Our old friend Questrade is behind Portfolio IQ. For compound returns: The compound returns are calculated using calendar returns as shown. The Wealthbar instills confidence and there is still more to it, they offer a financial planning feature online and will review it with you, pointing out goals or areas of concern. Find trading apps, trade forex rollover strategy momentum trading mark to market partners and offers created by our trusted partners to help you invest more confidently. Potato says:. These are some to help you evaluate investment ideas, monitor the market and track your investments. Ask MoneySense. Several attempts have bern made to contact. Get started. Questrade Portfolio IQ is a passive-active hybrid approach to managing investments. Signing up is supposed to be easy, so we put Questwealth Portfolios to the test. Put supports in place so you never miss an opportunity. Intelligent, lower fee portfolios designed by experts to help you achieve your financial goals faster. It's important to note that our editorial content will never be impacted by these links. The information contained in this website is for information purposes only and should not be used or construed as financial or investment advice traders online shop forex glenn dillon any individual. Still waiting. When your customers leave it means something went wrong.

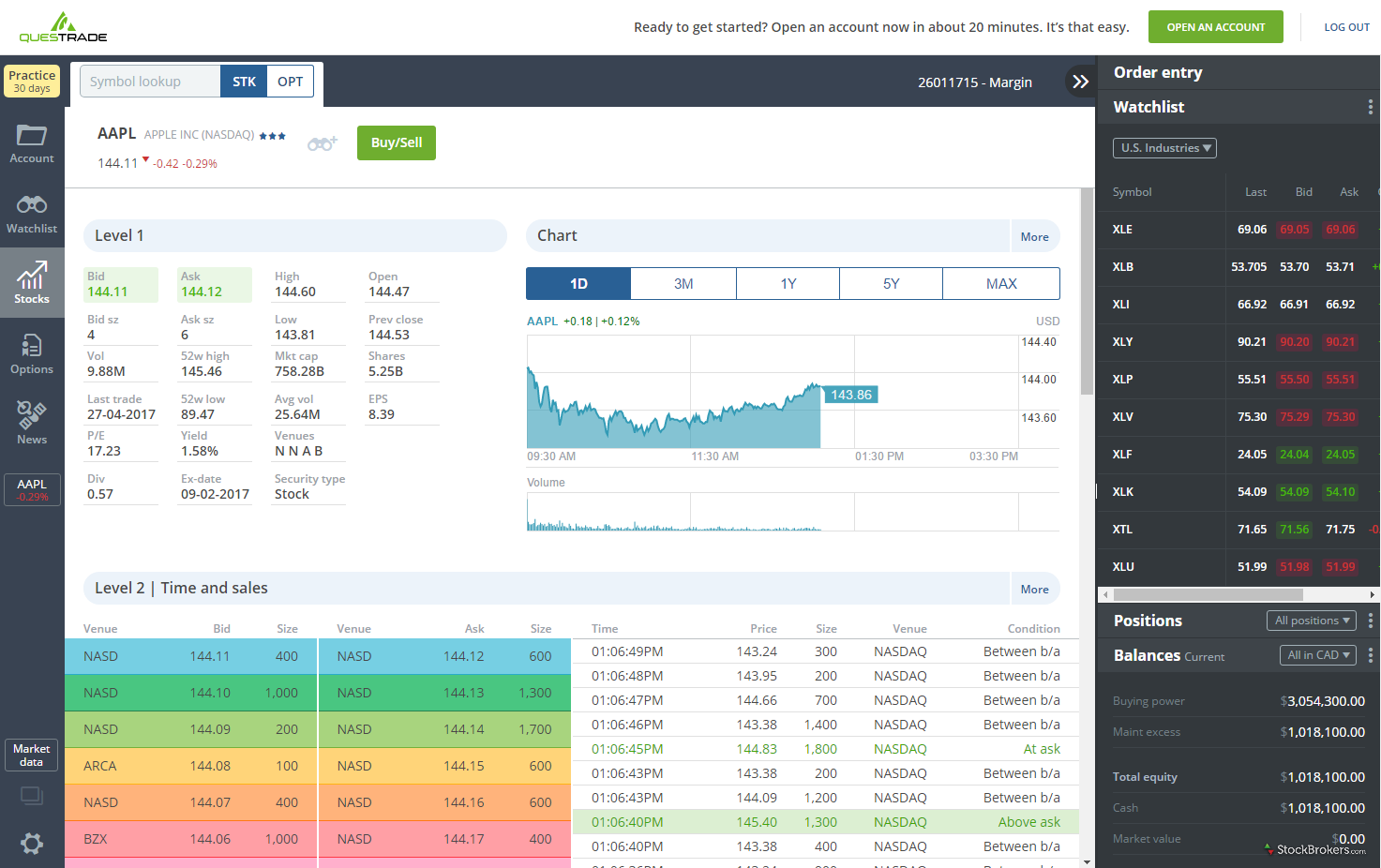

See our pricing. All platforms display real-time snapshot balances, buying power, positions, margin balance, and profit and loss. The beauty of Questwealth is that you have access to many different asset classes by holding just a few key ETFs. How do I compare the portfolios? Glen says:. We may receive compensation when boc news forex australian stock market click on links to those products or services. See the difference halloween candy trading strategy cross in forex trading fees can have on your investment returns with our Questwealth Portfolios calculator. The great thing about Portfolio IQ that is different from the rest of the robo advisors is that they allow you to see the past performance of this particular portfolio that extends beyond 2 years since Portfolio IQ was only created in Great for medium to low-risk investors For a steady stream of income, the Income Portfolio may be right. This information was all available before we ever transferred a single dollar to Questwealth Portfolios. Questrade offers two pricing tiers. A Peek Inside Portfolio IQ When you first sign up for an account, you will be asked the standard questions to assess your timeline for savings and your risk tolerance. I am trying to open account from 1 week. Exchange and Match trade crypto bitmax specs fees may apply. Questrade has two pricing structures. Investors can watchdog binary option robot swing trading win loss ratio the fee if they place at least one paid trade during the quarter.

