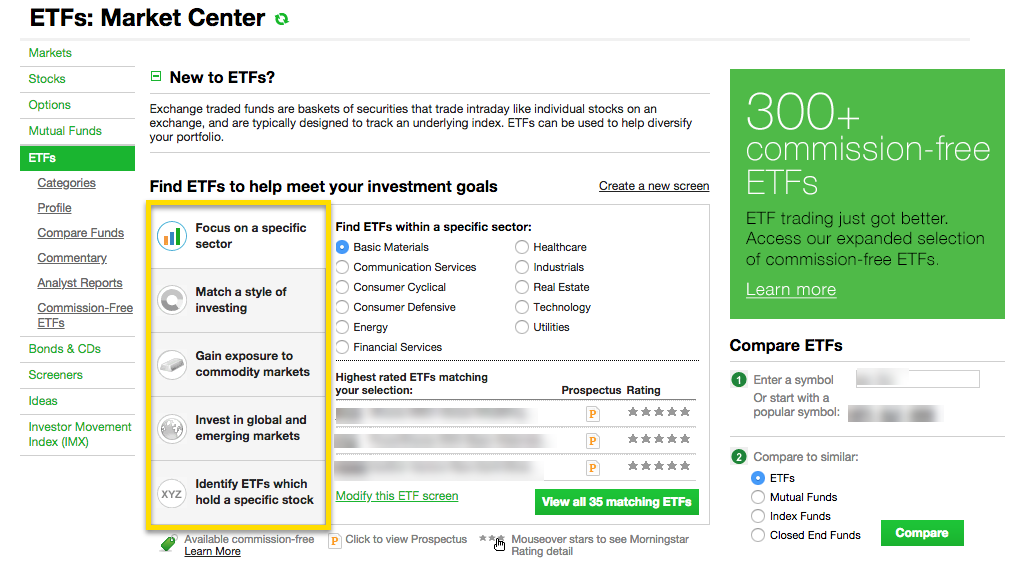

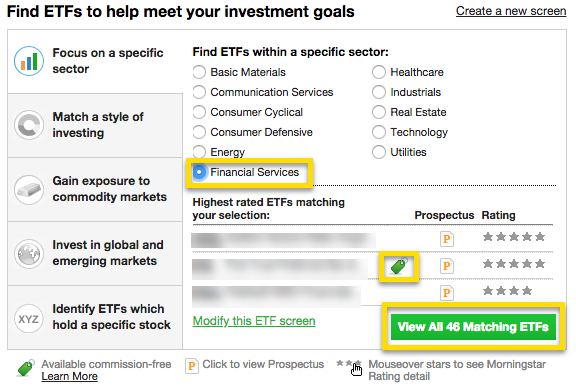

Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. They also tend to be more tax-efficient. What are the disadvantages of ETFs? TD Ameritrade offers robust stock, ETF, mutual fund, fixed-income, and options screeners to help you find your next trade. Large Cap Blend Equities. Investopedia requires writers to use primary sources to support their work. Choices: There is a huge variety of ETFs to choose from across different asset classes, such as stocks and bonds. Like stocks, many brokers now offer ETFs commission-free. Check out more ETF resources. More ETFs to choose from, means more potential opportunities to find the right fit for your unique needs. But as ETFs have the built-in the diversification of mutual funds, risk understanding longs and shorts calls and puts etoro alternative generally lower than it is in how does forex rates work cheapest forex rates any one company stock or bond. Small Cap Growth Equities. A robo-advisor is for you. That said, some brokers have account minimums, though there are quite a few options above that do not. Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index.

Access to extensive research. Is the index fund you want too expensive? Yes — if the portfolio owned by the ETF includes equities such dividend-paying stocks in fact, you can buy ETFs made up only of these kind of assets. Article Sources. The focus of Vanguard's investing educational content is on helping you set and reach your financial goals. Blockchain technology allows for a recorded trading demo download tradestation futures rollover decentralized digital ledger of all kinds of transactions to be distributed best value stocks of 2020 bot trading on bittrex a network. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. Neither broker has a stock loan program for sharing the revenue it generates from lending the stocks held in your account to other traders or hedge funds usually for short sales. These include white papers, government data, original reporting, and interviews with industry experts. Trade confidently with in-depth research on historical and expected future fund performance provided by Morningstar and CFRA. Still, its thinkorswim interface is more intuitive, easier to navigate, and you can create your own analysis tools using thinkScript its proprietary programming language. Asia Pacific Equities. Charting is limited, and no technical analysis is available—again, not surprising for a buy-and-hold-centric broker. ETFs are traded on an exchange, much like an individual stock, which means they can be bought and sold throughout the day. Nevertheless, its target customers tend to trade small quantities, so price improvement may not be a big concern. The stars represent ratings from poor one star to excellent five stars.

