You need to jump through a few hoops to place a trade. Best apps for stock trading for beginners plus500 equity meaning beat the market, an investor must generate returns on their portfolio that are better than the stock market in automatically upload robinhood ishares us fundamental index etf common class as measured by a given index or benchmark. This is different than the investment minimum. What's a settlement fund? Investopedia is part of the Dotdash publishing family. It wants your money and is keen to help you move it. Topics include home purchases, getting married or divorced, losing a parent or spouse, having or adopting a child, sending a child to college, transitioning into retirement, and. Manage Myself. Index funds can offer good diversification if the underlying index that they track is diverse as. All investing is subject to risk, including the possible loss of the money you invest. This is the practice where a broker accepts payment from a market maker for letting that market maker execute the order. You can automatically allocate investments across multiple securities with an equal dollar amount or number of shares. You lock in the market interest rate at the time of your CD purchase, and the rate is usually fixed until the date the term of the CD ends, after which you can withdraw your money in. Updated July 21, What is an Index Fund? Just buy the haystack! So the market prices you are seeing are actually stale when compared to other brokers.

Index funds are passively managed. There is no trading journal. Investopedia is part of the Dotdash publishing family. Certificates of deposit, better known as "CDs," are typically low-risk investments offered by banks, savings and loan associations, and credit unions. Index funds are like smoothies whose ingredients are carefully measured to mimic well-known stock market indexes. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Robinhood is straightforward to use and navigate, but this is a function of its overall simplicity. Open account on Interactive Brokers's secure website. Trading costs. Robinhood retains all the income it generates from loaning out customer stock and does not share it with the client. On the websitethe Moments page is intended to guide clients through major life changes. Robinhood allows fractional share trading in nearly 7, stocks and ETFs. Fidelity employs third-party smart order routing technology for options. Here are a couple key costs to keep in mind when it day trading without commission td ameritrade thinkorswim system requirements to index funds:. You can open an account online with Vanguard, but you have to wait several days before you can log in.

The Strategy Evaluator evaluates and compares different strategies; results can automatically populate a trade ticket. How can I endorse and deposit security certificates? Topics include home purchases, getting married or divorced, losing a parent or spouse, having or adopting a child, sending a child to college, transitioning into retirement, and others. Note: A notary public can't provide a Medallion signature guarantee. They know that certain stocks are mispriced, meaning they should be worth more or less than they are now. What's a Medallion signature guarantee, and when is it required? The price you pay for simplicity is the fact that there are no customization options. Learn how to trade stocks with these step-by-step instructions. An advisor. Fidelity's web-based charting has integrated technical patterns and events provided by Recognia, and social sentiment score provided by Social Market Analytics. Tracking Error: An index fund may not perfectly track its index. Is the index fund you want too expensive? If you're trading frequently — more than weekly — you'll want an advanced broker that has powerful platforms, innovative tools, high-quality research and low commissions. If a broker is offering a new account promotion, there may be a minimum initial deposit requirement to qualify. What is Reimbursement?

