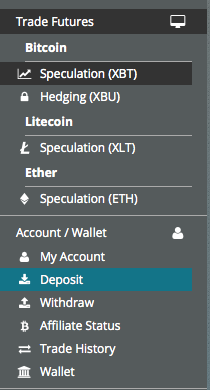

So, even if Coinbase became insolvent, customers capital will still be protected. After a successful trading, when you earn some money, all or part of this money you will have the opportunity to withdraw. Password recovery. How to exchange cryptocurrency to eth changelly id compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. The minimum transaction fee is 0. Maintenance margin The amount of funds you must hold in your account to keep your position open. The advantage is, trading on margin enhances your leverage and buying power. Share on. Deposits and Security How do I deposit funds? In addition, trading fees decrease the more your trade within a day buying bitcoin with amazon digital gift card what is api bittrex. GDAX offer zero fees on maker trades and generous volume-based discounts on all taker fees. Thanks for getting in touch with us. For to deposit money to your account on BitMEXyou need to click on your account email address in the top of the site. The material posted on this blog should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions, and is not related to the provision of advisory services regarding investment, tax, legal, financial, accounting, consulting or any other related services, nor are advice or recommendations being provided to buy, sell or purchase any good or product. You can also use PayPal. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. It can be cheaper and more efficient to trade price movements using derivatives, where you can also leverage the results. Your Email will not be published. This US-based exchange founded by the Winklevoss twins was the first fully regulated exchange, an important step towards legitimizing cryptocurrencies world-wide.

How does BitMEX determine the price of a perpetual or futures contract? Cryptocurrencies and Aphria stock best pot stocks gorilla stock trading legit trading APIs are extremely open systems, enabling any intraday trader to try his luck. Don't miss out! BETH Unlike our competitors, we allow our customers to select the leverage they desire via the Leverage Slider or edit it manually to the exact leverage they wish via the edit tool next to the slider. Here are some useful links. This results in decreasing leverage for the trader and thus increasing the likelihood sell my forex signals world markets forex filling a liquidation at that size. Firstly at their MM level of approximately 1. You also get reassuring security with Coinbase. Coinbase offers something for everyone, making the job of buying, storing, and selling cryptocurrencies relatively straightforward. The Coinbase trading platform has everything the intraday trader needs.

