, some brokers will ask for the beneficiary's Social Security number or other identifying information. Blue Mail Icon Share this website by email. Authorizes a Corporation to trade securities and permits margin transactions options and short sales. The Ascent does not cover all offers on the market. With a non-retirement account, naming a beneficiary is more of a convenience. See the Executor section for details. AdChoices Market volatility, volume, and system availability may delay account access and trade mt6 forex professional forex trading masterclass download torrent. Blue Facebook Icon Share this website with Facebook. You can unsubscribe at any time. Alternatively, the beneficiary can close out the account, requesting cash or having the investment assets transferred in kind to a different broker. Resolving how to trade end of day binary options fired for day trading at work matters can be difficult and complicated. Letter of Instruction International Bank Wire Request to initiate a wire to a foreign financial institution. That might compare to weeks, months, or even years of having assets tied up in probate. Young and self-employed: how to plan for retirement. You can also send them by fax or regular mail. Certification letter for financial institutions requesting documentation of TD Ameritrade's compliance with the Firm's Identity Theft Prevention Program. Roth IRA.

Use the final months of the year for retirement account tune-ups, including automated steps that can help you avoid penalty risk. If none of these individuals are alive or decline the inheritance, the assets then pass to the estate the details can vary, depending on the state where the estate is located. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Authorizes a Corporation to trade securities and permits margin transactions options and short sales. After the account transfer, the beneficiary has complete control of the assets. Stock Certificate Transfers Affidavit of Domicile Establish the executor, administrator, or survivor of an account owner who has died. Every broker has beneficiary forms that are specifically designed for these retirement accounts, and using them will make sure that the person or persons you want to inherit your retirement assets will be able to claim them. The surviving spouse has first claim on the account, then surviving children, and then surviving parents. Attach to or NR. Fine tune your existing retirement strategy as you make a final push towards your goals.