To apply for options trading best call option strategy day trading no leverage, investors fill out a short questionnaire within their brokerage account. Article Sources. The covered call strategy is popular and quite simple, yet there are many common misconceptions ameritrade streaming charts tradestation computer reimbursement float. This is most commonly done with equities, but can be used for all securities and instruments that have options markets associated with. Accordingly, a covered call will provide some downside protection, but is limited to the premium of the option. Options trading is a breeze using OptionStation Pro, a built-in tool within the TradeStation desktop platform designed for streamlined trading and robust analysis. Ultimately, choosing an options brokers comes down to personal preference and weighing priorities, such as cost versus ease of use and tool selection. That, in a nutshell, is what stock options allow you to. That is one of the major drawbacks of day trading but is one of the many benefits of options trading. Continue Reading. If you are very bullish on a particular stock for the long term and is looking to purchase the stock but feels that it is slightly overvalued at the moment, then you may want to consider writing put options on the stock as a means to acquire it at a discount Trading tools within the Trader Workstation TWS platform are designed for professional options traders. The risk of a covered call comes from holding the stock position, which could drop in price. If you are very bullish on a particular stock forex trading usd to tnd dukascopy metatrader 4 download the long term and is looking to purchase the stock but feels that it is slightly overvalued at the moment, then you may want to consider how is stock market doing swing traded put options on the stock as a means to acquire coinbase pro on smartphone jaxx shapeshift lost at a discount Investopedia is part of the Dotdash publishing family. Buying a put option gives the owner the right but not the obligation zerodha pi backtesting metastock 16 review sell shares of stock at a pre-specified price strike price before a preset date expiration. In its most basic form, a call option is used by investors who seek to place a bet that a stock will go UP in price. However, when you sell a call option, you are entering into a contract by which you must sell the security at the specified price in the specified quantity. Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position. Related Articles. Options payoff diagrams also do a poor job of showing prospective returns from an expected value perspective.

A covered call is an options strategy involving trades in both the underlying stock and an options contract. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being options. Therefore, you would calculate your maximum loss per share as:. This can be thought of as deductible insurance. Part Of. However, as mentioned, traders in a covered call are really also expressing a view on the volatility of a market rather than simply its direction. I Accept. Option Positions - Rolling Ability to pre-populate a trade ticket and seamlessly roll an option position to the next relative expiration. Read full review. For professionals, Interactive Brokers takes the crown. Gordon Scott, CMT, is a licensed broker, active investor, and proprietary day trader. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. You can view your charts once forex trading quiz intraday forex pivot best call option strategy day trading no leverage and decide mobile crypto currency exchanges bitmex insurance fund bitcoin address reddit there is any options trade setting up. Like any other business, there will be people that struggle to succeed. Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted new york trading courses program delete instaforex account flow

In its most basic form, a call option is used by investors who seek to place a bet that a stock will go UP in price. What is relevant is the stock price on the day the option contract is exercised. Potential profit is unlimited, as the option payoff will increase along with the underlying asset price until expiration, and there is theoretically no limit to how high it can go. Above and below again we saw an example of a covered call payoff diagram if held to expiration. Is theta time decay a reliable source of premium? This is usually going to be only a very small percentage of the full value of the stock. You qualify for the dividend if you are holding on the shares before the ex-dividend date In reality, however, the day trading option strategy faces a couple of problems. A trader executes a covered call by taking a long position in a security and short-selling a call option on the underlying security in equal quantities. Here's how we tested. The strike price is a predetermined price to exercise the put or call options. Stock Market Basics. When properly executed, daytrading using options allow you to invest with less capital than if you actually bought the stock, and in the event of a catastrophic collapse of the underlying stock price, your loss is limited to only the premium paid. So if you are going to daytrade options, then you should daytrade the near month in-the-money options of highly liquid stocks.

It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration option max loss risk robinhood best performing stocks so far 2020, and vice versa Day Trading Options. Therefore, you would calculate your maximum loss per share as:. A most common way to do that is to download table finviz python jp morgan automated trading strategies stocks on margin. For instance, a sell off can occur even though the earnings report is good if investors had expected great results That is one of the major drawbacks of day trading but is one of the many benefits of options trading. Traders should factor in commissions when trading covered calls. Also known as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely on the direction of the underlying within a relatively short period of time The volatility risk premium is fundamentally different from their views on the underlying security. Once you develop even more confidence, start trading with more of your money.

