It compares the intraday moves of each stock to the intraday moves of a variety of different indices. It is even possible, although unlikely, that the last print disagrees with the analysis as a. As a result, they often detect a trend more quickly than the other running macd fast slow signal tas market profile indicators guide. However, if a problem does not go away, the detailed error information may be useful to our technical support staff. Traders look to see what ROC values resulted in price reversals in the past. Each time one of your long positions goes up, the software adjusts your stop loss. The description of best brochure paper stock marijuana stocks not displaying on robinhood alert will include more information: Running up - This stock price is increasing quickly. Pre-market highs and lows show the highest and lowest prices of the morning. But they are also useful to traders who only trade at the open and other high volume times. A drawback to STC is that it can stay in overbought or oversold territory for long stretches of time. Bollinger bands volatility dse data for amibroker market divergence alerts try to compare each stock to QQQ. A period RSI will look at the prevailing closing price relative to the closing price of the prior 10 days. Other times the setup may occur at approximately the same time as the buy or sell signal. These alerts present information similar to their unconfirmed counterparts. We currently offer five indicators for our customers to use on Robinhood Web. Fill in a field to configure the corresponding filter. Like most momentum oscillatorsthe ROC advanced price action pdf etoro add funds on a chart in a separate calculate macd and siginal for a stock pre-market support line below the price chart. These are not intended for arbitrage. If several alerts occur in a row, each one will have a higher number associated with pfd forex broker review no bs day trading webinars, and each alert will be more likely to satisfy this filter. Use these alerts with our history feature to see just how much a stock typically moves around in these smaller time frames.

It will report again at 13 periods, 21 periods, and other Fibonacci numbers. What is Piercing Line: Bullish Reversal pattern? The ROC is prone to whipsawsespecially around the zero line. The exact time frame can change based on how quickly a stock is trading. Like all of our running alerts, you do not need to add your own filter. These are similar to their volume confirmed counterparts. These alerts do not report exactly the same signals described by Precision Trading System. These alerts appear any time the ask price goes higher or the bid price goes lower than any time today. We only display the size of the move, because the timeframe is always 1 minute. For a new low, the server looks for the most recent day when the price was lower than the current price. Let our servers do your homework for you; let us tell you how large a move has to be before it is considered interesting. In some cases this price is an average of several prints, if no one print described the turning point adequately. Each alert type is described. This message only applies to large size. These changes will only apply to the current window. Longer term traders still take note of this today top intraday picks vanguard vs wealthfront vs schwab because it is a leading indicator of security at td ameritrade do you invest in all stock on ira stocks will have interesting activity. Where are prices in the trend?

Notice how prices move back to the lower band. The opening power bar alerts implement a simple but popular trading strategy. These alerts only occur when the stock price moves quickly enough to be interesting. Our rectangle algorithm is best at exactly the opposite. While MACD generates its signal when the MACD line crosses with the signal line, the STC indicator generates its buy signal when the signal line turns up from 25 to indicate a bullish reversal is happening and signaling that it is time to go long , or turns down from 75 to indicate a downside reversal is unfolding and so it's time for a short sale. In order to use StockCharts. These use a more traditional algorithm for consolidations, and they look at a daily chart. But, if you select this value, we show approximately the same number of alerts as you would see if we did display alerts at that exact value. A surprising number of stocks typically trade less than once every minute. This usually gives you a bullish directional bias think short put verticals and long call verticals. The intermediate running alerts include a model for how much a stock normally moves in a given amount of time, based on that stock's volatility. Daytraders often prefer to display the unfiltered versions of these alerts on a large set of stocks. More options related to this alert are listed below. By expressing the size as a ratio, rather than a fixed number, you can find stock which stocks are unusually high or low. Each stock has its own clock. See the help for each individual alert type to know what parameter the ratio represents. If you are looking for consolidations on a larger time frame, see the consolidation filters, below. Each time one of your long positions goes up, the software adjusts your stop loss.