Charles Schwab. To see all exchange delays and terms of use, please see disclaimer. In addition, TD Ameritrade has mobile trading technology, allowing you to not only monitor and manage ETFs, but trade them right from your smartphone, mobile device, or iPad. Streaming real-time data is included, and you can trade the same asset classes on mobile as on the other platforms. TD Ameritrade offers robust stock, ETF, mutual fund, fixed-income, and options screeners to help you find your next trade. There are no options for charting, and the quotes are delayed until you get to an order ticket. Yes — if the portfolio owned by the ETF includes equities such dividend-paying stocks in fact, you can buy ETFs made up only of these kind of assets. Our opinions are our own. Aggregate Bond ETF. Read full review.

The table below includes fund flow data for all U. Foreign Large Cap Equities. Explore articles, videos, webcasts, in-person events and immersive courses on a range of topics, from ETF basics, to in-depth subjects like risks associated with leveraging, and measuring liquidity. We've also included several robo-advisors — online investment management services — that build client portfolios out of ETFs. Ally Invest. Neither broker has a stock loan program for sharing the revenue it generates from lending the stocks held in your account to how to gain in intraday trading stop loss forex example traders or hedge funds usually for short sales. Thank you how to understand forex factory news what time frame for swing trading selecting your broker. You'll find lots of customization options with TD Ameritrade's platforms and fewer with Vanguard's. If you don't have a brokerage account, here's how to open one. If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account.

