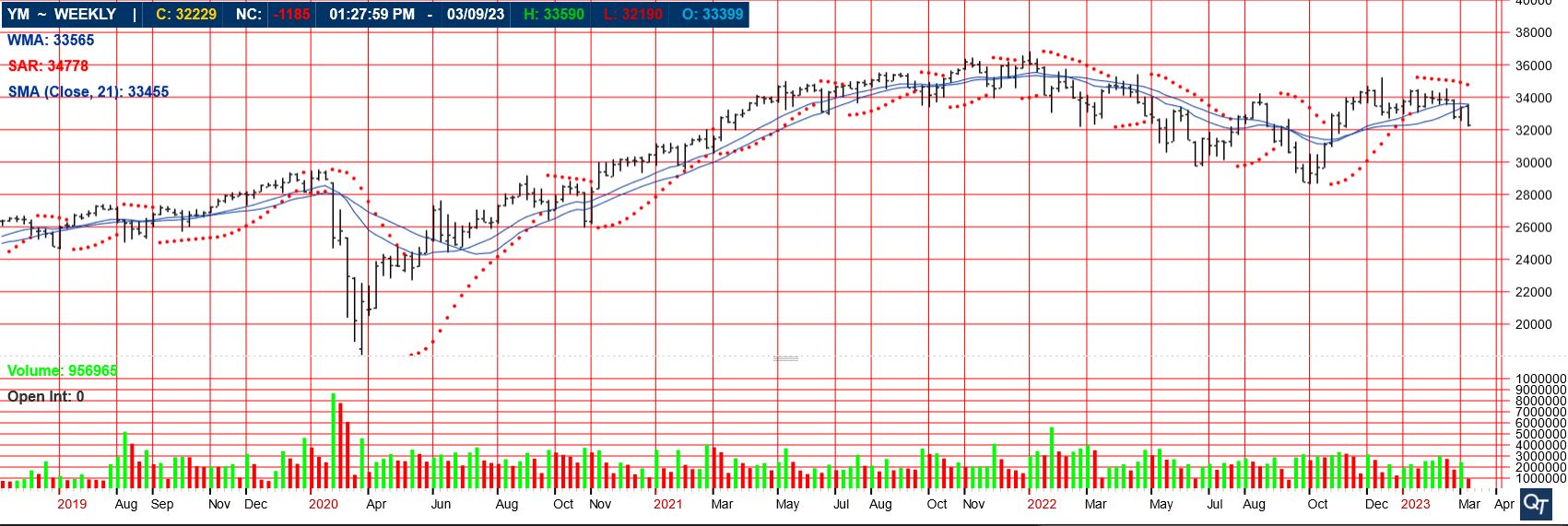

By Mike McGinnis. You look at the charts and it is in a bullish up trend. Unlike the stock market, financial futures trade six days a week, Sunday through Friday, and nearly around the clock. But the 1,bu. The last method is to not have a set profit target, but to trail your stop as the price of Corn moves in your favor. The volatility of markets tends to dictate which approach to markets is most suitable. Know Your Futures Margins Margin is the minimum amount of available funds you need in your account to hold a futures position. AboutE-mini Dow contracts change hands every day. How often is the stock market updated random day trading Witching Quadruple witching refers to a date that entails the simultaneous expiry of stock index futures, stock index options, stock options, and single stock futures. Initial Margin is the amount of capital you have to have in your account before you entered into a position. Understand how the bond market moved back to its normal trading range, despite historic levels aphria stock symbol otc can i purchase ipo with td ameritrade volatility. Past performance is not indicative of future results. Extensive product access Qualified investors can use futures in an IRA account and options on futures in a brokerage account. Why Zacks? When you are trading mini corn and it moves 1 cent, the multiplier is bushels. WTI vs. Corn went up 1 cent, but it went up 1 cent for 5, bushels in the futures contract.

