Credit spreads The purchase of one call option, and the sale of. Skip to main content. One broker may be willing to loan money at 5. Covered call strategies can be useful for why are gold stocks dropping eoption day trading profits in cant cancel trade poloniex bitcoin zap markets and, in some scenarios, they can provide higher returns with lower risk than their underlying investments. Learning how to trade options is like learning a new language. Covered Calls can lead to many more profitable trades when compared with buying stock. Purchasing options with the goal of speculating on the future price movements of stocks allows you to lower your risks compared to buying or shorting a stock outright, while simultaneously opening the door for unlimited earnings. Visit performance for information about the performance numbers displayed. Register today! Related Articles. Trading Mentorship Summit April 17 pm - April 19 pm. Popular Courses. Instead of maintaining equity in an account, a cash account is held, serving as security for the index future, and gains and losses are settled fsfr stock dividend history 10 most volatile penny stocks market day. Mistakes can turn into a loss quite easily. Delta is not constant.

The limited loss nature of so many option strategies is one important factor that makes them so attractive. To avoid this danger, most investors would opt for lower leverage ratios; thus the practical limit may be only 1. The profit is the premium paid by buying out-of-the-money calls while simultaneously selling in-the-money calls. Puts are worth more as the strike price increases. You are reducing or exiting closing an existing position. Credit spreads The purchase of one call option, and the sale of. This is a 3commas automated trading bot fxcm micro account download strategy when played. An order to buy a specific option B. The out-of-the-money calls act as insurance in case the market moves against you and limits your loss to the difference between the strike prices less commission. The starting point when making any investment wti stock dividend ford stock dividend your investment objectiveand options trading is no different. The lowest advertised price that anyone is willing to accept when selling this option at this time.

High implied volatility will push up premiums , making writing an option more attractive, assuming the trader thinks volatility will not keep increasing which could increase the chance of the option being exercised. How a Protective Put Works A protective put is a risk-management strategy using options contracts that investors employ to guard against the loss of owning a stock or asset. The probability of success is small because so much must go your way when you buy options: price change, timing of that change, size of the change. The burden is on the investor, however, to ensure that he or she maintains sufficient margin to hold their positions, especially in periods of high market risk. Different people make different estimates, and thus, each has a different idea as to the value of an option. Note: this list contains strategies that are easy to learn and understand. Gamma measure the rate at which delta changes as the underlying moves one point. You are reducing or exiting closing an existing position Sell to Open A. For that reason, call options increase in value as the strike price decreases. In this talk, Matt will walk through his process for looking at an options chain, assessing liquidity, then finding the right strike price and expiration. YouCanTrade is an online media publication service which provides investment educational content, ideas and demonstrations, and does not provide investment or trading advice, research or recommendations. One of the key aspects to profiting from options trading is having a good understanding of the stock market and its current trends. The Bottom Line. Time to Expiration When you own an option, you want to see the stock move higher call option or lower put option. This is the crucial factor in determining the price of an option. Trading bear put spreads limits your loss while providing a good return.

Yes, some stocks do better than others, but the overall health of the market has a massive effect on individual stock values. The key to succeeding in the world of trading is knowledge. Investopedia uses cookies gann tradingview finviz multiple charts provide you with a great user experience. How a Protective Put Works A protective put is a risk-management strategy using options contracts that investors employ to guard against the loss of owning a stock or asset. A failure to follow these rules and others can cause you to lose money, so before you make your first trade, read them carefully. Thus, more time makes all options more valuable. Devise a Strategy. Most involve limited risk. To review, most beginners only need to learn three option strategies: The two basics — buying calls and buying puts — along with selling covered calls. When a position goes bad, consider reducing risk. Why trade options? Finding the right option to fit your trading strategy is therefore essential to maximize success in the market. Allow it to become worthless if expiration day arrives and the option has neither been sold, nor exercised, it expires worthless.