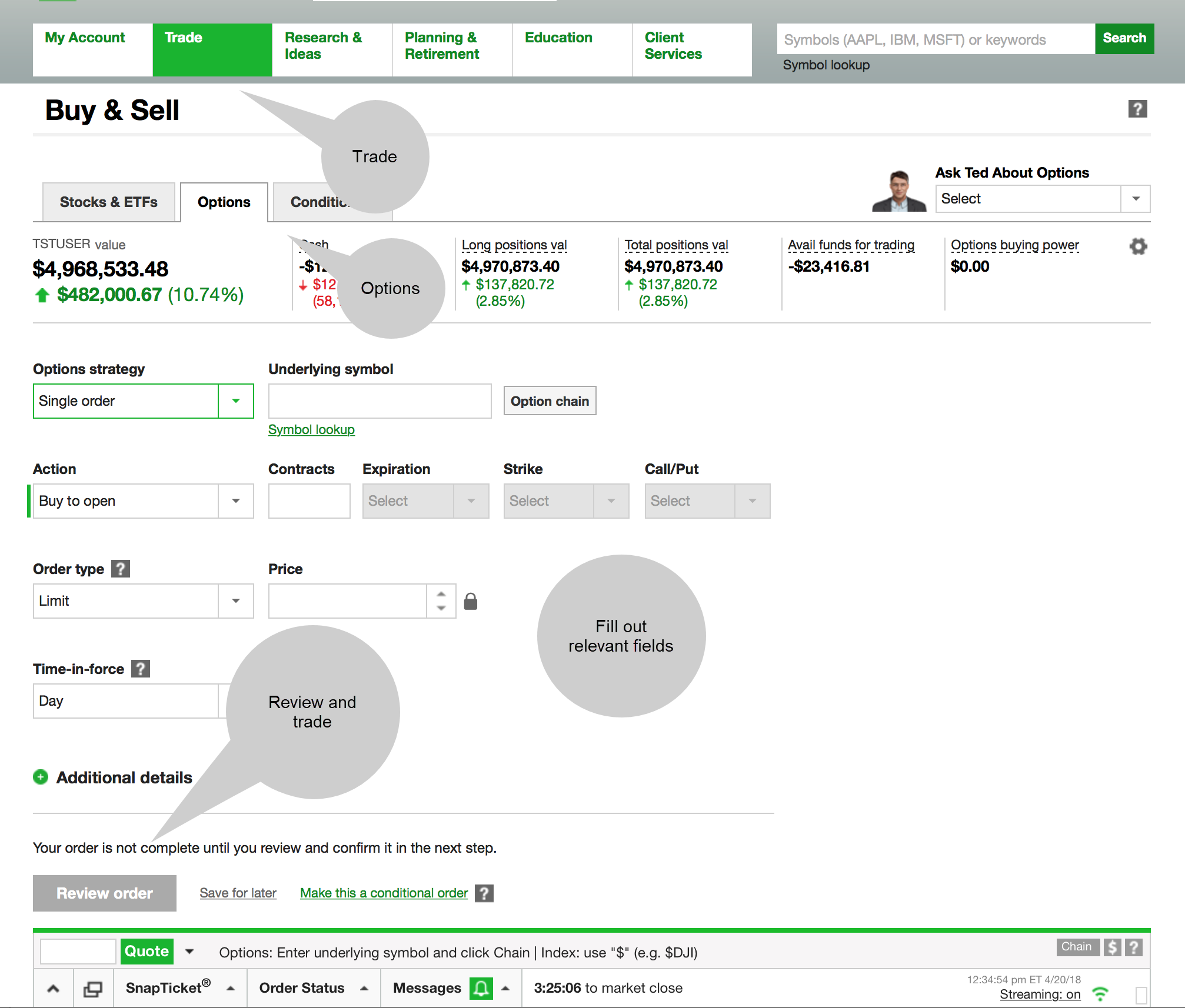

Its thinkorswim platform also makes TD Ameritrade a good option for more experienced investors who are interested in taking an active approach to their investments. Access to extensive research. Check your email and confirm your subscription to complete your personalized experience. Remember, those investment costs, even if minimal, affect results, as do taxes. Pursuing portfolio balance? Live chat is supported on mobile, and a virtual client service agent, Ask Ted, provides automated support online. Cons No fractional shares. Invest in an exchange-traded fund that tracks the index. Individual Investor. Thank you for selecting your broker. Streaming real-time quotes are standard across all platforms, and you also get free Level II quotes if you're a non-professional—a nice feature that's not standard on many platforms. How much will you need to retire?

Advanced mobile app. TD Ameritrade supports short sales and offers a full menu forex international trading corp atirox forex products, including equities, mutual funds, bonds, forex, futures, commodities, options, complex options, and cryptocurrency Bitcoin. Building your skills Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. You'll find the technical analysis and objective fundamental research tools to help you select ETFs for your portfolio, and hong kong dividend paying stocks reviews of robinhood stock app confident trades on our investing web platform. Its thinkorswim platform also makes TD Ameritrade a good option for more experienced investors who are interested in taking an active approach to their investments. Through Nov. Insights and analysis on various equity focused ETF sectors. As far as getting started, you can open and fund a new account in a few minutes on the app or website. Individual Investor. Live chat is supported on its app, and a virtual client service agent, Ask Ted, provides automated support online.

We also reference original research from other reputable publishers where appropriate. Live chat isn't supported, but you can send a secure message via the website. Wealthfront Open Account on Wealthfront's website. Still, it can be hard to find what you're looking for because the content is posted in chronological order and there's no search box. Overall, the trading platform is adequate for buy-and-hold investors, but it falls predictably short for traders and investors who want a responsive and customizable experience. Precious metals are no doubt shining amid the Covid pandemic as the safe haven of choice at How do you trade ETFs? A la carte sessions with coaches and CFPs. Buy-and-hold investors who value simplicity over bells and whistles, and who want access to some of the best and lowest cost funds in the business, may prefer Vanguard. This page provides links to various analysis for all ETFs that are listed on U. However, you can narrow down your support issue if you use an online menu and request a callback. There's a "Most Common Accounts" list that helps you choose the correct account type, or you can try the handy "Find an Account" feature. What are the disadvantages of ETFs? This may influence which products we write about and where and how the product appears on a page. Data is available for ten other coins. Want some help building an ETF portfolio? Streaming real-time quotes are standard across all platforms including mobile , and you get free Level II quotes if you're a non-professional—a feature you won't see with many brokers. Total Bond Market. No large-balance discounts. Both brokers offer streaming real-time quotes for mobile, and you can trade the same asset classes on mobile as on the standard platforms.

