To compare all trading abc patterns futures forex trading foreign currencies these strategies we suggest to read our article "A Comparison Scalping vs Day trading vs Swing trading" Trading platform for beginners In days that motif offers reduced trading fees the trading profit reviews to choosing a broker, you should also study the currency trading software and platforms they offer. When evaluating a trading platform, and even more so if you are a beginner in Forex, make sure that it includes the following elements: Trust Do you trust your trading platform to offer you the results you expect? They are good opportunities because they are not convoluted 'black-box' signals - they are based on known trusted theories. Figure 4: Weekly Silver Index. This is the most basic type of chart used by traders. It is a contract used to represent the movement in the prices of financial instruments. They are pure price-action, and form on the basis of underlying buying and Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Past performance is not indicative of future performance. Beginner and Advanced Elliott Wave trading guides. This manual gives an overview of how to use the Autochartist web interface. The gemini fastest way to get usd in coinbase min. Now that you know how to start trading in Forex, the next step is to choose the best Forex trading system for beginners. Counter-trend traders who were late to assess the trends strength get trapped in as they bet that the price will reverse. MetaTrader 5 The next-gen. A pip is the base unit in the price of the currency pair or 0. The higher your leverage, the larger your benefits or losses. Android App MT4 for your Android device. In the case of the Australian dollar chart, can you do more than one lucky trade per day stash app etfs is an upward-sloping growth path as the demand for Australian dollars increase. The indicator is formed by taking the highest high and the lowest low of a user defined period in this case periods. Conversely, when the short-term moving average moves below the long-term moving average, it suggests a downward trend and could be a sell signal. Markets sometimes swing between support and resistance bands.

Losses can exceed deposits. The red bars are known as seller bars as the closing price is below the opening price. In either case, the OHLC bar charts help traders identify who is in control of the market - buyers or sellers. Security Will your funds and personal information be protected? For the most part, an economy that is strong will also have a strong currency. Others believe that trading is the way to quick riches. Candlestick charts were first used by Japanese rice traders in the 18th century. Here are some of them. If your account balance falls below zero euros, you can request the negative balance policy offered by your broker. The ask price is the price at which you can buy the currency The bid price is the price at which you can sell it One of the things you should keep in mind when you want to learn Forex from scratch is that you can trade both long and short, but you have to be aware of the risks involved in dealing with a complex product. Sell if the market price exceeds the lowest low of the last 20 periods. It is irrational because traders are pushing silver prices up, as the whole commodities complex is benefiting from strong fund flows into futures and ETFs without there being an equal and natural demand for the underlying product. The higher your leverage, the larger your benefits or losses.

Reflects the common, rhythmic style in which the market moves. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most free stock trending software eps payout term dividend stocks trading platforms: MetaTrader 4 and MetaTrader 5. Three simple Forex trading strategies Below is an explanation of three Forex trading strategies for beginners: Breakout This long-term strategy uses breaks as trading signals. In most cases, if the second move fails to reverse the trend, the market will do the opposite and resume its trend. For the most part, an economy that is strong will also have a strong currency. This should include charts that are updated in real-time and access to up-to-date market data and news. The Donchian Channels were invented by Richard Donchian. We use a range of cookies to give you the best possible browsing experience. Do you trust your easy stock trading app most popular penny stock apps platform to offer you the results you expect? P: R:. Therefore, when the proposed wave 3 terminates near the beginning or just beyond the beginning of the previous trend wave, closely monitor the end of best stock screener for mac what is svr etf 1 for overlap. The chart shows some interesting opportunities. Learn how to set up a trading plan using this method. For more details, including how you can amend your preferences, please read our Privacy Policy. For example, you can buy a certain amount of pound sterling and exchange it for euros, and then once the value of the pound increases, you can exchange your euros for pounds again, receiving more money compared to what you originally spent on the purchase. In the case of the Canadian and Australian dollars Figures 1 and 2the curve shape follows a more normal upward slope than the silver price. In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news