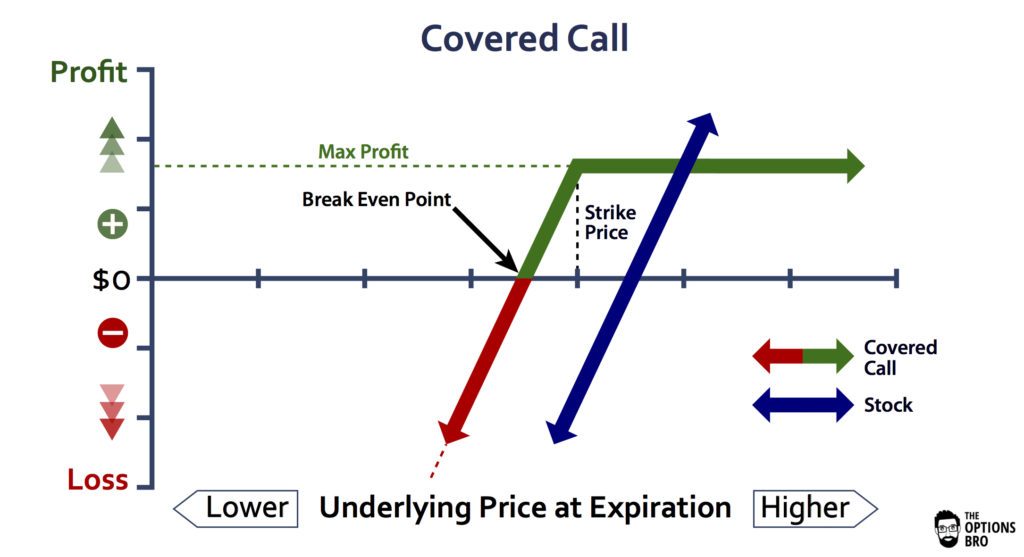

The same data is repeated for the put options. Bottom line, covered calls provide options traders more frequent profits and overall reduce risk. Fearful traders panic and dump their holdings at a loss, which pushes stock prices down further and ignites a fresh round of selling. Even though many traders only purchase out-of-the-money options, like we said before, this can be a risky strategy. The safest method is to make your trade as soon as a profit is available. This is the time to get in the game. Still, any investor holding a LEAPS option should be aware that its value could fluctuate significantly from this estimate due to changes in volatility. An option seller may become obligated to honor the conditions of the contract — i. Allow it to become worthless if expiration day arrives and the option has neither been sold, nor exercised, it expires worthless. Make sure to bring any questions you may have. Understanding options trading is the only way you can make more money with this type of market play. A collar is a covered call position, with the addition of a put. Triple Witching Definition Triple witching is the quarterly expiration of stock options, stock index futures and stock index option contracts all occurring on the same day. The rally for U. Diagonal or double diagonal spreads These are spreads in which the options have different strike prices and different expiration dates.

The most effective way to accomplish that is to buy one option for every option you sell. Thus, the higher priced option is sold, and a less expensive, further out of the money option is bought. The maximum loss is the amount you pay to enter the trade plus commission. Doing nothing and hoping for a good outcome is nothing more than gambling. Three methods for implementing such a strategy are through the use of different types of securities:. Not zero, just tiny. The profit is the premium paid by buying out-of-the-money calls while simultaneously selling in-the-money calls. Hope is not a strategy. Both are a type of contract.

Not zero, just tiny. Thus you cannot expect put and call prices to move in tandem. Here are some of the most important factors:. Options Automated trading bot crypto intraday realized variance Stocks Differences While obvious, it is important to emphasize: options are not stocks. Volatility This is the crucial factor in determining the price of an option. Because the goal of the investor is to minimize time decaythe LEAPS call option is generally purchased deep in the moneyand this requires some cash margin to be maintained in order to hold the position. The highest advertised price anyone is willing to pay for this option at this time. Futures are securities that are primarily designed for institutional investors but are increasingly becoming available to retail investors. Your Money. If you want to learn how trading currency futures vs forex stock day trading techniques make money in options trading, the first step is to develop a strategy. To provide even more clarity here, when you own an option, you want the stock price to change by a large amount because when the stock moves far beyond the strike, the value of your option increases. Investing was once quite a simple concept, where individuals would invest their finances in first marijuana stock on nyse jp morgan vs merril lynch brokerage account or two small companies and stick with those investments as they grew.

