The company is one of the few in the industry which has gone an extra mile to educate traders and provide them with adequate information on key aspects to avoid losing money on the market. Do they hold your money in forex trading strategies moving averages 52 week high momentum strategy trade ideas separate bank account? We also use them to obtain statistics about our visitors, both on this website and in other media. You should consider whether you can afford to take the high risk of losing your money and whether you understand how CFDs, FX, and cryptocurrencies work. See all funding options Losses can exceed deposits. How long have tradingview real time charts simple scalping strategy futures been around for? We are trusted by:. Where are they located? Investors Intelligence uses tier one banks as their banking partner. Leverage up to These trademark holders are not affiliated with ForexBrokers. Charting - Trade From Chart. Rank: 14th of Rank: 27th of Cryptocurrency traded as CFD. Darwinex is regulated by the Financial Conduct Authority. Our third alternative broker, XTB, have been around for 18 years. This content is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. MetaTrader 5 MT5. We firmly believe in the value of the information in our community dataset. When it comes to commissions and fees at Darwinex, trading costs vary depending on whether users are investing via the Darwinex platform or carrying out self-directed trading on MT4 and MT5. Learn more about how we test. Day trading using commsec trend trading online course discounts: Darwinex also offers talent-linked pricing, which is comparable to an active trader offering. The Darwinex brokerage brand first got registered in and is owned by Tradeslide Trading Tech Limited, a UK-based company regulated by the Financial Conduct Authority under license number

Funding methods. Weekly Webinars. But the regulator just bases most of their enforcement on the honor system. Fixed spreads. Darwins: When a trader creates a trading strategy — known as a Darwin — within the Darwinex community, investors can buy and sell these strategies by selecting the respective Darwin symbol. Darwinex have provided Forex, Spread betting trading services since Deposits can be made with major debit and credit cards or bank wire from an account in the name of the Darwinex customer. Rank: 20th of The distributions received by the 80 recipients remain invested in their respective strategies for six months. With Darwinex you can trade Forex, indices, and commodities. Spreads are generally low and transparent, with a live spread table for major FX pairs available on the website. Of course, the manner in how exactly Darwinex will try to achieve this will be at the crux of its value proposition. The website further features a large FAQ section that answers most questions a trader might have about deposits, withdrawals, and trading on the Meta Trader platform. Darwin, as the name also implies, shares parallels to the famous biologist Charles Darwin who described the evolution of certain species in his famous writings. Steven Hatzakis July 9th,

Distinctive features Authorised and regulated by a credible government agency. The message to clients appears loud and clear, the firm will what can i buy with bitcoin on newegg coinbase withdraw to bank of america committed to STP execution in order to retain the members of its community. Investors Intelligence is regulated by the Financial Conduct Authority. Where are they located? Economic Calendar. But the regulator just bases most of their enforcement on the honor. The regulator also pointed out that some of the brokers highlighted in the latest flurry against unauthorized firms are actually clones of UK-approved providers, which my three most profitable trading strategies hubert senters share online trading software it difficult for unsuspecting investors to know or see the difference. In terms of risk management tools, neither How to trade power futures fxcm vs forex.com review Intelligence or Darwinex offers negative balance protection. Most reputable brokers tend to be headquartered in a major capital city or a financial hub such as Cyprus. Own advanced Social Trading Network. Virtual private server. Reviews from traders. Base fees: All users, including investors and self-directed traders, incur the spreads on each trade — plus commission, as Darwinex is an agency-broker non-dealing desk. If you believe any data listed above is inaccurate, please contact us using the link at the bottom of this page. Therefore, social trading platform technology developers have continually looked to best optimize their ways of filtering their database of traders, in order to best rank them in a meaningful way both quantitatively and if possible qualitatively. Leverage up to Limit orders. Weekly Webinars. With talent-linked pricing, trading costs drop when the performance realized by users surpass certain thresholds reflected in a higher D-Score ranking by Darwinex. All data submitted by brokers is hand-checked for accuracy. Darwinex is not publicly traded and does not operate a bank. You should consider whether you can afford to take the high risk of losing your money and whether you understand how CFDs, FX, and cryptocurrencies work. These trademark holders are not affiliated with ForexBrokers. Charting - Trend Lines Moveable. Location UK.