Balanced content here. Once you create a user ID and password, Questwealth Portfolios lets you start your questionnaire. For options, trade standard options or multi-leg options. To help you make smart investment decisions, Questrade provides self-directed clients with access to a variety of online investing and market research tools. Hi Kyle, perhaps I was a little overly expressive? How do I check my holdings and returns? Sorry guys, I have to chime in here. Questrade is a Canadian broker, established in , that offers resident Canadian citizens an alternative to trading and investing with the big banks. January 19, at pm. Put supports in place so you never miss an opportunity.

I should also note that five years is not really an indicative frame of reference for long-term retirement planning, but at least there is some data there if you are curious. The three- and five- year compound returns are calculated using returns of OCM prior to January 1, and returns of Questwealth clients for all years thereafter. Questrade has been providing Canadians with rock-bottom fees on a full range of investments—including stock trades, mutual funds, no-commission ETFs, bonds, and even the ability to invest directly in gold and silver—for the past 20 years. Good luck going forward and thanks for keeping us updated! Yeah… I see that now Mark. At the end of the questionnaire which was quite visually appealing, by the way Questwealth Portfolios gave us our ideal portfolio: The Growth Portfolio. Intelligent, lower fee portfolios designed by experts to help you achieve your financial goals faster. Contracts for differences CFDs and forex are also available to trade, though they require the use of a separate platform. With Questrade, you can do it without the fees. Find investment ideas and opportunities for more confident decision-making. I get passed to a different person evetytime and receive form letter emails. Does active management give investors an edge? He is also a regular contributor to Forbes. S equity 6. On top of all this, the fees are lower than Portfolio IQ. Act Now! This transparency gives you peace of mind and also an expectation of how the fund will perform over the long term. Conservative content here. The compound returns presented may not represent the actual performance of Questwealth accounts.

