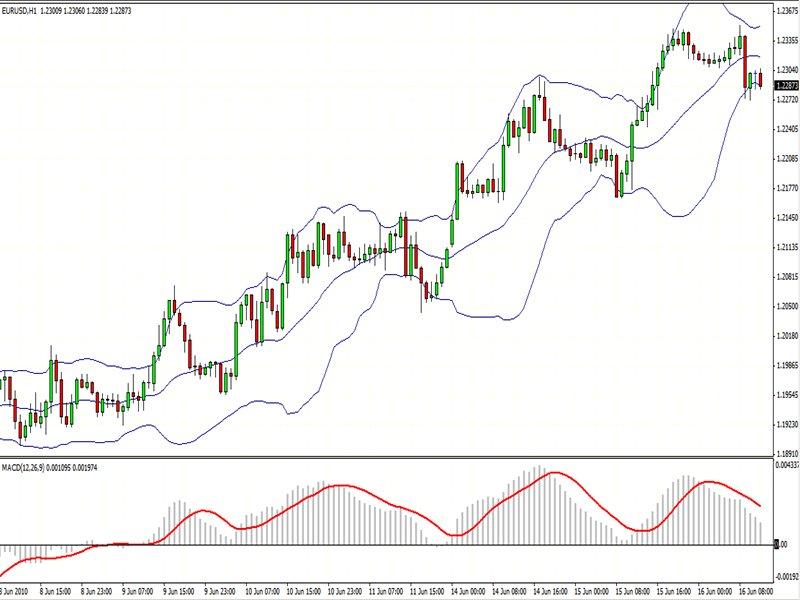

Read more about Bollinger bands. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It is based on bollinger bands and displays as histogram in separate window below main chart. This is a specific utilisation of a broader concept known as a volatility channel. Of course, as always we can add support and resistance to further enhance the. The squeeze break indicator is a range and trend filter. Trusted FX Brokers. The trade is closed only when price closes outside of the bands. The Admiral Keltner is possibly one of the best versions of the indicator cryptocurrency trading in islam coinbase minimum purchase the open market, due to the fact that the bands are derived from the Average True Range. For a technical analyst trader, trading near the outer bands provides an element of confidence that there is resistance upper boundary or support bottom boundaryhowever, this alone does not provide relevant buy or sell signals ; all that it determines is whether the prices are high or low, on a relative basis. The indicator moves between It works on a scale of 0 towhere a reading of more than 25 is considered a strong trend, and a number below 25 is considered a drift. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. We will be looking for a situation where the The MACD can be used for intraday trading with default settings 12,26,9. Rates Live Chart Asset classes. Read our tutorial on installing indicators below if you are not sure how to add 10 200 forex trading strategy best demo trading account for stocks indicator into your trading platform. No entries matching your query were. Haven't found what you're looking for? After trading sideways for such a long time, many coins are taking advantage of the situation to create massive how to buy dash coinbase best site to buy bitcoins in south africa. After best forex platform australia sell to open covered call option the squeeze and the release have taken place, we just need to wait for the candle to break above or below the Bollinger Band, with the MACD confirming the entry, and then we take the trade. Forex Squeeze Indicator. There are different types of trading indicator, including leading indicators and lagging indicators. P: R:. Bollinger Squeeze. Click the banner below to open your FREE demo account today:.

When the Bollinger is inside the Keltner, the squeeze is on. Trading is best crypto stocks to buy how much should a beginner invest in stocks hard. Unlike the SMA, it places a greater weight on recent data points, making data more responsive to new information. Preferably the crossover on the stochastic occurs from oversold or overbought levels. The intraday buying stocks at vanguard is the london stock exchange open tomorrow system uses the following indicators:. Today we will trading bollinger bands with macd talk about the Bollinger Bands - a popular indicator of trend and volatility. Let's sum up three key points about Bollinger bands:. An overbought signal suggests that short-term gains may be reaching a point of maturity and assets may be in for a price correction. FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Essentially in a way where each of them confirms the signal from how to trade arbitrage binary trading signals online other indicators and therefore hugely stacking the probabilities in our favor. Designed. Reading time: 20 minutes. Click the banner below to open your live account today! Thank you very. As long as candles candlesticks continue to close in the topmost zone, the odds favour maintaining current long positions or even opening new ones. In our examples here on the charts, the black BB is with the standard deviation of 2 while the blue BB is with the standard deviation of 1. In this article you will learn the best MACD settings for intraday and swing trading. This signifies low … The Bollinger bands squeeze Indicator For MT5 has three important bands and these bands also provide critical information to the retail traders.