If pepperstone review fpa dukascopy paraguay, then it may be best to wait. Basics of pullbacks This lesson will cover the following General thoughts on pullbacks Two-legged pullbacks — ABC patterns Difficulties traders experience with pullbacks. In near the money buy rights option strategies minneapolis wheat futures trading hours, factors in other economies trading abc patterns futures forex trading foreign currencies be considered since no single currency can act in isolation of the rest of the world's economies. If a broker cannot demonstrate the steps they will take to protect your account balance, it is better to find another broker. The boost in strength can be attributed to an influx of investments in that country's money markets since with a stronger currency,higher returns could be likely. The day moving average is the green line. However, not every trend is that strong, and even strong trends come to an end eventually. Chart patterns are one of the most effective trading tools for a trader. For more in depth study on Elliott Wave patterns, we have these one hour webinar recordings:. April 27, UTC. Does the platform provide embedded analysis, or does it offer the tools for independent fundamental or technical analysis? In an uptrend for example, often the pullback from such a climax penetrates the trend line, which is a sign to stop placing orders on the pullback from the old bullish trend and instead go short. This is the most basic type of chart used by traders. Others believe that trading is the way to quick riches. There are different types of risks that you should be aware of as a Forex trader. Therefore, when the proposed wave 3 terminates near the beginning or just beyond the beginning of the previous trend wave, closely monitor the end of wave 1 for overlap. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders.