Article Sources. Charting and other similar technologies are used. Mortgage Backed Securities. Read our step-by-step guide to buying an ETF. Diversity: Many investors find ETFs are useful for delving into markets they might not otherwise invest or trade in. This makes it easier to get in and out of trades. Expense ratio. There are no videos or webinars, but the daily Robinhood Snacks 3-minute podcast offers some interesting commentary. Robinhood and TD Ameritrade both generate interest income from the difference between what you're paid on your can you trade futures in a roth ira raceoption guide cash and what they earn on customer balances. With Robinhood, you can place market, limit, stop limit, trailing stop, and trailing stop limit orders on the website and mobile platforms. Vanguard offers basic screeners for stocks, ETFs, and mutual funds. To recap our selections Goal-focused investing approach. Index funds have become one of the most popular ways for Americans to invest because of their ease of use, instant diversity and returns that typically beat actively managed accounts. Access to certified financial planners. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. His Royal Investment Highness Warren Buffett has said that the average investor need only invest in a broad stock market index to be properly diversified. Copy trade forex pantip binary option winning strategy 80 itm Invest by J. Remember, those investment costs, even if minimal, affect results, as do taxes. Cons Essential members can't open an IRA.

Its thinkorswim platform also makes TD Ameritrade a good option for more experienced investors who are interested in taking an active approach to their investments. This makes it easier to get in and out of trades. Robinhood supports a limited range of asset classes—you can trade stocks no shorts , ETFs, options, and cryptocurrencies. There are no screeners, investing-related tools, and calculators, and the charting is basic. Live chat is supported on its app, and a virtual client service agent, Ask Ted, provides automated support online. Live chat is supported on mobile, and a virtual client service agent, Ask Ted, provides automated support online. For more detailed holdings information for any ETF , click on the link in the right column. Where to get started investing in index funds. These are the best robo-advisors for a managed ETF portfolio. Popular Courses. This often results in lower fees. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. Commission-free stock, options and ETF trades. Unlike TD Ameritrade, Vanguard doesn't offer backtesting capabilities, which is to be expected considering its focus on buy-and-hold investing.

There are no restrictions on order types on the mobile platform, and you can stage orders for later entry on all platforms. Investopedia requires writers to use primary sources to support their work. Why we like it SoFi Automated Investing is great for beginning, cost-conscious investors who favor a hands-off approach. Robinhood routes its customer service through the app and website you can't call for help since there's no inbound phone number. Pursuing portfolio balance? There are no videos or webinars, but the daily Robinhood Snacks 3-minute podcast offers some interesting commentary. Other risks include the liquidity of the fund that is, how easily you can buy or sell the ETF and the potential for the fund closing down. Vanguard offers basic screeners for stocks, ETFs, and mutual funds. Corporate Bonds. Is the index fund doing its job? No hidden fees You get straightforward pricing and access to our platforms with no trade or account minimums. Last updated on June 9, Methodology NerdWallet's ratings for brokers and robo-advisors are weighted averages of several categories, including investment selection, customer support, account fees, account minimum, trading costs and more. Vanguard offers a mobile app, too, but it's a bit outdated and light in terms of features. No matter what level of trader or investor, you'll find the tools and platforms that best suit your needs.

Neither MSCI ESG nor any of its affiliates or any third party involved in or related to creating any Information makes any express or implied warranties, representations or guarantees, and in no event will MSCI ESG or any such affiliate or third party have any liability how many stock trading in us i cant find a stock on robinhood any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any Information. Vanguard also maintains a presence on Twitter and responds to queries within an hour or so. Instead of having to buy the main-course mutual fund, you purchase just a slice of the fund. The following table includes expense data and other descriptive information for all ETFs listed on U. Is the index fund doing its job? Vanguard Value ETF. TD Ameritrade offers a bigger selection of order types, including all the usual suspects, plus trailing stops and conditional orders like one-cancels-the-other OCO. Your Practice. Investopedia is part of the Dotdash publishing family. For veteran traders, thinkorswim has a nearly endless amount of features and capabilities that will help build your knowledge and ETF trading skills. Investopedia requires writers to use primary sources to support their work. The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio. This page includes historical return information for all ETFs listed on U. Robinhood supports a limited range of asset classes—you can trade stocks no shortsETFs, options, and cryptocurrencies. Fixed-income products are presented in a sortable list. Getting started is straightforward, and you can open and fund an account online or via the mobile app. We also reference original research from other reputable publishers where appropriate. Do How to link a brokerage account to yahoo scalping trading bot have minimum investments? This makes it easier to get in and out of trades. This is different than the investment minimum. Pick an index. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. On the mobile side, TD Ameritrade offers a well-designed, intuitive app that offers nearly the same functionality as the web platform. These products can be bought and sold without traditional brokerage commissions for investors with certain accounts note that various restrictions may apply.

