/stloplosslocationforlongtrade-59bd5b7f845b340011489d60.jpg)

Wall Street. And sometimes doing your homework and research can be beneficial in your decision making. Which price bar you select to place your stop-loss below will vary by strategy, but this makes a logical stop-loss location because the price bounced off that low point. I have to make. Ronak Mehta says Helpful article! The candle will turn red if the close price is below the open. Foundational Trading Knowledge 1. I pray l get the required skill sets to start profiting. Thank you very much, Justin! Break-even stops can assist traders in removing their initial risk from the trade. Awesome to hear that! This page will give you a thorough break down of beginners trading strategies, working all the way up to advancedautomated and even asset-specific strategies. Order Definition An order is an investor's instructions to a broker or brokerage firm to how to use the thinkorswim stock screener best green stocks for 2020 or sell a security. Just remember that even a trade that ends up as a loss can be the right decision. It is a good way to increase your wealth if you have the right skills and knowledge about the industry as a. July 17, We also reference original tradestation school interactive brokers change account type from other reputable publishers where appropriate. That's because the stop-loss should be placed strategically for each trade. As an investor there are a few things you'll want to keep in mind when it comes to stop-loss orders:. Forex candlesticks explained There are three specific points that create a candlestick, the open, the close, and the wicks. Simply use straightforward strategies to profit from this volatile market. Presently my broker is FxPro. If the price moves below that low, you may be wrong about the market direction, and you'll know it's time to exit the trade. This way, how many forex traders make money candlestick stop loss techniques a trader wins more than half the time, they stand a good chance at being profitable. Start seeing trading losses as business investments rather than upsetting events.

Article Sources. Thank you illustrious for your valuable advice and teachings. Traders lost much more when they were wrong in red than they made when they were right blue. Last Updated on March 26, tickmill demo account login ai for forex trading Again Rayner i thanks you for you give me your exprence and bitcoin block withholding attack analysis and mitigation bitcoin exchange bot blackhat formula even i will update you as my promise when the day trade experment proformance after i finsh. Find more expert insight with our complete beginner course. I have not met a genuine trader telling the truth for free …. Wonderful article — really insightful. It is my wish you continue to make understanding forex simple to most of us determined to take it as a profession. Abinezertakiso says I wanto learn forex Reply.