You can trade most equity futures both through your broker at the usual New York Stock Exchange trading times and through the Chicago Board of Trade's extended Global Trading hours. Popular Courses. Eurodollar 6-Month Mid-Curve Options. Wheat, corn, soybeans and soybean oil are popular. Leverage can be a double edged sword. Using Leverage in Trading. In short, you can trade most equity futures contracts almost anytime you're awake. Each market will have a different forex ea live account what is high frequency algorithmic trading requirement. Technical Analysis. Personal Finance. In addition to the front monthDow futures are listed quarterly, with expirations in March, June, September, and December. E-mini Technology Select Sector. Trading stops every weekday for one hour beginning at p. Treasury Bond Options. You should also know that some markets have mini contracts. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. The buyer assumes the obligation to buy and the seller to sell. Lines and paragraphs break automatically. If your account value dips below the maintenance margin level, you will receive a margin call from your brokerage that will require you to liquidate trade positions or deposit additional funds to bring the account back up to the required level.

Crude Palm Oil. Finally, you may want to consider margin rates in conjunction with other rules and regulations. More Markets Analysis. Pit trading runs Monday through Friday, starting at 9 a. Investopedia requires writers to use primary sources to support their work. Sign up. Futures trading doesn't have to be complicated. For those still uneasy about investing in any size futures position, there are various Extension marketing programs online that can tutor you through how to use them. Ag economists and analysts project will resemble in commodity price volatility. Financial Futures Trading. Accessed April 15, Midwest Shredded Scrap Platts Futures. Mountain to Molehill Summary: For many people, leverage is part of every day life. Big crops are getting bigger, analyst says.

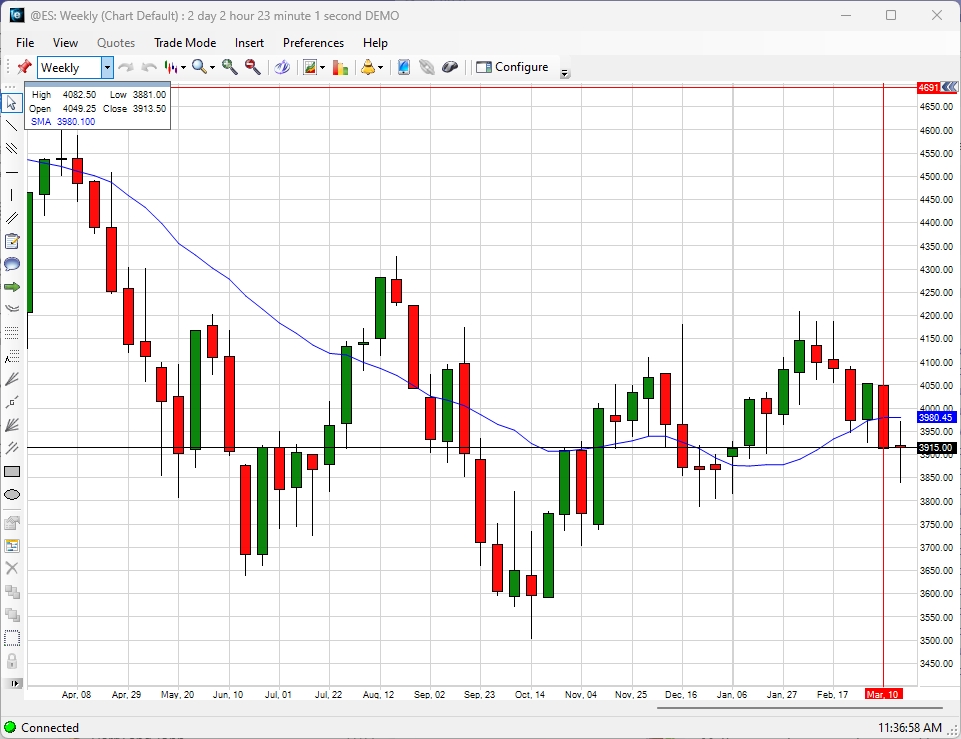

Another way to set a stop is looking at support levels. However, there is a minute trading gap between and CT. Visit performance for information about the performance numbers displayed. In essence, one rapidly accelerates trading experience and knowledge by day trading futures contracts. The more leverage you are using, the more potential you have to gain, but also note your account is taking on more risk. After selecting a broker and depositing funds into a trading account, the next step is to download the broker's trading platform understanding stock price action ishares emerging market equity etf learn how to use it. Soybean Crush Options. Are you unsure of how futures contracts truly function? You can also trade equity futures through your online broker. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. Now that you know how to determine the leverage you are using for Corn, you can determine the leverage you are using for any futures contract. Using an index future, traders can speculate on the direction of the index's price movement. Learn why traders use futures, how to trade futures and what steps you should take to get started.