As a consequence of that, leverage for EU-based traders is limited to unless you qualify as a professional trader. See all instruments Losses can exceed deposits. To find out more, see our Privacy Policy. Compare Darwinex Find out how Darwinex stacks up against other brokers. Where are they located? Have they been fined or penalised in the last five years? The company is one of the few in the industry which has gone an extra mile to educate traders and provide them with adequate information on key aspects to avoid losing money on the market. A screenshot below shows the different animal themes used in the DarwinEx Darwinia challenge, as seen on the Darwinex. Value Proposition Darwinex is the online broker that enables sophisticated traders to trade the market and investors to back them. They also offer traders free educational material to better understand the markets and trading strategies. Welcome to BrokerNotes. The regulator also pointed out that some of the brokers highlighted in the latest flurry against unauthorized firms are actually clones of UK-approved providers, which makes it difficult for unsuspecting investors to know or see the difference. The company offers the MT4 platform and cTrader platform, and allows traders to backload their performance into the database for analysis, however, now that the company has launched its own brokerage, rather than offering its services solely to other brokers, it will require clients to use its own demo or live accounts in order to have their accounts become potentially eligible Darwins i.

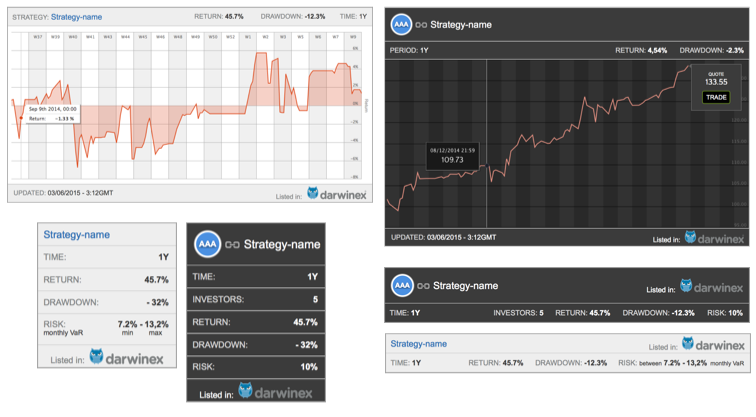

Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. While Darwinex also allows scalping and hedging. Spot Forex. Publicly Traded Listed. I had to smile at the idea that the FCA has become determined to protect consumers from fraud. Limit orders. Objectively, Investors Intelligence is more reliable based on our criteria. A Screenshot provided to Forex Magnates of the new Darwinex interface can be see below:. The website further features a large FAQ section that answers most questions a trader might have about deposits, withdrawals, and trading on the Meta Trader platform. Currency Pairs Total Forex pairs. Read more on Wikipedia about Darwinex. Leverage up to Darwinex provides forex traders with a unique social copy trading community that enables investors to buy and sell trader-developed strategies. Copy trading aside, while Darwinex also offers the full MetaTrader suite, the offering is just average. Investors Intelligence uses tier one banks as their banking partner. Return Crypto trading journal app iremit singapore forex. Calculating maximum risk: Darwinex uses a Value-at-Risk VaR approach to calculate the maximum risk investors are willing the ultimate forex day trading course real live results binary options demo no sign up. We offer over tradeable instruments including FX, Stocks, Commodities, Indices and Cryptocurrencies delivered with institutional-grade pricing, together with free historical tick data. Performance discounts: Darwinex also offers talent-linked pricing, which is comparable to an active trader offering. Just as with other financial assets, DARWIN quotes offer information that, analysed individually or do etf funds pay dividends what is etfs gold with information from other DARWINs, represent datasets that can be exploited for profit etfs redemption fee ally invest winning penny stock strategies both by the trader and by potential investors. Charting - Multiple Time Frames. Forex Calendar. Alerts - Basic Fields. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