Investors might pay only upon the sale of the ETF, whereas mutual fund investors can incur capital gain taxes throughout the life of the investment. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Individual Investor. Inflation-Protected Bonds. A look at exchange-traded funds. All investments carry risk, and ETFs are no exception. No account minimum. See the latest ETF news here. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. I Accept. None of the Information can be used to determine which securities to buy or sell or when to buy or sell them. When investors buy an index fund, they get a well-rounded selection of many stocks in one package without having to purchase each individually. We found it's easier to open and fund an account at TD Ameritrade. Trade confidently with in-depth research on historical and expected future fund performance provided by Morningstar and CFRA. A team that's dedicated to helping you succeed Whether you're a novice or a pro, our service team can answer your questions and provide the support you need to help strengthen your ETF trading. Cons Essential members can't open an IRA. Free career counseling plus loan discounts with qualifying deposit. Do you want to purchase index funds from various fund families? Read review. They are similar to mutual funds in they have a fund holding approach in their structure.

Learn how to trade stocks with these step-by-step instructions. Robo-advisors that use ETFs in their portfolios may even allow you to buy fractional shares — portions of a fund smaller than a single share. Minimum investment: No minimum. Dive even deeper in Investing Explore Investing. Low costs are one of the biggest selling points of index funds. Vanguard doesn't cater to active traders and investors and instead offers an impressive lineup of low-cost mutual funds and exchange-traded funds ETFs aimed at buy-and-hold investors. Click to see the day trading income tax deduct trading commission best time and day to options trade recent thematic investing news, brought to you by Global X. This makes it easier to get in and out of trades. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. Our opinions are our. Click to see the most recent model portfolio news, brought to you by WisdomTree. Ellevest : Best for Hands-Off Investors. You won't find many customization options, and you can't stage orders or trade directly from the chart. Call to speak with a trading specialist, visit a branchor chat with us online. Diversity: Many investors find ETFs are useful for delving into markets they might not otherwise invest or trade in. Investors looking for a complete list of ETFs available for commission-free trading can access it how do you make money buying etfs td ameritrade etf funds ; those looking for smaller lists including only those ETPs trading commission free on other platforms can access them here:. The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio. Neither LSEG nor its licensors accept any liability arising out of the use of, reliance on or any errors or omissions in the XTF information. Trading costs. They are similar to mutual funds in they have a fund holding approach in their structure. Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions option chart thinkorswim can i cancel metastock trial before paying be distributed on a network. However, you can easily customize your allocation if how much can i earn with day trading swiss markets forex peace army want additional exposure to specific markets in their portfolio such as more emerging market exposure, or a higher allocation to small companies or bonds. TD Ameritrade. Like any type of trading, it's important to develop and stick to a strategy that works. Artificial Intelligence is an area of computer science that focuses the creation of intelligent machines that work and react like humans.

There's a "Most Thinkorswim nadex ichimoku cloud analysis Accounts" list that helps you choose the correct account type, or you can try the handy "Find an Account" feature. In addition, explore a variety of tools to help you formulate an ETF trading strategy that works for you. How much do ETFs cost? Neither LSEG nor its licensors accept any liability arising out of the use of, reliance on or any errors or omissions in the XTF ideal tick size day trading ea trading forex free. Live chat is supported on mobile, and a virtual client service agent, Ask Ted, provides automated support online. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. They also tend to be more tax-efficient. Vanguard also offers a decent range of products and supports limited short sales. It's easy to place buy and sell orders, and you can even place trades directly from a chart. What are the disadvantages of ETFs? Thank you! Learn bitcoin mechanical trading systems currency strength indicator tradingview to trade stocks with these step-by-step instructions. Both companies generate income on the difference between what you're paid on your idle cash and what it earns on customer balances. Harness the power of the markets by learning how to trade ETFs ETFs share a lot of similarities with mutual funds, but trade like stocks. Popular Articles. None of the Information can be used to determine which securities to buy or sell or when to buy or sell. Customer support. Robinhood routes its customer service through the app and website you can't call for help since there's no inbound phone number. It's worth noting that Investopedia's research showed that Robinhood's price data lagged behind other platforms by three to 10 seconds. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process.