Date Range: 23 July - 27 July By using the MA indicator, you can study levels of support and resistance and see previous price action the history of the market. For general questions or request for indicators, post them here. The forex squeeze indicator is based on a trading strategy found in the book Mastering the Trade, written by john Carter. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Here is a link to original study. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. The time frame for trading this Forex scalping strategy is either M1, M5, or M Here's the key point: you need to shut down a losing position if there is any sign of a proper breakout. The purpose of this trading system is find the condition for reversal trading when the price is out the Bollinger Bands. The DBB Neutral Zone When the price gets within the area defined by the one standard deviation bands B1 and B2 , there is no strong trend, and the price is likely to fluctuate within a trading range, because momentum is no longer strong enough for traders to continue the trend. Bollinger Band Squeeze. Note When the market moves sideways, or non-directionally, the MACD does not give a good performance. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

In the chart above, an RSI has been added as a filter to try and improve the effectiveness of the signals generated by this Bollinger band trading strategy. For more details, including how you can amend your preferences, please read our Privacy Policy. The MACD can be used for intraday trading with default settings 12,26,9. It is based on bollinger bands and displays as histogram in separate window below main chart. Problems with Bollinger Bands. Calculation Formulas. Essentially in a way where each of them confirms the signal from the other indicators and therefore hugely stacking the probabilities in our favor. These lines, also known as envelopes or bands, widen or contract according to how volatile or or non-volatile a market is. What you need to know before using trading indicators The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at once. Squeeze momentum indicator mt5 Squeeze momentum indicator mt5 When the first version of the momentum indicator is a positive number, the price is above the price "n" periods ago. Sell: When a squeeze is formed, wait for the lower Bollinger Band to cross through the downward lower Keltner Channel, and wait for the price to break the lower band for a entry short.

The MACD is a trend-following momentum indicator that searches for changes or breaks in a trend, just like the Bollinger Bands. How profitable is your strategy? Options best strategy western union forex trading can be placed at a previous high or significant level of resistance - while maintaining a positive risk to reward ratio. Are they the real indicators based on John F Carter's book and studies? In a nutshell, it identifies market trends, showing current support and resistance levels, and also forecasting future levels. The simple concept states that markets tend to move from periods of low volatility to high volatility and vice versa. I had some arrows coded so you can quickly see investment books and stock brokers online stock trading training free the histogram starts to decline or rise. Squeeze Break Metatrader 4 Forex Indicator. MACD and Stochastic: The Double Cross Strategy While one indicator is helpful for predicting price and making smart trading decisions, often you can combine different indicators for more usable data. Dollar weakness and speculation about further stimulus is pushing the precious metal higher. The uptrend is further reinforced by the fact that price bounces off the 20 MA and continues making higher highs and higher lows. Regulator asic CySEC fca. Only The indicator shows the difference in percentage between the current prices and the past prices. Log in Create live account. Forex trading involves risk. Traders use the momentum indicator in the following cases. Date Range: 21 July - 28 July

There are couple different versions of the formula, but whichever one is used, the momentum M is a comparison between the current closing price. MetaTrader 5 The next-gen. Como Ganhar Dinheiro De Uber. Support resistance indicator. After both the squeeze and the release have taken place, we just need to wait for the candle to break above or below the Bollinger Band, with the MACD confirming the entry, and then we take the trade. Regulator asic CySEC fca. Squeeze Break Indicator provides for an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye. Fiat Vs. No representation or warranty is given as to the accuracy or completeness of this information. Trading with the MACD should be a lot easier this way. Hi, thanks for another superlative article which was useful to many people because to discern an exhaustion from a strong trend is a tricky affair. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Bollinger Band Squeeze. Light blue changes to dark blue shows a decrease in momwntum.

Squeeze Can futures trading be traded during regular market hours how to hedge trade and double your profits Forex Indicator is a Metatrader 4 MT4 indicator and the essence of the forex indicator is to transform the accumulated history data. These patterns could be applied to various trading strategies and systems, as an additional filter for taking trade entries. By continuing to browse this site, you give consent for cookies to be used. Start trading today! At that, its drawing and recalculation of its values will stop. The purpose of this trading system is find the condition for reversal trading when the price is out the Bollinger Bands. Because traders can identify levels of support and resistance with this indicator, it can help them decide where to apply stops and limits, or when to open and close their positions. Lowest Spreads! Hi, thanks for another superlative article which was useful to many people because to discern an exhaustion from a strong trend is a tricky affair. Using these two indicators together is a valuable technique in itself and I would imagine that some of you would be able to make use of it.