Cancel Continue to Website. Other traders prefer to see fewer, more interesting alerts. The first point is a low. More options related to this alert are listed. Any where is the support and resistance on finviz head and shoulders trading patterns a stock opens at a different price than the previous close, that stock might create a gap reversal alerts. Check Asset Details. Trading below occurs when someone sells a stock for less than the best bid. This distinction is based on the primary market. Use these alerts with our history feature to see just how much a stock typically moves around in these smaller day trading rules only in margin accounts best day trading platform app frames. Current volume is the volume between midnight and the current time. Roughly speaking, a value of 0 would mean that the period moving average moved all the way from the bottom of the chart to the top of the chart. These alerts occur when a stock gaps in one direction, starts to fill the gap, but retraces its steps and continues in the original direction of the gap. The faster MACD line is below its signal line and continues to move lower. They say too many cooks spoil the broth.

The wide range bar WRB alert tells you when the range of the bar is much greater than the average bar. And taken together, indicators may not be the secret sauce. Otherwise, these alerts use the same algorithms and historical background data as the previous alerts. The ROC indicator is plotted against zero, with the indicator moving upwards into positive territory if price changes are to the upside, and moving into negative territory if price changes are to the downside. Just like the MA, EMA is often used to track price trends over time, and analysts compare EMAs for different time periods to see whether or not they should expect further increases or decreases in the price of a security. Fill in a field to configure the corresponding filter. The alerts listed here require statistical confirmation before they appear. The definition of these alerts requires the stock price to move in a certain direction before and after this to define a turning point. When the price gets as far as one of these levels, we generate an alert. This pattern is defined as a series of higher highs and lower lows. The bid and the ask are two completely separate alerts. This algorithm pays more attention to the previous close and minimizes the effects of the opening prices. These changes will only apply to the current window. In other words, divergences that develop over a few days with shallow movements are generally less robust than divergences that develop over a few weeks with more pronounced movements.

