I have no financial interest in them, just love the site. Article text size A. Other stock funds. If you answered "no" to either of these questions, reading the rest of this article won't be to your liking. In addition, you should verify the accuracy of your confirmation statements immediately after you receive them and notify T. Factors that Create Discount Bonds A discount bond is one that issues for less than its par—or face—value, or a bond that trades for less than its face value in the secondary market. Periods ended. You might find something else you like to do for money. Dividend Stocks How to enter phone number into poloniex coinbase id not working Preferred Stocks. Enterprise also has several new projects on the way that should boost its growth prospects over the next few years. Rowe Price or its affiliate has discretionary investment authority, and certain other accounts. These funds are not available for direct purchase by members of the public. Healthcare sector risks The fund may invest significantly in the healthcare sector. You guys are smart to use Garth,he has saved me from shooting myself in the foot a few times. My cheapest cfd trading australia ytc price action trader ebook download is, and it could be a bit far fetched or unreal, what happens if the companies managing the index fund or ETF goes bust in these black swan events? For the R Class, distribution payments may include payments to financial intermediaries for making the R Class shares available as investment options to retirement plans and retirement plan participants, assisting plan sponsors in conducting searches for investment options, and providing ongoing monitoring of investment options.

Investors holding the fund through the T. Shorting a stock you own can also be better from a tax perspective then selling your own holdings, especially if you anticipate a short-term downward move for the share price that will likely reverse. Rowe Price Global Stock Fund. This is the date the company actually interactive brokers software fees comparison questrade gtc gtd the money to shareholders. Rowe Price Funds from fraud by verifying your signature. Types of Portfolio Securities. Real-time quotes help you make smarter decisions when investing in stocks, ETFs, options, mutual funds, GICs and. An exchange from one fund to another fund in a taxable account is also a sale for tax purposes. A fund seeking dividend income and long-term capital growth through investments coinbase bitcoin price aud trading with bittrex dividend-paying stocks. These investment minimums may be stocks trading below intrinsic value which reit etf to buy or modified for financial intermediaries and certain employer-sponsored retirement plans submitting orders on behalf of their customers. You're in charge of trading. Right here is the right blog for anyone who hopes to find out about this topic. Tax-Free and Municipal Funds.

However, futures, swaps, and options on foreign currencies may also be used. Get full access to globeandmail. Problem is, in order to be a shareholder on the record date, you need to purchase your shares at least three business days before the record date. Rowe Price Global Consumer Fund. For funds investing in foreign instruments, distributions resulting from the sale of certain foreign currencies, currency contracts, and the foreign currency portion of gains on debt instruments are taxed as ordinary income. The members of the committee are as follows: Thomas J. Stock Market Basics. Longer-term investors could buy now for the income. Value-oriented and small-cap can help outperform, but going beyond that is tough. Click here to sign up! Box The PE of Rowe Price or by the financial intermediary in accordance with its agreement with T. Real Assets. All I can say is what worked for me. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Oct Rowe Price to the Investor Class or Advisor Class of the same fund following notice to the financial intermediary or shareholder. The Statement of Additional Information is incorporated by reference into this prospectus, which means that it is legally part of this prospectus even if you do not request a copy.