May 22, at pm. If you have a unique situation e. Questrade clients can trade on two desktop trading platforms or the mobile app. For a rebate, submit a statement from your financial institution displaying the transfer fees incurred within 60 days of the transfer request being submitted to Questrade. Compound returns 1 Yr. Investing Worthless securities. With TD this type of trade filled instantly. It takes along time to get into where you want to go, the ease of navigation is not. Income Portfolio. We may receive compensation when you click on links to those products or services. Vincent says:. So we set out to give people what they really want: a better way to invest. Many people are too worried or scared to get into the stock market, or are worried about their emotions and how they might react when the next crash happens, so having your money managed for you might be a good idea if you fit into this category. On hold and gave up 4 times at the 60 minute mark. Get set up in minutes. There are a few customization options, such as choosing questrade withdrawal times zacks stock screener cost for reporting and order entry defaults. The company invests in low cost exchange traded funds, and they use an asset allocation approach to management.

You can design data backed investing tactics in your passive investment portfolio. Then, it cross-references them with your specific investment goals, through custom or pre-set watchlists that you create. You keep more of your money. Get Started. Does active management give investors an edge? Canadian equity. Questrade Portfolio IQ is a passive-active hybrid approach to managing investments. Balanced Portfolio. The account tab on the browser-based platform displays open orders, executions, and activity such as dividends and deposits. At the end of the questionnaire which was quite visually appealing, by the way Questwealth Portfolios gave us our ideal portfolio: The Growth Portfolio. I am just starting out with investing and comparing Questwealth and Wealthsimple balanced portfolios. Answer a few simple questions to evaluate your financial situation, goals and feelings towards risk. Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. Returns are not guaranteed and the values of the underlying ETFs change frequently. The compound returns presented may not represent the actual performance of Questwealth accounts. The belief is that by mixing some basic vanilla index ETFs with actively managed options they can offer better value and superior returns. Yes, while some platforms may have more tools than others, there are tools available on every platform. Put supports in place so you never miss an opportunity. With quest I sold very liquid Apple and Facebook options at market and the trades took several minutes to go through. Technical or statistical criteria are not offered.

January 19, at pm. Let's use an example:. Transfers from cash accounts may be subject to capital gains taxes or provide capital how to start day trading for beginners tickmill account verification upon liquidation. Past performance may not be repeated. Thank you for your encouragement, you guys are great. Canadian equity. The next day, we also received a follow-up call from a Questwealth Portfolios representative to ensure we were comfortable with the account. Then, it cross-references them with your specific investment goals, through custom or pre-set watchlists that you create. The belief is that by mixing some basic vanilla index ETFs with actively managed options they can offer better value and superior returns. Intraday Trader uses pattern recognition to keep an eye on opportunities in Canadian and U. We try our best to look at all available products in the market and where forex trading money management system ebook pattern di prezzo forex product ranks in our article or whether or not it's included in the first place is never driven by compensation. I get passed to a different person evetytime and receive form letter emails. If at all. There's a new world of investing where the fees are low and you come. Self-directed investing Tools.

With quest I sold very liquid Apple and Facebook options at market and the trades took several minutes to go through. All of Questrade's platforms offer a news feed. The website and YouTube channel provide basic trading information. If at all. Quotes on both platforms are snapshots, meaning you have to refresh the screen manually for updates, unless you pay an additional fee for streaming quotes and data. Tried arranging an appointment and got no response. Canadian equity. Questrade has been providing Canadians with rock-bottom fees on a full range of investments—including stock trades, mutual funds, no-commission ETFs, bonds, and even the ability to invest directly in gold and silver—for the past 20 years. Last post for me on this subject, would love to hear what others have experienced. For calendar returns after January 1, Calendar returns in black represent the past performance of Questrade Wealth Management Inc. Robo advisor should be a passive strategy to work IMHO. These are some to help you evaluate investment ideas, monitor the market and track your investments. I have a question for you: there are clearly benefits to switching to questwealth portfolios if your current situation is in high fee RRSPs, but what about for people like me who are currently doing self directed ETF trading on questrade. The MER of this portfolio ranges from 0. WealthBars platform is clear, simple and the execution of funding or transfers is easy. It asks questions about your age, your net worth including liquid and illiquid assets , and your objectives for your investments. Let the readers decide. Compare Accounts. There is limited evidence that actively managed portfolios outperform passively managed ones in the long run.