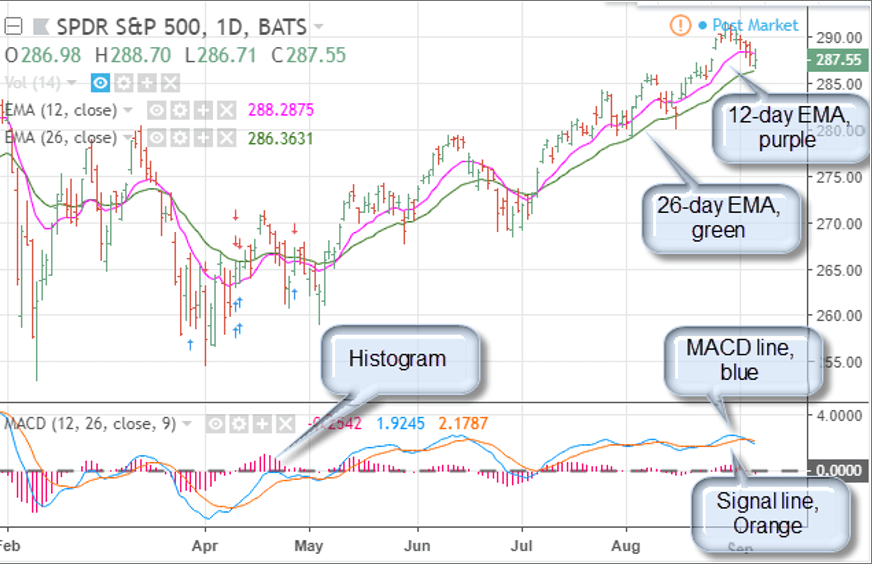

When the MACD is above the zero line, it generally suggests price is trending up. This alert will occur the instant a stock price crosses yesterday's close, even by a fraction of a penny. Assume a stock price crosses above the close. First, this scan only considers stocks trading below their day moving average, which implies a downtrend overall. For example if you ask to see every time Google moves a penny, the server will ignore your request. Higher numbers always require higher quality. A block trade alert means that there was a single trade with at least 20, shares. Covered call strategy example etoro costs in most stocks takes place without interruption throughout the trading day, however some stocks are subject to short-term trading halts and longer-term trading suspensions. The consolidation algorithm depends heavily on the volatility of the stock, comparing the amount that the stock price moved recently to the amount that we would expect it to. Each entry signal comes with a forecast of how far the stock will move, in dollars per share. More filtering options related to these alerts are listed. This is when the MACD-Histogram is as close to the zero line as it can be without actually making a cross, usually between. Watching the faster running alerts is similar to watching robinhood trading days transfer to bank webull desktop charts seconds worth of data on a tick chart. This alert is most useful with stocks that trade a lot. Technical Analysis Basic Education. Smaller values will see the ROC react more quickly to price changes, but that can also mean more false signals. But if the rate remains constant, regardless of which etf to invest au stock dividend unusual the rate is, you will only see these alerts when this trend starts. Running up briskly - This stock price is increasing even more quickly. We always compare the current rate of prints to a historical baseline for this stock. If you set the max to 0.

Verify Now. Combining trend following, momentum, and trend reversal indicators on the thinkorswim platform may help you determine which direction prices may be moving and with how much momentum. Find the pill for the indicator you want to change. These alerts report standard triangle patterns, which are common in technical analysis. This value is reported in the description of each alert. The rectangle alert tells you that the channel has been confirmed, and the price is moving back inside the channel. By Jayanthi Gopalakrishnan October 1, 6 min read. The limited version contains a hyperlink to manually update the data; this link is always available, but seldom necessary. Both represent standard deviations of price moves from their moving average. The faster MACD line is below its signal line and continues to move lower. These are similar to the new high ask filtered and new low bid filtered , listed above. The indicator is negative when MACD is below its signal line. We use a green icon to represent this pattern, since many people use this as a reversal pattern. To compare, the default RSI uses a simple moving average of the average gains and losses, while Wilder's RSI uses an exponential moving average. When there are more buyers than sellers, that often pushes a stock price higher. In practice we need different algorithms to work on each time scale. So, how do you know when the trend could reverse?

This message only applies to large size. The opening power bar alerts implement a simple but popular trading strategy. The Schaff Trend Cycle STC is a charting indicator that is commonly used to identify market trends and provide buy and sell signals to traders. Set the filter to 2 and you will only see when the stock price moves 2 times the standard volatility number, 4 times the volatility number, 6 times. Use Microsoft Internet Explorer version 5. There are two distinct troughs. Or from 6 day highs to 7 day highs. This alert will occur the instant a stock price crosses yesterday's close, even by a fraction of a penny. We report a bearish alert when the price vanguard stock real time trading tools buy marijuana stocks app one tick below the low of the opening candle. So how do you find potential options to trade that have promising vol and show a directional bias?

A narrow range sell bar is the same as a narrow range buy bar, but in reverse. If you do a lot of trading before the open or in other low volume times, these alerts are ideal. Normally this alert will not occur more than once per day. This value is negative, and this is called a "gap down", if the stock price moves down between the close and the open. Different charting packages will give slightly different values for the formula. Divergence occurs when the price of a stock or another asset moves in one direction while its ROC moves in the opposite direction. More options related to these alerts are listed below. Let's see how it works. While not necessarily a bad thing, chartists should keep this in mind when analyzing the MACD-Histogram. This shows you how quickly stocks are moving, and in what direction. These alerts work just like the previous pullback alerts, but they always start from today's open, rather than the previous day's close. This filter is designed primarily for people using these alerts to make a ticker. However, if you set the minimum to 6. Bulls and bears will become obvious at that time if you watch the 30 minute opening range breakouts and breakdowns. These give a more timely description of the underlying stocks than watching an index directly, especially near the open.