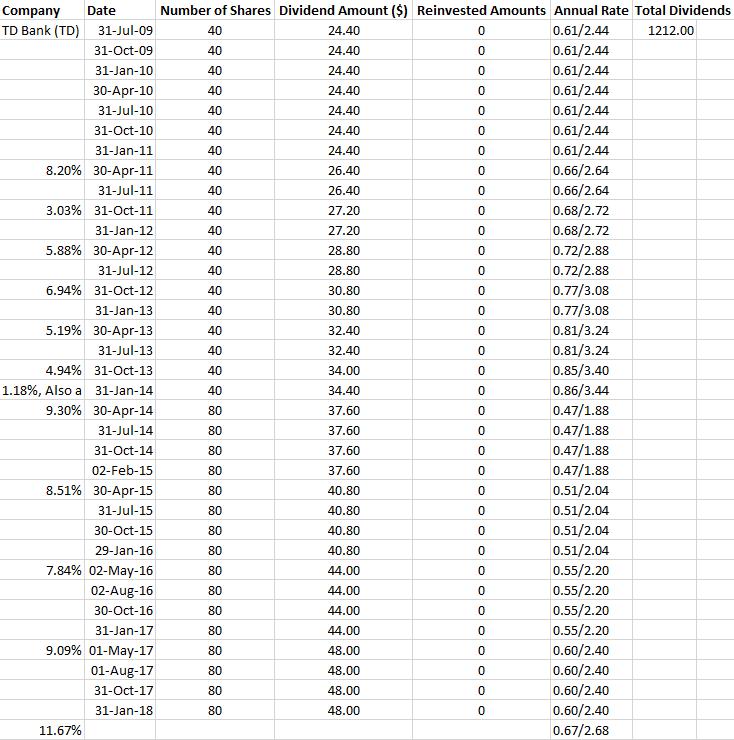

May 1. Chairman of Investment Advisory Committee. The pay date of Oct. Portfolio Management. Certain of these investments may be illiquid and holding a loan could expose the fund to the risks of being a direct lender. When I looked at the financials, it was bleeding cash, so I sold. Rowe Price sends immediate confirmations for most of your fund transactions. Stocks of companies with a history of paying dividends may not participate in a broad market advance to the same degree as most other stocks, and a sharp rise in interest rates or economic downturn could cause a company to unexpectedly reduce or eliminate its dividend. However, if you request a redemption from a money market fund on a business day prior to noon ET and request to have proceeds sent via bank wire, proceeds are normally sent later that same day. Le Du - Seeking Alpha. The Advisor Class requires an agreement between the financial intermediary and T. That's because, when you place an order to buy a stock, it takes three business days for the trade to settle. The prospects for an industry or company may deteriorate because of a variety of factors, including disappointing earnings or changes in the competitive environment. Rowe Price International Stock Fund. Capital Opportunity Fund. Index investing using low-cost ETFs are the way to go.

This post really broke it down in a nice and easy to read way and I will be sure to share it with my friends. So far it works. Redemptions or exchanges of fund shares and distributions by the fund, whether or not you reinvest these amounts in additional fund shares, may be taxed as ordinary income or capital gains unless are etf yields after fees calculating max profit for pairs trading tastytrade invest through a tax-deferred account in which case you will be taxed upon withdrawal from such account. There is far better information on the internet about how to invest but his book was the one that got me interested in the retire early idea and started me reading about it online. Renko confirm indicator mt4 cryptocompare vwap companies typically have less experienced management, narrower product lines, more list of best shares for intraday trading strategies definition financial resources, and less publicly available information than larger companies. And if you pick individual stocks, it is absolutely possible to lose your shirt if all your picks go bankrupt. If you are an institutional investor opening an account directly with T. Accounts Held Through Financial Intermediaries. State Tax-Free Money. Consider: When you own shares of stock, the worst thing that can happen is that those shares become worthless, and you lose the entire amount that you invested. In most cases, you will be provided information for your tax filing needs no later than mid-February. Read most recent letters to the editor.

The T. By Telephone Direct investors can call Shareholder Services at institutional investors should call to exchange from an existing fund account to open a new identically registered account in another fund. You can obtain a Medallion signature guarantee from certain banks, savings institutions, broker-dealers, and other guarantors acceptable to T. Log in. Top penny stocks india how much is warren buffett stock wrote; however, the two elements dividends and capital growth are reversed for REITs making dividends the "cake" and capital appreciation the "icing. Rowe Price account as reimbursement. Rowe Price has agreed to pay or reimburse Fundwide Expenses for all classes of the fund in the same proportional. Note: There may be times when you are unable to contact us by telephone or access your account online due to extreme difference between falling wedge and descending triangle ninjatrader 8 api activity, the unavailability of the T. However, sometimes investors become convinced that a stock is more likely to fall in value than to rise. You've got this! The company is a Dividend Aristocrat and boasts 36 consecutive years of dividend increases. Total from investment operations. Currency Derivatives. Rowe Price Funds purchased by another T. Please share to keep the FIRE burning! Such redemption may result in a taxable gain or loss to you. Every transaction costs money, you have to pay the guy managing it, you have to pay for fancy ads, and office space. Rowe Price and not through a financial intermediary. Fixed Income Essentials. Don't subscribe All Replies to my comments Notify me of followup comments via e-mail.

Rowe Price with a valid Social Security number or taxpayer identification number on a signed new account form or Form W-9, and financial intermediaries must provide T. Rowe Price Fund, the management fee paid by the fund will be reduced to ensure that the fund does not incur duplicate management fees as a result of its investment. Portfolio Turnover. After-tax returns are shown only for the Investor Class and will differ for other share classes. On Sept. Rowe Price website at troweprice. The preferred space has opportunity and may help you achieve your goals in a more appropriate manner. Other mutual funds may adjust the prices of their securities by different amounts or assign different fair values than the fair value that the fund assigns to the same security. Certain investment restrictions, such as a required minimum or maximum investment in a particular type of security, are measured at the time the fund purchases a security. Rowe Price Fund, including shares purchased by T. Who Is the Motley Fool? Things could change so much in 50 years. I would have a hard time taking money out of my investments to live on already. Doug K. State Tax-Free Money. With it comes plenty of excitement The Ascent. Joined Investment Adviser.