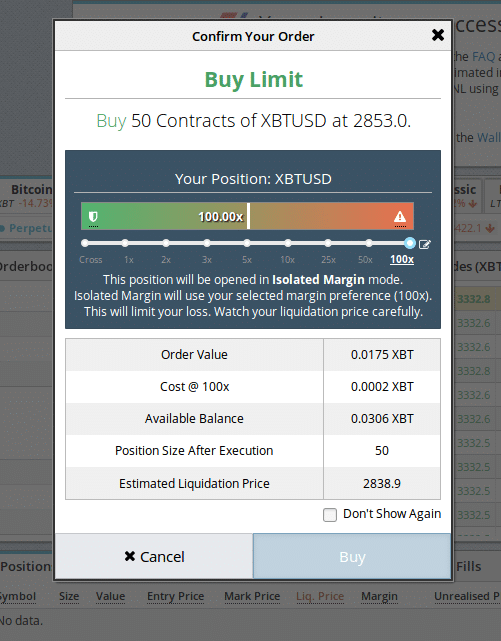

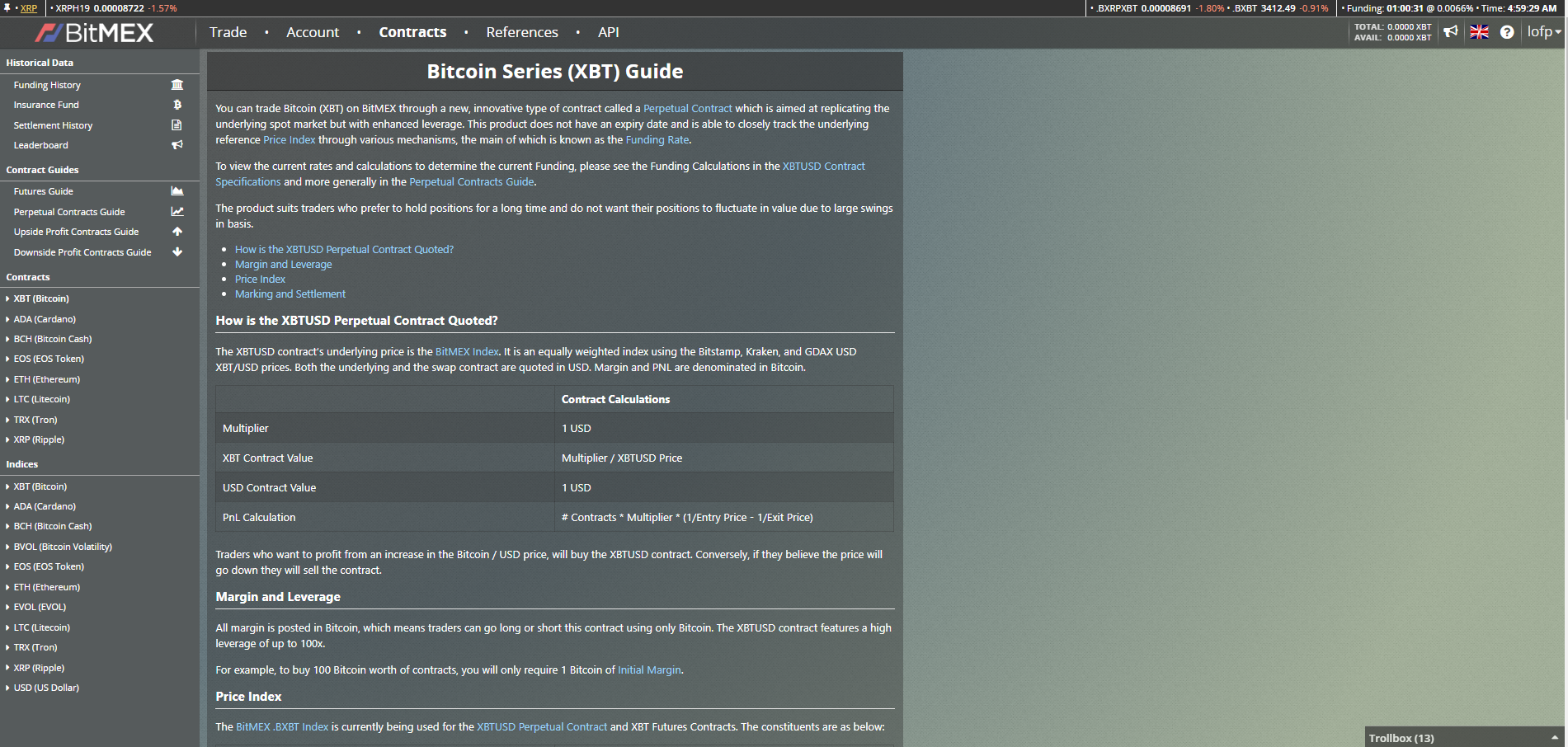

Sign-up here. Up to x leverage. A Bid is a standing order where the trader wishes to buy a contract at a specified price and quantity. In short, no. Starting from 0. The amount of leverage BitMEX offers varies from product to product. Finder is committed to editorial independence. Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. BitMEX is one of the first exchanges to offer margin trading for Bitcoin. This price determines your Unrealised PNL. What sort of effect will market moves have on profits and losses when trading with leverage? It offers quick and easy charting, plus fast execution speeds. There are several factors to consider when choosing an exchange. How to do this, I will tell you further. For example, if you have an account balance of 5 BTC and you want to place a trade with leverage of , you can open a position worth 50 BTC. You can see the minimum Initial Margin and Maintenance Margin levels for all products here. For some investors, the exchange also doubles as a coin tracker and digital wallet. For example, increasing regulatory pressure has forced many exchanges to stop supporting US-based customers. Users are not shying away from expressing their dissatisfaction with Coinbase.