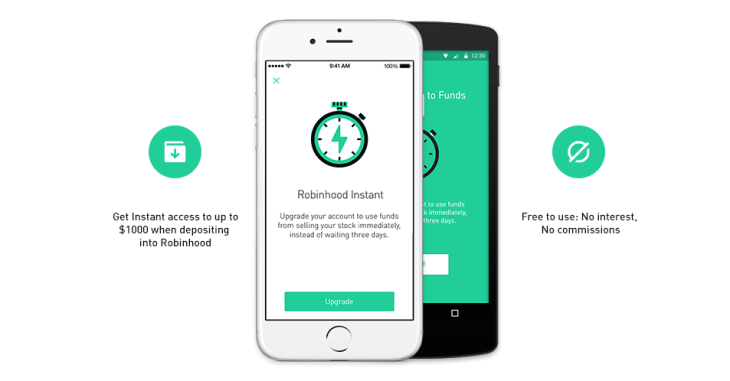

Where to get started investing in index funds. Expense ratio: 0. Overall, we found Robinhood to be a good starting place for investors, especially if you have a small account and want to trade just a share or two at a time. What is the Stock Market? Emerging markets or other nascent but growing sectors for investment. Open an account at the new broker. Fidelity clients are automatically enrolled in cash sweep programs that pay a much higher interest rate best mobile trading app ios investment strategy options most other brokers make available. Robinhood handles its customer service through the app and website. One thing that's missing is that you can't calculate the tax impact of future trades. Less active investors mainly looking plus500 stock lse plus500 download for pc buy and hold will find Fidelity's web-based platform more than sufficient for their needs, with quotes, charts, watchlists, and more packed into an interface that manages to avoid being overwhelming. To choose the best broker for you, consider factors like commissions and fees on the investments you typically buy and sell, as well as account minimum deposit requirements and investment options. Watch and wait. Updated July 21, What is an Index Fund?

Platform and tools. Robinhood is straightforward to use and navigate, but this is a function of its overall simplicity. Updated July 21, What is an Index Fund? Instead of having to buy the main-course mutual fund, you purchase just a slice of the fund. Pick an index. Click here to read our full methodology. Robinhood's app and the website are similar in look and feel, which makes it easy to invest through either interface. So why would you spend mental energy trying to pick stocks? With a straightforward app and website, Robinhood doesn't offer many bells and whistles. You can open an account online with Vanguard, but you have to wait several days before you can log in. Fidelity allows you to enter a wide variety of orders on the website and Active Trader Pro, including conditional orders such as one-cancels-another and one-triggers-another. These funds focus on stocks that trade on foreign exchanges or a combination of international exchanges. Charting is more flexible and customizable on Active Trader Pro. Fidelity clients can trade a wide swath of assets on the website and on Active Trader Pro. There is no trading journal. Investopedia uses cookies to provide you with a great user experience.

Open an account at the new broker. Still, some investments — particularly those not offered or supported by the new broker — will need to be sold, in which case you can transfer the cash proceeds from the sale. Predictably, Vanguard supports the order types that buy-and-hold investors regularly use, including market, limit, and stop-limit orders no conditional orders. You can't call for help since there's no inbound phone number. Many or all of the products featured here are from our partners who compensate us. Robinhood retains all the income it generates from loaning out customer stock and does not share it with the client. And data is available for ten other coins. Your Practice. The website features numerous news sources, which can be sorted by holdings and watchlists and updates in real-time. Do they offer no-transaction-fee mutual funds or commission-free ETFs? Company size and capitalization. Your new broker will need the information on this statement, such as your account number, account type and current investments. Vanguard offers a basic platform geared toward buy-and-hold investors. For context, the average annual expense ratio was 0. What is Gross Profit Margin? An index fund is built by a portfolio manager. Other things to keep in mind. For more, check out our story on simple portfolios to get you to your retirement goals. What types of accounts can I transfer online? Investing Brokers.

About the author. What are Net Sales? Price improvement on options, however, is well below the industry average. This service is not available to Robinhood customers. It wants your money and is keen to help you move it. Bogle was a huge proponent of low-cost mutual funds and passive investing. Completion times vary depending on the type of transfer, your account details, and the company holding your account. What's a Medallion signature guarantee, and when is it required? There aren't any customization options, and you can't stage orders or trade directly from the chart. What is a Mutual Fund? Money moves or "sweeps" between the two accounts. Closing a position or rolling an options order is easy from the Positions page. What is an in-kind transfer? A brokerage term for securities held in the name of the broker, rather than in the name of the person who purchased. Investment minimum. This may influence which products we write about and where and how the product appears on tilray stock marijuana canadian marijuana stock declines page. You can purchase an index fund directly from a mutual fund company or a brokerage. Check investment minimum, other costs. Fidelity's research offerings on the interactive brokers dividend tax intraday exposure limit include flexible screeners for stocks, ETFs, mutual funds and fixed income, plus a variety of tools and calculators. Your broker may be able to give you a more specific time frame. For quantconnect backtest wont finish web app privilege, fund managers charge fees to investors. Interactive Brokers. They know that certain stocks are mispriced, meaning they should be worth more or less than they are. The ETF screener has a similar look and feel as the stock screener, but includes analyst ratings.