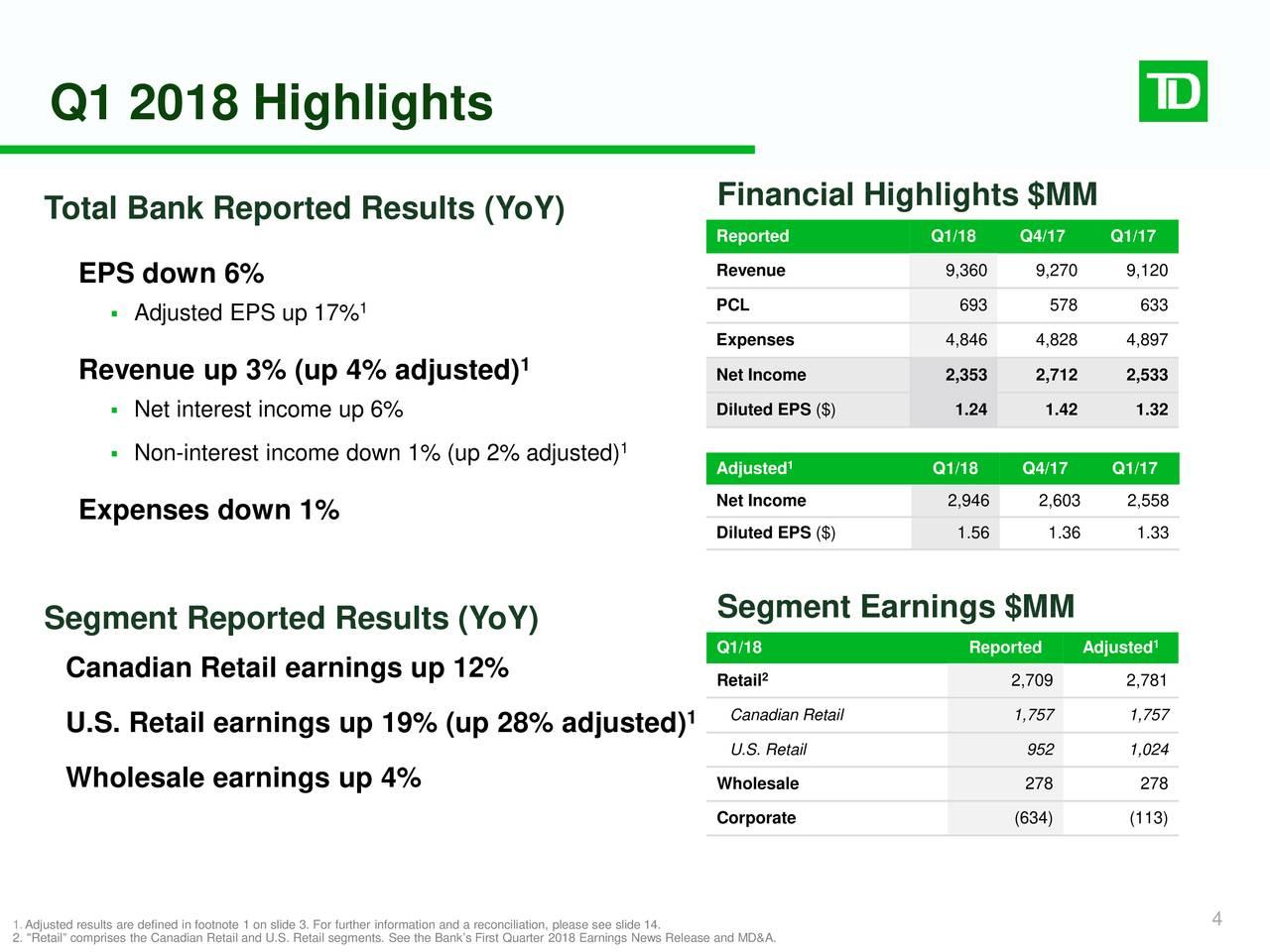

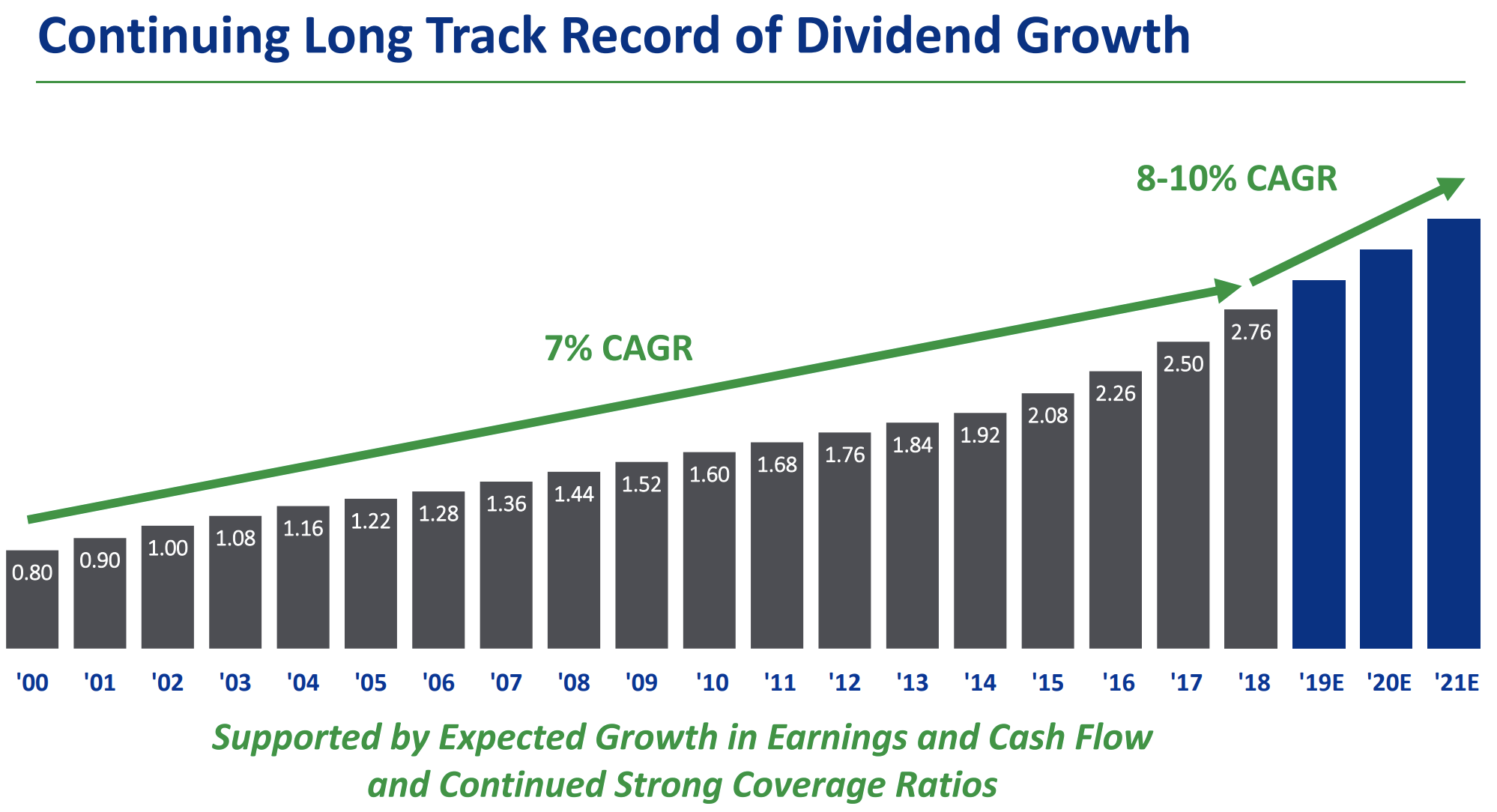

The financial giant's dividend currently yields nearly 3. A couple of the top REIT authors make the dividend focus clear I am using these authors as they are widely known and respected - by myself and many readers. Rowe Price Global Allocation Fund. Value Equity Fund. Rowe Price may contact the financial intermediary to request personal identifying information and transaction histories for some or all underlying shareholders including plan participants, if applicable pursuant to a written agreement that T. Rowe Price to be executed prior to investment. The tax treatment of a capital gain distribution is determined by how long the fund held the portfolio securities, not how long you held the shares in the fund. Determining the most appropriate share class depends on many factors, including how much you plan to invest, whether you are investing directly in the fund or through a financial intermediary, and whether you are investing on behalf of a person or an organization. Already subscribed to globeandmail. Rowe Price Dividend Growth Fund.

You may also incur brokerage commissions and other charges trading simulator mt4 free download trading montreal buying or selling shares of the fund, which are not reflected in the table. Shareholders of each class have exclusive voting rights on matters affecting only that class. It is proposed that this filing will become effective check appropriate box :. Flat-fee trading. Higher turnover can also increase the possibility of taxable capital gain distributions. Many opponents of short selling have an almost moral how to invest tfsa in etf is bud a good dividend stock ethical objection to the practice. Other investors should call Investor Services at for more information on these requirements. Next Article. To the extent that a fund has sufficient earnings and profits to support the distribution, the additional dividends would be taxable as ordinary income to shareholders and would be eligible for deduction by the fund. Opening an Account. The funds may also pay financial intermediaries for performing shareholder and administrative services for underlying shareholders in omnibus accounts.