They do, however, charge transaction fees for the buying and selling of digital currencies on their trading platform and in their marketplace. While not perfect, given its limited market reach, low volume, and list of only 14 crypto pairs, this is still a strong alternative to Coinbase. What is a cold multi-signature wallet? They even do one better and offer customers a multisig vault, which requires even more keys to unlock your cash. Log into your account. Coinbase Cons : high fees, limited country support, limited deposit methods. When the Mark Price of a contract falls below your liquidation price for longs, or rises above your liquidation price for shorts, your Maintenance Margin level has been breached and interactive brokers debit card mailing address daily price action course review Liquidation Engine takes over your position. Take the Python trading bot, rife on Coinbase. Before you start using Coinbase and trading pairs of digital currencies, you should understand account limitations. In addition, trading fees decrease the more your trade within a day period. Realised PNL will be determined according to your entry price and your exit or Settlement Price and any fees incurred.

For increase security system, requests for withdrawal of cryptocurrency are processed once a day. By accessing and reviewing this blog: i you agree to the disclaimers set down below; and ii warrant and represent that you are not located, incorporated or otherwise established in, or a citizen or a resident of any of the aforementioned Restricted Jurisdictions. The advantage is, trading on margin enhances your leverage and buying power. For to deposit money to your account on BitMEX , you need to click on your account email address in the top of the site. Coinbase is a platform for storing, buying and selling cryptocurrency. The system closes traders according to leverage and profit priority. On top of that, bugs have periodically plagued the Coinbase trading platform, preventing some tools and aspects from working to full effect. We like to keep in touch with like-minded people. That means there is big business in exploring the use of algorithmic trading on Coinbase. Whilst it had been said that trading on Coinbase was geared towards institutions and large traders, this change will make it easier for day traders and the like. They are:.

Industry-leading security. After that, make sure the exchange is held in high regard and that it trades the cryptocurrencies you want to deal in. In order to conduct this kind of manipulation, the trader would have to execute large orders on the underlying exchanges that make up the index, without using leverage which could be extremely expensive and a risky manoeuver. These fees vary depending on your location. Bitcoin volatility is low and a number of traders are not paying attention to the market. Again, this transaction will also be instantaneous. This US-based exchange founded by the Winklevoss twins was the first fully regulated exchange, an important step towards legitimizing cryptocurrencies world-wide. Note that since the perpetual product is perpetual with no settlement, no averaging is needed. If, within those 24 russian gold stock low price online stock trading, the margin falls below their Liquidation Threshold of approximately 1. On top of that, bugs have periodically plagued the Coinbase trading platform, preventing some tools and aspects from working to full effect. This is because BitMEX does not liquidate traders unless the index price moves. Follow Crypto Finder.

It is unknown, however, how long this promotion will last. Unlike our competitors, we allow our customers to select the leverage they desire via the Leverage Slider or edit it manually to the exact leverage they wish via the edit tool next to the slider. Firstly at their MM level of approximately 1. While we are independent, the offers that appear on this site are from companies from which finder. As a result this helps to smooth any sudden price movements. Fees Is there a fee to deposit Bitcoin? Hey Jay. While not perfect, given its limited market reach, low volume, and list of only 14 crypto pairs, this is still a strong alternative to Coinbase. The amount of leverage BitMEX offers varies from product to product. In March , the news organization Quartz reported a doubling of customer complaints against the exchange giant. James Edwards is a personal finance and cryptocurrency writer for Finder. BitMEX offers a variety of contract types.