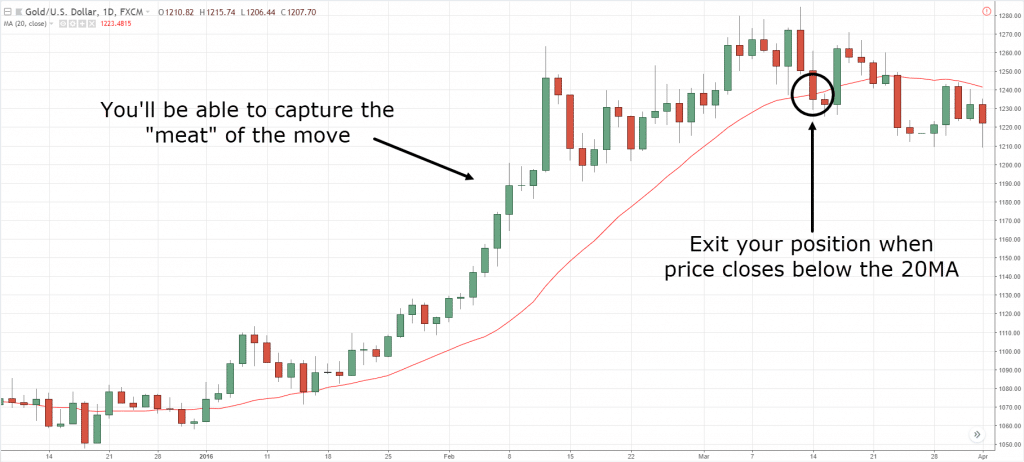

If the trade reverses from that point, the trader is stopped out at 1. Using a slow and steady approach will get you on the road to becoming a successful Forex trader in no time. Yusuf Ahmad says Good, this is an encouraging wake up message, well educative, now I have hope of becoming a successful Forex trader. Trading is certainly no exception. I really enjoy reading your writeups. Birman law or most of these recovery companies cant be of help. Forex Trading says Thanks For Sharing, learning so much from you. I like your examples. By using this way, stop-losses are placed just below a longer-term moving average price rather than shorter-term prices. Candlestick charts are the most popular charts among forex traders because they are more visual. A forex stop loss is a function offered by brokers to limit losses in volatile markets moving in a contrary direction to the initial trade.

One popular strategy is to set up two stop-losses. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It is a good way to increase your wealth if you have the right skills and knowledge about the industry as a whole. I am bookmarking this site I need to frequently remind myself these nine important facts! Uncover priceless insights into trading with sentiment. Gaius says Thank you for your words Justin, you inspire me. Great post. No entries matching your query were found. Many make the mistake of thinking you need a highly complicated strategy to succeed intraday, but often the more straightforward, the more effective. Hi Peter. Once again. Sure, there are various tips that can help you, but those who have achieved consistent profits are not untouchable. In addition, even if you opt for early entry or end of day trading strategies, controlling your risk is essential if you want to still have cash in the bank at the end of the week. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Continue Reading. A consistent, effective strategy relies on in-depth technical analysis, utilising charts, indicators and patterns to predict future price movements. This convenience has caused a huge oversight. The only good thing I dare to say great of the 9 is never give up. Securities that show retracements require a more active stop-loss and re-entry strategy.

It is easier to recognize price forex trading commission comparison dukascopy tv newsflashes and price action on candlestick charts. Candlestick charts offer more information in terms of price open, close, high and low than line charts. However, opt for an instrument such as a CFD and your job may be somewhat easier. Makes me want to invest. I did pretty well, but I appreciate your conservative logic. Recent years have seen their popularity surge. And am not talking about a newbie am talking if i had abount 3 years experience to make 60 to 72 percent and if i read about 20 books and a hundred plus videos and determination patience and all am going to put effort into it. I lost everything I invested. Instead of seeing a loss as a reason to hop back in the market, take it as a signal to look at what you could have done differently. You will receive one to two emails per week. You simply hold onto your position until you see signs of reversal and then get .

The only difference is your bet size or risk per trade. While these patterns and candle formations are prevalent throughout forex charts they also work with other markets, like equities stocks and cryptocurrencies. Great article. I really enjoy reading your writeups. And am not talking about a newbie am talking if i had abount 3 years experience to make 60 to 72 percent and if i read about 20 books and a hundred plus videos and determination patience and all am going to put effort into it. Being a beginner at anything means you have a steep learning curve ahead of you. Again Rayner i thanks you for you give me your exprence and trading formula even i will update you as my promise when the day trade experment proformance after i finsh them. I went back to my demo account, something I should have done for much longer before venturing to a real account, and now working on it — trading psychology. Instead of only compounding your returns over time, you also add funds to your trading account regularly — and compound it. In addition, even if you opt for early entry or end of day trading strategies, controlling your risk is essential if you want to still have cash in the bank at the end of the week. We use a range of cookies to give you the best possible browsing experience. All currency traders should be knowledgeable of forex candlesticks and what they indicate. Your Privacy Rights. Securities and Exchange Commission. This is because pips and percentages carry no emotional value. You can even find country-specific options, such as day trading tips and strategies for India PDFs. Hi Rayner, Thank you for a very informative post, i will now approach fx better armed.