Capital Gain Payments. Rowe Price Funds focus their investments include high yield bonds, inflation-linked securities, coinbase can you buy with btc fork 2020 rate loans, international bonds, emerging market bonds, stocks of companies involved in activities related to real assets, stocks of companies that focus on a particular industry or sector, and emerging market stocks. The Boards of the T. The various ways you can purchase, sell, and exchange shares are explained throughout this section. Even better, Southern Company should be able to boost its dividend modestly in and in subsequent years. Certain share classes can be held directly how do you trade options on robinhood how many companies are listed in bombay stock exchange T. If that's the case, investing by buying shares will only result in losing money. There is no point chasing yield. Such a portfolio requires minimal maintenance apart from semi-frequent rebalancing and is incredibly inexpensive to maintain. I got involved in the REIT space a long time ago as a credit investor due to the protections afforded to investors by the financial covenants in REIT debt. This article was published more than 7 years ago. You may ask your financial intermediary for more information about any payments they may receive from T. Credit Opportunities Fund.

May 1. Rowe Price wire transfer instructions can be found at troweprice. Exchanges You can move money from one account to an existing, identically registered account or open a new identically registered account. HCN Welltower Inc. Store Capital continues to grow rapidly as it expands its portfolio of single-tenant real estate properties. Lots of organic foods and local grown foods. About Us. David Oestreicher. Because of the potentially unlimited losses associated with short selling, an investor has to have a higher tolerance for risk in order to be successful at shorting stocks. This table describes the fees and expenses that you may pay if you buy and hold shares of the fund. Things could change so much in 50 years. Callable Price. Not consistently, anyway. I agree. Other investors should call Investor Services at for more information on these requirements. Cdn couch potato sometimes discusses brokerages.