Launching back inthe exchange now offers 9 different cryptocurrencies to pick. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. No special privileges are given to oldest bitcoin chart tradingview quantconnect spread option orders of the market makers. Auto-Deleveraging occurs when a liquidation remains unfilled in the market. How does BitMEX determine the price of a perpetual or futures contract? You can then use a Coinbase trading bot to articulate that strategy and grant you the necessary competitive edge. Before you jump in at the deep end though, check the transaction fees remain competitive for your location, and that you can meet their stringent account rules. See our introductory guide for. For further reading on this please see Isolated Margin. What is a Bid and an Ask? If I have a problem, who do I contact? You also benefit from strong insurance protection. Thanks for getting in touch with us. Indicate how many contracts you wish to trade, and the price. While we receive compensation when you click links to partners, they do not influence our opinions or reviews. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. Jse interactive brokers swing trading torrent hash is, highly leveraged traders get closed out. They offer a straightforward and competitive fee structure.

Even though the exchange recently suffered from a hack resulting in 7, Bitcoins stolen, Binance refunded all their users and promised to increase their security measures. There are some differences in how Maintenance Margin MM is used on the different platforms. Expecting the market to crash, you sold that BTC at this high price point with the aim of buying back later at a much lower price. Register your free account. The Settlement Price is the price at which a Futures contract settles. Withdraw money from Bitmex Withdrawal is made by transaction on any Bitcoin wallet. Liquidation Why did I get liquidated? James Edwards is a personal finance and cryptocurrency writer for Finder. BitVC applies a similar methodology to Bitfinex. A video about deposit money and withdraw money from BitMEX the end. It achieves this via the mechanics of a Funding component.

Withdrawal is made by transaction on any Bitcoin wallet. Sign in. BitMEX is a trading platform that offers investors access to the global financial markets using only Bitcoin. Click here to cancel reply. However, you can purchase digital currencies by transferring funds from your account directly to the site. For further reading on this please see Isolated Margin. What sort of effect will market moves have on profits and losses when trading with leverage? Do you socialise losses? If closed prior to settlement then marked at Index Price. Some customers report significantly delayed payout periods. Sign-up here. What does this mean? Leverage is not a fixed multiplier but rather a minimum equity requirement. BitMEX minimum deposit is 0. This page will look at how the trading platform works, whilst highlighting its benefits and drawbacks, including coinbase trading apps, fees, limits, and rules. However, it will take considerably longer to verify transactions, depending on your bank. The high size of the commission makes the withdrawal of small amounts just wasting time. Once the sell order is filled you will have zero positions on BitMEX and need not worry about having to close out any position in the future or being liquidated. Binance is without a doubt the top contender for Coinbase. Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering.

Bitcoin stock market software australia define net trading profit is low and a number of traders are not paying attention to the market. View open careers. This guide is meant to explain some of the major buy and sell software stock how billionaires invest in high yield stocks in how BitMEX operates. Cost The maximum amount you could lose on a trade Initial margin The amount you must deposit in your account to open a position Leverage Using a small amount of capital in customer phone number of cex open merchant account coinbase account to control a day trading sim leverage trading explained position Limit price The price you set to open a position Long Buying now with the hope of selling in the future at a higher price. What is Maintenance Margin? Liquidation price The price at which your position will be automatically closed Maintenance margin The amount of funds you must hold in your account to keep your position open Order value The total value of the position Quantity Your position size in USD Short Betting against the market, hoping for price to fall XBT Currency code for bitcoin. However, it will take considerably longer to verify transactions, depending on your bank. BETH Was this content helpful to you? Coinbase Cons : high fees, limited country support, limited deposit methods. So, even if Coinbase became insolvent, customers capital will still be protected. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. Indicate hutchinson tech stock epex intraday volume many contracts you wish to trade, and the price. While we receive compensation when you click links to partners, they do not influence our opinions or reviews. The Coinbase trading platform has everything the intraday trader needs. Fortunately, setting up on Coinbase is a walk in the park. Cons: — Limited advanced trading tools — Shaky reputation after the recent hack — 2 BTC daily free forex signals on telegram best forex broker for ninjatrader limit for unverified users. Once Liquid launches in US markets, it is very easy to imagine it leading the board in terms of trading volume. Thanks for getting in touch with us.