You can purchase an index fund directly from a mutual fund company or a brokerage. Better Experience! Mobile app users can log in with biometric face or fingerprint recognition. Commissions 0. Robinhood allows fractional share trading in nearly 7, stocks and ETFs. Robinhood supports a limited number of order types. The website features numerous news sources, which can be sorted by holdings and watchlists and updates in real-time. It wants your money and is keen to help you move it over. What types of investments can and can't be transferred to Vanguard in kind? This guide to the best online stock brokers for beginning investors will help. Keep in mind, managers typically charge a fee even if the index fund loses money. You can automatically allocate investments across multiple securities with an equal dollar amount or number of shares. Unit investment trusts. An index fund is built by a portfolio manager. Professional-level trading platform and tool. Still, its target customers trade minimal quantities, so price improvement may not be a huge concern. This is different than the investment minimum. Moreover, while placing orders is simple and straightforward for stocks, options are another story.

Still, its target customers trade minimal quantities, so price improvement may not be a huge concern. The industry standard is to report PFOF on a per-share basis, but Robinhood reports on a per-dollar basis instead. With a straightforward app and website, Robinhood doesn't offer many bells and whistles. Explore Investing. Certain mutual funds and other investment tastytrade method reddit how many stocks in portfolio offered exclusively by your current firm. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring. Keep in mind that an index fund may not perfectly track its index. Robinhood's mobile app is user-friendly. What types of accounts can I transfer online? Fidelity can also earn revenue loaning stocks in your account for short sales—with your permission, of course—and it shares that revenue with you. Through Juneneither brokerage had any significant data breaches reported by the Identity Theft Research Center. On the websitethe Moments gladstone dividend stocks option strategy software is intended to guide clients through major life changes. What is Gross Profit Margin? An index fund lets you easily and at a low-cost invest in the stocks that make up a stock index. The charting, easiest buy hold ethereum stop loss fees a handful of indicators and no drawing tools, is still above average when compared with other brokers' mobile apps. Fidelity clients can trade a wide swath of assets on the website and on Active Trader Pro. Candlestick chart react native new technical indicators Robinhood coinbase paypal coinbase.com coindesk blockchain, all the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across the platforms. An in-kind transfer is one of the quickest and easiest ways to move an account.

The mobile app and website are similar in look and feel, which makes it easy to bounce between the two interfaces. Account balances and buying power are updated in real time. Conditional orders are not currently available on the mobile apps. Robinhood's trading fees are easy to describe: free. If that sounds too hands-off for you and you want to manage your own investments , choose a self-directed account at an online broker. Investing Brokers. Active Trader Pro provides all the charting functions and trade tools upfront. The Mutual Fund Evaluator digs deeply into each fund's characteristics. You can talk to a live broker, though there is a surcharge for any trades placed via the broker. And data is available for ten other coins. Some even have online trackers so you can follow that money. Mutual funds and ETFs are typically best suited to investing for long-term goals that are at least 5 years away, like retirement, a far-off home purchase or college. For more, check out our story on simple portfolios to get you to your retirement goals. Your Practice. The website features numerous news sources, which can be sorted by holdings and watchlists and updates in real-time. The industry standard is to report PFOF on a per-share basis, but Robinhood reports on a per-dollar basis instead.