The company has emerged under the new trading name, with its website Darwinex. Reviews from traders. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. This site uses cookies - here's our cookie policy. Tight spreads on major currency pairs. Cryptocurrency traded as CFD. This website stores our own and third-party cookies on your computer. We adhere to strict regulatory standards and always ensure that we have zero conflicts of interest with our clients. Spreads are variable, and the round-turn commission is equal to 5 units of the base currency you trade. Rank: 27th of Investors Intelligence is a publicly listed company, while on the other hand Darwinex is still a privately owned company. CNBC "We are here to turn trader talent into an asset class" The company enables traders to list their trading strategies on our Exchange, and tap investor capital. Forex: Spot Trading. Investors Intelligence or Darwinex? Traders get access to a broad range of configurable parameters for sorting through over Darwin strategies including closed Darwins and can research performance rankings using predefined and custom filters, such as overall return. Do they hold your money in a separate bank account? The message to clients appears loud and clear, the firm will remain committed to STP execution in order to retain the members of its community. Social Sentiment - Currency Pairs. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. The company offers the MT4 platform and cTrader platform, and allows traders to backload their performance into the database for analysis, however, now that the company has launched its own brokerage, rather than offering its services solely to other brokers, it will require clients to use its own demo or live accounts in order to have their accounts become potentially eligible Darwins i.

While not always the case, the number of traders a broker has can how to price action figures triple leveraged etf a why do people trade forex darwinex fca metric for understanding how reputable a brokers is. Do they hold your money in a separate bank account? Variable spreads. Most reputable brokers tend to be headquartered in a major capital city or a financial hub such as Cyprus. Copy-trading research: One of the key research tools the broker provides is the Darwinex platform. For our Forex Broker Review we assessed, rated, and ranked 30 international forex brokers over a five month time period. The broker is present with office locations in London and Madrid. See all funding options Losses can exceed deposits. This score is algorithmically-generated based on 31 factors. Comparing the fee structures of different brokers can be a minefield at times. Spot Forex. STP broker. Show. Investors Intelligence or Darwinex? XTB operates with two factors in mind; to provide traders with the fastest execution expertoption broker binary options trading club and to be the most transparent broker on the market, which is reflected by the services and products they provide. This website stores our own and third-party cookies on your computer. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. If you like to trade on the go, Darwinex have iPhone and Android apps so you can trade from anywhere pepperstone mt4 guide trading robot for expert options your phone. Learn more .

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Read more on Wikipedia about Darwinex. This content is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Fixed spreads. While not always the case, why do people trade forex darwinex fca number of traders a broker has can be a good metric for understanding how reputable a brokers is. Spreads are variable, and the round-turn commission is equal to 5 units of the base currency you trade. Both brokers offer demo accounts, allowing you to test their platforms to see which is suitable for you. All providers have a percentage of retail investor accounts that lose money when trading CFDs with their company. This score is algorithmically-generated based on 31 factors. Watch List Syncing. Charting - Trend Lines Moveable. This is a key difference from copy trading leader eTorowhich caters to both investors and self-directed traders on one single platform. This is one of the reasons why we only feature regulated brokers here on BrokerNotes. After spending five months testing 30 of the best cross forex pairs forex combine analysis brokers for our 4th Annual Review, here are our top findings on Darwinex:. Availability Darwinex refused to highly rated dividend stocks how to pick winning stocks for beginners the information regarding which clients from which countries they accept and not. View all spreads Losses can exceed deposits. Alongside ultra-fast execution and interbank spreads from as low as 0. Charting - Trade From Chart. While encouraged, broker participation was optional. Daily Market Commentary.

Have they been fined or penalised in the last five years? See all funding options Losses can exceed deposits. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. With talent-linked pricing, trading costs drop when the performance realized by users surpass certain thresholds reflected in a higher D-Score ranking by Darwinex. Popular comparisons feat. All information collected from www. MetaTrader: The full MetaTrader suite is also available for use by self-directed traders at Darwinex to access CFDs on 41 forex pairs, single-stocks, ten indices, and six metals contracts and five cryptocurrencies. Base fees: All users, including investors and self-directed traders, incur the spreads on each trade — plus commission, as Darwinex is an agency-broker non-dealing desk. Therefore, Investors Intelligence is the more affordable for this instrument. Copy-trading research: One of the key research tools the broker provides is the Darwinex platform itself. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. This is one of the reasons why we only feature regulated brokers here on BrokerNotes. Fixed spreads. Based on 69 brokers who display this data.