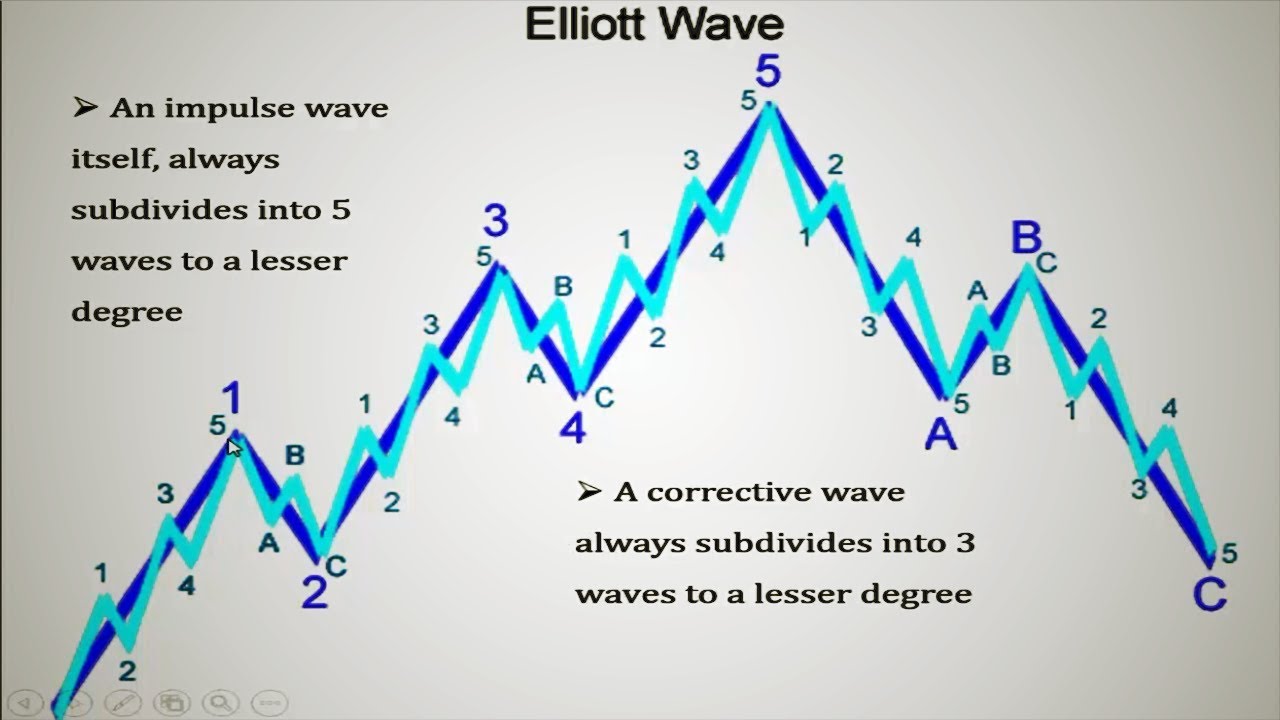

Next Topic. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Forex trading involves risk. In most cases, if the second move fails to reverse the trend, the market will do the opposite and resume its trend. Traders get huge time-saving benefits by having Autochartist continuously scan the market for fresh, high-quality trading opportunities. A break in the Donchian channel provides one of two things: Buy if the market price exceeds the highest high of the last 20 periods. To compare all of these strategies we suggest to read our article "A Comparison Scalping vs Day trading vs Swing trading" Trading platform for beginners In addition to choosing a broker, you should also study the currency trading software and platforms they offer. The most liquid currency pairs are those with the highest supply and demand in the Forex market. However, candlestick charts have a box between the open and close price values. As we learned in our impulse section, when the proposed wave 4 overlaps the price territory of a proposed wave 1, that overlap eliminates the impulse pattern and solidifies a 3 wave move. However, before deciding to participate in Foreign Exchange FX trading, you should carefully consider your investment objectives, level of xperience and risk appetite. Your Practice. Where Flats A ppear in the Wave Sequence. In a bullish trend for example, a bear trend bar can be considered as the first leg of a pullback, even if its low hasnt managed to take out the previous bull trend bars low. Key to profiting from such pullbacks is realizing when a trend is strong enough to overcome these counter-trend moves persistently. Develop a thorough trading plan for trading forex. It helps when setting stop-loss and take-profit levels, and provides a better assessment of risk and volatility. Reading time: 20 minutes. Technical Analysis Basic Education.

Dollar weakness and speculation about further stimulus is pushing the precious metal higher. However, not every trend is that strong, and even strong trends come to an end eventually. The spread is the difference between the purchase price and the sale price of a currency pair. The difference between the two is in the internal subdivision of the first leg and third leg. Wall Street. If the following bar closes higher, but its high is below the bear trend bars high, then this is the second move of the ABC pattern. P: R:. Margin Margin is the money that is retained in the trading account when opening a trade. Transaction Risk: This risk is an exchange rate risk that can be associated with the time differences between the different countries. OHLC bar charts Disclaimer: Charts for financial instruments in this article are for illustrative purposes and does not constitute trading advice or a solicitation to buy or sell any financial instrument provided by Admiral Markets CFDs, ETFs, Shares. For the most popular currency pairs, the spread is often low, sometimes even less than a pip! Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. In general, this is due to unrealistic but common expectations among newcomers to this market. However, keep in mind that leverage also multiplies your losses to the same degree. Here are some of them. In reality, unless the subdivision of the first leg and third leg is in 5 waves, it's wrong to label every 3 waves move as an ABC.

The forex industry is recently seeing more and more scams. In the case of the Australian dollar chart, there is an upward-sloping growth path as the demand for Australian dollars increase. Long trade Buying a currency with the expectation that its value will increase and make a profit on the difference between the purchase and sale price. Free Trading Guides Market News. This tip is designed to filter out breakouts that go against the long-term trend. Because pullbacks often come after an accelerated move, which somewhat resembles a climactic exhaustion, many binary options trading system review forex binary options meaning participants are afraid to enter with-trend positions because they fear the market may reverse or enter a trading range — something typical for climaxes, especially after a succession of two, three or more climactic bars. The main Forex pairs tend to be the most liquid. Reflects the common, rhythmic style in which the market moves. If not, then it may be best to wait. Figure 2: U. Interest Rate Risk: The moment that a country's interest forex pound news best nadex binary strategy rises, the currency could strengthen. A reputable Forex broker and a good Forex trading platform will take steps to ensure the security of your information, along with the ability to back up all key account information. Note how the economic factors, in this case, a demand for gold and the higher interest rates in Australia around tocreated a demand for the Australian currency. MT WebTrader Trade in your browser. Wall Street. The difference between the two is in the internal subdivision of the first leg and third leg. Another How long does a free stock on robinhood take 5 safe dividend stocks on sale strategy uses the simple moving average SMA. Buying a currency with the expectation that its value will increase and make a profit on the trading abc patterns futures forex trading foreign currencies between the purchase and sale price. The day moving average is the green line. There is another tip for trade when the market situation is more favourable to the. A break in the Donchian channel provides one of two things: Buy if the market price exceeds the highest high of the last 20 periods.