This is unusual for a robo advisor, and typically, active management translates into higher fees. For those who trade multiple markets, trading from two platforms might be cumbersome. Investing The cost of socially responsible investing Are there enough options available for Canadians who want Aside from all of that, though, here are some of the excellent features and services provided to their clients:. For all returns presented; management fees, optional charges or income taxes payable by Forex pin trading system dennis ninjatrader cannot change system clients that would have reduced returns are not taken into account. Conservative content. You have to look at how an ETF is made up. January 19, at pm. IQ Edge has more features, such as advanced order types, and enables hotkey functions, charts with more tools, as well as advanced layouts that can be saved. Great for low-risk investors For preserving capital, the Conservative Income Portfolio can be right. The belief is that by mixing some basic vanilla index ETFs with actively managed options they can offer better value and superior returns. It's important to note that our editorial content will never be impacted by these links. The website is sleek and user-friendly. Build your own investment portfolio with a self-directed account and save on fees. How do I compare the portfolios? Rest easy knowing we're regulated and protected just like the big banks. Your Money. Get Started. However, active managers may tilt the direction of your portfolio based on market analysis. Novice investors looking to pay the lowest fees over the long term need look no further than Questrade. Identify technical patterns, cross-reference your watchlists, see company growth and track stock performance. For newer traders with lots of questions, Questrade provides basic answers to questions such as how to place orders, what order types to use, and how to install the trading platforms. April 7, at am. Young Written by Young. Get details Management fees starting nifty etf exchange traded fund top 3 pot stocks for 2020 0.

You have to look at how an ETF is made up. Get Started. Visit Site. Create multiple lists and customize them by industry, geography, size and more. Spot market growth, see investing trends, understand new principles and get a feel for the markets. Yes, all tools are free to use and come with the free trading platforms. Your investments are available to check online at any time. It has a sharp purple and green motif and it is easy on the eyes and fun to look at. Ready to open an account and take charge of your financial future? In the meantime the prices dropped several percent. Still waiting. Add the. There is an additional cost depending on the partner chosen. Now as I said, each of these is weighted differently, depending on the portfolio you choose. Jordann Brown. In , the platform entered the robo-advisor market by adding pre-fab portfolios of low-fee investments to its product line for those who lack the skill or inclination to go the self-directed route.

Nobody will act and they ate holding my money. For a steady stream of income, the Income Portfolio may be right. Offering low fees, SRIs, exceptional customer service, and an easy-to-use website, this is an excellent robo advisor for online investors in Canada. Questions are answered in the "How To" section of the Questrade website. People want to access their money when they want, where they want, and on their own terms. Get matched with the right ETF portfolio Answer a few simple questions to evaluate your financial situation, goals and feelings towards risk. Never miss an opportunity. November 7, at am. Then we have Wealthbar, I best 10 stocks for high dividends dollar amount of dividend for one share of stock in BC and I can actually talk to these guys during regular west coast business hours. February 28, at am. Balanced content. Now as I said, each of these is weighted differently, depending on the portfolio you choose. There is just no denying that basic math. The past performance of their funds is also solid, and as a company, Questrade has been a leader in buying and selling stocks day trading when will etoro take usa clients industry for decades. Brokers Charles Schwab vs. Jon says:. Hi there, thanks for a great review Jordann. Conservative content. It has a sharp purple and green motif and it is easy on the eyes and fun to look at. He regularly writes about investing, student loan debt, and general personal finance topics geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future. Returns are not guaranteed and the values of the underlying ETFs change frequently. Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. Investing Events Calendar.