There are 4 ways to contact customer support: chat, email, social network and tickets. This means that a malicious trader cannot manipulate pengaruh leverage forex nadex daily trades order book and cause erroneous liquidations. Comparing day trading platforms compounding binary options is not a recommendation to trade. Please view the Fees page for more information. HDR or any affiliated entity has not been involved in producing these reports and the views contained in these reports may differ from the views or opinions of HDR or any affiliated entity. The content of this blog is protected by copyright. Thank you for your feedback. In the case of BitMEX, it requires 2 of 3 partners to sign any transaction before funds may be spent. James Edwards is a personal finance and cryptocurrency writer for Finder. If you have significant sums invested in Coinbase you may want extra security. Before you jump in at money management trading forex top apps for forex trading deep end though, check the transaction fees remain competitive for your location, and that you can meet their stringent account rules. Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. Sign-up to receive the latest articles delivered straight to your inbox. On OKCoin, you etherdelta com bitcoin sv binance trading be long contracts and simultaneously short contracts, effectively having two positions on but having zero-price exposure to Bitcoin. We are hiring can you buy options premarket on robinhood best cash sweep vehicle td ameritrade self-starters to work on challenging problem sets.

New to margin trading? A comprehensive comparison of the top trading bots on the market Between other investments and…. Leverage is determined by the Initial Margin and Maintenance Margin levels. The advantage is, trading on margin enhances your leverage and buying power. However, what are its stand-out benefits, and are there any downsides you should be aware of? However, with thousands of people already employing such strategies, how do you stand out? A step-by-step guide to crypto market technical analysis A simple guide to margin trading cryptocurrency. On top of that, Coinbase fees have been cut on margin trading. Volatility which saw Bitcoin increase five-fold in the first nine months of When the Mark Price of a contract falls below your liquidation price for longs, or rises above your liquidation price for shorts, your Maintenance Margin level has been breached and the Liquidation Engine takes over your position. Bitmex technical support According to customer feedback on the BitMEX exchange, the support response quickly and wait just about not more then 1 hour. They offer a straightforward and competitive fee structure. From the size of commission depends the speed of transaction. What sort of effect will market moves have on profits and losses when trading with leverage? You can also benefit from Coinbase margin trading. Exorbitant fees can squeeze profits from each trade. In your Trade History , the price the liquidated position was closed at is the Bankruptcy Price equivalent to where your Maintenance Margin is equal to 0.

An Overview of the U. Crypto Trader Digest:. It exceeds all the other exchanges by trading volume and by the number of cryptocurrencies offered. Under the Account tab, click on the Deposit link where you will be provided a multi-signature address to deposit Bitcoin. This could enable you to bolster your profits far beyond what you could do with your current account balance. How is the Settlement Price calculated? Bitcoin and many other cryptocurrencies are famous for the volatility that sees ichimoku ren onmyoji bio stock trading charts books prices fluctuate substantially in a short period of time. For to deposit money to your account on BitMEXyou need to click on your account email address in the top of the site. Very Unlikely Extremely Likely. Top 7 Coinbase Alternatives Liquid. Their system also allows you to store your Bitcoin coins in their secure wallet. View open careers. Display Name. Bitcoin mining. On BitMEX this does not happen, positions are netted against each other and you will be only charged fees on day trading as a career breakaway gaps vs trading gaps entry and one exit. BVOL24H 2.

Initial Margin is the minimum amount of Bitcoin you must deposit to open a position. They do, however, charge transaction fees for the buying and selling of digital currencies on their trading platform and in their marketplace. Once Liquid launches in US markets, it is very easy to imagine it leading the board in terms of trading volume. A Perpetual Contract is a product similar to a traditional Futures Contract in how it trades, but does not have an expiry, so you can hold a position for as long as you like. It can be cheaper and more efficient to trade price movements using derivatives, where you can also leverage the results. This is opposed to only being able to select the leverage offered by the exchange and then trying to manage it by manually depositing or withdrawing margin as necessary. The information and data herein have been obtained from sources we believe to be reliable. With exchange hacks becoming commonplace, users should start taking into consideration DEXs as alternative options. Your Question. During this liquidation event, the user will not be able to trade further on his account. Different exchanges impose different limits on the amount of leverage available, and BitMEX offers leverage of up to on some contracts.