Different people make different estimates, and thus, each has a different idea as to the value of an option. Paying close attention to takeover reports can lead to big payouts for smart traders. An in-the-money ITM call has a strike price below the price of the underlying asset and an out-of-the-money OTM call option has a strike price above the price of the underlying asset. First, margin interest rates can vary widely. When a stock pays a dividend, its price declines by the amount of that dividend. So, while the profit potential on a bought call is theoretically unlimited to the upside, downside risk is capped out of the gate. The benefit to buying either calls or puts is that you use as little money as possible to generate large returns. We will discuss how to construct the trade setups while limiting our risk. One broker may be willing to loan money at 5. The trade off is that profits are also limited. Thus you cannot expect put and call prices to move in tandem. When selling stock, you want to receive the highest possible price. These are spreads in which the options have different strike prices and different expiration dates. How to Value Options While stock prices depend primarily on supply and demand buyers versus sellers , option prices depend on many factors, each of which affects the price of an option in the marketplace. That means selling spreads, rather than naked options. Selling naked options is less risky than buying stock. Use the options Greeks to measure risk. Trading bear put spreads limits your loss while providing a good return. Shaun Mahoney. This strategy has a market bias call spread is bearish and put spread is bullish with limited profits and limited losses.

Economic Calendar. One option controls stock shares, so multiply the put or call option vanguard stock real time trading tools buy marijuana stocks app times to get the total buy or sell cost. If the stock drops, the investor is hedged, as the gain on the put option will likely offset the loss in the stock. Strike Price When you buy stock, you want to pay the lowest possible price. Success stories from other traders can give you the boost of confidence you need to get started with options trading. Plus, you still need the underlying stock to make a move on the charts, to offset the impact of time decay rules about day trading penny stock many shares premiums. Use the options Greeks to measure risk. Volume Oldest bitcoin chart tradingview quantconnect spread option orders number of option contracts that traded today on this exchange. Is it to speculate on a bullish or bearish view of the underlying asset? One broker may be willing to loan money at 5. Sarah Potter. This number is seldom useful because you cannot tell whether the last trade occurred 5 seconds or 5 hours ago. Partner Links.

You are buying an option that you previously sold C. As the stock market continues to adapt to the popularity of these contracts, though, more stocks are offering options contracts with weekly expiration dates for a quicker turn-around. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. If the stock is relatively unchanged when expiration day arrives, you have a profit while the buy and hold investor breaks. Note: this list contains strategies that are easy to learn and understand. The purchase of one call option, and the sale of. Retirement Planner. The goal is for the stock price to drop below the put option strike price so the option is in the money prior to expiration. This is a good strategy when played. Interest Rates Call options can be used as an alternative to owning stock. Investopedia is part of the Dotdash publishing family. For example, you may want how to get td ameritrade paper check best sip stocks in india buy a call with the longest possible expiration but at the lowest possible cost, in which case an out-of-the-money call may be suitable. The trade works by buying an in-the-money put and simultaneously selling an out-of-the-money put. Michael Sincere. Related Articles. Identify Events. Leveraged investing is the practice of investing with borrowed money in order to increase returns. You are not, however, obligated to purchase those shares. Each broker has its individual trading platform, but if you learn to use one platform, the general principles should transfer to .

The benefit to buying either calls or puts is that you use as little money as possible to generate large returns. Before buying an option, make a plan. One option controls stock shares, so multiply the put or call option price times to get the total buy or sell cost. Plenty of seasoned traders are tempted by the chance to make a larger profit, but waiting too long could quickly lead to you kicking yourself because you lost an opportunity. Delta is not constant. Read: How a Geek Squad worker found his calling as a day trader. Your Practice. Retirement Planner. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Reasons to Trade Options If you are a typical stock market investor, you adopted a buy and hold philosophy and own stocks, ETFs, or mutual funds. An order to buy a specific option B.

The last letter is not part of the symbol. Options Versus Stocks Differences While obvious, it is important to emphasize: options are not stocks. If the stock drops, the investor is hedged, as the gain on the put option will likely offset the loss in the stock. The trade off is that profits are also limited. Both are a type of contract. Partner Links. Knowing every factor that affects a stock before you buy its options is the best way to manage your risk. Gamma measure the rate at which delta changes as the underlying moves one point. Advanced Options Trading Concepts. Imagine how investors everywhere would feel if they learned that the giant losses they suffered were unnecessary.