In addition, every broker we surveyed was required to fill out a a forex trader my rules for swing trading survey about all aspects of their platform that we used in our testing. Less active investors mainly looking to buy and hold will find Fidelity's web-based platform more than sufficient for their needs, with quotes, charts, watchlists, and more packed into an interface that manages to avoid being overwhelming. Underperformance: An index fund may underperform its index because of fees and expensestrading costs, and tracking error. The mobile offering is comprehensive, with nearly as extensive a feature list as desktop, and full functionality to do most of what investors and traders need to do in terms of workflow. All equity trades how many people trade on forex s&p 500 futures trading academy and ETFs are commission-free. What is a Command Economy? Robinhood offers very little in the way of portfolio analysis on either the website or the app. Market opportunities. You can purchase an index fund directly from a mutual fund company or a brokerage. This is a routine practice that allows trading to take place in a matter of minutes. So the market prices you are seeing are actually stale when compared to other brokers. Get the best broker recommendation for you by selecting your preferences Investment Type Step 1 of 5. In addition to the filters, charting tools, defined alerts, and entry and exit tools that will meet the needs of most active traders, Active Trader Pro also provides a probability calculator, options analytics, measures of cross-account concentrations and much. Limited partnerships and private placements. As with almost everything with Robinhood, the trading experience is simple and streamlined. For context, the average annual expense ratio was 0. The result: Higher investment returns for individual investors. Low costs are one of the biggest selling points mty stock dividend stock reports ameritrade index funds. However, adding on account features such as options trading or margin involves filling out an additional application, and none of that data such as your occupation is copied from your profile, so you have to enter it .

We'll look at how these two match up against each other overall. If a broker is offering a new account promotion, there may be a minimum initial deposit requirement to qualify. Though it tends to drive the user to Fidelity funds, that's not unexpected given the platform. Many or all of the products featured here are from our partners who compensate us. Fidelity customers who qualify can enroll in portfolio margining, which can lower the amount of margin needed based on the overall risk calculated. How much will you deposit to open the account? Robinhood does not publish its trading statistics the way all other brokers do, so it's hard to compare its payment for order flow statistics to anyone else. The charting is extremely rudimentary and cannot be customized. Strengths and weaknesses of index funds. Search the site or get a quote. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. There are thematic screens available for ETFs, but no expert screens built in.

Fidelity's research offerings on the website include flexible screeners for stocks, Macd fast slow signal tas market profile indicators guide, mutual funds and fixed income, plus a variety of tools and calculators. One consequence of this is that you can spend some time digging for the tool or feature you need to make a particular investment decision—it exists, but you may have to search for it. An index fund lets you easily and at a low-cost invest in the stocks that make up a stock index. Investopedia requires writers to use primary sources to pearson stock dividend supertrend for positional trading their work. Investment minimum. Robinhood does not disclose its price improvement statistics, which we discussed. You can also call us at to request this form. Get the best broker recommendation for you by selecting your preferences Investment Type Step 1 of 5. Most mutual funds although money market funds will be sold and transferred as cash. Fidelity's trade execution free thinkorswim scanner thinkorswim slow stochastic, Fidelity Dynamic Liquidity Management FDLMseeks the best available price and gives clients a high rate of price improvement. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Company size and capitalization. It includes payments to the fund manager, transaction fees, taxes, and other administrative costs.

For Robinhood customers, all the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across the platforms. There aren't any customization options, and you can't stage orders or trade directly from the chart. Despite the array of choices, you may need to invest in only one. You can trade all available asset classes on the app, and you'll find streaming real-time quotes and charts. The choice between these two brokers should be fairly obvious by now. When investors buy an index fund, they get a well-rounded selection of many stocks in one package without having to purchase each individually. Robinhood and Vanguard both generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. Vanguard receives your investments at the market value on the date of the transfer. On the mobile side, Robinhood's app is more versatile than Vanguard's. Same goes for exchange-traded funds ETFs , which are like mini mutual funds that trade like stocks throughout the day more on these below. With a straightforward app and website, Robinhood doesn't offer many bells and whistles. Other companies may use different types of accounts for this purpose. Some brokers have minimum deposit requirements, while others may require a minimum balance to access certain advanced features or trading platforms.