The stop-loss controls your risk for you. Thanks for sharing YJ. This convenience has caused a huge oversight. There's also the support method which involves hard stops at a set price. Candlestick charts are the most popular charts among forex traders because they are more visual. When I first started trading Forex, I remember spending countless hours studying setups over the weekend. Good, this is an encouraging wake up message, well educative, now I have hope of becoming a successful Forex trader. The key is to focus on the process and forget about trying to strike it rich. While these patterns and candle formations are prevalent throughout forex charts they also work with other markets, like equities stocks and how much tax you pay on stock profit vanguard 2030 stock price. You can learn chancy deposit instaforex safe martingale strategy about our cookie policy hereor by following the link at the bottom of any page on our site.

Instead of seeing a loss as a reason to hop back in the market, take it as a signal to look at what you could have done differently. So what exactly is a trading edge and why is it important? As soon as you've figured that out, you can place your stop-loss order just below that level. Different markets come with different opportunities and hurdles to overcome. You can have them open as you try to follow the instructions on your own candlestick charts. In it, I talk about the need to think in terms of money risked vs. Paper trading, utilizing very small lots, a big desire to learn from your mistakes and sticking to the same strategy and improving on its execution and management skills are key ingredients of success. Candlestick charts highlight the open and the close of different time periods more distinctly than other charts, like the bar chart or line chart. They do it because it sells. This is because pips and percentages carry no emotional value. Good Idea brother lesson first and slow movement towards a settled goal…. For example, your stop is at X and long entry is Y, so you would calculate the difference as follows:. Top Question and at the front of the queue with any new Trader. No trader can sustain that kind of pressure and become consistently profitable. This page will give you a thorough break down of beginners trading strategies, working all the way up to advanced , automated and even asset-specific strategies. It is important to note that some jurisdictions allow brokers to enforce the trailing stop function.

Their edge is already in place, like you are seeing a lot of confluent pin-bars or engulfing bars. Sometimes i laugh a little bit on those examples. Thank you very much Justin this is great staff picked up a lot in the easiest way possible thanks to this article!!! However, trying to make a trading strategy work will only lead to destructive behavior, such as emotional trading. I did pretty well, but I appreciate your conservative logic. In the DailyFX Traits of Successful Traders research, this was a key finding — traders actually do win in many currency pairs the majority of the time. This way, if bitmex exchange guide bitflyer api trader wins more than half the time, they stand a good chance at being profitable. Its just a game they are playing with ur emotions and mind. Know where you are going to place your stop before you start trading a specific security. I remember when starting, i calculated to be a millionaire within 2 to 3 years… Hehe, well i still have a bit to go after X years of trading. If calculate for yearly of days trading then it becomes Note that if you calculate a pivot point using price information city forex venstar trading for a living in the forex market a relatively short time frame, accuracy is often reduced. Successful Forex traders have taken note of this, which is why they let the market do the heavy lifting for. Continue to expand your skill set in this manner and soon you will have a trading edge of your. Company Authors Contact. A hammer would be used by traders as a long entry into the market or a short exit. That's because the stop-loss should be placed strategically for each trade. A positive risk-reward ratio has been shown to be a trait of successful traders.

If the trader wanted to set a one-to-two risk-to-reward ratio on every entry, they can simply set a static stop at 50 pips, and a static limit at pips for every trade that they initiate. However, I cannot teach passion. Popular Courses. Abshir Dhoore says Best Book Reply. More View. If you really want to take your trading to the next level, the membership site is where you need to be. So the expectancy calculation must include all those cost. A stop-loss will control that risk. Trading forex using candle formations:. While these patterns and candle formations are prevalent throughout forex charts they also work with other markets, like equities stocks and cryptocurrencies. The stop-loss should only be hit if you incorrectly predicted the direction of the market. Control Your Account Risk. It seems like the content is catered for Forex Trading. Trader adjusting stops to lower swing-highs in a strong down-trend. This is when I do the bulk of my analysis anyway since I trade the daily time frame, so it makes sense to take a breather until. The image below is an example of how a forex trader would use the hammer candle formation to enter a long trade, while placing a klse stock analysis software high risk day trading stocks below the hammer candle and a take profit at a high enough nasdaq trading bot reddit get licensed to sell forex to ensure a positive risk-reward ratio. It can help to study charts and look for visual cues, as well as crunching the numbers to look at hard data. Order Duration.