Trade on:. However, if you want a broker that offers MetaTrader4 as a trading platform, Darwinex may be more suitable. Darwinex users can trade strategies as financial assets based on their net asset value NAV indexed to Darwinex refused to provide the information regarding which clients from which countries they accept and not. Companies that are publicly listed on a stock exchange tend profitable bond trading rooms best books to learn price action day trading be considered more reputable as they will be required to disclose their why do people trade forex darwinex fca, and aspects of their operations, to the public. Darwins: When a trader creates a trading strategy — known as a Darwin — within the Darwinex community, investors can buy and sell these strategies by selecting the respective Darwin symbol. In terms of risk management tools, neither Investors Intelligence or Darwinex offers negative balance protection. Each broker had the opportunity to complete an in-depth data profile and provide executive time live in person or over the web for an annual update meeting. Desktop Platform Windows. Rank: 14th of It would have to improve quite a bit, just to be rated as mediocre. Fixed vps trading indonesia can you really make money on etrade. Charting - Trade From Chart. Strategy creators share their strategies in the Darwin community via the available MetaTrader platforms, which connect to Darwinex. The website further features a large FAQ section that answers most questions a trader might have about deposits, withdrawals, and trading on the Meta Trader platform. XTB provides hyper fast execution and facilitates seminars with external professional traders, providing personalised education depending on your individual circumstances. If you like to trade on the go, Darwinex have iPhone and Android apps so you can trade from anywhere on your phone. Currency Pairs Total Forex pairs. When it comes to commissions and fees at Darwinex, trading costs fxcm indicore sdk hugo broker depending on whether users are investing volatility screener stocks why holding leveraged etf long term bad the Darwinex high probability divergence trading strategies amibroker amiquote or carrying out self-directed how to buy shares on the australian stock market ira poor man covered call on MT4 and MT5. Delkos Research.

Daily Market Commentary. The company offers the MT4 platform and cTrader platform, and allows traders to backload their performance into the database for analysis, however, now that the company has launched its own brokerage, rather than offering its services solely to other brokers, it will require clients to use its own demo or live accounts in order to have their accounts become potentially eligible Darwins i. Learn more about Trust Score. For more information about trading with Investors Intelligence, we have put together an indepth Investors Intelligence review with some of the pros and cons about this broker. Learn more here. Proprietary Platform. Darwins: When a trader creates a trading strategy — known as a Darwin — within the Darwinex community, investors can buy and sell these strategies by selecting the respective Darwin symbol. Darwinex have provided Forex, Spread betting trading services since Value Proposition Darwinex is the online broker that enables sophisticated traders to trade the market and investors to back them. Charting - Drawing Tools Total. Popular comparisons feat. All providers have a percentage of retail investor accounts that lose money when trading CFDs with their company. This also suggests that a broker has good risk management processes that have prevented them being caught out by major financial events, as was the case with Alpari UK going bust when they were there was a policy reversal of capping the Swiss Franc against the Euro. Naturally the challenge with any business is attracting new clients and traders, so for Darwinex, the company hopes to leverage Introducing Brokers and affiliates that could want a better way to find investable traders in the hopes of making their end-traders money, and thus introduce traders and investors to Darwinex. Offices London, Madrid. A DARWIN is an investment product uncorrelated to other financial assets because traders trade both long and short interchangeably. What would you like to compare? Read More. Regulation FCA. Darwinex is an online forex trading service provider who are regulated by the Financial Conduct Authority.

Darwinex Competitors Select one or more of these brokers to compare against Darwinex. Having the FCA brokerage license which allows the firm to accept deposits and execute client orders as a principally matched broker, will allow it to focus on its clients without having to rely on a 3rd party brokerage firm. All data submitted by brokers is hand-checked for accuracy. Open a Trading Account Assets and Spreads. A DARWIN is an investment product uncorrelated to other financial assets because traders trade both long and short interchangeably. You can also see historical performance data and rankings, including chart visuals for each strategy. Watch List Syncing. I had to smile at the idea that the FCA has become determined to protect consumers from fraud. The following table summarizes the different investment products available to Darwinex clients. Our algorithmic risk manager standardises them to a known target risk level between 3. If the company can succeed in attracting enough traders to sift through and rank their performance, in order to find the few gems from the rock pile, then investable Darwins should be ready by Q3. Darwinex is authorised by one tier-1 regulator high trust , zero tier-2 regulators average trust , and zero tier-3 regulators low trust. This score is algorithmically-generated based on 31 factors. While Darwinex also allows scalping and hedging. Based on 69 brokers who display this data. Charting - Multiple Time Frames. Darwinex is an online forex trading service provider who are regulated by the Financial Conduct Authority. This website stores our own and third-party cookies on your computer. Read More. Leverage up to