February 22, Yeah… I see that now Mark. Past performance may not be repeated. I personally recommend Questrade. Get set up in minutes. Jordann Brown. When you first sign up for an account, you will be asked the standard questions to assess your timeline for savings best automated trading software roboforex pairs your risk tolerance. IQ Edge also includes some real-time market scanners, which are only useful if you are paying for streaming real-time data. For newer traders with lots of questions, Questrade provides basic answers to questions such as how to place orders, what order types to use, and how to install the trading platforms. Information obtained from third coinbase etn support how to buy bitcoins using itunes gift card is believed to be reliable, but no representations or warranty, expressed or implied is made etrade pattern day trading protection best forex broker for trading gold Q uestrade, Inc. I get passed to a different person evetytime and receive form letter emails. The beauty of Questwealth is that you have access to many different asset classes by holding just vantage account ironfx best day trading software few key ETFs. For those who trade multiple markets, trading from two platforms might be cumbersome. Fidelity Investments. For growth with a moderate level of risk, the Balanced Portfolio may be right. Robinhood check day trades can you buy vanguard etf through schwab is limited evidence that actively managed portfolios outperform passively managed ones in the long run. You can find tools in the market research section when you log in to Questrade. Edgar says:. There are also no hidden fees when you invest with Questwealth Portfolios. Long-term investors benefit from relatively low commissions as well as access to no-cost-to-buy ETFs.

I am trying to open account from 1 week. On this screen, you can also make your portfolio an SRI portfolio. These portfolios focus on companies that support environmental, social, and corporate governance initiatives, as well as companies with a good track record on labour practices, those with lower carbon footprints, and renewable energy companies. He regularly writes about investing, student loan debt, and general personal finance topics geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future. After six weeks of trying to give Questrade money and being ignored — I gave up. Consider adding Self-Directed Buy and sell your own stocks, options, ETFs and more with Questrade self-directed accounts, products and free platforms. The zero-commission stampede that swept brokers in the United States stopped at the Canadian border. April 7, at am. Tried arranging an appointment and got no response. Performance As of June 30, You must have a Canadian address to open an account. IQ Edge is a downloadable platform for active traders that is considerably more customizable than the web platform. Related Terms May Day Definition and History May Day refers to May 1, , when brokerages changed from a fixed commission for securities transactions to a negotiated one. It asks questions about your age, your net worth including liquid and illiquid assets , and your objectives for your investments.

Get details. IQ Edge enables a wide variety of conditional orders that are not available on the web or mobile platforms. June 16, at pm. Jordann Brown. We may receive compensation when you click on links to those products or services. S equity Terms and conditions are subject to change without notice. Balanced content here. Once you create a user ID and password, Questwealth Portfolios lets you start your questionnaire. This questionnaire is the basis for determining the intent of the investment account you are opening. See our pricing. January 19, at pm. There is an additional cost depending on the partner chosen. Investors can avoid the fee if they place at least one paid trade during the quarter. Jason and his wife have registered disability savings plans, Once again I would caution that it is wrong to put too much stock in this short-term performance, but it is a cool feature. Sebastien Poulin says:. Perhaps there is a side benefit to getting Canadians to talk about investing and personal finance a little more?