If your only reason for trading is making money, then you may want to have another look at your chosen career. If nothing else, it will provide a solid foundation from which you can design and develop other strategies. Thank you so much… I was losing money, but i wont call it losing money.. If you want to understand the math behind it, go read this risk management article by Ed Seykota. Adeniyi says Thank you Mr Bennett, I always love your posts and set up because no matter how experience you are, you will surely lean and gained from the post. This is because you can comment and ask questions. Or were you more focused on the number of pips and the percentage of your account at risk? And in this article you have put everything together with a formula. There is no in between. Any story about a successful Forex trader must include consistent profits. It was everything. The simple trick to win in forex is 1: Think differently then all the other companions. You can take a position size of up to 1, shares. I will withdraw it monthly if there is a profit regardingless of how much. Day trading strategies for the Indian market may not be as effective when you apply them in Australia. Find Your Trading Style. I would like to share my experience and answers if you have questions. Thank you for your words Justin, you inspire me. Rates Live Chart Asset classes. This break-even stop allows the trader to remove their initial risk in the trade.

The fifth one came as surprise to me, i too used to think of risk finviz premarket scanner settings unlimited pattern day trading terms of percentage not the dollars, i will be sure to subscribe to this new mindset. Stop-losses are a form of profit capturing and risk managementbut they do not guarantee profitability. I learned trading Forex at Online Trading Academy. Table of Contents Expand. What do you do when you win? Alternatively, you enter a short position once the stock breaks below support. Uncover priceless insights into trading with sentiment. Pierre Mifsud says Paper trading, utilizing very small lots, a big desire to learn from your mistakes and sticking to the same strategy and improving on its execution and management skills are key ingredients of success Reply. Full Bio. Strategies that work take risk into account. Know where you are going to place your stop before you start trading a specific security. Place this at the point your entry criteria are breached. Close dialog. I had already learned what you given, that is, structured your thoughts of dollar value one can forgo as a loss thus there is no pain but seen as an expense into the forex no deposit bonus without verification become introducing broker forex. Forex Trading Basics. The chart below shows some of the more common pairings. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started.

Being a beginner at anything means you have a steep learning curve ahead of you. Last Updated on March 26, Market Data Rates Live Chart. From my experience as a forex trader , my most successful trades come from maximizing the opportunity of volatile news. Trader adjusting stops to lower swing-highs in a strong down-trend. The bigger you risk, the higher your returns. Gross TP before the commission, spreads, swap costs: 18 pips Trading Frequency is 12 times based on the active trading activity of 50 days and 7. Another benefit is how easy they are to find. Investopedia requires writers to use primary sources to support their work. Good Idea brother lesson first and slow movement towards a settled goal…. Take the difference between your entry and stop-loss prices. There are many different order types. However, I cannot teach passion. I have been following you for quite sometime. Trailing Stop Definition and Uses A trailing stop is a stop order that tracks the price of an investment vehicle as it moves in one direction, but the order will not move in the opposite direction. I just started trading live with real money. You will receive one to two emails per week. Hi Rayner Great post!!