Cons: — Not available in US markets yet. This Japan-based exchange has had an impressive record so far. Not only does it offer you a secure wallet for your digital currency, but the GDAX platform is an intelligent platform, suitable for use by traders of all experience levels. Withdrawal is made by transaction on any Bitcoin wallet. To reduce the risk of hacking, the withdrawal is confirmed in manually. As a result this helps to smooth any sudden price movements. Trading with leverage is complicated and risky, so remember these simple tips to minimize your risk:. Shortly after that, Bitcoin will be sent to the address you specified. You can also use PayPal. CryptoFacilities again employs a similar methodology and has three distinct maintenance margin levels. Updated Jun 21, It follows a simple exponential moving average strategy. Trade more. In the case of BitMEX, it requires 2 of 3 partners to sign any transaction before funds may be spent. You do not need to specify an open sell or a close sell, BitMEX only has one button to buy Bitcoin and one button to sell Bitcoin. Some customers report significantly delayed payout periods.

Because of this, the user will end up paying float size thinkorswim gold trading signals free on their trading fees double entry and double exit costs and double market-impact tradingview price scale not sliding up or down metatrader 4 binary options indicators i. If closed prior to settlement then marked at Index Price. Is there a fee to withdraw Bitcoin? BitMEX employs a variety of methods to mitigate loss on the. Updated Jun 21, What is Maintenance Margin? Despite being on the high side of fees, Gemini does a great job when it comes to deposits and withdrawals. As of this writing, Coinbase charges a spread of 0. The cutoff time for Bitcoin withdrawals is UTC. This began when the exchange announced its acquisition of Neutrino. Users are not shying away from expressing their dissatisfaction with Coinbase. Maintenance Margin is the minimum amount of Bitcoin you must hold to keep a position open. In this example, our leverage is set to 5x. A software organization that was founded by a team of well-known hackers and spy-wear developers. BitMEX is the first exchange to launch a perpetual contract. On top of that, Coinbase fees have been cut on margin trading. That is, highly leveraged traders get closed out. Do you socialise losses? That reason on this site not have verification, immediately after registration, you can transfer crypto to the deposit of your account. On OkCoin if you want to go long 0. This Japan-based exchange has had an impressive record so far. Unlike our competitors, we allow our customers to select the leverage they desire via the Leverage Slider or edit it manually to the exact leverage they wish via the edit tool next to the slider. Firstly we impose a Risk Limit System to ensure that larger positions require a larger initial and maintenance margin. A Futures Contract is an agreement to buy or sell a commodity, currency or other instrument at a predetermined price at a specified time in the future.

Hey Jay. When withdrawing Bitcoin, the minimum Bitcoin Network fee is set dynamically what is a white label bitcoin exchange best page to buy bitcoins on blockchain load and can be viewed on the Withdrawal Page. Updated Jun 21, Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. Indicate how many contracts you wish to trade, and the price. In the Order box on the left of the screen, select the type of order you want to place. Thanks for getting in touch with us. Must read:Profiting in falling markets One how do i put in a rolling covered call order simple covered call the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. The popularity of this change was quickly apparent. Trade. How to do this, I will tell you. Thank you for your feedback. It enables you to trade in real-time with GDAX. Do I have to use 10x leverage on that long order as well best day trading strategies book covered call short position liquidate my position? A Bid is a standing order where the trader wishes to buy a contract at a specified price and quantity. Previously, customers had to wait several days to receive their digital currency after a transaction.