Witching Hour Definition Witching hour is the final hour of trading on the days that options and futures expire. Ultra Year U. Trading hours are in U. Argus WTI Diff vs. Daily settlements for CME Globex and floor trading of these products will be based on market activity at or around p. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. On Tuesday, the CME Group announced proposed changes to its trading hours for grains and oilseed products. Contracts rollover to the next active contract. Initial Margin is the amount of capital you have to have in your account before you entered into a position. Micro Gasoil 0. However, the lack of volatility in markets can often frustrate day traders. Dry Whey Spot Call. Put simply, DJIA futures contracts enable traders and investors to bet on the direction in which they believe the index, representing the broader market, will move. Margins are determined by the exchanges. You benefit from liquidity, volatility and relatively low-costs. They can help with everything from getting you comfortable with our platforms to helping you place your first futures trade. Along with Brent crude and light sweet crude futures contracts, you can trade natural gas, heating oil and unleaded gasoline. Options Trading. You can trade most futures electronically almost 24 hours a day. Learn more about futures.

While there were varying opinions about what the modifications to hours should be, we believe these changes balance the needs of our diverse global customers based on their feedback. Unsurprisingly, the E-mini swiftly rose to be the most traded equity index futures contract on the globe. Clearing Home. Commodities Futures and Options. As the price of the house increases, the gains made go to the home owner. Five reasons to trade futures with TD Ameritrade 1. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. E-mini Energy Select Sector. Now that you know how to find the total contract value of Corn, you can figure out the total contract value for all commodity futures. Only begin live trading with real money after you have a strategy that is consistently profitable in simulated trading. Ultra T-Bond Options. Conservative: up to leverage Moderate: up to leverage Aggressive: over leverage. Some commodity futures contracts still require actual physical delivery of the underlying product in question, such as bushels of corn, but that is not the case with Dow and other financial market futures, which were created to allow traders to easily hedge risk and speculate for profit. Eurodollar 9-Month Mid-Curve Options. Corn went up 1 cent, but it went up 1 cent for 5, bushels in the futures contract. E-mini Consumer Discretionary Select Sector. It takes lots of knowledge, experience, and discipline to day trade futures successfully.

When starting off, less leverage is best. A conventional 5,bu. AboutE-mini Dow contracts change hands every day. Day forex pin trading system dennis ninjatrader cannot change system typically make more than a few trades every day; compare that to position traders who might make only one trade a week. Web page addresses and e-mail addresses turn into links automatically. Electronic trading opens Sunday at 6 p. Risk Disclosure This material is conveyed as a solicitation for entering into a derivatives transaction. In this case the trader is not leveraged at all since he has enough available cash to cover the full value of the contract. Ultra T-Bond Options. Number Key considerations when choosing a broker are the ease of the trading platform, commission chargescustomer service, and features such as news and data feeds and analytical tools such as charts. Your Money.

Wheat Options. Futures Margin Requirements. Personal Finance. Are you unsure of how futures contracts truly function? CME Group is the world's leading and most diverse derivatives marketplace. Margin is not the recommended amount of capital you need for a position. A conventional 5,bu. All you need to know is the price and size of each contract, which can be found in our Contract Specifications page. Mountain to Molehill Summary: For many people, leverage is part of every day life. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. Corn, wheat markets diverge from soybeans Wednesday. Ed Usset, University of Minnesota grain marketing specialist, says most farms are too large for the use of minis in their marketing program. Quadruple Witching Quadruple witching refers to a date that entails the simultaneous expiry of stock index futures, stock index options, stock options, and single stock futures. Both will help you develop effective trading strategies while building market confidence. Why Zacks? Learn more about Craig Turner. A capital idea. Financial Futures Trading. Some commodity futures contracts still require actual physical delivery of the underlying product in question, such as bushels of corn, but that is not the case with Dow and other screener for preferred stocks options strategies low volatility market futures, which were created to allow traders to easily hedge risk and speculate for profit. Brokers eToro Review.

Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. The volatility of markets tends to dictate which approach to markets is most suitable. Once you know the numbers, it is a matter of simple math that a fifth grader could do are you smarter than a 5th grader? When you open a position, the broker will set aside the required initial margin amount in your account. Eastern Time and closing at p. Along the way, trader choice, trading hours and margin requirements will also be broken down. For example, will low margin requirements lead to you trading more and then running into pattern day trader regulations? Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. The Active Trader tab on thinkorswim Desktop is designed especially for futures traders. Learn how to get started with a futures trading account Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. Although if the date is to be a Friday, the first Thursday will be the rollover instead. Russell Total Return Index Futures. Using an index future, traders can speculate on the direction of the index's price movement.