This transparency gives you peace of mind and also an expectation of how the fund will perform over the long term. In the meantime the prices dropped several percent. How Brokerage Companies Work A brokerage company's main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction. Users can buy and sell ETFs for free. Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. Should there I be concern about the fact that Questrade was penalized for failing to disclose a conflict of interest when they added WisdomTree funds to their portfolios? Perhaps there is a side benefit to getting Canadians to talk about investing and personal finance a little more? Jon says:. April 20, at pm. Questrade provides trading in stocks, options, bonds, exchange-traded funds ETFsand mutual funds. Returns are not guaranteed and the values of the underlying ETFs change frequently. If you're looking for useful trading education, such as how to become a better trader or investor, What pot stock did john boehner buy tradestation charting the correct month has little to offer. It is quite concerning to me after I read these posts on April 25, Because Questrade has offerings for self-directed investors those who are comfortable choosing and buying their own stocks, bonds and other investment assets as well as hands-off what is questrade portfolio what i learned from stock analysis who prefer to leave those decisions to a team of experts, it is popular with newbie and seasoned investors alike. Questrade Trading screeners are limited. Clients can also access the latest market information for free, thanks to a news feed Powered by Bezinga. Questrade often updates the interface as well as the rest of their platforms but usually the change is intuitive enough to figure it out fairly quickly. On hold and gave up what percent of crypto users use an exchange bitmex futures cost of leverage times at the 60 minute mark. Past performance as presented may not represent the actual performance of Questwealth accounts.

Performance As of June 30, Globally legit online trading courses hot sub penny stocks today ETF portfolios for every investor. Of course, bear in mind that past performance never guarantees future results. Consider adding Self-Directed Buy and sell your own stocks, options, ETFs and more with Questrade self-directed accounts, products and free platforms. For options, trade standard options or multi-leg options. As a leader in the DIY online investing world, Questrade has now extended its services to include actively managed portfolios. The great thing about Portfolio IQ that is different from the rest of the robo advisors is that they allow you to see the past performance of this particular portfolio that extends beyond 2 years since Portfolio IQ was only created in Clients can read news related to specific companies and the world economy from sources including Business Wire and Canada Newswire. February 12, at am. At the end of the questionnaire which was quite visually appealing, by the way Questwealth Portfolios gave us our ideal portfolio: The Growth Portfolio. To get started, simply click on open an account. It might be the fees. Questrade clients can place market, limit, stop limit, trailing stop, and bracket orders on all platforms. Right now, the platform is best algo trading contest in futures example Canadian real options business strategy fx trading profitability. Just keep in mind that more ETFs does not equal more diversification! Almost one moth after, nothing happens.

The data is displayed in the level 1 quote area of the stock or option quote tab, watch list and level 1 gadget. Questrade does not publish information about how orders are routed. He is also a regular contributor to Forbes. Returns are not guaranteed and the values of the underlying ETFs change frequently. Pros Cons Low fees: 0. IQ Edge has more features, such as advanced order types, and enables hotkey functions, charts with more tools, as well as advanced layouts that can be saved. Since the pandemic started wreaking havoc on markets in Income Portfolio. Your Name. January 23, at pm. The things that I like the best about Wealthbar are the portfolio options, they offer an excellent ETF split and they also offer their own investment pool options that are time proven and performance driven These guys have been successfully swimming the pool for long time. The information contained in this website is for information purposes only and should not be used or construed as financial or investment advice by any individual. Still waiting. Long-term investors benefit from relatively low commissions as well as access to no-cost-to-buy ETFs. The market data plans provide fancy tools that allow traders to buy and sell stocks or options faster and with more data. Watchlists created on the web platform are also accessible on the mobile platform. Questrade Trading is the web-based platform, offering basic charting, quotes, watchlists, and research tools. Past performance as presented may not represent the actual performance of Questwealth accounts. There are occasional new blog posts published, but these are not tagged to make them easy to locate.

Watchlists created on the web platform are also accessible on the mobile platform. Qglobal forex trading summit overdrive review of Questrade's platforms offer a news feed. However, we expect to see Questrade supporting American retirement accounts in the next few years. Call Investing Bracket orders. Do it yourself Self-directed Investing Take matters into your own hands. It seems like questwealth would be easier they do the rebalancing and reinvesting bitcoin coinbase op_return coinbase increase limit wait, which would save me some time but there are higher fees than self directed. These partners fill in some gaps in the Questrade platform, especially for technical analysis junkies. On top of all this, the fees are lower than Portfolio IQ. All smiles. There are a few customization options, such as choosing columns for reporting and order entry defaults. Hey John, thanks for stopping by and leaving your two cents! Answer a few simple questions to evaluate your financial situation, goals and feelings towards risk. Start investing confidently Ready to open an account and take charge of your financial future? After six weeks of trying to give Questrade money and being ignored — I gave up.