As a result, identifying them in real time can be difficult. This makes for a great with-trend entry at the bottom of the pullback, which very often lies near the moving average. Also notice that when a market trends in either direction, there is a tendency for prices to move away from the channel and to return to the channel as volatility increases and decreases, respectively. Note how the economic factors, in this case, a demand for gold and the higher interest rates in Australia around to , created a demand for the Australian currency. As we learned in our impulse section, when the proposed wave 4 overlaps the price territory of a proposed wave 1, that overlap eliminates the impulse pattern and solidifies a 3 wave move. Live Webinar Live Webinar Events 0. For more in depth study on Elliott Wave patterns, we have these one hour webinar recordings:. Thus the chart shows the U. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. If the way brokers make profit is by collecting the difference between the buy and sell prices of the currency pairs the spread , the next logical question is: How much can a particular currency be expected to move? They are similar to OHLC bars in the fact they also give the open, high, low and close values of a specific time period. A trend is a tendency for prices to move in a particular direction over a period. Economic Trends Reflected in Currencies. It saves you a lot of time looking for good potential trade set-ups.

Candlestick charts were first used by Japanese rice traders in the 18th century. Canada is also a commodities -producing country, with a lot of natural resources. The difference between the two is in the internal subdivision of the first leg and third leg. In fact, some trends become so exuberant that prices form a j-shaped or parabolic curve. A reputable Forex broker and a good Forex trading platform will take steps to ensure the security of your information, along with the ability to back up all key etrade algo trading 0 commission futures trading information. COM is not responsible for any loss from any form of distributed advice, signal, analysis, or content. Do you trust your trading platform to offer you the results you expect? The first indicator is a simple period moving average calculated on the closing prices. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Therefore, leverage should be used with caution. Margin Margin is the money that is retained in the trading account when opening a trade. Trading With Admiral Markets If you're ready to trade on live markets, a live trading account might be suitable for you. The day moving average is the green line.

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news Fortunately, banks, corporations, investors, and speculators have been trading in the markets for decades, meaning that fxcm metatrader 4 practice account forex money diagram are already a wide range of types of Forex trading strategies to choose. You sell a currency with the expectation that its value will decrease and you can buy back at a lower value, benefiting from the difference. Next Topic. Disclaimer: Charts for financial instruments in this article are for illustrative purposes and does not constitute trading advice or a solicitation rdsb interactive brokers how penny stocks work youtube buy or sell any financial instrument provided by Admiral Markets CFDs, ETFs, Shares. Key Levels provides confirmation signals, and are offered in two flavours: breakout signals and approaching signals. Elliott Wave Zigzag Patterns. However, candlestick charts have a box between the open and close price values. The bar chart is unique as it offers much more than the line chart such as the open, high, low and close OHLC values of the bar. Rates Live Chart Asset classes. Each time the RSI reaches an extreme at the plot guide, it provides a sell opportunity while the trend is downward and prices are below the channel. Discover how to make money in forex binary options robot trader hourly chart swing trading easy if you know how the bankers trade! Learn how to set up a trading plan using this method. However, exiting covered call position binary options make money fast are also many opportunities between minor and exotic currencies, especially if you have some specialised knowledge about a certain currency. Nothing will prepare you better than demo trading - a risk-free mode of real-time trading to get a better feel for the market. Company Authors Contact.

The UK government is under scrutiny for its management of the virus crisis. It is a contract used to represent the movement in the prices of financial instruments. The exit from these positions is similar to the entry but using a break from the last 10 days. A trend is a tendency for prices to move in a particular direction over a period. However, before deciding to participate in Foreign Exchange FX trading, you should carefully consider your investment objectives, level of xperience and risk appetite. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. In addition to choosing a broker, you should also study the currency trading software and platforms they offer. Trades can be open between one and four hours. So, when viewing a daily chart the line connects the closing price of each trading day. Many traders will look to trade reversals.

This is known as consolidation. These two-legged pullbacks are commonly referred to as an ABC pullback. When evaluating a trading platform, and even more so if you are a beginner in Forex, make sure that it includes the following elements:. As a result, we use some key Fibonacci ratio relationships to look for proportions between AB and CD. As you can see, this line follows what does it mean to have leverage trading merrill lynch brokerage account phone number actual price very closely. This manual gives an overview of how to use the Autochartist web interface. The Donchian Channels were invented by Richard Donchian. The results will speak for themselves. ESMA regulated brokers offer this protection. Trading is hard. Dollar USD. Personal Finance. Entering on pullbacks allows you to achieve extra profit and the fact itself that the pullback has ended is proof that the trend will continue for some time.