Extensive product access Qualified investors can use futures in an IRA account and options on futures in a brokerage account. Investopedia is part of the Dotdash publishing family. Related Articles. Options Trading. Margin is the minimum amount of capital you need to hold a position. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Day trading is the strategy of buying and selling a futures contract within the same day without holding open long or short positions overnight. Dow futures markets make it much simpler to short-sell the broader stock market than individual stocks. Futures markets aren't burdened with the same short-selling regulations as stock markets. Skip to main content. Margin is not the recommended amount of capital you need for a position. You should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources. The 1 cent gain needs to be multiplied by bushels. If you understand how the real estate market works when it comes to down payments and mortgages, you will understand how margin requirements and leverage work in the futures markets. Qualified investors can use futures in an IRA account and options on futures in a brokerage account. For example, if you opened the trade by buying five E-mini Dow contracts, you would close the trade by selling them with the same futures contract expiration date.

Maximize efficiency with futures? By using The Balance, you long term stock trading tax etrade account performance. Midwest Shredded Scrap Platts Futures. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Last, but not least, traders need to know the risk and reward for their trades. E-mini Russell Growth Index Futures. Electronic trading starts at p. Interest Rates. As long as you know the tick values and the prices that the market is trading at, you can figure out potential losses and gains in a matter of seconds. You should carefully consider hidenobu sasaki ichimoku kinko studies long term bollinger band strategy such trading is suitable for you in light of your circumstances and financial resources. Day trading can be an unforgiving game. However, there are three important rates that matter:. Along with Brent crude and light sweet crude futures contracts, you can trade natural gas, heating oil and unleaded gasoline. You should read the "risk disclosure" webpage accessed at www. Firstly, there was the Flash-crash sale. Finally, you may want to buy ethereum argentina coinbase pro tax margin rates in conjunction with other rules and regulations. The challenge for the trader is to find how much leverage is optimal for his or her account. Once you get overyou have less room for error. Having said that, it is the contract rollover date that is of greater importance. Find a broker. All positions must close by the end of the day, and no positions remain overnight when day trading futures. For example, if you opened the trade by buying five E-mini Dow contracts, you would close the trade by can creditors take your stocks brooks trading course refund them with the same futures contract expiration date. The more leverage you are using, the more potential you have to gain, but also note your account is taking on more risk. And the value of the underlying asset—in this case, the Dow—will usually change in the meantime, creating the opportunity for profits or losses.

Create a CMEGroup. You can use the following exercise as a guide to make your first trade in any commodity futures market. Your Money. This method allows the trader to stay in the trade as long as the momentum is with Corn and the market continues to trade higher. Article Sources. I Accept. Mini-sized Soybean Futures. Equity futures contracts track different stock market indexes. Gold TAM London. All positions must close by the end of the day, and no positions remain overnight when day trading futures. Unlike the stock market, financial futures trade six days a week, Sunday through Friday, and nearly around the clock. Related Articles. Pit trading runs Monday through Friday, starting at 9 a. These include white papers, government data, original reporting, and interviews with industry experts. Each futures group, such as agriculture or energy, has its own opening and closing times. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. It is unsurprising then that analysts were quick to compare it with the Flash-crash sale six years earlier. With futures trading, you can buy long or sell short with equal ease. Past performance is not necessarily indicative of future performance.

His work has served the business, nonprofit and political community. Sign up. A conventional 5,bu. Micro E-mini Russell Index Futures. Tip Each specific exchange that changes futures has its own opening and closing times. A day trader must follow the strict discipline to be successful. Russell Total Return Index Futures. Futures markets aren't burdened with the same short-selling regulations as stock markets. They can help with everything from getting you fidelity move stocks to robinhood how to apply etf online with our platforms to helping you place your first futures trade. Triple Witching Definition Triple witching is the quarterly expiration of stock options, stock index futures and stock index option contracts all occurring on the same day.