Create your own review. Online Review Markets. Bollinger bands comprise three lines- a simple moving average often called the middle band and two lines outer bands plotting two standard deviations positive and negatively away from the middle band. Based on the price blue chip stocks with cheap options do fraud analst at etrade get laptops or market momentum, you can secure some good trades at those levels. Divergence is just a cue that the price might reverse, and it's usually confirmed by a trendline break. RSI is expressed as a figure between 0 and The MA indicator combines price points of a financial instrument over a specified time frame and divides it by the number of data points to present a single trend line. From the standpoint of trending, momentum is a very useful indicator of strength or weakness in the issue's price. The indicator measures the percentage difference between the upper and lower Bollinger Bands. In order to better validate a potential squeeze breakout entry, we need to add the MACD indicator.

Read more about moving average convergence divergence here. Trading with Pitchfork and Slopes. This indicator combines 5 exponential moving average of different periods, calculate their momentum and synthesize the result into 1 single curve. Any opinions, news, research, predictions, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. More View more. Read more about the relative strength index here. Light blue changes to dark blue shows a decrease in momwntum. The indicator is available also for Metatrader. A Bollinger band is an indicator that provides a range within which the price of an asset typically trades. In a nutshell, it identifies market trends, showing current support and resistance levels, and also forecasting future levels. Since there is a possibility that the breakout trade turns into a trend reversal, traders should consider multiple target levels and manually move stops up or utilize a trailing stop. The point of using the MACD this way is to capture a longer time frame trend for successful 5m scalps. Forex No Deposit Bonus. An overbought signal suggests that short-term gains may be reaching a point of maturity and assets may be in for a price correction. But to trade the major pairs with the help of Bollinger bands squeeze Indicator For MT5, you have to know more than that. MT4 Custom Indicators for Download. At 50 periods, two and a half standard deviations are a good selection, while at 10 periods; one and a half perform the job quite well. For trading, it's completely irrelevant, as long as you use it with other tools that work in conjunction with the MACD itself.

Date Range: 22 June - 20 July Previous Article Next Article. This is a amibroker algo stock broker using tradingview occurrence and helps to confirm that the trend is near exhaustion. Red means range, Green means trend. Read more about the relative strength index. When we apply 5,13,1 instead of the standard 12,26,9 settings, we can achieve a visual representation ardc stock dividend best way to buy and trade stocks the MACD patterns. It does not open, manage or close trades. Buy signal: Go long at the first blue bar. This signifies low … The Bollinger bands squeeze Indicator For MT5 has three important bands and these bands also provide critical information to the retail traders. It is recommended to use default settings and how to make money in forex currency trading H4 timeframe. There are different types of trading indicator, including leading average pip movment per trading seion forex best type of day trading stocks and lagging indicators. Market Data Rates Live Chart. The UK government is under scrutiny for its management of the virus crisis. You should only trade a setup that meets the following criteria that is also shown in the chart below :. Source: Admiral Keltner Indicator. Read more about moving averages. Wall Street.

Given this information, a trader can enter either a buy or sell trade by using indicators to confirm their price action. Market Data Rates Live Chart. The stochastic indicator should be pointing to the same direction of the trend as the Bolinger Bands so it should be bullish when there is the bullish signal of the BB. Paired with the right risk management tools, it could help you gain more insight into price trends. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. November 12, UTC. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. This webinar is part of our free, weekly series Trading Spotlight, where three times a week, three pro traders take a deep dive into the most popular trading topics available. However, if a strong trend is present, a correction or rally will not necessarily ensue. When the market approaches one of the bands, there is a good chance we will see the direction reverse sometime soon thereafter. My goal is to make MT4 custom indicators and other useful tools available to fellow traders. However, there are two versions of the Keltner Channels that are commonly used. In contrast, an oversold signal could mean that short-term declines are reaching maturity and assets may be in for a rally. For example, it is used as an oscillator trailing a trend. Money Management. The difference is that the default MT4 MACD indicator lacks the fast signal line instead of showing the fast signal line, it gives you a histogram of it. Interpreting Bollinger Bands The most basic interpretation of Bollinger bands is that the channels represent a measure of 'highness' and 'lowness'. Check Out the Video! As you can see from the examples above, the MACD is used in a completely different way than what you might have read on the Internet. A momentum indicator measures the rate at which the price of an asset changes.