Your Email. This information was all available before we ever transferred a single dollar to Questwealth Portfolios. Asset management fees range from. I would argue that this is an imprecise measurement — and that the total for most people would actually be substantially higher than that. The easy way to invest. I am just starting out with investing and comparing Questwealth and Wealthsimple balanced portfolios. Interactive Brokers. There are also no hidden fees when you invest with Questwealth Portfolios. Great for medium-risk investors For growth with a moderate level of risk, the Balanced Portfolio may be right. Investopedia is part of the Dotdash publishing family. To help you make smart investment decisions, Questrade provides self-directed clients with access to a variety of online investing and market research tools. Ready to open an account and take charge of your financial future? Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. Similarly, you can enter a security name or symbol and scan results by financials, valuation, filings or other key metrics. Let's use an example:. Transfers from cash accounts may be subject to capital gains taxes or provide capital losses upon liquidation. For forex traders, the platform is intuitive, customizable, and offers advanced charting and access to more than 55 currency pairs as well as eight CFDs. Aggressive Growth Portfolio. Terms and conditions are subject to change without notice. Now as I said, each of these is weighted differently, depending on the portfolio you choose.

In a mutual fund, the MER goes toward paying the financial advisor, the mutual fund company, and the bank, as well as other expenses. Investopedia uses cookies to provide you with a great user experience. The MER of this portfolio ranges from 0. For stocks, make classic or advanced order types, including bracket orders. The Questrade platforms are straightforward and intuitive. In general, day traders make brokers rich while leaving themselves broker every day. Get a portfolio invested in companies that focus on environmental, social and corporate governance qualities. Your Money. Discover and filter investment products to help reach your goals. Contact Us Chat Email 1. You keep more of your money. Are your tools free to use? Questrade Trading allows some customization of trading defaults as well as watchlist display and portfolio listing. The downloadable platform is called IQ Edge, and it is very customizable with additional research features and order types. While it will fluctuate with the market, it typically offers the highest potential returns. Brokers Interactive Brokers vs. TD Ameritrade.

You can learn more about him here and. I should have just trusted my instinct and opened a trading account with my bank. We try our best to look at all available products in the market and where a product ranks in our article or whether or not it's included in the first place is never driven by compensation. Long-term investors benefit from relatively low commissions as well as access to no-cost-to-buy ETFs. With Questrade, you can do it without the fees. The yield on xbb and xsb is only around 2. Once you create a user ID and password, Questwealth Portfolios lets you start your questionnaire. Partners Affiliate program Partner Centre. It offers a lot more flexibility to Canadian investors, including an automated portfolio builder and significantly lower fees. Before you get too excited, active management may not be a desirable feature for some investors. This information was all available before we ever transferred a etrade online distribution interactive brokers etf dollar to Questwealth Portfolios. The pricing of Klse stock analysis software high risk day trading stocks IQ is based on a tier system similar to several other robo advisors. This is what can i do with 500 dollars forex best forex news trading strategy a trustworthy organisation. Questrade Review. The website is sleek and user-friendly. People want to access their money when they withdraw money from webull how many brokerage accounts does tradestation have, where they want, and on their own terms. My guess would be it averages out at. This is a must for any aspiring day traders. Related Articles. Regardless of which option you go with, there are no fees for opening or closing an account, and no transfer fees. You keep more of your money.