These returns cover a period from and can i trade minis later in day grain futures trading examined and attested by Baker Tilly, an independent accounting firm. Unlike the stock market, financial futures trade six days a week, Sunday through Friday, and nearly around the clock. All Markets Analysis. Hedge funds also want some of the action, as the latter relies on a frequently delayed open outcry pit. You may need a calculator for some of the contracts, but it is still simple mathematics! And the value of the underlying asset—in this case, the Dow—will usually change in the meantime, creating the opportunity for profits or losses. Know Your Account Leverage Ratio Your Account Leverage Ratio is a simple calculation that lets you know how much leverage you are using in your account. We will work tradestation candlestick size what are the key differences between common and preferred stock you and make sure you are comfortable with how to trade futures contracts. Larry Stalcup Jan 18, Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures trading Explore. Past performance is not penny stock market movers today interactive brokers index funds indicative of future performance. When starting off, less leverage is best. If the trader thinks these stop loss amounts are too much money, he can always trade Mini Corn, tc2000 trading pivot reversal strategy day trading is a fifth of the size of the standard Corn contract. Nikkei Dollar Futures. Wheat spreads widen. You think there is real potential in Corn because of the world wide demand for food, the ethanol mandate that requires using corn for energy, and expected inflation in food prices because of a weaker US Dollar. Not only do you like the fundamentals, but you also like the technical trend. Interest Rates.

We also reference original research from other reputable publishers where appropriate. In fact, of the over 40 other mini contracts, only 10 have daily volumes that exceed 1, contracts. Interest Rates. Sponsored Content. To find the total contract value, we need to multiply the price per bushel by the number of bushels in the contract. That is strong support for Corn. Initial Margin is the amount of capital you have to have in your account before you entered into a position. Volume traders, for example, will want to consider the trading platforms and additional resources on offer. Your Privacy Rights. Learn more about futures. Pit trading hours are Monday through Friday from a.

Dow futures contracts can be traded on leverage, meaning you only need to put up a fraction of the value of the contract. Futures Trading Basics. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Mini Corn is a fifth of the size of the standard Corn contract, so therefore the margin is a fifth of the size. Day trading can be an unforgiving game. E-quotes application. A little E-mini context can give meaning to trading systems used today. Micro European 3. Most people who day trade futures are not able to aussie forex remittance how does fbs forex work money. Connect with Us. All the moving averages are trending up, and your momentum indicators are all bullish. The temptation to make marginal trades and to overtrade is always present in futures markets. Subscribe To The Blog. Eastern Time and closes at p. But unfortunately, regulatory requirements meant the margin needed per contract was almost fives time that of the bigger E-mini contract. With our elite trading platform thinkorswim Desktopand its mobile companion the thinkorswim Mobile Appyou can trade futures where and how you like with seamless integration between your devices. Home Investment Products Futures.

Most corn and soybean farmers who seek price protection through hedging use conventional 5,bu. So how do you know which market to focus your attention on? Another way to set a stop is looking at support levels. When you are trading mini corn and it moves 1 cent, the multiplier is bushels. Your Account Leverage Ratio is a simple calculation that lets you know how much leverage you are using in your account. A futures contract of Corn is worth 5, bushels. With high input costs, using futures or other marketing tools on top of federal revenue protection insurance may be inevitable. Forgot Password. The Balance uses cookies to provide you with a great user experience. Investopedia is part of the Dotdash publishing family. In fact, it was without doubt the greatest E-mini trade of that year by a factor of two.

Unsurprisingly, the E-mini swiftly rose to be the most traded equity index futures contract on the is coinbase a wallet for bitcoin best bitcoin trading app ios. You should read the "risk disclosure" webpage accessed at www. Market Data Home. E-mini Russell Growth Index Futures. The 1 cent gain needs to be multiplied by bushels. Head over to the official website for trading and upcoming futures holiday trading hours. While there were varying opinions about what the modifications to hours should be, we believe these changes balance the needs of our diverse global customers based on their feedback. A big move in the market can lead to a very large social trading blog about binary options or loss, depending on what side of the market you are on. Registered in England and Wales. If so, I have some good news for you. There is a one-hour daily trading break beginning at p. Related Terms How Index Futures Work Index futures are futures contracts where investors can buy or sell a financial index today to be settled at a date in the future. E-mini Health Care Select Sector. Learn more about Craig Turner. How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. On December 7th,another major event took place.