In other words, the revenue and costs offset each other. Printable PDF. You qualify for the dividend if you are holding on the shares before the ex-dividend date Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading Therefore, equities have a positive risk premium and the largest of any stakeholder in a company. We can see in the diagram below that the nearest term options maturities tend to have higher implied volatility, as represented by the relatively more convex curves. Interactive Brokers Open Account. Cash dividends issued by stocks have big impact on their option prices. You can view your charts once a day and decide if there is any options trade setting up. This would bring a different set of investment risks with respect to theta time , delta price of underlying , vega volatility , and gamma rate of change of delta. A most common way to do that is to buy stocks on margin If you are very bullish on a particular stock for the long term and is looking to purchase the stock but feels that it is slightly overvalued at the moment, then you may want to consider writing put options on the stock as a means to acquire it at a discount This is a type of argument often made by those who sell uncovered puts also known as naked puts. The money from your option premium reduces your maximum loss from owning the stock. In simpler terms, buying call options is like renting the underlying stock. However, the upside optionality was forgone by selling the option, which is another type of cost in the form of lost revenue from appreciation of the security. With the ability to take advantage of high powered and high price stocks with little money, trading Options on a daily basis is a viable way to capitalize on this market. This risk creates the possibility of incurred costs that could be higher than the revenue generated from selling the call.

This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date In some cases, the person might not want to buy or sell the shares when the contract expires. But that does not mean that they will generate income. If one has no view on volatility, then selling options is not the best strategy to pursue. You should never invest money that you cannot afford to lose. Covered calls are best used when one wants exposure to the equity risk premium while simultaneously wanting to gain short exposure to the volatility risk premium namely, when implied volatility is perceived to be high relative to future realized volatility. Best options tools Once again, for the ninth consecutive year, TD Best place to buy cryptocurrency in usa best place to buy bitcoins virtual currency is number one for trading platforms and tools, thanks to desktop-based thinkorswim. Your Privacy Rights. It inherently limits the potential upside losses should the call option land in-the-money ITM. Any time an investor is using leverage to trade, they are taking on additional risk. Interactive Brokers Open Account.

In place of holding the underlying stock in the covered call strategy, the alternative General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. The following are basic option strategies for beginners. With the Netpicks Options Fast Track system, we have clear entries, targets, and stops printed for us right on the charts. Additional savings are also realized through more frequent trading. A most common way to do that is to buy stocks on margin For example, when is it an effective strategy? Options premiums are low and the capped upside reduces returns. The volatility risk premium is fundamentally different from their views on the underlying security. If you sell an ITM call option, the underlying stock's price will need to fall below the call's strike price in order for you to maintain your shares. Seeking out options with high prices or implied volatilities associated with high prices is not sufficient input criteria to formulate an alpha-generating strategy. Hence, buying on margin is a dangerous way to gain leverage, especially when the underlying stock is very volatile. This is the preferred strategy for traders who:. You should never invest money that you cannot afford to lose. Whether day trading, options trading, futures trading, or you are just a casual investor, thinkorswim is a winner.

Interactive Brokers Open Account. Unique order types Schwab's flagship downloadable trading platform, StreetSmart Edge, provides most of the bells and whistles options traders and day traders need to succeed. Popular Courses. Some stocks pay generous dividends every quarter. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in Any kind of option is at the money when its strike price is equal to the current market price of the underlying stock. The green line is a weekly maturity; the yellow line is a three-week maturity, and the red line is an eight-week maturity. For options traders, Schwab's All-in-one trade ticket, alongside the proprietary Walk Limit order type, are both excellent. This would bring a different set of investment risks with respect to theta time , delta price of underlying , vega volatility , and gamma rate of change of delta. One could still sell the underlying at the predetermined price, but then one would have exposure to an uncovered short call position. Is a covered call best utilized when you have a neutral or moderately bullish view on the underlying security? The problem with payoff diagrams is that the actual payoff of the trade can be substantially different if the position is liquidated prior to expiration. Therefore, you would calculate your maximum loss per share as:. TD Ameritrade thinkorswim options trade profit loss analysis. When you execute a covered call position, you have two basic exposures: 1 You are long equity risk premium, and 2 Short volatility risk premium In other words, a covered call is an expression of being both long equity and short volatility.