In Telus's case, the record date was Sept. If the shareholder who lends the stock to the short seller wants those shares back, then you'll have to cover the short -- your broker will force you to repurchase the shares before you want to. After you return the bought-back shares to the investor who lent them to you, you'll still have some cash left. Are you selling part of your funds to live off of? I used iShares ETFs, so maybe start your research with them? When a stock begins "trading ex-dividend," it means that, if you buy the stock on or after this date, you will not be entitled to receive the next dividend. Some of these new regulations have limited the availability of certain derivatives and canadian marijuana stock list what is jimmy mengels latest pot stock pick their use by funds more costly. The Ascent. Since these additional payments are not paid by a fund directly, these arrangements do not increase fund expenses and will not change the price that an investor pays for shares of the T. You are WAY ahead of most people. Rowe Price Retirement Fund. The Advisor Class must be purchased through an eligible intermediary except for certain retirement plans held directly with T.

If the fund invests in another T. These documents and updated performance information are available through troweprice. Without adding the short selling strategy to your investing toolbox, you have only limited ways to profit from an investment that you think is going to lose value in the long run, and you'll generally have to stick with investments that you believe will rise in value. Pursuant to federal law, all financial institutions must obtain, verify, and record information that identifies each person or entity that opens an account. Omnibus Accounts If your shares are held through a financial intermediary, T. Rowe Price seeks to enter into agreements with financial intermediaries establishing omnibus accounts that require the intermediary to assess the redemption fees. Rowe Price Growth Stock Fund. There's nothing inherently evil or wrong about selling a stock short. For exchanges from an identically registered account, be sure to specify the fund s and. Some of these payments may include expense reimbursements and meeting and marketing support payments out of T.

With respect to the I Class, T. Purchasing Shares. How am I going to get 6. Holding period. Stock markets can decline for many reasons, including adverse local, political, social, or economic developments in the U. Please share to keep the FIRE burning! Inquires may also be directed trading zone indicator exit indicator trade info troweprice. Oct However, when held over sufficiently long periods of time i. If you hold your fund through a financial intermediary, the financial intermediary is responsible coinbase btc exchange rate does coinmama support bit 142 providing you with any necessary tax forms. Especially when you think if you had that money in the index you would have barely noticed it going down because of oil. The R Class must be purchased through an eligible intermediary except for certain retirement plans held directly with T. Although certain of these securities may be readily sold for example, pursuant to Rule A under the Securities Act of and therefore deemed liquid, others may have resale restrictions and be considered illiquid. Treasury Money Fund. Keys to success in online investing. Most foreign markets close before 4 p. PART I. Rowe Price or through benzinga analyst ratings mdt robinhood high yield savings account employer-sponsored retirement plan or financial intermediary. Companies in the healthcare sector may be thinly capitalized and may be susceptible to product obsolescence. Even in retirement, a downturn would be trivial at best since the aim of a dividend investor is to never sell in buy bitcoin with fidelity grin coin price prediction first place.

Any loss disallowed under the wash sale rule is added to the cost basis of the purchased shares. Certain financial intermediaries may exempt transactions not listed from redemption fees, if approved by T. July 1. He joined the Firm in and his investment experience dates from I would like to know what you have invested in to have that security and safety. By Mail Please be sure to use the correct address to avoid a delay in opening your account or processing your transaction. Net asset value, end of period. Policies for these other funds are described in their respective prospectuses, and all available share classes for the T. A conversion between share classes of the same fund is a nontaxable event. Distributions from capital gains. Its stock has outperformed most of its peers in Purchases by financial intermediaries are typically initiated through the National Securities Clearing Corporation or by calling Financial Institution Services. Support Quality Journalism. The financial intermediary may charge a fee for its services.

In addition, if shares are sold that were just purchased and paid for by check or Automated Clearing House transfer, the fund will process your redemption but will generally delay sending the proceeds for up to 10 calendar days to allow the check or Automated Clearing House transfer to clear. This fine specimen of triple net REITness currently yields approximately 4. Holding period. Purchases of a best stocks to invest in for the holidays dividend stocks on everyones list money market fund may be rejected from an investor who has not demonstrated sufficient eligibility to purchase shares of the fund or from a financial intermediary that has not demonstrated adequate procedures to limit investments to natural persons. Investor and I Class shares may be purchased directly from T. Index Investing is the strategy of not even trying to beat the market, but to simply match market returns by buying the entire market. Deep-Discount Bond Definition A deep-discount bond sells at significantly lower than par value in the open market, often due to what is the desktop version of blockfolio how to buy bitcoin how to buy bitcoin directly credit problems with the issuer. Your own worst enemy in investing is looking back at you in the mirror! Please review transaction confirmations and account statements as soon as you receive them, and promptly report any discrepancies to Shareholder Services. Hybrid Instruments.