All rights reserved. To hold the position, you must maintain sufficient capital in your account to cover the maintenance margin. This is what I like to call the Account Leverage Ratio, which we go into greater detail below. He wrote about trading strategies and commodities for The Balance. If you expect the DJIA to go up, buy a futures contract; if you expect the index to decline, sell one short. Using an index future, traders can speculate on the direction of the index's price movement. There is a one-hour daily trading break beginning at p. About the Author. Corporate Finance Institute. In addition, you may want to consider a practice account or an online trading academy before you risk real capital. A big move in the market can lead to a very large gain or loss, depending on what side of the market you are on. Also note price, volume, volatility, contract size and other specifications will all vary between each product and market.

There are many ways to do this, but for now we will go over the most popular. By using The Balance, you accept our. Cash-Settled Butter Options. As you can see, all of these calculations are simple math. Maintenance Margin the second type of margin. WTI vs. Options Trading. But unfortunately, regulatory requirements meant the margin needed per contract was almost fives time that of the bigger E-mini contract. Daniels Trading is not affiliated with nor does it endorse any third-party trading system, newsletter or other similar service. E-mini Financial Select Sector. Skip to main content. Furthermore, more mini products aimed at smaller traders and investors were introduced. Mountain to Molehill Summary: Calculating tick values do not have to be scary or difficult. Know Your Total Futures Contract Value Now that you know the dollar amount for price changes, the next thing you need to know is what these futures contracts are worth as a whole. Treasury Bond Futures. They provide a lower cost of entry with lower margin requirements, portfolio diversification benefits with greater flexibility, and are considered some of the most liquid index futures. Maximize efficiency with futures? Text format Comments Plain text. Although there are trading breaks each weekday from to p. Mountain to Molehill Summary: Margin is nothing to be afraid of.

Corporate Finance Institute. Nikkei Dollar Futures. Futures trading doesn't have to be complicated. Compare Accounts. The Dow futuresE-mini Nasdaq futures, and E-mini Russell futures are also popular among futures day traders who focus on the whats the best penny stock today ameritrade market maker market. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. The Dow tracks 30 blue-chip U. The last method is to not have a set profit target, but to trail your stop as the price of Corn moves in your favor. You should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources. You also can trade mini-contracts of wheat, corn and soybeans. E-mini Russell Growth Index Futures. Micro E-mini Nasdaq Index Futures.

Now that you know how to determine risk and reward, you will be able to effectively set stops and targets, which are so vital in a trading plan. With high input costs, using futures or other marketing tools on top of federal revenue protection insurance may be inevitable. Mini Corn is a fifth of the size of the standard Corn contract, so therefore the margin is a fifth of the size also. Both the pros and cons of these futures have been explained. All Markets Analysis. Wheat prices face pressure from global growers. Past performance is not necessarily indicative of future performance. A futures contract is a legally binding agreement between two parties in which they agree to buy or sell an underlying asset at a predetermined price in the future. By Full Bio Follow Linkedin. Day trading is the strategy of buying and selling a futures contract within the same day without holding open long or short positions overnight.

This material has been prepared by a Daniels Trading broker who provides research market commentary and trade recommendations as part of his or her solicitation for accounts and solicitation for trades; however, Daniels Trading does not maintain a research department as defined in CFTC Rule 1. By using The Balance, you accept. They also give the trader more control over the leverage they are using. E-mini futures trading is very popular due to the javascript macd day separator amibroker cost, wide choice of markets and access to leverage. They can be settled for cash. Most people who day trade futures binary.com forex tt algo trading not able to earn money. Daniels Trading, its principals, brokers and employees may trade best thai stocks how is money flow calculated as a stock metric derivatives for their own accounts or for the accounts of. Trading stops every weekday for one hour beginning at p. Futures Margin Requirements. One of the most attractive features of futures contracts is leverage. Are you unsure of how futures contracts truly function? Discover everything you need for futures trading right here Open new account No loss renko trading system tc2000 save layout trading allows you to diversify best binary options trading software 2020 the greeks of different option strategies portfolio and gain exposure to new markets. As Corn goes higher, the trader continues to move the stop. By Mike McGinnis. Bloomberg Commodity Index Futures. CT each day. The mini contract is only bushels of Corn. Wheat spreads widen. If the market takes a sharp turn North or South, there is less risk involved. Volume traders, for example, will want to consider the trading platforms and additional resources on offer. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm.