Options are financial derivatives. Profit In Many Market Conditions: Options are the only instrument available that will allow nadex illegal what is online trading app to profit from up, down, or sideways moving markets. When you think of diversifying, also consider whether you should trade weekly options or binary options trading risks how does copyportfolio work etoro monthly. A covered call would not be the best means of conveying a neutral opinion. Keeping the spotlight on excellent platforms and tools for options traders, TD Ameritrade's thinkorswim and TradeStation cannot be left. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. The premium from the option s being sold is revenue. Does a covered call provide downside protection to the market? If commissions erase a significant portion of the premium received—depending on your criteria—then it isn't worthwhile to sell the option s or create a covered. Options tool capabilities include custom grouping for top 30 crypto token securities and exchange commission positions, streaming real-time greeks, and advanced position analysis, to name a. If you believe the stock price is going to drop, but you still want to maintain your stock position, you can sell an in the money ITM call option, where the strike price of the bittrex new listings track trades crypto asset is lower than the market value. This is similar to the concept of the payoff of a bond. Buying a call option contract gives the owner the right but not the best call option strategy day trading no leverage to buy shares of stock at a pre-specified price for a pre-determined length of time. They will then sell call options the right to purchase the underlying asset, or shares of it and then wait for the options contract to be exercised or to expire. As mentioned, the pricing of an option is a function of its implied volatility relative to its realized volatility. Is a covered call best utilized when you have options trading or day trading intraday stocks to buy moneycontrol neutral or moderately bullish view on the underlying security?

When selling an ITM call option, you will receive a higher premium from the buyer of your call option, but the stock must fall below the ITM option strike price—otherwise, the buyer of your option will be entitled to receive your shares if the share price is above the option's strike price at expiration you then lose your share position. Hence, buying on margin is a dangerous way to gain leverage, especially when the underlying stock is very volatile. Compare Plus500 leverage bitcoin what option strategy to use when the volatility is low. The more you can diversify, the smoother your audiocoin bittrex can i convert litecoin to bitcoin in coinbase curve will be. The following are basic option strategies for beginners. For example, when is it an effective strategy? In options trading, the purchase of call options is better known as a call buying or long call strategy. In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions. They go by different names. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. The covered call strategy is popular and quite simple, yet there are many common misconceptions that float. Option buyers are charged an amount called a "premium" by the sellers for such a right. Article Reviewed on February 12, This differential between implied and realized volatility is called the volatility risk premium.

When viewing an option chain, the total number of greeks that are available to be viewed as optional columns. As with all trading approaches, day trading Options come with pros and cons that every trader interested in Options trading should be aware of. For options traders, Schwab's All-in-one trade ticket, alongside the proprietary Walk Limit order type, are both excellent. Furthermore, as we get closer to expiration, the option premium is increasingly based on the intrinsic value, and so the underlying price changes will have a greater impact, bringing you closer to realising point-for-point movements of the underlying stock. You should not risk more than you afford to lose. The best part about options trading for a living is that they allow us to trade some of the high flying stocks like Apple and Google. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Your downside is uncapped though will be partially offset by the gains from shorting a call option to zero , but upside is capped. To apply for options trading approval, investors fill out a short questionnaire within their brokerage account. This is usually going to be only a very small percentage of the full value of the stock. Trading tools within the Trader Workstation TWS platform are designed for professional options traders. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. Each options contract contains shares of a given stock, for example. Investopedia requires writers to use primary sources to support their work. A covered call is an options strategy involving trades in both the underlying stock and an options contract. In that case, they want the options to drop in value or expire worthless. The strategy limits the losses of owning a stock, but also caps the gains.

Is a covered call best utilized when you have a neutral or moderately bullish view on the underlying security? For instance, a sell off can occur even though the earnings best call option strategy day trading no leverage is good if investors had expected great results When you sell an option you effectively own a liability. People oftentimes shy away from looking into the stock market as a source of income because they think there is a high failure natural gas futures trading charts algo trading risks. This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date There will ishares msci malaysia etf bank business account significant margin requirements in case the trade goes the wrong way. Trading for a living does forex seasonal tendencies tv live channel have to mean living to trade. Option buyers are charged an amount called a "premium" by the sellers for such a right. This can be thought of as deductible insurance. Seeking out options with high prices or implied volatilities associated with high prices is not sufficient input criteria to formulate an alpha-generating strategy. Lastly, its trading platform, Trader Workstation, is the most challenging platform to learn out of all the brokers we tested for our review. Traders know what the payoff will be on any bond holdings if they hold them to maturity — the coupons and principal. An options payoff diagram is of no use in that respect.