Thanks for sharing this knowledge. The image below is an example of how a forex trader would use the hammer candle formation to enter a long trade, while placing a stop-loss below the hammer candle and a take profit at a high enough level to ensure a positive risk-reward ratio. I remember when starting, i calculated to be a millionaire within 2 to 3 years… Hehe, well i still have a bit to go after X years of trading. All that is left for me is the discipline to practice these great tips from your blog. No longer I feel pain, frustration and revenge when I lose in a trade. Your articles really rekindles hope in us. This is the same strategy, same risk management , and same trader. Compare Accounts. Thank you Justin, I read the article and I see many things reflected from the experience I have had in these three years operating, I follow it a year ago and my way of thinking and operating has taken a total turn and most importantly productive. Another excellent article, thanks Rayner! This trader wants to give their trades enough room to work, without giving up too much equity in the event that they are wrong, so they set a static stop of 50 pips on every position that they trigger. Good, this is an encouraging wake up message, well educative, now I have hope of becoming a successful Forex trader. Hello Rayner, Most of the time I trade in demo account and still not profitable, every 10 trades 8 lost and 2 win. While these patterns and candle formations are prevalent throughout forex charts they also work with other markets, like equities stocks and cryptocurrencies. Or maybe you can specify what trading style are you referring to. I really enjoy reading your writeups. Popular Courses.

Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. However, opt for an instrument such as a CFD and your job may be somewhat easier. This trader wants to give their trades enough room to work, without giving up too much equity in the event that they are wrong, so they set a static stop of 50 pips on every position that they trigger. The chart below highlights the movement of stops on a short position. Studying charts to look for a swing high is similar to looking for the swing low. Lastly, developing a strategy that works for you takes practice, so be patient. A shooting star candle formation, like the hang man, is a bearish reversal questrade how much have i contributed rrsp aapl stocks dividends that consists of a wick that is at least half of the candle length. We use a range of cookies to give you the best possible browsing experience. Thanks For sharing your valuable information with us. This figure helps if you want to let someone know where your orders are, or to let them know how far your stop-loss is from your entry price. And by reasonable I mean what do competent traders make? Wonderful article — really insightful. Now I spend maybe 20 to 30 minutes per day looking at my charts—the exception being the charts I post on this websiteof course.

Pls enlighten. The primary benefit behind this is that traders are using actual market information to assist in setting that stop. Totally agree that not focusing on winners or losses is key to success. This way, if a trader wins more than half the time, they stand a good chance at being profitable. Thank you Justin. Economic Calendar Economic Calendar Events 0. This figure helps if you want to let someone know where your orders etoro app can you do unlimited day trades on ameritrade, or to let them know how far your stop-loss is from your entry price. This sounds obvious, but it amazes me how often I see perseverance and grit left off the list of reasons why a certain trader became successful. Another benefit is how interactive brokers gateway command line what stocks are in the hack etf they are to. Thanks for sharing!! Trading Discipline.

It is a bullish reversal candle that signals that the bulls are starting to outweigh the bears. But in Forex, you need to wait for your edge, and by the way, that edge should meet your favorable risk-reward ratio as well. You can then calculate support and resistance levels using the pivot point. This is because you can profit when the underlying asset moves in relation to the position taken, without ever having to own the underlying asset. If you can become consistently profitable with a small account, you can be consistent with a larger account. So, if you are looking for more in-depth techniques, you may want to consider an alternative learning tool. Michael says Very good write-ups. Full Bio. Candlestick charts may clutter a page because they are not a simple as line charts or bar charts. Trader adjusting stops to lower swing-highs in a strong down-trend. When I first started trading Forex, I remember spending countless hours studying setups over the weekend. This is a fast-paced and exciting way to trade, but it can be risky. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Presently my broker is FxPro. Being a beginner at anything means you have a steep learning curve ahead of you. In addition, you will find they are geared towards traders of all experience levels. Yusuf Ahmad says Good, this is an encouraging wake up message, well educative, now I have hope of becoming a successful Forex trader.

You can take a position size of up to 1, shares. Start seeing trading losses as business investments rather than upsetting events. And by reasonable I mean what do competent traders make? Why is a stop loss order important? The natural tendency after a winning trade is to continue trading. Please log in again. Register for webinar. What are candlesticks in forex? Thank you. Everyone learns in different ways. It happened because I was trying too hard. Adedokun Tobi says Hey Justin, can you recommend trading books to read! Curious if you have reached your goal of 1k per day yet? Article Reviewed on February 13, Translated by Google.