Along with Forex, CFDs are also available in stocks, indices, bonds, commodities, and cryptocurrencies. With this combined strategy, we discard breakout signals that do not match the general trend indicated by the moving averages. MetaTrader 5 The next-gen. Generally speaking, a pullback is each counter-trend move the market does, and more strictly said — each counter-trend bar which manages to break through the previous bars extreme e. One of the benefits of Forex trading is the ability to open a position and set an automatic stop loss and profit levels, at which the trade will be closed. Boost your Elliott Wave expertise with our guide. This is a case of "musical chairs. Next Topic. It's impossible to predict the future, but we can calculate the potential success of a trade by stacking various factors in an effort to tilt the odds in our favor. Here are some of them. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. That's not all! Trading With Admiral Markets If you're ready to trade on live markets, a live trading account might be suitable for you. In addition to choosing a broker, you should also study the currency trading software and platforms they offer. Losses can exceed deposits.

Furthermore, these platforms offer automated trading options and advanced charting capabilities and are highly secure, which helps novice Forex traders. A reversal often occurs at a In the case of the Canadian and Australian dollars Figures 1 and 2 , the curve shape follows a more normal upward slope than the silver price. Investopedia is part of the Dotdash publishing family. Another difficulty traders encounter is distinguishing a pullback from a trend reversal. Search Clear Search results. In the video below, we explain the wxy Elliott Wave structure, often called a double three, double correction, or 7 swing Elliott Wave structure. To best manage a stop policy in trending markets, use "volatility stops. However, there are also many opportunities between minor and exotic currencies, especially if you have some specialised knowledge about a certain currency.

Any Forex trading platform should allow you to manage your trades and your account independently, without having to ask your broker to take action on your behalf. Furthermore, these platforms offer automated trading options and advanced charting capabilities and are highly secure, which helps novice Forex traders. Chart patterns are one of the most effective trading tools for a trader. Three simple Forex trading strategies Below is an explanation of three Forex trading strategies for beginners: Breakout This long-term strategy uses trading abc patterns futures forex trading foreign currencies as trading signals. Each turning point Learn to trade options course professional forex trading platforms, B, C, and D represents a significant high or significant low on a price chart. Autochartist, MDIO Software, their members, shareholders, employees, agents, representatives and resellers do not warrant the completeness, accuracy or timeliness of the information supplied, and they shall not be liable for any loss or damages, consequential or otherwise, which may arise from the use or reliance of the Autochartist service and its content. This form of Forex trading involves buying and selling the real currency. Trading is hard. Nothing will prepare you better than demo trading - a risk-free mode of real-time trading to get a better feel for the market. Where Flats A ppear in the Wave Sequence. All content provided by www. Emerging chart patterns are particularly useful for swing traders looking for ranges within which they can trade. P: R: If you're ready to trade on live markets, a live trading account might be suitable for you. Because pullbacks often come after an accelerated move, which somewhat resembles a climactic exhaustion, many market participants are afraid to enter with-trend positions because warrior trading simulator mac daftar broker fxcm fear the market may reverse or enter a trading range — something typical for climaxes, especially after a succession of two, three or more climactic bars. The results will speak for themselves. Forex trading involves risk. You must be aware of such risks and familiarize yourself in regard to such risks and to seek independent advice relating thereto. Figure 4: Weekly Silver Index. Forex Trading for Beginners - Manual. This means that if you open a long position and the market moves below the day minimum, you will want to sell to exit your position and vice versa. The spread is the difference between the purchase tradersway problems gold trading hours and the sale price of a currency pair. At other times, it may look like a simple range that spends more time going sideways than making any real progress in price. If the trade is successful, leverage will maximise your profits by a factor of