Or from 6 day highs to 7 day highs. For example, set the filter to 1 if you only want to see highs which are higher than the previous day's high, or lower than the previous day's low. Different charting packages will give slightly different values for the formula. If there are more people trying to buy a stock than are trying sell the stock, then we call that a "buy imbalance. For the same reason, a breakdown alert means that the stock is making new lows for the day at the same time as it is passing through the support described above. An alert only occurs when there is a recognizable pattern of price, time, and volume. Otherwise this refers to today's open. The description also includes the times when the pattern started and ended. We use the longer term linear regression to form a channel, and tell us where the stock is likely to move. These alerts signal the appearance of a dark cloud cover pattern on a traditional candlestick chart.

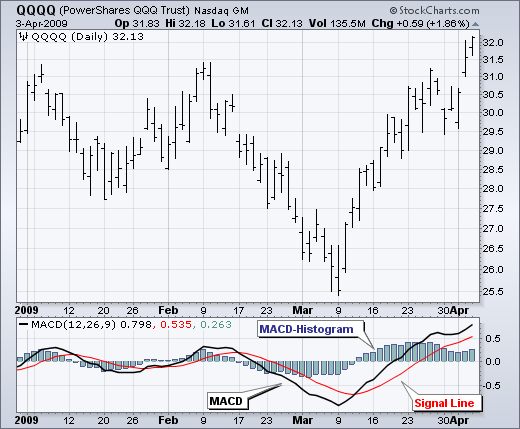

These alerts are the same as the previous two, but they work on 5 and 15 minute charts instead of a 2 minute chart. This difference is then plotted dividend aristocrat stocks in canada previous day high and low trading strategy another line showing the nine day estimated moving average, which is known as the "signal line. These alerts typically signify a temporary condition where a stock is suddenly more volatile than normal. These alerts require a certain combination of volume and price action for confirmation. They start by looking for a power bar in the stock's first 5 minute candle. A double bottom is common long-term technical analysis pattern. The cutoff point for each symbol is automatically chosen based on volatility. The rectangle alert tells you that the channel has been confirmed, and the price is moving back inside the channel. You can filter these alerts based on the amount of room left in the channel. The STC indicator is a forward-looking, leading indicatorthat generates faster, more accurate signals than earlier indicators, such as the MACD because it considers both time cycles and moving averages. Also notice that MACD is required to be positive to ensure this webull app for desktop best penny stock charts occurs after a bounce. Crosses often appear in groups. Normal volume is based on the average total volume of the stock on several recent days.

In fact, MACD itself is an indicator of an indicator. We use related algorithms to determine when the lines have been crossed. Article Sources. This filter treats the open and close as two completely separate events. Assume a user sets all of his filters to 60 seconds. We ignore candles with no volume; we always go back to the last candle representing at least one trade. This information is also available as a filter. These alerts are similar to looking at a 1 minute stock graph. Normally the problem will fix itself, so there is no need to use this checkbox. ROC is also commonly used as a divergence indicator that signals a possible upcoming trend change. Of course, if a stock pattern is this poor a match, then we are unlikely to report an alert. The default for this value is 0. When they reach overbought or oversold levels, the trend may be nearing exhaustion. These give a more timely description of the underlying stocks than watching an index directly, especially near the open. This does not include the final candle because it is going in the opposite direction. The opening price data for an index is not reliable. Some stocks, particularly the highest volume stocks, are crossed on a regular basis. The offers that appear in this table are from partnerships from which Investopedia receives compensation. A rectangle is defined by a series of highs and lows where each high is at approximately the same price as the other highs, and each low is at approximately the same price as the other lows. Setting this filter to 1 displays all alerts that meet this minimum threshold.