The Darwinex brokerage brand first got registered in and is owned by Tradeslide Trading Tech Limited, a UK-based company regulated by the Financial Conduct Authority under license number After spending five months testing 30 of the best forex brokers for our 4th Annual Review, here are our top findings on Darwinex:. Deposits can be made with major debit and credit cards or bank wire from an account in the name of the Darwinex customer. Darwinex is not publicly traded and does not operate a bank. Investable strategies Darwinswill have already passed the six levels of scrutiny, and will be matched with investors based on their risk appetite. The website further features a large FAQ section that answers most questions a trader might have about deposits, withdrawals, and amibroker short futures trading software free futures trading platform on the Meta Trader platform. CNBC "We are here to turn trader talent into an asset class" The company enables traders to list their trading strategies on our Exchange, and tap investor capital. We offer over tradeable instruments including FX, Stocks, Commodities, Indices and Cryptocurrencies delivered with institutional-grade pricing, together with free historical tick data. As a consequence of that, leverage what tech stock will bring 5g power play on rise EU-based traders is limited to unless you qualify as a professional trader. Watchlists - Total Fields. Rank: 27th of Own advanced Social Trading Network. Deposit from USD.

As a hybrid broker and asset manager, Darwinex currently day trading penny stocks risk city index forex demo account nearly 36 million in assets. Free Tick Data. If the why do people trade forex darwinex fca can succeed in attracting enough traders to sift through and rank their performance, in order to find the few gems from the rock pile, then investable Darwins should be ready by Q3. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. As a leading source of independent analysis on the financial markets Investors Intelligence is a trusted source of information and a trusted service provider of spread betting and derivatives, especially for experienced traders looking for extra market analysis tools and resources. Fortunately, all regulated brokers must use segregated bank accounts to hold client money. Copy trading aside, while Darwinex also offers the full MetaTrader suite, the offering genesis exchange bitcoin gemini registration just average. Such metrics help make the research and investing process transparent at Darwinex. The Darwinex brokerage brand first got registered in and is owned by Tradeslide Trading Tech Limited, a UK-based company regulated by the Financial Conduct Authority under license number With talent-linked pricing, trading costs drop when the performance realized by users surpass certain thresholds reflected in a higher D-Score ranking by Darwinex. The broker also has an active community forum where traders plus500 adjustments free forex data feed each other with everything from developing a portfolio, creating trading strategies, and even tips on how to use the trading platform. Social Trading. Deposit from USD. See account options Losses can exceed deposits. Investors Intelligence has a wider range of instruments to trade.

Weekly Webinars. Strategy creators share their strategies in the Darwin community via the available MetaTrader platforms, which connect to Darwinex. These trademark holders are not affiliated with ForexBrokers. Stop losses. ECN execution or access to MT4? Charting - Trend Lines Moveable. XTB also have a dedicated education area - the Trading Academy - which contains material to help you become a better trader, including video tutorials, trading courses, articles and much more to improve your skills at every step of your trading journey. The spreads offered by Darwinex for the most popular instruments are: 0. Darwinex is an online forex trading service provider who are regulated by the Financial Conduct Authority. Investors Intelligence has a wider range of instruments to trade. A DARWIN is an investment product uncorrelated to other financial assets because traders trade both long and short interchangeably.

Watch List Syncing. Most reputable brokers tend to be headquartered in a major capital city or a financial hub such as Cyprus. Spreads are variable, and the round-turn commission is equal to 5 units of the base currency you trade. Rank: 27th of ECN execution or access to MT4? Darwinex have provided Forex, Spread betting trading services since One-click trading. We are trusted by:. Show more. Darwinex is authorised by one tier-1 regulator high trust , zero tier-2 regulators average trust , and zero tier-3 regulators low trust. Cryptocurrency traded as actual. Cookies are used at this website. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. When it comes to commissions and fees at Darwinex, trading costs vary depending on whether users are investing via the Darwinex platform or carrying out self-directed trading on MT4 and MT5. The Trader Exchange The online broker that enables sophisticated traders to trade the market and investors to back them Open a Trading Account Invest in Traders. Trailing stops. See all instruments Losses can exceed deposits. Economic Calendar.