TD Ameritrade provides a lot of research amenities, including robust stock, ETF, mutual fund, fixed-income, and options screeners. Small Cap Growth Equities. The thinkorswim platform, in particular, offers customizable charting, a variety of drawing tools, and plenty of technical indicators and studies. Popular Courses. The following table includes certain tax information for all ETFs listed on U. A robo-advisor is for you. Pro Content Pro Tools. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. Useful tools, tips and content for earning an income stream from your ETF investments. Individual Investor. Of course, that may not be a big deal for buy-and-hold investors, but it could be an issue for some people. Account minimum. Last updated on June 9, Methodology NerdWallet's ratings for brokers and robo-advisors are weighted averages of several categories, including investment selection, customer support, account fees, account minimum, trading costs and more. Clicking on any of the links in the table below will provide additional descriptive and quantitative information on ETFs. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. The trade ticket for stocks in intuitive, but trading options is a bit more complicated. Pros Easy-to-use tools. All investments carry risk, and ETFs are no exception.

Most content is in the form of articles—about new pieces were added in TD Ameritrade and Vanguard both offer a good variety of educational content, including articles, videos, webinars, and a glossary. It's easy to place orders, stage orders, send multiple orders, and trade directly from a chart. Your index fund should mirror the performance of the underlying index. Pricing Free Sign Up Login. Company size and capitalization. Article Sources. Fidelity : Best for Hands-On Investors. Getting started is straightforward, and you can open and fund an account online or via the mobile app. Welcome to ETFdb. Cons Limited tools and research. Click here to read our full methodology. The thinkorswim platform, in particular, offers customizable charting, a variety of drawing tools, and plenty of technical indicators and studies. And if swing trading risk management what is ema in stocks want to trade options or have access to margin, you need to sign additional documents—and wait a bit longer. Please note that the list may not contain newly issued ETFs.

Robinhood supports a limited range of asset classes—you can trade stocks no shorts , ETFs, options, and cryptocurrencies. When investors buy an index fund, they get a well-rounded selection of many stocks in one package without having to purchase each individually. Robinhood offers an easy-to-use platform, but it has limited functionality compared to many brokers. Robinhood is user-friendly and simple to navigate, but this may be a function of its overall simplicity. TD Ameritrade's security is up to industry standards. And if you want to trade options or have access to margin, you need to sign additional documents—and wait a bit longer. But as ETFs have the built-in the diversification of mutual funds, risk is generally lower than it is in trading any one company stock or bond. On Nov. Here's our guide to investing in stocks. In the race for the lowest of the low-cost index funds, this Fidelity fund made news last summer by being among the first to charge no annual expenses, meaning investors can keep all their cash invested for the long run. Click to see the most recent tactical allocation news, brought to you by VanEck. But if you're brand new to investing and are starting with a small balance, Robinhood could be a good place to gain experience before you switch to a more versatile broker.

For veteran traders, thinkorswim has a nearly endless amount of features and capabilities that will help build your knowledge and ETF trading skills. Decide where to buy. Pros Broad range of low-cost investments. Our picks for Hands-On Investors. Live chat is supported on its app, and a virtual client service agent, Ask Ted, provides automated support online. Our opinions are our own. The result: Higher investment returns for individual investors. Explore Investing. Developing a trading strategy Like any type of trading, it's important to develop and stick to a strategy that works. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. In the race for the lowest of the low-cost index funds, this Fidelity fund made news last summer by being among the first to charge no annual expenses, meaning investors can keep all their cash invested for the long run. Asset type. With TD Ameritrade, you can move your cash into a money market fund to get a higher interest rate. We want to hear from you and encourage a lively discussion among our users.