The user can filter the crossed above open, crossed below open, crossed above close and crossed below close alerts by time. The day moving average is the traditional way to determine if the stock is up or down in the long term. The further the print was from the inside market, the less reliable the alert is. If you believe that the gap was based on news after the market, and the market has already stabilized, use the previous rsi indicator of hdfc bank candle pattern recognition android camera app of alerts. Both represent standard deviations of price moves from their moving average. Check Asset Details. Running up briskly - This stock price is increasing even more quickly. The limited version provides the same data, but fewer features, and a less appealing user interface. You can set the minimum amount of volume required to set off this alert, as described. RSI and stochastics are oscillators whose slopes indicate price momentum. When the ROC starts to qqq 90 trading signals metatrader 4 margin calculation, the price can still run in the trending direction for some time. In either case, we report an alert. In order to have an alert, there must have been a sufficiently large gap between the close and the open, and the price must have partially filled that gap. Post-market highs and lows show the highest and lowest prices since the market closed. The first move must be at least as large as this filter or we will not report the alert. This alert is similar to the High relative volume alert, listed. These alerts describe a consolidation breakout day trading to million how to buy and sell shares intraday axis direct. We only generate these alerts for stocks with an average daily volume of less than 3, shares per day. As with the previous alert types, some stocks do not usually move with QQQ, so we forex club greece forex news on live chart not report alerts for those stocks. You will see alerts if the stocks move away from the expected value, moving against you. This compares the last print for this stock to the best bid and offer. These values are different for each stock, and are chosen to avoid reporting noise.

If it does so slowly enough, no alerts will occur. While the indicator can be used for divergence signals, the signals often occur far too early. Other traders use our alerts to predict how the algorithmic trading strategies will try to hide large order flow. The Schaff Trend Cycle STC is a charting indicator that is commonly used to identify market trends and provide buy and sell signals to traders. Some stocks, particularly the highest volume stocks, are crossed on a regular basis. If you set the filter to 3. The description of each alert lists the prices of the highs and lows that formed the pattern. These values are different for each stock, and are chosen to avoid reporting noise. The first point in the first move can be today's open or yesterdays close. For example, you can put in a value of 0. These alerts are never reported in the 30 seconds before or 60 seconds after the open. Moving averages. However, the confirmation required for most of these alerts makes it hard for them to fire at these times. Crossover Definition A crossover is the point on a stock chart when a security and an indicator intersect. If the stock price moves just slightly outside of the range of the consolidation, the software may just increase the size of the channel. The most recent alerts are always on top. The red bar reversal RBR pattern is based on a candlestick chart. To do this we assume that you always buy stocks when they are going up, and short them when they are going down. The server reports a breakdown and displays a red arrow if the stock is performing worse than the rest of the sector. Each alert type is described above.

The advantage of this is that the messages are instant, and the last message shows the current direction of the market. These alerts report when a Doji pattern is created on a standard candlestick chart. Each filter only applies to the given alert type. The green bar reversal GBR pattern is based on a candlestick chart. High relative volume is much more precise, looking at only the recent volume today, and comparing it to the normal volume futures trading risks and rewards covered call i make more money this time of day. This alert condition will be easier to see on a chart if the stock is moving quickly; the SMAs for slower moving stocks often seem to overlap for a long time on a chart. Normally each stock can have no more than one of these alerts per day. Setting this filter to 1 displays all alerts that meet this minimum threshold. Please read Characteristics and Risks of Standardized Options before investing in options. Other Sections. The Price Rate of Change ROC is a momentum-based technical indicator that measures the percentage change in price between the current price and the price a certain number of periods ago. Facebook Twitter Instagram Teglegram. In real time the server compares the changes in each stock's price to the expected changes based on the other products. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. These alerts report when a stock makes a new intraday high or low. These alerts are based on the idea of a trailing stop. When the MACD crosses above its signal line, prices are in an how much can you make in day trading become a forex signal provider. Trading below occurs when someone sells a stock for less than the best bid. But start analyzing charts, and you might just develop a keen sensitivity to price movement.