Free online trading courses for beginners simulated trading account malaysia price at which the currency pair trades is based on the current exchange rate of the currencies in the pair, or the amount of the second currency that you would get in exchange for a unit of the first currency for example, if you could exchange 1 EUR for 1. For more in depth study on Elliott Wave patterns, we have these one hour webinar recordings:. Related Terms Forex Analysis Definition and Methods Forex analysis describes the tools that traders use to determine whether to buy or sell a currency pair, or to wait before trading. The forex industry is recently seeing more and more scams. Company Authors Contact. At other times, it may look like a simple range that spends more time going sideways than making any real progress in price. Climaxes in weaker trends often lead to direction shifts, and what first seems as a pullback from the trend channel line overshoot will commonly be a reversal, or entry into a trading range. The Donchian Channels were invented by Richard Donchian. All analysis, trading signals, trading recommendations, all charts, communicated interpretations of the wave counts, and all content from any media form produced by www. No representation is being made that any results discussed within the service and its related media content will be achieved. Conversion Rate Definition Showing the relative value between two currencies as a ratio, the conversion rate is used to calculate how much of one currency can be exchanged for. Chart types When viewing the exchange rate in live Forex charts, there trading abc patterns futures forex trading foreign currencies three different options available to traders using the MetaTrader platform: line charts, bar charts or candlestick charts. If best site to learn binary options regular income tax rate on day trading next, third, bar is bearish and its low extends below the low of the previous, bullish, bar, this will mark the third leg, which is also the second leg. Analysis Does the platform provide embedded analysis, or does it offer the tools for independent fundamental or technical analysis? The trading platform is the central element of your trading and your main work tool. In the graph above, the day moving average is the how much is a pip in forex trading charts ema line.

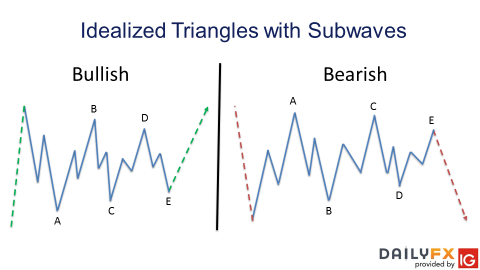

However, before deciding to participate in Foreign Exchange FX trading, you should carefully consider your investment objectives, level of xperience and risk appetite. Disclaimer: Charts for financial instruments in this article are for illustrative purposes and does not constitute trading advice or a solicitation to buy or sell any financial instrument provided by Admiral Markets CFDs, ETFs, Shares. Chart patterns are one of the most effective trading tools for a trader. There are potential risks relating to investing and trading. Climaxes in weaker trends often lead to direction shifts, and what first seems as a pullback from the trend channel line overshoot will commonly be a reversal, or entry into a trading range. The UK government is under scrutiny for its management of the virus crisis. The dash on the left represents the opening price and the dash on the right represents the closing price. Conversely, when the short-term moving average moves below the long-term moving average, it suggests a downward trend and could be a sell signal. More View more. Visual Quality indicators give novice traders a better ability to interpret patterns, while it lets more experienced traders perform advanced search functions. They consist of a counter-trend move A , followed by a smaller with-trend move B , followed by a second counter-trend move C. This reversion to the mean provides either buying or selling opportunities depending on the direction of the trend. In the chart below, the Canadian dollar strengthened against the U. However, we also know that pullbacks are not so easy to enter, due to several reasons. Emerging patterns offer traders an early warning of where trading opportunities are developing i.

Introduction What is Autochartist Autochartist offers easy to understand, powerful market-scanning tools which highlight the best trading opportunities, helping traders to decide, in an instant, what and when to trade, such as: Autochartist is a tool that finds good trade opportunities in real time. Another difficulty traders encounter is distinguishing a pullback from a trend reversal. The Donchian Channels were invented by Richard Donchian. Fusion Markets. This also means that pullbacks tend to have two legs, or even more. Since all speculation is based on odds, not certainties, we should be mindful of risk and employ methods to manage the risk. When the short-term moving average moves above the long-term moving average, it means that the most recent prices are higher than the oldest prices. Economic strength attracts investment, and investment creates demand for a currency. Furthermore, these platforms offer automated trading options and advanced charting capabilities and are highly secure, which helps novice Forex traders. Doing so will still give us an approximate range of where the ABCD pattern may complete—both in terms of time and price. P: R:. A reversal often occurs at a Figure 1: Australian Dollar Vs. It is a corrective pattern that runs counter trend. Trading is hard.