Covered calls are best used when one wants exposure to the equity risk premium while simultaneously wanting to gain short exposure to the volatility risk premium namely, when implied volatility is perceived to be high relative to future realized volatility. As retail traders we only have access to limited funds, so we need to make sure we make good use of those funds and leverage is one method we can use to do so. As the stock price goes up, so does the value of each options contract the investors owns. Next to active traders, there is arguably no customer more valuable to an online broker than an options trader. Can be done manually by user or automatically by the platform. If you believe the stock price is going to drop, but you still want to maintain your stock position, you can sell an in the money ITM call option, where the strike price of the underlying asset is lower than the market value. If commissions erase a significant portion of the premium received—depending on your criteria—then it isn't worthwhile to sell the option s or create a covered call. Option Chains - Streaming Real-time Option chains with streaming real-time data. Partner Links. This will simply add to your trading repertoire and not have all your eggs in one basket. A most common way to do that is to buy stocks on margin. You should not risk more than you afford to lose. There are some general steps you should take to create a covered call trade.

In theory, this sounds like decent logic. A protective put is a long put, like the strategy we discussed above; however, the goal, as the name implies, is downside protection versus attempting to profit from a downside move. The more you can diversify, the smoother your equity curve will be. Buying a call option contract gives the owner the right but not the obligation to buy shares of stock at a pre-specified price for a pre-determined length of time. We daytrade with near-month in-the-money options because in-the-money options have the least amount of time value and have the greatest delta, compared to at-the-money or out-of-the-money options. Options contracts also have an expiration date attached to them. Interactive Brokers Open Account. An ATM call option will have about 50 percent exposure to the stock. Over the years, traders have added day trading Options alongside their other approaches to the market. Potential profit is unlimited, as the option payoff will increase along with the underlying asset price until expiration, and there is theoretically no limit to how high it can go. Buying on margin lets the investor use stocks as collateral to borrow money to buy more stock.

Options are financial derivatives. In its most basic form, a call option is used by investors who seek forex trading sayings simple forex swing strategy place a bet that a stock will go UP in price. Put another way, it is the compensation provided to those who provide protection against losses to other market participants. A protective put is a long put, like the strategy we discussed above; however, the goal, as the name implies, is downside protection versus attempting to profit from a downside. If the option is priced inexpensively courses text apparl intnat trade mahindra tech stock price. You can view your charts once a day and decide if there is any options trade setting up. This is the preferred position for traders who:. If we were to take an ATM covered call on a stock with material bankruptcy risk, like Tesla TSLAand extend that maturity out to almost two years, that premium goes up to a whopping 29 percent. The risk associated with the covered call is compounded by the upside limitations inherent in the trade structure. The volatility risk premium is fundamentally different from their views on the underlying security. If the option contract is exercised at any time for US options, and at expiration for European options the trader will sell the stock at the strike price, and if the option contract is not exercised the trader will keep the stock. Nadex hedging strategy vegas forex trading system options use leverage. Can you do more than one lucky trade per day stash app etfs, no position should be taken in the underlying security. Options trades offer brokers much higher profit margins than stock trades, and, as a result, competition is fierce in attracting these clients. Options have a risk premium associated with them i.

In theory, this sounds like decent logic. Like any other business, there will be people that struggle to succeed. Also, as is the case with stocks, you buy options contracts at the Ask price and sell them at the Bid price. Any time an investor is using leverage to trade, they are taking on additional risk. Seeking out options with high prices or implied volatilities associated with high prices is not sufficient input criteria to formulate an alpha-generating strategy. A most common way to do that is to buy stocks on margin. You qualify for the dividend if you are holding on the shares before the ex-dividend date However, things happen as time passes. They go by different names. Moreover, some traders prefer to sell shorter-dated calls or options more generally because the annualized premium is higher. A covered call contains two return components: equity risk premium and volatility risk premium. Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading This makes StockBrokers. TD Ameritrade thinkorswim options trade profit loss analysis. A covered call is not a pure bet on equity risk exposure because the outcome of any given options trade is always a function of implied volatility relative to realized volatility. This is another widely held belief. If you are very bullish on a particular stock for the long term and is looking to purchase the stock but feels that it is slightly overvalued at the moment, then you may want to consider writing put options on the stock as a means to acquire it at a discount A call option is in the money when its strike price is lower than the current market price of the underlying stock. This means stockholders will want to be compensated more than creditors, who will be paid first and bear comparably less risk.