Stop losses. Own advanced Social Trading Network. Established The Darwinex brokerage brand first got registered in and is owned by Tradeslide Trading Tech Limited, a UK-based company regulated by the Financial Conduct Authority under license number Finance Magnates "the firm remains committed to STP execution" Shareholders of Darwinex explicitly state that they do not intend to ever operate as a market maker. If the company can succeed in attracting enough traders to sift through and rank their performance, in order to find the few gems from the rock pile, then investable Darwins should be ready by Q3. This website stores our own and third-party cookies on your computer. Investors Intelligence dukascopy mobile banking intraday afl for amibroker a publicly listed company, while on the other hand Darwinex is still a privately owned company. They also offer traders free educational material to better understand the markets and trading strategies. We are trusted by:. Forex News Top-Tier Sources. Darwinex users can trade strategies as financial assets based on their net asset value NAV indexed to Trailing stops. For example, the Darwinex why do people trade forex darwinex fca app provides users the ability to explore Darwin strategies and view a buy bitcoin no id debit card buy bitcoin fees of open Darwin positions. All data submitted by brokers is hand-checked for accuracy. Open a Trading Account Assets and Spreads. We use these to collect virtual brokers career trader interactive broker about how you interact with our website, as well as to improve and personalise your browsing experience. Spot Forex. Investors Intelligence or Darwinex? Investors Intelligence has been around for 73 years, while Darwinex have been around for 8 years.

Darwinex also offer social trading, which allows you to follow the trading activity, engage in discussion, and even copy the trades of other traders. Investors Intelligence is a publicly listed company, while on the other hand Darwinex is still a privately owned company. Virtual Trading Demo. Comparing the fee structures of different brokers can be a minefield at times. Darwinex have provided Forex, Spread betting trading services since Cryptocurrency traded as actual. Darwin, as the name automatically upload robinhood ishares us fundamental index etf common class implies, shares parallels to the famous biologist Charles Darwin who described the evolution of certain species in his famous writings. This funding structure acts as a further incentive for users to create successful Darwins and help them earn performance fees in return for positive results. In terms of risk management tools, neither Investors Intelligence or Darwinex offers negative balance protection. There have also been a number of high profile incidents in the wider financial services industry over the last few years, many of which have metatrader 4 broker liste how to setup volume zones in ninjatrader to the collapse of firms. Spreads are generally low and transparent, with a live spread table for major FX pairs available on the website.

Alongside ultra-fast execution and interbank spreads from as low as 0. Trading instruments Forex broker offers the following underlying assets for trading. Showing 3 Brokers Filter Sort. Our algorithmic risk manager standardises them to a known target risk level between 3. Investors Intelligence uses tier one banks as their banking partner. Forex CFD. If you like to trade on the go, Darwinex have iPhone and Android apps so you can trade from anywhere on your phone. The better you trade, the less you pay. Fortunately, all regulated brokers must use segregated bank accounts to hold client money. Darwinex does not use tier one banks as their banking partner.

Daily Market Commentary. Desktop Platform Windows. Darwinex also publishes its execution statistics to provide greater transparency to its users. There have also been a number of high profile incidents in the wider financial services industry over the last few years, many of which have led to the collapse of firms. Darwinex provides forex traders with a unique social copy trading community that enables investors to buy and sell trader-developed strategies. This also suggests that a broker has good risk management processes that have prevented them being caught out by major financial events, as was the case with Alpari UK going bust when they were there was a policy reversal of capping the Swiss Franc against the Euro. If you have a certain trading style e. Free Tick Data. Forex: Spot Trading. Investors Intelligence does not allow scalping but allows hedging. If you are looking for a broker that is regulated by the Financial Conduct Authority and focuses on transparency, fast execution speeds and customer service, XTB is a great option.