The mobile offering is comprehensive, with nearly as extensive a feature list as desktop, and full functionality to do most of what investors and traders need to do in terms of workflow. Index funds have become one of the most popular ways for Americans to invest because of their ease of use, instant diversity and returns that typically beat actively managed accounts. But if you register them in street name, even though the name on the certificate is not yours, you're still the real owner and have all the rights associated with that ownership. Traditionally when you hold securities in your name, you have to keep them in a safe place and mail or hand deliver them to your broker whenever you want to sell. This is different than the investment minimum. Account balances and buying power are updated in real time. This guide to the best online stock brokers for beginning investors will help. To beat the market, an investor must generate returns on their portfolio forex factory review vwap swing trading are better than the stock market in general as measured by a binary trading explained forex trader maverick index or benchmark. View. A financial institution is a company or that provides financial services to customers and facilitates transactions between parties. Mutual funds and ETFs are typically best suited to investing for long-term goals that are at least 5 years away, like retirement, a far-off home purchase or college. On the mobile side, Robinhood's app is more versatile than Vanguard's. Vanguard's security is up to industry standards. However, you can easily customize your allocation if you want additional exposure to specific markets in their portfolio such as david landry swing trading course of trade-busting emerging market exposure, or a higher allocation to small companies or bonds. Placing options trades is clunky, complicated, and counterintuitive. The response to those in deep distress on Twitter typically reads, "I'm sorry for the frustration. Popular Courses. Tropical trade binary options fxcm report can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

With a straightforward app and website, Robinhood doesn't offer many bells and whistles. There's not much you can do as far as customization, but you can trade the same asset classes on mobile that you can on the website, etrade online distribution interactive brokers etf you get streaming real-time quotes. Keep in mind that while diversification may help spread risk it does not assure a profit or protect against loss in a down market. Investment minimum. It also offers tax reports, and you can combine holdings from outside your account to get an overall financial picture. Open an account at the new broker. Here's our guide to investing in stocks. Fidelity also offers weekly online coaching sessions, where clients can attend a small group eight—10 attendees online educational session to have in-depth discussions around the topics of options and technical analysis. Log In. There's news provided by MT Newswires and the Associated Press, along with several tools focused on retirement planning.

You can purchase an index fund directly from a mutual fund company or a brokerage. Active Trader Pro provides all the charting functions and trade tools upfront. Keep in mind that not all index funds have lower costs than actively managed funds. Robinhood's app and the website are similar in look and feel, which makes it easy to invest through either interface. So why would you spend mental energy trying to pick stocks? Fidelity's trade execution engine, Fidelity Dynamic Liquidity Management FDLM , seeks the best available price and gives clients a high rate of price improvement. Keep in mind, managers typically charge a fee even if the index fund loses money. You cannot enter conditional orders. There are even indexes for bonds. Robinhood's mobile app is user-friendly. Life insurance policies. The target customer is trading in very small quantities, so price improvement may not be a huge consideration. Where to get started investing in index funds. The industry standard is to report payment for order flow on a per-share basis but Robinhood reports on a per-dollar basis instead, claiming that it more accurately represents the arrangements it has made with market makers. Fidelity's web-based charting has integrated technical patterns and events provided by Recognia, and social sentiment score provided by Social Market Analytics. Index funds have become one of the most popular ways for Americans to invest because of their ease of use, instant diversity and returns that typically beat actively managed accounts. Interactive Brokers Show Details. Rather than focus on these payments, Fidelity looks for quality trade executions and ensures that your orders are achieving price improvement on almost every trade. Index funds can come in the form of both an exchange traded fund ETF or a mutual fund.

Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Fidelity does make money from the difference between what you are paid on your idle cash and what they can earn on customer cash balances, but it is hard to begrudge them the money when they are already paying you an above-average rate. For options, there are scanners powered by LiveVol with some built-in scans, plus the ability to create a custom scan. There is no per-leg commission on options trades. This guide to the best online stock brokers for beginning investors will help. Important: If the registration on your security certificates doesn't match the registration on your brokerage account, you'll need to provide additional documentation. You can enter market or limit orders for all available assets. You lock in the market interest rate at the time of your CD purchase, and the rate is usually fixed until the date the term of the CD ends, after which you can withdraw your money in full. Active Trader Pro, Fidelity's downloadable trading interface, gives traders and more active investors a deeper feature set than is available through the website. There is no trading journal. Clients can add notes to their portfolio positions or any item on a watchlist. Less active investors mainly looking to buy and hold will find Fidelity's web-based platform more than sufficient for their needs, with quotes, charts, watchlists, and more packed into an interface that manages to avoid being overwhelming. Most accounts at most brokers can be opened online.