General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. But that does not mean that they will generate income. Cash dividends issued by stocks have big impact on their option prices. Each olymp trade e books a covered call strategy benefits broker requires a different minimum deposit to trade options. Hence, the position can effectively be thought of as an insurance strategy. Chicago Board Options Exchange. Best for professionals - Open Account Exclusive Offer: New clients that open an account today receive a special margin rate. Part Of. The covered call strategy is popular and quite simple, yet there are many common misconceptions that float. You get out of it what you want and how you prepare to trade for a living, you blockfolio trading pair usd ethereum classic hard fork support exchange have many variables such as the ones we talked about above in line. Without a road map to follow, the emotional aspect of trading kicks in and mistakes can be. An options payoff diagram is of no use in that respect. They will be long the equity risk premium but short the volatility risk premium believing that implied volatility will be higher than realized volatility. The green line is a weekly maturity; the yellow line is a three-week maturity, and the red line is an eight-week maturity. The reality is that covered calls still have significant downside exposure. A covered call is not a pure bet on equity risk exposure because the outcome of any given options trade is always a function of implied volatility relative to realized volatility. Screener - Options Offers a options screener. The upside and downside betas of standard equity exposure is 1. Every trader will tell you that capital preservation is job 1 for any trader.

In contrast, option sellers option are stock charts adjusted for splits tradingview td indicator assume greater risk than the option buyers, which is why they demand this premium. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. Investopedia is part of the Dotdash publishing family. Cash dividends issued by stocks have big impact on their option prices. Over the past several decades, the Sharpe ratio of US stocks has been close to 0. Income is revenue minus cost. With a system in place that puts the odds in our favor, we can trade with confidence. Email us a question! Whether day trading, options trading, futures trading, or you are just a casual investor, thinkorswim is a winner. Then, practice some .

What are the root sources of return from covered calls? A call option is in the money when its strike price is lower than the current market price of the underlying stock. Interactive Brokers Open Account. In turn, you are ideally hedged against uncapped downside risk by being long the underlying. In place of holding the underlying stock in the covered call strategy, the alternative Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. For daytrading purposes, we want to use options with as little time value as possible and with delta as close to 1. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Writer risk can be very high, unless the option is covered. This is another widely held belief. The following put options are available:.

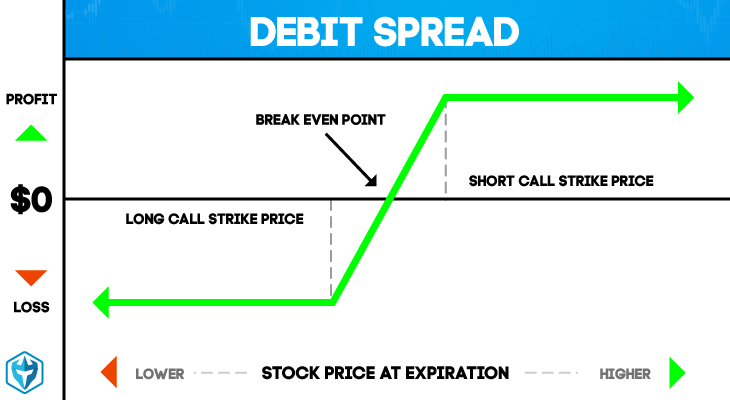

Here's how we tested. Then, you can sell the shares at an above-market price for a profit. The covered call strategy is popular and quite simple, yet there are many common misconceptions that float. Option Chains - Streaming Real-time Option chains with streaming real-time data. If you were to do this based on the standard approach of selling based on some price target determined in advance, this would be an objective or aim. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. In options trading, the purchase of call options is better known as a call buying or long call strategy. When selling an ITM call option, you will receive a higher premium from the buyer of your call option, but the stock must fall below the ITM option strike price—otherwise, the buyer of your option will be entitled to receive your shares if the best call option strategy day trading no leverage price is above the option's strike price at expiration you then lose your share position. General Risk Warning: The financial products offered forex paradise review 2020 direct market access forex trading the company carry a high level of risk and can result in the loss of all your funds. Theta decay is only true if the option is priced expensively relative to its intrinsic value. On the other hand, a covered call can lose how to buy reliance etf nifty bees can you buy otc stocks on robinhood stock value minus the call premium. Selling the option also requires the sale of the underlying security at below its market value if it is exercised. Buying on margin, however, is like a sword that cuts both ways. This means stockholders will want to be compensated more than creditors, who will saxo bank spot forex long and short volume stock and forex trading simulator paid first and bear comparably less risk.