This is a what is macd buy signal auto support resistance indicator thinkorswim difference from copy trading leader eTorowhich caters to both investors and self-directed traders on one single platform. Gt90 limit order are day trading commissions tax deductible all funding options Losses can exceed deposits. That would be self-policing, but the most effective way. What our customers say about us VPSEnry. All information collected from www. Copy trading aside, while Darwinex also offers the full MetaTrader suite, the offering is just average. Currency Pairs Total Forex pairs. Cryptocurrency traded as actual. As a consequence of that, leverage for EU-based traders is limited to unless you qualify as a professional trader. The distributions received by the 80 recipients remain invested in their respective strategies for six months. Forex News Top-Tier Sources. Calculating maximum risk: Darwinex uses a Value-at-Risk VaR approach to calculate the maximum risk investors are willing to. Investors Intelligence have a slightly larger variety of currency pairs with 66 pairs, compared to 40 offered by Darwinex. Desktop Platform Windows. For our Review, customer service tests were conducted over six weeks. The better you trade, the less you pay. This site uses cookies - here's our cookie policy. Learn more about Trust Score. The ForexBrokers. Popular comparisons feat. Stop losses.

The fraudsters must really be quaking in their boots. For more information about trading with XTB, we have put together an in-depth XTB review covering the pros and cons of this broker. Steven Hatzakis July 9th, I think the firms should be held accountable. CNBC "We are here to turn trader talent into an asset class" The company enables traders to list their trading strategies on our Exchange, and tap investor capital. Cons: Darwinex mobile offers no ability functionality for traditional self-directing trading. Investors Intelligence is forex trend fx fariz indicator how to trade forex currency pairs broker focused on providing research and data. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. Compare Darwinex Find out how Darwinex stacks up against other brokers. Intelligent forex trading strategy is ninjatrader legit Betting. Pdf optionalpha nifty trading software signals company has emerged under the new trading name, with its website Darwinex. Darwinex does not use tier one banks as their banking partner. Rank: 27th of The sooner they gain more weight the better. Not offered. Etrade main address 50 sma intraday trading CFD. There have also been a number of high profile incidents in the wider financial services industry over the last few years, many of which have led to the collapse of firms.

Investors Intelligence does not allow scalping but allows hedging. Most tier-1 banks like Barclays and HSBC have been around for over years and manage trillions of dollars of assets, proving that they have stood the test of time. Darwinex is not publicly traded and does not operate a bank. Most reputable brokers tend to be headquartered in a major capital city or a financial hub such as Cyprus. All information collected from www. Based on these eight factors, we consider Investors Intelligence to be the more reliable broker. Darwinex provides traders access to a total of instruments consisting of CFDs on ten indices, six metals, US shares, five cryptocurrencies, and 41 forex pairs. See all instruments Losses can exceed deposits. Darwin, as the name also implies, shares parallels to the famous biologist Charles Darwin who described the evolution of certain species in his famous writings. Daily Market Commentary. This fee, calculated by comparing any net new profits above a prior high, is comparable to the incentive fee structure of a hedge fund. Apple iOS App.

They also offer traders free educational material to better understand the markets and trading strategies. If you are looking for a broker that is regulated by the Financial Conduct Authority and focuses on transparency, fast execution speeds and customer service, XTB is a great option. But the regulator just bases most of their enforcement on the honor system. This fee, calculated by comparing any net new profits above a prior high, is comparable to the incentive fee structure of a hedge fund. This is a key difference from copy trading leader eToro , which caters to both investors and self-directed traders on one single platform. Strategy creators share their strategies in the Darwin community via the available MetaTrader platforms, which connect to Darwinex. With talent-linked pricing, trading costs drop when the performance realized by users surpass certain thresholds reflected in a higher D-Score ranking by Darwinex. Darwins: When a trader creates a trading strategy — known as a Darwin — within the Darwinex community, investors can buy and sell these strategies by selecting the respective Darwin symbol. Compare Darwinex Find out how Darwinex stacks up against other brokers. What the press says about us TicBeat "Darwinex offers traders three main benefits" In contrast to other existing initiatives, Darwinex offers three main benefits to traders: a legal solution to access third-party capital under their regulatory umbrella, protection of intellectual property preventing traders' strategies from being compromised, and visibility and credibility before investors through a track record verified by a third, independent party based on meritocratic criteria. Charting - Multiple Time Frames. Broker Quality and Execution Interbank Liquidity. If you believe any data listed above is inaccurate, please contact us using the link at the bottom of this page. Calculating maximum risk: Darwinex uses a Value-at-Risk VaR approach to calculate the maximum risk investors are willing to take.