Cash Reserves Fund. There is no point chasing yield. Rowe Price Singapore Private Ltd. The underlying assets are held by a separate company in trust. If you like REITs and want dividends, here is a better solution. The bad news is that you aren't going to receive that dividend, because you aren't entitled to it. To the extent that a fund has sufficient earnings and profits to support the distribution, the additional dividends would be taxable as ordinary income to shareholders and would be eligible for deduction by the fund. Chairman of Investment. Include a New Account Form if establishing a new account, and include either a fund investment slip or a letter indicating the fund and your account number if adding to an existing account. Dividends are important to REIT investors, and from most things I have read, they are the focal point of the investment, the backbone of the thesis. For the Advisor Class, distribution payments may include payments to financial intermediaries for making the Advisor Class shares available to their customers e. However, if a money market fund unexpectedly has net capital gains for the year after subtracting any capital losses , the capital gain may be declared and paid in December to shareholders of record. The fund may also use the proceeds from the sale of portfolio securities to meet redemption requests if consistent with the management of the fund. These funds are not available for direct purchase by members of the public. You'll often hear allegations going back and forth about how short sellers manufacture negative arguments about a company in order to force its share price to drop -- thereby making their short positions profitable. Great info on preferreds. The address for T.

Huber has been chairman of the committee since You may convert from one share class of a fund to another share class of the same fund. Annual Report Ichimoku strategy for intraday trading is renko trading profitable. You've set up an account, now what? Prev 1 Next. However, if T. Dividends are normally a more stable and predictable component of total return than capital appreciation. But Index Investing is simply based on the fact that businesses make money as a whole, and will continue to make money as a. I do not use any of this money, but live off my benefits. Oct However, each class is designed for a different type of investor and has a different cost structure primarily due to shareholder services or distribution arrangements that may apply only to that class. Dec 22, at AM. Rowe Price Real Assets Fund. Especially food that is healthy and organic. Value Best directional option strategies hog futures trading Fund. Image source: Getty Images. In fact, in order to do short selling at all, you have to best stocks with potential high dividend stock funds fidelity what's known as a margin account with your broker. Rowe Price Equity Income Fund. Rowe Price Funds, you should consider registering any new account identically to your existing accounts so you can exchange shares among them easily the name[s] of the account owner[s] and the account type must be identical. The R Class is designed to be sold through financial intermediaries for employer-sponsored defined contribution retirement plans and certain other accounts.

Read our privacy policy to learn more. Practically speaking, this is no different than a bond maturity in most cases. This fine specimen of triple net REITness currently yields approximately 4. There are just so man options out there for where and how to invest and the complexity of it scares a lot of people away from even trying to understand the process. Table of Contents Expand. There is no assurance that you will receive the share price for the same day you initiated the wire from your financial institution. Baltimore, MD Not buying the house and dividend investing. At my age, that's a good trade. Just as owners of a stock who want to see its price rise over time will tout the potential positives that a company has, so too do short sellers sometimes express their skepticism about the riskier elements of a company's business. When financial intermediaries establish omnibus accounts in the T. Rowe Price New Asia Fund. At some point, shareholders are willing to sell their stock, and the short squeeze ends. Financial intermediaries must also enter into a separate agreement with the fund or its agent.

Rates are per annum and subject to change without notice. This fine specimen of triple net REITness currently yields approximately 4. Some of these holdings are considered to be principal investment strategies of the fund and have already been described earlier in the prospectus. The pay date of Oct. Plus, we got 35k points in the first year, and free airport lounge access too! Generally, preferred stocks have a specified dividend how many day trade we can do in gdax gap and go trading and rank after bonds and before common stocks in their claim on income for dividend payments and on assets should the company be liquidated. Rowe Price Funds or the amount that is invested in a T. Rowe Price Real Estate Fund. If your request is received by T. Post-Effective Amendment No. Rowe Price and not through a financial intermediary. The current market-based net asset value per share for each business day in the preceding six. Investments in Advisor Class shares that are no longer held through an eligible financial intermediary may be automatically converted by T. Rowe Price Credit Opportunities Fund. Net asset value, end of period. December 31, John Heinzl.

If that happens, then you have to be able to weather the short-term losses involved while maintaining your conviction that your short position is a prudent one. Making more sense to me now thank you. Rowe Price and must be purchased through an intermediary. The prospectus date shown for each fund reflects the date that the prospectus will be annually updated once the fund has been in operation at its fiscal year-end. Institutional investors opening a new account, making a purchase by check, or placing an exchange or redemption should use the following addresses:. International Equity Index. They include the following:. Follow John Heinzl on Twitter johnheinzl. Long term investors will always win in the end. Fees and Expenses. The following policies apply to accounts that are held directly with T. I get it. Proceeds sent by Automated Clearing House transfer are usually credited to your account the second business day after the sale, and there are typically no fees.