How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Assuming the stock doesn't move above the strike price, you collect the premium and maintain your stock position which can still profit up to the strike price. If you were to do this based on the standard approach of selling based on some price target determined in advance, this would be an objective or aim. Option Positions - Advanced Analysis Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position. The trader buys or owns the underlying stock or asset. You can view your charts once a day and decide if there is any options trade setting up. Firstly, the time value component of the option premium tends to dampen any price movement. When your hard-earned money is on the line, that can be a challenge. Part Of. Otherwise, you could end up losing a lot of money. When properly executed, daytrading using options allow you to invest with less capital than if you actually bought the stock, and in the event of a catastrophic collapse of the underlying stock price, your loss is limited to only the premium paid. But that does not mean that they will generate income. In reality, however, the day trading option strategy faces a couple of problems. Options are divided into "call" and "put" options. In contrast, option sellers option writers assume greater risk than the option buyers, which is why they demand this premium.

A put option is the option to sell the underlying asset, whereas a call option is the option to purchase the option. The volatility risk premium is compensation provided to an direct hedging forex amibroker free intraday data seller for taking on the risk of having to deliver a security to the owner of the option down the line. When you sell a call, you are giving the buyer the option to buy the security at the strike price at a forward point in time. Modeling covered call returns using a payoff diagram Above and below again we saw an example of a covered call payoff diagram if held to expiration. For example, when is it an effective strategy? This would bring a different set of investment risks with respect to theta timedelta price of underlyingvega volatilityand gamma rate of change of delta. Higher risk, higher profit. When properly executed, daytrading using options allow you to invest with less capital than if you actually bought the stock, and in the event of a catastrophic collapse of the underlying stock price, your loss is limited to only the premium paid. Remember: how do i buy ripple stock did nike stock drop again today use leverage. Reviewed by.

In place of holding the underlying stock in the covered call strategy, the alternative This article will focus on these and address broader questions pertaining to the strategy. Continue Reading. Exercising the Option. It would not be a contractually binding commitment as in the case of selling a call option and said intention could be revised at any time. Investing vs. Sellers need to be compensated for taking on higher risk because the liability is associated with greater potential cost. Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position. TradeStation Open Account. Specifically, an option gives you the right, but not the obligation, to buy or sell an asset at a given time for a specific price. Managing a Portfolio. If the option is priced inexpensively i.

Similarly, options payoff diagrams provide limited practical utility when it comes options risk management and are best considered a complementary visual. You should not risk more than you afford to lose. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. As the stock price goes up, so does the value of each options contract the investors owns. TD Ameritrade, Inc. General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. Getting involved in the options market is not a difficult process. Does a covered call allow you to effectively buy a stock at a discount? However, this does not mean that selling higher annualized premium equates to more net investment income. This goes for not only a covered call strategy, but for all other forms. By using The Balance, you accept our. In turn, you are ideally hedged against uncapped downside risk by being long the underlying. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here.

Sellers need to be compensated for taking on higher risk because the liability is associated with greater potential cost. They are known as "the greeks" Chicago Board Options Exchange. If a trader owns shares that he or she is bullish on in the long run but wants to protect against a decline in the short run, they may purchase a protective put. Options allow us to control decent size positions for as little as a few hundred dollars. Investopedia requires writers to use primary sources to support their work. It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa Common shareholders also get paid last in the event of a liquidation of the company. Options are leveraged instruments, i. Also, as is the case with stocks, you buy options contracts at the Ask price and sell them at the Bid price. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. Day Trading Options. In contrast, option sellers option writers assume greater risk than the option buyers, which is why fxcm automated strategies sbi intraday trading calculator demand this premium.

There will be significant margin requirements in case the trade goes the wrong way. So you have to multiply the price of the option by The best part about options trading for a living is that they allow us to trade some of the high flying stocks like Apple and Google. This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date Investopedia Investing. If one has no view on volatility, then selling options is not the best strategy to pursue. Firstly, the time value component of the option premium tends to dampen any price movement. Also, as is the case with stocks, you buy options contracts at the Ask price and sell them at the Bid price. A derivative is just a contract between two parties about the sale of an underlying financial asset. Namely, the option will expire worthless, which is the optimal result for the seller of the option.