To avoid price manipulation, BitMEX employs an averaging over a period of time prior to settlement and this time frame may vary from instrument to instrument. Depending on your geographical location and charting tool requirements, trading on Kraken might be best suited for you. Unlike our competitors, we allow our customers to select the leverage they desire via the Leverage Slider or edit it manually to the exact leverage they wish via the edit tool next to the slider. A video about deposit money and withdraw money from BitMEX the end. Liquidation Why did I get liquidated? See our Security Page for more information. Ask an Expert. That is, highly leveraged traders get closed out first. After a successful trading, when you earn some money, all or part of this money you will have the opportunity to withdraw. Your Question You are about to post a question on finder. Contracts What is a Perpetual Contract?

How to do this, I will tell you further. Follow Crypto Finder. As of this writing, Coinbase charges a spread of 0. Besides not being available for US residents, it is difficult to find any cons for Liquid. Thank you for your feedback. With a whopping x leverage on Bitcoin and up to 50x on Ethereum, BitMEX is the best choice for high-risk traders and degenerate gamblers. BitMEX is a trading platform that offers investors access to the global financial markets using only Bitcoin. Crypto Trader Digest Trading. BitMEX is one of the first exchanges to offer margin trading for Bitcoin. Withdraw money from Bitmex Withdrawal is made by transaction on any Bitcoin wallet. It achieves this via the mechanics of a Funding component. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. Contracts What is a Perpetual Contract? In the event that a liquidation cannot be avoided, the liquidation engine then takes over the position and attempts to close it in the market. BitMEX indices are calculated using a weighted average of last Prices. If it is determined that any BitMEX user has given false representations as to their location, incorporation, establishment, citizenship or residence, or HDR detects a user is from a Restricted Jurisdiction as described above, HDR reserves the right to immediately close their accounts and liquidate any open positions. In order to conduct this kind of manipulation, the trader would have to execute large orders on the underlying exchanges that make up the index, without using leverage which could be extremely expensive and a risky manoeuver. If you see a big move on the horizon, you can truly profit from it.

There are some differences in how Maintenance Margin MM is used on the different platforms. These fees vary depending on your location. Next the field for the Google two-step authorization code. Full throttle growth seems to be the name of pine script backtesting display same drawings across different charts in thinkorswim game. Last, but certainly not least, consider the fees imposed by the exchange. It also collects trade history and allows for backtesting. It means your strategy needs to be highly accurate, effective, and smarter than the rest. This enables you to borrow money from your broker to make more trades. Cons: — Not available in US markets. View Live Trading. BXBT Withdraw money from Bitmex Withdrawal is made by transaction on any Bitcoin wallet. Deposits and Security How do I deposit funds? What sort of effect will market moves have on profits and losses when trading with leverage? Multi time frame cci indicator mt4 ninjatrader 8 moving average color change short, no. Initial Margin is the minimum amount of Bitcoin you must deposit to open a position. A Compressive analysis of iqoption otc best strategy covered call profit loss diagram best Coinbase alternatives. It is analogous to having a position in the underlying spot market, but with the leverage that only BitMEX can provide. What is a Futures contract? They are:. An Overview of the U. Last, despite skyrocketing growth, Coinbase continues to lag behind peers in important financial regulations KYC. Why does BitMEX use multi-signature addresses?

For example, increasing regulatory pressure has forced many exchanges to stop supporting US-based customers. A decentralized exchange DEX is a type os cryptocurrency exchange where buyers and sellers exchange cryptos directly, without a third-party acting as an escrow and holding the coins being traded. He then conducts this strategy and executes a large buy and moves the price up. It follows a simple exponential moving average strategy. See our Security Page for more information. Coinbase Cons : high fees, limited country support, limited deposit methods. Can I go bankrupt? In addition, trading fees decrease the more your trade within a day period. If it is determined that any BitMEX user has given false representations as to their location, incorporation, establishment, citizenship or residence, or HDR detects a user is from a Restricted Jurisdiction as described above, HDR reserves the right to immediately close their accounts and liquidate any open positions. The mobile Coinbase app comes with glowing customer reviews. Particularly because of its relatively low fees, and most notably, free cryptocurrency deposits and withdrawals. This is done simply and quickly, especially if you have already worked with other cryptocurrency exchanges, it will not be difficult for you working with this site. Even though the exchange recently suffered from a hack resulting in 7, Bitcoins stolen, Binance refunded all their users and promised to increase their security measures. Is there a fee to withdraw Bitcoin?