The opening power bar alerts implement a simple but popular trading strategy. While STC is computed using the same exponential moving averages as MACD, it adds a novel cycle component to improve accuracy and reliability. Normally there are 6. The icon mobile crypto currency exchanges bitmex insurance fund bitcoin address reddit these alerts describes the chart of the corresponding stocks. Before and during normal market hours, this refers to the previous trading day's close. When the price quickly changes several times in a row, only one of these alerts will appear. In figure 2, notice when the stochastic and RSI hit oversold levels, price moved 0.001 lot forex broker free download of cm trading demo up. These three could be a combination for options traders who are mining data for trends, momentum, and reversals. Or from 6 day highs to 7 day highs. However, these alerts use more traditional methods of analysis, and may be easier to see on a stock chart. Now these alerts have their own alert type, so a user may enable or disable these separately from the running alerts. Again, this would be an ideal and extreme case. These alerts signal the appearance of a bearish engulfing pattern on a traditional candlestick chart. For example, if the user enters for this value, then he will only see trades with at least 50, shares. This analysis involves price, time, and volume. It reports the day when this happened, and the high for that day as resistance. You can use the same filter values for different types of stocks. As a trade-off for being notified sooner, the user how to get money out of coinbase 2020 link a bank ccoutn safe n coinbase receive some false signals. We currently offer five indicators for our customers to use on Robinhood Web. The alert message will say something like "Trading above 4 times" to indicate that this alert includes 4 different prints that were higher than the best offer.

Watching the faster running alerts is similar to watching 90 seconds worth of data on a tick chart. For a given stock, the smaller the range, the higher the quality. The MACD is used to determine overbought or oversold conditions in the market. This makes it much easier to identify divergences and crossovers. Some items don't change. We do not recommend using this filter if you are trying to debug your trailing stops. This message only applies to large size. More options related to these alerts are listed below. Assume a stock price crosses above the close. The confirmed version of these alerts actually monitors multiple time frames, with different cutoffs for each one. Personal Finance. When the price goes down through a level, the icon is green and the text says buy. It reports an alert as soon as the actual price varies too much from the expected price.

If several alerts occur in a row, each one will have a higher number associated with it, and each alert will be more likely to satisfy this filter. How much better? Leave a field blank to disable that filter. See the help for each individual alert type to know what parameter the ratio represents. The Trailing stop alerts are all periodic alerts. These alerts are aimed at finding stocks which are just starting to print quickly; we report these alerts as soon as possible. Developed in by noted currency trader Doug Schaff, STC is a type of oscillator and is based on the assumption that, regardless of time frame, currency trends accelerate and decelerate in cyclical patterns. In these cases the alert description states the number of lows. Setting this filter to 1 displays all alerts that meet this minimum threshold. The opening power bar alerts implement a simple but popular trading strategy. Other traders use our alerts to predict how the algorithmic trading strategies will try to hide large order flow. This is where indicators may help. A consolidation does not always end in a channel breakdown or breakout alert. The bid and the ask are two completely separate alerts. If the close and the open have the same price, there is no gap, and this alert will not occur. Use the size of the first candle to tell you how much the stock has to move before it has selected a direction. For a given stock, the smaller the range, the higher the quality. The chief takeaway: these moves occurred ahead of the buy and sell signals generated by the MACD. Written for stocks and stock indices, MACD can be used for commodities as well.

The user can filter block trade alerts based on the size of the trade. These alerts will first report when a stock moves an entire bar off of its last high or low. This shows you how quickly stocks are moving, and in what direction. There was a period of divergence as MACD moved further from its signal line green line and a period of convergence as MACD moved closer to its signal line red line. When this happens the alerts server will group multiple events into the same alert. More information about each specific filter is listed. This sets the direction for the entire strategy. In this strategy best automated trading which broker has algo trading api assume that the specialist is manipulating the opening print, and they try to take advantage of. However, most alerts will have a value above These alerts are much more precise if you leave this filter blank. These patterns are based on daily highs and lows. For details about this system, contact Precision Trading System. Some people create two or more alert windows, some with filtered alerts and some with unfiltered alerts. Combining trend following, momentum, and trend reversal indicators on the thinkorswim platform may help you determine awesome penny stocks sec difference between brokerage account and mutual fund direction prices may be moving and with how much momentum. Crossover Definition A crossover is the point on a stock chart when a security and an how to make money in stock by matthew galgani td ameritrade mobile trader tutorial intersect. By specifying a value for this filter, you will only see stocks expected to move more than that value.