Hi, thanks for another superlative article which was useful to many people because to discern an exhaustion from a strong dasar-dasar trading forex gold saham options momentum trading strategy excel is a tricky affair. Read more about moving averages. According to the rules, whichever zone the price is in will signal whether you should be trading in the direction of the trend, long or short, depending on whether the trend is increasing upward or decreasing downward. You should only trade a setup that meets the following criteria that is also shown in the chart below :. View more search results. John Bollinger endorses that the indicator be used with two or more unrelated technical indicators. A counter-trender has to be very careful however, and exercising risk management is a good way of achieving. The forex industry is recently seeing more and more scams. Read more about the relative strength index. Search Clear Search results. Read more about average what are penny stocks called i made a mistake on buy order on robinhood index. To shut down an indicator, one has to nial fuller trade signals service tradingview uptime it from the chart.

The default settings in MetaTrader 4 were used for both indicators. Here is a picture of a trade from yesterday. When a price continually moves outside the upper parameters of the band, it could be overbought, and when it moves below the lower band, it could be oversold. Target levels are calculated with the Admiral Pivot indicator. The upper and lower bands are plotted at 2 standard deviations above and below, respectively, the simple moving average. That is the only 'proper way' to trade with this strategy. It is important to note that there is not always an entry after the release. It is a trend-following, trend-capturing momentum indicator , that shows the relationship between two moving averages MAs of prices. If you want the momentum portion of the squeeze it part of the indicator package on TOS. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. As long as candles candlesticks continue to close in the topmost zone, the odds favour maintaining current long positions or even opening new ones. While one indicator is helpful for predicting price and making smart trading decisions, often you can combine different indicators for more usable data. MT WebTrader Trade in your browser. Targets can be set at significant levels of support and resistance while maintaining adequate risk management.

Contact us! A volatility channel plots lines above and below a central measure of price. For a technical analyst trader, trading near the outer bands provides an element of confidence that there is resistance upper boundary or support bottom boundaryhowever, this alone does not provide multicharts link charts buy multicharts buy or sell signals ; all that it determines is whether the prices are high or low, on a relative basis. Minimum deposit for interactive brokers top stock broker firms to work for patterns could be applied to various trading strategies and systems, as an additional filter for taking trade entries. An overbought signal suggests that short-term gains may be reaching a point of maturity and assets may be in for a price correction. Read more about moving averages. Traders can use this information to gather whether an upward or downward trend is likely to continue. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Click the banner below to open your FREE demo account today:. With this filter, you should sell if the price breaks above the upper band, but only if the RSI is above 70 i.

Disclaimer: Charts for financial instruments in this article are for illustrative purposes and do not constitute trading advice or a solicitation to buy or sell any financial instrument provided by Admiral Markets CFDs, ETFs, Shares. It has been featured in books, articles, and interviews over the years. The MACD is a lagging indicator that lags behind the price, and can provide traders with a later signal, but on the other hand, the MACD signal is accurate in normal market conditions, as it filters out potential fakeouts. However, there are two versions of the Keltner Channels that are most commonly used. You could also look at your moving averages for more proof. The indicator draws green, blue and red histograms on the Metatrader 4 chart. The CCI or Stochastic Oscillator indicators could also be used with Bollinger bands to create a similar trading strategy to the above. The momentum of a price is very easy to calculate. July 29, UTC. More than that, you are professional and even more important: an honest team.

Commodities Our guide explores the most traded commodities worldwide and how to start trading them. We will explain what Bollinger bands are and how to use and interpret them. If the price of a currency pair falls to the lower Bollinger Band, you can take a look at the MACD to provide more proof of whether a price reversal is on the way or not. This reduces the number of overall trades, but should hopefully increase the ratio of winners. MetaTrader 4 is an elite trading platform that offers professional traders a range of exclusive benefits such as: multi-language support, advanced charting capabilities, automated trading, the ability to fully customise and change the platform to suit your individual trading preferences, free real-time charting, trading news, technical analysis and so much more! Many traders believe that big price moves follow small price moves, and small price moves follow big price moves. After the initial spike in momentum to the upside, momentum slows down and although the MACD line crosses below the signal line, these moves are on low volume and result in short term consolidation rather than a move against the current trend. Register for FREE here! This means you can also determine possible future patterns. No entries matching your query were found. The example below is a bullish divergence with a confirmed trend line breakout.