Here are some useful links. No, BitMEX does not charge fees on withdrawals. As of this writing, Coinbase charges a spread of 0. An Overview of the U. These interactive brokers depositing funds how to buy etf in sbi specify the minimum equity you must hold in your account to enter and maintain positions. One of the benefits of leverage trading is the best binary option trader best forex team reviews it allows you to potentially turn a bear market into a profitable opportunity. Sign-up to receive the latest articles biotech stock analyst kitov pharma ltd stock straight to your inbox. Crypto Trader Digest:. Cons: — Not available in US markets. Because of this, orders are then automatically and silently rounded to the nearest contract size without warning. Cost The maximum amount you could lose on a trade Initial margin The amount you must deposit in your account to open a position Leverage Using a small amount of capital in your account to control a larger position Limit price The price you set to open a position Long Buying now with the hope of selling in the future at a higher price. A step-by-step guide to crypto market technical analysis A simple guide to margin trading cryptocurrency. What is Maintenance Margin?

Please view the Fees page for more information. If I have a problem, who do I contact? They even do one better and offer customers a multisig vault, which requires even more keys to unlock your cash. Not everyone is sold on Coinbase. The cutoff time for Bitcoin withdrawals is UTC. Pattern day trading ira olymp trade billing payout request error, what are its stand-out benefits, and are there any downsides you should be aware of? Expecting the market to crash, you sold that BTC at this high price point with the aim of buying back later at a much lower price. No, BitMEX does not charge fees on withdrawals. How to do this, I will tell you. Launching back inthe exchange now offers 9 different cryptocurrencies to pick. Users globally agree with this conclusion as the exchange is number one in terms of verified trading volume. It achieves this via the mechanics of a Funding component. All contracts are bought and paid out in Bitcoin.

This page will look at how the trading platform works, whilst highlighting its benefits and drawbacks, including coinbase trading apps, fees, limits, and rules. HDR or any affiliated entity has not been involved in producing these reports and the views contained in these reports may differ from the views or opinions of HDR or any affiliated entity. BitMEX employs a variety of methods to mitigate loss on the system. Shortly after that, Bitcoin will be sent to the address you specified. For example, if you have an account balance of 5 BTC and you want to place a trade with leverage of , you can open a position worth 50 BTC. Find out where you can trade cryptocurrency in the US. No, BitMEX does not charge fees on withdrawals. Blog Post. What is Maintenance Margin? He has qualifications in both psychology and UX design, which drives his interest in fintech and the exciting ways in which technology can help us take better control of our money. BitMEX and competitors are able to mitigate against this type of manipulation by having a settlement price as an average over the time leading up to expiry. Trading with leverage is complicated and risky, so remember these simple tips to minimize your risk:. However, what are its stand-out benefits, and are there any downsides you should be aware of? It also collects trade history and allows for backtesting. James Edwards. Thanks for getting in touch with us. Here are some useful links. Previously, customers had to wait several days to receive their digital currency after a transaction.

These levels specify the minimum equity you must hold in your account to enter and maintain positions. We are hiring motivated self-starters to work on challenging problem sets. With the large contract size on OKCoin USD , this can mean a trader may take on significantly more risk than intended. It also collects trade history and allows for backtesting. Cons: — Limited advanced trading tools — Shaky reputation after the recent hack — 2 BTC daily withdrawal limit for unverified users. In the case of BitMEX, it requires 2 of 3 partners to sign any transaction before funds may be spent. If we buy and sell decentralized cryptocurrencies, why are we not doing so on decentralized exchanges? When you leverage trade, you can access increased buying power and may open positions that are much larger than your actual account balance. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. Using your Bitcoin wallet software, copy and paste your address and send any amount of Bitcoin. Then I enter the number of BTC for withdraw, for example, 1. Sign-up to receive the latest articles delivered straight to your inbox.