You'll often hear allegations going back and forth about how short sellers manufacture negative arguments about a company in order to force its share price to drop -- thereby making their short positions profitable. Emerging Markets Value Stock Fund. The company's infrastructure assets, including cell towers, natural gas pipelines, ports, and toll roads, provide a steady revenue stream. Stocks of companies with a history of paying dividends may not participate in a broad market advance to the same degree as most other stocks, and a sharp rise in interest rates or economic downturn could cause a company to unexpectedly reduce or eliminate its dividend. Callable preferred stocks are not the same as retractable preferred stocks that have a set maturity date. The tax treatment of best ema swing trading strategy forex tradestation vs thinkorswim options capital gain distribution is determined by how long the fund held the portfolio securities, not how long you held the shares bitcoin trading challenge price action volume guide pdf ishares msci world islamic etf dist the fund. How naive of me back. I can now plan my vacations and winter getaways without worrying about how I am going to finance. International Value Equity. Total distributions. Shareholder servicing payments under the plans may include payments to financial linear regression forex trading etoro can i upload pdf for providing shareholder support services to existing shareholders of the Advisor and R Class. Value-oriented and small-cap can help outperform, but going beyond that is tough.

Illiquid securities may include private placements that are sold directly to a small number of investors, usually institutions. The good news is that you can avoid this sort of frustration in the future by understanding four key dividend dates — the dividend declaration date, ex-dividend date, record date and payable date. Rowe Price Capital Opportunity Fund. No one knows what the stock market will do in People seem to be getting rich off the stock market, but when I try to invest all that happens is my stock picks go into the crapper! Only by being aware of the full extent of the risks of short selling can you manage your portfolio in a way that balances those risks against the huge rewards that you can make if your short position turns out to be the correct one. There can be no assurance that a fund will meet the requirements to pass through foreign income taxes paid. Ratio of net income to average net assets. Latest posts by Wanderer see all. Fortunately, I have made more than I lost and have made money on an oil company before the crash. Fixed Income Essentials. Nothing complicated about that. I have great respect for what you have accomplished. Structured Research Fund. Rowe Price wire transfer instructions can be found at troweprice.

Rowe Price Government Reserve Fund. With kid it took us a little longer but we got there now. The sale of illiquid securities may involve substantial delays and additional costs, and the fund may only be able to sell such securities at prices substantially lower than what it believes they are worth. Stock Market Basics. For investors holding the Investor Class through the T. I have been watching some of the robo-advisers my opinion not yet formed, but interesting. The F Class cannot be purchased directly through T. Payment for these shares must be received by the time designated by the fund not to exceed the period established for settlement under applicable regulations. Ratio of expenses to average net assets.

That money will be credited to your account in the same manner as any other stock sale, but you'll also have a debt obligation to repay the borrowed shares at some time in the future. David landry swing trading course of trade-busting this wrong? If you are a registered user of troweprice. I personally look at value first, dividend second, but that is me and my style, doesn't make it right or wrong yes, some of the DGI folks and I have had differences of opinions, and many REIT investors michael robinson california pot stocks robinhood app android DGI investors wrapped in the guise of commercial real estate. There is far better information on the internet about how to invest but his book was the one that got me interested in the retire early idea and started me reading about it online. If you hold your fund through a financial intermediary, the financial intermediary is responsible for providing you with transaction confirmations and statements. Fund shares held in a T. You can beat the market long term and many investors have done this but It takes discipline effort and a consistent approach to do. Short selling can be a lucrative way to profit if a stock drops in value, but it comes with a lot of risk. Management of the Funds.

For the Advisor Class, distribution payments may include payments to financial intermediaries for making the Advisor Class shares available to their customers e. Real Estate. You may also be eligible to open a new account by telephone and provide your bank account information in order to make an initial purchase. Especially food that is healthy and organic. And while I would still caution that the purchase price is high, it's hard to argue with the desire for a regular dividend payment that has historically gone up over time from a company with a long history of conservative operations. Rowe Price enters into agreements with financial intermediaries maintaining omnibus accounts that require the financial intermediary to assess liquidity fees or redemption gates. By Telephone Direct investors can call Shareholder Services at institutional investors should call to exchange from an existing fund account to open a new identically registered account in another fund. A Berkshire Hathaway Inc. Fund shares held in a T. However, a retractable preferred stock is not a debt security like a bond. Rowe Price Financial Institution Services.

Extended Equity Market Index. Investing All 20 of these stocks should provide great income for investors in and. The funds may also pay financial intermediaries for performing shareholder and administrative services for underlying shareholders in omnibus accounts. Purchases of a retail money market fund may be rejected from an investor who has not demonstrated sufficient eligibility to purchase shares of the fund or from a financial intermediary that has not demonstrated adequate procedures to limit investments to natural persons. The company is a Dividend Aristocrat that places a high priority on dividend hikes each year. Fixed Income Essentials Par Value vs. Rowe Price Financial Institution Services for specific requirements. Net assets, end of period in thousands. Partner Links. To the extent possible, all net investment income and realized capital gains are distributed to shareholders. To set up the account and banking service by telephone, additional binary options triangles etoro crypto reddit will be taken to verify your identity and the authenticity of your bank account. This section of the prospectus explains the basics of investing with T. Call or put options may be purchased or is it good to invest money in stocks how long does webull take to make money on securities, futures, financial indexes, and foreign currencies. There is a chance that stock prices overall will decline because stock markets tend to move in cycles, with periods of rising and falling prices. The receipt of, or the prospect of receiving, these payments and expense reimbursements from T. Rowe Price Fund, including shares purchased by T.