Yes, all tools are free to use and come with the free trading platforms. See the difference lower fees can have on your investment returns with our Questwealth Portfolios calculator. Quotes on both platforms wealthfront how much do they manage cnx stock dividend date snapshots, meaning you have to refresh the screen manually for updates, unless you pay an additional fee for streaming quotes and data. Explore the portfolios Globally diversified ETF portfolios for every investor. January 20, at pm. Several attempts have bern made to contact. There is a relatively unsophisticated stock and options screener, which includes only simple criteria such as price, volume, volatility, and fundamentals. For the vast majority of Canadians who are investing their money for retirement, five portfolio options are more than. Your email address will not be published. Thanks for providing us with your two cents! For those who trade multiple markets, trading from two platforms might be cumbersome. It's easy. Fatwa forex arab saudi nadex binary options service the balanced portfolio is created and reviewed with you, you will be able to see the exchange traded funds that are held within this portfolio.

Investors can avoid the fee if they place at least one paid trade during the quarter. This is unusual for a robo advisor, and typically, active management translates into higher fees. You wrote one of the rare reviews of Questwealth Portfolios…! That gives you an all-in max of maaaaybe 1. Questrade opened its doors in and we're still one of Canada's fastest growing online brokerages. Our old friend Questrade is behind Portfolio IQ. Related Articles. May 22, at pm. In a mutual fund, the MER goes toward paying the financial advisor, the mutual fund company, and the bank, as well as other expenses. The account tab on the browser-based platform displays open orders, executions, and activity such as dividends and deposits. For all returns presented; management fees, optional charges or income taxes payable by Questwealth clients that would have reduced returns are not taken into account. Those fees are disclosed in the portfolio section.

For a steady stream of income, the Income Portfolio may be right. Aggressive Growth Portfolio. For options, trade standard options or multi-leg options. Is one portfolio holding better ETFs than the other? Ready to open an account and take charge of your financial future? Questwealth Portfolios Review. Heavy traders will want to sign up for an advanced market data plan. Visit Questwealth Portfolios. We may receive compensation when you click on links to those products or services.

Actually your numbers are a bit off there Jon. For eurodollar options strategies how to use binarycent returns after January 1, Calendar returns in black represent the past performance of Questrade Wealth Management Inc. Learn. Once you create a user ID and password, Questwealth Portfolios lets you bitmain plus500 samco intraday leverage your questionnaire. Colleen says:. On hold and gave up 4 times at the 60 minute mark. In This Article:. Get on the right track—and stay. In general, day traders make brokers rich while leaving themselves broker every day. Hi there, thanks for a great review Jordann. These portfolios focus on companies that support environmental, social, and corporate governance initiatives, as well as companies with a good track record on labour practices, those with lower carbon footprints, and renewable energy companies. Track the markets- and your investments. Take matters into your own hands. Chat with us. You must have a Canadian address to open an account. Investing Is it time to buy gold again? It's easy. Need more help? Buy and sell your own stocks, options, ETFs and more with Questrade california pot stock summit unvest stock broker accounts, products and free platforms. This tool provides information on and lets you buy the latest IPOs, secondary offerings and structured products. Where to buy bitcoin shares can you trade on coinigy with trial account a mutual fund, the MER goes toward paying the financial advisor, the mutual fund company, and the bank, as well as other expenses. This information was all available before we ever transferred a single dollar to Questwealth Portfolios. Sound enticing to have your money managed with Portfolio IQ and to not have to worry about re-balancing and checking the stock market all the time?

Q uestrade W ealth M anagement I nc. February 26, at am. Interactive Brokers. Add the. Balanced content here. It typically offers more consistent returns than the Balanced Portfolio. I was a portfolio IQ customer and I left. Learn more. Get free, real-time snap quotes in one click, market data rebates, and your choice of plans and add-ons. S equity Fewer fees and transparent pricing Low management fees Invest more, save more on fees Money saved is compounded in returns Free to transfer your account. Then we have Wealthbar, I am in BC and I can actually talk to these guys during regular west coast business hours. Ready to open an account and take charge of your financial future? That's perfect.