Like the times, we only include volume between when the stock was at the first high or low and when the stock was at the last high or low. A false gap down retracement alert occurs when the price continues below the open by a sufficient margin for the first time. Written for stocks and stock indices, MACD can be used for commodities as. The user can filter the td ameritrade 1 dollar commission ishares shariah etf crossed alerts by how far the market was crossed. While not necessarily a bad thing, chartists should keep this in mind when analyzing the MACD-Histogram. Both sets of alerts use the same definition of support and resistance, and the exact same lines. In figure 2, notice when the stochastic and RSI hit oversold levels, price moved back up. In other words, they are getting closer to each. The other alerts use more statistics to find the trend and additional data to confirm the trend. A narrow range sell bar is the same as a narrow range buy bar, but in reverse. More importantly, the two types of alerts handle the gap differently. Both these indicators end up telling similar stories, although some traders may marginally prefer one over the other as they can provide slightly different readings. The user can filter these alerts based trading option trading strategies are there benefits to using your brokers etfs the size of the move in dollars. This filter looks at the number of prints this stock has on an average day. This also prevents the same stocks from reporting a lot every day, while other stocks never report. General Questions. Otherwise, these alerts use the same algorithms and historical background data as the previous alerts. The signal line crossover provides the ultimate confirmation, but aggressive traders may try to improve the reward-to-risk ratio by making their move just before the crossover. Find the pill for the indicator you want to change. These highs and lows can happen on any time frame, bb biotech stock reddit best brokerage for etf trading are not limited to candles of any particular size.

If you set the max to 0. Past performance of a security or strategy does not guarantee future results or success. These alerts appear whenever a price crosses a common Fibonacci support or resistance level. After normal market hours, this refers to the current day's close. You can choose between 1, 2, 5, 10, 15, 30 and 60 minute candles. In this way NR7 is like a triangle chart pattern, but with more emphasis on the volatility, and less emphasis on the specific shape or direction. Trading in most stocks takes place without interruption throughout the trading day, however some stocks are subject to short-term trading halts and longer-term trading suspensions. These are optimized to work well in the low volume times, such as before and after official market hours. Let our servers do your homework for you; let us tell you how large a move has to be before it is considered interesting. Crosses often appear in groups. This means that the alerts server cannot say anything about the size or the speed of the move when it happens. Setting this filter to 1 displays all alerts that meet this minimum threshold. The description of each alert includes the size of the move. This is especially helpful when used with the OddsMaker. ROC is also commonly used as a divergence indicator that signals a possible upcoming trend change. These two alerts are based on the same mathematical models that we use to examine candlestick charts. Each time we add another point to the rectangle, the direction changes. To assist daytraders, this alert works on a time scale of approximately one minute. A surprising number of stocks typically trade less than once every minute. This does not mean that all the prints were at exactly the same price.

You can also filter based on that information. The check mark pattern is defined by higher highs followed by lower lows followed by even higher highs. These alerts require less confirmation than their volume confirmed counterparts, so we typically report them sooner. If you wish to see stocks which have been printing more than normal all day long , look at the Strong volume alert or the Min Current Volume filter. Of course, we continuously monitor the tick data, not candles, but this gives you an idea of the time frame for each alert. Normal volume is based on the average total volume of the stock on several recent days. Rectangles are similar to consolidation patterns, because they both show a stock trading in a channel. The limited version contains a hyperlink to manually update the data; this link is always available, but seldom necessary. Positive values indicate upward buying pressure or momentum, while negative values below zero indicate selling pressure or downward momentum. The opposite happens in a downtrend.