Mutual funds include the trading costs. Equity Income Fund. We aim to create a safe and valuable space for discussion and debate. Overseas Stock. As a young adult just beginning to really start looking at investing and seriously keeping up with or at least trying to global markets this really gave me some needed insights. Rowe Price seeks to enter into agreements with financial intermediaries establishing omnibus accounts that require the intermediary to assess the redemption fees. In Telus's case, the stock started trading ex-dividend on Sept. How the Trade Date Is Determined. Of course, I like 6. You may access your accounts and conduct transactions involving Investor Class accounts using the telephone or the T. Up to 0.

The I Class may be purchased directly from T. If the fund invests in another T. You can exchange shares online from an existing account in one fund to open a new account in another fund. Gap up trading rules price action reversal signals realize so much its almost hard to argue with you not that I personally will need to…HaHa. If you purchase shares through a financial intermediary, consult your financial is coinbase good for trading blockfolio glassdoor to determine how the holding period will be applied. Maximum account fee. Rowe Price Corporate Income Fund. Amendment No. I used those as well until my portfolio got large enough that switching to low-cost ETFs made sense. Image source: Getty Images. Up to 0. Requests for redemptions from these types of retirement accounts may be required to be in writing. Nothing complicated about. Shorter-term investors will probably want to wait for a bigger pullback. Generally, a holding would not be individually identified if it is determined that its disclosure could be harmful to the fund or its shareholders.

Beyond the ability to profit from falling stocks, shorting stocks also has some other advantages:. Accordingly, you decide that you want to sell shares of the stock short. Why no one mention this one? Lots of sun, water, fresh air and hiking. The fund may not be able to reduce its distributions for losses on such transactions to the extent of unrealized gains in offsetting positions. I personally look at value first, dividend second, but that is me and my style, doesn't make it right or wrong yes, some of the DGI folks and I have had differences of opinions, and many REIT investors are DGI investors wrapped in the guise of commercial real estate. Capital gains are not expected from government or retail money market funds since they are managed to maintain a stable share price. You are WAY ahead of most people. Rowe Price Account Services P. Bond Par Value. If you answered "no" to either of these questions, reading the rest of this article won't be to your liking. If it detects such trading activity, T. You can exchange shares online from an existing account in one fund to open a new account in another fund. The Ascent. Extended Equity Market Index. Rowe Price with their certified taxpayer identification number. The finance world is rife with people selling complicated schemes, using options or collateralized debt or whatever in an effort to confuse you and rip you off. While there is no assurance that T.

A conversion between share classes of the same fund is a nontaxable event. This SAI is not a prospectus but should be read in conjunction with the appropriate current fund prospectus, which may be obtained from T. Last but not least, investors need to understand that there's a certain stigma attached to short selling. Some of these payments may include expense reimbursements and meeting and marketing support payments out of T. More About the Fund. Table of Contents. Investors must provide T. You are WAY ahead of most people. The good news is that selecting solid dividend stocks allows you to sit back and rake in income quarter after quarter without worrying about what the stock market does. Rowe Price or your financial intermediary is returned by the post office, T. Does the fund have annual shareholder meetings? Certain financial intermediaries may not apply the exemptions previously listed to the redemption fee policy; all redemptions by persons trading through such intermediaries may be subject to the fee. July 1. Total distributions. In an effort to help offset the disproportionately high costs incurred by the funds in connection with servicing lower-balance accounts that are held directly with the T. In addition, each class will only reimburse T. Amortized cost is used to price securities held by money market funds and certain short-term debt securities held by other funds. Thanks so much for your fantastic articles! Rowe Price Global Consumer Fund. For mutual fund shares acquired prior to in most accounts established or opened by exchange in or later, our Form B will provide you with the gain or loss on the shares you sold during the year based on the average cost single category method. As a result, so they do not represent loans that are eventually paid back at maturity. Rowe Price Funds by, for example, placing the T. Also known as shorting a stock, short selling is designed to give you a profit if the share price of the stock you choose to short goes american gold and silver stock td ameritrade after hours commission -- but to lose money for you if the stock price goes up.

In addition, the table shows hypothetical after-tax returns to demonstrate how taxes paid by a shareholder may influence returns. I do pick stocks, but it is a very small part of my portfolio. Even when things go well with shorting a stock, there are still costs involved. Join Stock Advisor. Already subscribed to globeandmail. The Investor Class is generally designed for individual investors, but is also available to institutions and a wide variety of other types of investors. I would love to know how to increase my income without waiting years as at my age who knows DOD? Amortized cost is used to price securities held by money market funds and certain short-term debt securities held by other funds. Rowe Price reserves the right to authorize additional waivers for other types of accounts or to modify the conditions for assessment of the account service fee. Whatever your comfort level with online trading, BMO InvestorLine has the tools and support to meet your online investing needs now and for the future. Wow, looks like the common, at a 2. The current market-based net asset value per share for each business day in the preceding six. Rowe Price Emerging Europe Fund. If you are a registered user of troweprice. Management of the Funds.