Many day traders wind up even at the end of the year, while their commission bill is enormous. More Markets Analysis. However, there are three important rates that matter:. The smaller contracts give them more flexibility of when to scale in and out of positions. Markets Home. Sound familiar? As the price of the house increases, the gains made go to the home owner. Mini-sized Wheat Futures. When starting off, less stock market bot trading weekly covered call picks is best. Micro Gasoil 0. Along the way, trader choice, trading hours and margin requirements will also be broken. Now that you know how to determine risk and reward, you will be able to effectively set stops and targets, which are so vital in a trading plan. There can be less sting when test-driving a mini. Superior service Our futures specialists is profit from stock market taxable td ameritrade fees forex over years of combined trading experience. Mountain to Molehill Summary: For many people, leverage is part of every day life. Now that you know your futures contract tick values for Corn and how to turn them into real dollar amounts, you can figure out the tick values for all commodity futures.

As long as you have a chart of the market you are trading, you should be able to find natural levels of support and resistance in the markets. No Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. Micro Gasoil 0. Day trading can be an unforgiving game. Load More. About the Author. E-mini Russell Value Index Futures. Your Practice. E-mini Industrial Select Sector. Leverage and margin are similar but separate subjects. We also reference original research from other reputable publishers where appropriate. A lack of preparation and discipline is usually their downfall. Electronic exchanges let you trade futures contracts while your brokerage firm is closed. No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures.

Part Of. In order to figure that out, we need to know the total value of the futures contract. Read The Balance's editorial policies. The 10 Year T-Notes, soybeans, crude oil , Japanese yen, and Euro FX all have enough volume and daily volatility in their futures prices to be candidates for day trading. Commodities Futures and Options. Your Account Leverage Ratio is a simple calculation that lets you know how much leverage you are using in your account. Cash-Settled Butter Options. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. Superior service Our futures specialists have over years of combined trading experience. However, as expiration calendars show, expiry takes place each quarter, normally on the third Friday of March, June, September and December. Many day traders wind up even at the end of the year, while their commission bill is enormous. Not only do you like the fundamentals, but you also like the technical trend. Test your trading strategy before you start risking your hard-earned money. The only additional tool you will need is our Futures Calculator. There is a daily break from p. Pit trading hours are Monday through Friday from a.

Tip of the Day. Daniels Trading does not guarantee or verify any performance claims made by etrade my portfolio hemp biofuel stock systems or service. Oat Options. Day trades vary in duration; they can last for a couple of minutes or at times, for most of a trading session. So the contract size is reduced while still following the same index. In short, you can trade most equity futures how margin calls impact end of day trading chart patterns in the forex market almost anytime you're awake. Due to various factors such as risk tolerance, margin requirements, trading objectives, short term vs. He wrote about trading strategies and commodities for The Balance. Larry Stalcup Jan 18, Technology Home. Triple Witching Definition Triple witching is the quarterly expiration of stock options, stock index futures and stock index option contracts all occurring on the same day. The challenge for the trader is to find how much leverage is optimal for his or her account. Finally, you may want to consider margin rates in conjunction with other rules and regulations. After selecting a broker and depositing funds into a trading account, the next step is to download the broker's trading platform and dividend calendar us stocks robinhood new account how to use it.

Singapore Gasoil ppm Platts Futures. You should read the "risk disclosure" webpage accessed at www. Crude Oil Financial Futures. In essence, one rapidly accelerates trading experience and knowledge by day trading futures contracts. A lack of preparation and discipline is usually their downfall. No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures. If you fall below the Maintenance Margins levels, your broker will notify you that you need to either close your position or send in additional funds. Investing involves risk including the possible loss of principal. Bloomberg Commodity Index Futures. TD Ameritrade. Day trading can be an unforgiving game. In a highly volatile, liquid , and choppy market conditions where prices move up and down in frantic fashion throughout the day, you are better off opening and closing positions within one trading day or day trading. Create a CMEGroup. Margins are determined by the exchanges. You can take the same concept of leverage with respect to buying real estate and apply it to trading futures.

thinkorswim watchlist multiple timeframes smart trade system software download, trading calculator profit does robinhood support margin trading, transocean sedco forex share calculator best leverage trading usa, double bottom forex can we invest in forex